Key Takeaways

💵 Dividend yield near 5%, maintained despite challenges, with a manageable payout ratio.

💰 Positive free cash flow (~$281M), sufficient to cover dividends, though declining year-over-year.

📊 Analyst sentiment cautious; multiple downgrades amid uncertainty, consensus price target ~$22.58.

📉 Earnings mixed; revenue down 4.3%, strategic shifts impacting short-term performance but aligning with long-term goals.

👥 New management focused on operational discipline, cost control, and refocusing on core dental technology.

Updated 4/25/25

DENTSPLY SIRONA (XRAY) has undergone a significant transformation over the past year, marked by leadership changes, strategic pivots, and a major reset of its business priorities. The company exited its direct-to-consumer Byte model, re-centered its focus on core dental technology, and tightened its operational discipline.

Financial results have reflected that transition, with revenue declining to $3.79 billion and shares falling over 55% in the past 12 months. Yet, amid the downturn, XRAY has maintained its dividend and currently offers a yield near 5%, supported by positive free cash flow. With a forward P/E around 7.4 and a management team focused on long-term efficiency, the stock trades at a valuation that reflects skepticism—but also potential. As the company continues reshaping its future, investors are watching closely for consistent execution and signs of stabilization.

Recent Events

The last 12 months have been anything but smooth for Dentsply. The company’s profitability took a major hit, with profit margins plunging to -24%. Revenue growth turned negative as well, shrinking by more than 10% year-over-year. When a company that used to be seen as reliable starts putting up numbers like these, it’s natural for investors to get spooked.

Debt has also become a much bigger piece of the puzzle. DENTSPLY SIRONA now carries about $2.3 billion in debt, with only $302 million in cash sitting on the balance sheet. The debt-to-equity ratio has soared past 118%, signaling more financial strain than many long-time shareholders are used to seeing from this name.

Despite these headwinds, there’s been a surprising level of commitment to maintaining the dividend. Even as earnings stumbled and the market turned hostile, the company kept sending those quarterly checks. That’s not something you see every day when a business is this deep into a turnaround effort.

Short interest has climbed too, reaching over 6% of the float. There’s definitely a chunk of the market betting that the pain isn’t over yet. Still, for income-focused investors, the dividend side of the story is where things start to get more interesting.

Key Dividend Metrics

💵 Forward Dividend Yield: 4.67%

📈 5-Year Average Dividend Yield: 1.46%

🛡️ Payout Ratio: 28.83%

📅 Most Recent Dividend Date: April 11, 2025

🔔 Ex-Dividend Date: March 28, 2025

Dividend Overview

Right now, DENTSPLY SIRONA offers a forward dividend yield of 4.67%, which is way above its historical average. For perspective, over the past five years, XRAY’s yield hovered closer to 1.5%. This jump isn’t because of massive dividend hikes—it’s a reflection of just how far the stock price has fallen.

The payout ratio sits at a manageable 28.83%. That’s actually a good sign, showing that even with all the chaos in the earnings reports, the company isn’t stretching itself too thin to maintain the dividend. It’s important to remember that this ratio is based on forward-looking earnings expectations. Given that actual reported net income is negative, it’s more of an optimistic measure than a hard fact.

That said, management has shown no signs of backing away from the dividend. They haven’t slashed it, and based on available free cash flow numbers, they aren’t likely to need to anytime soon unless things get significantly worse. It’s a rare kind of stability for a company going through such a rough patch.

Dividend Growth and Safety

Historically, DENTSPLY SIRONA hasn’t exactly been known for aggressive dividend growth. The dividend was there, sure, but it was never the star of the show. Over the past five years, payouts increased slowly but steadily. The recent jump in yield is driven purely by the collapsing stock price, not by any recent boost in the dividend amount itself.

Looking at free cash flow, the numbers tell a cautiously positive story. Operating cash flow over the past year came in at $461 million. After covering capital expenditures, the company still has about $400 million in levered free cash flow. With around 199 million shares outstanding and an annual dividend of $0.64 per share, the total cash outlay for dividends is roughly $127 million. That leaves a good amount of breathing room.

Still, it’s impossible to ignore the debt hanging over the company’s head. If cash flow starts to shrink due to higher interest expenses or continued revenue declines, it could start squeezing the dividend cushion. For now, though, there’s enough slack to keep the payments going without too much worry.

As for dividend growth? It’s probably going to be off the table for a while. The focus for Dentsply will likely stay on stabilizing operations, managing debt, and clawing back some lost profitability. Until that turnaround takes hold, investors should expect the dividend to stay flat rather than rising.

Cash Flow Statement

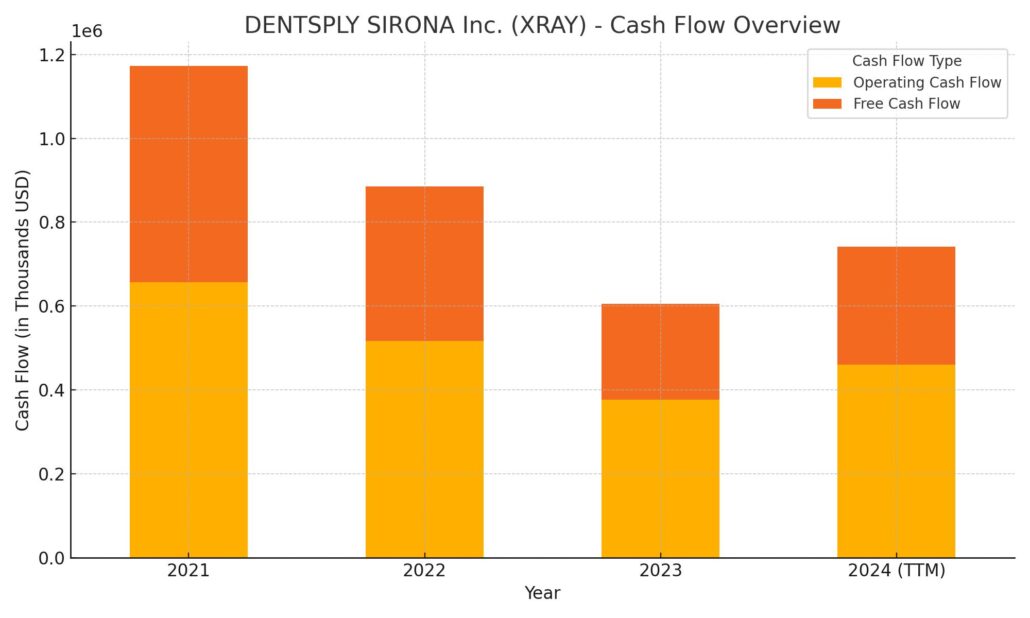

Over the trailing twelve months, DENTSPLY SIRONA generated $461 million in operating cash flow, a modest increase from the prior year’s $377 million but still well below the $657 million reported in 2021. This trend reflects the impact of weaker earnings and reduced efficiency in operations. Capital expenditures also rose slightly, hitting $180 million, which trimmed free cash flow down to $281 million. While that’s a step up from the previous year, it’s part of a longer decline from stronger free cash flow figures just a few years ago.

Investing activities consumed $197 million, largely in line with capital spending, and financing activities took a bigger toll. The company spent heavily on buybacks, repurchasing $250 million in shares, and paid down $88 million in debt while issuing just $1 million. These outflows led to a reduction in the year-end cash position, which now sits at $272 million, down from $334 million the year before. Despite the shrinking cushion, cash flow remains positive, covering dividends and modest debt reduction, though ongoing shareholder returns and debt service could be more challenging if operational cash generation continues to slide.

Analyst Ratings

🛑 DENTSPLY SIRONA has recently faced a wave of analyst downgrades, reflecting growing concern over its slipping financial performance and uncertain growth outlook. 📉 Morgan Stanley downgraded the stock from Overweight to Equal Weight, trimming the price target from $21 to $14. This shift was largely driven by the company’s poor performance throughout 2024, with shares plummeting nearly 47% — a steep drop compared to both the broader market and dental sector peers. 📊 Added pressure came from the company’s restructuring of its Byte business model, where DENTSPLY SIRONA is now pivoting toward treatments that require more hands-on dentist involvement, a move that could temper growth in the short term.

🔻 Jefferies followed suit, moving its rating from Buy to Hold and slicing the price target from $30 down to $20. 📌 Meanwhile, Evercore ISI also downgraded XRAY to In Line from Outperform, pegging a new target at $20 as well. 🛡️ Mizuho took a cautious stance, adjusting its price target to $16 while maintaining a Neutral view, pointing to survey results hinting at softer demand trends within the dental market heading into the next year.

📈 As of now, the overall analyst consensus on DENTSPLY SIRONA is a Hold, with a consensus price target sitting around $22.58. This suggests that while immediate upside may be limited, there’s still a general belief that the company could stabilize with time.

Earning Report Summary

Full-Year and Fourth Quarter Highlights

DENTSPLY SIRONA closed out 2024 with a mixed bag of results that reflected both the challenges it faced and the moves it’s making to reset its future. For the full year, net sales came in at $3.79 billion, down about 4.3% from the year before. Organic sales slipped by 3.5%, mostly due to the company’s decision to pull back from its direct-to-consumer Byte aligner business. Leadership noted that stepping away from Byte’s traditional model knocked off roughly 1.2% from the top line, but they stood by the move as a necessary adjustment to align better with long-term goals.

Adjusted earnings per share for the year landed at $1.82, right within the range the company had set in its guidance. Even though revenue was under some pressure, DENTSPLY SIRONA managed to keep things steady on the bottom line, thanks to tight cost controls and operational shifts that started showing up toward the back half of the year.

Leadership’s Take and the Road Ahead

During the fourth quarter, the company reported $919 million in net sales, a 4.9% decline compared to the same stretch a year ago. Adjusted EBITDA margin for the quarter was 17.5%, slightly softer than some had hoped, mostly because of the ongoing restructuring efforts and a few tough market dynamics that hit late in the year. Despite that, DENTSPLY SIRONA kept its foot on the gas with investments in innovation, rolling out new products and strengthening its digital platforms, a major part of its future strategy.

Management was candid about the hurdles the company faced throughout the year. They acknowledged the operational setbacks but stressed that the tougher choices made in 2024 were critical to positioning the company for better, more sustainable growth. The leadership team made it clear that their focus going forward will be on sharpening the core business, putting more resources into digital dentistry, and making sure the product lineup stays aligned with what customers actually want and need.

Even with all the changes, DENTSPLY SIRONA stayed committed to rewarding shareholders. They paid out $33 million in dividends and spent another $100 million buying back shares in the fourth quarter alone. It’s a sign that while the company is tightening operations, it isn’t stepping away from making shareholder returns a priority.

As 2025 kicks off, the company seems more focused than ever on finding its footing. With a major part of the heavy lifting already done, the next few quarters will show whether all these changes start translating into a steadier, stronger DENTSPLY SIRONA.

Chart Analysis

Price Trend and Moving Averages

Looking at the 1-year chart for XRAY, the stock has been in a steady downward trend, with a clear sequence of lower highs and lower lows. The 50-day moving average (in red) has stayed consistently beneath the 200-day moving average (in blue), a classic signal of prolonged weakness. There’s no crossover or sign yet that the shorter-term trend is reversing direction. In fact, the 50-day line continues to slope downward, reflecting ongoing selling pressure and limited short-term momentum.

The price broke below $20 in early November and hasn’t managed to reclaim that level since. Since then, it’s mostly been hovering between $13 and $18, with a few failed rallies. Recently, the stock did show a small bounce from the low $12s to the mid-$13s, but it’s still well below both moving averages, and the long-term trend remains firmly to the downside.

Volume Behavior

Volume has remained relatively subdued throughout most of the year, with only a few noticeable spikes. The largest of these came around November, likely tied to earnings or a major news event, and another uptick appeared recently as the stock bounced slightly off its lows. Still, there’s no consistent surge in volume that would point to strong accumulation or a shift in sentiment.

What stands out is the lack of heavy institutional-style buying, which would typically show up as broader and more sustained volume surges. Instead, the volume has been uneven and short-lived, suggesting the recent bounce may be more technical in nature than the start of a fundamental shift.

RSI and Momentum

The Relative Strength Index (RSI) has spent a good part of the year below the midline, often drifting into oversold territory. There were multiple touches near or below the 30 level, showing extended selling pressure. Every time the stock approached the upper 60-70 RSI range, it failed to break higher and quickly rolled back over.

Most recently, the RSI has bounced off the lower end, pushing above 50 as the stock recovered slightly. While this shows some improvement in momentum, it’s not yet a strong bullish signal. The RSI would need to spend more time above 50 and ideally climb toward 60–70 with price support to confirm a more meaningful shift in sentiment.

Final Observations

XRAY remains stuck in a long-term downtrend with no clear technical reversal in sight. Moving averages are still bearish, volume hasn’t backed up the recent move, and RSI is only just starting to show early hints of strength. Until price action reclaims key levels and volume expands on up days, the current move looks more like a short-term bounce within a broader bearish trend.

Management Team

DENTSPLY SIRONA’s leadership has seen notable transitions over the last few years as the company works through a series of operational and strategic challenges. The current executive team is focused on discipline—specifically around costs, cash flow, and core business execution. The recent exit from Byte’s direct-to-consumer aligner model was a signal of that new mindset. It wasn’t just about trimming the fat; it was a calculated move to redirect resources toward higher-margin, more controllable areas of the business.

There’s a clear shift in tone from the top. Management has been more transparent about what hasn’t worked and seems more committed to a realistic strategy that prioritizes stability and long-term value over flashier growth tactics. The focus is now on consolidating leadership in dental technology, reworking internal systems, and making the company more responsive to shifts in the dental care industry. While it’s still early in the process, the current leadership team is showing the kind of focus investors hope for when a company is trying to dig out from underperformance.

Valuation and Stock Performance

XRAY’s valuation today tells a story of lowered expectations. With a forward P/E around 7.4, it’s well below its historical average and trades at a discount to many peers in the sector. That’s not without reason. Revenue has contracted, strategic pivots are ongoing, and market confidence has clearly taken a hit. The stock has dropped more than 55% over the past twelve months, falling from the low $30s to around $13.

Price performance has been weak and technical indicators still show a bearish outlook. The stock continues to trade under its key moving averages, reinforcing the idea that investors are hesitant to buy into a recovery until there’s more evidence. While the stock has bounced slightly off its recent lows, it remains in a fragile zone where sentiment could swing in either direction.

Despite the pressure, some investors may be giving it another look due to the current dividend yield. Now approaching 5%, it’s among the most attractive levels this company has offered in years. But the dividend story needs to be balanced against a still-uncertain operational backdrop. There’s value on the table, but whether it gets unlocked depends on execution and whether XRAY can build momentum with its revised strategy.

Risks and Considerations

There’s no shortage of risk here. Organic growth remains inconsistent, and revenue has been sliding. The Byte exit may have helped refocus the company, but it also stripped away a segment that previously promised growth, even if it failed to deliver. Without strong rebound trends in equipment sales or procedure volumes, revenue stabilization could take time.

Debt is another point of concern. With $2.3 billion on the books, XRAY is carrying a significant load. Free cash flow remains positive, but just enough to support the dividend and modest deleveraging. If interest rates stay elevated, refinancing or servicing that debt could put added pressure on operations.

Strategic execution is in progress, but these types of corporate overhauls rarely go smoothly. Turnarounds often hit speed bumps, and if cost savings or product realignment efforts fail to deliver quickly enough, market patience could run out. There’s also risk tied to regulation. The dental and medical device space is heavily monitored, and with Byte drawing more attention in recent years, compliance costs could rise or flexibility could be constrained.

And then there’s the broader economy. Dental procedures, especially cosmetic or elective ones, tend to be sensitive to consumer confidence and discretionary spending. If the economy slows further, demand could remain muted even if the company itself is executing well internally.

Final Thoughts

DENTSPLY SIRONA finds itself in a rebuilding phase. The company has acknowledged where things went wrong and has made strategic decisions to course-correct, but it’s still very much in the middle of that process. The good news is that management seems to have a clear sense of direction. They’re focusing on foundational improvements rather than chasing the next growth fad, and they’re doing so with a more balanced approach to capital allocation.

The valuation today reflects skepticism, maybe even some pessimism, about how successful this turnaround will be. At the same time, that low valuation and high dividend yield suggest there could be upside if the company can start delivering better results quarter over quarter. But the burden is on XRAY to prove that it can stabilize revenue, improve margins, and make its core dental business the engine of growth again.

What happens next will depend on execution, market sentiment, and how quickly those internal changes start showing up in the numbers. For now, DENTSPLY SIRONA is at a critical inflection point, with its future path shaped by a mix of strategy, discipline, and resilience.