Key Takeaways

💰 Dividend yield sits at 1.64% with a low 31% payout ratio and consistent growth near 6% annually, reflecting a steady and sustainable income stream.

💵 Free cash flow remains strong at $345.8 million TTM, comfortably covering dividend payments and showing disciplined capital spending.

📊 Analysts hold a consensus rating of Hold with a $71.33 price target, reflecting cautious optimism amid modest short-term headwinds.

📈 Most recent earnings showed adjusted EPS growth despite a slight dip in revenue, with management maintaining margin strength and reaffirming full-year confidence.

Last Update: 5/1/25

Donaldson Company, Inc. (DCI) has built a century-long track record on consistency, innovation in filtration solutions, and disciplined capital management. With operations spanning mobile, industrial, and life sciences markets, the company delivers steady performance through changing cycles. Its leadership team, led by CEO Tod Carpenter, emphasizes long-term value creation, focusing on high-return investments and conservative financial stewardship.

Over the past year, DCI has faced some near-term softness, including a modest decline in revenue and earnings, but it continues to post strong margins, high return on equity, and solid free cash flow. The dividend remains well-supported with a low payout ratio and a steady history of increases. Recent analyst targets reflect cautious optimism, and while the stock has pulled back from recent highs, its valuation now sits at more reasonable levels. For investors focused on durable cash flow and shareholder returns, DCI presents a consistent, well-managed option with room to grow.

Recent Events

Over the last year, the stock has experienced a modest retreat. Shares are down around 10% from their 52-week highs, with the stock currently trading in the mid-$60s. Not a dramatic fall, but enough to catch the attention of value-focused investors. Despite the dip, the fundamentals haven’t unraveled—revenues slipped slightly, down 0.8% year-over-year, and earnings growth also nudged into negative territory at -2.8%.

What’s happening here isn’t a turnaround story or a warning sign. It’s more like a pause. The filtration industry is cyclical, and some softness in industrial activity can drag on short-term numbers. Still, Donaldson has kept margins relatively stable, with EBITDA coming in around $656 million and an operating margin near 15%. This is a business still running smoothly, just without the tailwinds that helped boost performance in prior quarters.

In terms of valuation, Donaldson is looking more reasonably priced than it has in a while. The forward P/E has drifted down to 16.3, below historical averages and suggesting the market has dialed back expectations. For long-term investors, this could be a sign that the stock has returned to more attractive levels.

Key Dividend Metrics 📊

🧾 Forward Dividend Yield: 1.64%

💸 Forward Annual Dividend: $1.08 per share

📈 5-Year Average Yield: 1.53%

🛡️ Payout Ratio: 30.99%

📆 Next Dividend Date: February 28, 2025

📅 Ex-Dividend Date: February 13, 2025

🔁 Dividend Streak: 28+ years of uninterrupted payments

📊 Dividend CAGR (5-Year): around 5.9%

🚀 Dividend Coverage: Excellent, supported by strong cash flow

Dividend Overview

Donaldson’s dividend may not jump off the page with a high yield, but it has all the signs of reliability. At 1.64%, the current yield sits a bit above its five-year average, which tells you one important thing: this could be a decent moment to take a closer look. When a dividend yield is running above its norm, it can mean the stock is undervalued or simply going through a soft patch that hasn’t shaken the company’s long-term stability.

What’s key here is sustainability. The company is only paying out about 31% of its earnings in dividends. That’s a very conservative number, and it means there’s room to grow the payout without putting strain on the business. It also signals that management is being careful—something income-focused investors can appreciate.

Donaldson isn’t just consistent; it’s a quiet achiever. The company has paid dividends for nearly three decades without interruption. Even better, they’ve raised that dividend every year for the past 12 years. That kind of track record builds trust. For shareholders relying on dividends as part of their retirement income or portfolio stability, it’s the kind of performance you can bank on.

Dividend Growth and Safety

If you’re more interested in dividend growth than just a high yield, Donaldson still fits the bill. Over the past five years, the dividend has been climbing at a pace of nearly 6% annually. It’s not explosive growth, but it’s the kind you can count on—and it hasn’t come at the expense of the balance sheet.

The company is in a strong financial position. Total debt is under $600 million, with a debt-to-equity ratio below 40%. It also holds close to $190 million in cash, and the current ratio is a healthy 1.86. These are signals of financial discipline, not signs of overreach.

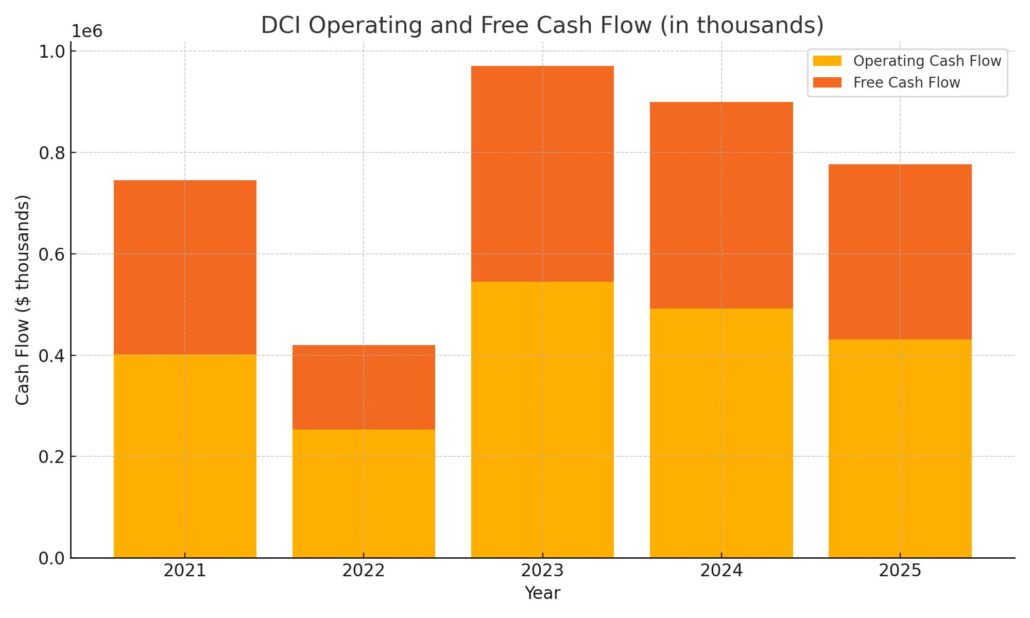

Free cash flow is another important piece of the puzzle. Donaldson generated over $430 million in operating cash flow and nearly $335 million in free cash flow. That means even after all capital expenditures, the company has more than enough cushion to keep paying and growing its dividend.

Returns on capital are equally solid. Return on equity is nearly 29%, and return on assets is above 12%. These numbers point to a business that not only protects investor capital but also puts it to good use. Donaldson isn’t just preserving wealth—it’s steadily compounding it.

Management hasn’t hinted at any big changes to the dividend policy, and that’s probably a good thing. Their approach has always been measured—raise the dividend a bit each year, keep the payout ratio modest, and use the remaining cash to reinvest or buy back shares. That discipline is part of what makes Donaldson attractive to long-term dividend investors.

The bottom line is this: Donaldson’s dividend doesn’t scream for attention, but it doesn’t have to. It quietly does its job—year in, year out—and that’s exactly the kind of consistency many investors are looking for in their income-generating portfolios.

Cash Flow Statement

Donaldson’s trailing twelve-month cash flow paints a picture of stability, with operating cash flow coming in at $430.8 million. While this reflects a decrease from last year’s $492.5 million, it’s still comfortably above levels from earlier fiscal periods. The company’s ability to consistently generate cash from operations—even in a slightly softer revenue environment—underscores the resilience of its business model. Capital expenditures held steady at $85 million, which is right in line with historical norms, and left free cash flow at a healthy $345.8 million.

On the financing side, Donaldson remained conservative. The company repaid $160.1 million in debt, continuing its steady deleveraging trend, and returned another $157.7 million to shareholders via stock buybacks. Total cash outflows from financing hit $272.7 million. Despite these significant uses of capital, the company maintained a strong cash balance of $194.4 million at period-end. It’s clear that management is prioritizing flexibility, supporting the dividend, and investing just enough to keep operations efficient while avoiding unnecessary risk.

Analyst Ratings

📉 Donaldson Company, Inc. (NYSE: DCI) has recently seen a shift in sentiment from analysts, with a few downward revisions to price targets reflecting a more cautious stance. Stifel Nicolaus trimmed its target from $70 to $63, keeping a neutral outlook. The reasoning centered around expected softness in earnings and an overall slowdown in industrial demand, particularly in end markets that Donaldson services through its Mobile Solutions segment.

📊 Morgan Stanley followed suit, pulling back its target slightly from $68 to $65. Their note pointed to restrained revenue growth expectations and the continued lag in contribution from the company’s newer Life Sciences segment, which hasn’t yet delivered the margin expansion originally projected. While these revisions reflect shorter-term concerns, they don’t suggest a fundamental breakdown—more a recalibration after several quarters of muted top-line growth.

📈 The current consensus among analysts is a Hold rating, with a collective price target sitting at $71.33. That implies a modest upside from recent trading levels. While sentiment is lukewarm, the company’s strong return on capital, lean operating model, and consistent cash generation continue to earn it respect in long-term dividend and industrial investor circles.

Earning Report Summary

Solid Quarter Despite Soft Spots

Donaldson’s most recent earnings report showed a business that’s holding steady even as it navigates some economic crosscurrents. Net income came in at $95.9 million for the quarter, with GAAP earnings per share landing at $0.79. That’s just a touch below last year’s $0.81, but when you back out some adjustments, EPS actually ticked up slightly to $0.83. That’s a modest gain, but it shows that the company is finding ways to keep moving forward.

Revenue for the quarter came in at $870 million, which was a small dip—about 0.8% down from the same period last year. The decline was largely due to unfavorable foreign exchange rates. On a constant currency basis, performance was more stable, helped by solid pricing across key segments. Management continues to focus on balancing volume pressures with strategic pricing, and it’s paying off to some extent.

Mixed Performance Across Segments

Looking across Donaldson’s different business lines, it was a bit of a mixed bag. In the Mobile Solutions segment, aftermarket sales managed to grow 4%, which helped cushion some sharper drops in Off-Road and On-Road sales, which were down 12.8% and 24.4%, respectively. That’s a notable slowdown, likely tied to weaker equipment production and sales globally.

The Industrial Solutions segment also had a tough quarter, with sales down 7.5% in Industrial Filtration Solutions. However, not all was bleak—Aerospace and Defense surged nearly 19%, showing strength in sectors tied to defense budgets and aircraft production. The Life Sciences segment also delivered, growing just over 9%. That’s a good sign for the company’s efforts to diversify into higher-margin, innovation-driven areas.

Leadership Perspective and Outlook

CEO Tod Carpenter was upbeat about the results, particularly when it comes to profitability. He called out the company’s focus on cost control and operating discipline as key reasons margins held up as well as they did. Despite the top-line softness, he remains confident that Donaldson is on track for record earnings this fiscal year.

The company isn’t planning any dramatic shifts. Instead, leadership is sticking with a strategy that’s been working: invest steadily in R&D, push new product development, and focus on expanding its position in niche filtration markets. That approach has made Donaldson a consistent performer, and management seems intent on building on that foundation rather than chasing short-term wins.

All in all, it wasn’t a blowout quarter, but it didn’t need to be. Donaldson showed that it can stay the course, even with some headwinds, and keep delivering the kind of results long-term investors tend to appreciate.

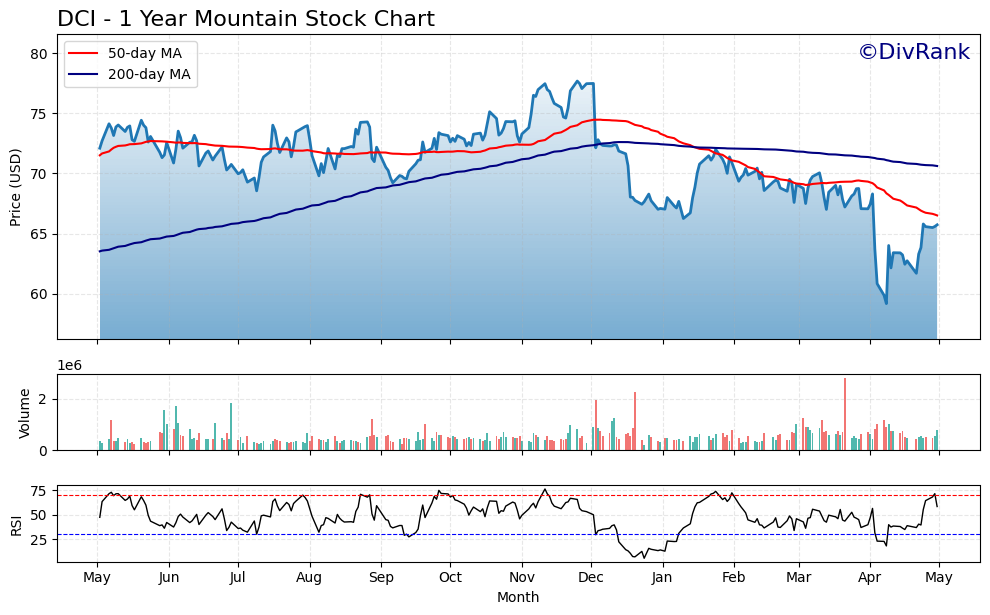

Chart Analysis

Price Movement and Trendlines

The past year of trading in DCI shows a clear shift in momentum. After a steady climb that lasted through most of the spring and early summer, the stock peaked around December and began a broad downtrend. This is evident from the declining 50-day moving average, which crossed below the 200-day moving average in early February—a classic sign of technical weakness. That crossover often suggests further downside pressure unless there’s a clear catalyst to reverse sentiment.

Through the fall, price action was choppy but still range-bound. However, since January, the breakdown below the 200-day average marked a shift in tone. There were brief rallies in March, but none could sustain above resistance around the 70–72 range. Most recently, DCI appears to be attempting a recovery off its lows in April, when it dipped near the 58–59 zone. It’s managed to reclaim some lost ground, though it’s still trading below both key moving averages, which often indicates the need for more confirmation before calling a trend reversal.

Volume and RSI Insight

Volume hasn’t been unusually high throughout most of the year, with a few exceptions—spikes in volume in early April and around late January signal institutional interest, likely during those sharp price moves. Higher volume on down days through winter hints at distribution, while the recent rally has shown lighter volume so far, meaning conviction is still building.

The RSI chart tells an interesting story. For much of the year, the stock hovered in a neutral zone, bouncing between 40 and 60. In early January, it dropped into oversold territory, which often signals exhaustion in selling pressure. That marked the bottom, and since then, RSI has moved steadily higher, now sitting around the 70 mark. While this shows strong short-term momentum, it also places the stock on the edge of being technically overbought. That doesn’t always mean a pullback is coming, but it does mean buyers have pushed hard in a short time.

General Takeaway

DCI has seen better technical days, but the latest bounce offers a sign that the worst may be behind, at least for now. What happens next depends on whether the stock can break above its declining moving averages with volume support and maintain momentum. The recent rally looks promising, but it needs to be watched for follow-through. Investors watching this chart are likely paying close attention to whether DCI can push through resistance and shift into a more stable trend heading into summer.

Management Team

Donaldson Company has long benefitted from a management team that leans into stability and long-term thinking. At the helm is Tod Carpenter, who serves as Chairman, President, and CEO. He’s been with the company for decades, holding various leadership roles before stepping into the top job. His experience has helped Donaldson maintain consistency even when markets get rocky. Under his leadership, the company has expanded into higher-margin segments like Life Sciences while continuing to fortify its core filtration business.

The broader executive bench reflects a similar depth of company-specific knowledge. Most of the leadership team has spent a significant portion of their careers at Donaldson or within the industrial and manufacturing sectors. This brings a sense of operational continuity, which is reflected in the company’s measured decision-making style—prioritizing steady margin expansion, prudent capital allocation, and long-term product development over splashy short-term plays.

The team also appears focused on disciplined capital spending and targeted innovation. They’re not chasing rapid disruption but are instead investing in technologies and processes that complement Donaldson’s core strengths. This is the kind of approach that tends to suit companies in mature, mission-critical industries, where performance is defined more by consistency than by reinvention.

Valuation and Stock Performance

DCI shares have had a muted stretch over the past year, falling around 10 percent from their 52-week highs. The stock currently trades in the mid-$60 range after dipping to the high $50s earlier this spring. For most of the past year, the stock has traded below its 200-day moving average, a sign that it’s been under some pressure, likely due to weaker earnings momentum and cautious sentiment around the industrial sector as a whole.

Looking at valuation, the numbers tell a fairly balanced story. The trailing price-to-earnings ratio sits just under 20, while the forward P/E is closer to 16, indicating that analysts expect modest earnings improvement moving forward. The PEG ratio, a metric that considers growth expectations, stands above 1.5, suggesting that while the company isn’t undervalued in the classic sense, its pricing still reflects the predictability and strength of its margins.

Donaldson’s price-to-sales ratio around 2.2 and price-to-book above 5 show that investors continue to assign a premium to the business. That premium comes from its reputation for durable earnings, not high growth. It’s worth noting that despite some weakness in recent quarters, the company still maintains strong return metrics—return on equity near 29 percent and return on assets above 12 percent. These figures suggest the business continues to generate solid profitability relative to its capital base.

Over the longer term, Donaldson has been a quiet performer. It doesn’t make headlines, but it has steadily delivered for shareholders, particularly those who value income and consistency over speculation. The recent dip in stock price may not change the company’s profile drastically, but it could open a window for investors who like to accumulate quality names during periods of softness.

Risks and Considerations

Donaldson is not without its risks, even if the business appears conservative on the surface. The most immediate concern is the industrial demand cycle. With much of the company’s revenue tied to heavy-duty equipment, transportation, and global manufacturing, any slowdown in capital spending or construction activity can weigh directly on its top line.

Currency fluctuations are another headwind, especially given Donaldson’s global footprint. Recent earnings reports showed how even small changes in exchange rates can knock a few percentage points off the revenue number. While management has navigated this well over the years, it remains a variable outside their control.

The company is also investing in newer verticals like Life Sciences. While these offer the potential for higher margins and less cyclicality, they also come with uncertainty. These markets are competitive and often require more aggressive R&D spending, regulatory navigation, and longer timelines to scale. Donaldson has taken a steady approach here, but success isn’t guaranteed, and returns may be uneven in the early stages.

Inflationary pressure, particularly on raw materials and logistics, can also squeeze margins if pricing power begins to erode. While the company has done well to manage costs and pass on price increases in the past, prolonged cost inflation could begin to pinch profitability.

Lastly, while Donaldson’s conservative capital structure is a strength, it also means investors shouldn’t expect large-scale acquisitions or aggressive growth bets. For those looking for explosive upside, this might not be the name to provide it. That said, its predictability can still be an asset in more volatile markets.

Final Thoughts

Donaldson Company stands out not for its flash but for its consistency. It’s the kind of stock that may not turn heads at cocktail parties, but it plays a dependable role in a well-rounded portfolio. Management has built a business with staying power—one that emphasizes operational strength, cash flow discipline, and incremental growth rather than high-stakes gambles.

Recent price weakness reflects broader macro concerns and some temporary softness in core markets, but the company’s long-term trajectory remains intact. The dividend is safe and slowly growing. Margins remain solid. And even during slower quarters, Donaldson has managed to deliver strong returns on invested capital.

This is a company that knows exactly what it is. It isn’t chasing trends or pivoting with every market cycle. Instead, it’s quietly building value year after year through filtration systems, aftermarket support, and niche solutions that rarely get disrupted. That approach may not win headlines, but it does win trust.

As it continues expanding into complementary segments and balancing cyclical exposure with more stable offerings, Donaldson looks well-positioned to keep doing what it has always done—showing up, delivering earnings, and returning value to shareholders. For those who appreciate consistency, durability, and a thoughtful management style, that’s a story worth sticking with.