Key Takeaways

💰 Chevron offers a compelling 4.96% dividend yield, supported by over 30 consecutive years of dividend increases and a solid 67% payout ratio.

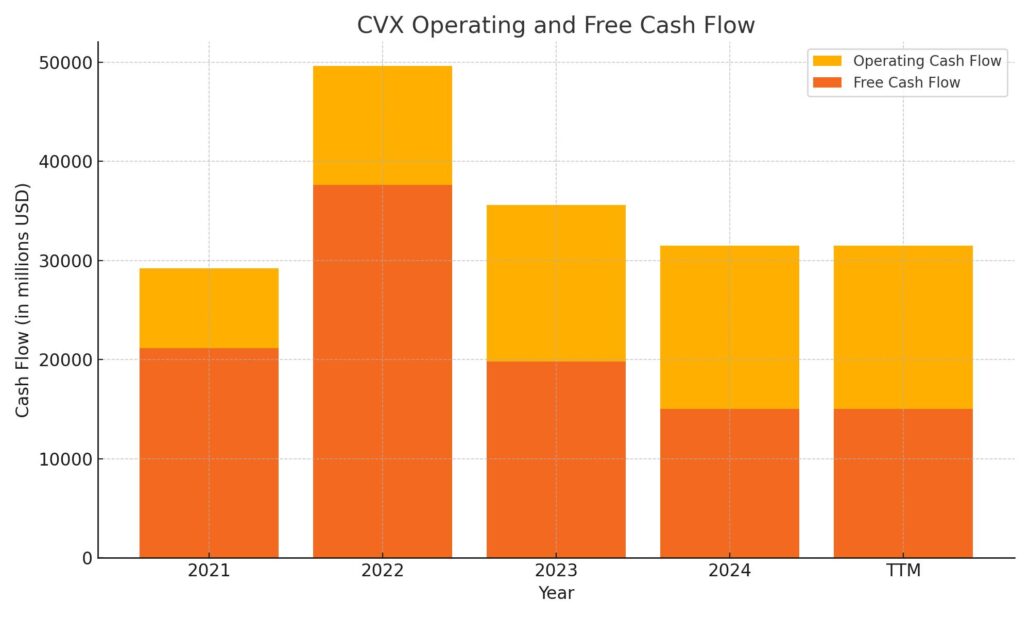

💸 Chevron maintains robust cash flow, generating $31.5 billion in operating cash flow and $15 billion in free cash flow, comfortably covering dividends and buybacks.

📊 Analyst sentiment remains generally positive, with a consensus target of $169.50, despite recent downgrades due to reserve concerns and uncertainty around the Hess acquisition.

📈 Chevron’s latest earnings showed record production growth (+7% globally) but revealed weakness in refining operations, resulting in mixed profitability.

👥 CEO Mike Wirth and the experienced leadership team are emphasizing disciplined capital allocation, operational efficiency, and strategic moves into cleaner energy initiatives.

Updated 4/21/25

Chevron Corporation (CVX) has long been a reliable presence in the energy sector, delivering consistent dividends backed by strong cash flow and disciplined capital management. With operations spanning upstream, downstream, and emerging low-carbon initiatives, the company blends scale with a steady hand at the helm. Recent earnings highlighted record production levels and resilient operating cash flow, even as downstream operations came under pressure.

Leadership continues to prioritize shareholder returns, recently increasing the dividend and executing sizable buybacks. While challenges remain—including reserve declines, environmental liabilities, and a pending acquisition under legal scrutiny—Chevron’s experienced management team is navigating these headwinds with cost-cutting plans and targeted global investments. Trading at a forward P/E below peers and offering a nearly 5% dividend yield, CVX stands out for its combination of income and long-term strategic direction.

Recent Events

It’s been a bumpy ride for Chevron’s stock lately. Shares are trading around $133, which is quite a bit off the 52-week high of $169. The drop comes on the back of shifting oil prices and a broader cooldown in the energy trade. But despite the headline numbers, Chevron’s underlying business is showing signs of resilience.

The company just posted a solid revenue increase of 8.6% year over year, and net income surged by more than 43%. That’s not a small feat in today’s environment. Instead of chasing production for the sake of growth, Chevron is staying focused on returns. That means putting money into higher-yielding projects and leaning into operational efficiency.

Chevron is also starting to put more attention into cleaner energy solutions—things like hydrogen and carbon capture. These aren’t huge revenue drivers yet, but they show that the company is thinking long term while still holding onto its core strengths in oil and gas.

Key Dividend Metrics 📈

💰 Forward Annual Dividend Rate: $6.84

📊 Forward Dividend Yield: 4.96%

🧾 Trailing Annual Dividend Rate: $6.52

📉 Trailing Dividend Yield: 4.73%

📅 Most Recent Dividend Date: March 10, 2025

🔁 Ex-Dividend Date: February 14, 2025

📏 5-Year Average Dividend Yield: 4.39%

🧮 Payout Ratio: 67.08%

With a yield just shy of 5%, Chevron stands out in the large-cap universe for delivering real income. This is the kind of payout that can make a meaningful difference for income-focused investors.

Dividend Overview

Chevron’s dividend is one of the most consistent in the business. Right now, the stock is yielding just under 5% based on the forward payout, which is well above the average yield in the S&P 500. Even more important, that yield isn’t artificially boosted by a plunging share price—it’s backed by real cash flow and disciplined management.

Free cash flow over the last twelve months came in at more than $16 billion. That easily covers the dividend, with room left over. Operating cash flow topped $31 billion, reinforcing the fact that this is a cash-generating machine, even in an unpredictable energy market.

The payout ratio sits at about 67%, which tells us Chevron isn’t overextending itself. It’s not throwing every dollar at shareholders just to keep up appearances. There’s still plenty left to invest in the business and handle debt. And speaking of debt, Chevron’s balance sheet is in excellent shape, with a very manageable debt-to-equity ratio and over $6.7 billion in cash.

Another thing that stands out is how steady Chevron has remained when others have wobbled. During past oil downturns, the company stayed the course. That kind of commitment gives dividend investors confidence that their income stream isn’t likely to dry up at the first sign of trouble.

Dividend Growth and Safety

Chevron isn’t just a dividend payer—it’s a dividend grower. The company has increased its dividend every year for more than three decades, putting it in elite territory. That track record doesn’t happen by accident. It’s the result of a management team that treats the dividend as a top priority.

The most recent increase brought the quarterly payout to $1.71 per share. It wasn’t a huge jump, but it was meaningful. In a sector known for wild swings, steady growth like that is worth paying attention to.

The safety of the dividend looks strong across the board. Earnings per share over the last twelve months came in at $9.72, more than enough to support the current payout. And the company has been careful not to stretch its finances too thin. That 67% payout ratio gives Chevron some flexibility—enough to continue paying (and potentially raising) the dividend even if oil prices soften.

Debt levels are low by industry standards, and with a beta of just 0.91, the stock doesn’t move as violently as many of its peers. That lower volatility adds an extra layer of comfort for investors who are looking to collect income without riding a roller coaster every quarter.

It’s also worth noting that Chevron hasn’t split its stock since 2004. That’s not necessarily a good or bad thing, but it says something about the company’s approach. It’s not chasing short-term excitement. It’s focused on delivering value over time—and for dividend investors, that’s the kind of philosophy that really matters.

All signs point to Chevron continuing to prioritize income as a core part of its value proposition. For investors who rely on steady dividends to meet financial goals or supplement retirement income, that makes CVX a compelling name to keep on the radar.

Cash Flow Statement

Chevron’s cash flow story over the trailing twelve months reflects a more disciplined approach to capital deployment. Operating cash flow came in at $31.5 billion, slightly lower than the prior year but still robust by any measure. The company continues to generate strong cash from its core operations, even in a more tempered commodity price environment. Free cash flow landed at $15 billion, which easily supports dividend payments and leaves room for other shareholder returns.

On the spending side, capital expenditures rose to $16.4 billion, up from previous years, signaling Chevron’s ongoing investments in future production and energy transition initiatives. Financing activities remain a significant outflow, with $23.5 billion going toward debt repayments, share repurchases, and dividend distributions. Notably, the company repurchased over $15.2 billion in stock, reinforcing its commitment to returning capital. While the end cash position has dipped slightly to $8.3 billion, Chevron remains well-capitalized and financially flexible.

Analyst Ratings

Chevron recently experienced a shift in sentiment from the analyst community. On April 11, 2025, Scotiabank revised its stance on the stock, moving it from Sector Outperform to Sector Perform. The firm also lowered its price target from $160 to $143. This downgrade came amid growing concerns about Chevron’s reserve replacement ratios and uncertainties surrounding its acquisition of Hess, which is currently entangled in legal proceedings. ⚖️

Despite this adjustment, overall sentiment among analysts leans positive. 🟢 Out of 17 analysts covering the stock, 11 rate it a buy, 5 suggest holding, and just 1 recommends selling. The consensus 12-month price target stands at $169.50, implying a potential upside of roughly 27% from the current trading level of $133.14. 📈 Price targets range from a conservative $140 to a high-end estimate of $189, indicating a wide spread based on different assumptions about future oil prices and strategic execution. 🎯

Those with a bullish view point to Chevron’s financial stability, its consistent and generous dividend history 💵, and a disciplined approach to capital allocation. There’s optimism around the company’s ability to grow free cash flow through tighter operational efficiency and smart project selection. On the other side, some analysts are cautious due to Chevron’s exposure to volatile energy prices and broader global macroeconomic pressures. 🌍

Earning Report Summary

Chevron wrapped up 2024 with a quarter that showed strength in some key areas but also revealed a few soft spots. On the whole, the company put up solid numbers—especially on the production side—though not everything went according to plan.

Mixed Bottom Line

In the fourth quarter, Chevron earned $3.2 billion, or $1.84 per share, on a GAAP basis. After adjusting for some one-time items, that number came out to $3.6 billion, or $2.06 per share. Revenue for the quarter came in at $52.2 billion, which is a healthy jump of 11% compared to the same time last year. That’s a decent performance on the top line, but profits were held back by over $1 billion in special charges, including things like severance costs and asset impairments.

Where the company really ran into some friction was in its downstream operations—specifically refining. This part of the business posted a loss of $248 million for the quarter. Lower refining margins and weaker jet fuel demand were the culprits here. It was the first time Chevron’s downstream segment dipped into the red since 2020, and it definitely caught some attention.

Strong Output and Capital Focus

Production, on the other hand, was a real highlight. Chevron delivered a record level of output, with global production up 7% from the year before. U.S. production climbed even higher, growing by 19%. A big part of that came from the Permian Basin, where output rose 14% year-over-year to hit 992,000 barrels per day.

CEO Mike Wirth made it clear that the company is sticking to a playbook focused on efficiency and disciplined capital spending. Looking ahead to 2025, Chevron is targeting 6% to 8% growth in production. That’s ambitious, but not out of reach given the kind of volumes they’re already delivering.

The company also has its eyes on several major projects across the globe. New investments are being made in places like Argentina, West Africa, and the Eastern Mediterranean. These are long-term bets aimed at expanding Chevron’s reach and diversifying its resource base. At the same time, they’re working on trimming $2 to $3 billion in costs by the end of 2026.

Chevron hasn’t taken its foot off the gas when it comes to rewarding shareholders. The board approved a 5% hike in the quarterly dividend, bumping it up to $1.71 per share. That’s right in line with the kind of steady income investors have come to expect from this company. On top of that, Chevron returned a record $27 billion to shareholders last year through a mix of dividends and stock buybacks.

So while the refining side of the business may have stumbled a bit, the company’s core strengths—strong upstream performance, disciplined strategy, and consistent shareholder returns—are still very much intact.

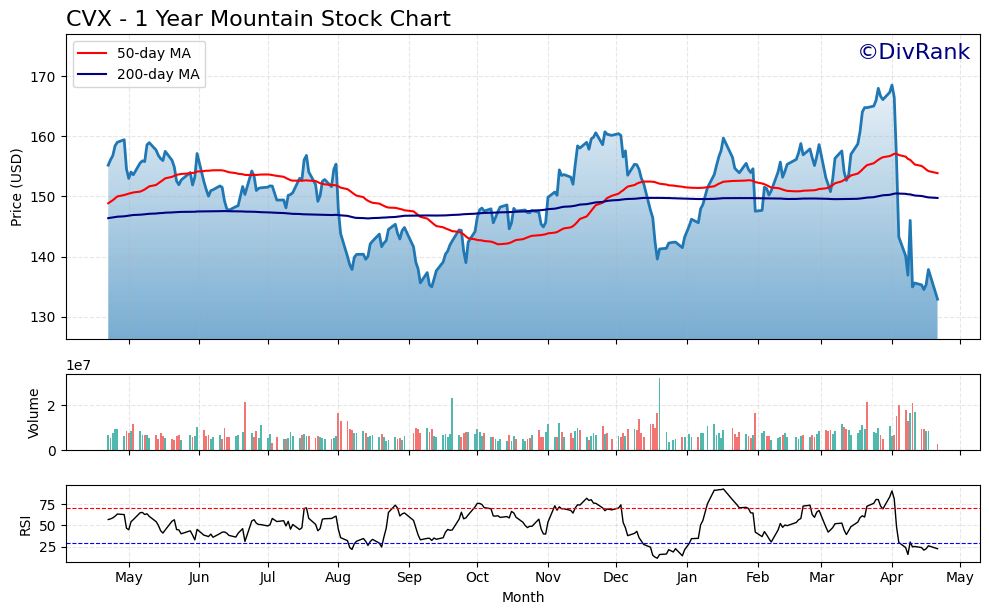

Chart Analysis

Chevron (CVX) has had a fairly turbulent 12-month stretch, with several clear shifts in trend playing out on the chart. After peaking near $170, the stock has sharply pulled back and is now trading closer to the $133 mark. That decline brings the price well below both the 50-day and 200-day moving averages, which have also begun to turn lower—particularly the 50-day, which has clearly rolled over and is acting as near-term resistance.

Moving Averages and Price Action

For most of last year, CVX hovered above the 200-day moving average, giving off a steady, sideways-to-upward trend. But once we moved into early spring, a breakdown occurred. The red 50-day moving average has crossed below the 200-day in a bearish signal, sometimes referred to as a “death cross.” While not always predictive, it does confirm the shift in short-term momentum and suggests the stock is struggling to reclaim any upside traction. Price is now comfortably beneath both averages, signaling ongoing weakness.

Volume and Selling Pressure

Looking at volume, the recent drop has been accompanied by some noticeable spikes. These bursts, particularly in early April, point to elevated selling pressure. Whether that was driven by earnings reactions, analyst revisions, or broader market movements, it’s clear that investors have been exiting in heavier-than-usual numbers.

RSI and Momentum

The Relative Strength Index (RSI) tells its own story. The indicator has dipped well below the 30 level multiple times in recent weeks and remains in oversold territory. That’s typically seen as a sign the stock may be due for a short-term bounce or some relief, but when combined with the declining trend, it suggests broader weakness rather than a short-lived dip. Throughout the year, RSI mostly hugged the middle range, showing balance, but the recent plunge below 30 is notable.

Final Takeaway from the Chart

There’s a visible shift from stability to downside pressure over the past two months. The lower lows, persistent selling volume, and deteriorating technical indicators all reflect that momentum has turned bearish. While the broader fundamentals for CVX remain tied to macro trends like energy prices and project development, this chart points to a market currently pricing in more caution than confidence. The stock has entered a correction phase, and price action suggests it hasn’t yet found a solid floor.

Management Team

Chevron’s executive leadership is led by Chairman and CEO Mike Wirth, who stepped into the top role in 2018. Since then, he’s shaped a clear direction for the company—prioritizing financial discipline, operational efficiency, and consistent shareholder returns. Wirth’s steady hand has guided Chevron through a volatile energy environment, all while balancing the demands of traditional fossil fuel operations with the early steps into cleaner energy initiatives.

The broader executive team brings deep industry experience. Eimear Bonner, the current CFO, has a strong track record in financial strategy and operational management. Recent internal shifts will see Clay Neff stepping into the role of President of Upstream and Bruce Niemeyer leading as President of Shale & Tight beginning July 2025. These transitions aim to better align leadership with Chevron’s long-term operating goals, especially as it looks to streamline performance across its global footprint.

This leadership group appears committed to steering Chevron through a period of change in the energy sector, leveraging the company’s scale while preparing for shifts in the global energy mix.

Valuation and Stock Performance

Chevron’s stock is currently hovering around $133, which is down significantly from its 52-week high of roughly $169. The recent slide reflects pressure from both sector-wide headwinds and company-specific developments, including the uncertainty surrounding the Hess acquisition. Still, valuation metrics suggest the stock isn’t stretched. The forward P/E ratio sits around 13.7, noticeably below the industry average, which could imply some undervaluation by the market.

Wall Street’s consensus 12-month price target sits at $169.50. That’s a sizable gap from the current price, suggesting that many analysts see room for recovery. Longer-term performance has been relatively strong—Chevron’s stock has climbed over 50% in the past five years, supported by strong cash flow, disciplined spending, and generous shareholder returns. While recent months have seen some turbulence, the broader track record speaks to Chevron’s resilience.

Risks and Considerations

Chevron isn’t without its challenges. One of the more pressing concerns is the decline in its oil and gas reserves, which have fallen to their lowest level in more than ten years. The company ended 2024 with about 9.8 billion barrels of oil equivalent in reserves, down from 11.1 billion in 2023. That drop has added urgency to the pending acquisition of Hess, which would bring a significant stake in Guyana’s offshore resources. But the deal faces hurdles, with legal action from ExxonMobil and CNOOC putting the timeline and structure of the transaction in question.

Operationally, Chevron is in the middle of a cost-cutting push. The company plans to trim its global workforce by up to 20% through 2026. This effort is tied to both cost pressures and project execution issues, particularly in Kazakhstan, where overruns have impacted margins. There are also legal and environmental issues coming into play. Chevron was recently hit with a $744 million court judgment related to environmental damage in Louisiana. Separately, regulators flagged the company in Colorado for inaccuracies in environmental filings—an issue that could further complicate its ESG narrative.

Final Thoughts

Chevron is navigating a complicated chapter. It’s still one of the biggest and most stable players in global energy, with a long-standing reputation for capital discipline and dividend consistency. But the next few years will require careful execution. The outcome of the Hess acquisition could reshape its reserve profile and growth outlook. At the same time, management must steer through a changing regulatory environment, internal cost pressures, and evolving investor expectations around sustainability.

The leadership team has experience on its side and a clear strategy focused on streamlining operations and returning capital. Still, the risks tied to legal and environmental matters, coupled with questions about future production capacity, make this a story worth watching. There are both headwinds and tailwinds at play—how Chevron navigates them may determine its trajectory for the rest of the decade.