Updated 4/11/25

Becton, Dickinson and Company, or BD for short, may not be the flashiest name in healthcare, but it’s the kind of business that dividend investors tend to appreciate. It’s been around since 1897, and during that time, it’s built a reputation as one of the more dependable players in the medical technology space. From surgical tools and diagnostic systems to medication management solutions, BD plays a critical role in the day-to-day operations of hospitals and clinics around the globe.

This isn’t a company chasing fads or pivoting to the next big thing every few years. It’s focused, methodical, and long-term oriented. That same mindset carries over to how it handles shareholder returns—especially the dividend. BD has been returning cash to investors for over half a century, and it’s done so through market cycles, crises, and regulatory shifts. Let’s break down where the company stands today, especially from the viewpoint of income-focused investors.

Recent Events

In the most recent quarter ending December 31, 2024, BD posted nearly 10% year-over-year growth in revenue—no small feat for a company of its scale. That brought total revenue for the trailing twelve months to $20.6 billion. Earnings also moved in the right direction, climbing 7.8% compared to the previous year. Diluted EPS for the same period came in at $5.93.

Margins are holding up, too, with an operating margin north of 15%. EBITDA reached $5.5 billion, showing that BD isn’t just growing, but doing so profitably.

Debt remains something to keep an eye on, sitting at $18.76 billion. That puts the debt-to-equity ratio at just over 74%, which isn’t insignificant. Still, with over $3.3 billion in levered free cash flow, the company’s financial footing is solid enough to manage that burden while still supporting capital returns to shareholders.

Key Dividend Metrics

📦 Forward Annual Dividend Rate: $3.98 per share

📈 Forward Dividend Yield: 1.92%

📊 5-Year Average Dividend Yield: 1.42%

💰 Payout Ratio: 65.49%

📆 Most Recent Dividend Date: March 31, 2025

⚠️ Ex-Dividend Date: March 10, 2025

🔄 Dividend Growth Streak: 52 consecutive years

Dividend Overview

BD isn’t one of those companies with eye-popping yields, but that’s not really the point. What you get here is predictability. At 1.92%, the forward yield sits modestly above its five-year average, which gives it a bit more appeal given the recent pullback in share price. With the stock currently trading around $202—well off its 52-week high near $252—the yield is slightly juicier than usual for new investors stepping in.

That yield is backed by real staying power. BD has increased its dividend every year for 52 straight years. That’s a level of consistency few companies can claim. The current payout ratio of 65.49% suggests there’s still some breathing room between earnings and what’s being paid out. It’s not ultra conservative, but it’s far from stretched.

Even with macroeconomic noise and rising costs in the healthcare supply chain, BD has managed to hold its ground. That says a lot about how the business is run and how carefully the dividend is managed. It’s not just a quarterly check—it’s part of the company’s identity.

Dividend Growth and Safety

One of the most appealing aspects of BD for dividend investors is the way it grows its payout. You won’t see wild swings or double-digit increases every year, but the growth is steady. Typically, dividend hikes come in at a pace that’s easy to digest—think mid-to-high single digits.

There’s a sense of rhythm to it. Earnings come in, cash flow holds steady, and the dividend ticks up again. It’s reliable, like clockwork. Over the past year, BD generated $3.65 billion in operating cash flow and nearly matched that with $3.36 billion in levered free cash flow. That gives plenty of cushion to not only sustain the dividend, but to continue growing it.

The balance sheet has some leverage, but management has shown they can handle it. That strong cash generation combined with stable margins gives confidence that the dividend isn’t in jeopardy, even in a tougher economic environment.

The stock’s valuation adds another layer of appeal for those eyeing dividend yield in relation to price. The forward P/E sits at 14.2—noticeably lower than its trailing P/E of over 33. That gap isn’t just a function of earnings catching up—it also reflects a stock that’s been out of favor recently. For income-focused investors, that can be an opportunity. When quality businesses get overlooked, yields quietly improve.

BD’s beta is just 0.38, which means it doesn’t move nearly as much as the broader market. For anyone building a dividend-focused portfolio that leans toward low volatility, that’s a huge plus. You’re getting consistent income with a smoother ride.

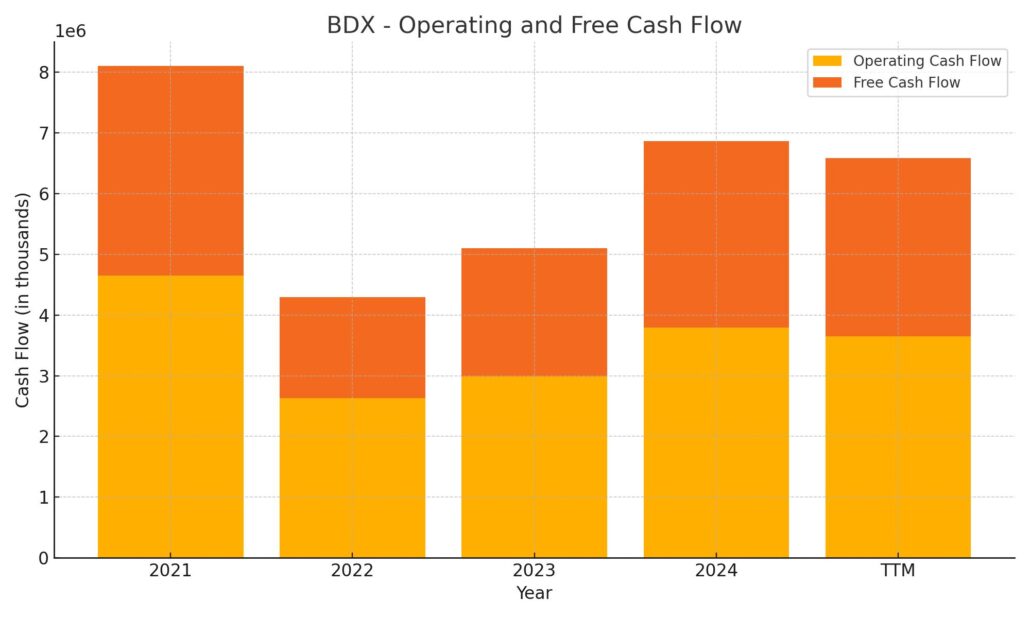

Cash Flow Statement

Over the trailing twelve months, Becton, Dickinson and Company generated $3.65 billion in operating cash flow, reflecting a steady increase from the prior two years. This strength in core operations helped support $2.94 billion in free cash flow, a figure that comfortably covers its dividend commitments and allows for reinvestment. Capital expenditures remain manageable at $714 million, showing a disciplined approach to growth without overextending financially.

On the investing side, BD recorded a cash outflow of $5.08 billion, signaling a significant allocation toward acquisitions or long-term assets. While this is the largest use of cash in recent years, the company offset some of that pressure with $1.02 billion in net financing inflows. Still, the end cash position declined to $828 million—down sharply from the prior year. This dip isn’t alarming but worth watching, especially if investment spending continues at this pace. Overall, the cash flow profile remains resilient and supportive of the dividend.

Analyst Ratings

📊 Becton, Dickinson and Company (BDX) has recently seen a mix of moves from Wall Street analysts. On April 7, 2025, Barclays maintained its “Overweight” rating but trimmed its price target from $279 to $261. The slight pullback reflects some caution around margin pressures and the financial impact of BD’s ongoing investment in innovation and infrastructure. Even so, Barclays remained constructive on the stock’s long-term trajectory.

📈 Meanwhile, Piper Sandler held firm on its “Overweight” rating as well but nudged its price target higher—from $275 to $280. Their more bullish stance stems from confidence in BD’s growth strategy, particularly the strength in its product development pipeline and continued operational execution.

💬 Overall, the consensus price target for BDX now sits around $269.33. That’s a decent spread above the current trading range, suggesting analysts generally see room for appreciation. The tone across the board leans positive, though there’s clear awareness of near-term headwinds. Analysts seem to agree that while BD may face some pressure in the short run, the business fundamentals remain solid enough to keep the long-term story intact.

Earning Report Summary

Becton, Dickinson and Company kicked off its fiscal 2025 with a strong start, delivering results that outpaced expectations and gave shareholders a bit more to smile about. The company reported first-quarter revenue of $5.17 billion, which marked a healthy 9.8% increase over the same period last year. That’s not easy to pull off for a business of this scale, but BD saw strong demand both at home and overseas, with U.S. sales jumping 12% and international sales up nearly 7%.

Adjusted earnings per share came in at $3.43—well ahead of what many on the Street had forecast. That’s a 28% increase from the prior year’s quarter, and it shows the company is managing to grow earnings even as it continues investing in its future.

Segment Performance

The Medical segment was clearly the standout this quarter. It brought in $2.62 billion in revenue, climbing more than 17% from a year ago. This was fueled by strength in Medication Delivery Solutions and contributions from BD’s Advanced Patient Monitoring business, which continues to gain traction since its acquisition.

Interventional products also had a good showing, pulling in $1.26 billion, up almost 6% year over year. Life Sciences saw more muted growth, coming in at $1.30 billion, which was just under a 1% increase, but still in positive territory.

Capital Moves and Strategy

On the capital allocation front, BD made a decisive move by completing a $750 million share repurchase. That kind of buyback not only signals confidence from leadership but also supports shareholder value in a tangible way. It’s a reminder that this is a management team with a long-term mindset, balancing growth with returns.

All in all, the quarter painted a picture of a company that’s executing well. With revenue growth across segments, improving earnings, and strategic financial management, BD looks to be setting a steady course for the rest of the year.

Chart Analysis

Price Action and Moving Averages

BDX has had a turbulent ride over the past year, and the recent price action reflects a stock that’s under pressure. After trading mostly sideways for much of the year, shares took a sharp downturn in late March and early April. That drop pushed the price well below both the 50-day and 200-day moving averages, which is rarely a positive technical signal. The 50-day average has also now crossed below the 200-day, forming what many see as a bearish pattern. While short-term in nature, this crossover can suggest underlying momentum has shifted to the downside.

What stands out is the failed attempt earlier in the year to sustain a breakout above $250. That rally was brief, and it didn’t take long before the stock reversed lower, losing support around the $230–$235 range. Since then, the decline has been fairly swift.

Volume and Momentum

Volume has picked up significantly during the selloff, suggesting there’s more than just a lack of buyers here—there’s active selling pressure. When price falls on higher volume, it often reflects conviction, which makes the recent downturn more concerning from a trend standpoint.

The RSI indicator at the bottom of the chart is another important signal. It dropped into oversold territory as the stock hit recent lows, dipping under the 30 level, which typically suggests the stock is stretched to the downside. Since then, it’s started to crawl upward, but hasn’t yet shown a convincing reversal. There could be a relief bounce ahead, but it doesn’t yet show strength building in a sustainable way.

Broader Takeaway

The stock’s recent break from a long period of consolidation suggests a shift in investor sentiment. While the business fundamentals may still be intact, the technical picture has weakened. That doesn’t necessarily mean long-term prospects are off the table, but it does show how quickly sentiment can change. If the price doesn’t reclaim support above the 200-day moving average soon, this may remain under pressure a while longer.

Management Team

At the helm of Becton, Dickinson and Company (BD) is Tom Polen, who serves as Chairman, Chief Executive Officer, and President. Polen has played a central role in shaping BD’s long-term strategy, with a strong focus on innovation, operational efficiency, and global market expansion. His leadership style is known to be forward-thinking yet grounded in the company’s century-long values.

Supporting him is Christopher DelOrefice, Executive Vice President and Chief Financial Officer. DelOrefice came to BD with deep experience in healthcare finance, having spent years in senior leadership roles at Johnson & Johnson. His focus has been on financial discipline, capital allocation, and guiding the company through a challenging economic and regulatory landscape. Together, Polen and DelOrefice present a steady hand for BD’s operations and its future direction, blending growth-oriented strategy with financial conservatism.

Valuation and Stock Performance

BDX shares have seen their fair share of movement over the past year. As of early April 2025, the stock trades around $202, near its 52-week low and well below the highs near $252. That decline has opened up valuation conversations, especially as earnings remain relatively stable.

The current trailing price-to-earnings ratio is hovering above 33, which might seem elevated, but the forward P/E sits closer to 14. That gap suggests the market may be pricing in a rebound in earnings. Investors appear cautious in the short term, but expectations for long-term growth, especially through BD’s product pipeline and international expansion, are still baked into the stock’s valuation.

When you factor in BD’s consistent dividend and history of annual increases, the share price decline could be offering a more attractive entry point for those focused on yield and total return. Still, volatility over the past 12 months has been notable, and the stock remains below its long-term moving averages.

Risks and Considerations

Every company carries risk, and BD is no exception. The most immediate headline risk came from a regulatory settlement related to the Alaris infusion pump. The company agreed to pay $175 million to settle charges that it had not adequately communicated certain risks to investors. While the matter is now behind them, it does serve as a reminder of the strict scrutiny companies in the healthcare space operate under.

Outside of regulatory issues, there are competitive and operational risks to consider. BD faces competition from other large med-tech firms that are aggressive in pricing and innovation. Cost pressures, potential supply chain disruptions, and changes in healthcare reimbursement policies could all impact profitability.

There’s also the matter of debt. With total debt around $18.7 billion, BD’s balance sheet is something to watch, especially in a higher interest rate environment. While cash flow has been more than sufficient to support both debt servicing and dividend payments, any unexpected downturn in operations could strain that balance.

Final Thoughts

BD is a company with staying power, built on decades of reliability and global presence in the healthcare sector. The leadership team has demonstrated stability and a clear vision, with long-term strategies that remain intact despite recent challenges. The stock’s current valuation reflects both the weight of recent headwinds and a degree of optimism around future performance.

While some risks linger, BD’s financial structure, cash flow generation, and commitment to shareholder returns continue to offer a level of confidence. For those willing to weather short-term uncertainty, BD still represents a business with strong foundations and a clear sense of purpose moving forward.