Updated 2/25/26

C.H. Robinson Worldwide (CHRW) is one of the largest third-party logistics providers in the world, offering freight transportation, logistics, and supply chain services across a range of modes and geographies. With a legacy spanning over a century and a customer base that includes many of the world’s largest shippers, the company plays a central role in global commerce. CHRW is in the midst of a strategic shift under new leadership, prioritizing cost discipline, margin expansion, and digital transformation.

Despite persistent freight market volatility, the company has maintained profitability and continued its long-standing commitment to dividends. Backed by strong cash flow, operational efficiency, and a revamped management team, CHRW is working to sharpen its edge in an increasingly competitive logistics landscape. From steady dividend growth to a refreshed strategic direction, the company is positioning itself for long-term resilience and performance in a complex global supply chain environment.

Recent Events

C.H. Robinson has carried its operational momentum into early 2026, building on a year in which management continued to execute on its cost discipline and technology integration agenda. CEO Dave Bozeman has kept the company focused on its digital transformation initiative, with expanded deployment of AI-assisted load-matching tools and continued investment in process automation across its North American Surface Transportation and Global Forwarding divisions. These efforts have been recognized externally, with the company maintaining its position as one of the largest freight brokers by volume in North America even as the broader market has remained uneven.

The freight environment itself remains a story of gradual normalization. After years of extreme volatility tied to pandemic-era disruptions and the subsequent demand correction, capacity and pricing are finding a more stable equilibrium. CHRW has benefited from this stabilization, with its asset-light brokerage model allowing it to capture improving spread dynamics without the capital intensity that weighs on asset-heavy carriers. Revenue for the trailing twelve months came in at $16.23 billion, reflecting the company’s scale in a market that continues to reward operators with deep carrier relationships and technology-driven efficiency.

The stock has had a remarkable run, climbing from its 52-week low of $84.68 to a current price of $175.91, reflecting renewed investor confidence in the company’s strategic direction and earnings recovery. Shares reached as high as $203.34 over the past year, suggesting some near-term consolidation after that peak, but the broader trend remains constructive for shareholders who stayed patient through the freight downturn.

Key Dividend Metrics

📈 Forward Yield: 1.40%

💵 Annual Dividend Rate: $2.52

📅 Last Dividend Payment: $0.63 per share

🧮 Payout Ratio: 51.55%

📊 EPS: $4.82

📈 Dividend Growth: Incremental and sustained

🔁 Dividend History: Over two decades without a cut

💼 Free Cash Flow: $742.47 million

Dividend Overview

CHRW’s dividend yield of 1.40% sits below its five-year historical average, which is a direct reflection of the stock’s significant price appreciation over the past twelve months rather than any deterioration in the dividend itself. For investors entering at current levels, the yield is modest, but the underlying dividend quality remains intact. The company raised its quarterly payment to $0.63 per share in the most recent declaration, bringing the annualized rate to $2.52, a step up from the $0.62 per quarter that was in place for much of 2024 and 2025.

The payout ratio of 51.55% against EPS of $4.82 is a healthier picture than CHRW has shown in recent years, when compressed freight margins pushed that ratio uncomfortably higher. With earnings recovering and the payout well below the two-thirds threshold, the dividend has meaningful room to grow from here without straining the balance sheet. For income investors, the combination of a rising dividend and a recovering earnings base is a more sustainable foundation than yield alone would suggest.

Liquidity remains a non-issue for anyone building or managing a position around dividend dates. Average daily trading volume supports smooth execution, and with a market capitalization above $20.8 billion, CHRW is large enough that institutional positioning doesn’t create undue friction for individual investors.

Dividend Growth and Safety

The dividend history over the past three years tells a careful but consistent story. CHRW held its quarterly payment steady at $0.61 per share from early 2023 through the first half of 2024, then nudged it to $0.62 in the third quarter of 2024, and most recently raised it again to $0.63 in the fourth quarter of 2025. These increments are modest in isolation, but they reflect a management team that has never wavered on its commitment to returning capital to shareholders, even through one of the more difficult freight cycles in recent memory.

The safety of that dividend is underpinned by the company’s cash generation. Operating cash flow for the trailing twelve months reached $914.52 million, and free cash flow came in at $742.47 million. Against an annual dividend obligation that, at current share counts, runs well under $300 million, the coverage is more than adequate. The payout ratio of 51.55% on an earnings basis confirms the same picture from a different angle, leaving ample room for continued increases without approaching a stress point.

Return on equity of 32.91% and return on assets of 10.04% speak to a business that generates strong returns on the capital it deploys, which is ultimately what funds a durable dividend. The stock’s beta of 0.90 means it moves roughly in line with the market rather than dramatically above it, a characteristic that tends to appeal to income-oriented investors who want participation in upside without outsized volatility on the downside. CHRW is not a high-yield holding, but it is a reliable one, and in the freight sector, that reliability carries real value.

Chart Analysis

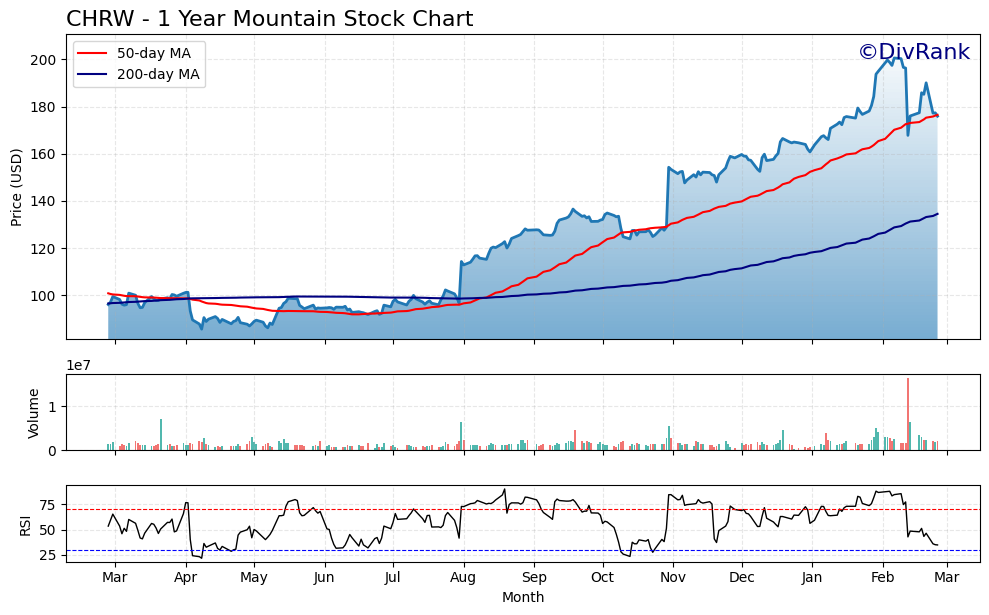

C.H. Robinson’s price chart tells a compelling recovery story over the past twelve months. The stock bottomed near $85.64 at its 52-week low and has since more than doubled, currently trading around $175.91 and sitting roughly 105% above that trough. That kind of move reflects a meaningful rerating as freight market conditions began stabilizing and the company’s cost-cutting initiatives gained traction with investors. The stock did reach as high as $200.59 over the past year, and the current price sits about 12.3% below that peak, which suggests some consolidation has set in after the powerful initial recovery leg.

The moving average picture is broadly constructive for longer-term holders. CHRW trades comfortably above its 200-day moving average of $134.51, a spread of roughly $41 that reflects just how far sentiment has shifted over the past year. The 50-day moving average at $176.48 has crossed above the 200-day, forming what technicians call a golden cross, which historically signals that intermediate-term momentum is aligned with the longer-term uptrend. The one nuance worth acknowledging is that the current price of $175.91 sits just a fraction below the 50-day average, meaning the stock is essentially hugging that near-term support level and has not yet decisively reclaimed it after the recent pullback from highs.

The RSI reading of 34.85 adds an interesting dimension to the setup. That figure places CHRW in oversold territory by conventional thresholds, and it reflects the selling pressure the stock has absorbed as it pulled back from its yearly high. For investors who do not already have a full position, an RSI near 35 combined with a price sitting near 50-day moving average support historically represents a more favorable entry point than chasing momentum at the top. The momentum picture is clearly cooler than it was earlier in the year, but that compression often precedes a resumption of the underlying uptrend rather than a structural breakdown, particularly when the 200-day moving average remains well below current prices as a substantial cushion.

For dividend investors evaluating CHRW from an income and total return perspective, the technical backdrop is reasonably supportive. The long-term trend is intact, the golden cross remains in place, and the oversold RSI reading suggests the recent weakness may be more of a digestion phase than the start of a meaningful reversal. Investors adding to positions at current levels are doing so closer to near-term support than recent resistance, which improves the risk-to-reward profile for those focused on collecting and growing the dividend over a multi-year horizon. The key level to watch on the downside is how the stock behaves around that 50-day average at $176.48, as a sustained break below it could open the door to a deeper test before the next upward leg develops.

Cash Flow Statement

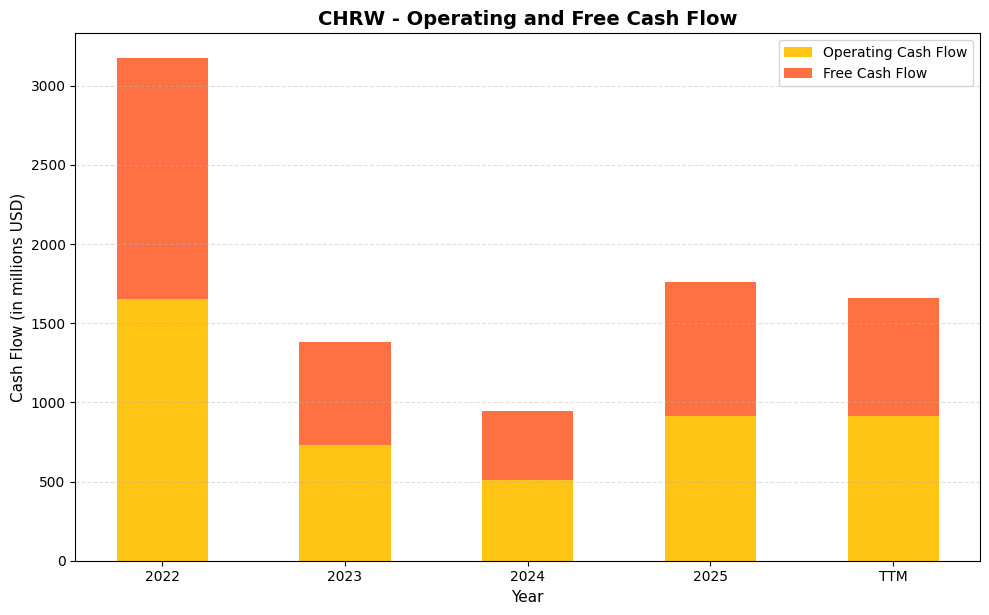

C.H. Robinson’s cash flow picture tells a story of sharp cyclical compression followed by a meaningful recovery. Operating cash flow peaked at $1.65 billion in 2022, a banner year for freight brokerage margins, before falling to $731.9 million in 2023 and compressing further to $509.1 million in 2024 as the freight market worked through a prolonged downturn in spot rates and volumes. The 2025 figure of $914.5 million represents a 79.6% rebound from that 2024 trough, which is an encouraging sign that the business is regaining its footing. Free cash flow followed the same arc, dropping from $1.52 billion in 2022 to $434.8 million in 2024 before recovering to $844.0 million in 2025. Against an annual dividend obligation running roughly in the $500 to $550 million range, the 2024 trough was the genuine stress point for dividend coverage, and the 2025 recovery brings free cash flow back to a level that covers the payout with meaningful room to spare.

Zooming out across the full four-year window, the capital efficiency story at CHRW remains intact. The company is an asset-light freight broker, so capital expenditures are modest and the conversion of operating cash flow to free cash flow is consistently high, with 2025 TTM free cash flow of $742.5 million representing roughly 81% of operating cash flow. The spread between operating and free cash flow has stayed narrow throughout the cycle, which reflects the low capital intensity of the model and management’s disciplined spending even during the downturn years. For dividend investors, the key takeaway is that CHRW never needed to tap debt markets to fund its dividend during the 2023 and 2024 compression, relying instead on its existing cash generation, and the current recovery trajectory suggests that free cash flow coverage of the dividend will continue to strengthen as freight market conditions normalize further into 2025 and beyond.

Analyst Ratings

The analyst community holds a buy consensus on CHRW as of February 2026, with 25 analysts covering the stock. The mean price target of $193.52 implies approximately 10% upside from the current price of $175.91, suggesting that while analysts remain constructive on the name, much of the recovery trade has already been recognized in the share price following the stock’s climb from its 52-week low near $84.68. The range of targets is wide, spanning from a low of $90.00 to a high of $225.00, which reflects genuine disagreement about the pace and durability of the freight market recovery and how much of CHRW’s operational improvement is already priced in.

The bull case embedded in the higher price targets centers on continued margin expansion, market share gains in truckload brokerage, and the company’s growing technology capabilities reducing operating costs at scale. At $225.00, the optimistic scenario assumes CHRW sustains its current earnings momentum and that freight demand continues to normalize toward a healthier equilibrium. The more cautious targets near $90.00 reflect concern that the stock has run ahead of fundamental improvement and that any renewed softness in freight volumes could pressure the multiple.

At current levels, the stock trades at a P/E of 36.50, which is elevated relative to the company’s own history and reflects investor willingness to pay for the earnings recovery rather than the current earnings level alone. Analysts who remain constructive point to the asset-light model, the improving cost structure under CEO Dave Bozeman, and the company’s unmatched scale in North American freight brokerage as reasons the premium is at least partially justified.

Earnings Report Summary

C.H. Robinson Worldwide delivered a full-year financial performance that validated the multi-year transformation effort underway since Bozeman’s arrival. The numbers reflect a business that has moved past the worst of the freight cycle and is now demonstrating operating leverage on the way back up.

Better Margins, Leaner Operations

Full-year revenue of $16.23 billion reflects CHRW’s scale in a market that remained competitive but stabilizing. More important than the top line, however, is what the company did with it. Net income of $587.08 million and EPS of $4.82 represent a meaningful recovery in per-share earnings, and the profit margin of 3.62% while modest in absolute terms is characteristic of the freight brokerage model and represents improvement from the compressed levels seen during the freight downturn. Return on equity of 32.91% is a standout figure, demonstrating that the capital-light structure continues to generate strong returns even in a recovering rather than booming freight environment.

The cost reduction program that management initiated in prior years has continued to pay dividends in the financial statements. Headcount reductions and process automation have lowered the personnel cost base, and the shift toward technology-assisted freight matching has improved the productivity of each employee the company does retain. Operating cash flow of $914.52 million underscores that earnings are being converted to cash at a healthy rate.

Leadership Commentary and Strategic Direction

CEO Dave Bozeman has consistently framed the company’s evolution around three pillars: operational efficiency, digital capability, and disciplined capital allocation. His commentary through the year has emphasized that CHRW is not simply cutting costs but restructuring how work gets done, with technology absorbing tasks that previously required human intervention at scale. The truckload segment has continued to grow market share, a trend that has now persisted for several consecutive quarters and suggests the strategy is translating into competitive wins rather than just internal improvements.

The Global Forwarding division has been a meaningful contributor to the profit recovery, with ocean freight pricing dynamics providing a favorable backdrop for margin capture. That division’s performance has helped diversify the earnings base away from pure dependence on domestic truckload conditions, which remain subject to capacity and demand fluctuations in the U.S. market.

What’s Next for CHRW

The forward agenda at C.H. Robinson is centered on deepening the technology advantage, continuing to gain truckload market share, and maintaining the cost discipline that has driven margin recovery. Management has signaled ongoing investment in generative AI applications for freight decisioning, carrier relationship tools, and customer-facing visibility platforms. The goal is to widen the operational moat that scale and technology together create in a brokerage business where pricing transparency is high and differentiation must come from execution quality and relationship depth. Investors will be watching closely to see whether earnings continue to recover toward levels that justify the current valuation multiple.

Management Team

C.H. Robinson’s leadership has evolved in recent years, with a clear focus on transformation and operational efficiency. At the center of this shift is Dave Bozeman, who took over as President and CEO in 2023. With a deep background that includes leadership roles at Amazon, Ford, and Caterpillar, Bozeman brings a mix of industrial know-how and tech-forward thinking. His strategy has been rooted in tightening execution and scaling smartly, emphasizing cost discipline while modernizing the business.

Supporting him is Arun Rajan, the Chief Strategy and Innovation Officer. He is no stranger to building digital platforms, having served in high-impact roles at Zappos and Whole Foods. At C.H. Robinson, he is helping lead the charge in aligning the company’s digital capabilities with long-term strategic goals, especially as customer expectations in logistics continue to rise.

The finance side is led by Damon Lee, who stepped in as CFO in 2024. Lee’s background in operational finance from companies like GE Aerospace adds strength to the leadership bench. His focus is on keeping the balance sheet healthy while supporting the push into more streamlined, tech-enabled services. Together, this team is reshaping the way C.H. Robinson runs its core business, and the financial results over the past year suggest the restructuring effort is gaining traction.

Valuation and Stock Performance

C.H. Robinson’s share price has delivered a remarkable recovery over the past twelve months, climbing from a 52-week low of $84.68 to a current price of $175.91. The stock reached as high as $203.34 during that span, and the current price reflects some consolidation after that peak rather than a fundamental deterioration. For investors who held through the freight downturn, the recovery has been substantial. For those considering entry today, the valuation picture requires more careful scrutiny.

At a P/E of 36.50 and a price-to-book of 11.29 against book value per share of $15.58, the stock is priced for a continued earnings recovery rather than current earnings alone. The elevated book multiple is a structural feature of CHRW’s asset-light model, where tangible assets are deliberately minimal and the value of the business resides in carrier relationships, technology, and operating scale rather than physical property. Return on equity of 32.91% helps justify that premium to book, as investors are effectively paying for the earnings stream those intangible assets generate.

The analyst consensus mean target of $193.52 implies roughly 10% upside from current levels, which is a reasonable but not dramatic cushion. The more interesting question for valuation purposes is whether EPS continues to recover toward levels that bring the current P/E down naturally over time. If freight market normalization continues and CHRW’s cost structure improvements hold, the earnings trajectory supports a more reasonable-looking multiple on a forward basis. At $175.91 with a market cap above $20.8 billion, the stock is pricing in execution success rather than leaving much margin for operational disappointment.

Risks and Considerations

The freight brokerage business is structurally cyclical, and CHRW’s financial results have demonstrated that reality vividly over the past several years. Revenue of $16.23 billion and recovering margins reflect improvement, but the underlying freight market can shift quickly with changes in industrial production, consumer spending, or trade policy. Any renewed softening in demand or oversupply of carrier capacity could compress the pricing spreads that drive profitability, and the company has limited ability to hedge against macro-driven volume and pricing swings.

The current valuation introduces its own layer of risk. A P/E of 36.50 leaves little room for earnings disappointment, and if the freight recovery stalls or reverses, the multiple compression could be painful even if the dividend remains intact. The stock’s round trip from the low $80s to nearly $200 and back toward $175 in the span of a year illustrates how quickly sentiment can shift when freight fundamentals change direction.

Competition from technology-enabled freight platforms continues to intensify. Startups and well-capitalized incumbents alike are investing heavily in digital brokerage capabilities, and while CHRW’s scale provides a durable advantage, the pace of innovation in load matching, carrier onboarding, and real-time pricing requires sustained investment to maintain. Any slowdown in the company’s technology buildout relative to competitors could erode the market share gains that have been a key part of the recent narrative.

Global trade policy remains a source of uncertainty that is particularly relevant for the Global Forwarding division. Tariff changes, shipping lane disruptions, and geopolitical tensions can shift ocean and air freight volumes in ways that are difficult to anticipate. The company’s international exposure, while a source of earnings diversification, also introduces regulatory and compliance complexity that carries ongoing cost and risk.

Final Thoughts

C.H. Robinson has executed meaningfully on its transformation agenda over the past two years, and the financial results are beginning to reflect that work. Operating cash flow above $914 million, a recovering earnings base, and a dividend that has been raised twice in recent quarters all point to a business that has moved past the worst of the freight cycle and is now generating the kind of returns that justify investor confidence. The dividend at $2.52 annually with a payout ratio of 51.55% is well-covered and positioned for continued growth.

The honest caveat for income investors entering at $175.91 is that the yield of 1.40% is not the reason to own this stock today. The reason is the combination of dividend safety, earnings recovery momentum, and a management team that has demonstrated genuine operational discipline in a notoriously difficult industry. For patient investors willing to accept a modest current yield in exchange for a durable, growing dividend backed by strong free cash flow and a recovering earnings trajectory, CHRW offers a compelling long-term case in the industrials space.