Updated 4/21/25

Cheniere Energy Partners (NYSE: CQP) owns and operates the Sabine Pass LNG terminal, a critical piece of U.S. energy infrastructure. With long-term, fixed-fee contracts forming the backbone of its revenue model, CQP generates reliable cash flow that supports consistent quarterly distributions. The company is led by an experienced management team with deep energy sector expertise and has shown steady stock performance, gaining over 25% in the past year. It currently offers a 5.5% dividend yield and maintains a disciplined payout strategy, even while managing over $15 billion in debt. With a stable valuation, lower-than-market volatility, and ongoing infrastructure expansion, CQP remains well-positioned in the evolving global LNG market.

Recent Events

Shares of CQP have been bouncing around lately. The stock is trading at about $58.22, down over 4% on the day. Still, it’s been a solid performer over the past year, up more than 25%, and staying well above its long-term averages. Its 200-day moving average sits at around $55, which gives it a cushion if markets get choppy.

Trading volume is on the lighter side, which is normal for a limited partnership like this. What’s more compelling is that nearly half of the company’s shares are held by insiders. That level of ownership tells a story—leadership is clearly aligned with long-term investors and income stability.

One other key factor: debt. CQP carries over $15 billion of it, which is substantial, but the cash flow picture tells a reassuring story. Levered free cash flow clocks in at $2.15 billion, and operating cash flow is nearing $3 billion. This isn’t a company in financial distress; it’s generating serious cash, and it’s putting it to work by paying out strong distributions while also managing its liabilities.

Key Dividend Metrics 📈

🪙 Forward Dividend Yield: 5.34%

📅 Ex-Dividend Date: February 10, 2025

💵 Dividend Rate (Annualized): $3.25 per share

🧮 Payout Ratio: 81.53%

📈 5-Year Average Yield: 6.96%

🏦 Cash Flow Coverage: Strong – Levered FCF of $2.15B

⚙️ Quarterly Payout Frequency: Yes

📉 Dividend Cut History: None since inception

Dividend Overview

This isn’t a stock where dividends are a side note—they’re the centerpiece. Right now, the forward yield stands at 5.34%, which is a solid return for investors focused on income. Even though that number is a little lower than its five-year average, it’s still delivering more than double what you’d get from the average S&P 500 stock.

That said, the payout ratio is just over 81%, which might catch your attention. But this is where the structure of the business matters. As a master limited partnership, CQP is designed to pay out a high percentage of its available cash. In this space, an 80%+ payout isn’t a red flag—it’s the norm.

Revenues have dipped a bit year over year, and earnings are down as well, but none of that seems to be shaking the foundation. The reason? Long-term take-or-pay contracts that lock in revenue. These agreements are what make the income stream so stable, even when energy prices fluctuate.

CQP also pays its distributions quarterly, which is something many income investors appreciate. It keeps the cash flowing regularly and makes this an attractive name for anyone using dividends for income or reinvestment strategies.

Dividend Growth and Safety

Now here’s the thing—this isn’t a dividend growth story. The payout has been held steady at $3.25 annually for a while now. That might sound boring to some, but for income-focused investors, there’s nothing wrong with consistency. Sometimes, steady wins the race.

Even though the yield isn’t climbing, the safety of the dividend seems intact. The company is producing enough free cash flow to cover its payout, even with inflation and a shifting economic backdrop. That steady cash engine is what makes CQP stand out in a sector known for booms and busts.

One thing to keep an eye on is the company’s debt. With more than $15 billion on the books and a current ratio under 1.0, CQP is definitely leveraged. However, they’ve been able to manage it well so far. Their long-term contracts and solid free cash flow give them room to handle maturities and interest obligations without having to dip into distributions.

The bottom line is that while this isn’t a stock for those chasing dividend hikes every year, it’s one of the more reliable income plays out there. The cash flows are sticky, the yield is attractive, and the structure of the business is set up to prioritize paying investors. For those looking to add a core energy infrastructure name to an income portfolio, CQP keeps delivering.

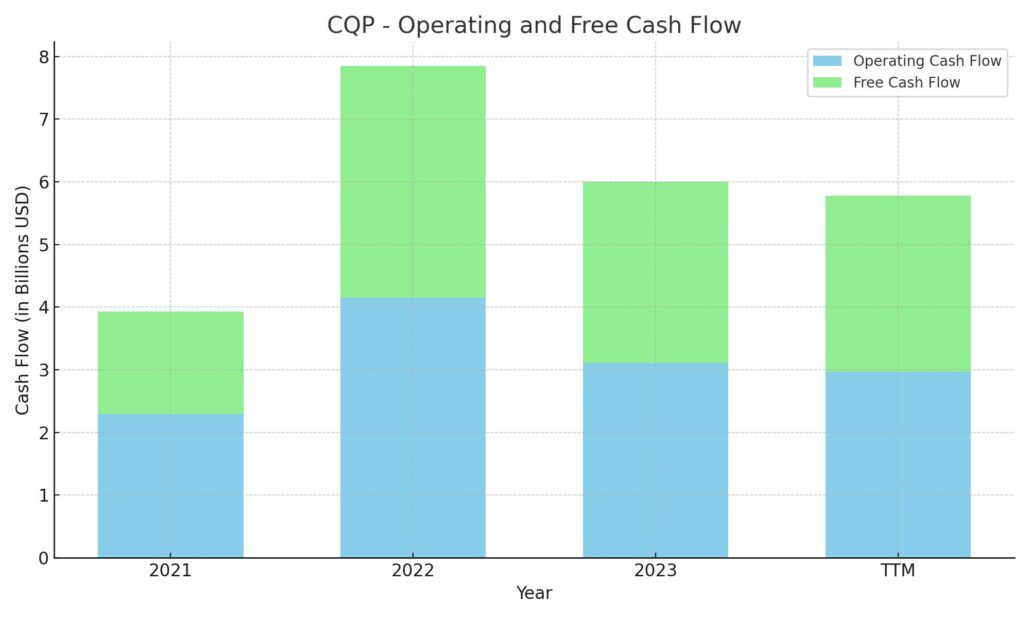

Cash Flow Statement

Cheniere Energy Partners has maintained solid operational performance, generating $2.97 billion in operating cash flow over the trailing twelve months. This is a slight dip from the $3.1 billion posted the year before, but still reflects a strong cash-generating business model rooted in long-term LNG contracts. Capital expenditures came in relatively low at $154 million, contributing to a robust free cash flow figure of $2.81 billion, nearly matching last year’s $2.89 billion. The business remains efficient, managing to convert a significant portion of its operating inflow into free cash.

On the financing side, the story has been more active. CQP paid down $2.03 billion in debt while issuing $1.23 billion, showing ongoing efforts to manage and restructure its capital obligations. Total cash outflows from financing hit $3.06 billion, keeping with prior years as the company prioritizes both debt servicing and distributions. Despite the hefty financing outflows, the end cash position landed at $379 million. It’s down from previous years, but still reflects a measured balance between liquidity, capital returns, and long-term financial commitments.

Analyst Ratings

🔻 Cheniere Energy Partners (CQP) has recently caught attention from analysts, but not all of it has been glowing. Stifel Nicolaus moved the stock from Hold to Sell, pointing to valuation concerns and the possibility of earnings pressure down the road. Their view seems to be that the recent performance may have run its course for now, and the upside potential is limited.

🔻 Adding to that cautious tone, Bank of America started coverage with an Underperform rating. The reasoning echoes similar themes—tightening margins, a less favorable pricing environment for LNG, and questions around long-term volume growth have created some clouds over the outlook.

🔸 On the other hand, not everyone is stepping back. RBC Capital maintained a Hold rating and placed a $63 price target on the stock. This suggests they see CQP as fairly valued at current levels, with a little room for movement either way depending on future developments.

🎯 Across the board, the consensus price target among analysts sits around $56.51. That’s slightly below the current trading price, which lines up with the more reserved tone coming from the analyst community lately. While there are no widespread downgrades, the cautious stance is definitely something dividend investors will want to factor in.

Earnings Report Summary

Quarterly Performance

Cheniere Energy Partners wrapped up 2024 with a mixed bag in its final quarter. Revenue for Q4 came in at $2.46 billion, which was a step down from the $2.69 billion they reported during the same stretch last year. Net income also cooled off a bit, landing at $623 million compared to $906 million the year before. Adjusted EBITDA followed a similar path, dropping to $890 million from just over $1 billion previously.

The company pointed to lower LNG margins and some unfavorable changes in their derivative positions as the main reasons behind the dip. It wasn’t a surprise, given the softer pricing environment and how markets have been shifting. Even with the pullback, they still managed to export 110 LNG cargoes in the quarter, only slightly down from 115 in the same period last year.

Full-Year Highlights

Over the full year, Cheniere posted $8.7 billion in revenue, down about 10% from 2023’s $9.66 billion. Net income also slid, coming in at $2.5 billion after hitting $4.25 billion the year before. Adjusted EBITDA for the year was steady at $3.57 billion—just a touch below 2023.

Despite the top-line pressure, the company continued to operate with discipline. LNG volumes were solid, even if they didn’t quite match prior-year levels, and the infrastructure remains reliable. Management made it clear they’re keeping long-term goals front and center.

Distribution Update

For income investors, the dividend news was consistent. Cheniere declared a fourth-quarter distribution of $0.820 per common unit. That included a base payout of $0.775 and a variable kicker of $0.045. When you stack it all up, full-year distributions landed at $3.25 per unit, right in line with expectations.

Looking ahead, the guidance for 2025 puts distributions somewhere between $3.25 and $3.35, with the base set at $3.10. It’s not a dramatic increase, but it shows the company’s commitment to keeping payouts steady even in a more challenging market.

Leadership Commentary

Executives acknowledged that 2024 came with its fair share of hurdles. But they were quick to underline the strength of the core operations and their confidence in what lies ahead. The big project on the horizon is the Sabine Pass expansion, which is expected to ramp up capacity and support future cash flows. Liquidity remains in solid shape too, with $2.2 billion available as of year-end—more than enough to keep the business running smoothly while staying on track with their long-term plans.

Chart Analysis

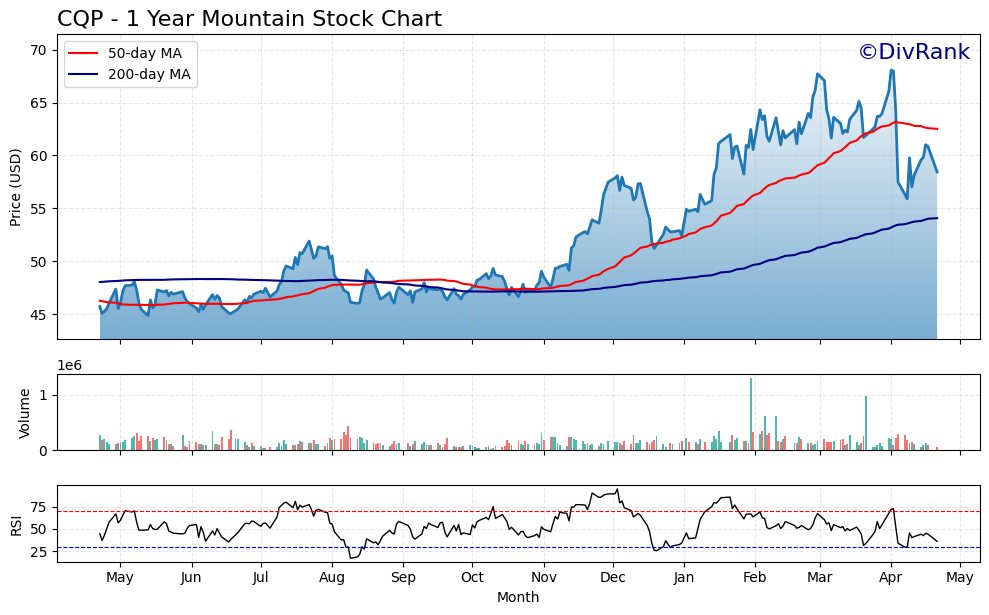

Price and Moving Averages

CQP has had a strong run over the past year, starting out relatively flat before staging a significant breakout in late October. The upward momentum carried well into early spring, with the price topping out near $70 before pulling back. What stands out here is the consistent climb above both the 50-day and 200-day moving averages. The 50-day (in red) remained well above the 200-day (in blue) for several months, a classic sign of strength. Recently, however, we’re starting to see a bit of softening in the 50-day slope, suggesting some of that upside momentum is cooling off.

Despite the pullback from recent highs, the price remains comfortably above the 200-day line. That’s important. It signals that the broader trend is still intact, even if the near-term looks a bit choppier. Investors watching for long-term positioning will likely note that this stock has continued to respect its longer-term average, even during volatile periods.

Volume Patterns

Volume stayed relatively muted for most of the year, with a few notable spikes around late January and early April. These surges may correspond with earnings announcements or dividend dates, both of which tend to attract more activity. Interestingly, volume didn’t fall off during the recent decline, which may suggest that selling wasn’t panic-driven. This kind of steady participation during a retracement is worth noting—it often reflects rotation rather than capitulation.

RSI Indicator

The Relative Strength Index (RSI) has told its own story. It spent much of late fall and early winter above the 70 mark, firmly in overbought territory, which coincided with the sharp climb in share price. Since then, RSI has gradually faded and is currently hovering around the lower end of the range, closer to 30. That shift hints at a loss of upward momentum and possibly a short-term oversold setup, though RSI alone doesn’t always give the full picture.

What’s encouraging is how the stock behaved after previous dips into the 30–40 RSI zone. There were several bounce points over the last year where lower RSI levels led to renewed price strength. If that pattern continues, the current technical setup could lead to stabilization or even a modest rebound in the weeks ahead.

Overall Tone

This chart shows a stock that’s already put in a lot of work over the past year. The trend has been positive, and while it’s no longer in its most aggressive uptrend phase, the longer-term structure remains healthy. The recent pullback looks like a breather rather than a reversal, and the broader technical posture suggests that it’s still positioned well within its historical rhythm.

Management Team

Cheniere Energy Partners (NYSE: CQP) is led by a management team with deep operational and financial expertise in the energy sector. At the center is Jack A. Fusco, who has been President and CEO since 2016. Fusco brings decades of experience, including leadership at Calpine and Texas Genco, where he guided companies through complex market and operational transitions. Under his leadership, CQP has expanded its LNG operations and maintained a strong position in global energy exports.

Supporting him is Zach Davis, Executive Vice President and CFO. Davis has played a critical role in overseeing the company’s financial strategy. His background includes investment banking and infrastructure finance, which has helped CQP navigate its capital needs while managing its debt profile. Anatol Feygin, Chief Commercial Officer, brings a strategic focus on market development and customer alignment. His market insights help keep Cheniere positioned competitively in a global LNG landscape. Rounding out the core leadership is Sean Markowitz, the company’s Chief Legal Officer, who manages compliance, regulatory affairs, and governance. Together, this team blends commercial vision with financial discipline and operational execution.

Valuation and Stock Performance

CQP’s stock has performed well over the past year. Shares are currently trading near $60, after a solid run that saw the stock climb over 25% in the past 12 months. This outperformance, relative to broader market benchmarks, reflects strong investor confidence in the company’s business model and contract-based revenue structure. The lower beta of 0.55 reinforces its appeal as a steadier holding, especially when markets get more volatile.

Looking at valuation, the stock currently trades at a price-to-earnings ratio around 16.5. It’s not cheap, but it’s not stretched either, particularly when you consider the consistency of cash flow. The price-to-sales ratio sits at 3.37, which is reasonable given the scale and predictability of revenue. While not a value play in the strictest sense, CQP still offers a compelling valuation narrative, especially for investors focused on income stability.

The dividend remains a standout feature. At a forward yield of around 5.5%, the stock continues to attract those looking for dependable payouts. It’s a yield that has held up well even through interest rate shifts and commodity cycles. Combine that with the overall stability of the unit price, and CQP remains a reliable piece in income-focused portfolios.

Risks and Considerations

Even with its strengths, CQP isn’t without its risks. One of the more obvious is the sensitivity to LNG demand and pricing. While much of the company’s revenue is locked in through long-term contracts, changes in global energy trends or geopolitical shifts could affect future contract renewals or expansion opportunities. The energy sector is cyclical by nature, and even well-hedged players like CQP feel some of that pressure.

Another layer of risk is the company’s debt load. With over $15 billion in long-term obligations, debt management is an ongoing focus. So far, the company has shown discipline in servicing and restructuring its liabilities, but high leverage always deserves attention—especially if market conditions tighten or cash flows become less predictable.

Operationally, Cheniere has been incorporating more grid electricity to reduce emissions, a move that fits well with broader ESG goals. However, this also adds a level of dependence on grid reliability, especially during times of peak demand or extreme weather. While it’s a forward-thinking decision, it’s not without its trade-offs.

Regulatory and environmental scrutiny also remains a background risk. With more attention on the carbon footprint of natural gas production and transport, CQP will need to stay proactive in its environmental practices and transparency. The company has already made progress here, but policy shifts could bring additional compliance costs or restrictions.

Final Thoughts

Cheniere Energy Partners continues to deliver on its core promise—steady income from a foundational U.S. energy export platform. The leadership team remains focused, experienced, and capable of guiding the company through both opportunity and challenge. Its valuation reflects the reliability of earnings and the appeal of its yield, without straying into overly expensive territory.

The risks are manageable and largely inherent to the industry. What makes CQP compelling is how it navigates them—with disciplined financial management, clear long-term planning, and operational consistency. For those looking for durable exposure to the LNG space with income at the forefront, this is a name that earns a place in the conversation.