Last Update 4/24/25

Comfort Systems USA (NYSE: FIX) is a national leader in mechanical and electrical contracting, serving commercial, industrial, and institutional clients across the country. The company has built a reputation for consistent execution, strong cash flow, and disciplined capital allocation. Backed by a growing project backlog of nearly $7 billion and a return on equity above 35%, FIX continues to deliver both earnings growth and operational strength. Its dividend, while modest in yield, has seen double-digit growth with a payout ratio just over 8%, leaving plenty of room for future increases. The stock has gained more than 1,000% over the past five years, and recent earnings showed record profitability, with management highlighting a positive outlook into 2026. Supported by a seasoned leadership team and strong financial footing, FIX has positioned itself as a resilient, income-generating industrial name with long-term potential.

Recent Events

FIX has been on a roll. Over the past year, the company’s revenue jumped nearly 38%, and earnings climbed by over 59%. Those are the kinds of numbers that tell you something more than just “growth”—they suggest a business hitting its stride operationally.

Its after-hours stock move, adding over 9% in a single session, points to growing optimism ahead of the upcoming earnings call. Whether that’s tied to continued top-line strength, new contract wins, or strategic developments, investors are clearly expecting more good news.

Financially, FIX is in great shape. The company is sitting on almost $550 million in cash, with debt at a modest $309 million. With a debt-to-equity ratio of just 18.1%, it’s clear management is keeping the balance sheet in check. Free cash flow came in just under $850 million—more than enough to support operations, growth investments, and shareholder returns.

Key Dividend Metrics 📊

💰 Forward Dividend Yield: 0.45%

📈 5-Year Average Dividend Yield: 0.52%

📆 Latest Dividend Payment: March 21, 2025

📉 Payout Ratio: 8.22%

📅 Ex-Dividend Date: March 10, 2025

🔁 Recent Dividend Growth: Over 33% YoY

Dividend Overview

Let’s get this out of the way: FIX doesn’t offer a sky-high yield. At 0.45%, it’s not going to make income-focused portfolios jump with excitement at first glance. But that number alone doesn’t do the full story justice.

What stands out is the company’s extremely low payout ratio—just over 8% of earnings. That’s almost unheard of for a company growing this quickly. Essentially, FIX is keeping most of its earnings to reinvest in the business, while still giving a modest slice back to shareholders.

And that conservative approach could pay off in spades down the line. It means the company has plenty of financial breathing room to keep raising its dividend, even during slower periods. It also signals that management isn’t just trying to appease investors with temporary high yields—they’re playing the long game.

For those building a dividend strategy that grows over time rather than stays static, FIX presents a very attractive profile.

Dividend Growth and Safety

If there’s one area where FIX stands out for dividend investors, it’s how fast and how safely it’s growing the dividend.

The jump from $1.20 to $1.60 in annualized dividends over the past year marks a 33%+ increase—something you don’t often see from companies this size. This isn’t just a token raise to keep shareholders happy. It’s a bold move that suggests serious confidence in future earnings.

Then there’s the safety aspect. With an 8.22% payout ratio, FIX could slash earnings by more than 50% and still easily cover the dividend. That makes it one of the more durable income sources out there, especially in a world where many companies are walking a tightrope between paying dividends and keeping up with costs.

Beyond the raw numbers, the nature of FIX’s business provides another layer of security. Demand for HVAC, plumbing, and electrical systems doesn’t disappear in downturns. Much of it is tied to compliance, safety, and infrastructure—all areas where spending tends to hold up, even in choppy markets.

The company’s return on equity, which stands at an impressive 35%, along with a return on assets of 11.6%, further supports the idea that every dollar being invested is generating serious results. For dividend investors, that kind of operational efficiency adds a lot of peace of mind.

Comfort Systems isn’t trying to be a flashy dividend story. But for those looking to add a dependable, financially strong, and quietly growing income stream to their portfolio, it’s worth a serious look.

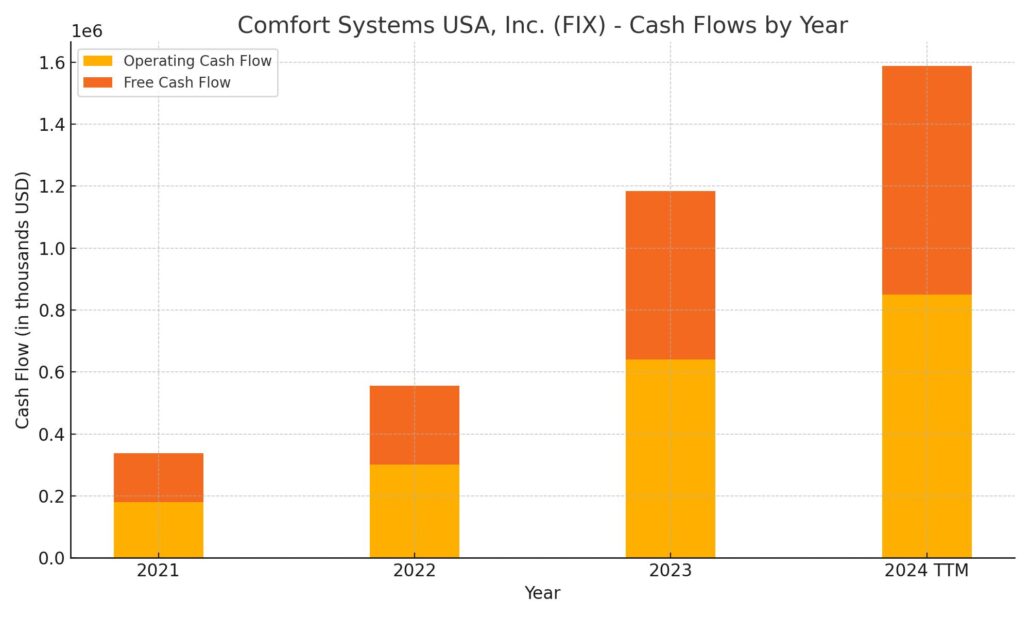

Cash Flow Statement

Comfort Systems USA posted robust cash flow figures over the trailing twelve months, driven by a significant increase in operating cash flow, which rose to $849 million. This reflects not only strength in earnings but also operational efficiency, as the company more than doubled its 2021 cash flow from operations. Free cash flow followed suit, reaching nearly $738 million, underscoring FIX’s ability to generate excess cash after capital expenditures, which totaled just over $111 million. This strong free cash flow gives the company considerable flexibility for reinvestment, dividends, and other shareholder-friendly moves.

On the investing side, outflows totaled around $343 million, much of which was allocated to strategic growth initiatives. Financing activities saw a net outflow of $160 million, impacted by significant debt repayments of $209 million and share repurchases of $58 million. While the company did raise about $183 million through new debt issuance, the overall financing cash flow indicates a deliberate effort to reduce leverage while still maintaining shareholder returns. The result of this disciplined capital management is a solid cash position of roughly $550 million, providing Comfort Systems with a strong financial cushion and the resources to navigate future growth or volatility with confidence.

Analyst Ratings

Comfort Systems USA (NYSE: FIX) has recently attracted more attention from the analyst community, leading to some notable updates in stock ratings and price targets. These changes highlight growing confidence in the company’s momentum and financial stability.

In early 2025, one firm maintained its buy rating on FIX but revised the price target downward from 🧮 $577 to 🧮 $471. The adjustment wasn’t a reflection of anything negative at FIX specifically, but more a response to a broader, more cautious market outlook. Despite this recalibration, the positive rating remained in place, pointing to continued belief in the company’s core strengths.

A few months earlier, FIX received an upgrade from neutral to buy, with the price target climbing from 📈 $396 to 📈 $525. That call came off the back of strong earnings growth and expanding operating margins—two factors that speak directly to management’s ability to execute in a competitive sector.

The current analyst consensus price target stands at around 🎯 $530.75, with estimates ranging from $471 to $575. Compared to where the stock is trading now, this suggests room for meaningful upside.

These revisions, along with FIX’s strong cash generation and disciplined capital deployment, show that analysts see real staying power here. Solid fundamentals, efficient operations, and a shareholder-friendly approach are giving FIX the kind of visibility and credibility that draws long-term support.

Earnings Report Summary

Strong Start to the Year

Comfort Systems USA kicked off 2025 with a powerful first-quarter performance, and it’s clear the company is hitting its stride. Revenue came in at $1.83 billion, which is a solid 19% bump from the same time last year. Net income also saw a big jump, landing at $169.3 million, or $4.75 per share. That’s a nice improvement over last year’s $2.69 per share—and this quarter got a little extra lift thanks to a $0.25 per share tax benefit related to a past interest income refund.

Margins are moving in the right direction too. Gross profit margin improved to 22%, up from 19.3% a year ago. This wasn’t just a matter of luck; the company’s been working on tightening operations and focusing on the right mix of projects. As a result, operating income surged 54% to $209.1 million, and adjusted EBITDA was up 43% to $242.7 million.

Backlog Tells the Real Story

One of the biggest takeaways from this quarter is the growing backlog. Comfort Systems is now sitting on $6.89 billion in backlog, which is a record for them. That’s a 15% increase just since the end of 2024, and even more impressive when you realize it’s up over 16% from the year before. What this really says is that demand isn’t slowing down. In fact, a lot of that demand is coming from tech and manufacturing projects—two areas where the company has been building serious traction.

A Bump in the Road with Cash Flow

Not everything was smooth sailing, though. The company did report negative cash flow from operations this quarter, with $88 million going out the door. Last year, they had nearly $147 million coming in during the same period. The change mostly came down to a large payment made to a major customer, which impacted working capital. Because of that, cash on hand dropped to about $204.8 million from nearly $550 million at the end of last year.

CEO’s Take on What’s Ahead

Brian Lane, the CEO, didn’t hold back in his praise for how the team performed. He called it the best first quarter in the company’s history, which says a lot considering the challenges that typically come with Q1 in the construction and contracting world. Lane pointed to the growing backlog and strong customer relationships as signs that Comfort Systems is set up for continued success. He also mentioned that the company’s staying cautious and preparing for different market scenarios, but overall, he’s upbeat about where things are headed.

In all, this quarter’s results paint a picture of a company that’s not just managing growth—it’s driving it, with clear plans and the numbers to back it up.

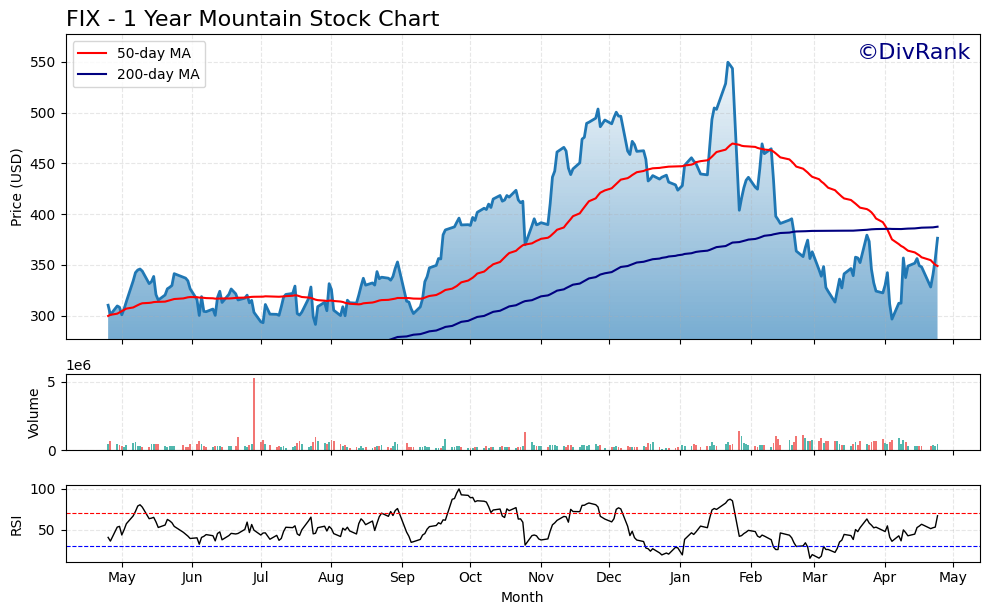

Chart Analysis

Price Trend and Moving Averages

The stock chart for FIX over the past year shows a clear narrative of momentum, consolidation, and recent recovery. The price climbed steadily from early summer through winter, with an especially strong move between October and January that pushed it above the $500 mark. This was supported by the 50-day moving average (red line), which tracked well above the 200-day moving average (blue line) during that run—typically a healthy sign of short-term strength.

However, beginning in February, the chart shifted into a corrective phase. The stock sold off sharply, and the 50-day moving average began to slope downward. That change in slope suggests waning momentum and a shift in sentiment. By late March, the price dipped below the 200-day moving average, hinting at broader weakness and a move into a more cautious phase of trading.

Now, though, there’s a notable change in tone. The most recent price action shows a sharp rebound back toward the 200-day moving average and a close reclaim of previous support around the $370–$380 level. That rebound, with increasing volume, points to renewed interest and a potential shift back into accumulation.

Volume and Market Activity

Looking at the volume below the main chart, it’s mostly steady throughout the year with a few spikes. One of the largest volume bars appears mid-year and aligns with a sharp price dip—likely representing a flush-out or capitulation move. More recently, the bounce off April lows is accompanied by a noticeable uptick in volume, which often validates the strength behind a move and suggests that it’s not just a short-covering bounce.

This kind of volume behavior during a bottoming pattern can indicate that larger investors are stepping back in and absorbing shares, potentially laying the groundwork for a longer-term base.

Relative Strength Index (RSI)

The RSI section tells an equally compelling story. The indicator spent a good amount of time above 70 during the winter run-up, showing strong upside momentum. As expected, that reversed during the correction, with RSI dipping near the 30 level in late March—classic oversold territory.

Since then, RSI has been climbing again and is now hovering near 60. That’s typically a sign of increasing bullish momentum without being overheated. If RSI continues to rise and clears above 70, it could confirm a return to a more aggressive uptrend, but even now it suggests the stock has moved off its lows with strength.

Taken together, the chart reflects a stock that’s been through a powerful uptrend, endured a healthy correction, and is now showing early signs of stabilization and potential recovery. The interaction between price and the major moving averages, supported by RSI strength and volume confirmation, hints that the worst of the pullback may be behind it—especially if price can hold above the 200-day line in the coming sessions.

Management Team

Comfort Systems USA is led by a highly experienced and stable leadership group. Brian E. Lane, who has served as CEO and President since 2011, brings more than 30 years of experience in engineering and construction. Before joining the company, Lane held leadership roles in business development and strategic planning at firms like Halliburton and Capstone Turbine. Under his leadership, Comfort Systems has seen meaningful expansion and consistent execution across its nationwide platform.

The board of directors complements management with a wide range of expertise, including legal, financial, real estate, and engineering backgrounds. Individuals like Franklin Myers and Herman E. Bulls contribute oversight grounded in decades of corporate and financial experience. The diversity in thought and industry knowledge within the boardroom helps guide long-term strategy and ensures thoughtful risk management across the business.

Valuation and Stock Performance

Comfort Systems USA stock, trading under the symbol FIX, has delivered impressive returns over the past few years. As of late April 2025, shares are priced around $376, well above the 52-week low near $273. The long-term chart tells a story of sustained growth, with the stock up more than tenfold over the past five years.

Analysts currently peg the consensus 12-month price target at just over $520. That signals potential upside from current levels, driven by the company’s strong profitability and operational efficiency. Key metrics such as a 35 percent return on equity and nearly 12 percent return on assets reflect an enterprise that’s making the most of its capital and maintaining strong margins.

The market has rewarded FIX for its consistent execution, but the valuation has expanded along with performance. Price-to-earnings ratios remain elevated compared to historical levels, though still reasonable given the company’s double-digit growth and healthy cash flow profile.

Risks and Considerations

No investment is without risks, and Comfort Systems is no exception. The company’s performance is closely tied to trends in commercial and industrial construction. Any slowdown in these sectors, whether due to economic downturns or interest rate changes, could put pressure on revenue.

There’s also the challenge of rising costs. Labor availability has become a more pressing concern across the industry, and material costs continue to be unpredictable. Comfort Systems has done a good job managing these factors so far, but it remains a key area to watch.

Another consideration is the company’s decentralized operating model. While it offers flexibility and local expertise, it can also make consistency and oversight more challenging as the business continues to scale. Regulatory risk is also something to keep in mind, especially given the increasing focus on energy efficiency standards and environmental regulations that could impact project costs and delivery timelines.

Final Thoughts

Comfort Systems USA has grown into a standout performer in the contracting and building services space. The leadership team has navigated both growth and market shifts with a steady hand, supported by a capable board and a culture of operational discipline. Backed by strong fundamentals, a sizable project backlog, and a track record of shareholder value creation, the company looks well positioned for the years ahead.

While there are risks to be mindful of, particularly tied to the construction cycle and input costs, Comfort Systems has shown that it can adapt and thrive through a range of environments. The company continues to demonstrate why it’s earned its place as a core name among well-run, growth-focused industrials.