Updated 2/25/26

Badger Meter might not be a household name, but if you’ve ever paid a water bill, chances are some of their technology played a part in getting that reading. This Milwaukee-based company has been in the flow measurement business for nearly a century, providing smart water solutions that help utilities manage consumption and infrastructure more efficiently. It’s a specialized niche, but one with staying power, and that’s exactly what long-term income investors tend to look for.

BMI’s footprint is growing, slowly and steadily. It’s not the kind of stock that dominates headlines, but that’s part of the appeal. It’s a low-drama performer with consistent profitability and a history of sharing its success with shareholders through regular dividends.

Recent Events

Badger Meter has continued executing on its smart water technology strategy through the past several quarters, with the business demonstrating resilience even as the broader mid-cap industrial space has faced some turbulence. The company pushed full-year revenue past $916 million, reflecting sustained demand from municipal utilities investing in digital metering infrastructure. That momentum has been driven in large part by continued adoption of advanced metering infrastructure platforms and the software analytics layer that sits on top of those systems, a segment that has become an increasingly meaningful part of the overall revenue mix.

On the product and market development front, Badger Meter has maintained its focus on the water utility space at a time when aging municipal infrastructure is driving modernization budgets across the country. Federal infrastructure spending commitments have continued to provide a favorable backdrop for companies like Badger that sit at the intersection of water technology and data management. The company’s positioning in this space remains a competitive advantage that is difficult to replicate quickly.

The stock has pulled back considerably from its 52-week high of $256.08, currently trading near $155.79. That move lower has brought the valuation back to more reasonable territory relative to where it was trading earlier in the cycle, which may be attracting renewed attention from long-term investors who had been waiting for a more attractive entry point.

Key Dividend Metrics

💰 Forward Yield: 0.93%

📈 5-Year Average Yield: 0.74%

📆 Most Recent Dividend: $0.40 per share

📉 Payout Ratio: 30.90%

⚙️ Free Cash Flow (ttm): $137.2 million

📊 EPS (ttm): $4.80

📈 Annual Dividend: $1.54

Dividend Overview

BMI isn’t throwing off massive income, but what it offers is stability and a track record of consistent growth. The forward dividend yield of 0.93% is modestly above the company’s five-year average yield of around 0.74%, which reflects both recent dividend increases and a stock price that has pulled back from its highs. For income investors, that combination is worth paying attention to.

The payout ratio sits at a comfortable 30.90%, which tells you there is plenty of room for future increases. Even in a scenario where earnings growth moderates, that buffer gives management the flexibility to maintain and grow the dividend without putting any real strain on the business.

Cash flow supports the picture well. Badger Meter generated $183.7 million in operating cash over the trailing twelve months while the annual dividend obligation remains a fraction of that total. The free cash flow figure of $137.2 million covers the dividend commitment many times over, which is exactly the kind of cushion long-term income investors want to see when evaluating sustainability.

Dividend Growth and Safety

Badger Meter raised its quarterly dividend from $0.34 to $0.40 per share in August 2025, a meaningful increase of nearly 18% that reflects management’s confidence in the durability of the business. That raise built on a similar step-up in 2024, when the dividend moved from $0.27 to $0.34. Looking at the dividend history, the pattern is consistent: Badger Meter tends to hold its rate steady for several quarters and then execute a deliberate increase, rather than making small incremental moves each year. That approach produces reliable, noticeable growth over time.

The safety profile here is strong across the board. Return on equity stands at 21.47% and return on assets sits at 12.82%, both of which signal a management team that deploys capital efficiently and generates real returns on what it invests. Profit margins of 15.45% are healthy for a company in this segment, and the combination of low payout ratio and strong free cash flow generation makes the dividend about as secure as you’ll find in this yield range.

For investors who prioritize quality over raw yield, Badger Meter continues to deliver. The dividend won’t make headlines, but it is consistent, well-funded, and has demonstrated a clear upward trajectory over a multi-year period. That kind of reliability tends to compound meaningfully for patient investors.

Chart Analysis

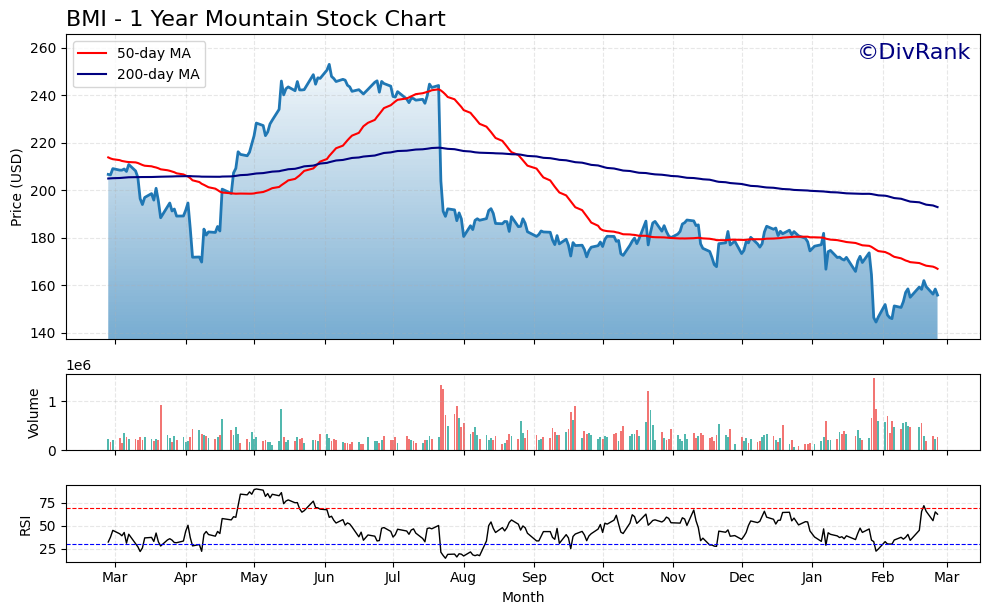

Badger Meter’s chart tells a story of significant deterioration over the past twelve months. Shares have fallen from a 52-week high of $253.01 to a current price of $155.79, representing a drawdown of roughly 38% from peak levels. The stock is now trading just 7.87% above its 52-week low of $144.42, which means the price floor is close and the margin for further slippage before hitting new lows is narrow. For a company with BMI’s quality profile, this kind of compression is worth taking seriously, as it reflects a broad repricing of the valuation premium the market had previously assigned to the shares.

The moving average picture confirms the bearish intermediate trend. BMI is trading below both its 50-day moving average of $166.87 and its 200-day moving average of $192.87, meaning the stock sits beneath two layers of overhead resistance that sellers have historically defended. More concerning is the formation of a death cross, where the 50-day has crossed below the 200-day, a condition that technical traders typically interpret as a signal of sustained downward momentum rather than a brief correction. Until the price can reclaim the 50-day moving average and that average begins turning higher, the path of least resistance remains to the downside on a purely technical basis.

The RSI reading of 62.76 introduces a nuance that dividend investors should weigh carefully. At that level, momentum is recovering and the stock is no longer in oversold territory, which suggests that some near-term buying interest has emerged off the lows. However, a reading approaching 70 without a corresponding improvement in the moving average structure can also indicate a bounce within a larger downtrend rather than the start of a durable recovery. The RSI is constructive on its own, but it does not override the bearish signals from the price trend and moving average configuration.

For dividend investors, the chart presents a classic tension between a compelling income entry point and a technically fragile setup. The yield has expanded meaningfully as the price has declined, which improves the forward income case. At the same time, buying into a stock trading below a death cross and just 7.87% above a 52-week low carries real short-term risk. Investors who prioritize long-term dividend growth over near-term price stability may find the current level attractive for a staged entry, but those sensitive to near-term drawdowns may prefer to wait for the price to establish a base above the $160 area and show some ability to hold above the 50-day moving average before committing new capital.

Cash Flow Statement

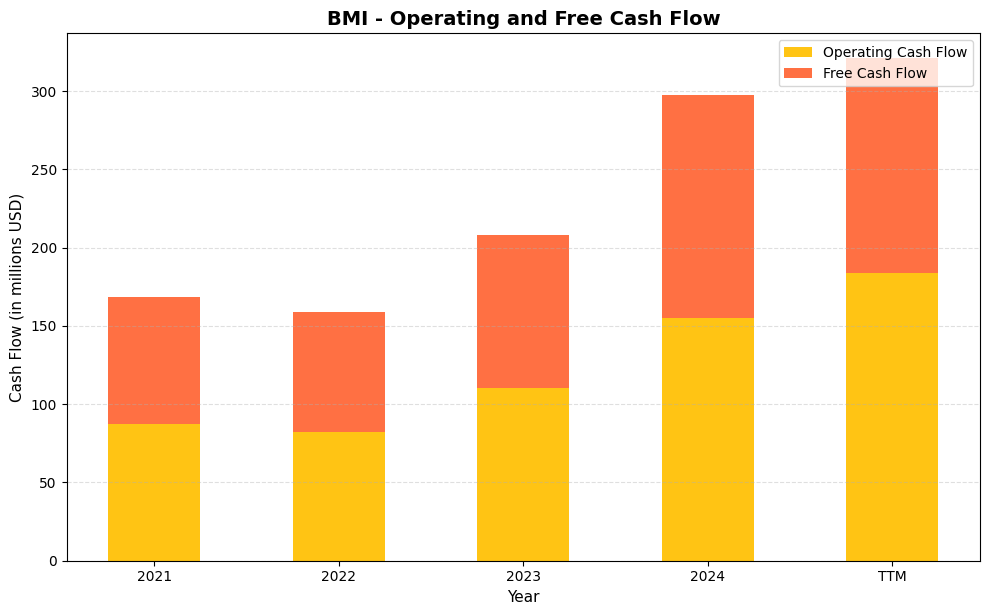

Badger Meter’s cash flow profile has strengthened considerably over the reporting period, and the most recent figures make a compelling case for dividend sustainability. Operating cash flow climbed from $87.5 million in 2021 to $155.0 million in 2024, a gain of roughly 77% in three years, with the TTM figure reaching $183.7 million and suggesting the momentum has not slowed. Free cash flow tells a similarly encouraging story, rising from $80.8 million in 2021 to $142.2 million in 2024 before settling at $137.2 million on a trailing twelve-month basis. The modest TTM dip in free cash flow relative to the 2024 full-year figure reflects a modest uptick in capital expenditures rather than any softening in the underlying business, and the conversion rate from operating to free cash flow remains well above 70% across every period shown. For dividend investors, a company generating $137 million or more in annual free cash flow while paying a dividend that costs a fraction of that amount is operating with substantial coverage headroom.

Stepping back to view the full arc from 2021 through today, BMI’s cash generation has compounded at a rate that meaningfully outpaces its revenue growth, which points to improving operating leverage and tighter working capital management rather than simply a larger top line. The sharpest single-year acceleration came between 2022 and 2023, when operating cash flow jumped from $82.5 million to $110.1 million, a period that coincided with stronger municipal water infrastructure spending and the company’s continued shift toward higher-margin smart metering solutions. Capital expenditures have remained disciplined throughout, never consuming more than roughly $18 million in any of the years shown, which keeps the free cash flow yield healthy even as the business scales. For shareholders, this combination of rising absolute cash generation and restrained reinvestment needs creates the kind of financial flexibility that supports not only consistent dividend growth but also the occasional special dividend or share repurchase that can enhance total return over time.

Analyst Ratings

Ten analysts currently cover Badger Meter, and the range of price targets in place tells an interesting story about where the stock sits today. The mean price target of $178.00 sits roughly 14% above the current share price of $155.79, while the high target of $220.00 implies upside of over 41% for those with a more optimistic outlook. The low target of $136.00 sits below the current price, suggesting at least one analyst sees limited near-term upside given how far the stock has already pulled back from its highs.

The spread between the low and high targets reflects genuine disagreement about how to weigh Badger Meter’s long-term growth potential against a valuation that, even after the recent pullback, still carries a meaningful premium to the broader market. Bulls point to the company’s dominant positioning in smart water infrastructure, its expanding software revenue, and a macro environment where municipal spending on water technology modernization remains a durable theme. The more cautious view centers on whether the current earnings run rate can justify even the compressed multiple the stock carries today. With no formal consensus rating available, the analyst community appears divided, though the mean target above the current price suggests the center of gravity leans modestly constructive at current levels.

Earning Report Summary

Solid Growth Across the Board

Badger Meter pushed through the $900 million revenue threshold on a trailing twelve-month basis, with full-year sales reaching approximately $916.7 million. That represents a meaningful step up from the $826.6 million reported for full-year 2024 and reflects continued expansion in the company’s core utility water segment. Municipalities across the country are accelerating the replacement of aging metering infrastructure with connected, data-driven systems, and Badger Meter has been one of the primary beneficiaries of that spending shift. The software and analytics component of the business continues to grow as a share of the total, which matters because it carries stronger margins and more predictable recurring revenue characteristics than hardware alone.

Profitability and Cash Flow Moving in the Right Direction

Net income for the trailing period came in at $141.6 million, producing earnings per share of $4.80. Profit margins of 15.45% reflect a business that has continued to improve its cost structure while growing the top line. Operating cash flow of $183.7 million was a record for the company, and it demonstrates that the earnings growth is translating into real cash rather than just accounting improvement. Return on equity of 21.47% remains at the high end of what you find in this segment of the industrial landscape, reinforcing the view that Badger Meter’s capital allocation has been executed thoughtfully over a sustained period. The combination of revenue growth, margin expansion, and cash flow generation gives the company a strong foundation heading into the next phase of its growth story.

Management Team

Badger Meter’s leadership is guided by Kenneth C. Bockhorst, who serves as Chairman, President, and CEO. Since stepping into the top role in 2019, Bockhorst has steered the company with a strong focus on operational performance and long-term strategic execution. His background in global operations has been a key factor in Badger Meter’s ability to scale smart water technology across an expanding customer base.

Supporting him is Robert A. Wrocklage, Senior Vice President and Chief Financial Officer. Wrocklage has played an important role in strengthening the company’s financial discipline since joining in 2018. His approach has helped maintain Badger Meter’s lean balance sheet and supported consistent cash flow generation.

Karen M. Bauer serves as Vice President of Investor Relations, Corporate Strategy, and Treasurer. She has been instrumental in shaping investor communications and aligning the company’s strategic priorities. Fred J. Begale leads engineering and product development, keeping innovation at the center of Badger Meter’s growth. On the legal and compliance side, William R.A. Bergum brings structure to governance as General Counsel. And overseeing global operations is Richard Htwe, whose experience in international manufacturing and supply chain strategy brings operational resilience to the organization.

Together, this leadership group blends experience, discipline, and a forward-looking mindset that has helped the company remain focused through various economic cycles.

Valuation and Stock Performance

Badger Meter’s stock has experienced a significant reset from its highs, trading near $155.79 after reaching a 52-week high of $256.08 earlier in the cycle. That decline of roughly 39% from peak to current levels has brought the valuation back into a range that looks considerably more reasonable than where the stock was trading when investor enthusiasm was at its peak. The current P/E ratio of 32.46 times trailing earnings is still a premium multiple by most measures, but it represents a meaningful compression from the 43-plus times multiple that was in place during the prior report period.

For long-term investors, the question is whether the current price adequately reflects the company’s earning power and growth trajectory. With EPS of $4.80 and a consistent record of profitable growth, the business itself has not deteriorated. The pullback appears to be more a function of valuation normalization and broader market rotation out of higher-multiple industrial names than any fundamental change in the company’s competitive position. The mean analyst price target of $178.00 implies the stock is trading at a discount to where the analyst community believes fair value sits, which is a different dynamic than existed when the stock was near its highs and trading well above most targets.

Price-to-book of 6.42 times on a book value per share of $24.27 reflects the intangible-heavy nature of a technology-oriented business. Beta of 0.88 suggests the stock tends to move with somewhat less volatility than the broader market, a characteristic that fits well within a dividend-focused portfolio.

Risks and Considerations

Even after the significant pullback from its 52-week high, Badger Meter still carries a premium valuation relative to the broader market. A P/E of 32.46 times earnings leaves limited room for disappointment, and any slowdown in revenue growth or margin pressure could result in further multiple compression. Investors entering at current levels are still paying up for quality, which means execution needs to remain consistent.

Municipal budget cycles represent an ongoing variable that is easy to overlook in a period of strong infrastructure spending. When federal stimulus dollars run out or local governments face fiscal pressure, capital spending on water infrastructure modernization can slow or be deferred. Badger Meter’s revenue is not immune to these cycles even if the long-term demand backdrop remains favorable.

Competition in the smart water technology space has intensified as the market has grown more visible to larger industrial and technology players. Badger Meter’s decades of domain expertise and customer relationships provide a meaningful moat, but sustaining that advantage requires continued investment in product development and software capabilities. Falling behind on innovation could erode pricing power over time.

Finally, while the company’s global operations are not as geographically diverse as some peers, international exposure introduces currency and geopolitical considerations that can create noise around quarterly results. Short interest of approximately 2.05 million shares, while not alarming, suggests a portion of the market remains skeptical about the pace of recovery from the recent price decline.

Final Thoughts

Badger Meter enters 2026 having delivered a strong operational year while also experiencing a meaningful reset in its stock price. The business crossed $916 million in revenue, generated record operating cash flow of $183.7 million, raised its quarterly dividend by 18%, and continued compounding its return on equity well above 20%. Those are the kinds of outcomes that dividend growth investors spend years waiting for when they identify a high-quality compounder early.

The more interesting question today is whether the current price of $155.79 represents an opportunity. The pullback from $256 has compressed the multiple, brought the yield up closer to 1%, and created a situation where the mean analyst price target sits above the current share price for the first time in a while. That combination doesn’t happen often with a business of this quality.

The risks are real: premium valuation even after the decline, municipal budget sensitivity, and a competitive landscape that requires sustained investment to navigate. But the core of the business, consistent cash generation, a disciplined management team, and a growing role in essential water infrastructure, remains intact. For investors who value predictability and long-term dividend growth over headline yield, Badger Meter continues to make a compelling case.