Updated 4/11/25

Boise Cascade isn’t a company that makes a lot of noise. It’s not one of those names you hear tossed around at every cocktail party or trending across financial Twitter. But if you’re someone who values consistent performance and thoughtful dividend policies, this wood products and building materials company might deserve a spot on your radar.

Headquartered in Boise, Idaho, the company manufactures engineered wood products and distributes building materials across North America. It’s a business deeply tied to the housing and construction cycle, so demand can ebb and flow with broader economic trends. But through those waves, Boise Cascade has quietly built a reputation for sound financial management and steady cash generation—two things dividend investors tend to care about most.

Recent Events

BCC’s stock has taken a noticeable step back over the past year. From its 52-week high of $155.42, shares have slipped nearly 37%, recently trading around the mid-$90s. That kind of drop might spook some, but it opens the door for long-term investors to take a closer look at what’s under the hood.

Revenue is down 4.7% year-over-year, and earnings have slipped nearly 30%, largely due to softening in residential construction. Homebuilding activity has cooled, and that naturally impacts demand for engineered wood and other building products. This isn’t unexpected—Boise Cascade operates in a cyclical space.

What stands out, though, is how well the company is weathering the storm. It’s sitting on more than $714 million in cash while keeping debt modest at around $528 million. That’s not something you see often in cyclical businesses. The result is a company that remains in control even when the environment isn’t cooperating.

Key Dividend Metrics

💸 Forward Dividend Yield: 0.88%

📈 5-Year Average Dividend Yield: 0.71%

🧮 Payout Ratio: 8.57%

🏦 Dividend Rate (Annualized): $0.84

📆 Next Dividend Date: March 19, 2025

⏳ Ex-Dividend Date: February 24, 2025

These figures paint the picture of a dividend that’s not oversized, but it’s reliable. And with such a low payout ratio, there’s little pressure on management to maintain it even in tougher years.

Dividend Overview

Boise Cascade’s dividend isn’t going to turn heads at first glance. The yield sits just under 1%, which might seem underwhelming. But when you look closer, what you see is a management team that prioritizes financial strength and avoids overextending.

The cash flow is solid—$438 million in operating cash over the past year—and the current ratio is sitting at 3.34, giving the company plenty of breathing room. There’s no strain here, no sense that the dividend is at risk. In fact, it’s the opposite. The company pays what it can comfortably afford, leaving room for capital investment or share repurchases when the opportunity arises.

Rather than chasing a high yield to attract short-term attention, Boise Cascade focuses on keeping its core operations strong and rewarding shareholders gradually. That strategy might not scream excitement, but for income-focused investors, it can be a thing of beauty.

Dividend Growth and Safety

Here’s where Boise Cascade really separates itself. That 8.57% payout ratio? It’s a cushion. Even if earnings were cut dramatically, the dividend would still be covered with room to spare. That’s the kind of security that lets dividend investors sleep well at night.

Dividend increases don’t come fast and furious, but they do come thoughtfully. The company takes its time, making sure any hike is sustainable. Special dividends also come into play during stronger periods, offering a way to share excess profits without locking into a higher recurring payout.

Compared to the five-year average yield of 0.71%, today’s yield of 0.88% offers a bit more income. That bump comes thanks to the recent price decline, not a change in policy, making this potentially a more favorable entry point for those building out a dividend portfolio.

While insider ownership is relatively low at under 1%, institutional investors own over 100% of the float. That tells you something—namely, that the big players trust the direction this company is heading, and that management has earned a reputation for steering the ship wisely.

Cash Flow Statement

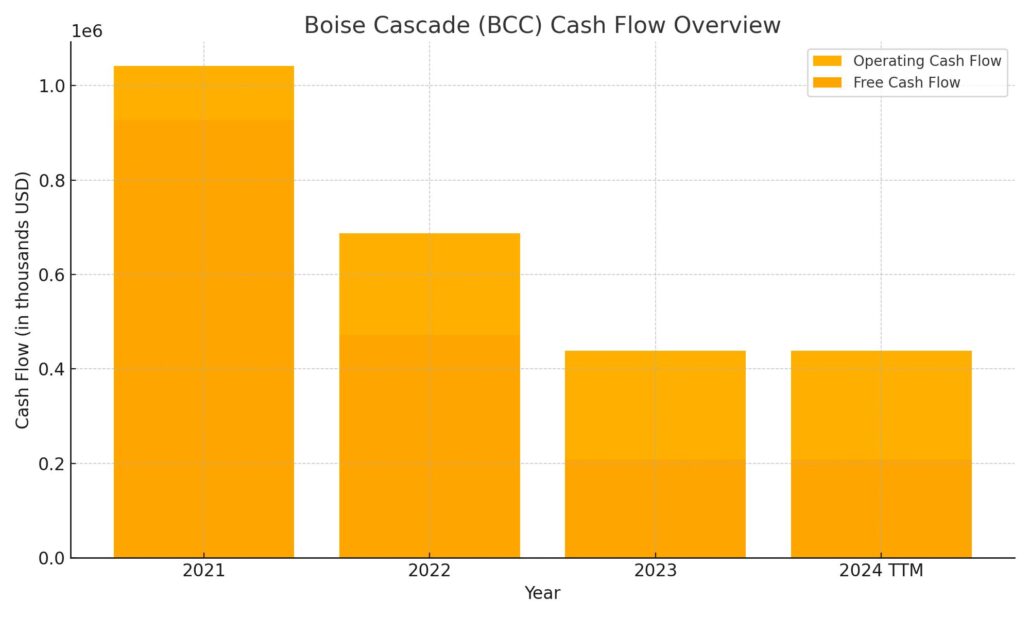

Boise Cascade generated $438 million in operating cash flow over the trailing 12 months, a noticeable drop from the peak of $1.04 billion recorded in 2021. That decline tracks with broader softness in the housing market, which has cooled demand for building materials and wood products. Still, the company managed to produce positive free cash flow of just under $209 million after capital expenditures, showing that even in a slower environment, it’s maintaining solid cash-generating power.

On the investing side, the company spent nearly $238 million, most of which went toward capital expenditures that have steadily increased over the past few years. Financing activities drained another $437 million, a sign Boise Cascade continues returning cash to shareholders and managing its balance sheet conservatively. Despite these outflows, the company ends the period with $713 million in cash—down from last year, but still a robust cushion that supports dividend stability and strategic flexibility.

Analyst Ratings

📊 Boise Cascade (BCC) currently holds a consensus rating of “Hold” among analysts, based on seven evaluations: one “Sell,” three “Hold,” and three “Buy.” 🎯 The average 12-month price target stands at $128.50, suggesting a potential upside of approximately 43% from recent trading levels.

🔧 Recent analyst actions include Truist Securities maintaining a “Buy” rating but lowering the price target from $157 to $134, reflecting adjustments to earnings expectations. 📉 Similarly, DA Davidson reaffirmed its “Buy” rating while trimming the target from $155 to $125, and Loop Capital held steady with a “Buy” outlook but slightly reduced the target from $145 to $140. These moves show a touch of caution in the short term but also a belief that the company’s underlying business remains solid.

🪟 On the other side, BMO Capital kept a “Hold” rating and adjusted its price target downward from $136 to $122, signaling a more reserved take on the near-term potential. Overall, while analysts are dialing back expectations slightly, there’s still general confidence in Boise Cascade’s operational footing and long-term stability. The revisions seem more about adjusting to market conditions than any fundamental shift in the company’s prospects.

Earning Report Summary

Revenue Takes a Breather

Boise Cascade’s most recent earnings report showed what many were expecting—things have cooled off a bit. After riding a wave of strong demand in recent years, the slowdown in the housing market is starting to show up in the numbers. Revenue came in lower compared to the same period last year, which isn’t surprising given the dip in new residential construction and building activity. Both the wood products and distribution segments saw less volume, a reflection of what’s happening across the broader market.

Still Holding Its Ground

Even with sales coming down, the company managed to keep profitability in check. Margins were compressed a bit, but Boise Cascade didn’t let things get out of hand. Net income for the trailing twelve months was just shy of $376 million, and earnings per share landed at $9.57. Those numbers are softer than the highs we saw during the peak construction boom, but they still show a business that’s holding its ground when conditions get a little tougher.

Cash Flow Remains Solid

One thing that stood out in the report was how well Boise Cascade is managing its cash. Operating cash flow stayed strong, even with the dip in revenue. Capital spending has gone up some, which shows the company is still investing in the future, not just pulling back and playing defense. It’s a smart approach—balanced and forward-looking.

Balance Sheet Strength

The company also continues to show financial discipline. It ended the period with more than $700 million in cash, and its debt levels remain low. The current ratio is sitting above 3, which is more than enough to give them breathing room if market conditions stay sluggish. That kind of financial cushion makes it easier to stick with dividend payments and keep options open for the right opportunities.

A Steady Hand

Boise Cascade’s leadership didn’t sugarcoat the slowdown—they acknowledged it. But they also pointed to long-term trends like the persistent undersupply in U.S. housing and their ability to pivot based on changing demand. They’re staying flexible, managing inventory carefully, and making sure they’re positioned for whatever the market brings next.

It’s not a flashy quarter, but it’s one that speaks to resilience. The company’s staying focused, keeping expenses in line, and riding out the slowdown with a steady hand.

Management Team

BlackRock is led by CEO and co-founder Larry Fink, who has played a central role in shaping the company into the world’s largest asset manager. With over three decades at the top, Fink brings not just experience but a clear, long-term vision that’s been tested through multiple market cycles. His focus on risk management, innovation, and steady growth has helped guide the firm through some of the most volatile financial environments in history.

Working alongside Fink is a deep and experienced executive bench. President Robert Kapito, also a co-founder, has been instrumental in managing the firm’s day-to-day operations and driving its product development strategy. CFO Martin Small and COO Rob Goldstein each bring specialized expertise, with Small overseeing the firm’s financial health and Goldstein spearheading its technology platforms, including Aladdin. There’s also been ongoing preparation for succession. Names like Rachel Lord and Rob Goldstein are frequently discussed as part of that next generation of leadership, which speaks to the company’s focus on continuity and long-term stewardship.

Valuation and Stock Performance

As of mid-April 2025, BlackRock shares are trading near $885. While the stock has come off its highs earlier in the year, its performance remains strong relative to broader market trends. The pullback appears more reflective of macro pressure than company-specific issues, especially given BlackRock’s solid fundamentals.

The company trades at a forward P/E of around 22 times earnings, which for a firm of this size and consistency, is seen as relatively fair. Its price-to-book ratio has hovered just under 3, and enterprise value metrics continue to show strong alignment between valuation and actual cash generation. Analysts currently have a 12-month consensus price target around $1,098, suggesting moderate upside from current levels based on earnings strength and asset growth.

Assets under management have reached a record $11.58 trillion. That figure isn’t just a headline—it reflects strong demand for BlackRock’s range of investment vehicles, particularly ETFs and fixed-income products. The company’s infrastructure, including its proprietary risk analytics system and global client base, has helped maintain a flow of capital even in choppier markets.

Risks and Considerations

Despite its position at the top of the asset management food chain, BlackRock isn’t without its vulnerabilities. Broader economic uncertainty, particularly surrounding inflation and interest rate policy, could impact investor behavior. Recent shifts in the macro landscape have created headwinds for capital markets, and while BlackRock has weathered them well so far, future volatility could present new challenges.

Regulatory risk is also worth watching. With BlackRock’s global reach and significant market influence, it often finds itself in the crosshairs of regulators and policymakers. Different jurisdictions carry different rules, and navigating that landscape takes constant oversight. Whether it’s related to ESG mandates, financial disclosure requirements, or political scrutiny, regulation can affect both operations and reputation.

Technology is another area of both opportunity and risk. BlackRock’s platforms like Aladdin are core to its value proposition, but reliance on complex systems brings cybersecurity into focus. As digital threats become more sophisticated, continued investment in protecting data and maintaining operational continuity is a must.

Final Thoughts

BlackRock stands out for its scale, consistency, and leadership. The management team has shown a steady hand in navigating a shifting investment landscape, and the firm’s focus on long-term strategy over short-term reaction has served it well. While valuation is no longer in deep discount territory, the stock still offers a balanced profile of income, growth potential, and defensive stability.

In the face of regulatory pressure, economic headwinds, and evolving investor demands, BlackRock continues to adapt without losing sight of its core strengths. That blend of innovation, risk discipline, and capital stewardship gives the firm a long runway. It’s not just about the numbers—it’s about the structure and mindset that have made BlackRock a pillar in the investment world.