Key Takeaways

🌿 Dividend yield of 3.81% with 43 consecutive years of dividend growth and a safe 39% payout ratio.

💵 Strong cash flow with $105.2 million in operating cash, comfortably supporting dividends and reinvestment.

📈 Analysts maintain a “Buy” rating, citing solid earnings, disciplined risk management, and steady growth potential.

📊 Q1 earnings were robust with net income of $22 million driven by strong loan growth and improved net interest margins.

👨💼 Experienced management team led by CEO Mark Gooch focuses on conservative banking and long-term stability.

Updated 4/25/25

Community Trust Bancorp (CTBI), a Kentucky-based regional bank, has built a reputation for delivering consistent financial results, a reliable dividend, and disciplined balance sheet management. With operations rooted in traditional community banking across Kentucky, West Virginia, and Tennessee, CTBI maintains a conservative approach that prioritizes strong asset quality, local market knowledge, and long-term stability.

Backed by a seasoned leadership team and over four decades of uninterrupted dividend increases, the company combines solid profitability with a focus on risk management. Its current dividend yield of 3.81% and a payout ratio under 40% reflect both strength and sustainability, while recent earnings, loan growth, and upward revenue trends underscore its ongoing performance. With a forward P/E of 11.22 and a price-to-book ratio of 1.14, CTBI trades at reasonable valuation levels, offering a compelling profile for investors who value income and steady execution.

Recent Events

Shares of CTBI recently traded around $49.32, which places it nicely in the middle of its 52-week range. The stock has bounced back from last year’s lows, showing decent strength in a volatile environment for regional banks. While others in the space have struggled under the weight of higher rates and real estate concerns, CTBI has managed to keep its footing.

Revenue is growing, up more than 11% year-over-year. Earnings per share are sitting at $4.79, and net income stands at $86 million over the trailing twelve months. These aren’t explosive numbers, but they’re consistent—and consistency is what a lot of investors are looking for right now. Return on equity is a respectable 11.54%, backed by a net margin of 35.27% and operating margin of 46.45%.

The bank also doesn’t bring a lot of drama to your portfolio. With a beta of just 0.57, the stock tends to move less than the broader market—something you definitely appreciate when things get shaky. There’s been a slight rise in short interest lately, but it’s still under 1% of float. Nothing that sets off alarms.

Key Dividend Metrics 📊💵

🟢 Forward Yield: 3.81%

🟢 Trailing Yield: 3.80%

🟢 5-Year Average Yield: 4.07%

🟢 Payout Ratio: 39.04%

🟢 Annual Dividend: $1.88 per share

🟢 Dividend Growth Streak: 43 years

🟢 Next Ex-Dividend Date: June 13, 2025

🟢 Next Payment Date: April 1, 2025

🟢 Last Stock Split: 11-for-10 in May 2014

Dividend Overview

CTBI’s dividend story is simple but effective. Right now, the bank is paying out $1.88 per share annually, which works out to a yield of just under 4%. That’s a respectable number, especially when you realize it’s backed by decades of dependable payments. The payout ratio of 39% shows there’s plenty of room left to handle bumps in the road.

If you’re someone who looks at dividend yield trends, CTBI’s current yield is right in line with its five-year average. That suggests the stock is priced reasonably, without any big discount or premium being placed on its income stream. You’re getting a solid, well-supported payout from a company that’s proven it knows how to keep the checks coming.

This isn’t the kind of dividend where you’re nervously watching the next earnings call to see if it’s going to get slashed. The numbers are sound, and the company isn’t stretching to maintain the payout. It’s a clean, stable setup for income investors.

Dividend Growth and Safety

This is where CTBI really earns respect. The company has raised its dividend for 43 consecutive years. That includes recessions, banking crises, rate spikes—you name it. Through it all, the board has found a way to keep the dividend growing. That kind of track record doesn’t just happen. It speaks to careful management and a commitment to rewarding shareholders over time.

From a safety standpoint, CTBI is in a strong position. The 39% payout ratio leaves plenty of breathing room, and the company’s earnings have been growing at a steady pace. Net income of $86 million covers the current dividend obligation with room to spare. Even without detailed free cash flow figures, the fundamentals give you confidence the dividend is secure.

The balance sheet is conservative. Debt sits at $327 million, while cash holdings total $68.5 million. Those are manageable levels, and the bank doesn’t appear to be taking on unnecessary risk. Book value per share is $43.32, which means the company isn’t relying on any smoke and mirrors to justify its current share price.

Beyond the numbers, what really supports the dividend is the nature of the business. CTBI isn’t trying to be everything to everyone. It’s focused on local communities, relationship banking, and consistent performance. That’s a great formula for stable earnings—and stable earnings are the foundation of safe dividends.

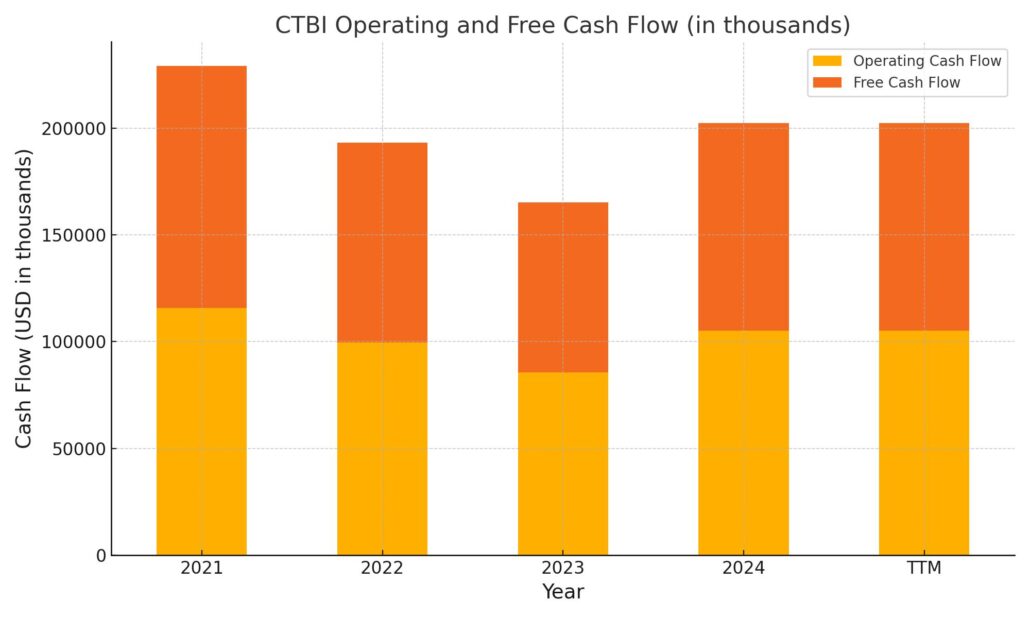

Cash Flow Statement

Community Trust Bancorp’s cash flow profile over the trailing twelve months shows a healthy core business generating $105.2 million in operating cash flow. That’s a notable improvement from the prior year and reflects increased earnings power and efficient operations. Free cash flow also came in strong at $97.1 million, maintaining the bank’s ability to comfortably fund its dividend and preserve financial flexibility without overextending itself.

On the investment side, CTBI continues to deploy capital at a high rate, with $335.7 million in cash outflows, primarily related to securities and loan originations. Financing activities offset much of this, with $328.6 million brought in—mostly from issuing debt and managing deposits. Despite those outflows, the company’s end cash position rose to $369.5 million, the highest it’s been in years. It’s clear CTBI is effectively managing liquidity while balancing investment and shareholder commitments.

Analyst Ratings

Community Trust Bancorp (CTBI) has recently attracted a wave of positive attention from analysts, reflecting renewed confidence in its steady financial performance and long-term outlook. 📈 The stock currently holds a consensus “Buy” rating, supported by encouraging reviews across several firms. Analysts have pinned the average 12-month price target at $61.00, with expectations ranging between $58.00 and $64.00, hinting at potential upside from its current level. 💹

The bullish stance stems from CTBI’s strong earnings, boosted by growing net interest income and stable credit quality. Solid profitability indicators like return on assets and return on equity continue to set CTBI apart from peers in the regional banking space. Analysts have cited the bank’s disciplined risk profile and consistent execution as key factors supporting their outlook.

One of the recent moves included a maintained “Outperform” rating by a major firm, even as the price target was slightly trimmed from $60.00 to $58.00, signaling more about valuation caution than a change in confidence. Meanwhile, another analyst initiated coverage with a “Buy” rating, pointing to CTBI’s track record of operational consistency and reliable dividend growth as attractive qualities. 🔍 These perspectives reflect a belief in CTBI’s ability to navigate through a shifting interest rate landscape while continuing to deliver for shareholders.

Earning Report Summary

Community Trust Bancorp kicked off 2025 with a solid first quarter, showing once again that its steady, disciplined approach to banking continues to pay off. The company reported net income of $22 million, or $1.22 per share, which came in slightly ahead of what analysts had been expecting. Revenue hit $66.16 million, up a healthy 12.1% from the same time last year—driven largely by strong performance in its core lending business.

Growth in Lending Keeps Momentum Going

A big part of the strength this quarter came from loan growth. Total loans were up 11.4% year-over-year, and that helped boost net interest income to $51.27 million, a solid improvement over the $43.59 million posted a year ago. Net interest margin also widened, which suggests the bank is managing its asset mix and funding costs effectively in a still-evolving rate environment.

On the flip side, noninterest income was down a bit. Deposit and loan-related fees softened, which has been a trend across the sector as fewer transactions and tighter margins in fee-based services take their toll. Operating expenses edged higher too, with occupancy costs and some legal fees nudging up total noninterest expenses.

A Watchful Eye on Credit Quality

Asset quality remains stable, though there are a few things worth noting. Nonperforming loans dipped slightly from the previous quarter, which is encouraging, but they’re still higher than this time last year. The bank also set aside more for credit losses this quarter, a move that seems more cautious than reactionary. With economic uncertainty still hovering in the background, it makes sense that management is keeping a buffer in place.

Leadership Commentary and Looking Ahead

In comments following the report, leadership remained upbeat but grounded. They emphasized their focus on managing risk carefully while continuing to grow the bank’s presence in its core markets. There was clear confidence in their ability to maintain momentum in lending and deposits, even as the interest rate environment remains in flux.

Looking forward, the tone is one of quiet confidence. Management is leaning on their strong capital position and local market expertise to navigate whatever comes next. While they’re not chasing aggressive expansion, there’s an eye on opportunities to deepen relationships and improve operational efficiency across the board.

All told, CTBI delivered a solid, consistent quarter—exactly what long-term investors, especially income-focused ones, tend to appreciate. The fundamentals are strong, the balance sheet looks healthy, and leadership is staying focused on the long game.

Chart Analysis

CTBI has been through a notable cycle over the past year, and the chart tells a story of both resilience and transition. It began the period trading just under $40 and pushed well above $60 by early winter, before gradually pulling back to the mid-$40s where it appears to be stabilizing once again.

Moving Averages Show a Momentum Shift

The 50-day moving average (red line) was in a strong uptrend for much of the year, steadily rising from late spring through January. That momentum has since faded, with the 50-day curling downward and now crossing below the 200-day moving average (blue line). This crossover often signals a shift toward more cautious sentiment. However, the 200-day continues to trend upward, showing that longer-term strength is still intact despite recent weakness.

The most recent price action shows a sharp bounce off recent lows, pushing back above $48 with increased volume. That’s a positive signal suggesting renewed interest from buyers at these lower levels. If price can reclaim and hold the area around the 200-day average, it would mark a key technical step toward reestablishing upward momentum.

Volume Activity Signals Accumulation

Volume has been relatively steady for most of the year, but a spike in green bars during the recent rebound suggests some accumulation is taking place. This kind of volume behavior often appears when stronger hands are stepping in after a correction. There hasn’t been a dramatic increase in selling volume even during the decline, which helps reinforce that the pullback may have been more about profit-taking than a fundamental shift in sentiment.

RSI Is Recovering from Oversold Territory

The RSI (Relative Strength Index) dropped to near oversold levels just before the recent price rebound and has since moved decisively higher. It’s now approaching the midpoint between 50 and 70, which typically indicates growing bullish momentum without yet being overextended. That shift in RSI supports the idea that the recent low could represent a near-term bottom, especially if it holds and consolidates with some follow-through.

CTBI’s chart suggests a cooling off after a strong run, but with early signs of stabilization. The way it behaves around the 200-day moving average over the next few weeks will be important to watch. If volume remains supportive and RSI continues higher, the stock could be preparing for another leg up after digesting last year’s gains.

Management Team

Community Trust Bancorp (CTBI) is led by a steady and experienced executive team that’s been with the company through various economic cycles. At the top is Mark A. Gooch, who serves as Chairman, President, and CEO of both the holding company and its banking subsidiary. His tenure reflects a strong commitment to the company’s mission and values, and his leadership style has kept the organization focused on consistent, long-term performance rather than short-term gains.

The executive team also includes key leaders like Thomas E. McCoy, Executive Vice President and General Counsel, who plays a pivotal role in keeping the company aligned with regulatory expectations while helping guide its strategic decisions. Together, this leadership team has built a culture rooted in conservative banking, community relationships, and a thoughtful approach to growth. Their depth of experience continues to serve CTBI well as they navigate a changing financial environment while maintaining the bank’s solid reputation.

Valuation and Stock Performance

CTBI shares were recently trading around $49.32, placing the company’s market cap just under $900 million. Its valuation metrics are fairly conservative, with a trailing P/E of 10.30 and a forward P/E of 11.22. These multiples sit comfortably below the broader market averages, and in line with what you’d expect from a regional bank with stable earnings and a reliable dividend.

The price-to-book ratio currently sits at 1.14, suggesting the market is placing a moderate premium on the company’s equity value. That speaks to investor confidence in the business’s long-term viability. Over the past year, the stock has moved between a high of $61.67 and a low of $40.19. That kind of range isn’t unusual in the current rate-driven environment, where regional banks have been under close watch. Still, CTBI’s low beta of 0.57 keeps the stock’s movements relatively mild compared to more volatile names.

Its performance has been supported by rising net interest income, controlled expenses, and strong capital levels. Add in a dividend yield near 4 percent, and the total return profile looks compelling for investors who value income and downside protection.

Risks and Considerations

Despite the company’s strengths, no investment is without risks. One of the biggest ongoing concerns for CTBI—and banks in general—is the interest rate environment. Sudden shifts in rates can compress margins or change borrower behavior. While CTBI has historically navigated these swings well, future rate movements remain unpredictable and could impact earnings growth.

Another area to watch is credit quality. The bank has done a solid job managing loan risk, but it does have exposure to commercial real estate. That segment has been under pressure in various regions, and any significant downturn there could impact loan performance. Additionally, as the financial industry evolves, the cost of staying competitive in technology and cybersecurity rises. CTBI needs to keep investing to meet customer expectations and guard against growing digital threats.

Regulatory pressures are another consideration. Though CTBI is not one of the large, systemically important banks, it still faces ongoing compliance obligations that can affect costs and operations. It’s also worth noting that the bank’s growth strategy remains fairly conservative, so those looking for aggressive expansion might need to look elsewhere.

Final Thoughts

CTBI stands out for its reliability and quiet strength. It’s the kind of company that doesn’t try to be flashy, and that’s exactly what has allowed it to build a track record of solid financial management and dependable shareholder returns. The management team’s experience, combined with a focus on fundamentals and a strong dividend, gives the company a firm foundation to continue performing in a variety of market conditions.

While there are risks tied to interest rates, regulation, and changing credit dynamics, the bank has shown that it knows how to steer through challenges without sacrificing its long-term strategy. For those who appreciate consistency, discipline, and a shareholder-friendly approach, CTBI offers a profile that continues to look attractive in the current environment.