Updated 4/21/25

Cboe Global Markets (CBOE) plays a central role in the global financial ecosystem, operating exchanges for options, equities, futures, and more. Known for managing the VIX volatility index and facilitating over 3.8 billion options contracts annually, the company delivers steady performance backed by a strong operating model.

In 2024, CBOE reported $2.1 billion in net revenue and grew adjusted EPS by 10%, with free cash flow exceeding $1 billion. Its dividend yield stands at 1.16%, supported by a modest 32.73% payout ratio. Under the leadership of CEO Fred Tomczyk, CBOE continues to invest in global access, technology, and new market opportunities. The stock has gained over 20% in the past year, with low volatility and consistent earnings giving it broad appeal. As it expands trading hours and data offerings, the focus remains on disciplined growth, innovation, and long-term value creation.

📰 Recent Events

Over the past year, Cboe’s business has continued to show why it’s built for long-term stability. Revenue climbed 14.3% compared to the previous year, pointing to a healthy pipeline of activity across its trading venues. While earnings growth dipped slightly—down 7.3% year over year—the company still delivered $761 million in net income. With an operating margin north of 27%, Cboe is doing a lot right operationally.

Their model doesn’t demand heavy capital reinvestment. That leaves more room for shareholder-friendly actions like dividend increases. On the balance sheet, Cboe holds $1.03 billion in cash and carries $1.6 billion in debt, keeping its debt-to-equity ratio at a moderate 37.37%. Liquidity is strong, and so is their ability to weather turbulence.

Cboe’s valuation might seem a bit stretched at first glance—with a forward P/E around 24.1—but considering the business quality and growth consistency, it doesn’t look out of line. Especially for a firm that tends to benefit from spikes in market activity, including during times of heightened volatility.

📊 Key Dividend Metrics

💸 Dividend Yield: 1.16% (Forward)

💹 5-Year Average Yield: 1.43%

📈 Dividend Growth (5-Year CAGR): Steady upward trajectory

🧮 Payout Ratio: 32.73%

📅 Next Dividend Date: March 14, 2025

⚠️ Ex-Dividend Date: February 28, 2025

💰 Dividend Overview

Right now, Cboe pays an annual dividend of $2.52 per share, which works out to a forward yield of 1.16%. That may not seem flashy, but there’s a lot more to it than just the headline number. What sets it apart is how comfortably that dividend fits within the company’s financials.

A 32.73% payout ratio shows Cboe isn’t stretching itself. There’s plenty of room to maintain and grow the dividend, even if the business hits a bump in the road. And with the kind of dependable free cash flow this company produces—$766 million in levered free cash flow over the past twelve months—that dividend is built on a sturdy foundation.

Cboe’s strategy of measured capital allocation means the dividend isn’t an afterthought. It’s a core part of how they deliver value to shareholders. It’s not trying to compete with high-yield plays; it’s offering peace of mind through consistent performance.

🌱 Dividend Growth and Safety

Cboe has been raising its dividend like clockwork for years, showing a real commitment to shareholder returns. It doesn’t make a big show of it, but the track record is there—steady increases, not huge leaps, but enough to keep income investors happy.

This is largely thanks to how the business is structured. Revenue streams are steady, recurring, and don’t fluctuate wildly quarter to quarter. Whether it’s transaction fees, market data, or licensing revenue, Cboe has a dependable income engine. That reliability makes it easier to plan and sustain regular dividend hikes.

What also helps is the conservative approach to debt and spending. The company isn’t overextended, and it holds more than enough liquidity to handle any short-term pressures. The 1.78 current ratio reflects solid financial footing, and they’re not depending on debt to fund shareholder returns.

There’s also comfort in knowing that about 88% of the float is held by institutions. Big-money investors typically look for stability and consistency, and Cboe checks those boxes. Add in a very low beta of 0.47, and you’ve got a stock that doesn’t tend to swing wildly with market sentiment—exactly what dividend investors often look for.

Cboe isn’t in the spotlight, and that’s okay. It’s the kind of stock you can quietly hold onto while it steadily delivers growing income. The yield might not make headlines, but the reliability and financial discipline behind it tell a more important story for long-term dividend investors.

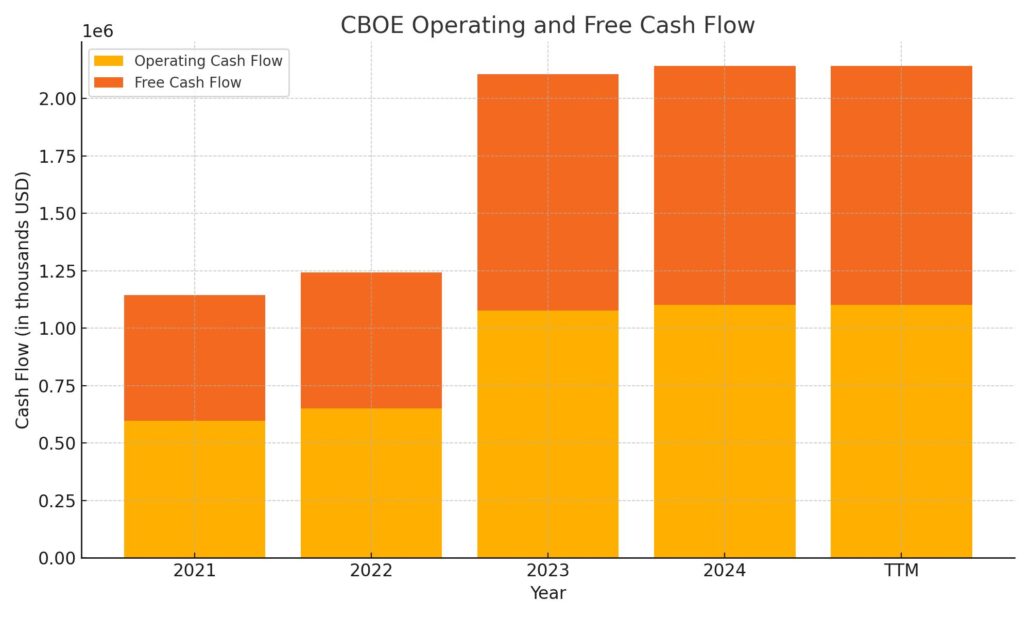

Cash Flow Statement

Cboe Global Markets generated $1.1 billion in operating cash flow over the trailing twelve months, reflecting continued strength in its core operations. This figure has held up well, slightly improving from the previous year and nearly doubling from just two years ago. Free cash flow came in at a solid $1.04 billion, thanks to disciplined capital spending and stable earnings, providing a reliable cushion for dividends and strategic investments.

On the investing side, outflows were relatively modest at $141.8 million, primarily from manageable capital expenditures and limited acquisition activity—far lighter than the $835 million in 2021. Financing activities saw a $495 million outflow, much of it tied to share repurchases and returning capital to shareholders. While the company didn’t issue or repay debt this past year, its financial strategy shows a shift toward organic growth and shareholder returns. The year ended with $1.77 billion in cash on hand, positioning Cboe with flexibility and resilience going into the next fiscal cycle.

Analyst Ratings

📉 Cboe Global Markets has recently experienced a shift in analyst sentiment. Bank of America downgraded the stock from Buy to Neutral, adjusting the price target from $260 to $227. The downgrade was driven by concerns around valuation and expectations of declining trading volumes heading into the second half of 2025. Analyst commentary pointed out that while Cboe has outperformed peers so far this year, that outperformance has also led to a premium valuation, which may be difficult to justify if volumes start to weaken.

📊 There’s also a forward-looking adjustment in earnings expectations. Forecasts for 2026 and 2027 were brought down slightly, suggesting analysts are being more conservative in projecting growth beyond the near term. The sentiment doesn’t necessarily reflect a lack of confidence in the business model—it’s more a reset in expectations after a strong run.

📌 The consensus among analysts currently sits at a Hold rating. The average 12-month price target is $222.67, offering limited upside from recent trading levels. Price targets range from a low of $172 to a high of $237, showing a fairly wide divergence in outlooks, likely tied to different assumptions about future trading activity and market volatility trends.

Earning Report Summary

Cboe Global Markets wrapped up 2024 on a strong note, delivering results that showed both stability and momentum across its core operations. The company pulled in $524.5 million in net revenue for the fourth quarter, marking a 5% increase from the same period a year earlier. Adjusted earnings per share came in at $2.10, just a touch higher than the $2.06 posted in Q4 2023. It might not seem like a big leap, but over the course of the full year, the performance added up—total net revenue hit $2.1 billion, and full-year EPS climbed 10% to $8.61.

Derivatives Continue to Lead

The derivatives segment was once again the engine behind much of Cboe’s growth. It was a record-setting year for options trading, with volume reaching 3.8 billion contracts. On a daily average basis, SPX index options came in at 3.1 million contracts, while trading in VIX options averaged 830,000. One interesting trend that stood out this quarter was the increased activity in zero-days-to-expiry (0DTE) options. These short-term contracts now account for more than half of SPX options volume—a sign that traders are leaning into more tactical, fast-moving strategies.

Data and Spot Markets Add Support

Beyond derivatives, Cboe’s Data and Access Solutions business—referred to internally as Data Vantage—also pulled its weight. Revenue in that segment grew 7% organically, helped by investments in tech infrastructure and international reach. Meanwhile, the Cash and Spot Markets business posted a 10% increase in net revenue, with solid trading volumes across North America and Europe helping to lift the numbers.

A Look Ahead

Cboe’s leadership seems focused on pushing forward with a clear growth agenda. During the earnings call, they spoke about plans to keep building out the derivatives ecosystem, improve global access for their clients, and invest in emerging tech—especially around data analytics and AI tools. One project that got attention was the initiative to expand U.S. equities trading hours to nearly 24 hours, five days a week. That could be a game-changer for attracting more international traders to the platform.

As for what’s next financially, the company is guiding toward mid-single-digit growth in organic net revenue for 2025. They expect similar growth from the Data Vantage segment and have pegged adjusted operating expenses to land somewhere between $837 million and $852 million for the year. That’s a bit of an increase, but it lines up with their plan to reinvest into key growth initiatives. Overall, it’s a continuation of the steady, well-managed expansion the company has become known for.

Chart Analysis

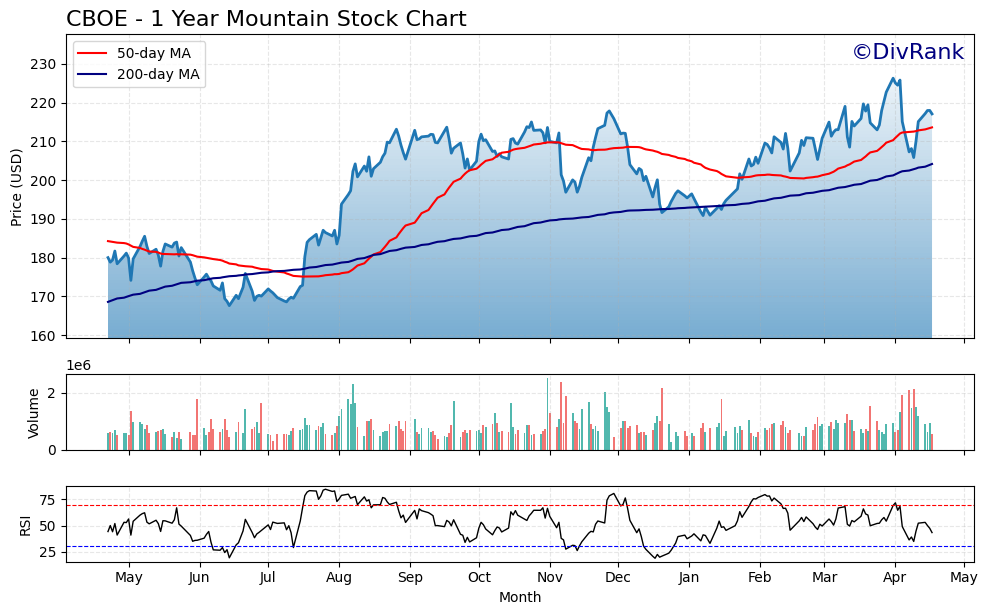

The chart for CBOE over the past year paints a picture of a company that’s held its ground and gradually built momentum, even through stretches of market turbulence. From the lows near $170 last spring, the stock has worked its way up steadily, recently brushing against the $230 mark before pulling back. There’s been some volatility along the way, but the overall direction has been constructive.

Moving Averages

The red 50-day moving average and the blue 200-day moving average tell an encouraging story. After a mid-year crossover where the 50-day pushed above the 200-day, the stock maintained that bullish formation through most of the second half of the year. Even during the dips in November and January, the longer-term 200-day average continued trending upward, reinforcing a strong underlying trend. In the most recent weeks, the 50-day is curling higher again, suggesting renewed strength.

Volume Trends

Volume has been fairly consistent, with no extreme spikes or concerning drop-offs. There were moments of heavier trading around the late summer breakout and again during the early April pullback, which could indicate healthy investor interest stepping in at key price points. Nothing here signals panic or exhaustion.

RSI Behavior

Looking at the RSI, the stock’s spent limited time in overbought territory, with readings mostly hovering between 40 and 70. That’s a sign of solid momentum without extreme euphoria. The brief dip in December brought RSI close to the oversold range, but that was quickly reversed as buyers stepped back in. Most recently, RSI has softened just under 60, giving the stock some breathing room without losing its upward bias.

This chart suggests a company with a steady hand behind it—pacing its gains, pulling back when necessary, and avoiding major cracks in its foundation.

Management Team

Cboe Global Markets is currently led by Fred Tomczyk, who took over as CEO in September 2023. He brought with him years of leadership experience, including his time at the helm of TD Ameritrade. Since stepping into the role, Tomczyk has emphasized consistency, innovation, and continuing to build on Cboe’s existing strengths, especially across derivatives and global market access.

Working alongside him is Chief Operating Officer Chris Isaacson, a long-time executive within the organization who has played a key role in expanding the company’s technology infrastructure and global presence. Jill Griebenow serves as Chief Financial Officer and is known for her pragmatic approach to financial stewardship. Together, the executive team blends deep institutional knowledge with experience across broader financial services. The continuity and clear vision from the top have helped the company navigate growth and change with a steady hand.

Valuation and Stock Performance

CBOE’s stock has had a solid 12-month run, trading between $166 and $234 during the period. It currently sits near $217, up over 20 percent from where it was a year ago. The stock has generally outpaced the broader S&P 500 over the same timeframe, reflecting growing investor confidence in its business model and future prospects.

The stock’s forward price-to-earnings ratio is just over 24, which may seem a bit rich at first glance but looks reasonable when set against the company’s consistent revenue growth, rising earnings per share, and leadership in the global options market. Its price-to-book sits around 5.3, and its enterprise value-to-EBITDA is under 19—suggesting the market is willing to pay a premium for its consistent profitability and efficient capital use.

Volatility is relatively low, with a beta of 0.47. That means the stock tends to move less than the overall market, which can be appealing for those looking to reduce portfolio swings. With a market cap approaching $23 billion, CBOE isn’t a small player—it’s a meaningful part of the financial infrastructure, and its stock reflects that.

Risks and Considerations

Even with a strong setup, no business is without risk. Cboe operates in a space that is closely linked to trading activity, and when volume dries up, revenue can take a hit. While Cboe has done a good job of diversifying into data, analytics, and global markets, its core still leans on the level of market engagement—especially in options and volatility products.

Regulatory risk is also a constant. The exchange business is deeply interconnected with global and national rules, and shifts in policy, especially around digital assets or cross-border trading, could add complexity. Cboe’s entry into cryptocurrency derivatives is an exciting growth lever but also comes with the added baggage of regulatory scrutiny and tech risk.

Cybersecurity is another area that can’t be overlooked. With its role as a market operator and data provider, Cboe must be vigilant in defending its systems against evolving threats. Any significant breach could not only disrupt operations but damage trust with clients and regulators.

Final Thoughts

Cboe Global Markets continues to show why it’s earned a spot among the top-tier names in the financial exchange world. Its strategy doesn’t rely on moonshot bets but instead on expanding reliable revenue streams, reinvesting in technology, and building out its global presence. The leadership team has brought clarity and continuity, and the balance sheet remains strong, backed by high free cash flow and conservative debt levels.

Even as the market changes and new competitors emerge, Cboe seems focused on staying ahead of the curve—whether that’s through extending trading hours, growing data offerings, or embracing select areas of digital finance. It’s a business that moves with intent, adapts with discipline, and keeps returning value in the process.