Key Takeaways

💰 EastGroup offers a forward dividend yield of 3.43% with a long history of annual dividend increases, supported by consistent funds from operations rather than traditional earnings.

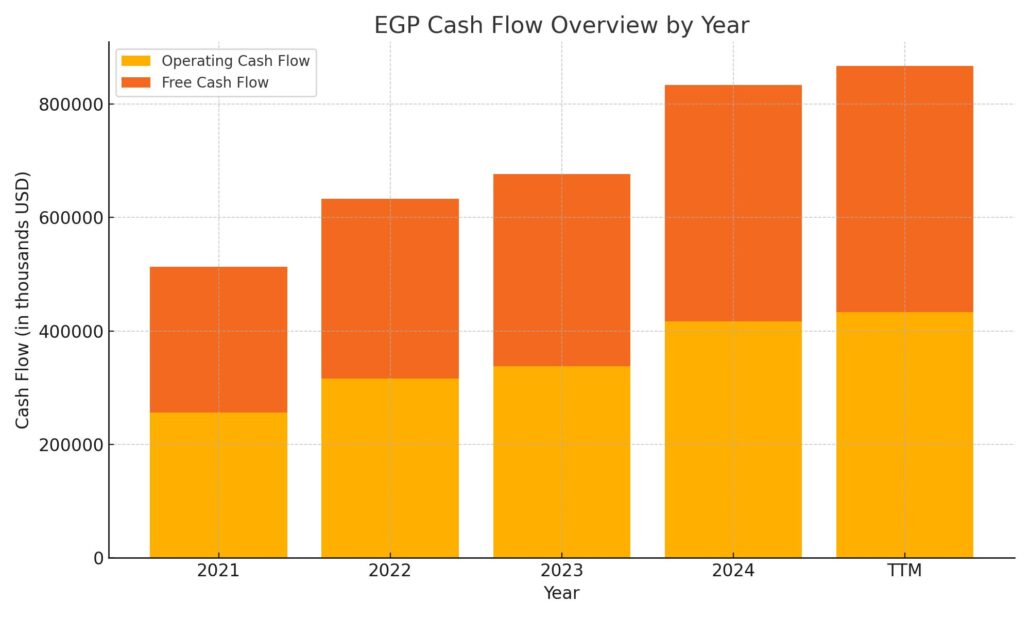

📈 Operating and free cash flow both reached $433 million over the trailing twelve months, showing strong internal cash generation and minimal drag from capital expenditures.

🔍 Analysts are mixed but leaning positive, with several recent upgrades and an average price target of $187.81 pointing to moderate upside from current levels.

📊 First-quarter results showed revenue growth of 10% year-over-year and a raised full-year FFO guidance, signaling confidence from management despite a modest dip in net income.

Last Update: 5/1/25

EastGroup Properties (EGP) specializes in industrial real estate with a focus on multi-tenant distribution facilities in high-growth Sunbelt markets. With a portfolio designed around supply chain efficiency and last-mile delivery, the company has built a reputation for operational consistency, high occupancy rates, and disciplined capital allocation. Its leadership has maintained a clear strategy centered on infill locations in major distribution hubs, supporting long-term rental income and tenant retention.

Backed by nearly 99 percent institutional ownership, EastGroup offers investors steady cash flow and a growing dividend, currently yielding over 3.4 percent. The stock trades at a premium relative to peers, supported by strong fundamentals and healthy FFO growth. Management continues to guide with confidence, raising full-year forecasts and pushing forward with a targeted development pipeline. In an environment marked by rate sensitivity and shifting logistics demand, EGP’s focused execution and geographic strength provide a solid foundation.

Recent Events

EastGroup has been moving through 2025 with measured momentum. The company’s most recent numbers show revenue at nearly $657 million on a trailing twelve-month basis, paired with net income of $228.5 million. That’s solid footing for a REIT, especially considering the ongoing uncertainty in commercial real estate.

Earnings per share came in at $4.58, and while the growth isn’t explosive—just over 1% year-over-year—it’s consistent. More importantly, the REIT has managed to keep its operations running efficiently, with operating margins approaching 38% and EBITDA at $425.9 million. That points to a business that knows how to scale without bleeding cash.

One area to keep an eye on is leverage. EastGroup’s debt-to-equity ratio stands at just under 45%, which is on the conservative side for a REIT. That’s a good sign, especially given the current interest rate climate. Cash on hand sits just shy of $37 million—not huge, but the operating cash flow of over $433 million gives the company plenty of flexibility.

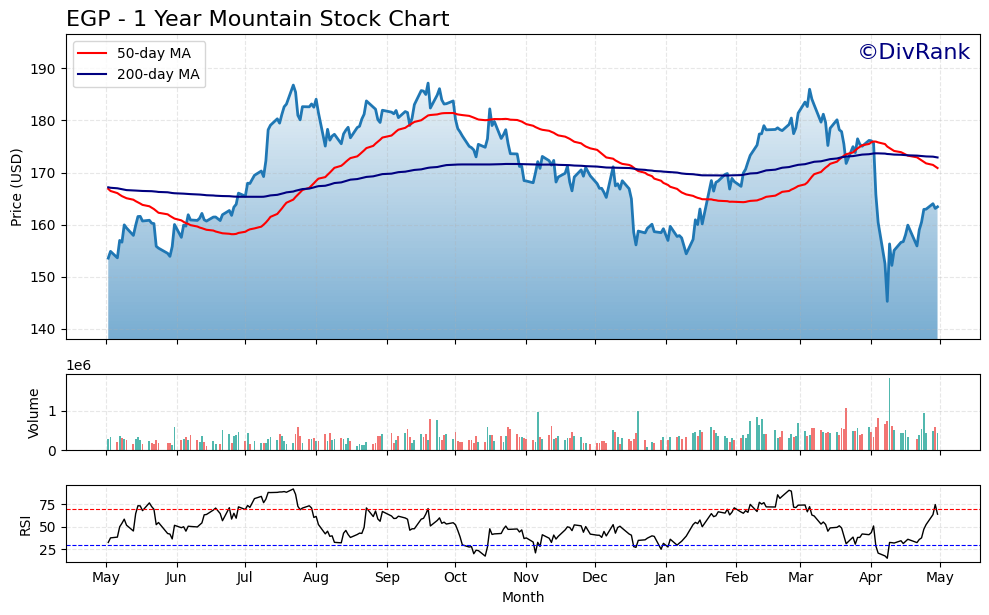

The share price has recently hovered around the $163 mark. It’s dipped below both the 50-day and 200-day moving averages, which could signal a consolidation period. That’s not necessarily bad news—especially for dividend-focused investors who might be looking for a more attractive entry point.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.43%

💵 Annual Dividend Rate: $5.60

📅 Last Dividend Paid: April 15, 2025

🔁 5-Year Dividend Growth: Steady and rising

🧮 Payout Ratio: 119.43% (based on earnings)

📊 5-Year Average Yield: 2.57%

🧷 Ex-Dividend Date: March 31, 2025

📉 Dividend Safety (based on FFO): Solid footing

Dividend Overview

When it comes to income, EastGroup delivers a blend of dependability and quiet strength. The current forward dividend yield sits at 3.43%, a decent notch above its five-year average of 2.57%. That might suggest the stock is offering a bit more yield than usual—possibly due to the recent dip in share price.

The annual payout stands at $5.60 per share, which is substantial considering the company’s size and focused asset base. Even more impressive, EastGroup has managed to raise its dividend year after year without missing a beat. In an environment where many companies are pausing hikes or even cutting back, that kind of consistency stands out.

One point that may catch the eye is the payout ratio—sitting over 119% based on traditional earnings. That might seem high at first glance, but for REITs, earnings don’t tell the whole story. These companies report under GAAP accounting, which includes hefty depreciation charges that don’t reflect the actual cash available to pay dividends. When you look at it from a funds-from-operations (FFO) perspective, EastGroup’s dividend appears to be well-covered.

This is a business model that’s built around stable, recurring rental income. Tenants tend to stick around, especially in the types of infill, last-mile properties that EastGroup specializes in. That keeps occupancy high and cash flow predictable—two crucial ingredients for reliable dividend payments.

Dividend Growth and Safety

EastGroup has a strong dividend growth story that goes beyond just the numbers. It’s about management’s discipline and the company’s positioning in one of the more durable corners of the real estate world. The latest increase brought the quarterly dividend up to $1.40 per share, and it marks another year in a long streak of hikes. For long-term investors, that compounding effect adds up in a meaningful way.

Over the past five years, EastGroup’s dividend has grown faster than inflation, helping investors preserve—and even increase—their purchasing power. That’s no small feat, especially in a world where yield is hard to find and even harder to trust.

The dividend safety profile is also worth noting. Even with a payout ratio over 100% based on earnings, the real story lies in the company’s FFO. That’s where EastGroup shines. With over $433 million in operating cash flow and a conservative approach to debt, the company has the breathing room to keep rewarding shareholders without stretching its balance sheet.

It’s also worth pointing out that nearly all of EastGroup’s shares are held by institutions—just under 99%. That institutional ownership suggests a level of trust and oversight that helps anchor the stock. Insiders, meanwhile, hold a modest stake at under 1%, which isn’t unusual for a REIT of this size.

Technically speaking, the stock is sitting below key moving averages, which might be read as a short-term cooling off period. But for dividend investors, that’s often when the best opportunities emerge. Lower prices push up yield, and in the case of a company like EastGroup, that could mean more income for the same investment.

This is a REIT that’s not trying to be everything to everyone. It knows its niche, executes well, and pays investors to stick around. For those who value predictable income and a steady hand at the wheel, EastGroup continues to check a lot of the right boxes.

Cash Flow Statement

EastGroup Properties continues to generate strong cash from operations, with trailing twelve-month (TTM) operating cash flow reaching $433 million. This figure marks a steady climb from previous years and highlights the company’s ability to translate rental income into usable capital. Free cash flow mirrored operating cash flow exactly in the latest period, suggesting minimal drag from maintenance or recurring capital expenditures—an encouraging sign for dividend stability and potential reinvestment flexibility.

On the investing side, outflows remain substantial at $677 million TTM, largely driven by property development and acquisitions—core to EastGroup’s growth strategy. Financing cash flow provided a counterbalance, coming in at nearly $249 million. The company has been actively managing its debt, with new issuances of about $58 million but repayments significantly higher at $278 million. The result is a reduced end cash position of $20.5 million, lower than some prior years but not out of line for a REIT that reliably cycles capital to fuel expansion.

Analyst Ratings

EastGroup Properties has recently drawn a mix of reactions from analysts, reflecting a balance of strong fundamentals and cautious macroeconomic sentiment.

🟢 On the bullish side, one major firm upgraded the stock from “Hold” to “Buy” earlier in April, holding a price target of $180. This upgrade was driven by the company’s consistent leasing success and prudent approach to debt and development. Another analyst boosted their target to $194, pointing to EastGroup’s solid growth in funds from operations and the continued strength in occupancy across its portfolio. Similarly, a separate upgrade from a prominent investment bank lifted its target price from $174 to $194, highlighting the REIT’s strategic concentration in fast-growing Sunbelt metros.

🟠 On the flip side, not every analyst is leaning bullish. One firm downgraded EastGroup from “Overweight” to “Neutral” and dropped its target to $175. Their concern centered around potential headwinds from shifting trade policies that could weigh on industrial property demand. Another firm maintained a “Sector Perform” stance while trimming its price target from $189 to $183, reflecting a more cautious near-term outlook as the real estate sector adjusts to higher-for-longer interest rates.

📊 The average analyst price target currently sits around $187.81. That leaves some room for upside, especially for income-focused investors willing to ride out short-term market fluctuations.

Earning Report Summary

Solid First Quarter Performance

EastGroup Properties kicked off 2025 with a solid first-quarter report, showing it’s still on a steady track despite some economic headwinds. Funds from operations came in at $2.12 per share, edging out expectations and keeping the company’s consistent track record intact. Total revenue climbed to $174.45 million, up 10% from the same period last year. That kind of growth speaks to the continued strength in the industrial space, particularly in the high-demand Sunbelt markets where EastGroup has focused its energy.

While net income dipped slightly to $1.14 per diluted share, compared to $1.22 the previous year, it wasn’t a surprise. The slight drop reflects timing differences in property sales and development completions rather than any structural issues with the business itself. The core portfolio remains healthy, with strong occupancy and very few concessions needed to keep or attract tenants.

Leadership Commentary and Outlook

Marshall Loeb, the company’s CEO, spoke confidently about the quarter, noting that the EastGroup team stayed disciplined and focused during a period that’s been unpredictable for many in real estate. He highlighted the company’s success in maintaining leasing momentum, which continues to be one of the major strengths of their model. He also made it clear that their strategy—leaning into well-located, infill properties in supply-constrained markets—is paying off.

Looking forward, management bumped up full-year guidance for funds from operations, now expecting to land between $8.84 and $9.04 per share. That revision signals more than just optimism; it reflects what the team is seeing on the ground. New developments are progressing well, and leasing continues to run ahead of plan in many cases.

There’s also a strong commitment to keeping capital allocation tight. Loeb made a point of saying they’re not just growing for the sake of growth—they’re keeping an eye on long-term value and making sure every move adds to the company’s overall durability. With more development projects in the pipeline and a conservative balance sheet to back it up, EastGroup seems positioned to keep delivering, especially for income-focused investors.

Chart Analysis

Price Trend and Moving Averages

Looking at the chart for EGP, the past year tells a story of a stock that’s experienced both momentum and correction. The price climbed steadily through mid-year, peaking near $190 before entering a choppier period in the fall and winter. The 50-day moving average, represented in red, moved sharply above the 200-day average over the summer, signaling a strong uptrend. However, by early spring, the 50-day line dipped below the 200-day average, forming what technical watchers call a “death cross” — often a bearish signal, or at least a sign of waning upward momentum.

Despite that, the stock found some footing in April, rebounding sharply from a recent dip that took it near its 52-week low. This recent bounce, while still beneath both key moving averages, shows that buying interest is returning as the stock stabilizes in the low $160s.

Volume and Participation

Volume over the year has been mostly steady, with a few standout spikes. These volume bursts seem to align with notable price moves—both upward surges and sharp declines. While there’s been no overwhelming shift in participation, the volume spikes during sell-offs hint at short-term panic rather than fundamental shifts in sentiment. Recent volume suggests renewed interest, possibly buyers stepping in at perceived value levels.

Relative Strength Index (RSI)

The RSI offers another layer of insight. For much of the year, EGP spent time in or near overbought territory, especially during its climb over the summer. As prices softened heading into spring, RSI dipped toward the oversold line. In April, RSI touched below 30 before rebounding sharply to the 70 level. This recent movement suggests a potential short-term rally may be underway, but it also warns that the stock is quickly approaching an overheated zone again.

Overall Technical Posture

EGP’s chart reflects a business that’s been riding a favorable long-term wave but is now navigating a bit of turbulence. The recent recovery in price, rising RSI, and support near prior lows all point to underlying resilience. It’s not in breakout territory just yet, but the way the stock reacts around its moving averages in the weeks ahead will say a lot about the next leg of its journey.

Management Team

EastGroup Properties is led by a stable, experienced executive team that has remained disciplined in its long-term strategy. Marshall Loeb, serving as CEO, brings over two decades of real estate expertise and a steady hand, which is reflected in the company’s focus on core industrial assets in growing Sunbelt regions. Under his guidance, EastGroup has maintained a clear vision: build and operate functional, infill distribution space in supply-constrained markets. The clarity and consistency in this approach have contributed to the company’s ability to deliver dependable results through various market cycles.

Supporting Loeb is a leadership bench deeply familiar with the industrial sector. The team is known for prioritizing high occupancy, tenant retention, and capital efficiency. Rather than chase every trend or expand beyond their comfort zone, the company sticks to what it does well. That includes targeting strong logistics corridors and placing tenants who are likely to grow and stay. This operational focus has helped keep turnover low and long-term leasing metrics strong. Across the board, the management team has consistently shown that it values measured growth, shareholder returns, and a conservative balance sheet.

Valuation and Stock Performance

EastGroup’s stock is currently trading in the $160s, slightly below its longer-term averages and about 15 percent off its recent highs. While it’s underperforming compared to the broader market year-to-date, it’s not unusual for real estate stocks, particularly REITs, to face headwinds in a higher interest rate environment. What stands out is that this pullback has opened the door to a higher-than-usual yield, now above 3.4 percent, which could appeal to investors focused on income.

From a valuation perspective, EastGroup isn’t cheap, but it’s rarely been a bargain-bin stock. The current price-to-book ratio is around 2.6, and its enterprise value to EBITDA stands above 21. Those multiples might seem steep on the surface, but they’re largely supported by consistent performance and a very stable income stream. Investors have historically been willing to pay a premium for that kind of operational dependability, and the company has earned it through a disciplined model and long-term tenant relationships.

Over the longer horizon, EastGroup has performed well. Even if the current year is muted due to market conditions, it continues to generate positive total returns thanks to a rising dividend and consistent FFO growth. Its five-year performance stacks up nicely against peers, and its nearly 99 percent institutional ownership signals broad confidence among large, long-term investors.

Risks and Considerations

Interest rates remain the biggest near-term headwind for EastGroup. As a REIT, its cost of borrowing and investor sentiment are closely tied to the broader rate environment. Although the company has managed its balance sheet well and kept debt levels in check, rate volatility can still put pressure on share price and capital deployment.

There’s also concentration risk. EastGroup has a strong regional focus in the Sunbelt, which has generally been a tailwind. However, any slowdown in these markets—be it economic or regulatory—could affect demand for its properties. It’s a calculated focus, not a flaw, but it still represents a degree of exposure investors should be aware of.

In terms of operations, the company’s success has been fueled by demand from logistics, manufacturing, and e-commerce. Should any of those sectors slow significantly, leasing activity could soften. There are no immediate red flags here, but market shifts could alter tenant behavior or expansion plans, especially if supply grows faster than demand in key markets.

Lastly, while the dividend is well supported by funds from operations, the payout ratio based on net income appears high. For REITs, this isn’t uncommon, as depreciation masks true cash earnings. Still, it’s a factor worth watching, especially during prolonged economic slowdowns or unexpected disruptions.

Final Thoughts

EastGroup Properties continues to reflect the traits of a company built for the long term: experienced leadership, consistent performance, and a focused approach to real estate that doesn’t chase trends. Its commitment to disciplined growth and operational efficiency has allowed it to thrive in both calm and uncertain markets.

The current share price, while off its highs, offers a potentially more attractive entry point for those who value steady income and a clear strategic direction. Its valuation reflects the quality of the underlying portfolio and the strength of its tenant base. With strong fundamentals, a reliable dividend, and a focused pipeline of development, EastGroup remains well-positioned to manage through short-term pressures while continuing to deliver for long-term investors.

Its formula isn’t flashy, but it’s effective: stay focused, invest wisely, and return capital to shareholders. That approach has worked well for years, and there’s little indication the company plans to change course.