Updated 4/11/25

Brookfield Corporation (BN) is a global asset manager and operator with a presence across infrastructure, real estate, renewable energy, and private equity. With over $900 billion in assets under management and a history of disciplined capital deployment, it has built a reputation for long-term value creation. The company delivered strong 2024 results, including $6.3 billion in total distributable earnings and a 55% stock price increase over the year. Its leadership, anchored by CEO Bruce Flatt, has consistently emphasized patient, opportunistic investing. While the dividend yield remains modest at 0.78%, Brookfield’s strategy focuses on compounding value through asset growth and shareholder alignment, supported by active share repurchases and robust cash generation. For investors focused on long-term fundamentals and consistent execution, BN remains a name that reflects both scale and stability in a shifting global market landscape.

Recent Events

Brookfield’s had a solid run lately. Over the past year, the stock’s up nearly 20%, outpacing the broader market. That’s impressive, especially when you consider that total revenue actually dropped 18% over the last year. For most companies, that would be a red flag. For Brookfield, it’s more of a footnote. That’s because this isn’t your typical company driven by quarterly sales targets—it’s a long-term investor and capital allocator.

Earnings have been softer too, down more than 38% year-over-year in the most recent quarter. But again, that doesn’t tell the whole story. Brookfield continues to put capital to work across high-conviction areas like infrastructure and distressed real estate. It’s in moments like this—when markets are uncertain—that Brookfield tends to plant seeds for future growth.

The company’s scale is massive. With a market cap close to $70 billion and an enterprise value approaching $290 billion, it’s one of the largest players in the global asset space. Yes, it’s highly leveraged—debt sits at over $249 billion—but that’s typical in its line of business. And with more than $15 billion in cash and a current ratio over 1.0, it has the liquidity to manage near-term obligations comfortably.

Another point that might catch investors’ eyes: insider ownership stands at a healthy 17.5%, and institutional holders control nearly 59% of shares. That level of buy-in from people who know the business best adds a layer of confidence for income-minded investors.

Key Dividend Metrics

📈 Forward Yield: 0.78%

📆 Dividend Date: March 31, 2025

🔪 Payout Ratio: 103.23%

💵 Forward Annual Dividend: $0.36 per share

🧮 5-Year Average Yield: 1.04%

📉 Trailing Dividend Yield: 0.68%

📅 Ex-Dividend Date: March 14, 2025

Dividend Overview

Let’s set expectations upfront—Brookfield’s dividend isn’t the kind of yield that gets featured in top-income stock lists. At 0.78%, it’s modest. But for investors who appreciate quality over quantity, it’s not about how much you’re getting today. It’s about where the dividend is going and how it fits into a broader strategy of compounding value.

Brookfield has been consistent with its payout. It’s not flashy, but it’s reliable. And in the world of dividend investing, that counts for something. The company’s most recent dividend came in at $0.09 per share, which lines up with its past payments. There’s no racing to raise the dividend here, but there’s also no drama. The checks keep coming.

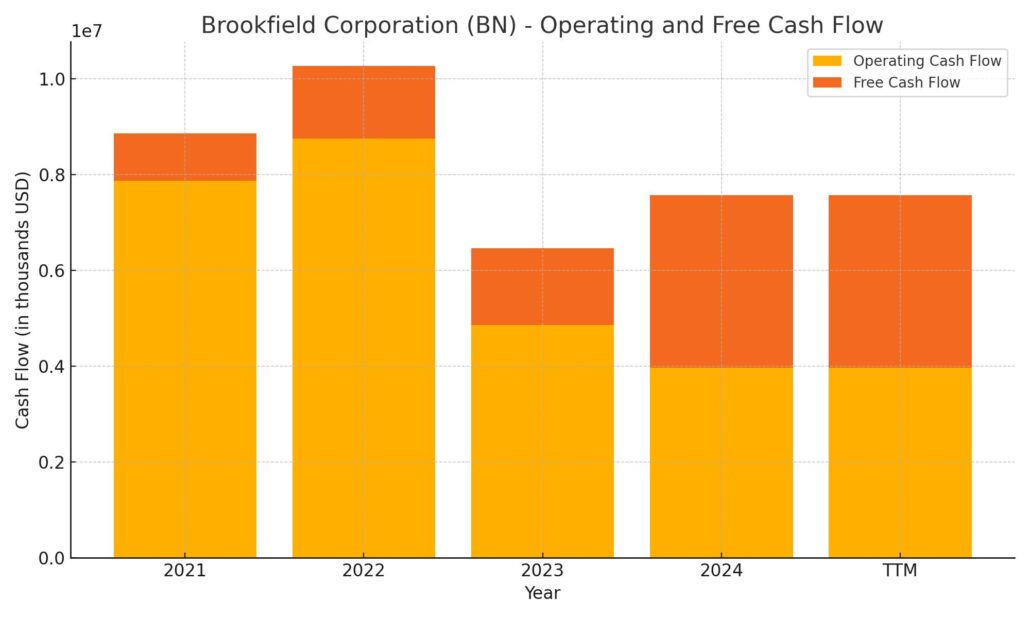

The payout ratio looks high—over 100%—but it’s not quite as concerning as it might seem. That figure is based on GAAP net income, which can swing wildly for a complex company like Brookfield. When you dig into the actual cash flow, the story looks a lot more stable. With nearly $7.6 billion in operating cash flow and a positive levered free cash flow position, Brookfield has the resources to keep supporting its dividend, even with that high payout number on paper.

Dividend Growth and Safety

Brookfield isn’t trying to be a high-yield name. It’s trying to be a long-term, total-return story that also happens to reward shareholders with consistent income along the way. And that’s exactly what it’s done. Over the last several years, the dividend has been steady—not growing rapidly, but also not cut. That kind of predictability is what makes it appealing for certain types of portfolios.

Is the dividend safe? Based purely on the GAAP earnings, you might worry. But Brookfield’s structure makes those numbers less relevant. The company earns a significant chunk of its income from managing external capital and collecting fees—income that’s far more predictable than earnings from asset sales or one-time gains.

That fee-related revenue stream gives Brookfield a stable foundation to support its dividend. Plus, the company owns large stakes in its publicly traded affiliates like Brookfield Renewable and Brookfield Infrastructure, which themselves are dividend-paying machines. Those upstream dividends give Brookfield added flexibility to continue paying shareholders, even if the top-level earnings fluctuate.

It’s also worth noting that Brookfield has a history of managing its capital with long-term discipline. The company is careful not to overextend on dividends just to appease short-term yield hunters. Instead, it reinvests heavily in areas with higher long-term returns, while maintaining a reasonable, steady payout to shareholders.

Cash Flow Statement

Brookfield’s trailing twelve-month (TTM) cash flow paints a clear picture of how capital-intensive its business truly is. The company generated $7.57 billion in operating cash flow, which is a step up from the prior year and shows the core business is still producing meaningful cash despite macro headwinds. However, free cash flow came in negative at -$3.6 billion, largely due to heavy capital expenditures of over $11 billion. This underscores Brookfield’s ongoing investments into long-term infrastructure and asset-backed projects that won’t yield immediate returns but are aimed at long-term value creation.

On the financing side, Brookfield remains highly active. The company brought in a massive $111.9 billion through new debt issuance while repaying $86.4 billion, reflecting its usual strategy of rotating capital through refinancing and restructuring debt. The net result was a solid increase in its end cash position to just over $15 billion, up from $11.2 billion the year before. While the negative free cash flow might catch attention, Brookfield’s business model—anchored in long-duration assets—frequently involves periods of heavy investment funded by debt and capital markets activity. It’s consistent with the way the company has historically grown and managed its financial structure.

Analyst Ratings

Brookfield Corporation (BN) has seen a few noteworthy analyst moves recently that reflect a cautious optimism about its long-term outlook. 📈 Morgan Stanley initiated coverage with an “Overweight” rating and set a price target of $80. The rationale? They see strength in Brookfield’s asset management platform and its consistent ability to find value across global markets.

🏦 TD Securities continues to back the stock with a “Buy” rating, nudging its target up slightly from $74 to $75. This suggests ongoing confidence in management’s capital allocation strategy and how the company is positioning itself in a more uncertain economic environment.

📊 Scotiabank remains constructive but slightly more conservative, holding a “Sector Outperform” stance while trimming the price target from $71 to $68. That shift appears to be more about macroeconomic caution rather than company-specific concerns.

💬 Across the board, the consensus rating is a “Moderate Buy,” with analysts setting an average price target of $63.63. With shares recently around $48, that implies a potential upside of roughly 36%. Targets range from a low of $46 to a high of $80, showing a decent spread in sentiment but skewed toward the positive.

🔍 The general takeaway from these updates is that while there’s some hesitancy due to broader market volatility, analysts see Brookfield’s diverse and cash-generating asset base as a long-term strength worth keeping on the radar.

Earnings Report Summary

Brookfield Corporation closed out 2024 with solid momentum, delivering a performance that reinforced its reputation as a well-oiled capital allocator. It wasn’t a flashy quarter, but it was the kind of steady, high-quality execution that long-term investors have come to expect from the firm.

Net Income and Distributable Earnings

For the full year, Brookfield reported net income of $1.9 billion. More telling, though, were the gains in distributable earnings. The company posted $4.9 billion in distributable earnings before realizations—up 15% from the year before. That breaks down to $3.07 per share, which gives a clearer picture of the company’s ability to generate cash. When you include realizations, total distributable earnings came in at $6.3 billion, marking a 31% year-over-year increase. These are the numbers that underpin Brookfield’s financial flexibility and long-term dividend potential.

Strength in Asset Management and Wealth Solutions

The asset management business continues to be the engine. Distributable earnings in that segment hit $2.6 billion, helped along by more than $135 billion in inflows. That’s pushed fee-bearing capital up to $539 billion, an 18% gain. Meanwhile, the wealth solutions segment nearly doubled its contribution, with $1.4 billion in distributable operating earnings. Clearly, the expansion into private wealth and retail capital is starting to pay off.

Capital Returns and Future Pipeline

Brookfield was also active on the capital return front. It repurchased around $1 billion worth of its own shares last year, which ended up adding $0.80 in value to each remaining share. They didn’t stop there—another $200 million in buybacks followed in early 2025. That kind of shareholder alignment is always reassuring.

The company also pointed to a deep pipeline of upcoming asset sales and a growing pile of unrealized carried interest—about $11.5 billion in total, with $10 billion belonging to the parent. That gives Brookfield plenty of dry powder to deploy when the right deals surface.

Outlook

Looking into 2025, management struck a confident tone. Market conditions are more favorable than they’ve been in a while, and Brookfield sees strong tailwinds for growing earnings and increasing intrinsic value per share. It’s not chasing short-term wins—it’s methodically building value, quarter after quarter.

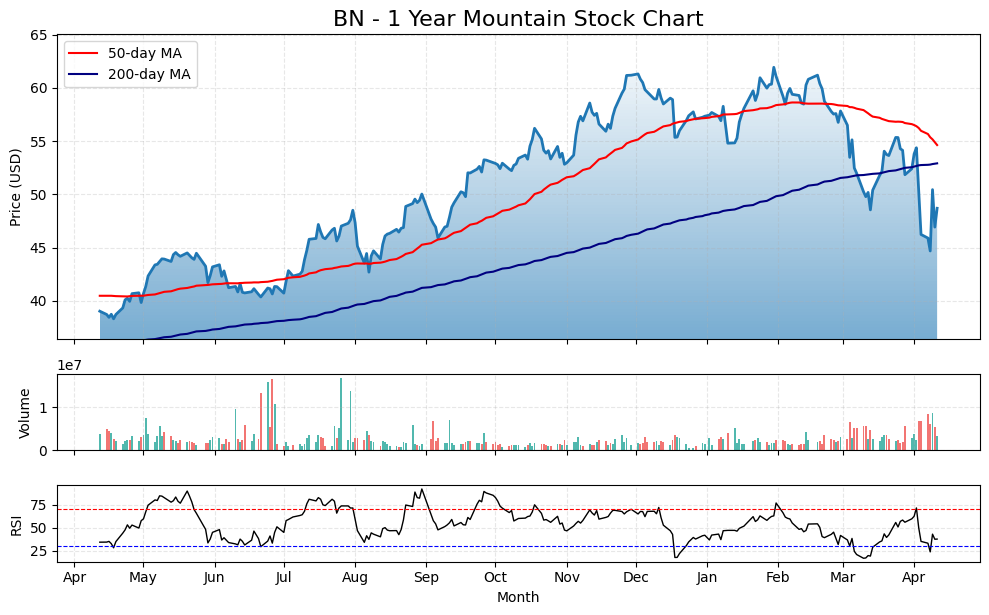

Chart Analysis

BN has had quite a ride over the past year, and this chart reflects a story of strength, fatigue, and a possible shift now taking shape. From the lows of last spring, the stock carved out a strong rally through summer and fall, pushing up past $60 by early 2024. But that momentum didn’t last. Since February, the tone has changed, and the recent price action suggests we’re in a different phase now.

Moving Averages

The 50-day moving average, which had been trending nicely above the 200-day for most of the year, has started to roll over. That red line has now curved downward and crossed back below the price action. Meanwhile, the 200-day moving average continues to slope upward, but at a more gradual pace. This suggests a longer-term uptrend is still intact, though recent weakness is putting it to the test. Prices dipping below both averages shows the market is reevaluating the recent bullish trend.

Volume

Volume hasn’t exploded, but there are some noticeable spikes around the sharp dips—especially during March and early April. That kind of activity often signals institutional positioning, either rotating out or stepping in after a pullback. The increased turnover during those declines indicates that the recent selling wasn’t just passive. Someone was hitting the exits, or buying with conviction into the weakness.

RSI

The relative strength index has been dancing near oversold territory a few times recently, especially during that drop into April. It hasn’t spent much time below the 30 mark, but it came close, which reflects a lot of near-term pressure on the stock. Now that RSI is climbing again, there’s a bit of short-term recovery brewing, but momentum is still fragile. It’s not signaling exuberance—if anything, it looks like a wait-and-see mood has taken over.

All in, the chart suggests BN is coming off a cooling period after a long run, and it’s now sitting at a more reflective level. The longer-term trend isn’t broken, but it’s definitely being tested. The next few weeks will be important for seeing whether this bounce has legs or if it stalls out below the longer-term average.

Management Team

Brookfield Corporation is led by a seasoned and stable leadership team that has guided the company through decades of growth and transformation. At the helm is Bruce Flatt, who has served as CEO since 2002. Flatt is known for his disciplined, long-term approach to capital allocation and has been instrumental in expanding Brookfield’s global footprint across infrastructure, real estate, renewable energy, and private equity. His leadership has earned him a reputation as one of the most influential figures in the alternative asset management industry.

Supporting Flatt is Nicholas Goodman, who holds the dual role of President and Chief Financial Officer. Goodman has been with Brookfield since 2010 and has played a key role in overseeing the company’s financial strategy and operations. His experience spans various leadership positions within Brookfield, including CFO of Brookfield Renewable Partners. Connor Teskey, President of Brookfield Asset Management and CEO of Renewable Power & Transition, is another pivotal figure. Teskey has been instrumental in driving Brookfield’s renewable energy initiatives and expanding its presence in Europe. The leadership team’s deep experience and cohesive vision have been central to Brookfield’s sustained success.

Valuation and Stock Performance

Brookfield’s stock has demonstrated robust performance, with a notable 55 percent increase in 2024. This surge reflects investor confidence in the company’s strategic direction and its ability to generate consistent returns across its diversified portfolio. Despite this strong performance, Brookfield’s shares have often traded at a discount to intrinsic value, a phenomenon attributed to the complexity of its corporate structure and the opacity of its financial reporting.

Analysts have highlighted that Brookfield’s intrinsic value, calculated through a combination of discounted cash flow and relative valuation methods, stands considerably higher than its current market price. This suggests that the stock is undervalued by a significant margin. The company’s forward price-to-earnings ratio of 12.62 and price-to-book ratio of 1.67 further indicate attractive valuation metrics relative to industry peers. Brookfield’s strong asset base, including significant holdings in renewable energy and infrastructure, underpins its valuation and offers potential for long-term appreciation.

Risks and Considerations

Investing in Brookfield comes with certain risks that warrant consideration. The company’s complex organizational structure, involving numerous subsidiaries and investment vehicles, can obscure transparency and make it challenging for investors to fully assess its financial health. Additionally, Brookfield’s reliance on non-standard financial metrics, such as distributable earnings, has drawn scrutiny and raised questions about the comparability of its financial statements.

Another concern is Brookfield’s use of internal transactions to boost reported earnings. The company has engaged in buying and selling assets between its own entities, which, while legal, can complicate the true representation of its earnings and asset valuations. Critics argue that such practices may inflate earnings and obscure the company’s actual financial performance. Moreover, Brookfield’s significant exposure to real estate and infrastructure assets means it is susceptible to market fluctuations and economic downturns, which could impact asset values and income streams.

Final Thoughts

Brookfield Corporation stands as a formidable player in the global asset management arena, with a diversified portfolio and a leadership team renowned for strategic acumen. The company’s strong stock performance and attractive valuation metrics underscore its potential for long-term growth. However, investors should remain cognizant of the complexities inherent in Brookfield’s structure and financial reporting practices. While the company’s approach to internal transactions and reliance on non-standard metrics may raise questions, its track record of delivering returns and managing a vast array of assets suggests a capacity to navigate these challenges effectively. A thorough understanding of the company’s operations and a careful assessment of its financial disclosures are essential for making informed investment decisions.