Updated 2/25/26

ConnectOne Bancorp (CNOB), a regional bank headquartered in New Jersey, continues to build on its reputation for disciplined management and reliable shareholder returns. With a current yield of 2.68% and a payout ratio just above 44%, the dividend remains well-covered by earnings. The stock trades at $27.50, just below book value of $29.16 per share, and five analysts covering the name carry an average price target of $31.70, implying meaningful upside from current levels. With the First of Long Island merger now in the rearview mirror and the bank focused on integrating its expanded footprint, ConnectOne is entering a new phase of its growth story.

CEO Frank Sorrentino has maintained a consistent strategic focus on relationship banking, controlled credit quality, and measured expansion across the New York metro region. At a price-to-book of 0.94x and a P/E of 16.87x, the stock offers an attractive entry point for income investors who value balance sheet discipline and a dividend that has shown steady, if unhurried, progress.

Recent Events

ConnectOne has been navigating a regional banking environment that remains competitive on both the deposit and lending fronts. The bank’s integration of The First of Long Island Corporation, which closed in mid-2025, has been a central operational focus over the past several quarters. Management has emphasized that the deal strengthens the bank’s Long Island presence and deepens its reach across the New York metro corridor, adding meaningful deposit relationships and branch infrastructure to its existing footprint.

On the financial reporting front, the bank posted full-year revenue of $341.3 million and net income of $74.4 million, translating to earnings per share of $1.63. Return on equity came in at 5.72% and return on assets at 0.67%, figures that reflect the near-term costs and dilution associated with absorbing a merger of this scale. Profit margins of 23.57% are running somewhat below the highs seen in prior periods, which is consistent with integration-related expenses and the current interest rate environment pressing on net interest margins across the regional banking sector.

Short interest stands at approximately 1.57 million shares, a modest figure that does not signal any significant bearish conviction among market participants. The stock has traded in a 52-week range of $20.61 to $29.28, with the current price of $27.50 sitting closer to the upper end of that band, reflecting improving sentiment as the post-merger picture comes into clearer focus.

Key Dividend Metrics

📈 Forward Yield: 2.68%

💵 Annual Dividend: $0.72 per share

🧮 Payout Ratio: 44.17%

📅 Last Ex-Dividend Date: February 13, 2026

🔁 5-Year Average Yield: 2.49%

📆 Last Dividend Payment: $0.18 per share

These numbers reflect a dividend that is sustainably funded, conservatively managed, and trading above its five-year average yield, offering income investors a modestly attractive entry relative to historical norms.

Dividend Overview

At 2.68%, CNOB’s current yield sits above its five-year average of 2.49%, which means investors buying at today’s price are locking in a slightly above-average income rate relative to the stock’s own history. That premium is modest, but it reflects a stock that has recovered meaningfully from its 52-week low of $20.61 while the dividend has remained unchanged, compressing the yield somewhat from what income hunters could have captured earlier in the cycle.

The payout ratio of 44.17% is conservative enough to leave room for dividend continuity through a weaker earnings quarter without putting the payment at risk. ConnectOne is paying out less than half its earnings in dividends, which means the capital retention policy remains intact and the bank is not stretching to fund shareholder returns at the expense of its balance sheet.

The quarterly payment of $0.18 per share has been consistent since May 2024, when the bank raised its dividend from $0.17 to $0.18. That increase, while small in absolute terms, represented the first raise in several quarters and signaled management’s confidence in the earnings trajectory. The most recent payment was made on February 13, 2026, and income investors should watch for the next ex-dividend announcement as the bank moves into its spring declaration cycle.

Dividend Growth and Safety

The dividend history tells a straightforward story. ConnectOne held its quarterly payment at $0.17 per share through most of 2023 and into early 2024, then raised it to $0.18 in May 2024, where it has remained ever since. That single step-up represents a roughly 5.9% increase and has now been maintained for eight consecutive quarters, which is a meaningful signal of stability even if the pace of growth is measured.

Safety is grounded in the fundamentals. A payout ratio of 44.17% against earnings of $1.63 per share gives the bank substantial cushion. Even if earnings were to pull back modestly due to integration costs or a softer credit environment, the $0.72 annual dividend would not be in jeopardy. The bank’s book value of $29.16 per share, against a stock price of $27.50, provides an additional margin of safety for equity holders.

Return on equity at 5.72% is below the levels ConnectOne has historically generated, and that bears watching. The merger with First of Long Island introduced dilution and integration costs that are working through the income statement, and ROE should improve as those headwinds fade and the combined balance sheet is optimized. Until that improvement materializes in a sustained way, the dividend growth cadence will likely remain gradual rather than accelerating. That said, the payout ratio leaves room for a future increase without any heroic assumptions about earnings recovery.

Short interest of approximately 1.57 million shares is not a concern from a dividend safety perspective. The modest float overhang is unlikely to pressure the stock in any meaningful way, and there is no sign that short sellers are making a directional bet against the dividend itself. Overall, ConnectOne’s dividend profile earns a steady, if unspectacular, grade on both growth and safety dimensions.

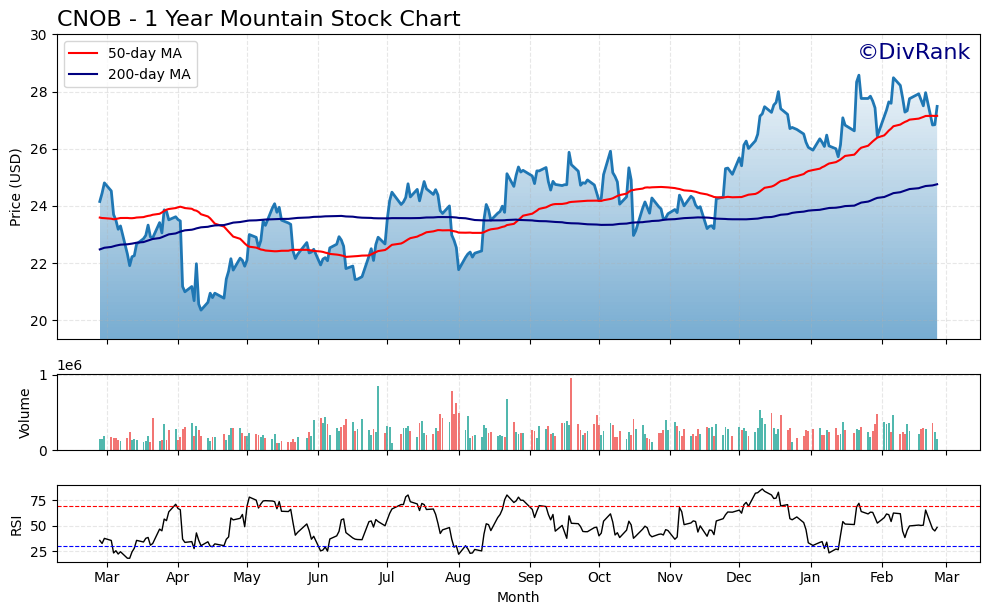

Chart Analysis

ConnectOne Bancorp has put together an impressive recovery over the past year, climbing from a 52-week low of $20.36 to its current price of $27.48, a gain of roughly 35% from that trough. That kind of price appreciation from a regional bank in the current rate environment reflects a meaningful shift in market sentiment toward the name. The stock has been pressing toward the upper end of its annual range, sitting just 3.82% below its 52-week high of $28.57, which suggests the path of least resistance has been upward and that sellers have not meaningfully reasserted control even as the stock approaches territory that previously capped gains.

The moving average picture is constructive for income-oriented investors monitoring entry points. CNOB is trading above both its 50-day moving average of $27.15 and its 200-day moving average of $24.76, and the 50-day has crossed above the 200-day to form what technicians call a golden cross. This configuration typically signals that shorter-term momentum is aligned with the longer-term trend, and for dividend investors it often indicates a stock that has moved past a period of distribution or uncertainty and into a more stable accumulation phase. The spread between the two moving averages, with the 200-day sitting nearly $2.72 below current price, confirms that the recovery has had meaningful duration rather than being a brief oversold bounce.

The current RSI reading of 48.55 is one of the more encouraging data points from a timing perspective. Sitting almost precisely at the midpoint of the 0 to 100 scale, the stock is neither overbought nor oversold, meaning there is no technical pressure in either direction forcing a near-term mean reversion. For a dividend investor considering a position, this is generally the preferred setup, as buying into an extended RSI above 70 often leads to short-term giveback even when the underlying thesis is sound. Here, momentum is balanced, which leaves room for the stock to continue drifting toward its 52-week high without immediate technical headwinds.

Taken together, the technical backdrop for CNOB is supportive rather than cautionary. The trend is intact, the moving averages are favorably aligned, and momentum is neutral enough to suggest a reasonable entry window for investors focused on collecting the dividend rather than timing a short-term trade. The proximity to the 52-week high does warrant some patience, as a modest pullback toward the 50-day moving average near $27.15 would represent a cleaner risk-reward setup, but the overall chart does not present any meaningful red flags for a long-term income investor building a position at current levels.

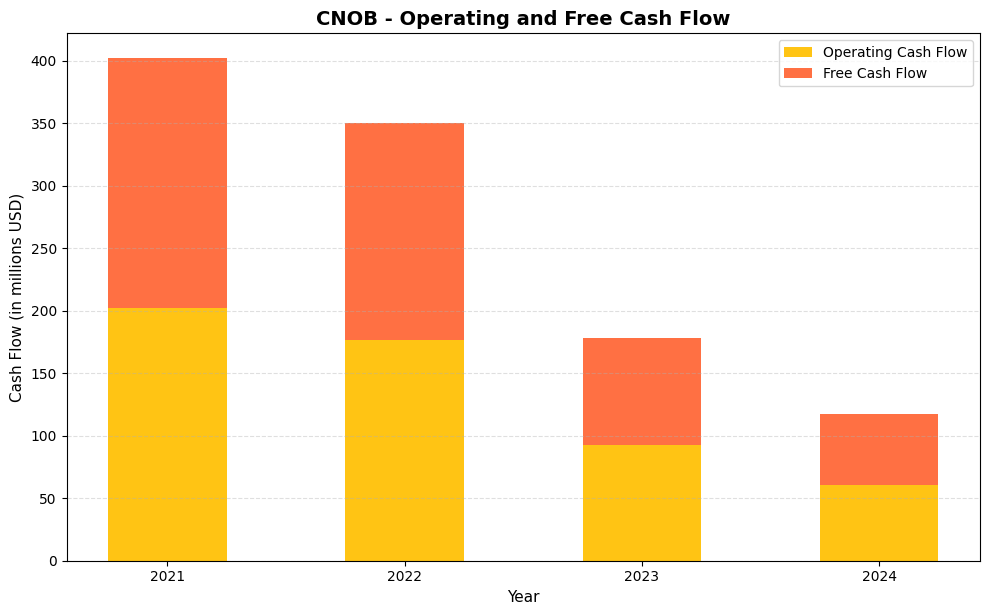

Cash Flow Statement

ConnectOne Bancorp’s cash flow profile has softened considerably over the four-year period, with operating cash flow declining from $202.3 million in 2021 to just $60.7 million in 2024, a drop of more than 70% over that span. Free cash flow followed an nearly identical trajectory, falling from $199.5 million to $56.9 million over the same period. The narrow spread between operating and free cash flow in each year does reflect disciplined capital expenditure management, as the bank consistently retained the vast majority of its operating cash after capex. That said, the absolute level of free cash flow in 2024 leaves a thinner margin of safety for dividend coverage than income investors would typically prefer, and any further compression in operating earnings would tighten that cushion further.

The trend across these four years tells a clear story about the shifting operating environment for community banks, with rising funding costs and margin pressure translating directly into reduced cash generation at the business level. The steep step-down between 2022 and 2023, where operating cash flow dropped from $176.8 million to $92.9 million, was particularly sharp and suggests the rate cycle had a meaningful impact on the bank’s core earnings conversion. Capital efficiency remains a relative bright spot, given how little cash is consumed by physical infrastructure, but shareholders should recognize that the dividend’s sustainability now depends heavily on whether 2024 represents a trough or the continuation of a longer deterioration. Management’s ability to stabilize net interest margins and grow core deposits will be the most critical variables to watch for any recovery in free cash flow generation.

Analyst Ratings

Five analysts currently cover ConnectOne Bancorp, and while no formal consensus rating has been assigned in the most recent reporting period, the price target distribution tells an encouraging story. The average 12-month price target sits at $31.70, with a low estimate of $30.50 and a high of $33.00. Against a current price of $27.50, the mean target implies upside of roughly 15%, and even the most conservative analyst target of $30.50 represents a gain of approximately 11% from today’s level.

The tight clustering of price targets between $30.50 and $33.00 is itself notable. When analysts converge in a relatively narrow range above the current price, it often reflects shared confidence in the fundamental trajectory rather than wide disagreement about the bank’s outlook. In this case, the post-merger integration thesis and the improving interest rate environment appear to be driving a consistent view that CNOB is undervalued at current levels relative to its earnings and book value.

With the stock trading at a 5.7% discount to book value and a P/E of 16.87x, the analyst community’s constructive stance is grounded in valuation rather than speculative enthusiasm. If ConnectOne can demonstrate steady improvement in ROE and ROA as integration costs roll off, the case for re-rating toward book value or above becomes more compelling, and the upper end of the analyst target range at $33.00 moves into view.

Earnings Report Summary

Integration Year Leaves Its Mark on Reported Results

ConnectOne’s most recent full-year financials reflect the reality of a bank that spent much of 2025 absorbing a significant acquisition. Revenue of $341.3 million and net income of $74.4 million produced EPS of $1.63, a figure that trails the $1.84 per share the bank posted in the prior comparable period. The decline is attributable in meaningful part to merger-related expenses, integration costs, and the dilutive effect of shares issued as part of the First of Long Island transaction.

Profit margins of 23.57% are running below the highs of prior years when the bank operated at a leaner cost structure. ROE of 5.72% and ROA of 0.67% are similarly below the levels ConnectOne has historically achieved, and both metrics are worth monitoring closely over the coming quarters as the combined entity’s efficiency profile is refined. On a more positive note, the bank has maintained a clean dividend record and has not cut or deferred payments through a period that included significant organizational change.

Management’s Focus on Integration Execution

CEO Frank Sorrentino has framed 2025 as a foundational year for the expanded ConnectOne franchise, with the emphasis squarely on integration execution, deposit retention, and building out the relationship banking model across the newly acquired Long Island markets. His commentary has pointed to improving loan and deposit dynamics within the combined portfolio and a disciplined approach to managing credit quality through the transition period.

Management has also continued to signal confidence in the dividend, maintaining the $0.18 quarterly payment through the full integration year without interruption. That consistency is a meaningful form of communication from leadership, indicating that the earnings base, even in a year of elevated costs, is sufficient to support the income commitments made to shareholders.

Dividend Remains Steady at $0.18 Per Quarter

The quarterly dividend of $0.18 per share has been paid without interruption, with the most recent payment processed on February 13, 2026. That continuity through an operationally demanding year reinforces the case that the dividend is structurally sound and not dependent on any single quarter’s performance for its sustainability.

Management Team

ConnectOne Bancorp is led by Frank S. Sorrentino III, who serves as Chairman, President, and Chief Executive Officer. Sorrentino has been with the company since its founding and has guided it through multiple cycles of growth, including the transformative acquisition of The First of Long Island Corporation. His leadership style reflects a community banking ethos combined with a sophisticated understanding of regional market dynamics across New Jersey and the New York metro area.

William S. Burns serves as Senior Executive Vice President and Chief Financial Officer, overseeing the bank’s financial management, capital allocation, and reporting functions. Burns has been a steady presence through several years of balance sheet growth and has played a central role in managing the financial structure of the First of Long Island integration. His focus on maintaining prudent capital ratios while sustaining the dividend has been a consistent theme in management communications.

Together, Sorrentino and Burns represent a leadership team with a long shared history at the institution and a demonstrated track record of executing on stated strategic priorities. Their collective tenure at ConnectOne provides continuity and institutional knowledge that is particularly valuable during integration periods, where cultural alignment and operational discipline are as important as financial engineering.

Valuation and Stock Performance

ConnectOne’s stock has staged a meaningful recovery from its 52-week low of $20.61, trading at $27.50 as of February 25, 2026. That recovery of approximately 33% from the trough reflects growing investor recognition that the post-merger earnings drag is temporary and that the combined franchise has a credible path to improved profitability as integration costs normalize.

From a valuation standpoint, the stock continues to trade at a modest discount to book value, with a price-to-book ratio of 0.94x against book value per share of $29.16. For a well-capitalized regional bank with a clean dividend history and a diversified loan book, a sub-1x price-to-book multiple represents an attractive entry point. The P/E ratio of 16.87x is somewhat elevated relative to prior years, but that reflects the depressed earnings base from integration costs rather than a premium multiple on normalized earnings power.

The analyst consensus price target of $31.70 implies roughly 15% upside from current levels, and the tight band between the low target of $30.50 and the high of $33.00 suggests the investment community sees a relatively clear path to value realization as the merger benefits begin flowing through. The beta of 1.13 indicates the stock moves in modest excess of broader market swings, which is typical for regional banks and should not be a deterrent for income investors with a longer time horizon.

Risks and Considerations

ConnectOne’s geographic concentration in New Jersey and the New York metro area remains its most structural risk. The bank’s loan book and deposit base are deeply tied to the economic health of a single region, and a localized downturn in commercial real estate, employment, or business activity could pressure asset quality and loan demand simultaneously. The addition of Long Island through the First of Long Island merger deepens rather than diversifies this geographic exposure.

Interest rate sensitivity continues to be a meaningful variable for any regional bank, and ConnectOne is no exception. The bank’s net interest margin has faced pressure in recent periods, and the trajectory of the Federal Reserve’s rate policy will play a significant role in determining whether margins expand or compress from current levels. An environment of prolonged rate cuts could reduce the yield on earning assets faster than the cost of deposits adjusts, creating a headwind for revenue growth.

The integration of The First of Long Island Corporation, while strategically sound, introduces execution risk that will persist through at least the near term. Mergers in the banking industry carry inherent challenges around systems conversion, customer retention, and employee alignment. If cost savings are slower to materialize than projected, or if deposit attrition in the acquired markets runs above expectations, the earnings improvement that analysts are anticipating could be delayed.

Regulatory compliance adds a layer of ongoing operational complexity. The banking sector operates under a demanding and evolving regulatory framework, and any changes in capital requirements, lending standards, or consumer protection rules could affect how ConnectOne allocates resources and manages its balance sheet. The expanded size of the bank following the merger may also attract heightened regulatory scrutiny compared to its prior scale.

Final Thoughts

ConnectOne Bancorp is at an inflection point. The First of Long Island merger has temporarily weighed on margins and returns, but the strategic rationale for the deal remains intact, and the bank is now operating with a larger, more diversified regional footprint than at any point in its history. For income investors, the $0.72 annual dividend, supported by a 44.17% payout ratio and a book value that exceeds the current stock price, represents a grounded and sustainable yield of 2.68%.

The analyst community’s price target range of $30.50 to $33.00, against a current price of $27.50, reflects a shared view that the market has not yet fully credited the post-merger earnings power of the combined franchise. As integration costs roll off and the operating leverage of the expanded balance sheet becomes more visible, there is a credible path to both multiple expansion and dividend growth. For investors willing to hold through the near-term noise of a post-merger year, ConnectOne offers a combination of income, book value support, and earnings recovery potential that compares favorably within the regional banking peer group.