Last Update 4/24/25

Colony Bankcorp, Inc. (CBAN), based in Fitzgerald, Georgia, is a regional bank delivering consistent performance and income for long-term investors. Over the past year, the stock has gained more than 40%, backed by strong earnings growth, a stable dividend, and effective leadership. With a net interest margin holding firm at 2.84%, rising deposits, and solid credit quality, CBAN has positioned itself as a dependable financial institution. Management, led by CEO Heath Fountain, continues to emphasize profitability, operational efficiency, and disciplined expansion.

The stock trades at a reasonable valuation, with a price-to-earnings ratio around 12 and a price-to-book near parity, supported by a dividend yield of roughly 3%. Recent earnings showed resilience and momentum, and technical indicators suggest buying interest is returning after a brief pullback. As CBAN looks ahead, the foundation appears strong for continued stability and income potential.

Recent Events

Colony Bankcorp, Inc. has had a quietly impressive run over the past year. The stock has climbed more than 42% in that time, outpacing many of its regional banking peers. It’s not a flashy growth story, but it’s a meaningful one—especially for those who care about dividends supported by solid fundamentals.

The financials tell a compelling story. Revenue grew nearly 13% year over year, and earnings growth came in even stronger at over 32%. That kind of profitability uptick doesn’t happen without something going right behind the scenes—think tighter expense management, stronger loan performance, and maybe some help from a more favorable rate environment.

Despite the solid run, the stock remains reasonably valued. The trailing P/E sits just above 11, with the forward P/E even lower. For dividend-focused investors, this is the kind of setup that matters—income backed by earnings, not inflated hype. The balance between performance and price has been thoughtful, not reactionary.

Key Dividend Metrics

💰 Dividend Yield: 2.98%

📈 5-Year Average Yield: 3.11%

📆 Recent Dividend Date: February 19, 2025

📉 Ex-Dividend Date: February 5, 2025

🧮 Payout Ratio: 33.09%

📊 Trailing Dividend Growth Rate: Slow and steady

Dividend Overview

CBAN’s dividend approach feels like a reflection of its roots—practical, reliable, and focused on the long haul. The current dividend yield sits just shy of 3%, which puts it right in the comfort zone for investors who want steady income without taking on too much risk.

That yield is slightly below its historical five-year average, but that’s largely because the stock price has been climbing. As prices rise, yields naturally compress. So, this shift could be seen as a sign of strength, not weakness. Investors are showing confidence in the company’s future, and that’s getting reflected in the valuation.

The annual dividend payout of $0.46 might not jump off the page, but its significance lies in its sustainability. Management hasn’t tried to juice the payout for short-term attention. They’ve kept it conservative, and that’s a good thing. With a payout ratio around 33%, CBAN has plenty of breathing room. The dividend is well-covered and doesn’t require heroic earnings to maintain.

Dividend Growth and Safety

There’s a quiet reliability in how CBAN handles its dividend. No big headlines, no sudden spikes—just a slow, deliberate approach to growth. While it hasn’t raised the payout every year, the general trajectory is positive. More importantly, the dividend hasn’t been cut, even when times got tough. That kind of track record says a lot about how management views its responsibility to shareholders.

Earnings per share currently stand at $1.37, giving the dividend a comfortable cushion. That coverage matters. It gives the bank flexibility to deal with interest rate swings, credit cycles, and any other curveballs that tend to show up in regional banking.

CBAN also stacks up well when you dig into the returns. Return on equity is nearly 9%, a decent number for a bank of its size. Return on assets is under 1%, which is typical for community banks that operate with high levels of deposits and cautious loan books.

Balance sheet strength adds another layer of comfort. Book value per share is $15.91, just a hair above where the stock is currently trading. That’s a bit of a rarity these days, finding a dividend stock priced near or below book. With over $230 million in cash and total debt at $249 million, they’re not carrying a heavy debt load. That helps ensure the dividend isn’t at risk from liquidity pressures.

Colony Bankcorp may not be grabbing headlines, but what it’s building quietly in the background is a dividend profile that’s all about consistency, prudence, and a clear understanding of what income-focused investors really want.

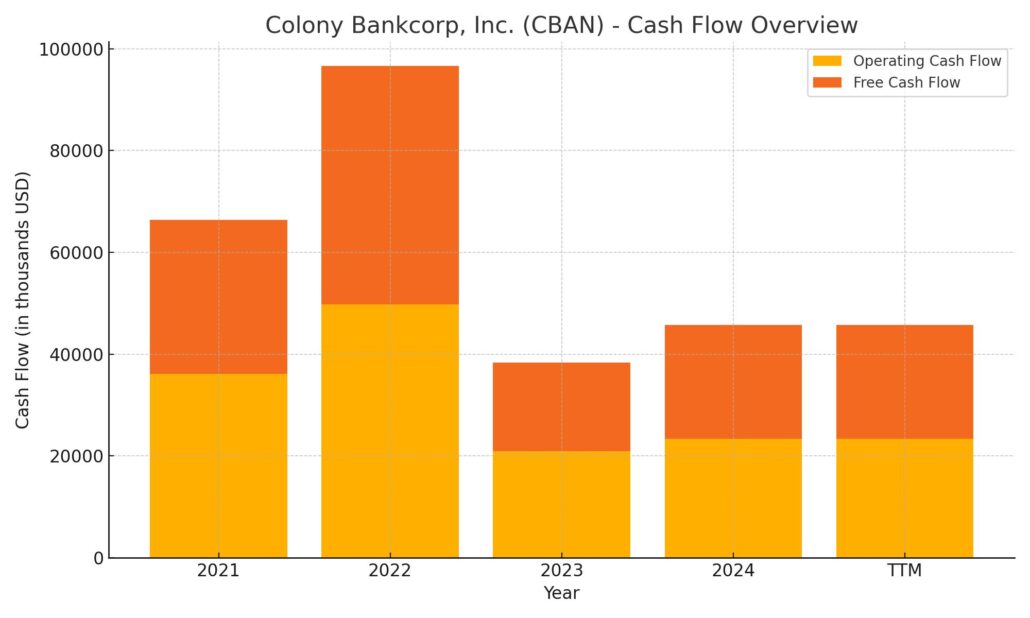

Cash Flow Statement

Colony Bankcorp’s cash flow activity over the trailing twelve months (TTM) paints a picture of a bank that has regained its footing after a few volatile years. Operating cash flow came in at $23.4 million, modestly higher than the prior year’s $21 million, signaling consistent earnings quality and manageable non-cash adjustments. The company also reported $22.3 million in free cash flow, reflecting a strong conversion of operating income into usable cash, even with capital expenditures kept light at just $1.1 million.

What stands out most, however, is the sharp positive swing in investing cash flow—$101 million in inflows this year versus steep outflows in previous years, suggesting significant asset repositioning or perhaps sales of securities. Financing activity remained active as well, with $23.2 million brought in, driven by $290 million in new debt issuance and offset by $280.5 million in repayments. These figures point to active balance sheet management, likely geared toward optimizing interest expense amid shifting rate conditions. The year ended with a healthy cash position of $231 million, much higher than recent years, providing CBAN with financial flexibility to support its dividend and lending operations.

Analyst Ratings

📉 Colony Bankcorp, Inc. (CBAN) has recently seen a shift in sentiment among analysts, moving from a more optimistic outlook to a more cautious stance. The consensus rating now stands at a ‘Hold’, indicating that analysts expect the stock to perform generally in line with the broader market for the foreseeable future.

📊 The average 12-month price target currently sits at $19.13, with individual estimates ranging from $18.75 to $19.50. That range reflects only moderate upside from its current price levels, suggesting analysts see limited catalysts for significant appreciation in the near term.

💼 The recent downgrade in outlook is primarily tied to concerns about sustainability in CBAN’s earnings growth. While the bank has posted impressive recent gains, including double-digit revenue and earnings growth, there are underlying questions about how long this performance can be maintained. Analysts are keeping an eye on macroeconomic factors such as interest rate pressures, regional lending trends, and potential shifts in credit quality.

🧮 Despite the downgrade to ‘Hold’, CBAN is still regarded as a fundamentally sound institution. The change isn’t a knock on its financial health—it’s more a reflection of current valuation and expectations being already priced in. For now, the consensus points to a stable but unspectacular path forward.

Earnings Report Summary

Colony Bankcorp just wrapped up their most recent quarter, and the results came in strong—especially for a community bank that’s all about steady execution. They’re not trying to outshine the big names, but they’ve got some solid momentum heading into the new year.

Solid Growth in Earnings

The bank reported net income of $7.4 million for the quarter, or about 42 cents per share. That’s up from $5.6 million, or 32 cents per share, during the same time last year. When you strip out some of the one-time items, their adjusted net income looked even better at $7.8 million, or 44 cents per share. It’s the kind of growth that makes you feel like they’re doing the right things behind the scenes—managing costs, watching margins, and making smart lending choices.

Net Interest Margin and Deposit Strength

One of the standout data points was the bank’s net interest margin, which edged up to 2.84% from 2.70% the year before. That might sound like a small move, but for banks, it’s a key indicator. It means they’re getting a little more efficient at making money off their loans and investments without paying too much on deposits.

Speaking of deposits, they added $43 million in new ones during the quarter, bringing the total to about $2.57 billion. Most of the growth came from everyday checking and savings accounts—the cheaper kind of funding banks like. At the same time, they saw fewer time deposits, which are typically more expensive, so that’s a plus for their cost structure.

Lending, Income, and Efficiency

Loan activity dipped slightly, down by around $43 million. That drop was expected though, and mostly due to older, lower-yield loans being paid off. On the noninterest income side, they pulled in more money from SBA loan sales and mortgage fees. The SBA team, in particular, had a busy quarter, closing over $22 million in loans and selling $30 million, which brought in solid fee income.

Expenses were kept in check, even with some upticks in salaries and spending on tech—two areas that show they’re investing for growth without letting costs get out of control.

Credit quality held steady. Nonperforming assets actually dropped a bit, and the amount set aside for potential loan losses was lower than last year. That’s always good to see—it suggests they’re not seeing red flags in the loan book.

On the capital front, they bought back 35,000 shares at a little over $15 each and declared another quarterly dividend of 11.5 cents. Nothing flashy, just a steady return to shareholders.

Outlook from the Top

CEO Heath Fountain sounded pretty upbeat in his comments. He mentioned they expect loan growth to pick back up later this year and emphasized the bank’s continued focus on efficiency and smart growth. They’ve also brought in new leadership to support those goals, signaling that they’re building for the long haul, not just trying to hit short-term numbers.

Overall, it’s a quarter that speaks to the kind of stability and discipline income-focused investors tend to appreciate.

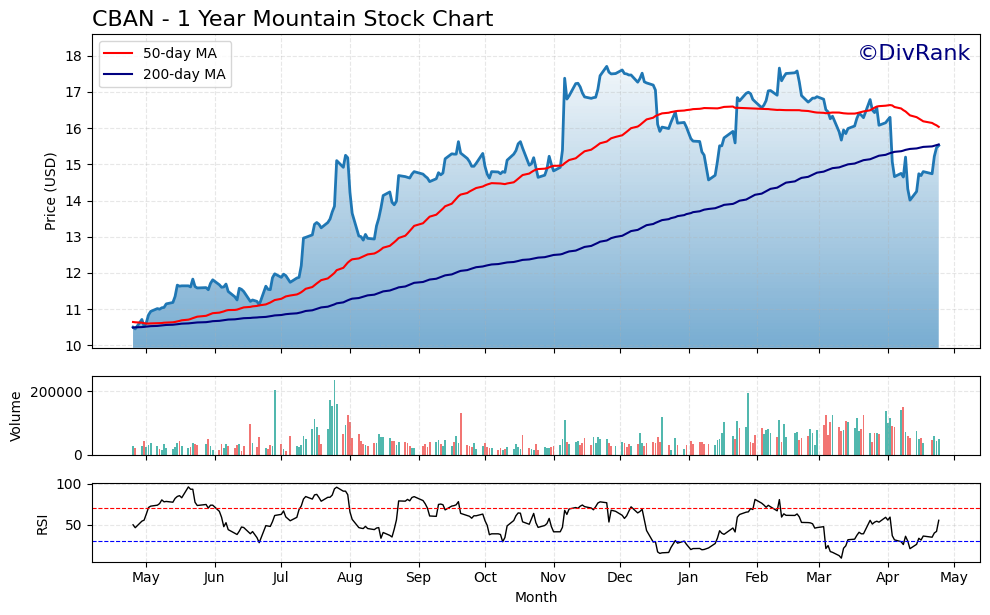

Chart Analysis

CBAN has put together a compelling one-year price action story that reflects both resilience and a cooling-off period after a strong run-up. The chart captures a clean upward trend from last spring into early winter, followed by a gradual drift lower through the first quarter of this year.

Price Trend and Moving Averages

The price moved steadily from around $10.50 to a peak near $17.50 between May and February, supported for much of that journey by the 50-day moving average. That short-term trend line showed consistent momentum until about mid-March, where it began to roll over. The recent dip in April saw the price fall below both the 50-day and 200-day moving averages, which tends to suggest a breakdown in the near-term trend. However, the stock has quickly rebounded back above the 200-day moving average, and is now testing the underside of the 50-day line. That kind of quick reclaim hints that buyers are still present and willing to defend the longer-term trajectory.

Volume and Momentum

Volume has remained steady, with no major spikes indicating panic selling. There were isolated bursts of higher volume on up days, especially during rebounds, which can often reflect accumulation rather than distribution. It’s not aggressive buying, but it’s definitely constructive.

The Relative Strength Index (RSI) dipped below 30 briefly in April, marking oversold conditions. Since then, it has climbed back toward the midpoint near 50, showing renewed strength and balance in buying and selling pressure. It’s still not overheated, which gives the current price room to rise without technical resistance from momentum traders pulling back.

Recent Candle Action

The last five candles on the chart tell a story of rebuilding confidence. There’s a strong bullish candle following a sharp pullback, showing buyers stepping in hard at support. Subsequent candles include a mix of smaller-bodied and wick-heavy sessions, pointing to a tug-of-war between buyers and sellers. The most recent candle shows another solid push higher with a small upper wick, suggesting price is pushing up into resistance but isn’t getting slammed down. That kind of candle can be a transition point before a new short-term trend begins.

CBAN is showing signs of stabilization after a healthy pullback. The stock remains above its 200-day average and appears to be regaining footing. While momentum isn’t explosive, the structure beneath the chart still leans toward long-term strength rather than breakdown.

Management Team

Colony Bankcorp is led by a team that blends deep industry knowledge with a clear vision for growth. At the center is CEO Heath Fountain, who has guided the company since 2018. His experience in community banking and strategic development has helped the bank navigate changing market conditions while maintaining a strong local presence. Fountain has emphasized profitable expansion and operational discipline, which has become a defining theme for the company over the last few years.

Working alongside him is President Dallis Copeland Jr., who plays a key role in broadening Colony’s operational capabilities. The leadership group also includes Ed Canup as Chief Banking Officer, Daniel Rentz as Chief Information Officer, and Laurie Senn as Chief Administrative Officer. Each executive brings a focused expertise, whether it’s in technology, customer engagement, or human capital. Their collective effort has shaped a management culture centered on strategic execution and long-term planning.

Valuation and Stock Performance

CBAN has had a strong run over the past year, with the stock rising more than 40% as of the latest data. It’s trading at a price-to-earnings ratio near 12, which is right in the sweet spot for a regional bank with consistent earnings. Not too cheap to raise red flags, and not too expensive to scare off investors looking for value.

The price-to-book ratio is hovering around 1.02, indicating the stock is being valued right around its net asset value. That’s often seen as a reasonable place for a bank of this size and profile to sit—suggesting the market sees it as a stable player with reliable returns. Its market cap of just over $270 million keeps it in the small-cap category, but its fundamentals suggest a company that’s punching above its weight.

For investors who are focused on steady dividend income, CBAN’s share price behavior and valuation profile offer a certain kind of calm. It’s not trying to be a high-flyer. It’s about predictability, and so far, it’s delivered.

Risks and Considerations

No bank is immune to risk, and that includes Colony. Interest rate changes can play havoc with margins. If rates fall quickly, it squeezes the spread between what banks earn on loans and what they pay on deposits. If they rise too fast, it can hurt loan growth and borrower performance. Managing this delicate balance is always a challenge in banking.

Credit quality is another consideration. While nonperforming loans have been kept in check, that can change if the economy turns. The company has built in cushions through its provision for loan losses, which helps, but it doesn’t eliminate the risk altogether. There’s also the reality that being a regionally concentrated bank means local economic issues—like employment trends or business slowdowns—can have an outsized impact.

The competitive landscape is evolving too. Larger banks are pushing deeper into community markets, and fintech firms continue to nibble away at parts of the banking value chain. Colony has been investing in technology, but staying ahead will require ongoing adaptation.

Final Thoughts

Colony Bankcorp continues to operate with a focus that many smaller banks lose when they chase fast growth. This is a company that knows its market, knows its strengths, and is growing at a pace that’s aligned with long-term value creation. Its leadership team has put the pieces in place to support stable returns without overreaching.

The stock looks fairly valued based on its current performance, and the recent momentum has come with a foundation in earnings growth, not hype. Risks exist, as they do with any financial institution, but the conservative approach to lending and capital management adds a level of reassurance.

All told, CBAN stands as a solid example of how disciplined banking can still create meaningful shareholder value, especially for those willing to tune out short-term noise and focus on the bigger picture.