Updated 4/11/25

The Bank of Montreal, or BMO as it’s better known in the market, has been around longer than Canada itself. Founded in 1817, it’s the oldest bank in the country and ranks among the top ten in North America when it comes to asset size. Over the years, BMO has built a reputation on the back of steady, dependable operations—and just as importantly, dependable dividends.

While some investors chase fast growth, BMO caters to those who want something more grounded: regular, reliable income. If you’re someone who values the consistency of quarterly payouts and a solid balance sheet, BMO might already be on your radar. And based on its latest earnings and dividend data, it looks like this institution is still checking the right boxes for income-focused portfolios.

Recent Events

BMO hasn’t been sitting idle. One of its biggest moves lately was acquiring Bank of the West from BNP Paribas, a deal that closed in early 2023. That single acquisition gave BMO a much bigger presence in the U.S., particularly across the western states where it now serves close to 2 million new customers. It also brought in a fresh stream of deposits and expanded its lending book at a time when many U.S. regional banks were on the back foot.

In terms of financial performance, the numbers for the quarter ending January 31, 2025, came in strong. Net income to common shareholders over the past year reached $7.75 billion, and earnings per share were $7.44. That’s a significant year-over-year jump, with earnings up over 65% and revenue climbing by more than 17%. Clearly, the integration of Bank of the West is paying off, and interest margins are looking healthier too.

However, it’s not all green lights. BMO’s operating cash flow was negative for the trailing twelve months, coming in at -$21.89 billion. That figure reflects changes in lending, deposits, and some of the temporary effects of the acquisition. While not ideal, it’s not alarming either—but worth watching if you’re thinking long term.

Key Dividend Metrics

💵 Forward Dividend Yield: 5.02%

📈 5-Year Average Yield: 4.42%

🔁 Payout Ratio: 58.44%

📅 Next Ex-Dividend Date: April 29, 2025

💰 Forward Annual Dividend: $4.47

📆 Dividend Date: May 27, 2025

📉 Trailing Dividend Yield: 6.97%

🧮 Dividend Growth Rate: Consistent and steady

🏦 Last Stock Split: 2-for-1 in March 2001

Dividend Overview

For dividend investors, BMO currently offers an attractive 5.02% forward yield. That’s higher than its five-year average of 4.42%, which tells you two things: the current stock price is lower than its historical average, and the income return is unusually strong for new buyers. For anyone building or maintaining a dividend portfolio, that’s good news.

Even more impressive is the trailing yield, which stands at nearly 7%. That’s a reflection of earlier share price weakness, but it gives a sense of how generous the dividend has been for those who held through the dip. More importantly, that dividend is backed by solid fundamentals—not pie-in-the-sky promises.

BMO’s payout ratio is right around 58%, a level that suggests it’s returning plenty to shareholders without overextending. This is especially reassuring for investors who depend on dividends for steady income and want to avoid the risk of a future cut. The balance sheet backs that up too, with a book value per share of $117.75, while shares currently trade around $90. That gives you a sense that this isn’t a company burning through capital just to maintain its yield.

Dividend Growth and Safety

BMO’s track record when it comes to dividend growth speaks for itself. While the financial crisis briefly paused increases, the bank never slashed its payout and has resumed a steady climb in the years since. Growth has been consistent, averaging in the mid-single digits annually. It’s not explosive, but it does a good job keeping pace with inflation—exactly what long-term investors are looking for.

Looking under the hood, BMO’s profitability remains solid. Return on equity is just shy of 10%, and the profit margin is close to 27%. Those aren’t headline-grabbing numbers, but in the world of banking, they represent stability and discipline.

There is one potential caution flag: the bank’s operating cash flow has turned negative. That’s not unusual following a major acquisition, especially one as big as Bank of the West. Still, it’s something income investors will want to monitor going forward. The good news is that the dividend doesn’t look to be in any danger. The payout is well covered by earnings, and with more than $426 billion in cash on hand, the company has plenty of flexibility to keep paying out even if headwinds build.

Looking at who’s holding the stock, insider ownership is minimal at just 0.03%, but institutional ownership is solid, nearing 54%. That shows BMO remains a trusted name among fund managers and pension portfolios. Short interest is low, and the relatively high short ratio suggests there’s limited pressure coming from the bear side.

BMO might not generate buzz like a tech stock, but for those who value stability and cash flow, it’s still a name worth knowing. It’s the kind of holding you can set and forget—while letting the dividends keep working for you.

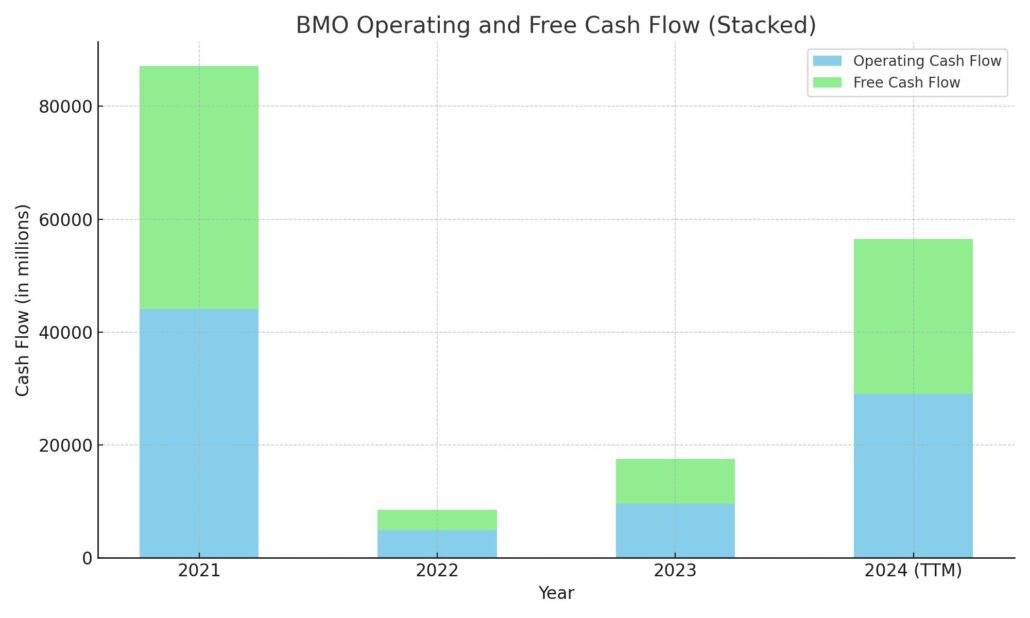

Cash Flow Statement

Over the trailing twelve months, Bank of Montreal has shown a meaningful rebound in its cash generation. Operating cash flow came in at $29 billion, a sharp recovery compared to the $9.6 billion in fiscal 2023 and just under $5 billion in 2022. Free cash flow followed the same trend, rising to $27.5 billion. This resurgence likely reflects stronger earnings and improved integration results from the Bank of the West acquisition, as well as higher interest income in a favorable rate environment.

On the other side, cash used for investing remained substantial at -$24.5 billion, consistent with the bank’s strategy of expanding its U.S. footprint and modernizing infrastructure. Financing cash flow dropped to -$17.4 billion, reflecting reduced debt issuance, active repayments, and a modest repurchase of shares. Notably, BMO’s end cash position continues to trend downward—now at $65.1 billion from $93.3 billion in 2021—though it still sits at a comfortable level for a bank of its scale. The bank also paid $45 billion in interest over the last year, highlighting the weight of funding costs in the current rate climate. Despite the capital outflows, BMO’s strong operational cash foundation reinforces its capacity to maintain dividends and manage financial flexibility.

Analyst Ratings

Bank of Montreal (BMO) has seen a slight shift in analyst sentiment lately, with a more balanced tone emerging across the board. 📊 The consensus rating is currently a “Hold,” reflecting a mixed outlook among analysts. Out of those covering the stock, 8 suggest holding while 7 lean toward a buy recommendation.

🎯 The average 12-month price target sits at C$146.85, suggesting a potential upside of around 17% from where the stock is trading now. This range indicates there’s still cautious optimism, even if some concerns have started to surface.

🔼 RBC Capital recently reaffirmed its “Outperform” stance and nudged its price target up from C$161 to C$163. Their view appears rooted in confidence around BMO’s ability to extract long-term value from its expanded U.S. footprint and cost efficiencies following the Bank of the West acquisition.

🔽 On the other hand, Scotiabank moved its rating from “Outperform” to “Sector Perform,” trimming the target from C$123 to C$112. Their downgrade seems to reflect worries about possible earnings softness in the coming quarters, likely tied to margin compression and integration risks.

Overall, the rating spread reveals that while some see upside potential, others are tapping the brakes as they wait to see how certain headwinds play out.

Earning Report Summary

Bank of Montreal kicked off fiscal 2025 on solid ground, with first-quarter results that pointed to strength across the board. Adjusted net income came in at $2.3 billion, and earnings per share landed at $3.04. These numbers weren’t just decent—they marked meaningful growth, thanks to strong performances in several of the bank’s key segments. Revenue climbed 18% from the previous year, and pre-provision, pre-tax earnings jumped 32%. Return on equity moved up to 11.3%, showing more efficiency in how profits are being generated, while the CET1 ratio—a key measure of capital strength—remained firm at 13.6%.

Canadian Banking and Capital Markets Shine

On the home front, BMO’s Canadian Personal and Commercial Banking division pulled in a record $3 billion in revenue. This was supported by steady growth in customer activity and lending volumes, a sign that BMO continues to deepen relationships and gain wallet share in the domestic market.

The Capital Markets segment had an especially strong quarter. Pre-provision, pre-tax earnings rose a whopping 67%, helped along by solid trading results in Global Markets. This is one area where volatility works in the bank’s favor, and BMO clearly capitalized on those conditions.

Wealth Management Growth and a Watchful Eye on Credit

Wealth Management also contributed in a meaningful way. Earnings from this division were up 48% before provisions and taxes, thanks to increased client activity and rising asset values. It’s clear that as markets rebounded, so did investor engagement—and BMO was well-positioned to benefit from that.

Of course, it wasn’t all blue skies. The bank set aside $1.01 billion in credit loss provisions during the quarter. While that’s a sizable amount, it’s more about being careful than facing immediate trouble. With economic uncertainty still in the air, BMO appears to be erring on the side of caution—a smart move, all things considered.

Another key point from the report: BMO repurchased 3.2 million of its own shares during the quarter. That’s a clear message from management—they believe the stock is undervalued and want to return capital to shareholders. It also signals strong internal confidence in the bank’s long-term outlook.

All told, the quarter highlighted the strength of BMO’s diversified model. From capital markets to retail banking to wealth management, every part of the business pulled its weight.

Chart Analysis

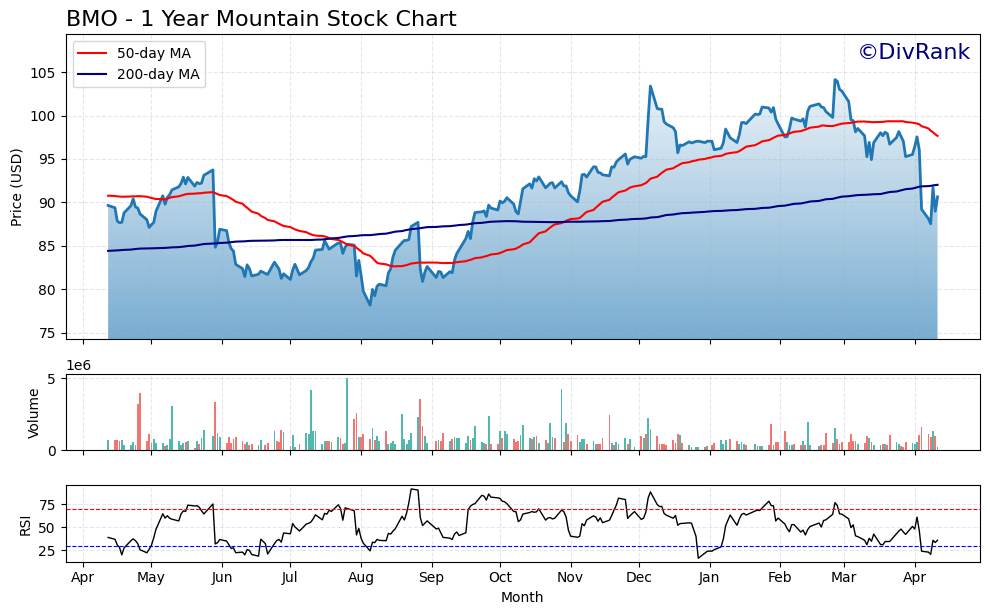

BMO’s chart over the past year reveals a stock that’s seen both optimism and correction, now in the process of recalibration.

Price Movement and Moving Averages

The price action in BMO has been generally constructive for much of the year, climbing steadily from the lows of June through to a peak in late February. It rode its 50-day moving average almost perfectly from September onward, which often indicates solid momentum. However, the recent dip below both the 50-day (red) and 200-day (blue) moving averages is noteworthy. When a stock breaks down through both key moving averages, it tends to suggest some softness in trend strength.

What’s interesting here is how the 50-day average has now rolled over and is pointing down, while the 200-day is still inching upward. That divergence is worth watching. If the price can reclaim and hold above the 200-day, it would signal that this pullback may just be a pause rather than a longer-term reversal.

Volume and Buying Interest

Volume patterns show some spikes during selloffs, particularly in early March and again in April. These higher-volume days indicate heavier institutional involvement, and the fact that price bounced back quickly afterward suggests some buyers stepped in when it dipped near $85. That reaction shows there’s still support at lower levels.

RSI and Momentum

Looking at the RSI at the bottom of the chart, momentum has cooled. The indicator hovered in overbought territory from November to mid-February, aligning with the price run-up. But since then, it’s spent more time below the midline. Most recently, RSI touched oversold levels and has started climbing back up—an early sign that selling pressure may be fading and buyers are testing the waters again.

This setup paints the picture of a stock that’s cooling off after a strong stretch, possibly resetting. It’s not breaking down, but it’s no longer in the clear uptrend it enjoyed for months. The reaction over the next few weeks—especially whether it can reclaim that 200-day average—will say a lot about where it wants to head next.

Management Team

Bank of Montreal (BMO) is led by an experienced executive team with a strong background in global finance and banking. At the forefront is CEO Darryl White, who has been with the bank for more than 25 years and took over the top role in 2017. Under his leadership, BMO has pursued strategic growth, most notably through the acquisition of Bank of the West, which significantly expanded its reach across the U.S.

Supporting him is Tayfun Tuzun, the bank’s Chief Financial Officer. Having joined BMO in 2021 after a long tenure at Fifth Third Bancorp, Tuzun brings a sharp focus on financial discipline and strategic capital management. His background in corporate finance and investor relations gives him a clear handle on what drives long-term shareholder value.

Piyush Agrawal serves as BMO’s Chief Risk Officer and joined the leadership team with decades of experience managing risk in large-scale institutions. His approach to enterprise risk and regulatory oversight supports BMO’s commitment to maintaining a solid and conservative risk profile.

Together, this leadership team is steering the bank through a transformative period with a strong emphasis on stability, innovation, and sustainable growth.

Valuation and Stock Performance

BMO’s stock has moved through its fair share of ups and downs over the past year, trading in a wide range between $77 and $106. It currently sits just above $90, with recent weakness creating a more attractive entry point for investors who view the long term with optimism.

Valuation remains reasonable based on key metrics. The current price-to-earnings ratio of about 11.7 is in line with peers, and its price-to-book ratio of roughly 1.2 suggests the market is valuing the company just slightly above its net assets. For a well-capitalized bank, that’s often a sign of balanced expectations—neither overhyped nor undervalued.

Over a longer horizon, BMO has held up well. Total return over the past five years has cleared 100% when you factor in both share price appreciation and dividends. That kind of performance speaks to the value of steady cash flows and the bank’s continued relevance in a shifting economic environment.

Risks and Considerations

There are, of course, some risks worth keeping in mind. Like all banks, BMO is exposed to interest rate volatility. Rising or falling rates can impact loan demand, net interest margins, and customer behavior. Economic slowdowns or recessions could lead to weaker credit quality and higher loan loss provisions, which would weigh on earnings.

Another key risk is the U.S. expansion. While the acquisition of Bank of the West opens up new markets, it also brings exposure to new regulatory frameworks, economic conditions, and potential integration challenges. It’s a bold move, but one that comes with operational complexity.

Technology and cyber risks remain a growing concern in the financial sector, and BMO is no exception. As more banking moves online, systems need to remain secure and robust. Fortunately, the bank has continued to invest in digital infrastructure and cybersecurity to stay ahead of these threats.

Final Thoughts

BMO stands on solid ground. Its long history, strong balance sheet, and disciplined management team offer a sense of stability in a sector that can be anything but predictable. The stock may not soar like high-growth names, but it rewards patience with consistency and income. As the bank continues to navigate new territory in the U.S. and lean into long-term strategy, the focus remains on delivering value in a way that balances risk and reward.