Key Takeaways

📈 DICK’S offers a dividend yield of 2.24% with a payout ratio of 38.58%, leaving ample room for continued dividend growth backed by solid earnings.

💵 Operating cash flow for the trailing twelve months reached $1.12 billion, supporting the dividend and ongoing capital investment in new store formats.

📊 Analysts maintain a buy consensus with a mean price target of $238.33, suggesting moderate upside from current levels near $212.49.

🧾 Revenue for the trailing twelve months surpassed $14.8 billion, with net income of $1.02 billion and EPS of $12.28, reflecting continued profitable execution.

Updated 2/25/26

DICK’S Sporting Goods (DKS) continues to demonstrate the kind of steady, disciplined execution that long-term income investors find reassuring. With trailing twelve-month revenue exceeding $14.8 billion and a growing network of experiential retail formats anchored by House of Sport and Field House locations, the company is deepening its competitive moat through physical retail differentiation at a time when many peers are retreating from it. Earnings remain robust, supported by consistent operating cash flow and a conservative payout ratio that leaves meaningful room for future dividend increases.

At $212.49 per share, DKS trades comfortably within its 52-week range of $166.37 to $237.31, and analyst sentiment has tilted constructive with a buy consensus and a mean price target of $238.33. Leadership under CEO Lauren Hobart and Executive Chairman Ed Stack continues to balance growth investment with shareholder returns, pressing forward with store expansion while maintaining a dividend that has been raised consistently over recent years. For income-focused investors, the current setup offers a reasonable entry point into a fundamentally sound retailer with a growing dividend.

Recent Events

DICK’S Sporting Goods has remained active on the store development front, continuing to roll out its House of Sport and Field House formats as the centerpiece of its long-term retail strategy. These experiential locations, which feature batting cages, climbing walls, golf simulators, and large-format athletic footwear sections, are designed to create a destination shopping experience that pure e-commerce cannot replicate. Management has emphasized that comparable sales performance at these newer format stores continues to outpace the legacy fleet, validating the investment thesis behind the buildout.

The company has also maintained momentum in its private label and vertical brand development, which supports both margin expansion and customer loyalty. By growing its own branded assortment alongside national names like Nike and Adidas, DICK’S creates a differentiated product mix that gives it pricing flexibility and reduces its dependence on any single wholesale partner. This has become increasingly important as some major athletic brands have pulled back from wholesale distribution in favor of direct-to-consumer channels.

From a market positioning standpoint, the stock has retreated from its 52-week high of $237.31, currently sitting at $212.49. Short interest stands at approximately 5.57 million shares, which is considerably lower than levels seen in prior periods and suggests that the most aggressive bearish positioning has faded. With a beta of 1.26, the stock moves with some amplification relative to the broader market, which has contributed to the price volatility observed over the past year. Nonetheless, the underlying business has remained on solid footing through that period.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.24%

💸 Annual Dividend Rate: $4.85

📅 Most Recent Quarterly Dividend: $1.213 per share

⏰ Most Recent Ex-Dividend Date: December 12, 2025

🔁 Payout Ratio: 38.58%

📊 EPS (Trailing): $12.28

🪙 Return on Equity: 23.79%

These metrics reflect a dividend that is well-covered, consistently growing, and backed by a business generating over $1 billion in annual operating cash flow.

Dividend Overview

DICK’S Sporting Goods approaches its dividend with the same methodical discipline it applies to store operations and capital allocation. The current annualized dividend of $4.85 per share translates to a yield of 2.24% at the current price of $212.49, which sits above the company’s five-year average yield and reflects a growing income stream rather than a yield inflated by stock price weakness. The payout ratio of 38.58%, while slightly higher than it was a year ago, remains conservative and well within a range that income investors should find comfortable for a specialty retailer of this caliber.

The cash flow backing behind that dividend is meaningful. Operating cash flow over the trailing twelve months came in at approximately $1.12 billion, a figure that comfortably covers the annual dividend obligation many times over. While free cash flow has turned negative due to elevated capital expenditures associated with the ongoing store expansion program, that spending is discretionary and strategic in nature rather than a reflection of operational stress. The dividend itself is funded out of operating cash generation, which remains strong.

Management has consistently prioritized the dividend as a key component of its capital return program, pairing it with opportunistic share repurchases. The combination of a growing payout and a declining share count means the per-share income stream for long-term holders has compounded meaningfully. With net income of $1.02 billion and EPS of $12.28, the earnings base supporting the $4.85 annual dividend is substantial, and nothing in the current financial picture suggests any pressure on the payment.

Dividend Growth and Safety

The dividend history for DICK’S tells a clear story of steady, deliberate growth. Quarterly payments stood at $1.00 per share throughout 2023, rose to $1.10 in 2024, and stepped up again to $1.213 in 2025, representing an increase of approximately 10.3% from the 2024 rate. That kind of consistent, double-digit annual growth is exactly what dividend growth investors look for, and it signals that the board remains confident in the company’s earnings trajectory and cash generation capacity.

The safety profile of the dividend is reinforced by multiple layers of financial strength. A payout ratio of 38.58% against trailing EPS of $12.28 leaves the company retaining well over six dollars per share in earnings after the dividend is paid. Return on equity of 23.79% and return on assets of 6.48% both indicate that management is deploying capital productively, which supports continued earnings growth and, by extension, future dividend increases. The profit margin of 6.86% is solid for specialty retail, where the operational demands of physical store networks compress margins compared to asset-light businesses.

The company’s private label strategy, combined with its experiential retail approach, provides a layer of competitive insulation that purely transactional retailers lack. Customers who come to a House of Sport location for the experience tend to spend more and return more frequently, which builds a more predictable revenue base. For dividend investors, that predictability is what underpins confidence in the long-term income stream. The dividend at DICK’S is not just sustainable at current levels, it appears positioned for continued growth as the store expansion program matures and capital expenditures normalize.

Chart Analysis

Dick’s Sporting Goods has put together a meaningful recovery over the past year, climbing from a 52-week low of $164.32 to its current price of $212.49, a gain of roughly 29% off the trough. That kind of move reflects genuine buying interest and a shift in sentiment from the pessimism that defined the lower end of the range. The stock did reach as high as $232.89 over the trailing twelve months, so the current price sits about 8.76% below that peak, which tells a story of a stock that has largely healed but has not yet returned to full strength at the top of its range.

The moving average picture is mixed and deserves careful reading. DKS is currently trading at $212.49, above both its 50-day moving average of $207.78 and its 200-day moving average of $208.36, which on the surface looks constructive. However, the 50-day moving average remains below the 200-day moving average, a configuration technically known as a death cross. That signal suggests the intermediate trend weakened enough in recent months to pull the shorter-term average beneath its longer-term counterpart, and even though the stock price has climbed back above both averages, that underlying cross is a reminder that the recovery is still working to fully reestablish itself on a trend basis.

The RSI reading of 58.86 sits in comfortable, measured territory. It is not flashing overbought conditions anywhere near the 70 threshold, nor is it showing any sign of exhaustion or deterioration. A reading in the high 50s typically reflects steady, controlled buying momentum rather than the kind of speculative surge that often precedes a sharp reversal. For income-focused investors, this is actually a reassuring setup because it suggests the current price level is not being propped up by frothy momentum trading.

Taken together, the technical picture for DKS is cautiously constructive for dividend investors with a patient time horizon. The stock has recovered substantially from its lows, price action has pushed back above both key moving averages, and momentum is positive without being overheated. The death cross configuration warrants some attention, but with the price already reclaiming ground above both averages, the signal may be in the process of resolving. Investors collecting DKS’s dividend are not being asked to buy into a euphoric top, and the distance from the 52-week high still offers a reasonable entry point relative to where the stock has traded.

Cash Flow Statement

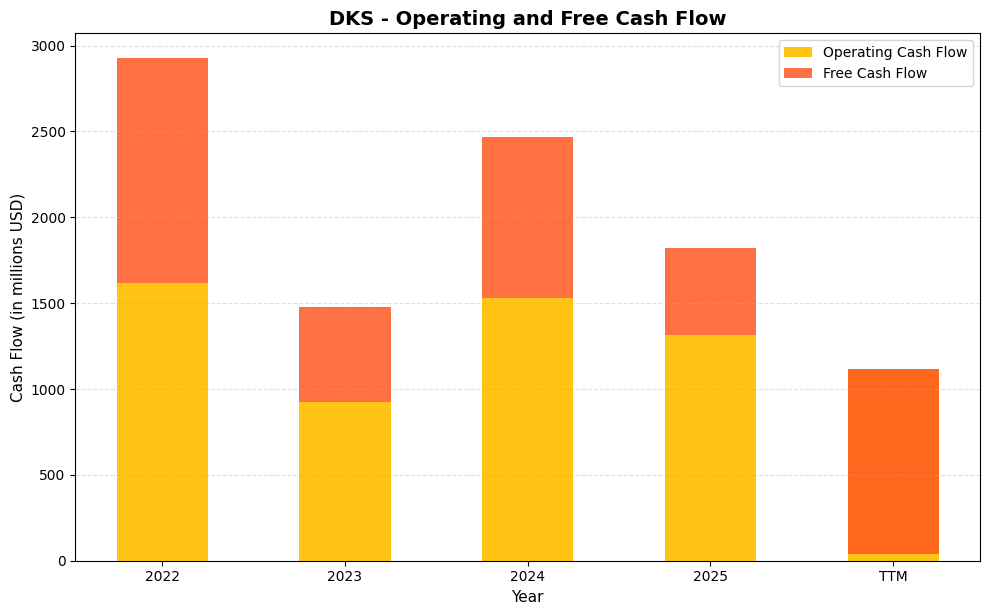

Dick’s Sporting Goods has generated operating cash flow in a range of roughly $920 million to $1.6 billion over the past four fiscal years, which speaks to the underlying earnings power of the business even as results fluctuate with inventory cycles and consumer spending patterns. Free cash flow tells a more nuanced story: the $1.31 billion FCF print in fiscal 2022 was exceptional, and the subsequent compression to $558 million in 2023 reflected heavier capital expenditure commitments as the company accelerated its House of Sport and next-generation store buildout. The recovery to $940 million in 2024 was encouraging, but fiscal 2025 saw FCF slide back to $509 million, and the trailing twelve-month figure has turned sharply negative at roughly negative $1.1 billion, a direct consequence of a significant uptick in capital spending that has outpaced operating cash generation in the most recent period. For dividend investors, the near-term FCF picture warrants attention, though the company has historically demonstrated the ability to generate substantial cash when its investment cycle moderates.

Stepping back across the full data set, the broader pattern reflects a company that generates genuinely strong operating cash flows through the cycle, with four consecutive years above $900 million in operating CF confirming that the core retail model is a durable cash producer. The current capital intensity is largely a deliberate strategic choice, as DKS is funding a store transformation program that management believes will drive higher revenue per location over time. If those investments deliver on their expected returns, the FCF profile should normalize and expand meaningfully in the years ahead. For shareholders collecting the dividend today, the key question is whether management maintains its commitment to the payout through this elevated spending phase, and given the company’s history of dividend raises and a still-solid operating cash flow base, the near-term drag from capital expenditures appears manageable rather than structurally threatening to income distributions.

Analyst Ratings

Wall Street’s current stance on DICK’S Sporting Goods leans constructive. Among the 21 analysts covering the stock, the consensus rating sits at buy, with a mean price target of $238.33 against a current price of $212.49. That implies roughly 12% upside to the average target, while the high-end target of $285.00 represents more than 34% potential appreciation for the most optimistic forecasters. The low-end target of $175.00 sits well below current trading levels, reflecting a minority view that the stock’s valuation could compress if consumer spending softens or tariff-related cost pressures intensify.

The breadth of the analyst community covering DKS is notable, with 21 firms engaged, which speaks to the stock’s relevance as a meaningful position within consumer discretionary portfolios. The distribution of targets, with the mean sitting roughly $25 above the current price and the median likely in a similar range, suggests that the majority of analysts see the stock as moderately undervalued at current levels rather than either stretched or deeply discounted. For income investors, that kind of measured consensus is a reasonable backdrop, as it points to a stock that is not pricing in excessive optimism and therefore carries a more balanced risk profile around the dividend.

At a P/E of 17.30 and a price-to-book of 3.43, the current valuation sits at a level that analysts appear to view as fair to slightly attractive relative to the company’s growth profile and return characteristics. The convergence of a buy consensus, a mean target above current prices, and a payout ratio that leaves room for continued dividend growth creates a reasonably favorable setup for investors focused on total return.

Earning Report Summary

Strong Finish to the Year

DICK’S Sporting Goods posted trailing twelve-month revenue of $14.88 billion, a meaningful step up from prior periods that reflects both unit growth and continued comparable sales momentum across its store network. Net income of $1.02 billion and earnings per share of $12.28 represent a healthy level of profitability for a specialty retailer operating in a competitive and evolving consumer environment. Profit margins of 6.86% hold up well against the sector, and the consistency of the earnings base provides a strong foundation for the company’s dividend and capital return commitments.

The ongoing expansion of House of Sport and Field House locations has been a meaningful driver of both topline growth and traffic. These formats command larger footprints and higher capital costs, but they also generate stronger per-visit economics and create a customer experience that drives repeat engagement. Management has consistently pointed to outperformance at these newer locations relative to the legacy fleet, which reinforces the case for continued investment in the format rollout.

Leadership Comments and Outlook

CEO Lauren Hobart has maintained a consistent message around disciplined growth, emphasizing that the company’s strategy is built for the long term rather than optimized for any single quarter. The focus on experiential retail, vertical brand development, and digital integration reflects a coherent vision for where sporting goods retail is heading, and DICK’S appears well-positioned to capture share as less differentiated competitors struggle to define their value proposition.

The company’s guidance framework has remained cautious relative to the recent earnings trajectory, with management pointing to macroeconomic uncertainty and potential tariff impacts as factors that warrant a measured approach to forward projections. Nevertheless, with EPS of $12.28 on a trailing basis and a business model that has demonstrated resilience through prior economic cycles, the earnings power underpinning the dividend and the buyback program appears durable. Executive Chairman Ed Stack has continued to emphasize long-term value creation as the organizing principle of capital allocation, and the dividend growth record over the past three years is consistent with that stated priority.

Management Team

DICK’S Sporting Goods is guided by a leadership team that combines deep institutional knowledge of the business with a forward-looking orientation toward retail transformation. Lauren Hobart, who assumed the CEO role in 2021, has been the driving force behind the company’s shift toward experiential retail and its investment in brand building. Her background in marketing and customer experience has shaped how DICK’S thinks about store design, loyalty programs, and the intersection of physical and digital commerce. Under her leadership, the company has accelerated the rollout of its highest-investment store formats while maintaining the financial discipline that characterizes the broader culture of the organization.

Executive Chairman Ed Stack, who built DICK’S into the national chain it is today over decades of leadership, continues to provide strategic guidance and institutional continuity. His presence ensures that the company’s long-term orientation and commitment to shareholder returns remain embedded at the highest level of governance. The broader executive team spans expertise in logistics, technology, merchandising, and store operations, creating a structure capable of managing both the complexity of a nearly $15 billion revenue base and the ambition of an ongoing physical retail buildout. Together, they have built a management profile that income investors can view with a reasonable degree of confidence in consistent execution.

Valuation and Stock Performance

At $212.49, DICK’S Sporting Goods trades near the midpoint of its 52-week range of $166.37 to $237.31, having pulled back from the upper end of that range over recent months. The current P/E ratio of 17.30 is reasonable for a profitable specialty retailer with a consistent growth record and a demonstrated ability to take market share. It does not reflect a deep value situation, but it also does not embed the kind of premium multiple that would leave income investors exposed to significant valuation compression if near-term results disappoint.

The price-to-book ratio of 3.43 against a book value per share of $62.00 reflects the market’s recognition that DICK’S generates returns well in excess of its cost of capital, with return on equity of 23.79% substantiating the premium to book. Market capitalization sits at approximately $19.1 billion, which places DKS among the larger names in specialty retail and gives it the institutional relevance that supports analyst coverage and liquidity. Beta of 1.26 is worth keeping in mind for investors managing overall portfolio volatility, as the stock will tend to move more sharply than the broader market in both directions during periods of macro-driven turbulence.

The analyst mean price target of $238.33 implies that the consensus view sees roughly 12% upside from current levels, which when combined with the 2.24% dividend yield produces a total return outlook in the mid-teens on a one-year basis if that target is reached. For dividend growth investors, the more important consideration is whether the business can sustain and grow its earnings over a multi-year horizon, and on that front the current setup remains encouraging.

Risks and Considerations

DICK’S operates in the consumer discretionary segment, which means its revenue and earnings are sensitive to shifts in consumer confidence, employment levels, and discretionary spending capacity. An economic slowdown or a prolonged period of elevated inflation that pressures household budgets could reduce traffic and transaction sizes across the store network, which in turn would put pressure on the earnings base supporting the dividend and buyback program.

Tariff exposure remains a real consideration. A meaningful portion of the company’s merchandise is sourced from overseas, including from manufacturers in Asia, and changes in trade policy could increase product costs. While DICK’S has demonstrated an ability to manage vendor relationships and pricing strategy through prior trade disruptions, a sustained increase in sourcing costs without offsetting pricing power could compress margins in ways that affect near-term earnings.

The competitive landscape in sporting goods and athletic apparel continues to evolve. Major brands like Nike and Adidas have pushed further into direct-to-consumer channels, which reduces their dependence on wholesale partners like DICK’S and could over time limit product exclusivity. At the same time, e-commerce competitors and general merchandise retailers continue to compete for the same consumer wallet. DICK’S experiential retail strategy is its primary defense against these pressures, but executing that strategy at scale across a growing store count requires sustained investment and carries execution risk.

Free cash flow has turned negative over the trailing twelve months as capital expenditures have accelerated to support the store expansion program. While this is an intentional strategic choice, it does reduce the financial flexibility available for opportunistic actions and means the company is relying on its balance sheet and operating cash generation to fund growth. If consumer spending softens at the same time that the construction pipeline remains elevated, the company could face a tighter capital allocation environment than management currently anticipates. The elevated beta of 1.26 also means that any broader market selloff or sentiment shift against consumer discretionary names could produce sharper-than-average stock price moves, which is a consideration for investors focused on capital preservation alongside income.

Final Thoughts

DICK’S Sporting Goods has built something that is genuinely difficult to replicate in modern retail: a physical store experience that gives customers a reason to show up, stay longer, and spend more. The House of Sport and Field House formats represent a meaningful investment in that vision, and the early evidence suggests the strategy is working. Revenue exceeding $14.8 billion, net income above $1 billion, and a dividend that has grown at a double-digit rate over each of the past two years all point to a company executing with purpose.

For dividend investors, the income picture is straightforward and reassuring. The $4.85 annual dividend is covered more than three times over by trailing earnings, the payout ratio of 38.58% leaves room for continued growth, and the operating cash flow base of $1.12 billion provides a durable funding source for the payment. The most recent dividend increase, from $1.10 to $1.213 per quarter, represents a raise of over 10% and continues a track record of consistent annual increases that income investors can reasonably expect to continue as the expansion program matures.

At $212.49 with a buy consensus and a mean analyst target of $238.33, DKS offers a combination of income, growth, and valuation that compares favorably within the specialty retail space. The risks are real, particularly around consumer spending sensitivity and tariff exposure, but they are well-understood and reflected in current positioning. For investors with a multi-year time horizon, DICK’S presents a compelling case as a dividend grower with a business model built for durability rather than just near-term performance.