Key Takeaways

🌿 Dividend yield of 3.06%, with over 50 consecutive years of dividend increases and stable growth.

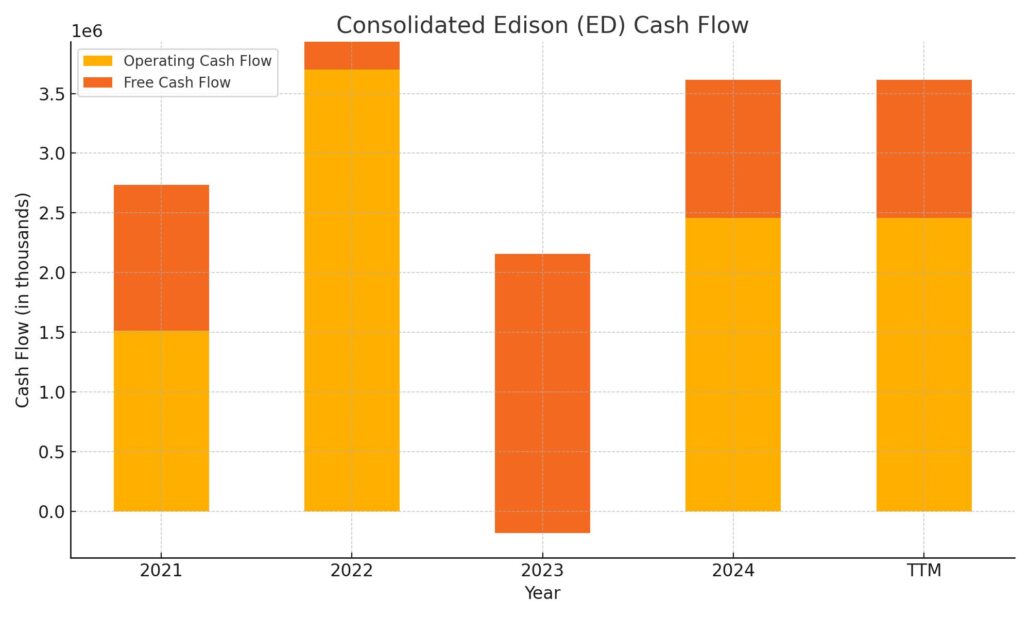

💰 Strong operational cash flow of $3.61 billion supports dividend sustainability despite heavy infrastructure spending.

📊 Mixed analyst sentiment with a consensus “Hold” rating, acknowledging stability but limited near-term upside.

📈 Solid Q4 earnings with adjusted full-year EPS up to $5.40, driven by disciplined execution and regulated operations.

👔 Experienced management team led by CEO Tim Cawley prioritizes grid modernization, reliability, and financial prudence.

Updated 4/25/25

Consolidated Edison (ED) is a long-standing regulated utility delivering electricity, gas, and steam to over 10 million people in the New York metropolitan area. The company has increased its dividend for more than 50 consecutive years and maintains a payout ratio around 63%, supported by stable earnings and strong operational cash flow.

Under CEO Tim Cawley, Con Ed has focused on core utility operations and grid modernization, while exiting less predictable business lines. With a forward yield of 3.06% and a stock price that has risen nearly 20% over the past year, ED continues to reflect investor confidence. Recent earnings show disciplined execution, while 2025 guidance points to continued growth. Though capital investments and regulatory decisions pose challenges, the company’s leadership, financial positioning, and infrastructure focus continue to support a resilient long-term outlook.

Recent Events

Consolidated Edison, better known to many as Con Ed, isn’t out to impress with fast growth or flash headlines—and that’s exactly why it continues to find a place in the portfolios of long-term dividend investors. With roots that stretch back more than a century, this New York-based utility provides electric, gas, and steam service to millions. It’s the kind of essential service business that may not dazzle, but it certainly endures.

Over the past year, ED has managed to quietly outperform. The stock is up nearly 20% over the last 12 months, outpacing the broader market. For a utility with a beta of just 0.25, that’s saying something. Stability is the name of the game, and even as interest rates have held firm, Con Edison has continued to hold its ground.

One of the most noteworthy shifts was its move to exit the renewable energy generation business. By selling off its Clean Energy Businesses in 2023, Con Ed chose to return to its core operations—regulated utilities in New York and New Jersey. While some might see that as a retreat, it’s more of a realignment, focusing on the areas where the company has the most consistent strength. There’s less unpredictability and more room to focus on reliable earnings and cash flow—two things that matter a lot to dividend investors.

With infrastructure investments planned and electric demand expected to remain solid in the metro area, Con Ed is positioning itself for steady performance, even without the bells and whistles.

Key Dividend Metrics

🪙 Forward Dividend Yield: 3.06%

💰 Trailing Dividend Yield: 2.95%

📈 5-Year Average Dividend Yield: 3.66%

📆 Upcoming Dividend Date: June 16, 2025

🔔 Ex-Dividend Date: May 14, 2025

🔄 Payout Ratio: 63.36%

🏛️ Years of Consecutive Increases: Over 50

🔓 Dividend Safety: Strong

Dividend Overview

For income-focused investors, Con Ed’s dividend is a core part of its appeal. The annual payout of $3.40 per share isn’t meant to compete with high-flying tech names—it’s meant to deliver stability. And in that department, it continues to do the job.

The company’s payout ratio of around 63% strikes a solid balance. It’s generous enough to provide an attractive yield, but conservative enough to give management flexibility in uncertain environments. Importantly, this dividend isn’t just well covered by earnings—it’s supported by a disciplined approach to capital management. That includes shedding more volatile business lines and doubling down on the consistency of its regulated base.

What you get with ED is predictability. That’s why it has earned a place among Dividend Aristocrats, a title reserved for those with at least 25 consecutive years of increases. Con Ed goes a step further, having increased its dividend every year for over five decades. It’s the kind of track record you can build around.

The current yield might sit a bit below its five-year average, but that’s mostly because of recent stock price appreciation. For many investors, that slight yield compression is a trade-off they’re willing to make in exchange for the company’s dependability.

Dividend Growth and Safety

Growth may be modest here, but consistency is king. Con Edison typically raises its dividend once a year, usually in the low single digits. The most recent increase—announced in early 2024—bumped the quarterly payout from $0.81 to $0.855, marking a 5.6% hike. For a utility, that’s a healthy move, and it suggests management has confidence in future cash flow.

Looking back over the last decade, annual increases have hovered between 2% and 4%. That’s not going to make headlines, but for a conservative investor looking for regular income, it’s exactly what you’d want to see. The growth rate is steady, manageable, and not likely to strain the company’s balance sheet.

Earnings per share for the trailing twelve months come in at $5.24, giving the dividend a comfortable cushion. Cash flow from operations over the same period totaled $3.61 billion. Even though levered free cash flow was negative—due largely to infrastructure spending—that’s a temporary reflection of investment, not weakness.

Yes, the debt load is high, with total debt at nearly $28 billion and a debt-to-equity ratio over 126%. But this is a capital-heavy business. Utilities are expected to carry more debt, and Con Ed isn’t unusual in that regard. The key is whether they can service it without compromising the dividend. So far, they’ve done just that.

The safety of this dividend isn’t just a function of ratios and numbers—it’s embedded in how the company operates. Conservative management, a regulated revenue model, and a firm grip on spending all support a payout that’s built to endure.

Cash Flow Statement

Consolidated Edison’s cash flow profile over the trailing twelve months shows a business in active investment mode, typical of regulated utilities. Operating cash flow came in at $3.61 billion, a solid improvement over the previous year’s $2.16 billion, and a sign that core utility operations are generating healthy, consistent cash from the regulated base. However, heavy capital expenditures of $4.77 billion pulled free cash flow into negative territory at -$1.16 billion, continuing a multi-year trend where infrastructure upgrades outpace operational inflows.

On the financing side, Con Ed raised $3.48 billion in new debt while repaying $477 million, suggesting a deliberate effort to fund capital investments externally while maintaining dividend stability. The positive $1.8 billion in net financing cash flow helped support overall liquidity, keeping the company’s end-of-period cash balance at $1.33 billion. Despite the negative free cash flow, this approach is strategic rather than distressing—focused on long-term grid investments and maintenance of its regulated footprint, all while preserving its long-standing dividend program.

Analyst Ratings

📊 Analyst sentiment on Consolidated Edison (ED) has been a mixed bag lately, reflecting a blend of cautious optimism and continued skepticism. The stock holds a consensus rating of “Hold,” with analysts currently setting the average 12-month price target around $103.30. That puts it slightly below recent trading levels, suggesting expectations for stability more than upside.

🟢 Citigroup recently reiterated its “Buy” stance and nudged the price target up from $116 to $120. Their view leans on the company’s consistency, especially when it comes to delivering reliable earnings and dividends. The strong regulated utility presence in the New York area seems to be doing exactly what it’s supposed to—keep the cash flowing without surprises.

🟡 UBS is sticking with a “Neutral” call but still raised its target from $110 to $113. That adjustment signals a nod of approval for management’s current strategy, particularly the sharper focus on core utility operations following the sale of its clean energy unit.

🔴 Meanwhile, Morgan Stanley remains in the “Underweight” camp but lifted its price target slightly, from $91 to $94. Their concern seems to center around valuation—essentially saying the stock is solid, but not compelling at current prices. Barclays took a similar approach, maintaining its “Underweight” rating while raising its target from $95 to $100.

These updates show that while Con Ed isn’t under heavy fire, it’s also not receiving overwhelming endorsements. Most analysts appear to respect the company’s predictability but aren’t expecting fireworks. For investors relying on dividends, that level of conservatism might be exactly what they’re looking for.

Earning Report Summary

Consolidated Edison closed out 2024 with the kind of steady performance investors have come to expect. It wasn’t a blowout quarter, but it was solid—especially considering the environment utilities have been operating in lately. The company kept its focus sharp, sticking to its bread-and-butter regulated utility operations while continuing to push forward on infrastructure improvements.

Fourth Quarter Snapshot

For the last quarter of the year, Con Ed brought in $310 million in net income, which translated to $0.90 per share. That’s a touch lower than the $0.97 per share reported this time last year, but nothing alarming. On an adjusted basis, earnings came in at $0.98 per share, down just slightly from $1.00 per share in the prior-year quarter. The dip was expected, and considering the capital investments the company is making, the numbers held up well.

Full-Year Performance

Over the full year, adjusted earnings hit $1.87 billion, or $5.40 per share—an improvement over 2023’s $5.07 per share. That kind of steady progress shows that Con Ed is hitting its targets. Execution within the utility rate plans has been strong, and the company continues to put real money into upgrading the grid and prepping for the future of energy use across New York.

Leadership’s Take

CEO Tim Cawley seemed upbeat about the direction the company is heading. He pointed out how the company continues to support customer adoption of clean energy solutions while maintaining what he called “the most reliable electric service in the nation.” There’s clearly a sense of pride in that, and also a recognition that the transition to cleaner energy isn’t slowing down. For Con Ed, it’s about being ready for that shift—especially when it comes to how buildings and transportation are moving toward electrification.

CFO Kirk Andrews also chimed in, highlighting the company’s financial moves. He mentioned a recent equity forward transaction that helps secure pricing for a big chunk of the 2025 funding needs. That adds a bit of financial stability heading into the new year. He was pretty clear in his message: they’re investing heavily, but doing so in a measured, responsible way that doesn’t put the dividend or the balance sheet at risk.

Looking Ahead

The guidance for 2025 points to continued growth. Management expects adjusted earnings per share to land between $5.50 and $5.70, and they’re targeting a 6% to 7% compound annual growth rate over the next five years. That kind of projection isn’t meant to wow anyone—but for a utility stock, it’s right on brand. Con Edison seems to be aiming for slow, steady progress backed by a focus on reliability and long-term planning. It’s not chasing trends—it’s sticking to what it knows best and preparing for the next phase of energy demand.

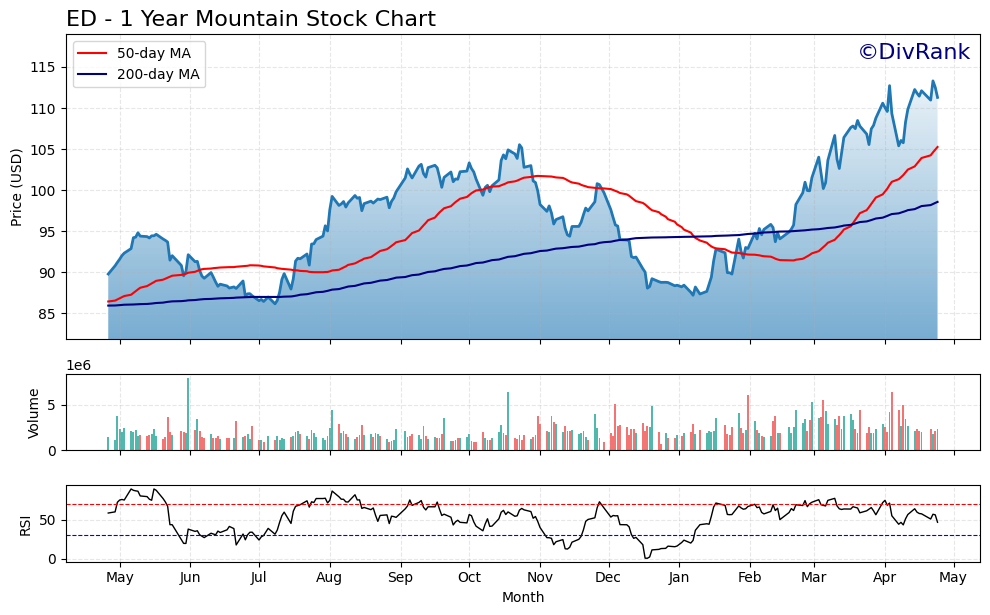

Chart Analysis

The chart for ED over the past year paints a picture of a company regaining strength after a mid-cycle dip, with momentum steadily building into the spring. There’s a lot happening technically that speaks to the underlying confidence in the name, even if it’s not a high-octane growth story.

Moving Averages and Price Trend

For most of the year, the stock has respected the 200-day moving average as a longer-term support level. Even during the softer stretch between November and January, ED found footing right around that level before turning higher. What’s notable is the golden cross formation in late February, where the 50-day moving average pushed above the 200-day. That’s a bullish signal, and the stock has followed through on it convincingly, climbing from below $95 to over $115 in just a couple of months.

The shape of the 50-day line confirms this strength—it’s sharply sloping upward now, suggesting accelerating short-term momentum. Price is currently well above both moving averages, which speaks to strength but also raises the question of whether it’s overextended in the short term.

Volume Behavior

Volume has been relatively steady, though there were a few spikes around the late December lows and again during the March breakout. This kind of action typically suggests accumulation—larger players stepping in when the price shows strength or bounces off key support. What’s missing is any serious selling pressure during the recent rally. That absence of high-volume red bars implies holders are in no rush to take profits.

RSI and Momentum

The relative strength index (RSI) hovered in neutral territory for much of the summer and early fall, then briefly dipped into oversold territory in December. Since then, it has lived comfortably above 50 and even touched overbought levels in March. That’s typical of a strong uptrend, where pullbacks tend to be shallow and buyers show up quickly.

Right now, RSI is high but not flashing red. It’s the kind of setup that suggests momentum is still with the name, though it may need a cooling-off period soon if the price continues to climb without a break.

Overall Setup

ED has made a strong technical recovery since its low in December. The crossover of the major moving averages, strong price action above those lines, and the behavior of RSI all reflect a chart that’s in a healthy uptrend. There’s no immediate sign of exhaustion, but a minor pause or pullback would be a natural part of the process at these levels. The underlying structure remains supportive, and the steady hand guiding this trend hasn’t wavered.

Management Team

Consolidated Edison is led by Tim Cawley, who serves as Chairman, President, and CEO. He’s been with the company for decades and has worked his way through the ranks, including time as CEO of Orange and Rockland Utilities, one of Con Ed’s subsidiaries. His leadership reflects a steady hand and a long-term approach to transitioning the company through an evolving energy market. Under his guidance, the company has focused more sharply on regulated operations and long-term infrastructure investment.

Kirkland B. Andrews is the CFO, bringing financial expertise and a pragmatic approach to capital allocation. He’s been focused on maintaining the company’s balance sheet strength while navigating ongoing investment needs. Alongside them, senior leadership includes experienced voices in legal, operations, investor relations, and treasury. This team isn’t chasing quick wins—they’re playing the long game and investing in reliability and modernization without overextending the company’s financial footing.

Valuation and Stock Performance

ED closed at $111.29 on April 24, just a few percentage points below its 52-week high. It’s been on a strong upward trend, with a nearly 20% gain over the past year, comfortably outperforming the broader market. While it might not have the excitement of tech names or high-growth sectors, it’s doing exactly what it’s built for—slow and steady upward movement.

Valuation-wise, the stock trades at a trailing price-to-earnings ratio of 21.24 and a forward P/E of 19.88. It’s not screaming cheap, but that’s typical for a company with this level of predictability and dividend reliability. The price-to-book ratio sits at 1.83, and the enterprise value to EBITDA is 12.15. These aren’t the kind of numbers that suggest deep value, but they do indicate investors are willing to pay a premium for stability, consistent earnings, and long-term payout dependability.

Risks and Considerations

There are a few wrinkles to keep in mind. One is the ongoing debate around proposed rate hikes for customers in New York City and Westchester County. Con Edison is seeking double-digit increases for both electric and gas services starting in 2026. That’s not going over smoothly with state regulators or consumer advocates, so there’s some uncertainty about how much of that proposal will be approved and how it might affect public sentiment or usage trends.

Another risk is the broader impact of climate change and extreme weather. Con Ed operates in one of the most demanding urban environments in the country, and the infrastructure has to hold up under real pressure. The company is investing in flood-resistant equipment and grid hardening, but those upgrades come at a cost. While the investments are necessary, they do put pressure on cash flow and may require additional financing over time.

Final Thoughts

Consolidated Edison doesn’t aim to be flashy—and that’s part of the appeal. It’s built for consistency, with a leadership team that prioritizes steady growth and financial discipline. The company continues to adapt to the changing energy landscape while keeping its regulated base strong. With ongoing infrastructure upgrades and a clear strategy, it’s positioned to deliver stable returns even in a challenging environment.

There are certainly headwinds, especially around regulation and capital costs, but the fundamentals remain intact. For those who appreciate measured performance and a focus on long-term value, ED still looks like a name that’s staying the course.