Updated 2/25/26

Curtiss-Wright Corporation (CW) is a well-run, diversified engineering company operating across defense, aerospace, and energy markets. With a history dating back to 1929, the company has evolved into a consistent performer with strong margins, disciplined capital allocation, and a growing backlog that continues to reflect robust demand across its core end markets. Its leadership team, led by CEO Lynn Bamford, continues to emphasize innovation, operational efficiency, and shareholder returns.

Over the past year, CW’s stock has surged dramatically, trading near $698.36 and sitting close to its 52-week high of $717.50. Free cash flow came in at $466 million and the payout ratio remains exceptionally lean at 7.23%, leaving ample room for continued dividend growth and share repurchases. With a consensus buy rating from analysts and a mean price target of $711.43, CW continues to deliver on its reputation as a high-quality industrial compounder.

Recent Events

Curtiss-Wright has maintained strong business momentum heading into early 2026, driven by sustained demand across its defense electronics, naval propulsion, and commercial nuclear segments. The company’s ongoing work supporting U.S. Navy submarine programs remains a key growth driver, with multi-year procurement plans underpinning visibility well beyond the current fiscal year. Defense modernization spending at both the domestic and allied-nation level continues to generate incremental opportunities for CW’s specialized systems and components.

On the capital allocation front, management has continued its disciplined approach to share repurchases, which alongside steady dividend increases has reinforced confidence among institutional shareholders. The company raised its quarterly dividend to $0.24 per share in mid-2025, a move that reflected both earnings strength and management’s conviction in the durability of its cash flow profile. That increase brought the annualized rate to $0.96, up from the $0.84 rate in place at the start of 2024.

The broader aerospace and defense sector has benefited from elevated geopolitical tensions and increased allied defense budgets, trends that have translated directly into stronger order flow for companies like Curtiss-Wright with deep program integration across naval, ground vehicle, and aerospace platforms. Management has pointed to record backlog levels and new orders momentum as evidence that the company’s strategic positioning is paying off in real demand terms.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.14%

💰 Forward Annual Dividend Rate: $0.96

📅 Most Recent Dividend Payment: $0.24 per share

🔔 Most Recent Ex-Dividend Date: November 28, 2025

🛡️ Payout Ratio: 7.23%

📊 5-Year Average Dividend Yield: 0.47%

Dividend Overview

At first glance, Curtiss-Wright’s dividend yield near 0.14% is not going to attract investors whose primary goal is current income. For those chasing yield, there are far more obvious options in the market. But the dividend story at CW is not about the yield in isolation. It is about what the yield signals regarding the financial condition of the underlying business.

A payout ratio of 7.23% means CW is distributing less than eight cents of every dollar it earns. That is one of the most conservative payout profiles among publicly traded industrials, and it speaks directly to the company’s priorities: reinvest in growth, repurchase shares opportunistically, and let the dividend grow steadily over time without ever stretching the balance sheet to support it. The result is a dividend that feels essentially untouchable in any realistic economic scenario.

Supporting that conclusion is operating cash flow of $643 million and free cash flow of $466 million. The annual dividend obligation at current rates represents only a small fraction of either figure. Even in a meaningful earnings downturn, Curtiss-Wright would have extensive internal resources to sustain the dividend without any structural stress. For long-horizon investors who value reliability above all else, that kind of margin of safety is genuinely valuable.

Dividend Growth and Safety

Curtiss-Wright’s recent dividend history tells a clear story of quiet, consistent progress. The quarterly payment stood at $0.19 in early 2023, moved to $0.20 by mid-2023, held at that level through the first quarter of 2025, and then stepped up to $0.24 starting with the June 2025 payment. That represents a roughly 26% increase in the quarterly rate over a span of about two years, achieved without any fanfare and with zero apparent strain on the balance sheet.

The safety of that dividend is as strong as it has ever been. With a payout ratio below 8% and free cash flow coverage that is extraordinarily wide, there is essentially no plausible short-term scenario in which CW’s dividend would face pressure. Return on equity of 19.43% and return on assets of 8.22% confirm that the company is generating genuine, high-quality returns on the capital it deploys, not just managing accounting outcomes.

CW’s beta of 0.93 positions it as a slightly below-market-volatility name, which is a meaningful attribute for dividend-focused investors who want equity exposure without the whipsaw risk of more cyclically sensitive industrials. The stock’s relative stability, combined with its consistent earnings and cash flow, makes it a natural fit for portfolios that prize predictability and compounding over time.

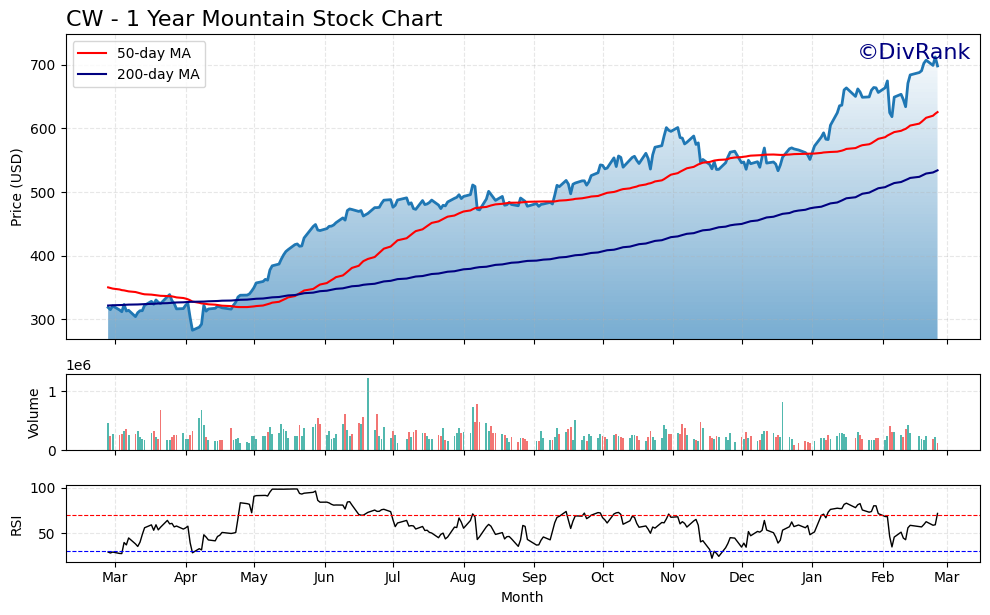

Chart Analysis

Curtiss-Wright’s chart tells a compelling story of sustained momentum over the past twelve months. The stock has rallied approximately 147% off its 52-week low of $282.78, a move that reflects a dramatic shift in institutional sentiment toward the defense and industrial sectors. At a current price of $698.36, shares are sitting just 1.98% below their 52-week high of $712.45, which signals that the stock is operating near peak territory rather than presenting an obvious entry point at a discount. For dividend investors, that kind of price appreciation is a welcome bonus on top of the income stream, though it does raise questions about near-term valuation that are worth weighing carefully before initiating or adding to a position.

The moving average picture is unambiguously constructive. CW is trading well above both its 50-day moving average of $625.79 and its 200-day moving average of $534.21, with the 50-day crossing above the 200-day to form a golden cross, one of the more reliable long-term bullish signals technical analysts rely on. The spread between the current price and the 200-day average is substantial at roughly $164, which confirms that the underlying trend has genuine strength behind it rather than being a fleeting bounce. That kind of separation between price and the longer-term average historically suggests a trend with staying power, though it also means a mean-reversion pullback toward those averages would represent a significant percentage drawdown from current levels.

The RSI reading of 71.62 places CW in overbought territory by conventional standards, with the typical threshold sitting at 70. A reading in this range does not automatically signal an imminent reversal, as strongly trending stocks can hold elevated RSI levels for extended periods, but it does indicate that buying pressure has been intense and that the risk of a short-term consolidation or pullback is elevated. Momentum is clearly running in the bulls’ favor right now, yet investors adding capital at these levels should be prepared for the possibility that the stock digests some of its recent gains before pushing toward a fresh breakout above $712.45.

For dividend-focused investors, the technical backdrop presents a classic tension between trend confirmation and valuation comfort. The golden cross, the proximity to 52-week highs, and the strong distance from the 200-day average all argue that the long-term trend remains intact and that the market continues to reward CW shareholders. At the same time, the overbought RSI and the slim cushion below the 52-week high suggest that patience may serve income investors better than urgency here. Those already holding shares have little reason for concern from a chart perspective, while prospective buyers may find a more favorable risk-reward setup if the stock pulls back toward the $650 to $660 range, where price would find better support from the rising 50-day moving average.

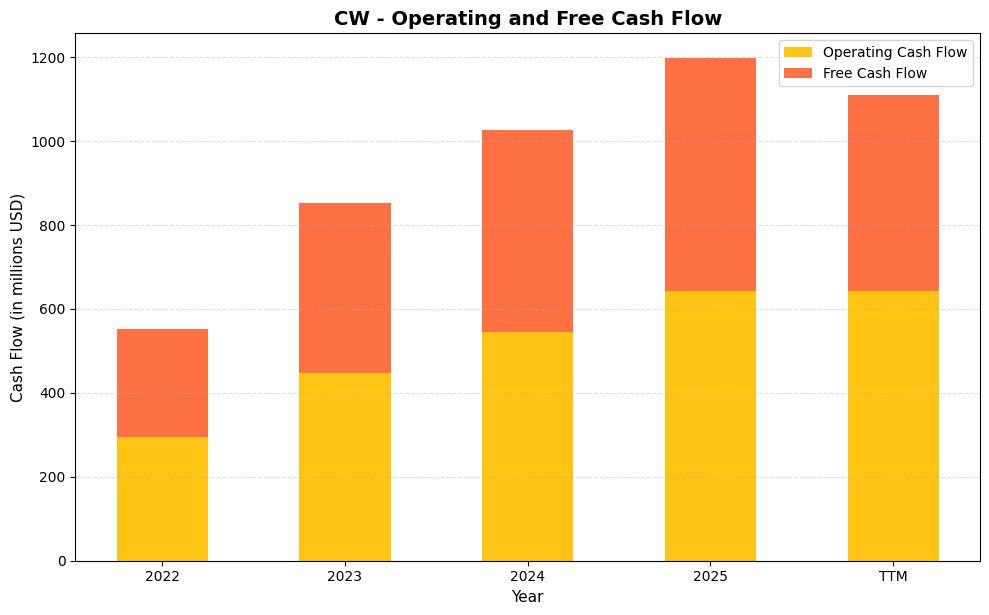

Cash Flow Statement

Curtiss-Wright’s cash generation has been one of the cleaner stories in the defense and industrial space over the past several years. Operating cash flow climbed from $294.8 million in 2022 to $544.3 million in 2024, then reached $643.4 million in 2025, a figure that also represents the trailing twelve months. Free cash flow has tracked closely alongside, rising from $256.6 million in 2022 to $483.3 million in 2024 and $553.7 million in 2025, before the TTM figure settles at $465.7 million, reflecting the timing of capital expenditures in the most recent period. For dividend investors, the core message is straightforward: the company is generating far more cash than it needs to fund its current payout, which means the dividend is covered with substantial room to spare and management retains meaningful flexibility to continue raising it.

The trajectory here tells a compelling capital efficiency story. From 2022 to 2025, operating cash flow more than doubled while free cash flow grew by roughly 116 percent over the same span, and that kind of expansion did not happen because revenue alone surged. It reflects improving margins, disciplined working capital management, and a capital expenditure profile that has stayed modest relative to the cash being generated. The conversion of earnings into actual cash has been consistently high, which matters considerably more to a dividend investor than reported net income alone. With free cash flow running well above $400 million on a sustained basis, Curtiss-Wright has the financial foundation to support continued dividend growth, opportunistic buybacks, and bolt-on acquisitions simultaneously, without leaning on the balance sheet to do any of it.

Analyst Ratings

The analyst community maintains a constructive view on Curtiss-Wright, with a consensus buy rating based on input from seven covering analysts. The mean price target of $711.43 sits just above the current share price of $698.36, suggesting that at current levels the market has largely priced in the near-term fundamental case. However, the high-end target of $770.00 leaves meaningful room for upside if the company continues to execute at its recent pace, while the low-end target of $614.00 implies that even the most cautious analysts see the stock as reasonably supported at these levels.

The tight clustering of targets around the current price reflects the challenge analysts face in modeling a stock that has re-rated dramatically over the past year, climbing from lows near $267 to within striking distance of $720. Bulls point to Curtiss-Wright’s record backlog, defense budget tailwinds, and proven management execution as justification for a premium multiple. More cautious voices acknowledge the same operational strengths but flag the elevated valuation as a constraint on near-term return potential, particularly if broader market conditions shift or defense spending priorities are realigned.

With seven analysts covering the name and none carrying an outright sell, the overall sentiment remains clearly favorable. Any incremental positive developments on the backlog or margin front could be sufficient to prompt target increases that pull the mean estimate higher, giving the stock a fresh catalyst to extend its run.

Earning Report Summary

Curtiss-Wright Corporation has continued to build on the strong 2024 close, with full-year financials reflecting the breadth and durability of its business model. Revenue reached approximately $3.5 billion for the trailing twelve-month period, with net income of $484 million and earnings per share of $12.90. These results represent solid progress on the growth trajectory management laid out coming into the year, with operating margins and returns on capital both moving in the right direction.

Leadership’s Take on the Quarter

CEO Lynn Bamford has consistently emphasized the importance of backlog quality and order discipline as leading indicators of sustainable growth. Her commentary across recent reporting periods has highlighted the strength of the naval nuclear propulsion business, ongoing demand for defense electronics, and expanding contributions from the commercial nuclear segment as the global energy transition accelerates interest in new nuclear capacity. Bamford has also pointed to acquisition integration and internal capacity expansion as key enablers of the company’s margin improvement targets.

Looking Ahead

Management has set expectations for continued revenue growth driven by organic expansion in defense and nuclear markets, supplemented by contributions from prior acquisitions. The company’s margin improvement roadmap remains intact, with leadership targeting further operating leverage as higher-value programs represent a growing share of the revenue mix. With a profit margin of 13.84% and return on equity approaching 20%, the financial foundation supporting those targets looks solid heading into the balance of 2026.

Management Team

Curtiss-Wright’s leadership team has shown a steady hand over the past several years, guiding the company through market cycles, strategic acquisitions, and operational shifts with consistent execution. At the helm is Lynn Bamford, who took over as CEO in 2021. Her background in defense and mission-critical technologies fits well with the company’s core segments, and her leadership has been marked by a clear focus on both innovation and margin expansion.

Under her direction, Curtiss-Wright has stayed disciplined with its capital allocation, balancing reinvestment in growth areas with a clear commitment to returning capital to shareholders. The leadership team has also demonstrated an ability to integrate acquisitions smoothly while maintaining profitability. Their communication with the market has remained consistent, with forward-looking statements backed by data and supported by performance track records that have earned credibility over multiple reporting cycles.

Executives are aligned with shareholders in terms of long-term performance incentives, and management’s focus on operational efficiency and free cash flow generation continues to support both the dividend and the share repurchase program. Across the board, the leadership team has instilled a culture of reliability, and that predictability has helped CW weather both industry and macroeconomic volatility with confidence.

Valuation and Stock Performance

Curtiss-Wright’s share price has delivered a remarkable run over the past year, surging from a 52-week low of $266.88 to trade near $698.36 today, approaching the 52-week high of $717.50. That kind of price appreciation in a single year is unusual for an industrial company and reflects a meaningful re-rating of the multiple investors are willing to assign to CW’s earnings and cash flow streams, driven by record backlog, strong defense spending trends, and consistent execution.

On a valuation basis, the stock now trades at a trailing price-to-earnings ratio of 54.14, which is elevated in absolute terms and well above where CW has historically traded. Price-to-book has expanded to 10.16 against a book value per share of $68.74, reflecting both retained earnings growth and the premium the market is assigning to the company’s return profile. These multiples are not typical for the industrial sector broadly, but CW’s combination of defense program exposure, nuclear energy tailwinds, and proven free cash flow generation arguably warrants a premium to more cyclically exposed peers.

The company’s return on equity of 19.43% and profit margin of 13.84% provide some fundamental justification for the elevated valuation, as does the free cash flow yield implied by $466 million in annual free cash flow against a market cap approaching $25.7 billion. With a beta of 0.93, the stock offers near-market volatility characteristics, which is a meaningful attribute at a time when high-multiple stocks in other sectors have shown vulnerability to sharp sentiment shifts. Institutional ownership remains high, and short interest of roughly 357,000 shares is modest relative to the float, suggesting limited technical pressure from the short side.

Risks and Considerations

The most immediate risk facing Curtiss-Wright at current levels is valuation. A trailing P/E above 54 embeds a significant amount of optimism about the company’s ability to sustain and grow earnings at a pace that justifies the multiple. Any earnings disappointment, guidance reduction, or slowdown in order intake could trigger a meaningful de-rating, as investors who paid a premium for consistency would have little tolerance for negative surprises. The stock’s dramatic ascent over the past year leaves limited margin for error in the near term.

Defense spending remains the central pillar of Curtiss-Wright’s revenue base, and changes in political priorities, continuing resolutions, or shifts in program funding timelines could introduce volatility into the company’s order flow and backlog conversion. While the long-cycle nature of naval and nuclear programs provides some insulation from year-to-year budget fluctuations, a sustained reduction in defense appropriations would eventually work its way into results and could pressure both earnings estimates and the multiple the market is willing to pay.

The commercial nuclear and energy segments, while growing, carry their own project-level risks. Large-scale nuclear infrastructure projects are complex and subject to regulatory, permitting, and construction delays that can shift revenue recognition in ways that are difficult to predict. Any high-profile setback in a major nuclear program could create a perception overhang even if CW’s direct financial exposure is limited.

Supply chain complexity remains a structural feature of Curtiss-Wright’s manufacturing environment, given the specialized nature of many components used in defense and nuclear applications. While the company has managed these challenges effectively relative to peers, persistent inflationary pressure on materials or labor, or a disruption to a critical supplier, could compress margins in ways that are difficult to offset quickly, particularly on fixed-price contract structures.

Finally, the macroeconomic backdrop introduces a degree of uncertainty that is difficult to fully model. While CW’s end markets are more insulated from consumer cyclicality than most industrials, a meaningful slowdown in global economic activity or a sustained tightening of financial conditions could reduce capital spending among commercial customers and slow the pace of international defense procurement, both of which would affect the top line over time.

Final Thoughts

Curtiss-Wright continues to operate from a position of strength. With a proven management team, exceptional free cash flow, and a dividend policy that prioritizes long-term sustainability over short-term yield, it offers a distinctive value proposition for investors who measure quality in decades rather than quarters. The company has executed consistently on its strategy, deepening its presence in essential industries like naval defense, aerospace, and commercial nuclear while maintaining the financial discipline that has defined its identity for nearly a century.

The stock’s extraordinary run over the past year reflects genuine fundamental progress, but it also means that new investors are paying a significant premium for that quality today. A P/E above 54 demands continued execution, and there is limited room for the kind of small stumble that would barely register at a lower multiple. For existing holders, the picture is more comfortable, as strong free cash flow, a growing dividend, and a record backlog provide a solid foundation for continued compounding even if the multiple moderates over time.

As always, risks exist. Defense budget dynamics, valuation vulnerability, and project-level uncertainty in the nuclear segment are all real considerations. However, Curtiss-Wright’s balanced approach to growth and capital stewardship, combined with a management team that has consistently delivered on its commitments, provides a measure of resilience that is genuinely rare. As it stands today, CW remains a name that continues to build quietly but confidently on its legacy.