Key Takeaways

💸 EWBC offers a 2.81% forward dividend yield with steady annual growth around 6%, backed by a low 26.85% payout ratio that leaves room for future increases.

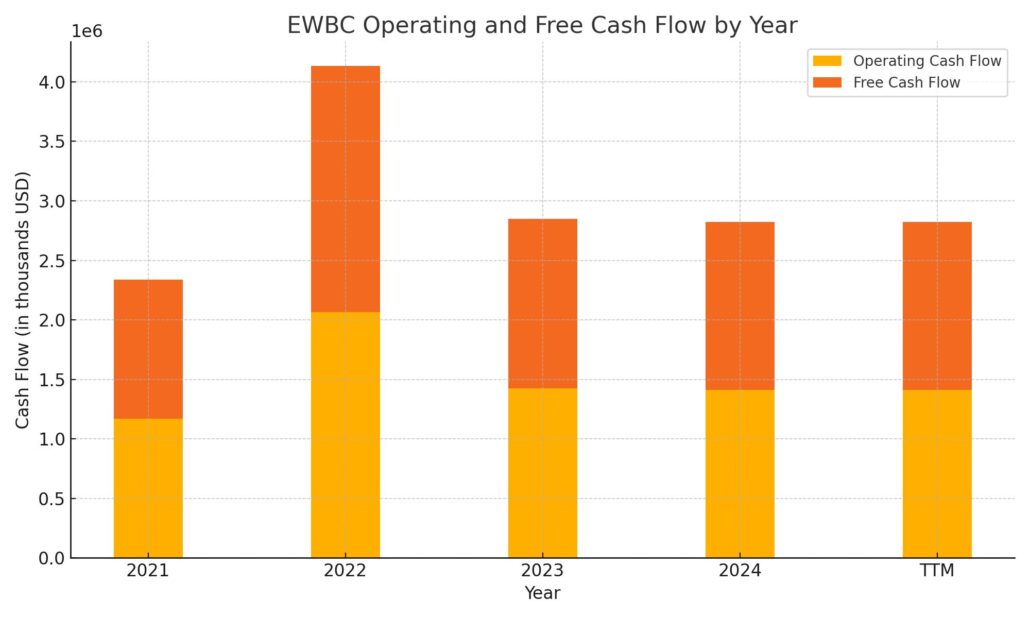

💼 Operating and free cash flow totaled $1.41 billion over the trailing twelve months, with cash reserves growing to over $5.2 billion, reflecting strong liquidity and disciplined capital use.

📊 Analyst sentiment is mixed, with a consensus price target of $105.75 and recent adjustments ranging from $90 to $110, reflecting sector caution but confidence in the bank’s fundamentals.

📈 First quarter earnings showed $2.08 EPS and record revenue of $693 million, with loan growth, expanding margins, and healthy asset quality reinforcing a stable forward outlook.

Last Update: 5/1/25

East West Bancorp (EWBC), headquartered in Pasadena, California, has built a reputation for disciplined growth, strong credit quality, and a steady focus on cross-border banking. With deep ties to U.S.-Asia commerce and a conservative lending approach, the bank has maintained solid performance through shifting market conditions.

Recent results reflect that strength—$2.08 in quarterly EPS, $1.4 billion in operating cash flow, and a return on equity near 16%. The stock trades around $85 with a forward P/E under 10 and offers a 2.81% yield, supported by a low payout ratio and consistent dividend growth.

Recent Events

East West Bancorp’s most recent quarter showed signs of strength and resilience. Earnings per share came in at $8.38 for the trailing twelve months, with net income just over $1.17 billion. Revenue grew modestly at 3.6% year-over-year, which might not sound like much until you realize how many banks are watching revenues slip in a higher-rate environment.

One of the more reassuring numbers was the bank’s liquidity. East West finished the quarter with nearly $4 billion in cash, essentially covering its entire debt load. That one-to-one cash-to-debt ratio speaks volumes about how conservatively this business is run. While some peers have scrambled to shore up deposits or raise capital, EWBC hasn’t blinked.

The stock has also been on the move. After touching a low near $68 in the past year, shares have clawed back into the mid-$80s. That’s a solid bounce, and while it hasn’t returned to last year’s high of $113, the trend is headed in the right direction. Investors seem to be recognizing the bank’s staying power, even if market sentiment toward regional banks remains a bit cautious.

In terms of timing, the next dividend is just around the corner. The ex-dividend date lands on May 2, with the actual payout set for May 16. For anyone already holding shares or looking to capture the next check, that’s a useful marker.

Key Dividend Metrics

📈 Forward Yield: 2.81%

💵 Annual Dividend Rate: $2.40

📆 Ex-Dividend Date: May 2, 2025

📊 Payout Ratio: 26.85%

📉 5-Year Average Yield: 2.41%

🔁 Last Split: 2-for-1 (June 2004)

🧮 Trailing 12-Month Dividend Growth: 6.67%

🔐 Dividend Safety Score (estimated): High, with strong earnings coverage and balance sheet support

These numbers don’t tell the full story on their own, but taken together, they form a clear picture: East West isn’t just maintaining its dividend—it’s building on it in a way that feels deliberate and sustainable.

Dividend Overview

Right now, East West Bancorp is paying out an annual dividend of $2.40, which gives it a forward yield of 2.81%. That’s a bit higher than its five-year average of 2.41%, and it reflects a combination of dividend growth and a stock price that’s still recovering from last year’s regional bank pullback.

This isn’t a flashy high-yield name. You’re not going to see 6% or 7% yields here. What you do get is consistency. The dividend has been paid quarterly without interruption, even through the pandemic. No pauses. No cuts. Just steady checks in the mail—or your brokerage account.

The low payout ratio of about 27% is also a big green flag. It tells us the company is using less than a third of its earnings to cover the dividend. That’s a wide margin for safety, which gives management plenty of room to navigate any bumps in the economy without putting the dividend at risk.

Dividend Growth and Safety

Over the last five years, EWBC has quietly delivered dividend increases in the ballpark of 6% to 7% annually. It’s not explosive growth, but it’s reliable. And that kind of upward movement—especially when it comes with a modest payout ratio and strong profitability—tends to add up over time.

Return on equity currently stands at a healthy 15.66%, while return on assets is just under 1.6%. Both metrics point to efficient use of capital, especially important for a bank that doesn’t rely on excessive leverage. Even without a flashy growth story, the underlying machine is working exactly as it should.

Cash levels are solid. With nearly $4 billion on hand and debt sitting just below that, the balance sheet isn’t stretched. That’s not always the case in regional banking, where some names are still dealing with unrealized bond losses or stressed deposit bases. East West, on the other hand, seems to be playing offense while others are stuck on defense.

Ownership is also something worth noting. Institutional investors hold more than 92% of the float, which keeps management accountable. This is the kind of shareholder base that watches dividends closely, and any whiff of unreliability would trigger immediate consequences. That dynamic creates another layer of confidence in the bank’s dividend commitment.

One more point worth calling out: East West hasn’t done a stock split since 2004. While that might seem like trivia, it actually tells you something about the bank’s long-term trajectory. A steady climb in the share price, even without frequent corporate moves, usually means the business is growing the right way—by earning more, lending better, and rewarding shareholders in a measured, durable fashion.

Cash Flow Statement

East West Bancorp generated $1.41 billion in operating cash flow over the trailing twelve months, essentially matching its total free cash flow. That’s a sign of clean accounting and minimal capital expenditure drag, which is rare and welcome in today’s market. While slightly down from the highs of 2021, this level of cash flow still represents strong internal generation and points to a well-run lending operation with consistent inflows.

On the investing side, the bank saw outflows of more than $6.2 billion, continuing a multi-year trend of aggressive deployment into securities and loan growth. Financing activity was robust, with $5.5 billion flowing in, driven mostly by $4 billion in new debt issuance. Even after absorbing those investment outflows, East West’s cash position improved to $5.25 billion, its highest year-end figure in the past five years. This liquidity build reinforces the company’s ability to support its dividend, weather tighter credit conditions, or capitalize on lending opportunities.

Analyst Ratings

East West Bancorp has attracted fresh attention from analysts lately, with recent moves reflecting a mix of optimism and growing caution. 🟡 Morgan Stanley lowered its rating on the stock from Overweight to Equal-Weight and dropped its price target from $118 to $90. The shift came as the firm revised its expectations for loan growth downward, now forecasting just 3% for 2025—below management’s guidance of 4% to 6%. They also flagged a potential rise in net charge-offs, anticipating they may reach the high end of the company’s expected range. 📉

Not everyone shares the same cautious tone. 🟢 Barclays bumped its price target up from $105 to $110, pointing to stronger-than-expected quarterly earnings and steady forward guidance despite broader market concerns about East West’s cross-border exposure. 🟢 DA Davidson followed suit by maintaining a Buy rating and adjusting its target to $100, while Wells Fargo trimmed its target to $100 but reiterated an Overweight rating. These perspectives underscore a broader recognition of the bank’s sound operations, even as macro factors create pockets of uncertainty.

Across the board, the consensus 12-month price target now averages around $105.75. 🎯 With the stock trading near $86, analysts are still projecting roughly 16% upside, suggesting that while the tone has become more nuanced, confidence in East West Bancorp’s long-term fundamentals remains intact.

Earning Report Summary

East West Bancorp started 2025 on a strong note, posting results that reflected both solid execution and a careful eye on the broader economic environment. The first quarter showed that the bank is still finding ways to grow, even as the rate cycle continues to evolve and pressure builds across parts of the banking sector.

Strong Profitability and Revenue Growth

Net income came in at $290 million for the quarter, which worked out to $2.08 per share. It wasn’t a huge surprise, but it was still a nice beat. Total revenue reached $693 million, and the majority of that came from interest income—no surprise given the current rate environment. What stood out was the uptick in net interest margin, which rose to 3.35%. That kind of movement isn’t always easy to come by when deposit costs are creeping up, but East West managed to expand margins by carefully managing its funding and loan mix.

They also saw nice traction in fee income, which hit a new record. That speaks to the breadth of customer activity and suggests that clients are still engaging across a wide range of services, not just borrowing.

Loan and Deposit Trends

Loan growth continued, with the portfolio climbing by over half a billion dollars during the quarter to hit $54 billion. Much of that growth came from residential mortgages and commercial real estate, both areas where East West has longstanding relationships and expertise.

On the deposit side, they ran a Lunar New Year CD promotion that did better than expected, helping keep funding costs stable while holding onto client balances. In a climate where deposit flight has been a major concern for regional banks, that kind of stability carries real weight.

Credit Quality Holding Up

One area management clearly isn’t compromising on is credit quality. Net charge-offs remained low at 0.12% of average loans, and the ratio of non-performing assets came in at just 0.24%. Those numbers tell you this isn’t a bank chasing growth at the expense of discipline. They also added a little more to the loan loss reserves, bumping the allowance to 1.35%, which shows a cautious stance without sounding alarm bells.

Leadership Outlook

CEO Dominic Ng was upbeat but grounded in his comments. He emphasized the bank’s balanced exposure and highlighted how many clients have taken steps to insulate themselves from global uncertainty, including rethinking supply chains over the last few years. That kind of forward-looking adjustment from their customer base gives East West more confidence heading into the rest of the year.

Looking forward, the message was pretty clear: the bank expects continued growth in interest income and plans to stick with a conservative approach to managing risk. With a strong capital base and thoughtful execution, East West seems well-positioned to keep delivering—even if the economy gets a bit bumpier from here.

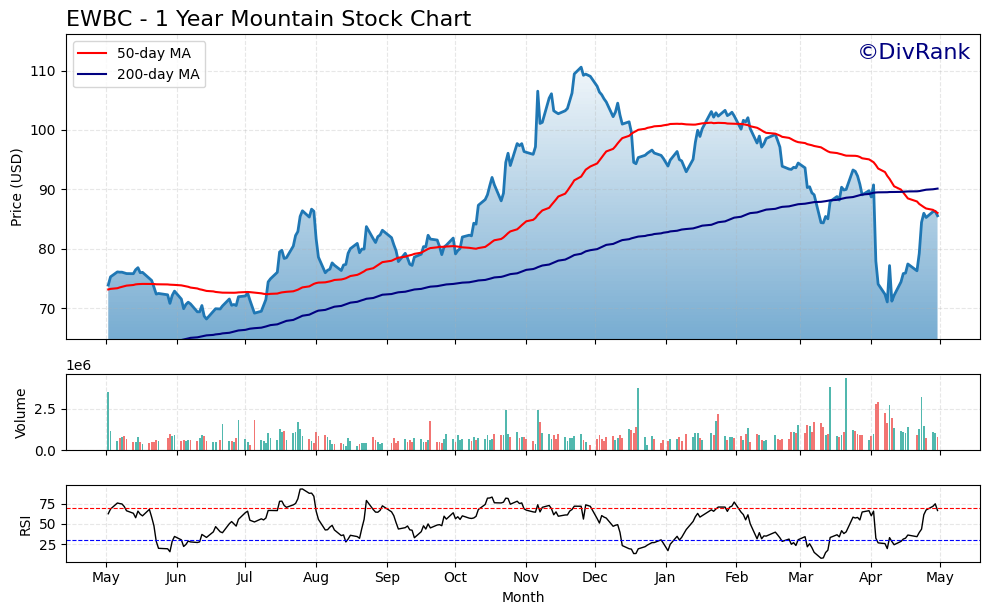

Chart Analysis

East West Bancorp (EWBC) has had a dynamic 12 months, and this chart paints a clear picture of shifting momentum, sentiment, and price strength. The overall pattern suggests a stock that experienced a strong run-up in the back half of 2023 before pulling back and attempting to stabilize more recently.

Price Action and Moving Averages

From early summer through late fall, EWBC climbed steadily, breaking through the $100 level by November. The price moved well above both the 50-day (red) and 200-day (blue) moving averages during this stretch, signaling strong momentum. The 50-day MA remained sharply upward-sloping until late January 2024, showing the kind of sustained buying that tends to attract longer-term attention.

However, that momentum started to fade in early 2024. The price began to flatten and eventually roll over in February and March. The 50-day moving average crossed below the 200-day MA in April—a bearish crossover that typically reflects softening sentiment or expectations. The chart shows EWBC recently bounced off the $70 range in mid-April and has since rallied back toward $85, but it’s now struggling right at the 200-day average. That zone could act as short-term resistance.

Volume and Buying Pressure

Looking at the volume profile, there’s no huge spike that stands out apart from a few bursts in April—likely tied to earnings or broader market volatility. What’s notable is that many of the high-volume days came on downswings, particularly during the sharp pullback in early April. That suggests some aggressive selling pressure, followed by renewed interest as the stock found its footing again.

The volume in the last two weeks has been more balanced, indicating that traders and investors may be reassessing positions rather than rushing to exit or aggressively accumulate.

RSI and Momentum

The RSI (Relative Strength Index) dipped below 30 in April, marking a brief period where the stock was clearly oversold. That coincided with the bounce off the April low, which looks like a textbook reaction to a sharp drawdown. Since then, the RSI has pushed back above 70, suggesting that the recent recovery has been strong enough to shift momentum back to the upside.

This kind of sharp RSI rebound doesn’t always hold, but it does indicate renewed buying interest. What happens next at the 200-day moving average may determine whether this is a new uptrend or just a temporary relief rally.

Broader Structure

When you zoom out, the chart reflects what looks like a completed markup phase in late 2023, followed by a period of distribution and now potential markdown. The recent rally could mark the start of a new accumulation zone, but the price needs to hold above key support levels and reclaim the moving averages to confirm that shift.

For now, EWBC is in a testing phase—battling to prove it can regain its previous strength. The setup suggests the next few weeks will be key in determining whether the stock transitions back into an uptrend or continues to trade in a wider consolidation range.

Management Team

Leading East West Bancorp is Dominic Ng, who has served as Chairman and CEO for over 20 years. During his tenure, the bank has grown from a niche lender into a major regional player with a national footprint and deep international ties. Ng’s leadership style is pragmatic and long-term focused. He brings a background in accounting and global finance, which has helped the bank stay measured in its growth while navigating through various market cycles.

The rest of the leadership team reflects that same disciplined mindset. Rather than chasing rapid expansion, they’ve emphasized high-quality lending and client relationships. Their approach has helped the bank avoid the kinds of missteps that have caught other regional banks off guard. Communication from the executive team is typically cautious but transparent. They’re quick to acknowledge risks without dramatizing them, and when conditions improve, they don’t overhype the upside. It’s a straightforward, no-nonsense style that fits the company’s operating culture.

Valuation and Stock Performance

East West Bancorp’s stock currently trades around $85, after bouncing back from a low near $68 earlier this year. It’s still below its 52-week high above $110, but the recovery has been meaningful. That rebound signals renewed investor confidence, especially as the bank continues to report steady earnings and maintain its dividend.

From a valuation perspective, EWBC looks attractively priced. The forward price-to-earnings ratio is under 10, and the trailing P/E is just over 10. That puts it well below the broader market average and suggests the stock isn’t getting full credit for its performance. These kinds of valuations tend to reflect broader concerns about the banking sector rather than issues specific to East West itself.

The price-to-book ratio sits at 1.49, which remains reasonable given the company’s return on equity of nearly 16 percent. It’s the kind of number that tells you the stock still has room to rerate if sentiment toward the sector improves. For investors who prioritize earnings consistency and capital discipline, it’s an appealing setup.

Over the longer term, EWBC has done a good job of delivering value to shareholders. The stock has outperformed many regional peers over the last five years, even through a series of economic challenges. That kind of track record comes from stable leadership, a clear business model, and the ability to avoid big mistakes in tough environments.

Risks and Considerations

While the fundamentals are strong, there are risks worth monitoring. One of the more unique considerations is the bank’s international focus. East West has deep ties to Asian markets and serves many clients involved in cross-border commerce. This is a strength in stable times but could become more complex if geopolitical tensions escalate or if there are new trade restrictions. Any major shift in U.S.-China relations could influence portions of the bank’s loan book.

Credit risk is another factor. Although asset quality remains solid, and charge-offs are low, a broader economic downturn could still put pressure on commercial real estate and small business lending. The bank has increased its loan loss reserves slightly, which shows they’re preparing for uncertainty without expecting the worst.

Liquidity and deposit costs are also areas to watch. So far, East West has managed both quite well, even as many banks have struggled to retain customer deposits without raising rates too aggressively. The bank’s recent deposit campaigns have been effective, but the competition for funding remains intense.

Lastly, the regulatory environment is always evolving. With heightened scrutiny on regional banks, compliance costs could rise, and new rules may require higher capital buffers. East West appears to be well capitalized today, but a more aggressive regulatory stance could squeeze future returns.

Final Thoughts

East West Bancorp doesn’t overcomplicate its business. It sticks to a focused model, builds long-term client relationships, and makes decisions with a conservative mindset. That clarity has allowed the bank to operate consistently, even during periods of volatility, and it’s one of the reasons it continues to stand out in a crowded field.

The fundamentals tell a clear story. Earnings are strong. Capital is healthy. The dividend is well-covered and has been growing steadily. And the stock trades at a valuation that still looks reasonable, if not outright discounted, relative to its long-term performance.

The market may still be catching up to the reality of how well East West is positioned. While broader concerns about regional banks linger, this one continues to show that it knows how to operate through different market environments. For investors who value a steady hand and a reliable income stream, it remains a name worth knowing.