Updated 4/25/25

Diamondback Energy, trading under the ticker FANG, has carved out a serious niche in the oil and gas world. Based in Midland, Texas, the company focuses almost entirely on the Permian Basin — an area that’s basically the crown jewel of American shale production. While other companies chase new opportunities or spread themselves thin across multiple regions, Diamondback has kept its focus tight, its operations lean, and its strategy pretty simple: acquire smart, drill smarter, and send a good chunk of the rewards back to shareholders.

In a world where energy stocks can be wild and unpredictable, Diamondback has built a reputation for steady, disciplined execution. And for dividend-focused investors, that’s an important thing to recognize. This isn’t a speculative story stock. It’s a real business delivering real cash, quarter after quarter, right into investors’ accounts.

Recent Events

The past year was anything but boring for Diamondback. Revenues surged to $10.56 billion on a trailing twelve-month basis. That wasn’t just luck with oil prices; it came from growing production and squeezing more out of each barrel. Profit margins came in strong at 31.61%, while operating margins hit an impressive 42.21%, showing just how efficient the company has gotten at pulling oil and gas from the ground without letting costs balloon.

Earnings growth year-over-year was 11.9%, not explosive but plenty solid, especially when you pair it with strong cash generation. Diamondback raked in $6.41 billion in operating cash flow over the last year. Even after paying off debts and covering essential spending, the company had $2.19 billion in levered free cash flow left over. That’s the real fuel behind those dividend checks investors care about.

Debt-wise, Diamondback carries $13.1 billion, which may sound hefty, but thanks to careful management, their debt-to-equity ratio sits at a very reasonable 32.86%. They’re not overloaded. They’re balancing growth and returns the way a disciplined operator should.

And the headline for dividend investors: Diamondback’s forward dividend is set at $6.21 per share, with a juicy forward yield of 4.56%. That’s real income backed by real assets.

Key Dividend Metrics

🛢️ Forward Dividend Yield: 4.56%

💵 Forward Dividend Rate: $6.21 per share

🧮 Payout Ratio: 53.38%

📈 5-Year Average Dividend Yield: 4.06%

⏳ Dividend Growth: Consistent and rising over recent years

📅 Next Dividend Date: March 13, 2025

🚨 Ex-Dividend Date: March 6, 2025

Dividend Overview

Diamondback’s dividend approach is all about sustainability. The 53.38% payout ratio shows management isn’t overextending. They’re paying shareholders a solid yield, but leaving enough cash in the business to weather the inevitable ups and downs in oil prices.

At a 4.56% yield, FANG’s dividend stands out in today’s market. It’s a payout that’s competitive with other top-tier energy names and even beats many income options outside the sector. Better yet, this isn’t a company promising the moon and scrambling when commodity prices fall. Diamondback’s dividends are funded by hard cash flow, not borrowed money or financial tricks.

What makes it even more appealing is the consistency. Over the past five years, the company’s dividend yield has averaged around 4.06%. That kind of slow and steady growth isn’t going to dominate headlines, but it’s exactly the sort of trend long-term dividend investors like to see. It suggests management isn’t just reacting to market moves — they’re planning for durability.

Dividend Growth and Safety

Diamondback’s dividend history shows a clear commitment to growth without reckless promises. Even when oil prices collapsed during the early days of the pandemic, Diamondback kept its head and maintained shareholder payouts without dramatic cuts. That’s a strong signal about the company’s confidence in its operations and financial base.

On the safety front, there’s plenty to like. A payout ratio just north of 50% leaves lots of breathing room. Even if oil prices soften, Diamondback has enough cushion to keep paying dividends without major adjustments.

Free cash flow coverage is strong too. With $2.19 billion in free cash flow after covering debt and capital spending, there’s plenty left over to support dividends. And the company’s return on equity, sitting at 12.92%, shows that management isn’t just sitting on profits — they’re reinvesting wisely, which bodes well for future earnings growth and dividend stability.

One thing to be aware of: Diamondback’s current ratio sits at a tight 0.44. In plain English, that means short-term liabilities outweigh short-term assets. In a manufacturing business that might be a red flag, but in oil and gas, it’s less of a concern as long as operating cash flow remains strong — and Diamondback’s cash engine is running hot.

Another major strength is location. The Permian Basin continues to be one of the lowest-cost, highest-return oil regions in the world. Diamondback’s deep exposure there gives it an edge over peers who might be operating in higher-cost fields. As a result, even if oil prices dip or volatility spikes, Diamondback is positioned to maintain profitability and, by extension, its dividend.

Cash Flow Statement

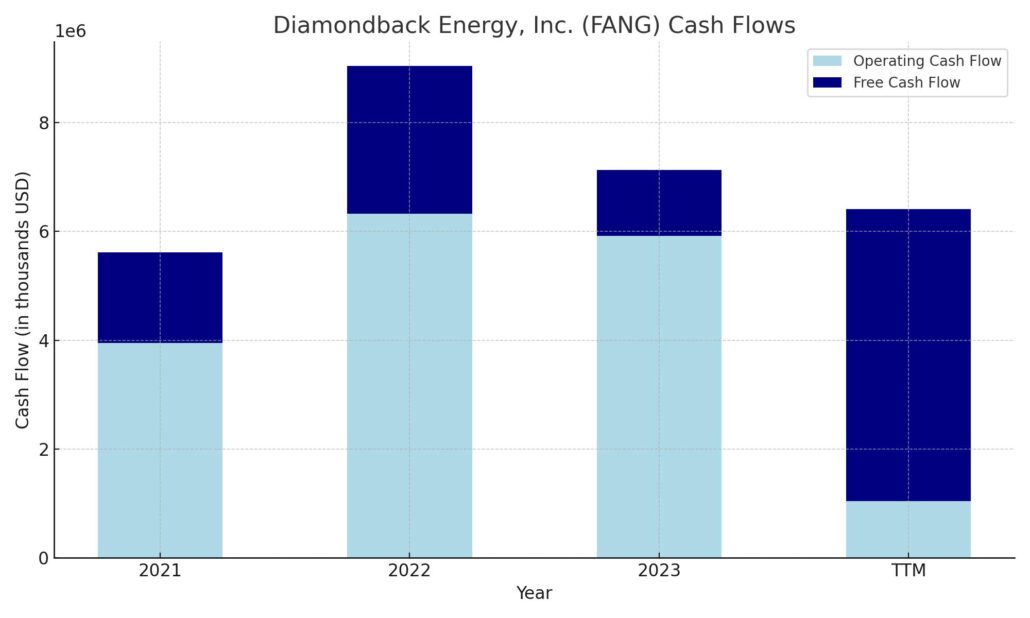

Diamondback Energy’s cash flow activity over the trailing twelve months paints a clear picture of a company aggressively investing for future growth while maintaining strong operational cash generation. The company produced $6.41 billion in operating cash flow, a solid figure that reflects strong profitability and efficient operations. However, heavy investment spending pulled overall free cash flow into the red, with a reported negative free cash flow of $5.37 billion. Capital expenditures jumped to $11.79 billion, significantly higher than previous years, signaling major expansion efforts or strategic asset acquisitions.

On the financing side, Diamondback raised $9.88 billion through debt issuance to help fund its aggressive investment program, while also managing $3.5 billion in debt repayments. Despite this major financial activity, the end cash position stood at $164 million, fairly tight but manageable given the company’s reliable operating cash generation. Interest and tax payments, while higher than prior periods, stayed within expected levels for a business of this scale. Overall, the cash flow statement shows Diamondback in a phase of heavy capital deployment, funded through a balanced combination of operating strength and external financing, positioning the company for future production and cash flow growth.

Analyst Ratings

Diamondback Energy has recently attracted attention from analysts, leading to a mix of rating adjustments and price target revisions. 🟢 Citigroup upgraded the stock from Neutral to Buy, setting a price target of $180. This upgrade reflects confidence in the company’s operational efficiency and strategic positioning within the energy sector.

🔵 On the other hand, UBS maintained its Buy rating but lowered the price target from $174 to $163, citing potential near-term challenges in the broader energy market. Similarly, TD Cowen adjusted its price target downward from $225 to $175 while still keeping a Buy rating, reflecting a slightly more cautious view on short-term sector dynamics.

🟣 Despite these slight adjustments, the overall analyst sentiment toward Diamondback Energy remains notably positive. The current consensus price target is around $200.96, suggesting a healthy upside from recent trading levels. Analysts generally continue to favor Diamondback’s strong balance sheet, efficient operations, and ability to generate robust cash flows even in more volatile market conditions.

🟡 In short, while some firms have trimmed their expectations a bit to account for market fluctuations, most still view Diamondback Energy as a fundamentally strong name with attractive long-term prospects for investors.

Earning Report Summary

Diamondback Energy closed out 2024 on a strong note, putting up numbers that really show the company is hitting its stride. Net income came in at $1.1 billion for the fourth quarter, working out to $3.67 per diluted share. After some adjustments, earnings landed at $3.64 per share, which was a little better than many folks were expecting. This wasn’t a fluke either — it reflected careful cost management and smart production growth across their key assets.

Production levels were another highlight. Diamondback averaged 883,400 barrels of oil equivalent per day during the quarter. That’s a hefty jump, largely thanks to the integration of new assets from the Endeavor Energy acquisition. Revenue for the quarter reached $3.71 billion, and when you pair that with $2.3 billion in operating cash flow, it paints a picture of a company that’s not just growing but doing so efficiently. After covering their costs, Diamondback still managed to generate $1.3 billion in free cash flow, keeping the balance sheet healthy.

Diamondback kept investing aggressively in projects they believe will pay off down the line. They spent about $933 million on capital expenditures in the quarter, staying disciplined while setting the stage for future growth. Even with that level of investment, they didn’t forget about shareholders. Diamondback returned $694 million through dividends and share buybacks, a clear signal that they’re serious about rewarding investors even as they build for the future.

Leadership’s Vision for 2025

Looking ahead, leadership has laid out a clear game plan. The capital budget for 2025 is expected to land somewhere between $3.8 billion and $4.2 billion. Part of that plan includes drilling between 446 and 471 gross wells, with a continued focus on keeping costs low and margins strong.

CEO Travis Stice pointed to the Endeavor Energy acquisition as a major win, giving Diamondback even more firepower in the Midland Basin. He sounded upbeat about how the combined assets position the company for long-term success. President Kaes Van’t Hof added some big-picture context, sharing that they expect to generate about $20 per share in free cash flow in 2025, assuming oil prices stick around the $70 mark.

The tone from leadership was confident but measured — they know the market can throw curveballs, but they believe they’ve built a business that can thrive through all kinds of cycles.

Chart Analysis

The stock performance of FANG over the past year has been anything but smooth, with a clear downward trend that became more pronounced heading into the second half. The chart reflects a stock that spent much of the early and mid-year trading in a relatively stable band between $180 and $200, but that began to shift noticeably starting in October.

Moving Averages

The 50-day moving average (red line) has been in a persistent decline since early November, now well below the 200-day moving average (blue line), which itself has started to slope downward. This kind of crossover pattern — with the short-term average crossing under the longer-term — often signals prolonged weakness and suggests the recent rally is more of a relief bounce than a reversal. The stock price recently attempted to break through the 50-day line but failed to hold above it, indicating resistance at those levels.

Volume and Price Action

Volume tells an interesting story too. There’s been a notable increase in activity, particularly on sharp down days. That spike in volume around early April coincided with a steep price drop, pointing to either heavy institutional selling or market reaction to a major event. Since then, price has attempted to recover, but the climb has been labored.

Looking at the price action over the past five months, it’s clear that lower highs and lower lows have defined the trend. The most recent low around $120 was met with a rebound, but momentum seems tentative. For a turnaround to have legs, price would need to push above both the 50-day average and eventually reclaim the 200-day.

RSI Trends

The RSI at the bottom of the chart is starting to recover from deeply oversold territory. After dipping below 30 — a level often associated with extreme pessimism — the indicator bounced back quickly. Still, the RSI remains under 50, suggesting momentum is only just beginning to rebuild, and confidence hasn’t fully returned. It’s not yet showing a clear bullish reversal, but it has moved away from the danger zone, which is a positive first step.

Overall, the chart shows a stock working through a corrective phase, trying to stabilize after a tough slide. There are signs of a base trying to form, but overhead resistance and cautious momentum could make any sustained move upward a slower process.

Management Team

Diamondback Energy’s leadership has built a reputation for capital discipline and consistent execution. At the helm is CEO Travis Stice, who has been with the company since its early days and played a pivotal role in scaling operations without sacrificing financial health. His background in engineering and operations has shaped the company’s strategic focus on cost control and high-return assets. Stice is known for taking a conservative but opportunistic approach, especially when it comes to acquisitions — the Endeavor Energy deal being a recent example that expands Diamondback’s already strong footprint in the Midland Basin.

Supporting Stice is President and CFO Kaes Van’t Hof, a key voice in Diamondback’s long-term planning. Van’t Hof brings a sharp financial perspective to the table, ensuring the company maintains a strong balance between capital investment and shareholder returns. Under their leadership, Diamondback has grown production responsibly while steadily increasing its return of capital through dividends and share repurchases. The team’s clear communication style and measured approach to growth have earned trust from both the market and long-term shareholders.

This management group isn’t focused on rapid expansion at any cost. Instead, they’ve kept their attention on efficiency, shareholder alignment, and maintaining a lean cost structure — values that tend to pay off in an industry known for volatility.

Valuation and Stock Performance

Looking at valuation, Diamondback Energy currently trades at a forward price-to-earnings ratio that suggests the market is still pricing in some caution around energy stocks. At a forward P/E below 11 and a trailing P/E closer to 9, the stock looks attractively priced relative to both its peer group and the broader market. It’s not uncommon for energy companies to carry lower multiples due to cyclicality, but in this case, Diamondback’s strong free cash flow generation and consistent dividends offer a layer of protection that those raw numbers don’t fully reflect.

From a price-to-book standpoint, Diamondback sits just above 1x, which implies the market values its asset base at near-book levels. That’s relatively conservative for a company with high-quality reserves and infrastructure in one of the most productive oil regions in North America. The stock also trades at a price-to-sales ratio under 3, again indicating a reasonable valuation for a business generating over $10 billion in revenue on a trailing twelve-month basis.

Stock performance over the past year has been mixed. Shares have pulled back significantly from their highs above $210 and are currently trading in the $130s. This reflects broader market sentiment toward energy during periods of falling crude prices and macro uncertainty. But despite the drawdown, Diamondback has held up better than some smaller or more leveraged names, which speaks to the strength of its operations and balance sheet. The technical chart shows signs of base-building, and while the road to recovery could take time, the underlying value remains compelling.

Risks and Considerations

Like any energy company, Diamondback is exposed to commodity price swings. A meaningful drop in crude oil or natural gas prices could compress margins, reduce cash flow, and force the company to scale back capital returns or drilling activity. While Diamondback has hedging strategies in place, they don’t fully eliminate the impact of a prolonged downturn in pricing.

Another key risk is the regulatory environment. As energy policy shifts, particularly with growing emphasis on emissions and renewables, traditional oil and gas companies may face increased compliance costs or new restrictions. While Diamondback operates primarily in Texas, a relatively favorable jurisdiction, federal regulations and public sentiment could still influence its business decisions.

Operationally, Diamondback has to execute well on its large-scale drilling plans. The capital budget for 2025 is ambitious, and hitting production targets while maintaining low costs will require everything to go smoothly in the field. Any disruptions — whether from labor shortages, supply chain issues, or equipment failures — could impact output and efficiency.

There’s also some integration risk with recent acquisitions. Merging new assets always carries the challenge of aligning systems, culture, and performance expectations. If the integration of Endeavor Energy assets doesn’t go as planned, it could lead to unexpected costs or underperformance in those fields.

Lastly, while the balance sheet is solid, the company is not debt-free. Managing $13 billion in debt requires continued discipline, especially in volatile markets. While interest coverage remains strong and repayments are well planned, any major negative shift in cash flow could change that equation.

Final Thoughts

Diamondback Energy is the kind of company that doesn’t chase headlines but delivers where it matters — through strong operations, disciplined capital use, and reliable shareholder returns. It’s managed by a team that understands the ups and downs of the oil business and isn’t afraid to slow down when the market demands it. That kind of steady hand matters, especially for those looking to build long-term exposure in energy.

With the integration of Endeavor assets and a sizable drilling program planned, 2025 will be a key year. The company is balancing its growth ambitions with a firm grip on expenses and capital allocation. And even as the stock trades below its previous highs, valuation metrics point to a name that still has room to move — particularly if commodity prices stabilize or strengthen.

Risks remain, as they always do in this space. But Diamondback enters the year with a well-defined strategy, a strong leadership team, and the kind of financial footing that provides flexibility in both good times and bad. The focus remains on efficient production, free cash flow generation, and meaningful capital returns — a formula that, over time, tends to reward patient investors.