Updated 4/21/25

Capital Southwest Corporation (NASDAQ: CSWC) is a business development company that specializes in providing flexible financing to lower middle-market companies. With a portfolio anchored in first lien senior secured debt and a growing equity co-investment component, CSWC combines credit discipline with income generation. Its dividend yield, currently above 12%, is supported by a layered approach that includes both regular and supplemental payouts. The company has recently undergone a leadership transition, with longtime executive Michael Sarner stepping into the CEO role, alongside internal promotions that strengthen its strategic depth. Though the stock has pulled back from last year’s highs, analysts maintain a neutral outlook with a consensus price target that reflects modest upside. As earnings growth softens and payout ratios rise, the focus remains on credit performance, dividend coverage, and capital structure. For those seeking income backed by a consistent lending strategy, CSWC offers a mix of stability and yield.

Recent Events

Over the past year, CSWC has had its share of ups and downs. The stock is currently trading around $19.68, well off its 52-week high of $27.23. That’s a drop of more than 22%, placing it closer to its 52-week low than investors might like to see. But context matters. This decline comes during a period of elevated interest rates and a more cautious credit market—conditions that impact all BDCs, not just CSWC.

Even with a choppy market, CSWC has stayed the course operationally. The company continues to build out its portfolio with solid debt investments and seems to be keeping a careful eye on credit quality. One area of note is the company’s earnings. Year-over-year earnings dropped more than 30%, which is certainly not ideal. But it’s also not unusual in the current environment where rising funding costs and cautious deal-making are part of the landscape.

What’s important for dividend investors is that CSWC hasn’t wavered in its commitment to return capital to shareholders. Despite the earnings dip, the dividend machine keeps humming.

Key Dividend Metrics

💰 Forward Dividend Yield: 12.91%

📈 Trailing Dividend Yield: 11.81%

📅 Dividend Date: March 31, 2025

📆 Ex-Dividend Date: March 14, 2025

📊 Payout Ratio: 180.71%

🔁 5-Year Average Yield: 9.67%

📌 Forward Annual Dividend Rate: $2.54

📌 Trailing Annual Dividend Rate: $2.30

Dividend Overview

Here’s where things get interesting. CSWC is offering a forward dividend yield just under 13%. That’s not only generous—it’s one of the more attractive yields you’ll find in this corner of the market. Compared to its five-year average yield of about 9.67%, the current payout suggests a combination of strong dividend distribution and a stock price that has pulled back enough to boost yield.

The company has a layered dividend structure. There’s a base dividend, and then there are periodic supplemental payouts that reflect realized gains or excess income. This approach gives management flexibility while offering investors the chance at some upside without risking a permanent cut if conditions tighten.

Yes, the payout ratio is high at 180%, and under normal circumstances, that would raise red flags. But with BDCs, it’s a different story. Their reported earnings include a mix of cash and non-cash items, and payout ratios can look bloated even when underlying cash generation supports the dividend. CSWC has consistently managed its obligations and hasn’t shown any signs of struggling to fund its distributions.

In fact, over time, the company has shown a solid track record of covering dividends through net investment income, and any shortfalls have been bridged with undistributed taxable income carried over from prior periods.

Dividend Growth and Safety

When you zoom out and look at CSWC over the last few years, you’ll see a pattern of steady and even growing dividends. This isn’t a company that just recently started trying to appeal to income investors. They’ve been doing it for a while, and the layered approach to dividend payments has made it possible to reward shareholders without putting long-term stability at risk.

That said, sustainability always matters. CSWC’s capital structure leans a bit aggressive, with a debt-to-equity ratio of 111%. That’s fairly normal in the BDC space, but it does mean the company has to manage risk carefully. So far, they’ve done just that. Operating margins are strong, hovering above 87%, and they’ve maintained a disciplined approach to credit selection.

The recent earnings decline isn’t insignificant, but the dividend still looks stable because CSWC isn’t relying on unrealistic growth to fund it. They’re leveraging portfolio income, staying conservative with expenses, and avoiding overextension.

Another point in their favor is that CSWC is internally managed. That’s a differentiator in the BDC world. Externally managed BDCs often carry higher costs due to advisory fees. With CSWC’s internal structure, there’s better alignment between management and shareholders, and generally more efficient use of capital.

Overall, this is a company that understands what its investors want—and has consistently delivered. As long as the credit quality in the portfolio remains solid, there’s no immediate reason to think the dividend is in danger.

The yield is high, the structure is smart, and the company seems committed to being a reliable income source in an otherwise uncertain market. For dividend investors looking for yield with a little extra personality, CSWC has carved out a compelling niche.

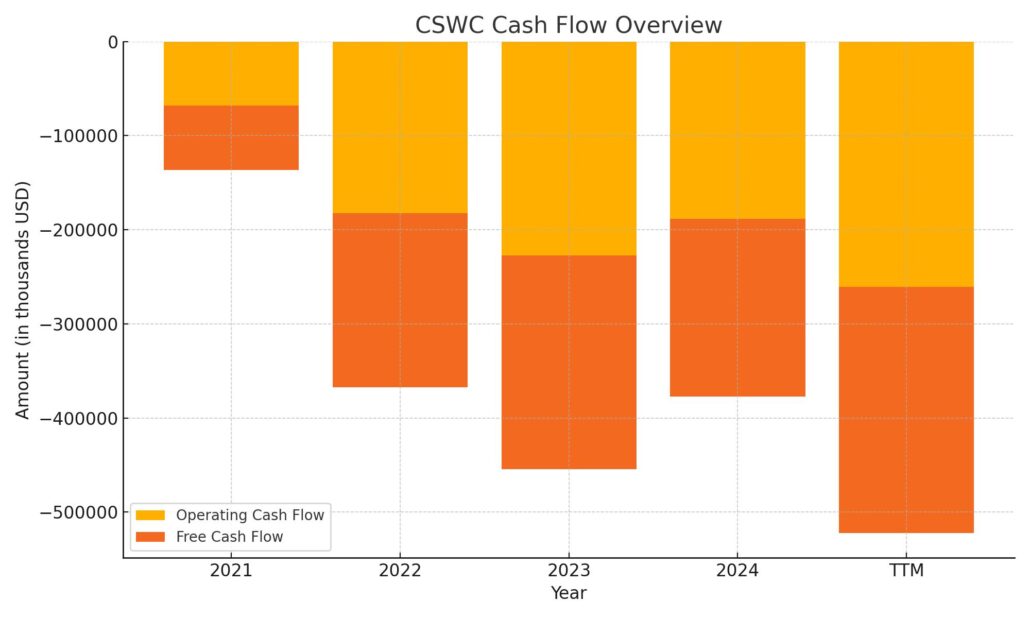

Cash Flow Statement

Over the trailing twelve months, Capital Southwest Corporation reported negative operating cash flow of approximately $260.6 million, reflecting the capital-intensive nature of its lending business and consistent with previous years’ patterns. Despite this, the company maintains operational continuity by strategically managing financing inflows. Free cash flow also came in negative at around $261.9 million, showing a consistent reliance on external capital rather than internally generated funds.

On the financing side, CSWC raised $651 million in new debt and used a significant portion—about $411 million—for debt repayment. The net inflow from financing activities totaled roughly $274.3 million, supporting the company’s dividend payments and portfolio expansion. The cash balance at the end of the period increased modestly to $36 million, up from $32.3 million the year prior, suggesting disciplined capital deployment and effective cash management amid ongoing lending activity.

Analyst Ratings

📊 Capital Southwest Corporation (CSWC) has recently seen a steady sentiment from analysts, with the current consensus rating sitting at “Hold.” This outlook reflects a balanced view—analysts recognize the company’s solid dividend profile but are also mindful of the broader market conditions and recent earnings softness.

🎯 The average analyst price target for CSWC is $22.50, which represents about a 14% upside from where the stock is currently trading. Within the range of opinions, price targets span from $20.50 on the low end to $24.50 on the high side. This spread highlights the mixed sentiment, with some seeing limited near-term catalysts while others are more optimistic about the company’s potential.

🔍 Those leaning on the bullish side likely see opportunity in CSWC’s internal management structure and strong yield, especially as interest rates begin to stabilize. There’s also the view that its portfolio could benefit from a more active lending environment as the year progresses.

⚖️ On the other hand, the neutral stance from many analysts reflects caution around recent earnings volatility and the elevated payout ratio. While the dividend remains a major attraction, some may be waiting for clearer signs of earnings growth before shifting to a more positive stance.

🧩 Overall, analyst sentiment suggests CSWC is well-regarded, but not without a few watchpoints. The steady “Hold” rating underscores the idea that the stock may be fairly valued in the current environment, while still offering attractive yield for those focused on income.

Earnings Report Summary

Solid Results with Strong Dividend Coverage

Capital Southwest Corporation wrapped up its third fiscal quarter with results that show they’re sticking to what they do best. The company posted pre-tax net investment income of $30.7 million, or $0.64 per share. That number is especially important because it easily covers the dividends paid out during the quarter—$0.58 in regular dividends plus a $0.05 supplemental payout. That extra cushion signals the company isn’t stretching itself to maintain its high yield.

Portfolio Growth and Activity

The investment portfolio continues to grow steadily, now reaching about $1.7 billion in total. The lion’s share of that, around $1.5 billion, is tied up in first lien senior secured loans. These are generally lower risk compared to other parts of the credit spectrum. The average yield on those debt positions is strong, coming in at 12.1%. That’s a healthy income stream in any market.

They didn’t sit still during the quarter either. CSWC made new commitments totaling $317.5 million, including deals with nine new portfolio companies and further investments in 20 others. On the equity side, they added $4.1 million in new co-investments, pushing the total equity book to about $158.8 million.

Valuation Swings and NAV Stability

There were some valuation changes worth noting. The company recorded net realized and unrealized losses of $13.7 million, mostly from declines in credit investments. That was partially offset by gains on the equity side, so it wasn’t all downside. Despite that, net asset value per share held steady at $16.59, showing that the balance sheet remains resilient even with a few bumps in the road.

Liquidity and Capital Moves

From a liquidity standpoint, things look solid. CSWC ended the quarter with $36 million in cash and over $376 million in available credit. The debt-to-equity ratio sits at 0.90 to 1, which is well within comfortable territory for a business development company.

They also moved to strengthen their capital base. During the quarter, CSWC raised about $53.6 million through its equity ATM program. In addition, they issued $230 million in convertible notes due in 2029, with a coupon of 5.125%. That should help lower funding costs and add flexibility going forward.

What’s Ahead

Looking to the next quarter, the board bumped the supplemental dividend to $0.06, on top of keeping the regular $0.58 payout. That brings the total dividend to $0.64 per share, a nice increase for income-focused shareholders.

In a notable development, CSWC received a green light from the Small Business Administration to apply for a second SBIC license. If approved, this could give them access to an additional $175 million in capital, opening up even more room to grow their investment base.

All in all, the tone from management was confident. They see opportunity ahead and appear to be managing risk while still rewarding shareholders.

Chart Analysis

Price Movement and Trends

Looking at the 12-month chart for CSWC, the price action tells a story of strength early in the year followed by a slow and steady decline. After peaking above 25 last summer, the stock began to lose steam, slipping below both the 50-day and 200-day moving averages. The breakdown became more pronounced in April, with a sharp drop below 19 before a modest rebound. The 50-day moving average crossed below the 200-day moving average a few months back, forming a bearish crossover that typically signals weakening momentum.

Throughout much of the year, price stayed above the 200-day moving average, suggesting longer-term stability. But that changed in the first quarter of the new year, when the stock started to close consistently below both key averages. As of now, the price remains under pressure, with both moving averages trending downward.

Volume Behavior

Volume spiked noticeably during sell-offs, especially during the steep drop in early April. That kind of volume surge often reflects institutional exits or panic selling, rather than measured rebalancing. Since then, volume has tapered back to normal levels as the price began to stabilize, suggesting the selling pressure may have exhausted itself, at least temporarily.

Momentum and RSI

The RSI at the bottom of the chart paints a picture of heavy oversold conditions during the early April dip, with the indicator falling well below the 30 mark. That’s typically a zone where short-term rebounds tend to occur, and that’s exactly what followed. After hitting those oversold levels, the RSI has now ticked higher, but still sits below the midpoint of 50, reflecting ongoing caution.

When RSI hugged the 70 line earlier in the year, it coincided with several short-term tops. The recent bounce has not brought RSI back to bullish territory, which shows momentum is still recovering. It hasn’t flipped into overbought, and price action confirms that buyers are returning, but without urgency.

Moving Average Context

The red 50-day moving average started turning lower late last year, while the 200-day in blue has held relatively flat but recently begun to slope downward as well. This pattern supports the idea that medium- and longer-term sentiment has shifted cautious. Until the stock price can reclaim those moving averages—especially the 200-day—there’s little indication of sustained upside.

At the moment, CSWC is attempting to bottom out, finding support after its recent lows. But it will take more than a short bounce to signal a lasting shift. Watching how it behaves near the 50-day moving average in the coming weeks will be key to understanding whether this is the start of a recovery or just a pause in a longer downtrend.

Management Team

Capital Southwest Corporation has recently seen a shift in leadership with Michael Sarner stepping in as President and CEO. Sarner, who joined the firm in 2015, brings over three decades of experience in finance and business development companies. Before this role, he played a central part in raising over $2 billion in both debt and equity for CSWC. His background includes a tenure as CFO at American Capital, which adds depth to his strategic and capital markets expertise.

Josh Weinstein has taken over as Chief Investment Officer after nearly a decade with the company. He’s been a driving force behind CSWC’s credit-focused investment strategy and has a strong understanding of the portfolio and market dynamics. Meanwhile, Chris Rehberger has moved into the role of CFO, Treasurer, and Secretary, bringing with him a background in financial planning and internal controls. Together, this team reflects a steady hand on the wheel as CSWC navigates growth and market cycles.

Supporting them is a board with broad experience across finance and business. David R. Brooks chairs the board, joined by directors like Christine S. Battist and Jack D. Furst, all of whom bring strong oversight and corporate governance experience to the table.

Valuation and Stock Performance

As of mid-April, CSWC is trading around $19.68, giving the company a market cap just under $1 billion. The current trailing P/E ratio is 14.06, while the forward P/E is significantly lower at 8.18. That suggests expectations for stronger earnings in the months ahead. The stock’s price-to-book ratio is 1.20, indicating it’s trading at a modest premium to its net asset value—common for income-generating BDCs with consistent performance.

Over the past 12 months, the stock has had a tough stretch, dropping over 22 percent. The S&P 500, by contrast, has managed a gain over the same period, which highlights CSWC’s relative underperformance. The 52-week range for the stock is between $17.46 and $27.23, and recent price action shows that the shares are hovering closer to their lows. The beta of 1.05 reflects a slightly higher than average volatility, something that’s been evident in recent swings.

Analysts covering the stock have an average price target of $22.50, implying around 14 percent upside from current levels. Most are sticking to a neutral “Hold” rating, which aligns with the current combination of attractive income potential and near-term uncertainty.

Risks and Considerations

Capital Southwest faces a number of risks that investors should consider carefully. A significant portion of the company’s flagged risk disclosures falls under financial and corporate concerns, which include earnings volatility, credit risk in the portfolio, and debt management. The company operates in a regulated space, so legal and policy shifts also carry weight. Broader macroeconomic risks—like inflation, interest rate moves, or geopolitical shocks—could influence borrower performance and funding costs.

One of the more immediate concerns is the payout ratio, which currently sits around 180 percent. While this isn’t unusual for BDCs that rely on taxable income calculations and supplement their regular dividends, it’s still a signal that the company is paying out more than it brings in on a GAAP basis. That’s sustainable in certain conditions but does require a healthy reserve of undistributed income and a stable credit book.

The leverage ratio is also worth watching. With debt-to-equity over 111 percent, CSWC is operating at the high end of its range. That’s not uncommon in the BDC world, but it means any shifts in the credit environment—particularly if interest rates stay elevated—could pressure the cost of capital or limit new deal activity.

Earnings growth has recently taken a step back, with year-over-year declines approaching 31 percent. That’s not the kind of trend any investor likes to see, though management has indicated a focus on maintaining portfolio quality and maximizing yield. It remains to be seen whether the softness in earnings is transitory or more persistent.

Final Thoughts

Capital Southwest offers a unique mix of high current income and a focused, disciplined approach to middle market lending. The leadership team has deep experience and appears intent on continuing the company’s steady investment strategy. They’ve been proactive in raising capital and managing risk, and the addition of a second SBIC license—if secured—would give them even more flexibility.

That said, there are caution flags. The company’s stock has underperformed, and while its dividend remains a central feature of the story, it’s not immune to market and operational pressures. The combination of a high payout, moderate leverage, and recent earnings declines warrants a close eye.

For those interested in steady cash flow from a professionally managed credit portfolio, CSWC continues to offer one of the more compelling yields in the space. But as always, it’s worth staying tuned into both the company’s performance and the broader market backdrop to see how the story evolves.