Updated 4/14/25

California Water Service Group (CWT) delivers regulated water utility services to communities across California, Washington, New Mexico, and Hawaii, backed by a 90-year operating history. With a consistent dividend growth record spanning 57 consecutive years, it has built a reputation around dependable income and operational stability. The company recently posted strong full-year earnings for 2024, with revenue surpassing $1 billion and earnings per share jumping to $3.25. Management continues to prioritize long-term infrastructure investment, pouring $471 million into capital projects while keeping a firm handle on operating cash flow and liquidity. Trading near $50 with a 2.38 percent dividend yield and a modest 34 percent payout ratio, the stock remains well-positioned for income-oriented investors. Analyst sentiment has grown more optimistic, with recent rating upgrades and a consensus price target of $54.67 reflecting steady confidence in the company’s financial and operational outlook.

Recent Events

Over the past year, CWT’s share price has floated between a low of $41.64 and a high just north of $56. As of the latest update, it’s sitting around $50.85—a solid 13.4% climb from where it stood a year ago. That outpaces the broader S&P 500’s return during the same period, and again, we’re talking about a water utility here—not exactly the flashiest corner of the market.

Despite that upward move, not everything is moving in the right direction. The company’s most recent quarterly earnings showed a decline of over 34% compared to the previous year. That’s not insignificant, and it likely reflects some of the challenges utilities are facing right now, including higher operating costs and regulatory headwinds.

Still, profit margins remain quite healthy. CWT delivered an 18.4% net profit margin over the last twelve months, with operating margins hanging in at 14.5%. It’s not explosive growth, but these margins give the company plenty of room to breathe—and more importantly, to keep its dividend payments flowing.

Key Dividend Metrics

💰 Forward Dividend Yield: 2.38%

📈 Five-Year Average Yield: 1.84%

🔁 Dividend Growth Streak: 57 years and counting

📆 Dividend Frequency: Quarterly

📊 Payout Ratio: 34.46%

📆 Last Dividend Paid: February 21, 2025

⚠️ Ex-Dividend Date: February 10, 2025

🔢 Trailing Annual Dividend: $1.12

🔮 Forward Annual Dividend: $1.20

Dividend Overview

CWT has carved out a reputation as a dividend payer that doesn’t miss a beat. For 57 consecutive years, the company has raised its dividend—a stretch of consistency that puts it among a rare group of long-term dividend growers. This isn’t just about handing out checks, either. The company has shown a commitment to sustainable dividend growth, not just keeping the streak alive for appearance’s sake.

At the moment, the forward yield of 2.38% is a step above its five-year average of 1.84%, which could suggest the stock is undervalued by yield-focused metrics. That higher-than-average yield, combined with the consistency of payments, makes it appealing for those focused on building income over time.

One of the more reassuring signals for dividend investors is the payout ratio. At just over 34%, the company isn’t stretching to fund its dividends. It’s a level that leaves a good cushion in place for reinvestment, debt service, and of course, continued payouts to shareholders. That balance is particularly important in a capital-intensive industry like water utilities.

Debt-wise, the company does carry a significant load—roughly $1.4 billion. That might raise eyebrows, but in this sector, heavy infrastructure investments are par for the course. What matters more is the company’s ability to manage it, and so far, CWT appears to be doing just that. Its consistent cash flows and regulatory framework help keep the risk in check.

Dividend Growth and Safety

There’s a difference between paying a dividend and growing it responsibly, and CWT manages both. The latest bump from $1.12 to $1.20 represents a healthy 7% increase year-over-year. It’s the kind of increase that outpaces inflation without putting strain on the business. Over the past decade, this has been the rhythm—mid-single-digit growth year after year, like clockwork.

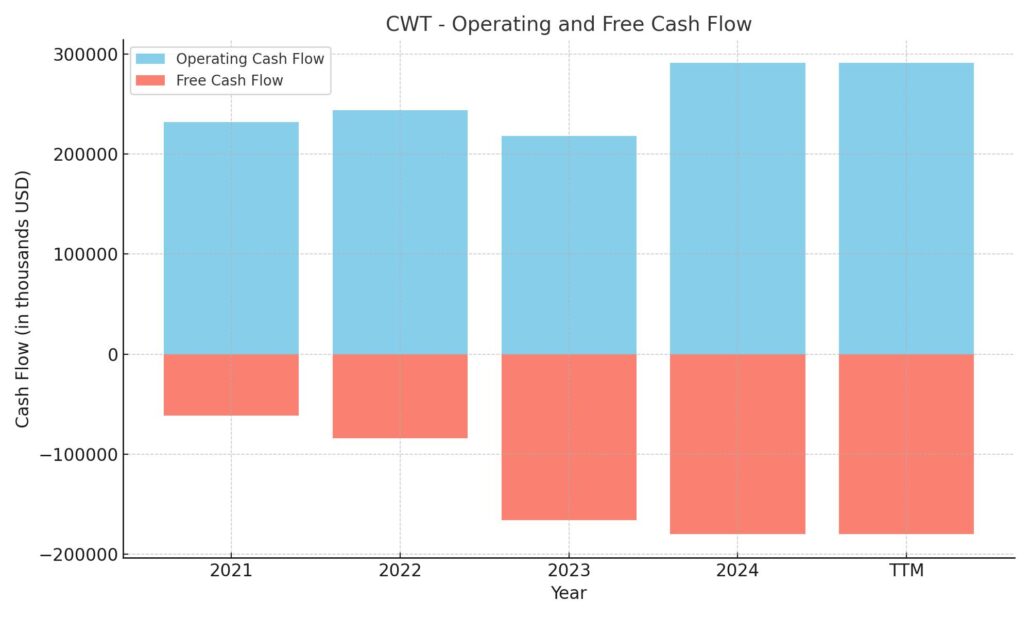

Looking under the hood, operating cash flow over the last twelve months totaled nearly $291 million. That’s the real engine behind the dividend. It shows the company is generating enough from operations to cover its payout comfortably. Levered free cash flow was in the red, which is worth noting—it signals that a lot of the money is going right back into the business. But again, this is typical in the utility space where long-term investments are part of the model.

The stock has a beta of just 0.55, which means it moves about half as much as the broader market. That low volatility is another layer of safety for income-seeking investors. It’s not going to rally hard during bull markets, but it’s also not going to crater when things turn south. For those relying on consistent cash flow, that kind of calm is exactly what you want.

Institutional investors hold a commanding 88.5% of the float, a sign that large, professional investors still believe in CWT’s long-term income story. Insider ownership is less than 1%, which isn’t unusual in a company like this. It’s managed with stability in mind, not high-conviction founder-led swings.

At the end of the day, California Water Service Group is about reliability. With a nearly six-decade history of dividend growth, low payout ratio, and steady financial performance, it remains a solid income pick for patient investors who value peace of mind alongside yield.

Cash Flow Statement

Over the trailing twelve months, California Water Service Group generated $290.9 million in operating cash flow, a notable increase from the $217.8 million reported in the prior year. This boost points to stronger core operations despite headwinds in earnings. However, the company’s aggressive capital spending continued, with $470.8 million in capital expenditures during the same period—more than wiping out operating cash flow and resulting in a negative free cash flow of $179.9 million. That’s a deepening trend from prior years, reflecting the ongoing infrastructure investments that are typical in the water utility space.

On the financing side, CWT raised over $629.8 million in new debt and issued $89 million in equity, while simultaneously repaying nearly $481 million in debt obligations. These moves kept the balance sheet fluid and helped support both operations and capital projects. Interest expense climbed to $55.7 million, signaling the rising cost of debt in this environment. Still, the end cash position improved to $95.7 million from $85 million a year earlier, suggesting management is keeping enough liquidity on hand to manage obligations and navigate through its capex-heavy phase.

Analyst Ratings

📈 California Water Service Group (CWT) has recently seen a shift in analyst sentiment, with a few firms adjusting their ratings and targets. 🟢 Seaport Research Partners moved the stock up from “Hold” to “Strong Buy,” setting a fresh target price of $54.00. This reflects renewed confidence in CWT’s ability to deliver consistent performance, particularly due to its dependable dividend history and defensive positioning in a choppy market environment.

📊 Wells Fargo also updated its stance, raising the rating from “Equal Weight” to “Overweight.” While the firm slightly trimmed its price target from $56.00 to $52.00, the revised rating signals a more favorable view of CWT’s long-term potential, especially given its utility-focused business model and relatively low beta.

🛠️ On top of that, Bank of America initiated coverage with a “Buy” rating and a price target of $57.00. Analysts there noted the company’s resilient operating metrics and solid infrastructure investments as reasons for their optimistic outlook.

💬 The current consensus rating among analysts stands at “Buy,” with an average price target of $54.67. That suggests about an 8.7% upside from the stock’s latest price. Targets range from $52.00 on the low end to $57.00 at the high, pointing to generally bullish expectations from the analyst community.

Earnings Report Summary

Strong Finish to the Year

California Water Service Group wrapped up 2024 with a solid performance that reinforced its position as a steady, well-managed utility. Total operating revenue for the year came in at just over $1.03 billion, which is a noticeable jump from the $794.6 million reported in 2023. What really stood out was net income—CWT pulled in $190.8 million, or $3.25 per diluted share, compared to just $0.91 per share the year before. A big part of that increase came from the final decision in their 2021 General Rate Case. That included several adjustments like interim rate relief and revenue recovery mechanisms that kicked in retroactively.

The company also benefited from higher water usage throughout the year, which gave revenues a lift. While some of the tailwinds were one-time in nature, they still reflect CWT’s ability to navigate regulatory hurdles and deliver results when it counts.

Fourth Quarter Snapshot

In the fourth quarter alone, CWT brought in $222.2 million in revenue, up slightly from $214.5 million in the same period last year. Net income for the quarter was $19.7 million, translating to $0.33 per diluted share. That’s a bit of a step down from the $0.52 they earned per share in Q4 2023, mostly due to lower water usage in December and a smaller tax benefit.

Expenses rose during the quarter too, largely driven by higher water production costs. Still, the company held its ground, managing through the cost pressures without letting it drag down the entire year’s performance.

Focused on Infrastructure and Growth

One of the biggest headlines from the report was CWT’s record-breaking capital investment total for 2024. The company poured $471 million into improving water systems across its service areas—an increase of 23% over the prior year. These upgrades are aimed at ensuring long-term reliability and better service for customers, especially as aging infrastructure becomes a more pressing issue across the industry.

CWT also shored up its balance sheet a bit, finishing the year with nearly $96 million in cash and about $395 million available through short-term borrowing. And with regulatory approval in hand, the company can now raise up to $1.3 billion in new debt or equity to help fund future projects.

Eyes on the Future

Looking ahead, the company is already deep into its next rate case and infrastructure plan, which proposes over $1.6 billion in investments between 2025 and 2027. The plan also includes a thoughtful component—a Low-Use Water Equity Program aimed at helping lower-income customers afford their utility bills.

CEO Martin Kropelnicki shared that he’s focused on working closely with regulators to move the current rate case forward. The strategy is clear: continue building out infrastructure while maintaining stable returns for shareholders and reliable service for customers. It’s the kind of measured, forward-thinking approach that long-term investors tend to appreciate.

Chart Analysis

Recent Momentum and Moving Averages

Looking at the one-year mountain chart for CWT, the stock has started to show a notable shift in trend after a prolonged period of weakness through late 2023 and early 2024. The price recently pushed above the 50-day moving average, and is now approaching the 200-day moving average from below. This kind of movement often signals a potential transition in sentiment, especially if it can sustain and build above both averages.

Back in late October and into November, CWT traded firmly above both moving averages, peaking around the $54 mark before entering a clear downtrend. That correction dragged it well below both trend lines, bottoming out near $43. Since then, there’s been a slow but determined climb back, and the current price action shows renewed strength. The red 50-day MA is now curling upward, another encouraging technical sign.

Volume and Price Behavior

Trading volume throughout the year has been relatively stable, with only a handful of noticeable spikes. There was a particularly sharp volume surge during the sell-off in late October, possibly signaling capitulation or institutional repositioning. More recently, higher volume has accompanied upward price moves, which tends to confirm that buyers are stepping in with conviction.

The price has recovered in a fairly organized fashion since February, moving in higher lows and higher highs—a classic early-stage recovery pattern. With the 200-day MA just overhead, how the stock behaves around that level in the coming weeks will be a key area to watch.

RSI and Buying Pressure

The Relative Strength Index (RSI) currently hovers just below the overbought threshold of 70. Over the past year, the RSI only touched these levels during May and again briefly in September, both times preceding short-term pullbacks. That doesn’t mean a drop is guaranteed, but it does suggest the stock may need a breather if the RSI continues climbing above 70.

On the flip side, the fact that RSI has steadily risen without reaching deeply oversold territory for some time shows that downward pressure has been easing. It’s a healthier profile now compared to the choppy and reactive moves seen through the winter months.

Overall Trend

CWT is working its way out of a period of technical weakness and has started showing signs of renewed strength. The current setup, with improving price action, rising short-term averages, and momentum pushing higher, hints at a stock regaining its footing. If it can push through and hold above the 200-day moving average, the broader trend may shift from recovery to a more sustained advance.

Management Team

At the helm of California Water Service Group is Martin A. Kropelnicki, who has served as Chairman, President, and CEO since May 2023. With over three decades of experience in finance and operations, including leadership roles at Pacific Gas & Electric and Deloitte, Kropelnicki brings a wealth of industry knowledge to the company. His tenure has been marked by a focus on strategic planning and operational efficiency.

Supporting him is James P. Lynch, who joined as Senior Vice President, Chief Financial Officer, and Treasurer in January 2024. Lynch’s background includes significant experience in the water utility sector, having previously served as CFO at SJW Group and as an audit partner at KPMG. His financial acumen is expected to play a crucial role in guiding the company’s fiscal strategies.

The broader leadership team comprises seasoned professionals like Michael B. Luu, Vice President and Chief Information Officer, and Greg A. Milleman, Vice President of Rates and Regulatory Affairs. Their combined expertise ensures that the company remains responsive to both technological advancements and regulatory developments.

This experienced management team provides a stable foundation for the company’s operations and strategic initiatives.

Valuation and Stock Performance

As of April 2025, California Water Service Group’s stock is trading around $50.34, reflecting a year-to-date increase of approximately 11 percent. The stock has experienced a 52-week range between $41.64 and $56.25, indicating moderate volatility.

From a valuation perspective, the company’s price-to-earnings ratio stands at 15.42, which is slightly below the industry average. The price-to-book ratio is 1.83, suggesting that the stock is trading at a reasonable valuation relative to its assets. Analysts have set a consensus price target of $54.67, implying a potential upside of about 8.7 percent from current levels.

The company’s consistent dividend payments, with a current yield of 2.38 percent, add to its appeal for income-focused investors. The dividend payout ratio is a conservative 34.46 percent, indicating ample room for future increases.

Overall, the stock’s performance and valuation metrics suggest a stable investment profile with moderate growth prospects.

Risks and Considerations

While California Water Service Group operates in a relatively stable industry, there are several risks to consider. The company carries a significant debt load, with a debt-to-equity ratio of 85.18 percent. This level of leverage could pose challenges, especially in a rising interest rate environment.

Regulatory risks are also inherent in the utility sector. The company’s revenues are subject to approval by state commissions, which can impact profitability. Additionally, environmental factors such as droughts or water quality issues could affect operations and lead to increased costs.

Furthermore, the company’s capital-intensive nature requires ongoing investments in infrastructure, which could strain financial resources if not managed carefully.

Investors should weigh these risks against the company’s stable earnings and dividend history when considering an investment.

Final Thoughts

California Water Service Group presents a compelling profile of stability and consistent performance. With a seasoned management team, reasonable valuation metrics, and a history of reliable dividend payments, the company stands as a noteworthy player in the utility sector. While there are risks associated with debt levels and regulatory factors, the company’s strategic initiatives and operational efficiency provide a solid foundation for future growth.

For those seeking a balance of income and stability, California Water Service Group offers an investment opportunity that continues to earn attention.