Updated 4/21/25

CareTrust REIT (CTRE) focuses on acquiring and leasing skilled nursing and senior housing properties across the U.S., supported by long-term demographic trends and steady tenant demand. Over the past year, the company has delivered strong financial performance, with operating cash flow reaching $244 million and a 16% increase in its annual dividend. Its stock has climbed roughly 26% in that time, fueled by solid earnings, strategic acquisitions, and disciplined balance sheet management. With a forward yield of 4.66%, a clear investment pipeline, and an experienced leadership team, CTRE has positioned itself as a reliable income generator in the healthcare real estate space.

🧭 Recent Events

CareTrust REIT, Inc. (CTRE) has been quietly building momentum, and it’s starting to show in its numbers. Over the past year, the stock has climbed around 22%, easily beating the broader market’s pace. What’s driving that growth? It’s not just investor optimism—underneath the hood, revenue jumped over 45% year-over-year, and earnings nearly doubled. That’s not something you see every day in the REIT world, especially one that deals primarily with senior housing and skilled nursing facilities.

Lately, the company’s been pretty active—expanding its portfolio and solidifying its finances. With $213.8 million in cash and just under $400 million in debt, the balance sheet looks lean and flexible. A low debt-to-equity ratio of 13.55% is especially impressive for a real estate trust, which usually leans a little heavier on leverage. That financial cushion sets them up nicely if more acquisition opportunities come up.

📊 Key Dividend Metrics

💰 Forward Dividend Yield: 4.66%

🔁 Trailing Dividend Yield: 4.05%

📈 5-Year Average Yield: 5.01%

📅 Dividend Growth: On the rise

🛡 Payout Ratio: 145% (typical for REITs)

📆 Ex-Dividend Date: March 31, 2025

📆 Pay Date: April 15, 2025

💵 Dividend Overview

For dividend seekers, CareTrust has some solid appeal. The forward yield of 4.66% provides a meaningful income stream, especially in today’s inflationary environment. That figure is also a step up from the trailing yield, suggesting the dividend has recently been bumped higher. In fact, the payout increased from $1.16 to $1.34 per share annually—an encouraging sign that the company feels confident in its cash flow.

While a 145% payout ratio may look steep at first glance, REITs play by different rules. They’re required to pay out most of their taxable income, and depreciation often skews the standard earnings figures. So, it’s more helpful to look at cash flow and, more importantly, funds from operations (FFO) when judging how sustainable the dividend is. CTRE’s rising revenue and earnings suggest that FFO is strong, even if we don’t have the exact figure here.

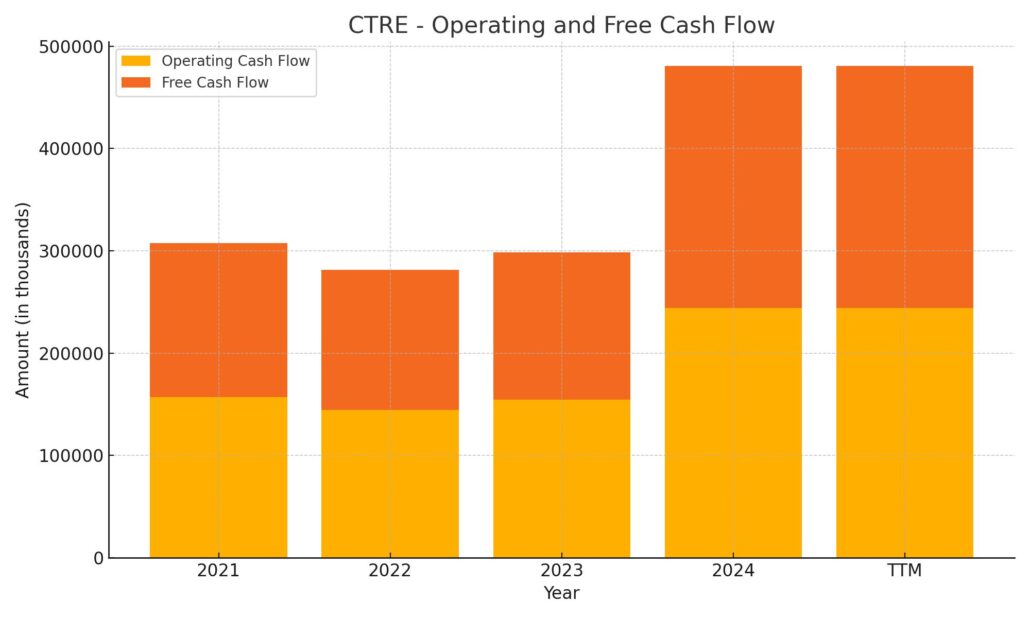

Operational cash flow came in around $244 million, and while free cash flow is much lower at $45 million, that’s not unusual for a REIT. The main takeaway is that the income stream supporting the dividend is still intact—and even growing.

🌱 Dividend Growth and Safety

One thing that stands out about CareTrust is how it approaches dividend growth. Management seems to prefer steady, sustainable increases over flashy, unsustainable ones. The recent hike in the annual payout is consistent with that approach. It’s a strategy that often builds long-term trust with income-focused investors.

Another key point: the company isn’t buried under debt. With a conservative debt profile and a current ratio above 3, CTRE looks financially sound. That gives them room to maneuver—whether it’s weathering economic bumps or seizing new opportunities.

Insider ownership sits at around 0.55%, while institutions hold more than 98% of the float. That level of institutional interest tends to reflect confidence in the business and in management’s ability to continue delivering returns.

Most importantly, CareTrust operates in a sector with structural demand. As America’s senior population continues to grow, the need for skilled nursing and senior housing doesn’t slow down. The facilities they own serve a necessary function, which makes their revenue stream less sensitive to economic cycles. Even during the thick of the pandemic, CTRE held firm and didn’t cut its dividend—a notable sign of stability in a tough time.

All in all, CareTrust is starting to shape up as one of those REITs that delivers steady, reliable income without taking on too much risk. If you’re looking for a name with solid yield potential and a balance sheet built to last, this one might be worth keeping on your radar.

Cash Flow Statement

CareTrust REIT’s cash flow statement for the trailing 12 months shows a significant jump in operating cash flow, reaching $244.3 million. This is a meaningful increase from the previous year and reflects a stronger earnings foundation and better collections from tenants. Free cash flow also improved sharply to $236.2 million, suggesting the company has solid control over its capital expenditures and is generating reliable excess cash after essential reinvestments.

On the investing side, cash outflows surged to $1.51 billion, more than five times the previous year. That level of spending signals a major ramp-up in acquisitions or property development—consistent with management’s strategy to expand its footprint. Financing activity matched the scale of investment, with $1.19 billion brought in, largely to support the growth initiative. The balance sheet also saw a shift, with $275 million in debt repayments offset by $75 million in new issuances. Despite the heavy movement, CTRE ended the period with $213.8 million in cash, keeping liquidity in check even after aggressive capital deployment.

Analyst Ratings

📉 Wedbush recently downgraded CareTrust REIT (CTRE) from Neutral to Underperform as of early January. Their main concern centered around valuation, suggesting the stock might be priced a bit ahead of its fundamentals. They also pointed to potential headwinds in the skilled nursing segment, which could put some pressure on near-term performance. The firm maintained a price target of $26.00, signaling a more cautious stance going forward.

📊 On the other hand, Wells Fargo kept its Overweight rating in place during their March update. While they slightly lowered their price target from $34.00 to $31.00, the tone was still optimistic. Their analysts expect solid results for the first quarter, supported by recent property visits and updated operating data that showed strength in the underlying portfolio.

📈 RBC Capital also stayed bullish, maintaining its Outperform rating in February. However, they made a similar move by trimming their price target from $37.00 to $32.00. The rationale there was more about adjusting expectations across the sector rather than anything specific to CTRE itself.

🎯 The current analyst consensus places the 12-month average price target at $31.80, with the lowest at $26.00 and the highest at $37.00. Analysts remain cautiously optimistic, acknowledging the REIT’s steady growth while keeping an eye on broader industry trends.

Earning Report Summary

Strong Finish to the Year

CareTrust REIT closed out 2024 with a really solid quarter. Net income came in at $52.1 million, or about $0.29 per share. That’s a noticeable jump from where they were a year ago. On the core metrics that matter for REITs, like Funds from Operations (FFO) and Funds Available for Distribution (FAD), they also saw a meaningful boost. Normalized FFO hit $72.9 million ($0.40 per share), and normalized FAD came in just a bit higher at $74.3 million ($0.41 per share). Compared to the previous year, those numbers are up more than 60%, which says a lot about how the company is managing its operations and investments.

They also stayed pretty aggressive on the expansion front. Over the year, CareTrust put almost $700 million into new acquisitions and property investments. They’ve been aiming for a 9.9% stabilized yield on those new additions, which is very respectable. To fund a lot of that growth, they raised just over $500 million through a public equity offering. On top of that, they extended their revolving credit line to $1.2 billion, locking it in through early 2029. So from a capital standpoint, they’re in a strong position.

Leadership Outlook and What’s Ahead

CEO Dave Sedgwick summed up the mood pretty clearly—2024 was a record year, capped off by a record quarter. He pointed out how well-positioned the company is heading into 2025, especially with a clean balance sheet, available cash, and long-term banking relationships. The tone was confident, but not overly flashy. Just steady execution and a belief in the business model.

Looking forward, CareTrust already has about $325 million worth of potential deals lined up, most of which involve skilled nursing facilities. They’ve also added a new $750 million ATM equity program to give them more flexibility to raise capital as needed. Right now, they’ve got roughly $205 million in cash, which gives them room to be opportunistic without taking on unnecessary risk.

For 2025, they’re expecting net income per share to land somewhere between $1.35 and $1.39. As for FFO, they’re guiding for a range of $1.68 to $1.72, and FAD is expected to be slightly higher at $1.72 to $1.76 per share. Those are healthy numbers, especially for a REIT that prioritizes stability.

They also declared a $0.29 per share quarterly dividend, keeping the payout ratio in the low 70% range based on FAD. That kind of consistency is exactly what long-term income investors like to see. CareTrust doesn’t seem to be chasing flashy gains—they’re just sticking to a disciplined plan and letting the numbers speak for themselves.

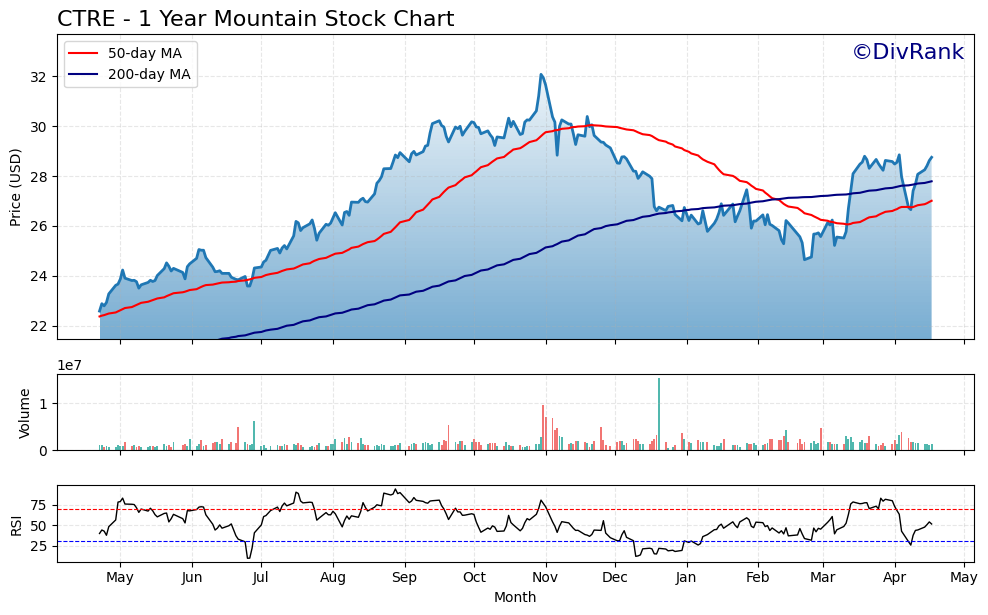

Chart Analysis

Price and Moving Averages

CTRE has shown a fairly strong uptrend over the past year, with the price climbing steadily from just under $23 to recent levels near $29. For a good stretch through mid-2023, the price remained well above the 50-day moving average, signaling consistent upward momentum. That trend began to shift heading into late Q4, when the stock pulled back from its peak above $32.

The 50-day moving average began to roll over in December and crossed below the 200-day average in early February—a technical sign of short-term weakness. Since then, though, the stock has clawed its way back. The price is now trading just above both moving averages again, suggesting a potential recovery in progress. That crossover could turn out to be a bear trap if the upward momentum holds.

Volume Behavior

Volume hasn’t spiked dramatically in recent weeks, but there are a few notable bursts—especially in early January and again in March. These higher-volume days coincided with price upticks, which often means institutional buying might have been at play. For most of the year, volume has stayed consistent, without large panic-driven selloffs, which reinforces the steady hand this stock tends to attract.

RSI Trends

The Relative Strength Index (RSI) has been mostly balanced, rarely staying in overbought or oversold territory for long. There was a strong overbought signal late in March as the stock climbed rapidly, but that quickly cooled off. Right now, the RSI is sitting just under the 70 line again, showing renewed strength without screaming overextension. It’s a sign that buyers are stepping in, but not in an overly aggressive way.

Altogether, this chart points to a company that went through a temporary shakeout but is finding its footing again. The technicals show improving strength, and the recovery in price—supported by moderate volume and a rising RSI—suggests the trend may have legs as we head into mid-year.

Management Team

CareTrust REIT is led by a management team with deep experience in healthcare operations and real estate investment. Dave Sedgwick, the CEO, has been with the company since its early days and took on the top role after serving in various leadership capacities. He originally came from The Ensign Group, which gave him hands-on exposure to the skilled nursing world—knowledge that directly informs how CareTrust works with its operators. His leadership style has leaned toward disciplined growth and consistent execution.

Supporting him is Bill Wagner, the company’s CFO. He plays a key role in ensuring the company’s balance sheet stays healthy while making sure growth is properly funded. James Callister, the Chief Investment Officer, brings both legal and real estate investment expertise, which is especially valuable when structuring complex deals. The executive team has also recently added more depth, including a new Chief Accounting Officer and a Senior Vice President of Investments—signaling a focus on operational rigor and growth strategy. Altogether, the team has the right blend of real estate acumen, healthcare experience, and financial discipline to navigate a complex and highly regulated industry.

Valuation and Stock Performance

Over the past year, CareTrust’s stock has moved steadily upward, gaining around 26% and comfortably outperforming broader market benchmarks. That growth has come not just from expanding valuation multiples, but also from fundamental improvements in the company’s operations and cash flow. Market cap now stands at roughly $5.4 billion, which reflects the growing investor confidence in the REIT’s consistent income model and targeted expansion into need-based healthcare real estate.

The stock is currently trading at a price-to-earnings ratio in the low 40s, which may appear elevated at first glance. But for a REIT that’s consistently expanding its cash flow and tapping into long-term demographic trends, the premium seems justified. Analyst sentiment remains mostly favorable, with a consensus price target of around $31.78, leaving room for some modest upside from current levels.

One of the more noteworthy moves this year was the acquisition of Care REIT plc in the UK for around $817 million. That deal adds international exposure and broadens the company’s tenant mix, particularly in care homes and long-term care facilities. With that acquisition and others in the pipeline, CareTrust continues to prove that it’s not just growing for growth’s sake—it’s making strategic moves to build a stable, yield-generating portfolio.

Risks and Considerations

Despite the strengths, there are a few real-world risks to keep in mind. The company’s performance is closely tied to the financial health of its tenants, which mostly operate in the skilled nursing and senior housing sectors. These types of facilities can be sensitive to changes in government reimbursement, labor shortages, and broader healthcare policy shifts. If operators run into trouble, it can trickle up to CareTrust.

Another layer of risk comes from the REIT structure itself. The requirement to pay out most of its taxable income as dividends limits how much capital can be retained for reinvestment. That makes access to credit and equity markets important, especially during times when capital becomes more expensive. Rising interest rates are always something to watch for in the REIT space—they affect both financing costs and real estate valuations.

There’s also some integration risk related to recent acquisitions. Adding a large international portfolio isn’t a small task, and the success of that move will depend on how well the company can manage across borders while preserving the same standards that have worked domestically.

Final Thoughts

CareTrust continues to carve out a strong position in the healthcare real estate space by focusing on the fundamentals—steady cash flow, careful growth, and working with tenants who provide essential services. The management team has demonstrated a disciplined, no-fluff approach to acquisitions and balance sheet management, and their results over the last year back that up.

While there are always risks, particularly around tenant stability and policy changes, the company has taken smart steps to diversify and reinforce its financial position. The recent acquisition adds another layer of income potential and could open up further international growth. For investors looking for exposure to healthcare real estate with a steady hand at the wheel, CareTrust is a name worth watching.