Updated 2/25/26

BWX Technologies (BWXT) operates at the center of the nuclear sector, supplying components and fuel for U.S. Navy submarines and carriers, while expanding into medical isotopes and advanced nuclear technologies. The company generated $3.2 billion in annual revenue, supported by robust operating cash flow of $480 million and a conservative payout ratio near 30%. Shares have surged dramatically over the past year, now trading at $208.27 and approaching their 52-week high of $220.57. Analysts maintain a buy consensus with a mean price target of $229.78. Despite a rich valuation with a P/E above 62, BWXT’s position in national defense, clean energy, and medical technology keeps demand durable, and ongoing investment in advanced manufacturing and capacity expansion underscores a company built for long-term compounding.

.

Recent Events

BWX Technologies has remained active on the strategic front as it moves deeper into 2026. The company has continued to benefit from the broader resurgence of interest in domestic nuclear infrastructure, with government momentum behind both naval propulsion programs and the buildout of advanced reactor technologies accelerating meaningfully. Defense budget discussions in Washington have been broadly favorable for BWXT’s core naval nuclear business, and the company has positioned itself to capture incremental contract activity tied to submarine production rate increases under the AUKUS framework.

On the commercial nuclear side, BWXT has seen growing engagement around its microreactor and advanced reactor programs, which align well with the federal government’s push for energy security and carbon-free baseload power. The medical isotope business, which the company has invested in steadily over recent years, continues to scale and diversify the revenue base beyond traditional defense work. These non-defense verticals are becoming a more meaningful part of the growth story as the company executes on its longer-term strategic vision.

The stock has reflected this enthusiasm emphatically, rising from a 52-week low of $84.21 to a current price of $208.27, a gain of roughly 147% from the trough. That kind of move captures genuine investor confidence in BWXT’s positioning across multiple secular growth themes, from nuclear renaissance to national security.

Key Dividend Metrics

💰 Forward Dividend Yield: 0.49%

📈 5-Year Average Yield: ~1.10%

📅 Most Recent Dividend Payment: $0.25 per share

📉 Ex-Dividend Date: November 19, 2025

🧮 Payout Ratio: 29.64%

📊 Dividend Growth Trend: Positive

🧾 Annual Dividend Rate: $1.02 per share

Dividend Overview

BWXT’s dividend yield of 0.49% is modest by any measure, sitting well below its historical averages as the stock price has dramatically outpaced dividend growth over the past year. That compression in yield is a function of share price appreciation rather than any deterioration in the dividend itself, and income investors should view it accordingly. The company continues to pay a consistent quarterly dividend, most recently at $0.25 per share, and the annual rate of $1.02 keeps the payout well within comfortable reach of earnings and cash flow.

The dividend isn’t the primary reason to own BWXT, and management has never positioned it that way. What the payout signals is a disciplined approach to capital allocation, where shareholders receive a growing but conservative return while the company retains the majority of its earnings for reinvestment in a business that continues to expand into high-value, long-duration markets.

In a business where contract visibility can stretch across decades, the stability of BWXT’s dividend feels intentional and durable rather than aspirational. Income investors should calibrate expectations accordingly: this is a total-return story with a dividend component, not a pure yield play.

Dividend Growth and Safety

BWXT’s dividend history tells a consistent story of measured, predictable growth. In early 2023, the quarterly dividend stood at $0.23 per share. By early 2024, it had moved to $0.24, and in March 2025 it stepped up again to $0.25, where it has remained through the most recent payment in November 2025. That trajectory reflects a compound annual growth rate in the mid-single digits, which, while not aggressive, is steady and repeatable in a sector not known for sharp earnings swings.

From a safety standpoint, the dividend looks very well protected. The payout ratio sits at just under 30%, which leaves significant retained earnings for reinvestment, debt management, and share repurchases. Operating cash flow of $480 million provides a wide margin of coverage above the roughly $93 million the company pays out annually in dividends. Even accounting for capital expenditures, which have reduced free cash flow to approximately $133 million, the dividend remains comfortably funded.

The beta of 0.83 indicates BWXT moves with less volatility than the broader market, a characteristic that income investors tend to value. Institutional ownership remains very high, reflecting the conviction of long-duration holders who see the company’s defense and clean energy positioning as a durable moat. Return on equity of 28.52% demonstrates that even as the company carries debt to support its capital-intensive operations, it is deploying that leverage productively. The dividend, while modest in yield, is underpinned by a business generating real, recurring cash flows from contracts that often span years or even decades.

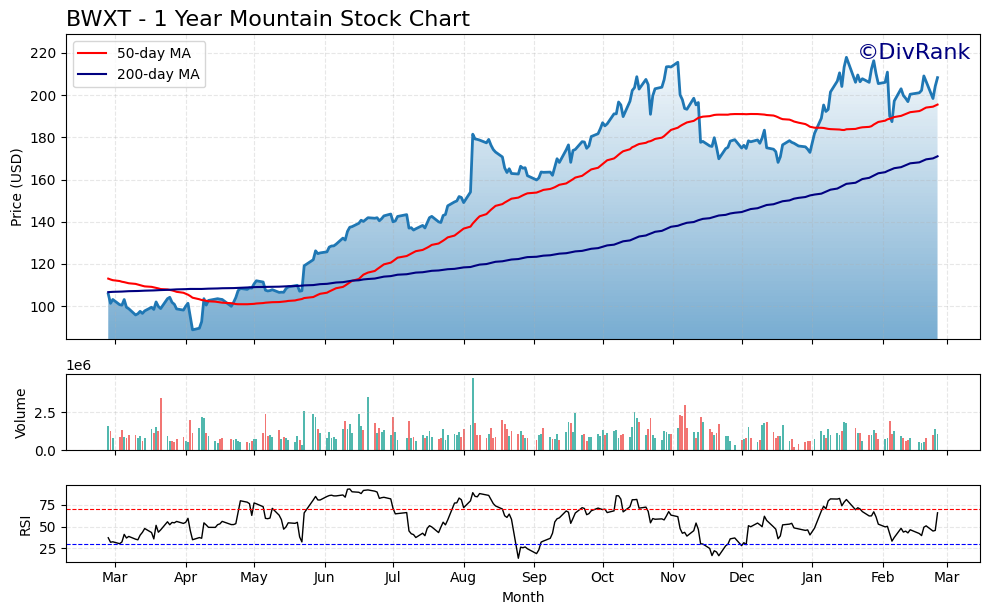

Chart Analysis

BWX Technologies has delivered one of the more striking price recoveries in the defense and nuclear services space over the past year. The stock bottomed near $88.78 at its 52-week low and has since surged to a current price of $208.27, representing a gain of roughly 135% from trough to present. That kind of appreciation is unusual for a company that dividend investors tend to think of as a slow-and-steady compounder, and it reflects a meaningful re-rating in how the market is pricing BWXT’s long-term contract visibility within the U.S. naval nuclear propulsion and small modular reactor ecosystems. The stock is now sitting just 4.42% below its 52-week high of $217.89, which signals that buyers have remained committed even as the share price has entered rarefied territory relative to its recent history.

The moving average picture is unambiguously constructive. BWXT is trading well above both its 50-day moving average of $195.50 and its 200-day moving average of $171.00, and the 50-day has crossed above the 200-day to form what technicians call a golden cross, a configuration that has historically been associated with sustained upward momentum rather than short-term noise. The spread between the current price and the 200-day average is now roughly 22%, which reflects how much ground the stock has covered in a compressed timeframe. That distance is a double-edged observation: it confirms genuine trend strength, but it also means there is limited near-term support if sentiment shifts and the stock needs to consolidate.

📊 RSI sits at 65.91, which places BWXT in firm bullish momentum territory without yet triggering the classic overbought threshold of 70. For income investors, this is actually a reasonably comfortable reading. A reading deep into the 70s or above would suggest the stock is vulnerable to a near-term pullback regardless of fundamentals, but at 65.91 there is still some room for the rally to continue before momentum exhaustion becomes a pressing concern. The caveat is that RSI has been elevated for a stretch now, so any softness in broader defense or energy sector sentiment could see that reading compress quickly.

For dividend investors evaluating BWXT on a total return basis, the technical setup supports a constructive but patient posture. The trend is intact, the moving average structure is bullish, and momentum has not yet reached the kind of extreme that would counsel against initiating or adding to a position on principle alone. The more relevant consideration is that the stock’s rapid appreciation has compressed the dividend yield considerably, which means new buyers are accepting a lower starting yield in exchange for exposure to what the market clearly views as a structurally advantaged business. Investors who already hold shares are in an enviable position; those considering entry should weigh the yield on cost they would be locking in against BWXT’s dividend growth trajectory before committing fresh capital near all-time high territory.

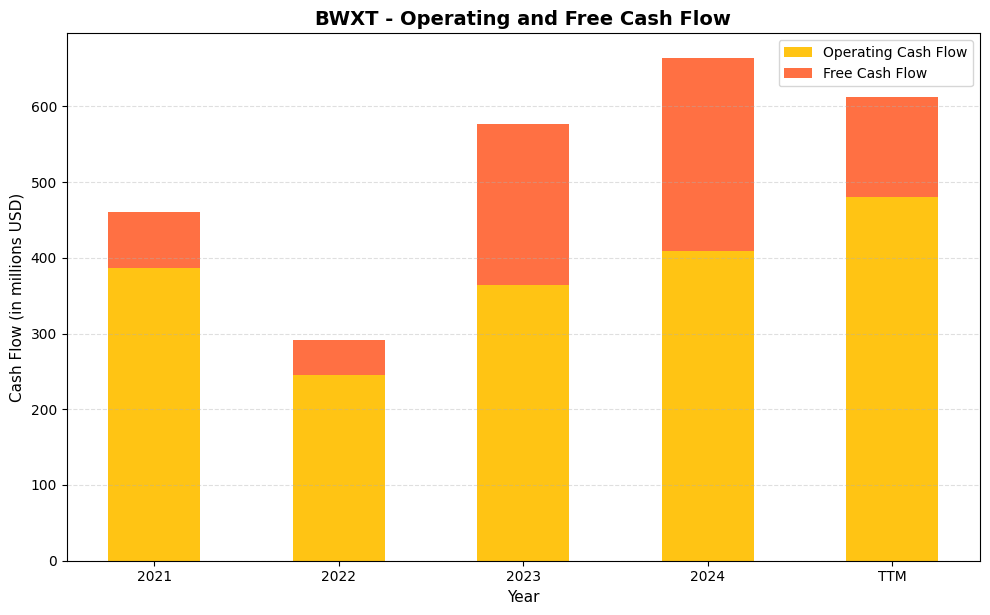

Cash Flow Statement

BWX Technologies has demonstrated a meaningful improvement in cash generation over the period shown, with operating cash flow climbing from $386.0M in 2021 to $408.4M in 2024 and the trailing twelve months reaching $479.8M. Free cash flow tells an even more encouraging story across most of that stretch, recovering sharply from a weak $46.4M in 2022 to $212.4M in 2023 and $254.8M in 2024. The TTM free cash flow of $132.6M represents a step down from the 2024 full-year figure, which warrants attention, but operating cash flow continues to expand, suggesting the near-term dip in free cash flow reflects elevated capital expenditures rather than any deterioration in the underlying business. For dividend investors, a company generating nearly $480M in operating cash flow annually provides a comfortable cushion to sustain and grow its dividend obligations without relying on debt or dilution.

The 2022 figures stand out as the weakest point in this dataset, with operating cash flow falling to $244.7M and free cash flow compressing to $46.4M, likely reflecting timing of contract milestones and working capital movements common in defense and nuclear services businesses. The recovery through 2023 and 2024 was both swift and substantial, and the four-year trajectory makes clear that BWXT’s cash conversion profile has genuinely strengthened. Capital spending appears to have increased in the TTM period, which is compressing near-term free cash flow even as operating cash flow hits a multi-year high, and that dynamic typically signals reinvestment in growth capacity rather than financial stress. For shareholders focused on income, the combination of rising operating cash flow and a manageable dividend payout suggests the distribution has strong fundamental support going forward.

Analyst Ratings

The analyst community holds a constructive view on BWX Technologies, with the consensus sitting at buy across nine covering analysts. The mean price target of $229.78 implies roughly 10% upside from the current price of $208.27, while the high target of $278.00 reflects meaningful optimism among the more bullish members of the coverage group. The low target of $203.00 sits just below the current trading price, suggesting that even the most cautious analyst does not see material downside from current levels.

With no specific named analyst actions available in the current data set, the aggregate picture nonetheless speaks clearly. A buy consensus with a target distribution skewed meaningfully above current prices reflects confidence in BWXT’s ability to sustain earnings growth through its defense contract base, advanced reactor pipeline, and medical technology expansion. The tight clustering near the low end of the target range, with the stock trading close to $208, does suggest that near-term upside from analyst targets is more limited than it was earlier in the stock’s run, and some price target revisions upward would likely be needed to sustain bullish momentum as the year progresses.

Earnings Report Summary

BWX Technologies delivered strong full-year results through the trailing twelve-month period ending in early 2026, with revenue reaching $3.2 billion, net income of approximately $329 million, and earnings per share of $3.35. The profit margin of just over 10% is consistent with prior periods and reflects the company’s ability to manage costs effectively within a highly regulated, contract-driven business environment. Return on equity of 28.52% and return on assets of 5.95% both point to a company that continues to generate meaningful value from its asset base.

Backlog and Business Momentum

BWXT’s backlog remains a critical indicator of future revenue visibility, and the company’s positioning in multi-year naval nuclear contracts, advanced reactor programs, and medical isotope supply agreements continues to support a robust pipeline. The government segment remains the largest and most stable contributor, anchored by long-term agreements tied to submarine and carrier production programs that are not easily disrupted by short-term budget fluctuations. Commercial and medical segments are growing in relative importance and adding diversification to what was historically a heavily defense-concentrated revenue base.

Strategic Moves and Expansion

Management has continued investing in capabilities that extend BWXT’s competitive moat. The Innovation Campus in Lynchburg and other manufacturing infrastructure investments reflect a deliberate effort to build capacity ahead of anticipated demand growth, particularly as the U.S. Navy accelerates its submarine build rate and as advanced reactor programs move closer to deployment. The medical isotope business represents a differentiated growth vector that leverages BWXT’s nuclear processing expertise in a commercially attractive market with favorable supply dynamics.

Looking Ahead

With EPS of $3.35 on a trailing basis and the stock trading at a P/E above 62, the market is clearly pricing in a meaningful acceleration in earnings growth over the coming years. Management’s prior guidance called for revenue approaching $3 billion in 2025, a target the company appears to have exceeded, setting a higher baseline for 2026 expectations. Analysts projecting a mean price target of $229.78 are implicitly expecting continued earnings growth and margin stability, making execution on the backlog and capital project timelines the central variable to watch.

Management Team

At the helm of BWX Technologies is Rex D. Geveden, serving as President and CEO. With a background that includes leadership roles at NASA and Teledyne Technologies, Geveden brings a deep bench of technical and operational expertise. His tenure has been defined by a focus on innovation in nuclear energy, disciplined capital deployment, and expanding the company’s footprint across government, commercial, and medical markets simultaneously.

Supporting Geveden is Robb A. LeMasters, Executive Vice President and Chief Financial Officer. LeMasters brings a strong foundation in investment strategy and corporate finance shaped by his experience at firms such as Blue Harbour Group. His approach has emphasized disciplined capital allocation, balance sheet management, and financial stewardship that keeps the company’s growth investments aligned with long-term shareholder value creation.

The broader leadership team includes Robert L. Duffy, who leads human resources and environmental health and safety as Chief Administrative Officer. Omar F. Meguid, as Chief Digital Officer, plays a pivotal role in guiding the company’s digital and advanced manufacturing initiatives, while Suzy C. Sterner oversees government affairs and corporate communications. Together, this executive team blends deep industry-specific knowledge with strategic vision, keeping BWXT aligned with long-term trends in energy security, national defense, and nuclear technology commercialization.

Valuation and Stock Performance

BWXT’s current valuation demands attention. Trading at $208.27 with a P/E ratio of 62.17 and a price-to-book of 15.45, the stock is priced for a level of earnings growth that leaves little margin for disappointment. The market cap of approximately $19 billion reflects a dramatic rerating of the company over the past twelve months, with shares more than doubling from their 52-week low of $84.21. That kind of appreciation compresses yield, inflates multiples, and raises the stakes for execution.

The premium valuation is not without justification. BWXT operates in markets with high barriers to entry, long-duration government contracts, and secular tailwinds from the nuclear energy renaissance and defense modernization spending. Earnings per share of $3.35 and a return on equity of 28.52% demonstrate genuine fundamental quality. Book value per share of $13.48 and the price-to-book of 15.45 reflect the intangible value of BWXT’s specialized capabilities, regulatory approvals, and customer relationships that don’t appear on the balance sheet.

For long-term investors who bought BWXT earlier in its run, the calculus is relatively straightforward. For new buyers at current prices, the valuation requires confidence that earnings will grow materially in the years ahead to justify a multiple that currently sits well above industrial sector norms. The stock is not cheap, but it is backed by a business with real visibility, genuine scarcity value, and a management team that has demonstrated the ability to deliver.

Risks and Considerations

The most immediate risk facing BWXT investors at current prices is valuation itself. A P/E ratio above 62 leaves the stock highly sensitive to any earnings miss, guidance reduction, or shift in growth expectations. A contraction in the multiple, even without a deterioration in underlying business performance, could result in significant share price pressure given how far the stock has already run.

BWXT’s revenue base remains heavily concentrated in long-term contracts with the U.S. government, which provides stability but also introduces meaningful dependency on federal budget decisions. Any slowdown in defense appropriations, restructuring of naval nuclear programs, or procurement delays could reduce revenue visibility and pressure near-term results. The AUKUS program and submarine production rate increases are broadly positive tailwinds, but execution timelines on complex defense programs rarely proceed without friction.

Regulatory risk is a constant in the nuclear space, and the margin for error is small. BWXT operates under rigorous compliance frameworks across all of its business segments, and any operational incident, quality control issue, or regulatory finding could have consequences for contract renewals and reputational standing with government customers. Public and political sentiment around nuclear energy, while generally improving, can shift in ways that affect the pace of investment in the sector.

The company’s free cash flow of $132.6 million, while sufficient to fund the dividend, is notably lower than operating cash flow due to elevated capital expenditure levels. If those capital projects take longer than expected to generate returns, or if cost overruns emerge, the company’s financial flexibility could narrow. Rising interest rates or tighter credit conditions would also increase the cost of debt that supports BWXT’s capital-intensive operations.

Final Thoughts

BWX Technologies is a company that has earned its premium valuation through years of disciplined execution, strategic positioning in irreplaceable niches, and consistent delivery on long-term government contracts. The nuclear sector is having a moment, and BWXT is firmly at the center of it, with exposure to naval defense, clean energy, and medical technology that gives the business multiple vectors for growth over the coming decade.

The dividend at 0.49% is not the reason to own this stock, but it reflects a management team that treats shareholder returns as a consistent priority even as it invests aggressively in the future. For investors comfortable with a high-multiple, lower-yield, total-return-oriented holding, BWXT represents one of the more defensible growth stories in the industrial landscape. The risks are real, particularly around valuation and government budget dependency, but so is the quality of the underlying business. BWXT remains a compelling long-term hold for investors willing to pay for consistency, scarcity, and a business model built around the kind of work that few others can do.