Updated 4/21/25

Cencora, Inc. (NYSE: COR), formerly known as AmerisourceBergen, plays a vital role in the healthcare supply chain, distributing pharmaceuticals and providing services to providers across the globe. Over the past year, the stock has gained over 21%, supported by strong revenue growth, consistent dividend increases, and a steady strategic shift toward specialty care and digital innovation. Recent leadership changes, including the appointment of Bob Mauch as CEO, reflect a focus on long-term growth and operational efficiency. Despite a high valuation, analyst sentiment remains positive, with revised price targets and earnings guidance pointing to confidence in the company’s direction.

Recent Events

Cencora, Inc. (COR) has been moving through some interesting territory lately. You may remember it by its former name, AmerisourceBergen, but the rebrand to Cencora reflects a broader global strategy and a sharper focus on its expanding services. It might not be front-page news every day, but make no mistake—this company is one of the key players keeping the healthcare system running smoothly, especially when it comes to getting medications from manufacturers to the front lines where patients need them.

Over the last year, Cencora pulled in over $300 billion in revenue. That kind of number grabs attention, and it comes with a 12.8% jump in year-over-year revenue. Not bad for a company operating in a low-margin, high-volume space. That said, profits were a little softer, with quarterly earnings taking an 18.8% hit. That kind of dip isn’t ideal, but given the scale of the business and its razor-thin profit margins (about 0.46%), it’s not entirely unexpected either. Cencora is built to thrive on efficiency, and even modest shifts in costs can ripple through earnings.

On the market side, the stock has had a strong year—up more than 21% over the past 12 months. That’s far better than the broader S&P 500 over the same period. And it’s doing it with a beta of just 0.54, which tells us this isn’t a stock that whips around with every little market hiccup. Institutional investors seem to like what they see too. Over 92% of shares are held by big players who’ve likely crunched the numbers and see long-term value here.

There are some financial wrinkles to keep an eye on. Cencora’s debt load sits at $9.73 billion, with only $3.22 billion in cash, and a current ratio under 1. That’s not unusual for a distribution-heavy company like this, but it does suggest a tight balance sheet. Still, this isn’t uncharted territory for them. Historically, they’ve managed these dynamics well.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.77%

💸 Annual Dividend (Forward): $2.20

🧮 Payout Ratio: 29.5%

📊 5-Year Average Dividend Yield: 1.23%

📅 Next Dividend Date: March 3, 2025

🔔 Ex-Dividend Date: February 14, 2025

📉 Trailing Dividend Yield: 0.73%

📈 Dividend Growth Rate (5-Year): Positive and consistent

Dividend Overview

Cencora isn’t the kind of company that screams “high-yield,” but it has been a solid dividend name in its own right. The current forward yield sits at 0.77%, which might feel light, especially compared to more income-focused sectors. But when you dig a little deeper, the picture gets more interesting.

That relatively low yield isn’t due to weak payouts—it’s mostly because the stock price has climbed steadily, compressing the yield. It’s currently below its five-year average yield of 1.23%, which again reflects the strong share performance. In other words, the market has been bidding up this stock faster than the dividend has grown. That’s a good problem to have.

With a payout ratio of 29.5%, there’s plenty of breathing room. This isn’t a company that’s overextending itself to satisfy dividend expectations. In fact, that conservative payout strategy leaves room for future increases—even if cash flow gets tight for a stretch.

There’s been some red ink on the cash flow front lately, with negative operating and levered free cash flow. But those numbers don’t tell the whole story. In a capital-intensive business like this, especially one making tech investments and expanding globally, timing plays a huge role. The fundamentals suggest this is more about reinvestment and growth than trouble on the horizon.

Dividend Growth and Safety

This is where Cencora really starts to shine for the dividend-focused crowd. The company has a solid history of boosting its dividend—no big flashy hikes, but consistent and steady increases that compound nicely over time. That kind of predictability is gold when you’re building an income stream.

And while it doesn’t have the label of a Dividend Aristocrat, it operates with the kind of discipline and commitment you’d expect from one. Management clearly sees the dividend as part of the long-term value proposition, and they’ve never cut it—even when things have gotten choppy in the broader market.

One number that jumps out is the company’s massive return on equity—198.15%. That’s driven by a mix of strong earnings and a very small book value, thanks in part to consistent share repurchases. Some of that’s accounting-based, but it underscores how efficiently the business runs.

Cencora’s business is also naturally defensive. Demand for pharmaceuticals doesn’t ebb and flow with the economy in the same way as other sectors, and the company’s position in the distribution chain means it’s essential without being tied to the uncertainties of drug discovery or pricing volatility.

All of this adds up to a dividend that, while modest in size, feels extremely secure. The company could realistically double its dividend tomorrow and still maintain a reasonable payout ratio. But instead, they’re playing it smart—rewarding shareholders while keeping plenty of powder dry for whatever comes next.

That kind of strategy makes sense in a world where capital discipline is coming back into fashion. For dividend investors looking for consistency and long-term potential—not just short-term yield—Cencora deserves a closer look.

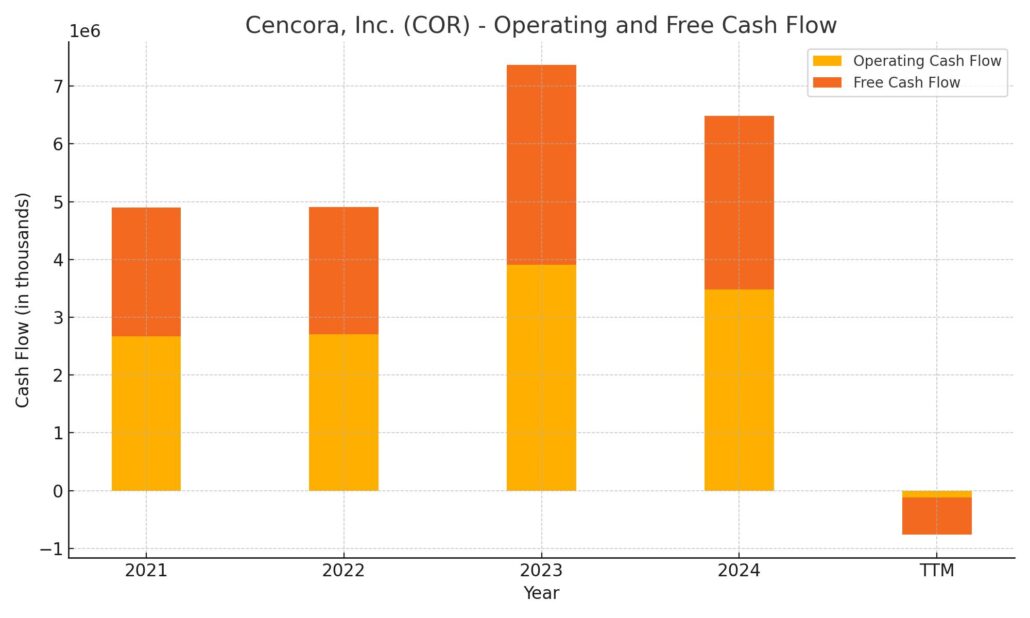

Cash Flow Statement

Cencora’s latest trailing twelve months show a sharp departure from its usual cash generation trends, with operating cash flow slipping into the red at -$119 million. That’s a stark contrast to the $3.48 billion generated in the prior fiscal year. The primary cause appears to be a timing mismatch between cash outflows and inflows, likely tied to working capital shifts rather than a structural downturn. Still, for a company known for reliable operations, it stands out and warrants watching, especially as capital spending remains steady around the half-billion mark.

On the financing side, activity picked up significantly. The company issued over $76 billion in new debt, nearly offset by $73 billion in repayments—highlighting how Cencora actively manages its debt stack rather than sitting on long-term obligations. Share repurchases also ramped up to nearly $1.5 billion. Despite the turbulence in operating cash flow, the end cash balance actually grew slightly to $3.45 billion. Free cash flow dipped to negative $638 million, which is unusual for Cencora, but when viewed alongside consistent investment and active capital returns, it reflects a business in transition, not decline.

Analyst Ratings

📈 Cencora (NYSE: COR) has recently attracted positive attention from analysts, with several firms adjusting their price targets higher. 💼 The current consensus 12-month price target is $284.55, with most analysts leaning toward a moderate buy rating. 🎯 That target reflects a balance between the most bullish estimate at $301.00 and the more conservative outlook at $274.00.

🧮 JPMorgan Chase & Co. recently raised its price target from $289 to $301, continuing to rate the stock as overweight. Their confidence stems from Cencora’s operational consistency and the impact of strategic shifts across its global business. Another firm, Evercore ISI, bumped its target from $270 to $280, noting strength in the company’s earnings trend and market position, especially in the high-demand pharmaceutical distribution space.

🏦 Wells Fargo also adjusted its outlook, lifting its target from $251 to $274. Their update reflected optimism around Cencora’s underlying financials and the broader industry tailwinds it seems to be riding. Analysts appear to be looking past the recent dip in operating cash flow, focusing more on the long-term execution and resilience of the business.

📊 Across the board, these upward revisions suggest growing conviction that Cencora is delivering on its potential and positioning itself well for future growth. Most analysts now recommend a buy, backing that view with higher price targets and positive commentary on recent performance.

Earnings Report Summary

Cencora kicked off its fiscal 2025 with a solid performance that gave investors plenty to feel good about. Revenue for the quarter came in at $81.5 billion, which was a 12.8% jump from the same quarter last year. That kind of top-line growth doesn’t happen by accident—it was fueled mostly by strength in their U.S. Healthcare Solutions business. Demand was especially strong in areas like diabetes and weight loss treatments, which have been booming lately.

Strong EPS Beats Expectations

On the earnings front, adjusted diluted EPS hit $3.73, up from $3.28 a year ago. That’s a 13.7% increase and came in ahead of what Wall Street had expected. However, the GAAP numbers told a slightly different story, with diluted EPS dipping to $2.50 from $2.98. The difference largely came down to some higher operating costs, including ongoing legal and opioid-related expenses that the company has been managing for a while now.

Margin and Profit Updates

Gross profit climbed 3.6% year over year to $2.6 billion. Not massive, but solid growth considering the scale of their operations. Operating income was down 14.2%, which might raise some eyebrows, but again, that’s mostly tied to higher expenses rather than any weakness in the core business. Their effective tax rate actually came down a bit to 20.4%, which helped cushion the hit to net income, which came in at $489 million.

Leadership Commentary and Outlook

Cencora’s leadership sounded optimistic in their remarks, pointing out not just the growth but also their strategic moves. One highlight was the recent acquisition of Retina Consultants of America, which strengthens their position in the specialty care space—a key area of focus going forward.

They also revised their full-year guidance upward, now expecting adjusted diluted EPS to land somewhere between $15.25 and $15.55. That’s a good sign that management sees more strength on the horizon and isn’t just riding a one-quarter bump. Overall, the message from leadership was clear: the company is on track, staying focused, and looking to build even more momentum through the rest of the year.

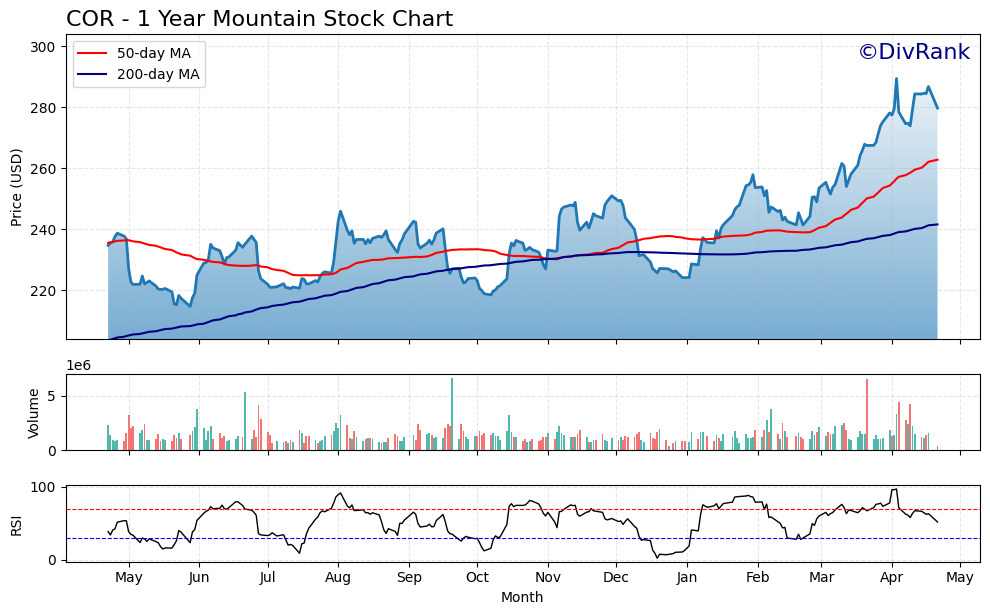

Chart Analysis

Price Momentum and Moving Averages

The stock price of COR has been steadily trending higher over the past year, showing a clear and consistent upward trajectory since late October. Earlier in the year, the price bounced between $215 and $240, consolidating through the summer and early fall before launching into a breakout phase that’s still in motion. The 50-day moving average, shown in red, is now well above the 200-day moving average, a classic signal that longer-term momentum has shifted in favor of buyers.

During the back half of the year, especially from January onward, the price climbed in tight, orderly waves—pausing for breath before resuming its climb. This kind of action often signals accumulation rather than speculative pops. The 200-day moving average continues to rise gradually, offering solid confirmation of the uptrend.

Volume and Trading Activity

Volume remains relatively stable, but notable spikes align with breakouts in price—particularly in late January and again in mid-March. These bursts of participation suggest institutional interest stepping in during key inflection points. There hasn’t been a sustained spike in selling volume, which means there’s been no major distribution phase evident in the chart.

Relative Strength Index (RSI)

Looking at the RSI, it hovered mostly in the neutral zone for much of the year, occasionally dipping near the oversold line but bouncing back quickly. Since the start of the new year, the RSI has spent more time pushing toward the upper end of the range, indicating persistent buying strength. Most recently, it flirted with the overbought line around mid-April but has cooled slightly since.

Overall, the chart tells the story of a stock that’s gained traction, with strong trend support and no major warning signs of exhaustion. Pullbacks have been shallow, and buyers continue to step in at higher levels. It’s the kind of setup that reflects confidence, not just in the company’s recent performance, but in its long-term positioning.

Management Team

Cencora’s leadership has recently undergone a refresh, bringing a blend of long-time insiders and new talent to the executive bench. In October 2024, Bob Mauch took over as CEO. He’s no stranger to the company, having held several key roles prior, and his focus now is on keeping operations tight while exploring new avenues for growth. Alongside him is CFO Jim Cleary, who has been with the company since 2018 and is widely respected for his steady hand in managing the balance sheet and capital allocation.

Other key players include Elizabeth Campbell, who leads legal strategy as Chief Legal Officer, and Silvana Battaglia, responsible for people and culture as Chief Human Resources Officer. Francois Mandeville recently joined as Executive Vice President of Strategy and M&A, signaling a more aggressive push on the acquisition front. Pawan Verma, the new Chief Data and Information Officer, is driving modernization and digital strategy. While the average tenure of this team is still under a year, the combined industry experience and focus on innovation give the company a fresh energy as it charts its next phase.

Valuation and Stock Performance

The stock has had a strong run. Over the past year, Cencora shares are up about 21%, riding a broader wave of confidence in the healthcare distribution space. It’s currently trading near its 52-week high, which is a good sign of sustained momentum. Zoom out to a five-year view, and the story looks even better, with the stock gaining over 200% in that time. Clearly, long-term holders have been rewarded.

But that outperformance comes with a price. The company is trading at a trailing price-to-earnings ratio of 40.33, which is quite a bit richer than many of its peers. The price-to-book ratio is also elevated, sitting north of 240. These numbers show that the market has already priced in a fair amount of optimism. That said, Cencora is still putting up the kind of revenue and profit growth that can support a premium valuation. Revenue is growing double digits year over year, and margins have held up well despite a tight operating environment. So while it’s not cheap by traditional metrics, the fundamentals give some backing to the valuation.

Risks and Considerations

Cencora’s position in the pharmaceutical supply chain makes it essential—but it’s not without vulnerabilities. One of the bigger concerns right now is disintermediation. If major healthcare clients start cutting distributors out of the loop and dealing directly with manufacturers, it could pressure margins and revenue. That’s more than a theoretical risk; players like Centene have already shown interest in that model.

There’s also the matter of cybersecurity. A recent breach compromised patient data, and while operations weren’t disrupted, it was a reminder that digital risk is very real, even in a company focused on physical distribution. On top of that, Cencora continues to carry the weight of past legal battles tied to opioid distribution. While major settlements have been reached, lingering litigation remains a concern.

Lastly, the high valuation means expectations are elevated. If there’s a stumble in earnings, or guidance comes in lighter than hoped, the stock could be more vulnerable to a pullback than peers trading at lower multiples. It’s a stock with strong foundations but not without exposure.

Final Thoughts

Cencora continues to execute well in a space that rewards consistency and scale. The recent shakeup in the management team brings fresh thinking, and the business has shown resilience in both operations and strategy. The company is investing in growth, exploring tech-driven efficiencies, and expanding its specialty services.

But no stock is without its complexities. Cencora faces headwinds in the form of industry shifts, cybersecurity concerns, and regulatory overhangs. It’s also not a bargain at today’s valuation levels, which raises the bar for future performance.

Still, the company’s core strength—its role in the healthcare system—remains intact. It sits at a critical juncture between manufacturers and care providers, and that role won’t be easy to replace. For those comfortable with the risks, it’s a name worth keeping an eye on as it continues to evolve.