Updated 4/14/25

Cactus, Inc. (WHD) is a well-run oilfield services company that specializes in pressure control equipment and spoolable technologies. With a leadership team that’s been together since its founding, the company has built a strong reputation for operational efficiency, healthy margins, and consistent cash generation. It ended 2024 with $343 million in cash and virtually no debt, while maintaining a payout ratio under 20%. Despite a pullback in its stock price, WHD continues to deliver solid profitability and steady dividend growth, supported by strong free cash flow and disciplined capital spending. The management team remains focused on expanding internationally and investing in scalable production, positioning the company to navigate industry cycles with stability and long-term vision.

Recent Events

It’s been a rough year for the stock price. WHD is down nearly 28% from its 52-week high of $70.01, and currently trades just north of $36. That’s a long way from its highs, but it also means the yield is looking more attractive than usual. More importantly, the underlying business remains solid.

Over the last 12 months, the company brought in $1.13 billion in revenue and booked net income of $185 million. That’s a profit margin over 16%. Even with slight year-over-year declines in both revenue and earnings, Cactus is still producing strong cash flows and maintaining impressive operating margins close to 26%. These are numbers that speak to a lean and disciplined business model.

What makes Cactus stand out even more is its balance sheet. The company holds $342 million in cash and carries just $41 million in total debt. With a debt-to-equity ratio of only 3.3% and a current ratio above 4, there’s not much to worry about in terms of financial stability. That kind of balance sheet gives WHD room to handle down cycles and still reward shareholders.

Key Dividend Metrics 🧾

💵 Forward Dividend Yield: 1.43%

📈 5-Year Average Yield: 1.04%

📆 Last Dividend Paid: March 20, 2025

📅 Ex-Dividend Date: March 3, 2025

💰 Payout Ratio: 18.05%

📊 Trailing Dividend Yield: 1.38%

🚀 Dividend Growth (Recent): Slow but steady

🔒 Balance Sheet Safety: Rock-solid

Dividend Overview

WHD’s current forward yield of 1.43% might not scream “high income,” but it’s comfortably above the company’s five-year average. That tells you something important—the dividend has become more attractive relative to the stock’s own history, thanks in part to the recent pullback in share price.

With a payout ratio sitting at just 18%, this is a company being very cautious about how much it distributes. That’s a good thing. It means there’s room for the dividend to grow, and little risk of it being cut, even if earnings were to dip further. The company is covering its dividend several times over with both earnings and free cash flow. Operating cash flow came in at $316 million, and levered free cash flow was a strong $228 million. In plain terms, the dividend is very well protected.

Dividend Growth and Safety

Cactus has steadily increased its dividend since going public, though not dramatically. The most recent hike brought the annual payout to $0.52 per share, up slightly from $0.50 the year before. That kind of measured increase might not grab headlines, but it builds trust with investors. Especially in the energy sector, where wild swings in payouts are more common than not.

The company’s approach is clear: only increase the dividend when it makes sense, not just to appease shareholders. That kind of financial discipline is exactly what you want if you’re investing for long-term income. When you combine the modest payout ratio with the strength of the balance sheet and the consistently high margins, there’s a lot to like from a dividend safety perspective.

There’s always some exposure to the broader energy market, of course. If capital spending in U.S. shale slows, that could impact demand for WHD’s equipment and services. But the company isn’t sitting back. It’s pushing further adoption of its SafeDrill™ technology and building a reputation as a go-to partner for safer, more automated drilling solutions. That effort should help Cactus maintain revenue even when the cycle softens.

Institutional ownership sits well above 100%, suggesting strong support from large funds and long-term holders. That’s another quiet vote of confidence in the stability of Cactus’s business model and its shareholder-friendly policies.

All in all, WHD is a solid name for dividend investors who prioritize long-term consistency and financial health over short-term yield grabs. It won’t lead the pack in dividend size, but its foundation is rock-solid—and for a dividend investor, that’s exactly what matters.

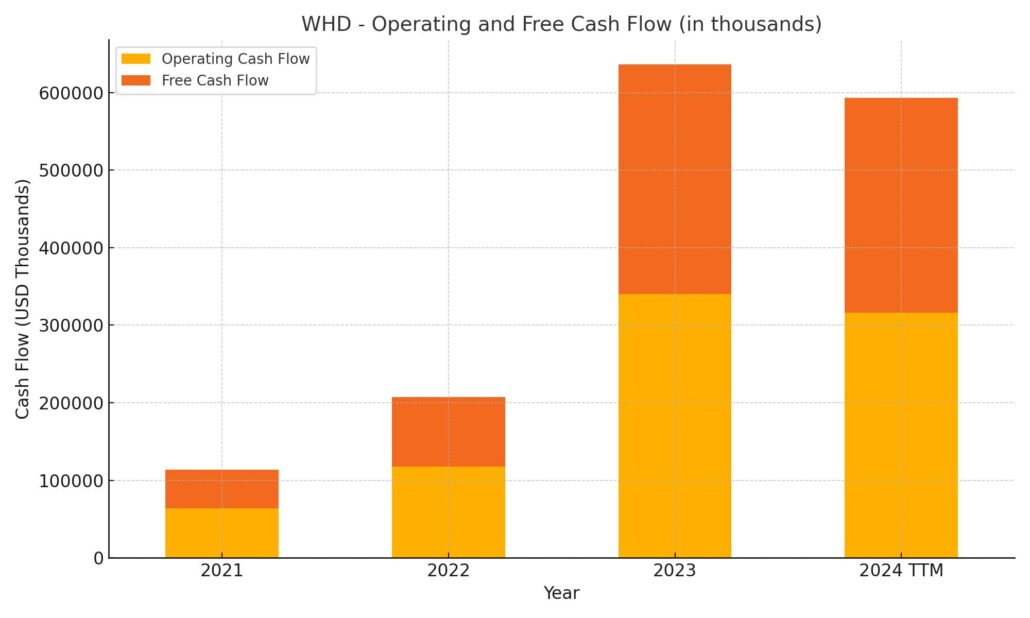

Cash Flow Statement

Cactus, Inc. has continued to show strength in its ability to generate cash from operations, reporting $316 million in operating cash flow over the trailing twelve months. While that’s a slight dip from the $340 million posted in the prior full year, it’s still more than double the levels seen just two years ago. This consistency highlights a business that is generating reliable earnings and converting a high percentage of those into actual cash.

Capital expenditures came in at just under $40 million, resulting in a strong free cash flow figure of $277 million. This provides Cactus with the flexibility to cover its dividend, invest in growth, and return capital through buybacks or other shareholder initiatives. On the investing side, outflows were minimal compared to last year’s substantial $655 million—suggesting a pause in major acquisitions or expansion efforts. Financing cash flow was negative, reflecting debt repayment and moderate buyback activity, all while still building the company’s cash position to a healthy $343 million at year-end.

Analyst Ratings

📉 Cactus Inc. (WHD) has experienced a shift in analyst sentiment over the past several months, reflecting a more cautious view of the company’s near-term prospects. In late 2024, Barclays lowered its rating on the stock from “Overweight” to “Equal Weight.” The primary concern was the potential for margin compression as customer spending patterns in oilfield services began to soften. While Cactus maintains healthy margins compared to peers, the broader backdrop of slower capital deployment by upstream operators raised some flags for analysts.

📊 Around the same time, Johnson Rice adjusted its stance from “Buy” to “Accumulate.” The firm pointed to valuation concerns, suggesting that the stock had already priced in much of the good news from recent quarters. There was also mention of tempered expectations for equipment orders as operators recalibrate in response to more disciplined capital budgets.

🔍 Despite these revisions, the overall analyst consensus remains at “Hold.” That sentiment lines up with the current average price target of $55.00, which reflects a fair amount of upside from current levels. Price targets across the board range between $48.00 and $64.00, showing a decent spread that captures both cautious and optimistic outlooks. Analysts still recognize Cactus’s strong fundamentals and clean balance sheet, but they’re watching closely for signs of sustained demand softness.

Earning Report Summary

Cactus closed out 2024 with a steady hand, navigating what was undeniably a slower patch in the oilfield services space. Revenue for the fourth quarter came in at $272.1 million, which was a bit softer than the prior quarter. Net income landed at $57.4 million, with adjusted earnings per share of $0.71—right in line with expectations. Margins stayed strong, and that’s a theme investors have come to expect from this company.

Performance Across Segments

The Pressure Control segment, which continues to be the core of the business, brought in $176.7 million. That’s a slight step down from earlier in the year, but nothing alarming. The drop was tied to normal seasonal patterns, something that leadership had been anticipating. On the other side, the Spoolable Technologies business delivered $96.1 million, down a bit more at 11% quarter over quarter. Again, seasonality was the main culprit, not a sign of deeper weakness.

Despite these declines, profitability held up really well. Cactus managed to post a 21% net income margin for the quarter, a solid figure considering the broader slowdown in oilfield activity. EBITDA margin stayed above 34%, which underscores how efficiently the company continues to operate.

Leadership Commentary and Outlook

CEO Scott Bender didn’t shy away from the softer numbers in Spoolable Technologies. He acknowledged the impact of the typical year-end slowdowns but pointed out that 2024 as a whole was a strong year for both business segments. The outlook for early 2025 is pretty measured—U.S. land activity looks to be holding steady, which should keep Pressure Control revenues on a flat to slightly higher trajectory. For Spoolable Technologies, expectations are a little more conservative heading into Q1, given the usual lull.

Financial Position and Strategic Focus

The balance sheet is one of the brightest spots. Cactus ended the year with $342.8 million in cash and no bank debt—something not many companies in the sector can claim. That kind of financial flexibility puts them in a good spot to invest where needed and continue rewarding shareholders. In January, they declared a $0.13 per share dividend, staying consistent with their capital return strategy.

Looking ahead, the company is keeping capital expenditures between $45 and $55 million for 2025. That’s aimed at expanding production capabilities and addressing supply chain challenges that have been lingering across the industry. There’s also a clear push to grow internationally, with a particular focus on the Middle East, which could become a more meaningful revenue contributor in the coming quarters.

All told, while the quarter had its soft spots, Cactus came through with strong profitability and a clear roadmap for 2025. The leadership team seems focused and pragmatic, balancing caution with opportunity as the new year unfolds.

Chart Analysis

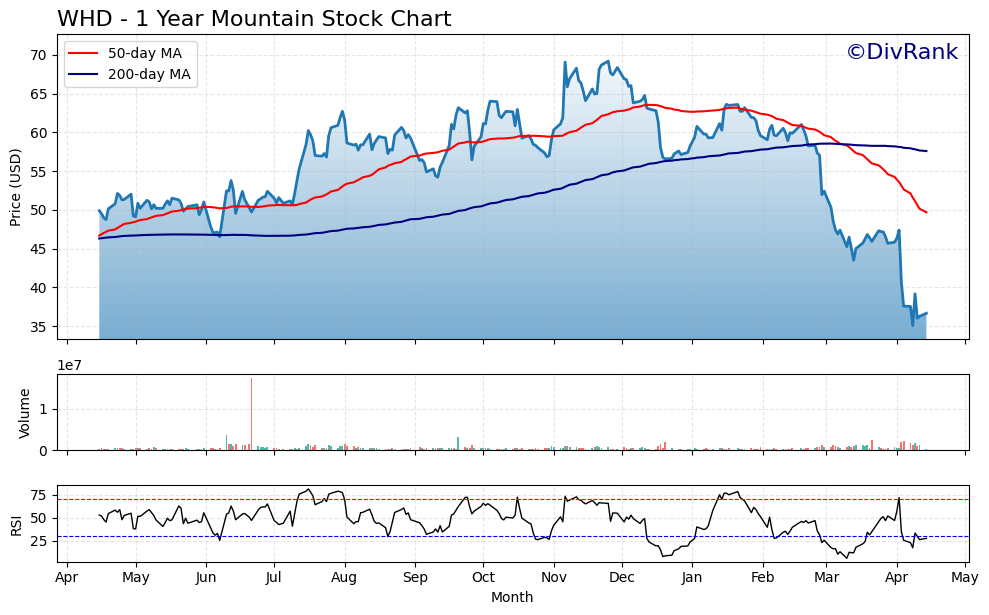

Price Action and Trend

The chart for WHD over the past year tells a story of a stock that held strong for much of 2023 before running into sustained selling pressure in early 2024. After peaking near $70, the price has steadily declined and now sits just above $35. This represents a sharp drop in a relatively short window, and it’s clear the downtrend has been persistent.

The 50-day moving average has crossed below the 200-day moving average, a classic technical signal that often indicates continued weakness ahead. That crossover happened a few months ago and has only grown wider, confirming the bearish momentum. The stock now trades well below both averages, and there’s been no meaningful sign of reversal yet.

Volume and RSI

Volume hasn’t spiked consistently during the decline, which suggests this isn’t panic-driven selling but more of a steady unwind. There was a notable volume spike in June and another modest rise in early April, but overall, the movement has been relatively orderly.

Looking at the RSI at the bottom of the chart, WHD is hovering near oversold territory. It’s dipped below 30 multiple times, including recently, which could suggest that it’s been pushed lower than fundamentals might warrant. Still, oversold doesn’t always mean reversal—especially in the context of a broader downtrend.

Momentum and Outlook

Momentum clearly shifted at the start of the year, and the price has been making lower highs and lower lows ever since. Until the 50-day moving average flattens or starts to curl upward, there’s little technical evidence of a bottom forming. A rebound would likely need to reclaim and hold above the 200-day moving average to signal a stronger shift in sentiment.

From a broader perspective, this chart reflects a correction phase, possibly tied to earnings results, sector sentiment, or broader market rotation. While the price action is unfavorable in the short term, periods like this often test conviction and patience.

Management Team

Cactus, Inc. is led by a management team with a long track record in oilfield services. Scott Bender, who serves as CEO and Chairman, co-founded the company and has been at the center of its steady growth. His experience in navigating market cycles and focus on operational discipline have helped shape Cactus into a respected name in its niche. Joel Bender, the company’s President, also co-founded the business and brings decades of hands-on industry experience to the table.

Jay Nutt joined as Executive Vice President, Chief Financial Officer, and Treasurer in mid-2024. His background includes senior financial roles at other energy service companies, and he brings a practical approach to capital allocation and balance sheet management. Steven Bender, Chief Operating Officer, has been instrumental in scaling operations as the company grew from a startup to a public player. Over in the Spoolable Technologies division, Stephen Tadlock now oversees the segment, focusing on expanding its role within the business.

This team isn’t new to energy cycles, and their leadership shows up in how the company has maintained strong cash flow, low leverage, and strategic patience even through softer quarters.

Valuation and Stock Performance

WHD’s stock performance over the past year has been a story of two halves. It started strong, reaching a 52-week high near $70, but the momentum faded into 2024. Now trading around the mid-$30s, the stock has shed a large chunk of its value, driven largely by sector-wide slowdowns and shifting sentiment across oilfield services. That said, the business itself remains fundamentally sound.

Valuation metrics suggest there may be some dislocation here. The current P/E ratio of just over 13 points to modest expectations priced into the stock. Free cash flow remains solid, the balance sheet is almost entirely debt-free, and the company is still returning capital to shareholders. The average price target from analysts sits at $55, indicating that many believe the current price underrepresents WHD’s true value.

The stock has also slipped below key technical levels, which can weigh on near-term sentiment. But for those focused more on fundamentals, the recent pullback looks more like a reflection of broad market pressures than a collapse in company quality.

Risks and Considerations

Like every company tied to the energy cycle, Cactus faces its share of risks. The most obvious is its sensitivity to upstream activity. When oil prices drop or operators slow down drilling and completions, demand for Cactus’s equipment and services can dip accordingly. These are natural industry headwinds, and while they can be short-term in nature, they often hit sentiment hard.

International expansion is another area with both opportunity and uncertainty. The company is eyeing markets like the Middle East, which could drive future growth, but these regions also come with additional regulatory and geopolitical complexities. Shifts in U.S. energy policy, ESG pressures, or sudden changes in raw material costs could also impact margins and planning.

The recent share price decline may reflect these broader themes more than any company-specific misstep, but it’s still something to weigh when evaluating future performance.

Final Thoughts

Cactus, Inc. has all the core qualities of a well-managed company in a tough industry. Leadership knows the space inside and out. The company is financially strong, with cash reserves that many competitors would envy. And despite recent softness, there’s a clear focus on long-term execution, not chasing quick fixes.

Valuation has come down significantly, offering a more compelling entry point than it did a year ago. Risks remain, particularly tied to commodity prices and market cycles, but the company’s history of disciplined growth and strategic focus stands out. How the next year plays out will depend as much on the broader energy landscape as it does on execution—but Cactus is entering that next phase from a position of strength.