Key Takeaways

📈 Duke’s dividend yield sits at 3.30%, with the quarterly payout raised to $1.065 in August 2025 and a payout ratio of 66.88% that reflects a healthier earnings base.

💵 Operating cash flow reached $12.3 billion in the trailing twelve months, with free cash flow of $10.8 billion representing a dramatic improvement from prior years.

🧐 Analysts hold a consensus buy rating across 17 firms, with a mean price target of $136.24 and a high target of $146.00, suggesting meaningful upside from current levels.

📊 Full-year EPS came in at $6.31, tracking above the company’s previously stated guidance range and supporting continued confidence in Duke’s long-term earnings trajectory.

Updated 2/25/26

Duke Energy (DUK) serves over 8 million customers across the Southeast and Midwest, with a strong base in regulated electric and gas utilities. Under CEO Harry Sideris, the company remains focused on reliability, clean energy investments, and steady shareholder returns as it continues to execute on a multiyear infrastructure plan.

In the trailing twelve months, Duke reported $6.31 in earnings per share against revenue of $32.2 billion, with operating cash flow of $12.3 billion underscoring the strength of its regulated operations. Shares are trading near their 52-week high of $130.03, reflecting sustained investor confidence in Duke’s earnings consistency and dividend profile.

Recent Events

Duke Energy has been active on several fronts heading into early 2026. The company has continued to advance its capital investment program across the Carolinas and Florida, with ongoing grid modernization projects and renewable energy additions moving through regulatory approval processes in multiple states. Duke’s infrastructure buildout, which targets tens of billions in capital expenditures through the end of the decade, remains central to its growth story and has attracted steady attention from utility-focused institutional investors.

On the regulatory front, Duke has been engaged with state commissions regarding rate cases designed to recover costs associated with grid hardening and clean energy transition investments. These proceedings are a routine but important part of how Duke translates capital spending into earnings growth, and the outcomes will shape near-term profitability across its key operating territories.

The company’s data center load growth story has also gained traction with investors. Duke’s service territory in the Carolinas and broader Southeast has become a focal point for large technology and manufacturing customers seeking reliable power, and that demand tailwind is increasingly cited by management as a structural driver of electricity consumption growth over the coming decade.

Duke’s stock has been trading near the top of its 52-week range of $111.22 to $130.03, reflecting both the sector’s renewed appeal as interest rate pressures have moderated and the company’s own execution on earnings and dividends. With a beta of 0.51, Duke continues to offer the kind of low-volatility price behavior that income investors prize during uncertain market cycles.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.30%

💵 Annual Dividend: $4.26 per share

📆 Most Recent Dividend Payment: February 13, 2026

🪙 Payout Ratio: 66.88%

🕰️ 5-Year Average Dividend Yield: 4.01%

📊 Last Quarterly Dividend: $1.065 per share

🧾 Dividend Growth Rate (5Y CAGR): Approximately 2–3% annually

🔢 Consecutive Years of Dividend Growth: 20+

Dividend Overview

Duke’s dividend continues to do what it has always done, show up reliably and grow at a modest but consistent pace. The current annual payout of $4.26 per share represents a yield of 3.30% at today’s price of $128.46, which sits slightly below the company’s five-year average yield of around 4.01%. That gap is largely a function of price appreciation rather than any weakening in the dividend itself, as the stock’s climb toward its 52-week high has compressed the yield from where it stood a year ago.

The payout ratio of 66.88% is notably more comfortable than the 72% range discussed in prior reports, a direct reflection of earnings growth outpacing dividend increases. For a regulated utility, a payout ratio in this range is well within the zone of sustainability. Duke isn’t stretching to pay its dividend, and the underlying cash flow generation more than supports continued distributions at the current level and beyond.

The foundation of Duke’s dividend reliability remains unchanged. Regulated utilities operate in a world of predictable demand and cost recovery mechanisms that translate into stable, repeatable earnings. Duke’s territory, spanning the Carolinas, Florida, Indiana, Ohio, and Kentucky, encompasses a growing population base with increasing electricity needs. That combination of regulatory structure and demand growth is exactly the kind of backdrop that allows a company to maintain and extend a long dividend growth streak without straining its financial resources.

Duke has now raised its dividend for more than 20 consecutive years. That streak reflects a management philosophy built around shareholder consistency and a business model that can sustain it across economic cycles, rate environments, and energy transitions alike.

Dividend Growth and Safety

The dividend growth trajectory at Duke remains measured and deliberate. Looking at the recent history, the quarterly payout moved from $1.005 in early 2023 to $1.025 later that year, then to $1.045 in mid-2024, and most recently to $1.065 beginning with the August 2025 payment. Each step represents an incremental increase that, annualized, runs in the 2% to 3% range. That pace is unlikely to draw excitement from growth-oriented investors, but for income investors building a portfolio of compounding dividend streams, it represents reliable real purchasing power preservation.

What has changed notably from prior periods is the free cash flow picture. Free cash flow now stands at $10.8 billion on a trailing basis, compared to the slim positive reading and prior years of negative levered free cash flow discussed in earlier reports. This is a meaningful shift and suggests that Duke’s heavy capital spending cycle, while ongoing, is being increasingly absorbed by a stronger earnings and operating cash base. Operating cash flow of $12.3 billion provides ample coverage for the dividend even after accounting for significant ongoing infrastructure investment.

The payout ratio of 66.88% reinforces that dividend safety is in better shape than it appeared in 2024. Earnings per share of $6.31 against an annual dividend of $4.26 leaves a comfortable buffer, and that coverage ratio has improved meaningfully as earnings have grown. Duke is not a company that needs to choose between investing in its system and paying its shareholders, at least not at current levels.

Institutional ownership remains a strong signal of market confidence in Duke’s durability as an income investment. Large holders continue to treat the stock as a core position within utility and dividend-focused mandates, a dynamic that tends to support price stability and reflects the kind of long-duration investor base that values consistency over catalysts.

Cash Flow Statement

Duke Energy’s trailing twelve-month cash flow profile represents a notable step forward in financial quality. Operating cash flow of $12.3 billion is consistent with the prior-year level, demonstrating that the company’s regulated operations continue to generate predictable and substantial cash inflows regardless of the broader macroeconomic backdrop. That stability is exactly what the utility model is supposed to produce, and Duke is delivering on it.

The more striking development is on the free cash flow line, which now stands at $10.8 billion. This represents a dramatic improvement from prior periods when heavy capital spending was consistently pushing free cash flow into negative territory. The improvement reflects a combination of strong operating performance and the natural evolution of a multiyear capital program that is now generating returns while the spending base has become more predictable and manageable. For dividend investors, a company producing $10.8 billion in free cash flow against an annual dividend obligation measured in the low billions is a reassuring picture. Return on equity of 9.72% and a profit margin of 15.41% round out a financial profile that speaks to efficient capital deployment within the regulated utility framework. Duke continues to rely on access to capital markets for its long-term financing needs, but its operating cash generation provides a strong internal foundation that reduces reliance on external funding for dividend support.

Chart Analysis

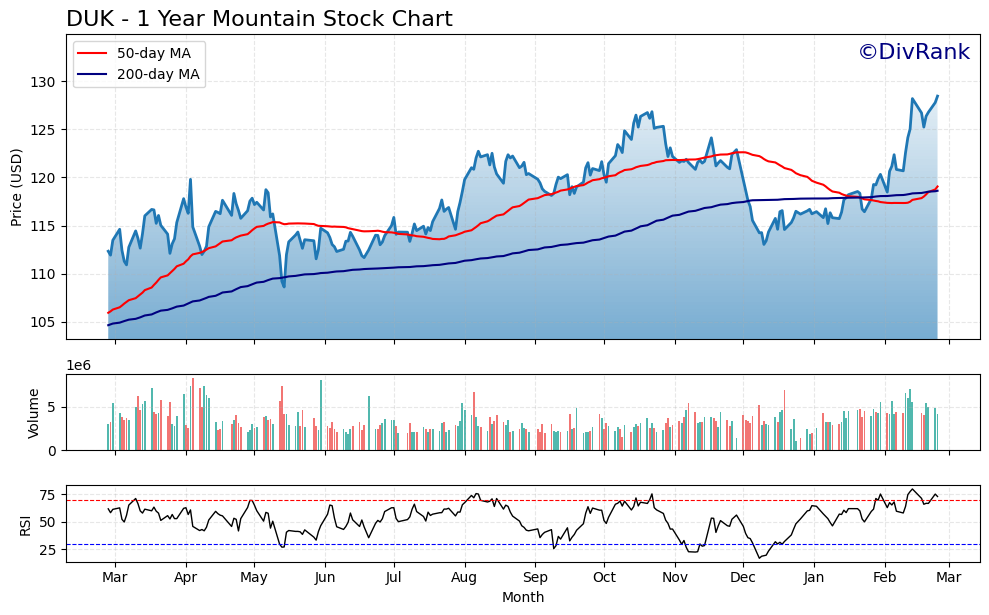

Duke Energy has had a strong run over the past twelve months, climbing from a 52-week low of $108.61 to its current price of $128.46, which also happens to be the 52-week high. That 18.27% gain from trough to peak is a meaningful move for a regulated utility, a sector that typically rewards patience over momentum. The stock has not simply drifted higher in a slow grind either. The price action reflects a sustained accumulation trend that has carried DUK well above where it traded for most of the prior year, and the fact that it is sitting precisely at its 52-week high today suggests buyers have shown no hesitation at higher levels.

The moving average picture reinforces that constructive view. DUK is trading above both its 50-day moving average of $119.07 and its 200-day moving average of $118.62, and the two averages are themselves in a bullish alignment, with the 50-day sitting above the 200-day in what technicians call a golden cross formation. The narrow spread between the two averages, less than fifty cents apart, tells you this crossover is relatively fresh, which historically signals the early-to-middle stages of a trend rather than its exhaustion. For a dividend investor, this kind of orderly technical structure is a reassuring backdrop, because it suggests the income stream is being supported by a price trend that is working in your favor rather than eroding your total return.

The one area that deserves attention is the current RSI reading of 72.87, which places DUK in technically overbought territory. A reading above 70 does not mean a reversal is imminent, but it does indicate that short-term buying enthusiasm has run well ahead of the stock’s recent average pace. Investors who are already holding shares and collecting the dividend have little to be concerned about here. Those considering a new position should be aware that initiating at the exact 52-week high with an elevated RSI carries the risk of a modest near-term pullback, which could present a better entry point at a modestly higher yield than today’s price offers.

The overall technical setup for DUK is objectively strong, and for a dividend growth investor the picture is broadly positive. The golden cross, the sustained trend above both moving averages, and the steady climb from last year’s lows all point to a stock with genuine underlying demand. The overbought RSI and the zero distance from the 52-week high are reasons for patience rather than alarm. Income-focused investors already in the position can hold comfortably. Those on the sidelines may find it worthwhile to wait for a cooling-off period that brings the RSI back below 65 and gives the moving averages time to catch up, turning any temporary weakness into an opportunity to buy a higher-quality yield than the current price affords.

Analyst Ratings

The analyst community is broadly constructive on Duke Energy heading into early 2026. Across 17 covering analysts, the consensus stands at buy, with a mean price target of $136.24 that implies approximately 6% upside from the current price of $128.46. The range of targets, from a low of $115.00 to a high of $146.00, reflects a spread of views on how aggressively the market should credit Duke’s data center load growth opportunity and its ongoing regulatory rate recovery, but the weight of opinion clearly leans positive.

At the current price near the top of its 52-week range, Duke is trading below the analyst consensus target, which suggests that even after a strong run, the stock has not yet fully priced in what the majority of analysts consider fair value. The $146.00 high target, held by the most bullish analyst in coverage, implies that a more aggressive re-rating is possible if Duke continues to execute on its infrastructure plan and benefits from accelerating electricity demand in its service territory.

The gap between the $115.00 low target and the current price of $128.46 indicates that some analysts remain cautious, likely weighing Duke’s debt load and the regulatory approval timeline against its earnings growth potential. That cautious minority does not dominate the conversation, but it is a reminder that not every analyst sees the current valuation as a straightforward entry point. On balance, the analyst setup for Duke is as supportive as it has been in some time, with a buy consensus and a mean target that gives the stock room to run.

Earning Report Summary

Strong Earnings Trajectory Into 2026

Duke Energy’s most recent full-year results reflect a company executing well against its financial targets. Earnings per share of $6.31 came in above the $6.17 to $6.42 guidance range midpoint that management had set heading into the year, representing meaningful growth from the $5.90 in adjusted EPS reported for 2024. Revenue reached $32.2 billion, and net income of $4.9 billion reflects a profit margin of 15.41%, a solid result for a capital-intensive regulated utility. The electric utilities and infrastructure segment continues to lead earnings contribution, supported by rate mechanisms and growing demand across Duke’s service territory.

Return on equity of 9.72% and return on assets of 2.81% are consistent with regulated utility norms, where capital allocation is disciplined by regulatory oversight rather than unconstrained growth. These metrics confirm that Duke is generating adequate returns on the substantial asset base it has assembled through years of infrastructure investment. The combination of revenue growth, controlled costs, and regulatory cost recovery mechanisms has allowed Duke to deliver earnings growth that tracks closely with its long-term 5% to 7% annual target.

Outlook and Strategic Direction

Under CEO Harry Sideris, Duke is pressing forward on the same strategic pillars that defined its prior leadership era: grid reliability, affordable rates, and a measured transition toward cleaner energy sources. The accelerating demand from data centers and large industrial customers in the Carolinas and broader Southeast has added a new growth dimension to what was already a solid regulated earnings base. Management has been increasingly vocal about the multi-decade electricity demand tailwind this represents for Duke’s service territory, and it is beginning to show up in the financial profile.

Capital spending plans remain ambitious, with Duke committed to significant annual investment in grid modernization, generation additions, and infrastructure hardening over the remainder of the decade. That spending will continue to weigh on near-term free cash flow in absolute terms, but the improved earnings base and stronger operating cash generation mean the company is better positioned to absorb that investment than it was in prior years. The long-term earnings growth target of 5% to 7% annually through 2029 remains in place, and current results suggest Duke is tracking to meet it.

Management Team

Harry Sideris is now firmly established as Duke Energy’s CEO, having stepped into the role following the departure of longtime leader Lynn Good. Sideris brings more than two decades of internal experience to the position, having worked across operations, customer service, and executive leadership within the company. His approach is one of operational continuity, maintaining Duke’s commitment to reliable service and steady shareholder returns while pushing forward on the energy transition agenda that defines the utility sector’s current moment.

The broader leadership team reflects the same philosophy. Duke’s executives are long-tenured operators who understand the regulatory landscape, the infrastructure demands of a large multistate utility, and the expectations of an investor base that prizes predictability. There is no appetite here for dramatic strategic pivots or speculative bets. The focus is on executing the capital plan, maintaining constructive regulatory relationships, and delivering the earnings growth that supports continued dividend increases.

That measured, process-driven management style has historically been well suited to Duke’s business model. Regulated utilities reward consistent execution far more than bold vision, and Duke’s team has demonstrated the discipline to stay the course through interest rate cycles, energy policy shifts, and major operational challenges. Investors holding Duke for income have every reason to expect that culture to continue under the current leadership structure.

Valuation and Stock Performance

Duke Energy is trading at $128.46, sitting near the top of its 52-week range of $111.22 to $130.03. The current price-to-earnings ratio of 20.36 reflects a modest premium to historical utility valuations, but it is not an unreasonable multiple for a company with Duke’s earnings visibility, dividend growth record, and strategic positioning in a high-demand service territory. Investors are willing to pay for predictability, and at a P/E just above 20, the market is pricing in continued earnings growth without demanding a speculative premium.

The price-to-book ratio of 1.96 against a book value per share of $65.38 is consistent with where well-regarded regulated utilities tend to trade. Duke is not cheap on this measure, but it is not stretched either, particularly given the returns on equity and assets the company is generating within the regulatory framework it operates under. Market capitalization has crossed $99.9 billion, placing Duke firmly in the large-cap utility category where institutional demand for income and stability tends to be structural rather than tactical.

The dividend yield of 3.30% sits below Duke’s five-year average of around 4.01%, which is a natural consequence of the stock’s price appreciation over the past year. Investors buying at today’s price are accepting a lower starting yield in exchange for a business that has demonstrated both earnings growth and dividend growth over a long period. The analyst consensus target of $136.24 suggests the stock has room to appreciate further while still delivering income, a combination that keeps Duke competitive within a diversified dividend growth portfolio.

Risks and Considerations

Duke’s balance sheet remains a primary consideration for any investor. The company carries a substantial debt load, and while the utility sector routinely operates with elevated leverage, interest rate movements have a direct impact on Duke’s cost of capital and refinancing expenses. The improvement in free cash flow is encouraging, but the company’s ongoing capital spending program means it will continue to rely on debt markets for a portion of its funding needs. Any sustained rise in long-term interest rates could pressure earnings and narrow the spread between Duke’s cost of capital and its regulated returns.

Regulatory risk is an ever-present reality for a multistate utility. Duke’s ability to recover infrastructure costs and earn a fair return on its investments depends on constructive outcomes in rate cases across the Carolinas, Florida, Indiana, and its other operating jurisdictions. Regulators in any of these states could push back on rate increases, disallow certain capital expenditures, or impose conditions that reduce the financial returns on Duke’s investment program. While Duke’s regulatory relationships have generally been productive, that dynamic requires continuous management and can shift with changes in political leadership or public utility commission composition.

The clean energy transition carries financial and execution risk that will play out over many years. Retiring older generating assets, integrating renewables at scale, and managing the grid reliability implications of a changing generation mix all require precise planning and substantial capital. Delays in project completion, cost overruns, or adverse changes in federal energy policy could affect the timeline and economics of Duke’s transition plan, potentially creating earnings volatility or impacting the rate recovery calculus with regulators.

Weather and climate-related operational risks deserve ongoing attention. Duke’s service territory is exposed to Atlantic hurricane activity, severe winter weather, and the infrastructure stress that comes with extreme temperature events. These episodes can increase operating costs, create capital needs outside the planned budget, and strain customer relationships in ways that complicate regulatory proceedings. Duke has invested significantly in grid hardening, but the physical risks of operating a large utility in storm-prone regions remain a genuine consideration for long-term holders.

Final Thoughts

Duke Energy enters 2026 in a strong position. Earnings have grown, the dividend has been raised, free cash flow has improved dramatically, and the analyst community is broadly constructive on the stock’s prospects. The company is executing on its infrastructure plan, benefiting from structural electricity demand growth in its service territory, and maintaining the financial discipline that has defined its approach to shareholder returns for more than two decades.

The stock’s proximity to its 52-week high suggests the market has already recognized much of this progress, which means new buyers are not getting a deep value entry point. But Duke has never been a stock that rewards investors through price discovery alone. The appeal is the combination of a durable and growing dividend, low volatility, and a business model that generates predictable cash flows across market cycles. At a P/E of 20.36 and a yield of 3.30%, that combination remains reasonably priced for what Duke delivers.

The risks around debt, regulation, and energy transition are real and should be monitored, but none of them represent a structural threat to the dividend or the earnings trajectory over a reasonable holding period. Duke is the kind of company that income investors hold for years, reinvesting dividends and allowing the compounding process to work. Nothing in the current setup changes that fundamental calculus.