Key Takeaways

📈 D.R. Horton offers a forward dividend yield of 1.01% with a payout ratio of just 15.01%, and has grown its dividend at an average rate of approximately 22% annually over the past five years, including a raise to $0.45 per quarter in late 2025.

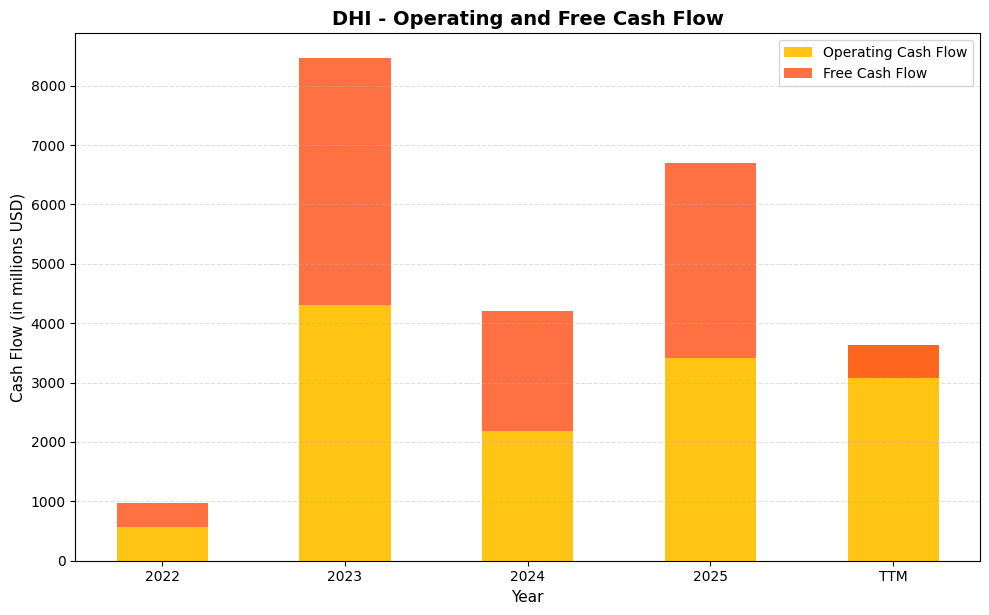

💵 Operating cash flow for the trailing twelve months came in at $3.63 billion, though free cash flow turned negative at roughly negative $547 million, reflecting elevated land and inventory investment as the company positions for future volume.

🔍 The analyst consensus sits at buy, with 14 analysts covering the stock and a mean price target of $160.50, suggesting modest upside from the current price of $156.95.

📊 With EPS of $10.98 and revenue of $33.5 billion, D.R. Horton continues to generate substantial earnings power, and the stock trades at a reasonable 14.3 times trailing earnings with a price-to-book of 1.90.

Updated 2/25/26

D.R. Horton (NYSE: DHI), the largest homebuilder in the U.S. by volume, continues to operate from a position of scale and discipline even as the housing market navigates a prolonged affordability challenge. The company operates across 45 states with a diverse product range spanning entry-level to luxury homes. Backed by an experienced leadership team and a track record of measured capital allocation, DHI has maintained profitability and dividend growth through cycles that have pressured weaker competitors far more severely.

Revenue has moderated from its peak, but the company continues to produce meaningful earnings, grow its dividend, and invest actively in land and community development. With shares trading near the midpoint of their 52-week range and analyst sentiment leaning constructive, DHI presents a grounded case for long-term investors who value consistent execution over headline growth.

Recent Events

The housing market continues to grapple with elevated mortgage rates and affordability constraints that have weighed on buyer demand across most price points. D.R. Horton, with its heavy concentration in entry-level and first-move-up homes, has felt those pressures as acutely as any large builder. The company’s trailing twelve-month revenue came in at $33.5 billion, reflecting the continued normalization from the peak volumes seen during the pandemic-era housing surge. Management has responded by actively adjusting incentive packages and mortgage rate buydown programs on a market-by-market basis, a strategy consistent with how the company has historically navigated demand softness.

In November 2025, D.R. Horton raised its quarterly dividend from $0.40 to $0.45 per share, a 12.5% increase that was followed by the February 2026 payment at the same rate. That consecutive $0.45 payment confirms the raise is sustained rather than a one-time adjustment, and it extends the company’s multi-year streak of annual dividend increases. The move signals that management retains confidence in the earnings and cash generation outlook despite the more challenging demand environment.

The company also continues to carry notable short interest of approximately 15.3 million shares, reflecting ongoing skepticism from some market participants about the near-term trajectory of new home demand. That bearish positioning, however, also sets up the potential for short covering if housing data or earnings surprise to the upside. Against a backdrop of persistent undersupply in the existing home market, D.R. Horton’s ability to offer incentives and mortgage support gives it a competitive advantage that smaller regional builders cannot easily replicate.

Key Dividend Metrics

📈 Dividend Yield: 1.01% (Forward)

💰 Payout Ratio: 15.01%

🔁 5-Year Average Dividend Yield: 0.93%

📆 Last Dividend Payment: $0.45 (February 5, 2026)

🪙 Dividend Growth Rate (5-Year Avg): ~22% CAGR

🔒 Dividend Safety: Excellent

Dividend Overview

At a yield of 1.01%, DHI’s dividend is not designed to attract investors who need current income above all else. The real appeal lies in the trajectory. The company has grown its dividend from $0.25 per quarter in early 2023 to $0.45 per quarter by the end of 2025, a cumulative increase of 80% in less than three years. That pace of growth, sustained against a backdrop of rising rates and softening demand, reflects the strength of the underlying earnings model.

With annual dividends of $1.80 and EPS of $10.98, DHI is paying out just 15% of its earnings to shareholders. That leaves an enormous cushion for future raises and makes the dividend essentially immune to any realistic near-term earnings decline. Even if earnings were to compress by a third, the payout ratio would still sit comfortably below 25%, a level most income-focused investors would consider very safe for a company of this quality.

Viewed against its own history, the current yield of 1.01% sits modestly above the five-year average yield of 0.93%, meaning investors are getting slightly more income per dollar invested than has typically been available. The dividend strategy here remains deliberate and conservative, with management using incremental quarterly raises to communicate long-term confidence rather than making large one-time adjustments that could be difficult to sustain.

Dividend Growth and Safety

D.R. Horton’s dividend growth record over the past five years is among the strongest in the homebuilding sector, with an average annual increase of approximately 22%. The most recent raise, from $0.40 to $0.45 per quarter effective with the November 2025 payment, extended that streak and represents a 12.5% year-over-year increase at the quarterly level. The subsequent February 2026 payment at $0.45 confirms the new rate is the established baseline.

Operating cash flow of $3.63 billion over the trailing twelve months provides the foundation for dividend security. Free cash flow turned negative at roughly negative $547 million, but that figure reflects aggressive investment in land acquisition and development rather than any deterioration in the core business. Land spending at this level is typically a leading indicator of future revenue, as communities opened today become closings twelve to twenty-four months from now. The dividend itself costs the company approximately $500 million annually at current rates, a sum easily covered by operating earnings and cash generation from ongoing closings.

The pattern of dividend increases has been notably consistent. From 2023 through 2026, the company raised its dividend twice at the $0.25 to $0.30 level, twice more from $0.30 to $0.40, and most recently to $0.45, with no skipped periods and no reversals. That kind of clean progression reflects a management team that treats dividend growth as a measured commitment rather than a marketing tool. DHI’s beta of 1.45 means the stock will move more than the market during volatile periods, but for investors focused on the dividend itself, that price volatility has had no effect on the actual income stream.

The combination of a 15% payout ratio, $3.6 billion in operating cash flow, and a consistent history of annual increases makes DHI one of the more dependable dividend growers available in the consumer cyclical space, even if the yield itself remains modest in absolute terms.

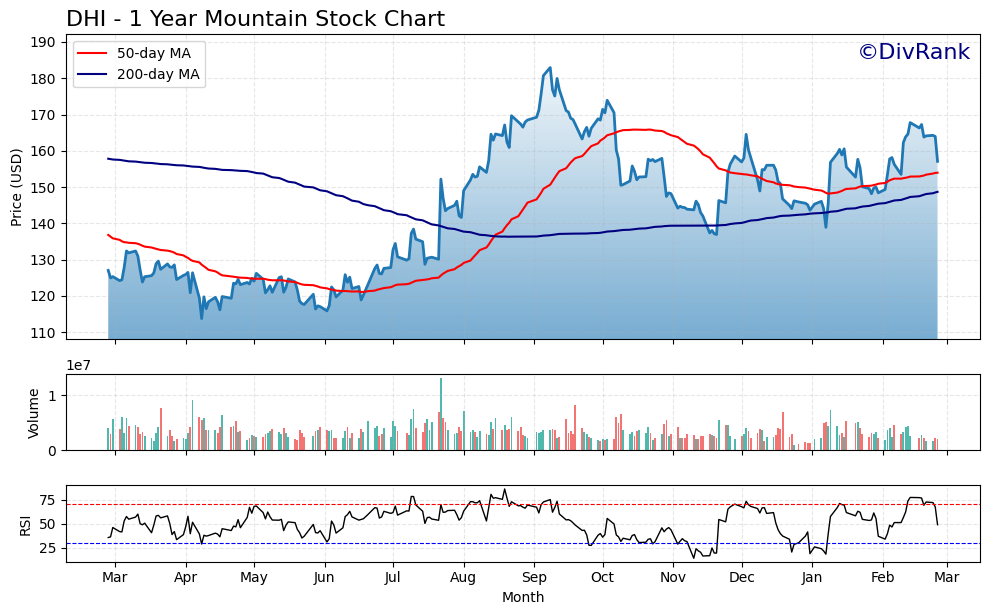

Chart Analysis

D.R. Horton has put together a meaningful recovery over the past year, climbing from a 52-week low of $113.76 to its current price of $157.10, a gain of roughly 38% off the bottom. That kind of range tells the story of a stock that experienced real selling pressure at some point in the trailing twelve months, but has since found its footing and rebuilt momentum. The 52-week high of $182.95 remains about 14% above the current price, so the stock has not yet reclaimed its peak, but the directional trend off the lows is constructive and reflects improving sentiment around the homebuilding sector.

The moving average picture is encouraging for income investors who care about trend stability. DHI is trading above both its 50-day moving average of $153.96 and its 200-day moving average of $148.69, which means the stock is in a technically healthy position on both a near-term and longer-term basis. More importantly, the 50-day has crossed above the 200-day, a setup technically referred to as a golden cross, which historically signals that intermediate-term momentum has turned in favor of the bulls. The spread between the two averages is meaningful but not stretched, suggesting the trend has room to develop further without being overextended.

The current RSI reading of 48.98 sits almost perfectly in neutral territory, just below the midpoint of the 0 to 100 scale. This is actually a favorable setup for dividend investors who are considering initiating or adding to a position, because it indicates the stock is neither overbought nor oversold. There is no technical evidence of speculative excess driving the price, and there is no sign of panic selling depressing it. A neutral RSI at a price that is still above both key moving averages suggests the stock is consolidating gains in an orderly way rather than running on fumes.

Taken together, the technical picture for DHI is quietly constructive. The trend is up, the moving averages are properly aligned with a golden cross confirmed, and momentum is neither frothy nor exhausted. For dividend investors, this kind of setup is preferable to chasing a stock at its 52-week high or trying to catch a falling knife. At $157.10, DHI offers a reasonable entry point from a technical standpoint, with meaningful distance from the recent low and a price structure that supports further upside if the fundamental backdrop cooperates.

Cash Flow Statement

D.R. Horton’s cash flow profile tells a compelling story for dividend investors, even if the TTM numbers require some unpacking. Operating cash flow swung from a modest $561.8 million in fiscal 2022 to a remarkable $4.3 billion in 2023, then moderated to $2.2 billion in 2024 before rebounding to $3.4 billion in 2025 and reaching $3.6 billion on a trailing twelve-month basis. Free cash flow followed a similar arc, peaking at $4.2 billion in 2023 and settling at $3.3 billion in 2025. The TTM free cash flow figure of negative $546.8 million stands out as an anomaly and reflects accelerated land and lot investment rather than any deterioration in the underlying business, a distinction that matters enormously when assessing dividend safety. With the current annual dividend running well under $1 billion in total payout obligations, the $3.3 billion in fiscal 2025 free cash flow alone covers that commitment more than three times over.

Stepping back across the full four-year window, the trajectory from $413.6 million in free cash flow in 2022 to consistently multi-billion-dollar figures in subsequent years reflects a homebuilder that has materially scaled its earnings power while maintaining disciplined capital deployment. The 2022 trough was largely a function of elevated inventory investment at peak cycle demand, and the recovery into 2023 demonstrated how quickly that working capital converts back to cash once construction timelines normalize. Capital efficiency has improved alongside volume growth, which is not always the case in asset-intensive industries, and it positions DHI shareholders to benefit from continued dividend growth, opportunistic share repurchases, and balance sheet optionality. The temporary dip in TTM free cash flow is a signal that management is reinvesting aggressively in future community count and lot supply, which historically has preceded revenue growth rather than preceded any kind of payout stress.

Analyst Ratings

The analyst community holds a buy consensus on D.R. Horton, with 14 analysts covering the stock as of late February 2026. The mean price target of $160.50 sits modestly above the current price of $156.95, implying limited but positive expected upside at current levels. The range of targets is wide, spanning from a low of $117 to a high of $193, which reflects genuine disagreement among analysts about how quickly housing demand will recover and what multiple the stock deserves in the current rate environment.

The low end of the target range at $117 represents a roughly 25% discount to the current price, suggesting that the more bearish analysts are pricing in a meaningful deterioration in closings or margins from here. The high end at $193 implies upside of about 23%, and those targets likely reflect a scenario where mortgage rates ease and pent-up demand translates into accelerating order activity over the next several quarters. At the current price of $156.95, the stock is trading very close to the mean target, which typically suggests the market has largely priced in the consensus view and that the next meaningful move will depend on whether incoming data surprises in either direction.

With short interest of approximately 15.3 million shares still elevated, there remains a contingent of market participants betting against near-term performance. That positioning, combined with a buy-leaning analyst consensus and a stock trading near fair value by target-based measures, sets up a relatively balanced risk/reward picture heading into the next earnings cycle.

Earning Report Summary

Solid Earnings Amid a Challenging Demand Environment

D.R. Horton’s most recent reported financials show trailing twelve-month revenue of $33.5 billion and net income of $3.34 billion, producing EPS of $10.98. The profit margin of 9.95% reflects the impact of incentive programs and mortgage rate buydowns that the company has been deploying to maintain order pace in a high-rate environment. While that margin is below the peak levels achieved during the post-pandemic housing boom, it remains competitive for the sector and demonstrates that the business model continues to generate meaningful profitability at current volumes.

Return on equity of 13.48% and return on assets of 7.83% are consistent with a well-run homebuilder operating through a mid-cycle slowdown rather than a distressed period. The company has maintained its operational discipline, and management has continued to emphasize the advantages of scale in managing land costs, construction expenses, and financing programs for buyers.

Investment Mode With an Eye on Recovery

The negative free cash flow figure of approximately negative $547 million signals that D.R. Horton is currently investing ahead of future demand rather than harvesting cash from existing inventory. That posture reflects management’s conviction that the housing undersupply dynamic in the United States remains structurally intact, and that builders who invest through the current affordability-driven slowdown will be positioned to capture volume when rate conditions eventually improve.

The dividend raise to $0.45 per quarter, effective in November 2025 and sustained through the February 2026 payment, is consistent with that confidence. Management is not treating the current environment as a reason to conserve every available dollar, but rather as a period to continue rewarding shareholders while building the community count that supports future growth. The overall tone from leadership has been measured but not defensive, which is consistent with a team that has managed the company through multiple housing cycles and understands the difference between a cyclical pause and a structural problem.

Management Team

D.R. Horton’s leadership team remains one of the most experienced in large-scale homebuilding. Executive Chairman David Auld spent nearly a decade as CEO before transitioning to his current role, and his influence on the company’s culture of operational discipline and cost efficiency continues to be felt throughout the organization. Auld joined the company in the late 1980s, giving him a perspective that spans multiple housing cycles and a range of interest rate environments that few executives in the sector can match.

CEO Paul Romanowski has been with D.R. Horton since 1999 and has built his career on deep knowledge of field operations and local market dynamics. His approach to the current environment has been pragmatic, emphasizing incentive flexibility and product mix adaptation at the community level rather than blanket policy changes that might not translate well across the company’s geographically diverse footprint. That local-first philosophy has helped D.R. Horton maintain order pace in markets where affordability pressure is most acute, while protecting margins in stronger regional markets. The management team’s long collective tenure and consistent strategic philosophy represent a meaningful competitive advantage in an industry where execution quality and relationship capital take years to build.

Valuation and Stock Performance

At a current price of $156.95, D.R. Horton trades at 14.3 times trailing earnings, a valuation that appears reasonable for a company generating $33.5 billion in revenue with a profit margin approaching 10% and a return on equity above 13%. The price-to-book ratio of 1.90 against a book value of $82.60 per share is similarly undemanding, and reflects the market’s lingering uncertainty about near-term housing demand rather than any fundamental deterioration in the asset base.

The stock has traded in a wide range over the past year, from a low of $110.44 to a high of $184.55, and the current price near $157 places it roughly in the middle of that band. The pullback from the 52-week high of $184.55 has brought the valuation back to levels that are more historically consistent with periods of mid-cycle uncertainty, and the mean analyst target of $160.50 suggests the consensus view is that the stock is approximately fairly valued at current prices.

The company’s market capitalization of approximately $45.7 billion reflects its dominant position as the largest U.S. homebuilder by volume, and the ongoing share repurchase program provides a steady source of demand for the stock. Management’s willingness to continue buybacks while also raising the dividend signals confidence in the long-term earnings trajectory. For investors with a multi-year time horizon, the current valuation offers a reasonable entry point into a proven franchise that has consistently delivered shareholder value across a range of market conditions.

Risks and Considerations

The most persistent risk facing D.R. Horton is the affordability squeeze that elevated mortgage rates have created for prospective homebuyers. The company has a significant concentration in entry-level and first-move-up price points, which are the segments most sensitive to monthly payment affordability. If mortgage rates remain elevated or move higher, order activity in those price points could remain subdued longer than the current consensus expects, which would put pressure on revenue and closings in fiscal 2026 and potentially beyond.

The negative free cash flow of approximately negative $547 million, while explained by land investment, is worth monitoring over coming quarters. If demand does not recover at a pace that justifies the current level of land spending, the company could find itself carrying elevated inventory in a softer pricing environment. That scenario is not the base case, but it represents a legitimate risk given the uncertainty around the rate outlook and consumer sentiment.

Input costs remain a source of margin pressure. Lumber prices have been volatile, labor availability in construction remains constrained in many markets, and any renewed inflationary impulse in materials or labor could compress the gross margins that management has worked to defend through incentive programs and efficiency initiatives. D.R. Horton’s scale provides some insulation, but it does not eliminate exposure entirely.

Regional concentration in the South and West, where much of the company’s community count is located, creates exposure to local economic conditions that can diverge from national trends. Markets in Texas, Florida, and Arizona, which have been important contributors to DHI’s volume, have experienced meaningful affordability deterioration as home prices rose sharply during the pandemic boom years. A correction or prolonged stagnation in those markets could have an outsized impact on overall results.

The elevated short interest of roughly 15.3 million shares reflects a meaningful segment of market opinion that is skeptical of the near-term outlook. While short interest alone is not a fundamental risk, it does suggest that any disappointment in upcoming earnings or order data could trigger outsized selling pressure. Investors should be prepared for above-average price volatility given the stock’s beta of 1.45 and the current short positioning.

Final Thoughts

D.R. Horton remains the gold standard for scale and operational execution in U.S. homebuilding. The company has navigated the post-pandemic demand normalization with its margins, balance sheet, and dividend growth streak all intact, which is a meaningful accomplishment given how severely affordability has been impaired by the rate environment of the past two years. The November 2025 dividend raise to $0.45 per quarter and its continuation into February 2026 demonstrate that management is not standing pat, but actively signaling confidence in the path forward.

The near-term picture carries real uncertainty. Mortgage rates have not cooperated with the recovery narrative, order pace remains sensitive to monthly payment dynamics, and the negative free cash flow figure reflects a level of land investment that requires demand to materialize in order to pay off. Those are legitimate considerations that any honest assessment of the stock must acknowledge.

Over a longer horizon, however, the structural undersupply of housing in the United States, combined with D.R. Horton’s unmatched scale and purchasing power, positions the company to be a primary beneficiary when affordability conditions do eventually improve. With a payout ratio of 15%, a buy consensus, and a stock trading near the analyst mean target, DHI offers a credible combination of income growth and capital appreciation potential for patient investors willing to look past the near-term noise.