Updated 4/21/25

C&F Financial Corporation (CFFI), a regional bank based in Virginia, operates through community banking, mortgage banking, and consumer finance segments. Over the past year, the stock has climbed more than 50%, reflecting solid financial performance and investor confidence. The company maintains a 3.08% dividend yield with a low 29% payout ratio, backed by stable earnings and a track record of dividend growth.

Management, led by CEO Tom Cherry, continues to focus on disciplined lending and capital returns, recently authorizing a new buyback program and raising the dividend. While the stock has pulled back from recent highs, it remains above its 200-day moving average and shows signs of base-building. Trading at under 10x earnings and below book value, CFFI stands out for its steady cash flow, low beta, and shareholder-focused approach.

Recent Events

C&F Financial Corporation (CFFI) might not be on every investor’s radar, but for those who value steady income and disciplined management, this small regional bank has a lot going for it. Headquartered in West Point, Virginia, the company operates through three core areas—community banking, mortgage services, and consumer finance. It’s a traditional model, but one that’s served it well over the years.

Over the past year, CFFI’s share price has put in an impressive performance. The stock has climbed more than 54%, handily outpacing the broader market. It’s been a strong recovery from its 52-week low of $34.95, with the stock now trading around $59. While not immune to the usual market volatility, CFFI has been a solid performer, especially for those with an eye on long-term dividend income.

Looking under the hood, the company delivered $6.01 in earnings per share over the last twelve months, backed by a 19.1% increase in quarterly earnings year-over-year. That kind of earnings momentum is encouraging, particularly for a bank of its size operating in a rate-sensitive environment. Revenue was down slightly—off 2.7% year-over-year—but margins held up, with a net profit margin of 17.4% and a return on equity just under 9%. For dividend-focused investors, those are solid, stable numbers that suggest continued strength.

Another standout stat? The beta. At just 0.33, the stock tends to move far less than the broader market. That low-volatility profile could be especially appealing to income seekers looking for smoother sailing.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.08%

💵 Forward Annual Dividend: $1.84 per share

📆 Most Recent Dividend Date: April 1, 2025

🔁 5-Year Average Yield: 3.33%

💸 Payout Ratio: 29.28%

🕒 Ex-Dividend Date: March 14, 2025

🔒 Dividend Coverage: 3.27x earnings

Dividend Overview

CFFI doesn’t offer an eye-popping yield, but it’s right in that sweet spot for long-term investors—enough to generate income without putting the business at risk. The current 3.08% yield is comfortably above the market average and backed by strong fundamentals. With an annual dividend of $1.84 per share and a payout ratio of just under 30%, there’s plenty of breathing room.

What’s reassuring here is how little of its earnings the company needs to set aside to maintain that dividend. That kind of buffer matters, especially when the economy turns uncertain. A company paying out more than it earns is a red flag. CFFI, on the other hand, is playing it smart—sharing profits with shareholders while keeping plenty in reserve.

Over the past five years, the average dividend yield has hovered around 3.33%, slightly higher than where it stands now. That difference isn’t a knock on the dividend itself—it just reflects the stock’s recent price appreciation. As the share price moves higher, yield can naturally compress a bit. But the underlying payout remains consistent and well-supported.

This isn’t a flashy dividend story. It’s one built on quiet consistency—paying out reliable income quarter after quarter without stretching the company too thin. That’s the kind of approach that long-term investors appreciate.

Dividend Growth and Safety

Let’s take a look at how the dividend has been growing. In 2025, the company nudged its annual payout up from $1.76 to $1.84. That’s a modest 4.5% increase, but it’s meaningful. It signals that management is confident in the business and committed to returning more to shareholders over time.

It’s also worth noting that the company has a habit of raising its dividend steadily. While it doesn’t have a formal “dividend growth” label attached to its name, CFFI’s history shows that it doesn’t take these decisions lightly. Dividend hikes come from real earnings strength—not financial engineering.

In terms of safety, this is one of the more comfortable setups you’ll find. With a payout ratio just shy of 30%, the dividend is very well covered. Even if earnings took a hit, the company would have plenty of flexibility to maintain its payout.

CFFI’s balance sheet also adds to the story. It’s holding around $72 million in cash, against $130 million in total debt. That’s a reasonable level of leverage for a bank, and the cash position gives it the ability to navigate bumps in the road. Book value per share is $70, which is actually higher than the current share price. That means investors are getting a strong asset base at a discount.

From a shareholder structure standpoint, there’s also some alignment. Insiders own nearly 7% of the stock, and institutions hold around 38%. That’s a nice balance—management has skin in the game, but there’s also professional oversight from larger investors.

At the end of the day, this is a company that’s not trying to dazzle anyone. It sticks to what it knows, generates solid returns, and shares a portion of those with shareholders in the form of a steady, growing dividend. For income-focused investors, it’s the kind of story that can quietly add value year after year.

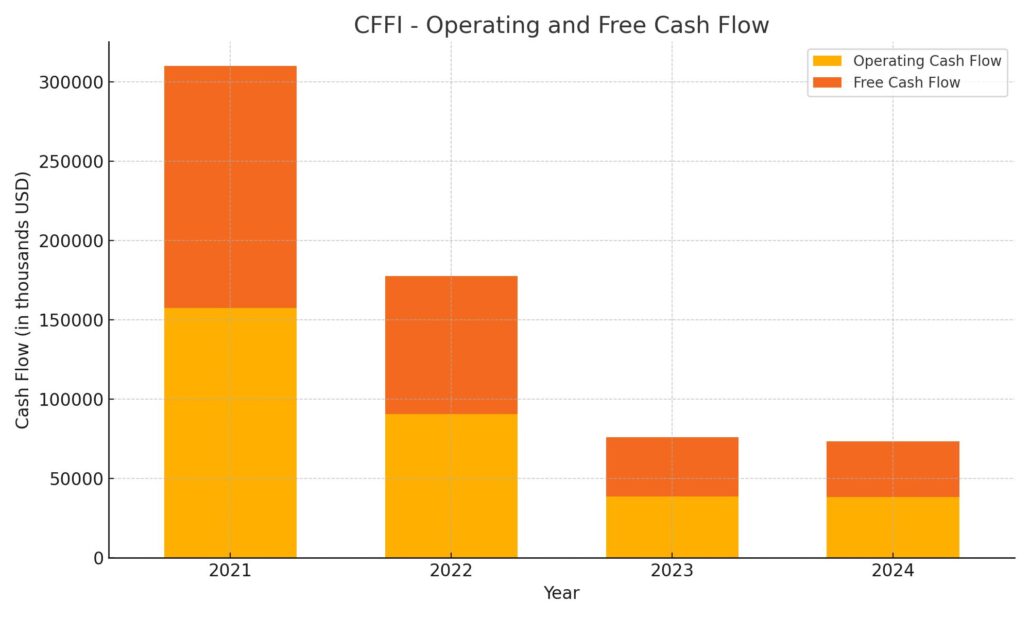

Cash Flow Statement

C&F Financial Corporation’s cash flow activity over the trailing twelve months reveals a disciplined but dynamic capital allocation strategy. Operating cash flow came in at $38.5 million, slightly below the previous year’s figure, yet still consistent with the company’s overall profitability. Free cash flow also held steady at $35 million, underscoring that the company continues to generate strong internal cash after covering capital expenditures, which totaled a modest $3.5 million.

The biggest shift came in investing activities, which posted a significant outflow of $148.6 million—more than double the prior year. This reflects increased deployment of capital, possibly into loan growth or securities purchases, typical for regional banks expanding their asset base. Financing cash flow helped offset this, with a $100.6 million inflow, driven in part by a $40 million debt issuance. Management also continued its shareholder return program, repurchasing nearly $8.8 million in stock. Despite the elevated capital activity, the company finished the period with a healthy $65.6 million in cash.

Analyst Ratings

C&F Financial Corporation (CFFI) recently received a fresh look from analysts, with sentiment coming in a bit divided. On April 4, 2025, StockNews.com shifted their rating from a hold to a buy ✅. The reasoning behind this upgrade came down to the fundamentals—solid profitability metrics, like an 8.97% return on equity and a net margin of 11.67%. These numbers reflect efficient management and steady earnings strength, both of which support a long-term bullish view. The company’s reliable dividend history also added weight to the more optimistic stance.

On the flip side, that same day brought a notable downgrade from another research outlet, cutting the stock from sell to strong sell ⚠️. This call leaned more heavily on technical indicators. Over the ten trading days leading up to the downgrade, shares had dropped nearly 17%, slicing through key support levels. That kind of technical breakdown tends to raise red flags for analysts who lean on price action and chart patterns in their assessments.

At the moment, there’s no published consensus price target from analysts covering the stock 🎯. The combination of mixed ratings and the lack of a clear target underscores the divergence in outlook depending on whether you’re looking at the chart or the balance sheet.

Earning Report Summary

C&F Financial wrapped up 2024 with a quarter that felt like a balancing act—some solid wins in their core banking business, tempered by challenges on the lending and consumer finance side. Overall, the results reflected a company that’s holding its ground, even as the financial landscape shifts.

A Steady Hand in Community Banking

The heartbeat of C&F—its community banking segment—delivered strong numbers to close out the year. Loans were up more than $21 million from the previous quarter and jumped by $180 million year-over-year. Deposits also grew steadily, rising by $35 million in the fourth quarter alone. This steady growth speaks to a loyal customer base and continued trust in the bank’s offerings. It’s clear that their relationships in the community are still paying off.

Mortgage Business Picks Up the Pace

One of the more upbeat parts of the report was the performance in mortgage banking. Loan originations surged nearly 33% year-over-year to hit $130 million in the fourth quarter. That’s a meaningful move in the right direction and shows renewed momentum, especially considering the slower pace that’s been hanging over the housing market in general.

Tougher Terrain for Consumer Finance

It wasn’t all smooth sailing. The consumer finance segment had a tougher time, largely due to an uptick in charge-offs. Net charge-offs rose to 2.62% of average loans, up from just under 2% the year before. That’s not unexpected in this kind of credit environment, but it did eat into profits from that part of the business. The good news is the company has remained efficient in its operations, helping to offset some of the sting.

What Leadership Had to Say

CEO Tom Cherry didn’t sugarcoat the challenges. He pointed to the tight interest rate environment as a headwind that’s pressured net interest margins over the past year. Still, he sounded cautiously optimistic, noting that margins held steady in the fourth quarter and could start to trend better as conditions stabilize. Cherry made it clear that the company isn’t just standing still—they’re looking ahead, and they feel they’re in a strong position going into 2025.

C&F didn’t pull back when it came to rewarding shareholders. The board approved a new $5 million stock repurchase plan for 2025 after wrapping up a $10 million buyback in 2024. And in a nod to dividend investors, the quarterly dividend was bumped up by 5% to $0.46 per share, with the next payout scheduled for April 1, 2025.

All in all, while 2024 had its rough patches, the company still managed to post a solid close to the year. The core business remains healthy, and management’s measured tone suggests they’re focused on building from a position of stability as they look ahead.

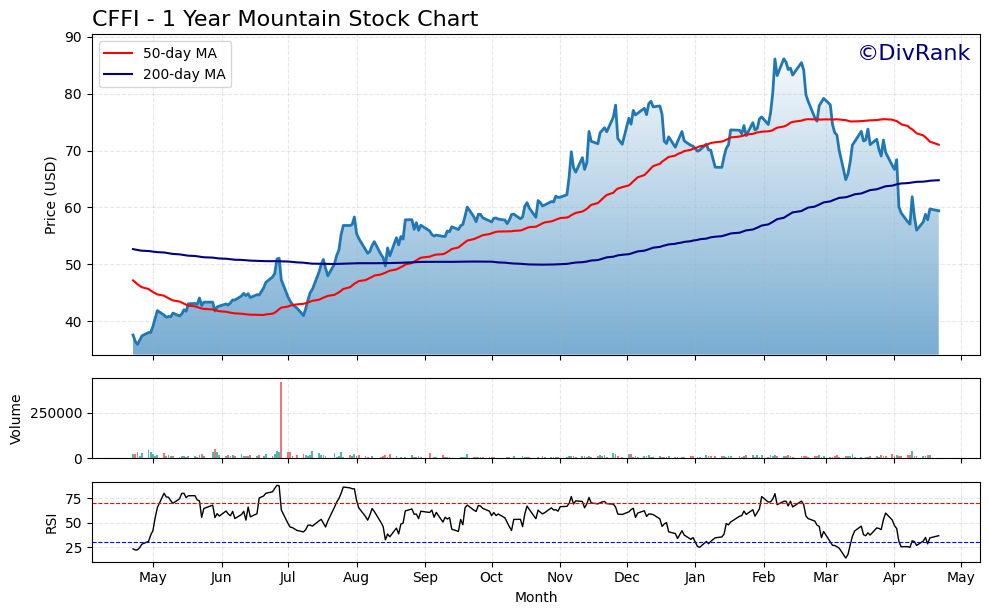

Chart Analysis

Price Movement and Trend

CFFI’s price chart over the past year paints a clear picture of a stock that saw a strong uptrend for most of 2023, followed by a correction in early 2024. The rise from the low-$30s in spring to nearly $90 by February is a significant move, and it’s not surprising that the stock pulled back from those elevated levels. Currently, it’s hovering just under $60, trying to find its footing.

The 50-day moving average, shown in red, has rolled over and is now trending downward. This reflects the recent loss of short-term momentum. Meanwhile, the 200-day moving average, in blue, has only recently started to turn up. That longer-term average still sits below the current price, which suggests there’s some support building underneath the stock even as short-term sentiment remains cautious.

Volume Behavior

Looking at volume, the standout spike in July suggests a high-activity event—likely news or an earnings report that triggered heavy buying. Outside of that, volume has stayed relatively subdued, even during the recent decline. That can be taken as a sign that the pullback wasn’t driven by panic selling but more likely a natural cooling-off period after a sharp run-up.

RSI and Momentum

The RSI (Relative Strength Index) gives additional insight into sentiment shifts. During the rally, RSI hovered in overbought territory several times, especially in late 2023 and early 2024. Since the February peak, RSI has dropped sharply and recently stayed close to the oversold line at 30. That signals weakening momentum, but also hints that the stock may be near the end of its current selling pressure, potentially setting the stage for stabilization or recovery.

Recent Candlestick Behavior

Over the past five sessions, the candlesticks show small bodies with wicks on both ends, reflecting indecision in the market. This kind of price action often signals a tug-of-war between buyers stepping in around support and sellers exiting positions after the recent slide. If this balance continues and volume starts to pick up, it could lead to a clearer direction soon.

Overall Take

CFFI is in the middle of a reset after a big run. The longer-term trend remains intact, with support forming near the 200-day moving average. The stock is trying to carve out a new base, and while short-term momentum has cooled, it’s not collapsing. The setup looks like one of consolidation, where patience may pay off if the broader market backdrop stays favorable.

Management Team

C&F Financial Corporation is led by a management team with deep experience in regional banking and a steady hand on long-term strategy. At the center is Thomas F. Cherry, who has been serving as President and CEO since 2015. He’s only the fourth person to hold that role in the company’s nine-decade history, which speaks volumes about the organization’s stability and culture of continuity.

Supporting Cherry is Jason E. Long, the company’s Executive Vice President, Chief Financial Officer, and Secretary. His focus on disciplined financial management has helped guide the company through changing interest rate environments and economic cycles. Also in key roles are Steven Crone, leading the consumer finance division, and John Seaman III, overseeing credit risk and quality across the banking segment. Together, this group has built a reputation for conservative growth, local engagement, and sound execution—values that are often overlooked but matter a great deal when it comes to building long-term shareholder value.

Valuation and Stock Performance

CFFI is currently trading around $59.75 with a market cap just under $200 million. Over the last year, the stock has made a dramatic move—from a low of roughly $33 to a high near $90. Even with a recent pullback, it’s still holding well above its long-term averages, suggesting that the broader market is beginning to recognize the company’s earnings consistency and dividend reliability.

The stock’s price-to-earnings ratio is sitting around 9.94, which puts it in solid value territory. More notably, the price-to-book ratio is below 1.0, around 0.86—an indication that shares are trading at a discount to the company’s net asset value. That could be attractive to investors who focus on undervalued financials or who are looking for capital preservation alongside modest income.

Volatility has been low, with a beta of just 0.33, making the stock far less sensitive to broad market swings. This kind of profile tends to appeal to investors who are in it for the long run, not just chasing short-term price moves.

The company also announced a 5% increase to its quarterly dividend, now at $0.46 per share. That move is a clear signal from management that they believe the earnings base is strong enough to support a larger payout without compromising the balance sheet.

Risks and Considerations

No investment comes without risk, and there are a few worth keeping an eye on here. First, the consumer finance segment has shown signs of stress. Charge-offs increased this past year, with net losses as a percent of total loans rising from just under 2% to over 2.6%. That kind of jump can eat into profits if not carefully managed.

There’s also the matter of uninsured deposits. At nearly 30% of total deposits, they introduce some degree of liquidity sensitivity, especially in an environment where confidence in regional banks can shift quickly. While there’s no immediate red flag, it’s something to monitor in case economic conditions tighten or sentiment changes sharply.

Interest rate trends are another factor. As a traditional bank, C&F’s net interest margin plays a huge role in earnings. Fluctuations in the rate curve or unexpected moves by the Federal Reserve could have a direct impact on profitability.

Final Thoughts

C&F Financial stands out for its disciplined approach, long-standing leadership, and straightforward business model. The company’s steady dividend increases, conservative capital management, and local market focus provide a level of reliability that’s hard to find in smaller financial institutions. The current valuation adds to its appeal, especially for investors who are comfortable with a lower-profile, less volatile name.

Of course, it’s important to stay aware of the company’s exposure to consumer credit and shifting rate environments. But as it stands, CFFI continues to navigate those challenges in a way that’s consistent with its long-term track record. The outlook remains grounded, realistic, and steady—qualities that can serve shareholders well over time.