Updated 4/22/25

CNO Financial Group (NYSE: CNO) delivers insurance and retirement products to middle-income Americans through brands like Bankers Life and Washington National. Over the past year, its stock has climbed nearly 40%, supported by strong earnings growth, disciplined capital returns, and stable free cash flow generation. With a forward P/E around 9.7 and a conservative 16.84% payout ratio, the company offers a blend of value and income.

Leadership under CEO Gary Bhojwani has focused on operational efficiency, digital expansion, and agent growth, contributing to record production in both the Worksite and Consumer divisions. CNO’s dividend yield currently stands at 1.72%, and analysts see potential upside, with a consensus price target of $41. As it continues to build on this foundation, CNO stands out for its ability to grow earnings, return capital to shareholders, and maintain financial stability in a shifting market environment.

Recent Events

Over the past year, CNO’s stock has delivered nearly 40% in gains, well ahead of the broader market. That kind of move doesn’t happen without something going right under the hood. The most recent earnings report showed a massive year-over-year jump in earnings—up over 350%—and return on equity came in at a solid 17.14%. That’s the kind of number that tells you management is putting shareholder capital to work effectively.

The company has also managed to hold up despite a drop in revenue growth this past quarter. Like many insurers, CNO carries a fair amount of debt, with a debt-to-equity ratio sitting around 184%. While that might look high on the surface, it’s fairly typical in this industry, where debt is part of how these firms operate efficiently. More important is that the company has nearly $2 billion in cash on hand and a healthy current ratio of 3.43. In other words, there’s plenty of financial cushion here.

Key Dividend Metrics

📈 Forward Yield: 1.72%

💸 Annual Payout: $0.64 per share

🧱 Payout Ratio: 16.84%

📊 5-Year Average Yield: 2.25%

📆 Last Dividend Paid: March 24, 2025

📆 Ex-Dividend Date: March 10, 2025

📈 Dividend Growth Streak: Steady and building

Dividend Overview

At first glance, a 1.72% yield might not get dividend chasers excited. But this isn’t a high-yield play—it’s a steady, low-drama income generator. The yield has dipped slightly below its five-year average, but that’s actually a good sign. It means the stock price has been rising faster than the dividend, reflecting investor confidence in the company’s fundamentals.

One of the most appealing aspects of CNO’s dividend is just how safe it is. With a payout ratio of only 16.84%, there’s a ton of breathing room. The company isn’t stretching to pay this dividend. In fact, it could likely double it without blinking. And yet, it’s choosing to stay disciplined, which tells you a lot about how management views long-term sustainability.

CNO pays its dividend regularly and hasn’t missed a beat even during tougher years. It’s not the most aggressive when it comes to dividend hikes, but it’s consistent. If you’re looking for a company that treats its dividend like a responsibility, not just a marketing tool, this one fits the bill.

Dividend Growth and Safety

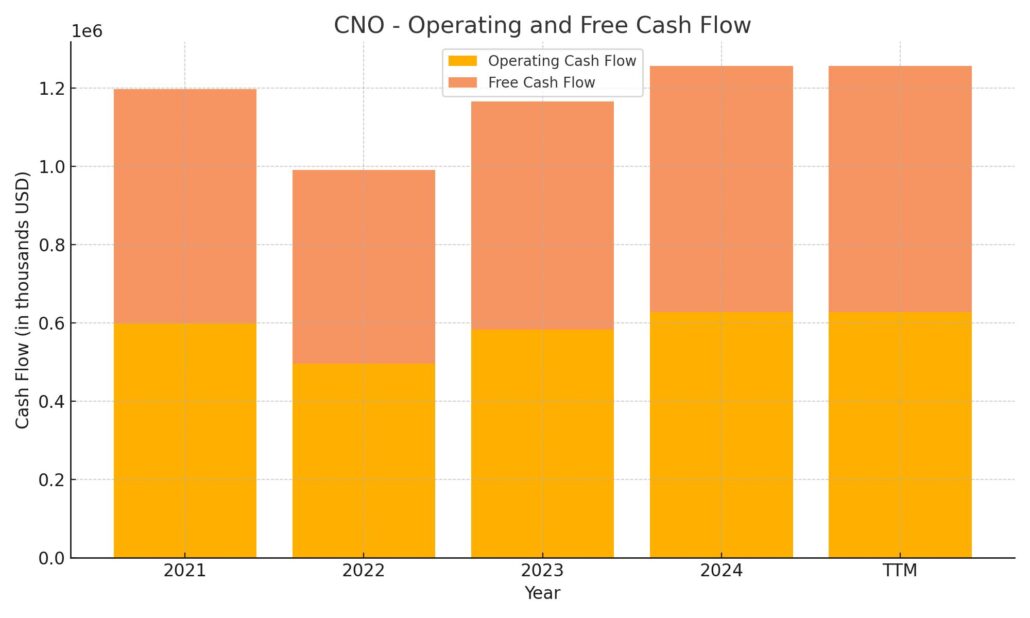

This is where things really get interesting for long-term income investors. CNO’s dividend growth isn’t headline-grabbing, but it is dependable. And it’s backed by strong fundamentals. The company produced $537 million in free cash flow over the past year, far more than needed to support its current payout. That kind of cash flow gives management plenty of flexibility to keep rewarding shareholders while still investing in the business.

The balance sheet also supports dividend safety. With $1.96 billion in cash and strong liquidity, the company is well-positioned to weather economic bumps without putting its dividend at risk. Even if earnings took a hit, the low payout ratio and solid cash reserves mean the dividend wouldn’t be the first thing on the chopping block.

CNO’s beta is under 1, which suggests it’s a relatively stable stock. That’s another plus for dividend-focused portfolios, especially those built for lower volatility. The stock isn’t likely to take wild swings, making it easier to count on those quarterly payments without second-guessing your position.

For investors who are focused on generating income without constantly monitoring the headlines, CNO offers a lot of what you want: steady financials, disciplined capital management, and a dividend that’s built to last. It’s not going to top the yield charts, but it doesn’t need to. What it offers is reliability—and that’s something you can build a portfolio around.

Cash Flow Statement

CNO Financial Group generated $627.7 million in operating cash flow over the trailing twelve months, reflecting a healthy uptick from the prior year’s $582.9 million. Free cash flow matched operating cash flow, meaning capital expenditures were minimal—a positive for shareholders who prefer to see cash returned rather than reinvested into lower-yielding projects. This stable cash generation highlights the predictability of CNO’s core insurance operations, even as revenue growth has shown some year-over-year decline.

On the financing side, the company took in nearly $1.58 billion in new debt and repaid $1.22 billion, while also spending $300.2 million to repurchase shares. Issuance of capital stock was minimal at just $11.2 million. The combination of significant financing inflows and continued buybacks suggests CNO is using debt strategically to enhance shareholder returns. Despite sizable outflows from investing activities—$1.49 billion over the TTM—CNO’s cash position ended strong at $1.99 billion, more than doubling from the previous year.

Analyst Ratings

📈 CNO Financial Group has recently seen a wave of analyst actions that lean toward cautious optimism. 🟢 Piper Sandler kept its “Overweight” rating and bumped the price target from $46 to $49, pointing to confidence in the company’s earnings trajectory. 🟢 Royal Bank of Canada also reiterated its “Outperform” rating and increased its target from $40 to $45, noting improving trends in the company’s core operations. 🟡 Keefe, Bruyette & Woods lifted their price target from $42 to $44 while holding a “Market Perform” view, signaling steady expectations for the stock’s near-term performance.

🔻 On the more reserved side, Evercore ISI maintained its “Underperform” rating but raised the price target from $27 to $29, indicating a slightly better outlook than before but still below peers. 🟡 Meanwhile, BMO Capital Markets initiated coverage with a “Market Perform” rating and a $38 price target, suggesting a neutral stance and anticipation of moderate growth without big surprises.

🎯 The current analyst consensus puts the average 12-month price target for CNO at $41.00, with a range that spans from $29.00 on the low end to $49.00 on the high side. That suggests moderate upside from current levels, with analysts generally expecting a stable, reliable performance.

Earning Report Summary

CNO Financial Group wrapped up 2024 on a high note, posting numbers that reflected solid execution across its business and a strong finish to the year. The fourth quarter really stood out, with net income jumping to $166.1 million, or $1.58 per share. That’s quite a leap from the $36.3 million, or $0.32 per share, the company reported in the same quarter the year before. For the full year, net income totaled $404 million, which translates to $3.74 per share—up from $2.40 in 2023.

Operating Results That Show Consistency

CNO’s operating income also painted a positive picture. In Q4, net operating income came in at $138 million, or $1.31 per share, slightly above last year’s $133.9 million and $1.18 per share. Full-year operating income stood at $429.3 million, or $3.97 per share—marking a steady climb from $3.09 the year before. The message here is clear: the company’s core insurance and financial operations are performing well and doing so consistently.

Strong Growth Across Business Segments

Growth showed up in all the right places. New annualized premiums were up across the board—23% higher in the Worksite Division and 11% higher in the Consumer Division for the fourth quarter. Annuity premiums saw a healthy 12% boost, notching another record-setting quarter. Medicare Supplement sales climbed 44%, and Medicare Advantage applications jumped 39%. On top of that, CNO grew its producing agent base by 8% in both divisions. That kind of expansion reflects real demand and a strong sales pipeline.

Capital Returns and Book Value on the Rise

CNO wasn’t shy about returning capital to shareholders either. They handed back $108 million in the fourth quarter alone, bringing the full-year total to $349.3 million—a 50% increase compared to 2023. Book value per share came in at $24.59, while the adjusted book value, which excludes some accounting-related losses, was a much stronger $37.19, up about 10% year-over-year. The company also posted a return on equity of 16.4% for the year, with an operating return on equity of 11.9%. That kind of return signals efficient use of capital and healthy profitability.

Leadership Comments on the Future

CEO Gary Bhojwani didn’t mince words when reflecting on the quarter. He described it as one of the best operational performances the company has seen in recent years. He credited the results to strong underwriting margins, solid investment income, and strict cost control. Bhojwani also pointed out that the company is growing its business while improving profitability—something not every insurer manages to pull off at the same time.

Looking ahead, CNO seems confident about continuing on this path. Leadership sees plenty of opportunity to grow in the current environment, especially given the aging population and ongoing demand for retirement and insurance products. With momentum on their side, the company is setting itself up to keep delivering strong returns.

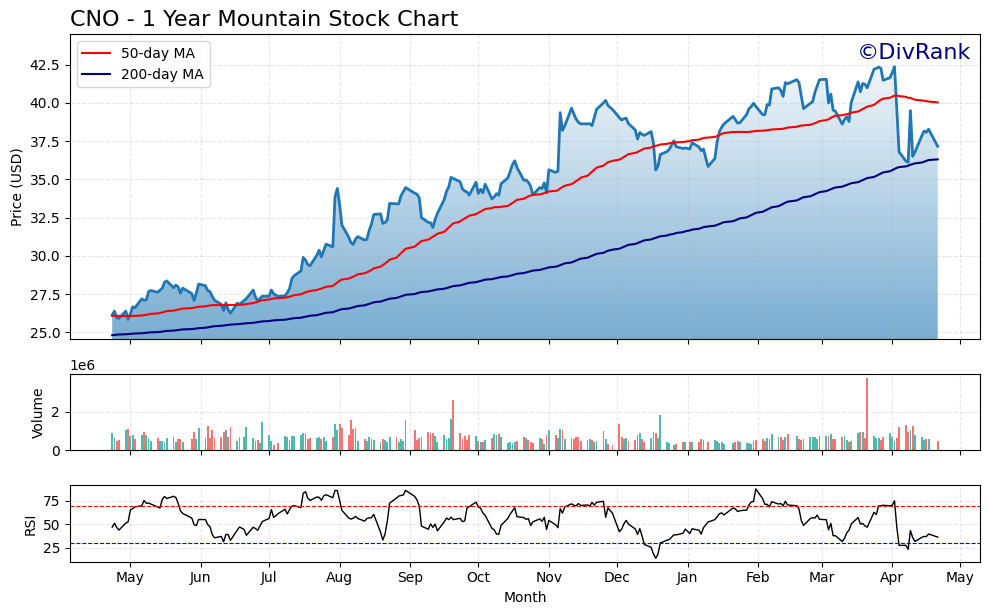

Chart Analysis

CNO has shown a strong, upward-sloping price trend over the past year, gradually moving from the $25 range in early spring to peak around $43 before retreating slightly. The climb was orderly for much of the year, supported by healthy pullbacks that didn’t disrupt the overall structure of the trend. The most recent drop in April was sharp, but the stock found support right around its 200-day moving average, which is still in an upward slope.

Moving Averages

The 50-day moving average has stayed comfortably above the 200-day for nearly the entire year, a classic sign of sustained strength. That said, there’s been a recent flattening and slight downturn in the 50-day line as the price pulled back from its highs. This could be an early signal of consolidation or a cooling-off period. Still, with the 200-day moving average continuing to climb, the long-term direction remains positive unless this trend changes dramatically.

Volume and Momentum

Volume has remained relatively stable throughout the year, with a few notable spikes—especially during early April’s drop. That kind of high-volume selloff often signals either institutional repositioning or a quick reaction to news. What’s key is how the stock behaves afterward, and right now, it’s attempting to stabilize.

Looking at momentum, the RSI spent much of the year hovering in the upper half of the range, even flirting with overbought territory several times between January and March. But since the sharp dip in April, RSI has fallen closer to the lower boundary, hinting that the stock may have entered short-term oversold territory. This tends to act as a support zone, particularly if underlying fundamentals remain intact.

Overall Structure

The general pattern of higher highs and higher lows over the past year is still in place, despite the recent shakeout. The fact that the price has not broken meaningfully below the 200-day moving average suggests that long-term support is still holding. While the stock might move sideways or test recent lows in the near term, there’s no indication here of a full trend reversal yet.

CNO has had a solid technical setup for most of the year, and this chart tells the story of a stock that has earned its gains step by step. The recent pullback might present an area of stabilization rather than a signal of a deeper breakdown, particularly if the price can find footing above the long-term trend line.

Management Team

CNO Financial Group is led by CEO Gary Bhojwani, who stepped into the role in 2018. He brings decades of experience from previous leadership positions at major industry players like Allianz and Lincoln General Insurance. Under his direction, the company has focused on expanding its customer base, strengthening distribution channels, and pushing forward with digital initiatives to modernize operations.

Backing him is a stable and experienced executive team. Paul McDonough, the CFO since 2019, has helped drive disciplined capital allocation and financial transparency. Jean Linnenbringer, who serves as Chief Operations Officer, has over 30 years of operations leadership experience in the insurance space and plays a key role in streamlining the company’s customer-facing processes. Mike Mead, the CIO, heads up technology and cybersecurity efforts—an increasingly critical area as more services shift online. Rocco Tarasi, the Chief Marketing Officer, focuses on refining the company’s market messaging and growing brand awareness through multiple distribution platforms.

The board of directors is chaired by Daniel Maurer, whose background spans finance and consumer tech, adding perspective on innovation and governance. The overall structure reflects a thoughtful balance of insurance expertise and strategic oversight.

Valuation and Stock Performance

CNO’s stock is currently trading around $37.16, representing a nearly 40 percent gain over the past year. That kind of appreciation is well above the broader market and shows a healthy degree of investor confidence. From a valuation standpoint, the stock remains reasonable. Its trailing P/E ratio is just under 10, and the forward P/E is around 9.7—both signaling that the stock is still attractively priced relative to its earnings profile.

The price-to-book ratio sits at 1.49, suggesting the stock isn’t cheap but also not overly expensive. For a company with growing earnings and strong capital returns, that multiple feels justified. Analysts currently have an average 12-month price target of $41, with the range spanning from $29 to $49. That wide spread reflects some debate about the macro backdrop and industry headwinds, but overall sentiment leans positive.

CNO also has a relatively low beta of 0.92, which tells us that the stock tends to move less than the overall market. That lower volatility can be a plus for portfolios looking to dial down risk without completely stepping away from equity exposure.

Risks and Considerations

There are a few risks worth keeping in mind. First, like all insurers, CNO is sensitive to interest rates. Lower rates can compress investment returns, which is a major revenue stream for insurers. On the flip side, higher rates might create pressure on bond valuations and affect balance sheet metrics. That kind of macro sensitivity is something investors need to monitor.

There’s also regulatory risk. Insurance is a heavily regulated business, and changes in state or federal rules can impact the types of products offered and the capital requirements companies must meet. On top of that, consumer behavior is evolving. People are increasingly shopping for insurance online, comparing policies more aggressively, and expecting digital experiences. CNO has been adapting, but staying ahead of those changes is a moving target.

Competition from both legacy players and newer digital-first entrants is intensifying as well. The company needs to remain focused on innovation while maintaining pricing discipline and service quality. A misstep in any of those areas could erode market share or margin.

Final Thoughts

CNO Financial Group has quietly built a track record of operational consistency and shareholder returns. It may not have the flash of some larger names, but it offers a compelling mix of financial strength, measured growth, and disciplined capital use. Leadership appears grounded, strategic, and focused on the long term. The stock has performed well and still trades at reasonable multiples, especially when considering the earnings momentum behind it.

While there are headwinds tied to interest rates, regulation, and changing customer expectations, the company has shown an ability to navigate those challenges with care. It’s not trying to reinvent the industry—it’s focused on doing what it does well, and doing it better every year. That steady approach, combined with solid fundamentals and strong cash generation, makes CNO a name that continues to deserve a closer look.