Updated 4/14/25

Canadian Imperial Bank of Commerce (CM) stands as one of Canada’s largest and most stable financial institutions, with a broad presence in personal banking, commercial lending, wealth management, and capital markets. The bank has steadily grown its North American footprint, especially in the U.S., while maintaining strong profitability and a consistent dividend track record. Backed by a solid capital base, CM has delivered double-digit earnings growth, a yield of 4.35%, and disciplined expense management. With a leadership transition underway and a focus on client-centric growth, the bank continues to balance opportunity and risk across economic cycles.

Recent Events

Over the past year, CM has quietly built up some solid gains. The stock has climbed about 19.7%, a sharp contrast to the more modest performance seen in broader benchmarks like the S&P 500. The move hasn’t been driven by hype or speculation, but rather by improving fundamentals and a more optimistic tone in the financial sector.

Most notably, the most recent earnings report for the quarter ending January 2025 showed strong progress. Revenue was up 19% year over year, while net income grew a healthy 26%. These numbers aren’t just good—they’re impressive given the backdrop of elevated rates and tighter lending conditions.

CM is trading around $58 right now, giving it a market cap just north of $53 billion. At roughly 10 times forward earnings, the valuation still looks reasonable. Its price-to-book ratio sits at 1.35, well within the comfort zone for conservative investors.

It’s not the kind of stock that whipsaws on headlines. Instead, CM’s story is about resilience and execution. And for investors prioritizing dividends, that’s exactly the kind of backdrop you want to see.

Key Dividend Metrics

💸 Forward Dividend Yield: 4.72%

📈 5-Year Average Yield: 5.14%

📆 Ex-Dividend Date: March 28, 2025

📅 Next Dividend Pay Date: April 28, 2025

💰 Trailing 12-Month Dividend Yield: 6.43%

🔢 Payout Ratio: 47.66%

🧾 Annual Dividend Rate: $2.70

🚀 Dividend Growth (Last 5 Years): Slow but steady

🧮 Book Value Per Share: $63.29

Dividend Overview

CM’s dividend is the kind that doesn’t need much salesmanship. The yield alone—hovering around 4.72% forward—is appealing in its own right. For anyone focused on generating consistent cash flow, it’s a number that earns attention. But what makes it more attractive is the reliability behind that yield.

Over the years, CM has shown it can deliver quarter after quarter, rarely missing a beat when it comes to payouts. It doesn’t chase high growth with aggressive dividend hikes, but it does what long-term investors care about—pays on time and doesn’t overextend itself.

The current payout ratio is under 50%, which means there’s still plenty of room for flexibility if earnings were to slow down. It’s the kind of margin that reassures you the dividend isn’t at risk, even if the economic picture becomes a little cloudy.

There’s also a small but telling detail in the yield figures. The trailing dividend yield is actually sitting a bit higher at 6.43%, suggesting that CM shares have climbed recently while the payout has remained stable. It’s a subtle but positive signal that the stock price is catching up to the value.

Dividend Growth and Safety

CIBC hasn’t been known for turbo-charged dividend increases, and that’s okay. What it does offer is steady, incremental growth. Most years, shareholders see modest raises—usually twice a year. That pace, though slow, has been consistent. And that consistency is often more valuable than flashy one-time bumps.

On the safety side, things look solid. The bank holds an enormous cash position of over $291 billion, against $285 billion in total debt. That’s not something you see every day, and it speaks volumes about its balance sheet strength. Pair that with a healthy 42% operating margin and return on equity above 13%, and you’ve got a business that generates the kind of profitability needed to sustain dividends even through tough cycles.

It’s also worth noting the environment CM is operating in. Higher interest rates can be a headwind for borrowers, but they’re often a tailwind for banks. CIBC benefits from better net interest margins and has shown it can put that to work. The latest revenue and income numbers prove it’s navigating the current rate landscape with confidence.

For Canadian banks in particular, there’s also a regulatory safety net. OSFI keeps a close watch on capital levels and payout practices. That oversight has protected dividends during major global disruptions. CM didn’t cut its payout during the financial crisis, nor did it blink during the pandemic. That kind of history matters when you’re relying on steady income.

All told, CIBC’s dividend profile is one that appeals to the steady hand. It’s not built on hope or aggressive projections—it’s rooted in earnings, efficiency, and careful stewardship. For those building a dividend-driven portfolio, it’s the kind of stock that can sit quietly in the background, doing its job year after year.

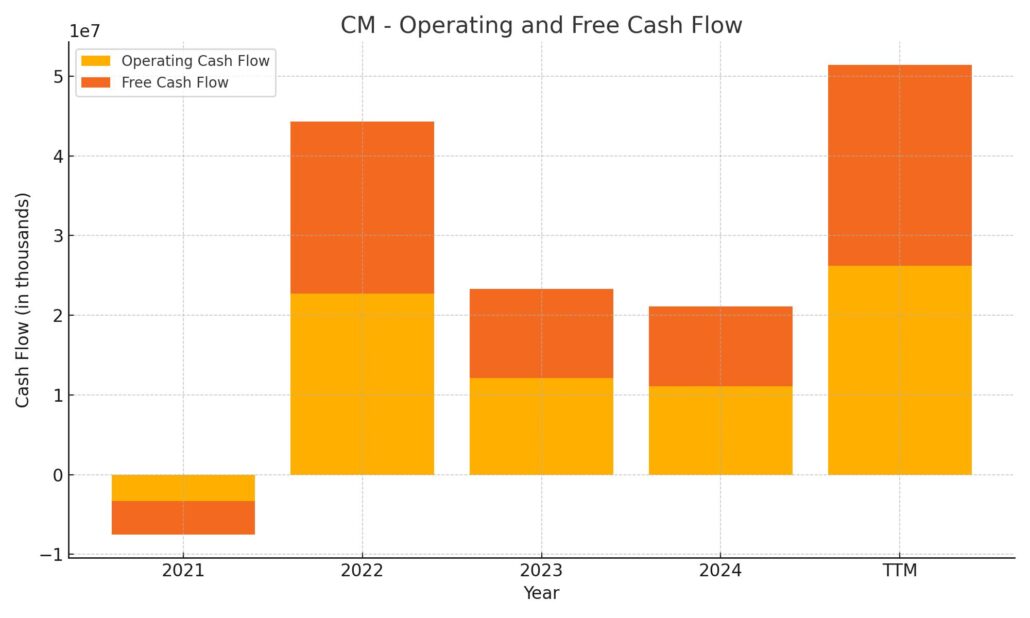

Cash Flow Statement

Canadian Imperial Bank of Commerce posted strong operating cash flow over the trailing twelve months, generating $26.2 billion—a noticeable improvement compared to the $11.1 billion from the previous fiscal year. This upswing signals a more efficient use of capital and stronger earnings quality. Free cash flow also grew substantially to $25.2 billion, up from $10 billion the year prior, underscoring the bank’s ability to cover dividends and reinvest in its business without straining liquidity.

On the investing side, cash outflows remained high at $17.6 billion, largely in line with prior years and reflecting ongoing capital commitments. Financing activities showed continued restraint, with $4.3 billion in outflows tied to debt repayments and share repurchases. The bank also boosted its ending cash position to $13.3 billion—up from $8.6 billion last year—suggesting improved balance sheet flexibility. While interest paid surged, now exceeding $38 billion, it aligns with a higher rate environment and does not appear to threaten dividend continuity.

Analyst Ratings

📈 In recent months, Canadian Imperial Bank of Commerce (CM) has seen a mix of analyst activity, reflecting both optimism and caution. 🧐 Royal Bank of Canada upgraded CM from “sector perform” to “outperform” in January, raising its price target from $97 to $103. 📊 This upgrade was driven by strong quarterly earnings and improved credit quality, suggesting a more favorable outlook for the bank’s performance.

📉 On the flip side, National Bank of Canada adjusted its price target downward from $101 to $95 in April. The move came amid concerns over potential margin pressures and the impact of a more challenging economic environment. 🏦 Despite this, the overall sentiment among analysts remains positive.

📌 The consensus rating on CM is currently a “Moderate Buy,” with an average price target of $92. This shows that while a few analysts remain cautious, many believe there’s still upside potential—especially if the bank continues to handle its operations with the discipline it’s shown in recent quarters. 🔍 For dividend-focused investors, this sentiment reinforces the idea that CIBC remains a solid, steady name in the financial sector landscape.

Earnings Report Summary

Canadian Imperial kicked off fiscal 2025 with a solid first quarter, showing some real strength across the board. The bank pulled in adjusted net income of C$2.18 billion, which was up 23% from the same time last year. Earnings per share came in at C$2.20, a jump of 22%. It’s the kind of performance that signals things are firing on all cylinders, not just a lucky quarter.

Capital Markets Deliver

A big part of that success came from the capital markets division. It brought in C$619 million in net income, up 19% from the year before. That growth came from stronger activity in areas like equity derivatives and debt underwriting—things that really benefited from a more active market environment. This isn’t just a one-off boost either; it reflects a well-run business that’s been positioning itself smartly.

Canadian Banking Holds Steady

Closer to home, the Canadian personal and business banking segment also posted gains. Net income there rose to C$765 million, marking a 7% increase. That came from a mix of loan volume growth and better margins—so nothing flashy, just solid, bread-and-butter banking results doing their job.

U.S. Operations Rebound

CIBC’s U.S. commercial banking and wealth management group showed a huge leap in profitability. Net income surged to C$256 million, compared to just C$8 million in the same period last year. A big factor was lower credit loss provisions, along with stronger top-line growth. It’s a good sign that the U.S. business is becoming a more meaningful contributor.

Focus from the Top

Leadership had a confident tone this quarter. The message was clear—they’re staying focused on clients and keeping the business resilient in the face of economic uncertainty. With a Common Equity Tier 1 (CET1) ratio of 13.5%, the bank has plenty of capital cushion to support future initiatives. Management also signaled they’re sticking to a diversified approach, which has helped them weather market changes more smoothly.

CIBC’s first quarter showed a well-rounded performance. It wasn’t just one area doing the heavy lifting, but a combination of improved efficiency, solid banking fundamentals, and smart positioning in both Canadian and U.S. markets. There’s still a lot of year left, but if this quarter is any indication, the bank seems to be moving in the right direction.

Chart Analysis

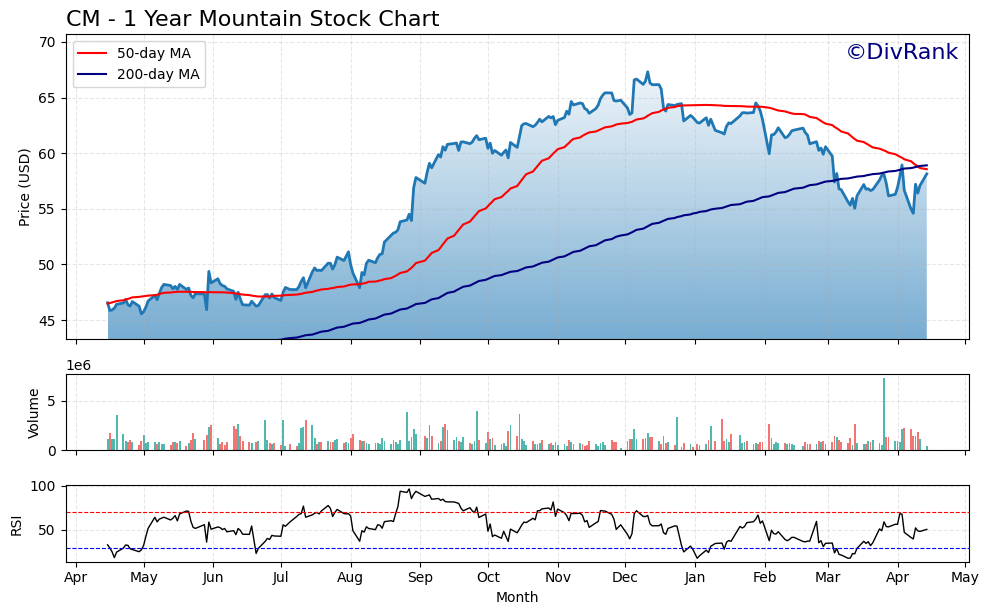

CM has spent the past year in a cycle that tells a fairly classic story—strong momentum, a plateau, then correction, and now signs of a possible recovery. The chart blends all three phases, and the moving averages, volume, and RSI each offer some important clues about where things might go from here.

Moving Averages

The 50-day moving average (red) made a steady climb starting last summer and continued upward into late January. But around February, that slope reversed, with the short-term trend now pointing downward. Meanwhile, the 200-day moving average (blue) has held its upward slope throughout, although at a more measured pace. What stands out now is how price has started to move back toward both moving averages, creating a potential convergence point. If price can push above both, it could signal the end of the current correction and the beginning of a new uptrend.

Volume and Momentum

Trading volume has remained relatively stable, with a few clear spikes in late March and early April, likely representing accumulation or reaction to key news. These bursts of interest often come before a breakout, but there hasn’t yet been confirmation through sustained follow-through in price. That said, the dips have also been met with quick recoveries, which speaks to underlying demand.

Relative Strength Index (RSI)

The RSI has bounced back from oversold conditions in late March and early April, climbing above 50 again. This shift suggests that selling pressure has eased and that buyers are stepping back in. The RSI hasn’t reached overbought territory recently, leaving room for further upside before momentum gets stretched.

What we’re seeing in CM is a stock that may be exiting its pullback phase and attempting to reestablish a longer-term uptrend. The support from the 200-day average and resilience in RSI hint at a base-building effort. Watching how the price reacts around these moving averages in the coming weeks will be key to confirming whether this is a genuine reversal or just a pause before another leg down.

Management Team

CIBC’s leadership is going through an important transition. Victor Dodig, who has been the bank’s CEO since 2014, is preparing to retire at the end of October 2025. Over his decade-long tenure, he steered the company through a range of major changes—from expanding its U.S. footprint to investing heavily in digital banking and reshaping the wealth management business. He’s leaving behind a stronger, more diversified institution.

Taking over the reins will be Harry Culham, the current Chief Operating Officer. Culham has deep roots in the bank’s capital markets division and brings a broad understanding of both international and domestic operations. The bank has also recently made changes to its broader executive lineup. Robert Sedran holds the CFO position with experience in capital allocation and investor strategy, while Hratch Panossian now leads Canadian personal and business banking. Susan Rimmer is steering the commercial banking and wealth management division, and Jon Hountalas has moved into a vice chair role to deepen key client relationships. Together, this team appears focused on keeping the bank competitive, steady, and client-driven in its next chapter.

Valuation and Stock Performance

CIBC shares are currently trading around $58, which places the stock at roughly 10 times forward earnings. That’s not a demanding multiple, especially for a bank that’s just posted solid earnings growth and operates with a high degree of capital discipline. It’s the kind of valuation that suggests investors aren’t pricing in aggressive expansion but are comfortable with slow, steady progress.

Over the past 12 months, the stock has quietly gained around 21%. It hasn’t been a straight shot higher—there’s been some choppiness along the way—but the general trend has been upward. Analysts have a consensus 12-month price target near $97. That doesn’t mean a surge is guaranteed, but it does reflect an underlying belief that the bank’s fundamentals can support further appreciation.

The dividend remains one of the bank’s strongest selling points, currently yielding about 4.35%. That’s comfortably ahead of many other income-paying equities, and when paired with a payout ratio that leaves room for reinvestment, it speaks to a balanced capital strategy. The stock also carries a relatively low beta of 0.74, which suggests it tends to move less aggressively than the broader market—a plus for anyone prioritizing lower volatility in their holdings.

Risks and Considerations

No stock is without its challenges, and CIBC has a few worth watching. The Canadian housing market continues to draw attention. If there’s a sharper-than-expected pullback, especially in urban centers, the bank’s mortgage book could face pressure. So far, the market has been more resilient than feared, but elevated rates and economic uncertainty could test that.

Then there’s the broader economic picture. Changes in interest rates, inflation trends, or consumer confidence could all affect the bank’s lending and deposit operations. On top of that, CIBC’s U.S. business, while a useful source of diversification, exposes the bank to a more competitive and less predictable environment than its home turf.

There’s also the digital transformation challenge. Banks everywhere are investing in tech—not just to improve client experience but to stay ahead of cybersecurity threats and streamline operations. CIBC has been making those moves, but it’s a never-ending game of catch-up. Continued investment here is critical, and that comes with both cost and execution risk.

Final Thoughts

CIBC seems to be navigating its way through a complex environment with a steady hand. The leadership transition feels well-structured, and the new executive team is familiar with the bank’s culture and long-term goals. That internal continuity should help keep things on track while offering fresh ideas in key growth areas.

The stock itself isn’t priced for perfection, which leaves room for upside if the bank continues to perform. Investors have responded positively to the latest earnings and seem to appreciate the consistent dividend and measured strategy. CIBC doesn’t promise fireworks, but it does offer reliability, a strong capital base, and a business model that’s built for staying power.

Looking ahead, it will be important to see how the bank adjusts to evolving economic conditions and how effectively the new CEO leads through the next cycle. The foundation is clearly there. Now it’s about execution.