Updated 4/13/25

Avnet, Inc. (AVT) operates as a global distributor of electronic components, serving industrial, automotive, and technology markets. With nearly a century of experience and a presence across key global regions, the company has built a resilient business model centered around supply chain efficiency and deep manufacturer relationships. Its long-tenured leadership team emphasizes operational discipline, consistent cash flow generation, and thoughtful capital allocation. Trading at a discount to book value and supported by strong free cash flow, the stock currently offers a 2.9% dividend yield and a payout ratio under 40%. While facing short-term revenue pressure and regional softness, especially in Europe, Avnet maintains solid liquidity, manageable debt, and steady shareholder returns. Its valuation and stable financials make it a compelling consideration for long-term investors focused on fundamentals and income.

Recent Events

Over the past few quarters, Avnet has had to navigate a more challenging operating landscape. Revenue over the trailing twelve months sits at $22.48 billion, though it’s down 8.7% year-over-year. The earnings picture also took a hit, with net income sliding 26% from the same period last year. That decline is tied in part to global supply chain normalization and slower ordering patterns as customers burn through inventory.

Still, the company isn’t showing signs of financial strain. Margins have held up better than expected, and most importantly for dividend investors, cash flow remains strong. Shares have drifted lower from their 52-week high of $59.24 and now trade around $45.66, putting the yield in more attractive territory.

Even with a 3% dip over the past year, the stock remains in a healthy position from a balance sheet and cash flow perspective. And for those focused on income, that stability might matter more than short-term share price movement.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.89%

💸 Forward Annual Dividend Rate: $1.32

🧮 Payout Ratio: 36.16%

📊 5-Year Average Dividend Yield: 2.45%

📆 Most Recent Dividend Date: March 19, 2025

🔁 Dividend Frequency: Quarterly

💪 Free Cash Flow (TTM): $1.44 billion

💼 Debt-to-Equity Ratio: 57.6%

Dividend Overview

There’s a lot to like about Avnet’s dividend setup, especially for those who prefer stable, predictable cash returns over fast growth. The company currently yields 2.89%, which is noticeably higher than its five-year average of 2.45%. That signals two things: better income for new buyers, and possibly an undervalued stock if fundamentals stay intact.

The annual dividend rate of $1.32 per share looks well supported. With a payout ratio of just 36.16%, Avnet isn’t overextending. That leaves room for reinvestment in the business and enough cushion to keep paying through economic slowdowns. The company is still generating strong free cash flow—$1.44 billion over the trailing twelve months—while spending a relatively modest portion on dividends.

There’s no sense of stress in how the company is funding shareholder returns. It’s not stretching or relying on debt to maintain its dividend. It’s doing it the old-fashioned way: with operating cash.

From a valuation standpoint, Avnet trades at just 0.82 times book value. That’s a rare discount in today’s market and one that income investors may find appealing. You’re getting the dividend, plus the potential for some multiple expansion down the line if sentiment shifts.

Dividend Growth and Safety

Growth has been measured, but deliberate. Avnet isn’t chasing high single-digit hikes each year, but it has steadily increased its dividend. The latest raise brought the annual payout to $1.32 from $1.28, marking a continuation of that cautious upward trend.

That might not excite investors looking for explosive growth, but it’s a comfort for those who want predictability and safety. This is a company that only raises the dividend when it believes it can support the increase through a full cycle. The absence of dividend cuts in recent years speaks to that discipline.

The debt load is manageable, too. Total debt comes in at $2.79 billion, with a debt-to-equity ratio just below 58%. That’s a bit elevated, but not concerning, especially with the company’s ability to generate strong operating cash flow and its healthy current ratio of 2.39. Liquidity isn’t an issue, and there’s plenty of room on the balance sheet to absorb future bumps.

Avnet’s approach to capital allocation is refreshingly conservative. Management isn’t swinging for the fences—it’s just aiming to keep delivering the kind of returns dividend investors can count on. And in this environment, that might be exactly what you want.

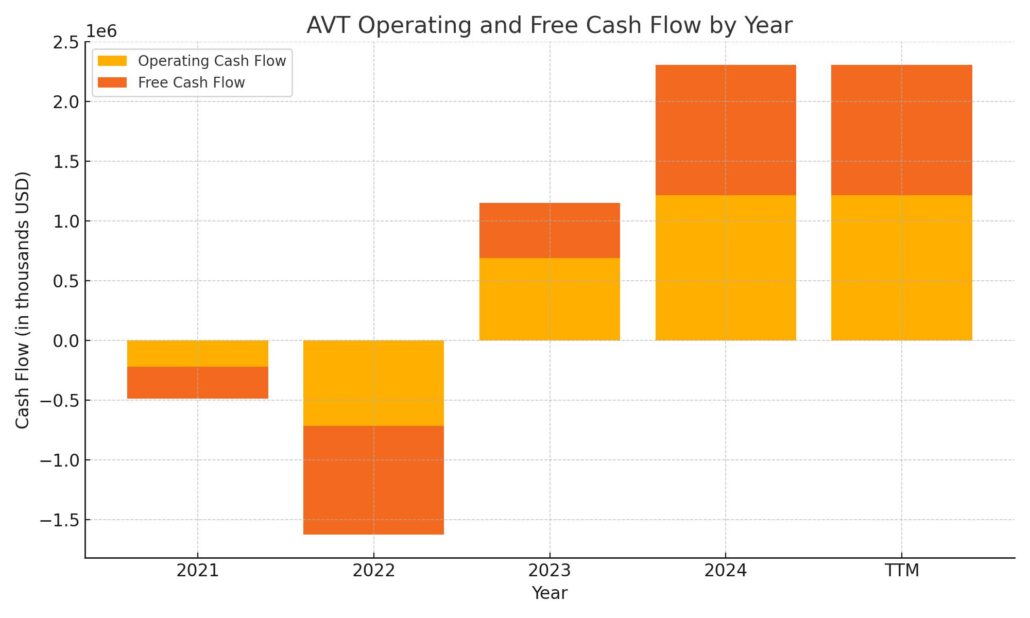

Cash Flow Statement

Avnet’s trailing twelve-month cash flow performance shows a company with significantly improved operational efficiency and financial discipline. Operating cash flow surged to $1.22 billion, a dramatic turnaround from past years where cash from operations was negative. This shift reflects tighter working capital management and more stable earnings, even as revenue growth faces headwinds. Free cash flow followed suit, reaching $1.09 billion—well above the prior year’s $463 million—offering a healthy cushion for dividends and potential buybacks.

On the investing side, outflows were modest at $128.6 million, primarily related to capital expenditures, which remained consistent year-over-year. Financing activities, however, saw a steep net outflow of $1.17 billion. This includes debt repayments, share repurchases, and lower debt issuance compared to previous years. Notably, the repurchase of capital stock and reduction in leverage point to a strategic focus on shareholder returns and balance sheet fortification. Despite this heavy outflow, Avnet’s ending cash position remains solid at $192.9 million, suggesting strong liquidity and no immediate funding concerns.

Analyst Ratings

🔻 Avnet has recently experienced a shift in analyst sentiment, with some firms pulling back on their outlook. In January, one major bank downgraded the stock from neutral to underperform, pointing to softening demand across industrial and computing end markets. The downgrade came with a revised price target, lowered from $58 to $48, reflecting caution around short-term earnings momentum and pressure on gross margins.

🟡 Another firm opted to maintain a hold rating but trimmed its target price slightly, moving it from $54 to $52. Their view was that while Avnet is navigating the environment reasonably well, the recent quarterly results—especially the decline in revenue and EPS—warrant a more conservative stance for now. The firm also noted that while free cash flow remains strong, future performance could be weighed down by slower component orders and a cautious customer base.

📉 Overall, the analyst consensus leans cautious, with the average 12-month price target sitting around $50. Ratings are mixed: two analysts currently rate it a sell, while the other two hold. The high estimate is $55 and the low sits at $45, suggesting modest upside from current levels near $45.66, but with a cautious tone surrounding near-term catalysts.

Earning Report Summary

Slower Top Line and Compressed Margins

Avnet’s most recent quarter, which wrapped up on December 28, 2024, came in a bit softer than the same time last year. Revenue dropped to $5.66 billion, which is an 8.7% dip year-over-year. The softness wasn’t a total shock given the broad slowdown in tech and industrial demand, especially in regions still working through excess inventory. Earnings also reflected the slowdown—diluted EPS landed at $0.99 compared to $1.28 the year before. Adjusted earnings per share came in at $0.87, down from $1.40, showing how margin pressures are starting to seep in.

Despite the earnings drop, Avnet continues to generate strong cash flow. They brought in over $300 million from operations this quarter, contributing to a solid $1.2 billion over the trailing twelve months. That kind of cash generation gives them flexibility. Management put some of that to work for shareholders, returning $80 million through a mix of dividends and buybacks. That steady return profile should be comforting for income-focused investors.

Regional Trends and What’s Holding Up

Asia turned out to be the bright spot this quarter. Sales in that region actually grew by 8.4%, pushing the total to $2.71 billion. It’s a good sign that at least one part of the business is still finding traction. Meanwhile, the Americas and Europe weren’t as fortunate. Sales in the U.S. and surrounding markets fell by 13.8%, and EMEA (Europe, Middle East, and Africa) was down even more at 25.1%. The uneven performance across regions highlights the ongoing demand volatility in the electronic components world.

Margins took a hit too. The total operating margin was 2.7%, lower than the 3.8% Avnet posted this time last year. Electronic Components, which is their core business, had a 3.4% margin, while the Farnell segment, focused on smaller-scale distribution, came in at just 1.0%. With pricing pressure and tighter volumes, it’s no surprise those numbers slipped a bit.

What They’re Expecting Next

Looking ahead, Avnet is keeping its expectations modest. For the next quarter, they’re guiding revenue in the range of $5.05 billion to $5.35 billion. Adjusted EPS is expected to fall between $0.65 and $0.75. Management is clearly bracing for a continued slowdown, especially if customers stay cautious about placing new orders.

In short, it wasn’t a standout quarter, but it wasn’t a stumble either. Avnet is leaning on its strong cash flow, managing costs, and keeping shareholder returns consistent. In this kind of market, that calm, steady hand might be just what long-term investors are looking for.

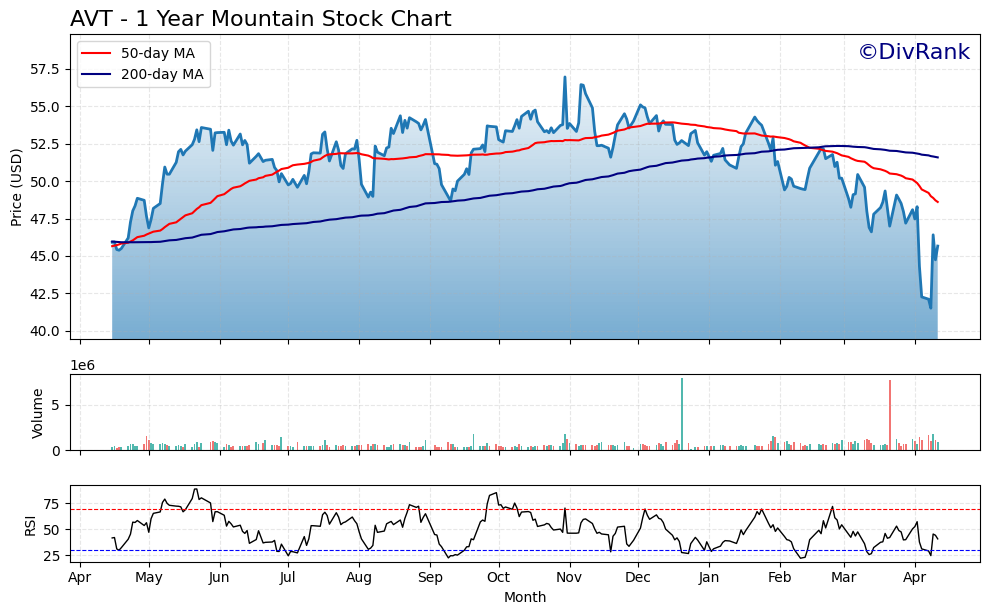

Chart Analysis

Price Movement and Moving Averages

Looking at AVT’s one-year chart, the price action tells a story of early momentum followed by a slow and steady fade. From April through late summer, the stock climbed steadily, staying comfortably above both its 50-day and 200-day moving averages. But starting around September, the trend began to weaken. The 50-day moving average started to level off and eventually rolled over, signaling a shift in sentiment.

By early 2024, the stock had clearly broken below its 50-day moving average, and more importantly, it began dipping beneath the 200-day moving average as well. The crossover that followed, where the 50-day fell below the 200-day, is often seen as a bearish technical signal. That pattern played out here with price grinding lower through the first quarter. The recent sharp drop in early April was the most dramatic leg down, with a quick bounce immediately after, but still well below where the moving averages sit.

Volume and Momentum Signals

Volume has remained relatively stable through most of the year, though there were a few high-volume spikes tied to noticeable down days. This suggests there were some forced sells or institutional moves during weakness, particularly in early April when the price briefly fell under $42. Those kinds of volume surges can indicate capitulation in some cases, though it remains to be seen if that marked a meaningful low.

Momentum, as shown by the RSI at the bottom, has dipped into oversold territory multiple times this year. Each time it reached the 30 level or below, the stock managed to bounce, but those rallies haven’t had staying power. What stands out recently is that the RSI bounced again from an oversold zone, lining up with the slight recovery in price during mid-April. That could be a short-term mean reversion, but the broader trend still appears weak without a clear sign of reversal.

Overall Technical Picture

The overall chart shows a stock that had strength earlier in the year but lost its footing and hasn’t yet found a new stable base. The downward pressure since the start of the calendar year is undeniable, with moving averages sloping lower and no clear upward pivot. That said, the long-term 200-day moving average is flattening, not falling sharply, which may indicate a longer-term stabilization is possible if price can hold current levels and build from here.

This is a name that will need to regain technical footing—particularly by reclaiming the 200-day average—before the trend can be considered healthy again. For now, it’s more of a wait-and-watch scenario from a technical standpoint.

Management Team

Avnet is led by a team with deep roots in the business and a strong grasp of the industry’s long-term rhythms. Phil Gallagher, the CEO, has spent decades at the company, rising through various operational roles before taking the helm. His leadership style reflects that background—focused on execution, supply chain optimization, and incremental progress rather than sweeping changes. That internal continuity has kept Avnet grounded, even as the tech landscape around it continues to evolve.

The broader leadership bench mirrors this approach. Key executives across finance, operations, and global distribution bring years of experience, many having worked their way up inside the company. They’ve shown discipline with capital allocation, maintaining a balanced approach between reinvestment in the business, returning capital to shareholders, and managing the balance sheet. While this management team may not generate headlines, they’ve demonstrated a steady hand and a clear focus on sustainable performance.

Valuation and Stock Performance

Avnet’s stock, recently trading in the mid-$40s, has pulled back from its 52-week high near $59. That decline reflects more than just market sentiment—it’s also tied to lower earnings growth and ongoing headwinds in a few major regions. Still, from a valuation perspective, the stock appears to offer value. The current price-to-book ratio is just 0.82, which is low both historically and relative to peers. The price-to-sales ratio is also compressed, sitting at just 0.18, indicating the market may be discounting the company’s earnings potential more than necessary.

The trailing price-to-earnings ratio stands at 12.9, which is modest for a business that remains cash flow positive and profitable even during cyclical downturns. Enterprise value to EBITDA is hovering in the mid-8s, a range that value investors often find appealing, especially when paired with consistent dividend payouts.

From a stock performance standpoint, Avnet has underperformed the broader market over the past year, down a few percentage points while the S&P 500 has gained. That underperformance isn’t surprising given the revenue and earnings compression seen in recent quarters. But when dividends are factored in, the total return is a bit more forgiving. The yield, now near 2.9%, offers some cushion and highlights the role this stock plays in portfolios focused more on income and capital preservation than aggressive growth.

Risks and Considerations

While Avnet brings a lot of strengths to the table, there are risks that deserve attention. Economic slowdown remains the biggest near-term concern. Several of Avnet’s major end markets—especially industrial, automotive, and communications—are cyclical and sensitive to capital spending trends. If customers continue to draw down inventory rather than place new orders, revenue could remain under pressure.

Geographic exposure also matters. The recent weakness in Europe was more pronounced than in other regions, and there’s no quick fix for that. Recovery will likely be uneven, and with operations across Asia and EMEA, currency swings can further complicate performance. It’s not just about volume—it’s also about translation and margin compression tied to foreign exchange.

Avnet doesn’t manufacture chips, but it’s deeply embedded in the semiconductor ecosystem. That makes it vulnerable to broader industry cycles. When chip demand softens, even if temporarily, the knock-on effect reaches distribution. The lag can be painful, and timing recoveries is never easy.

Debt, while manageable, is another factor. Total debt stands at $2.79 billion, which isn’t excessive, but it’s something to watch in a rising rate environment. So far, the company has done a good job managing interest expense, but refinancing could become more expensive depending on broader credit conditions.

Finally, the competitive landscape is always evolving. Avnet operates in a fragmented market where price competition, customer service, and digital capabilities all matter. It’s not a high-margin, high-barrier business. Even with scale and relationships, maintaining share requires ongoing investment in systems, logistics, and customer support.

Final Thoughts

Avnet is a company that doesn’t chase trends. Instead, it leans on operational strength, long-term partnerships, and steady cash generation. The management team understands this business at a fundamental level and hasn’t tried to reinvent the wheel. They’ve stuck with what works: disciplined capital allocation, moderate debt, and a commitment to returning value to shareholders.

While near-term softness is showing up in both earnings and price action, the company’s long-term health remains intact. The balance sheet is solid, the dividend is covered with room to spare, and cash flow generation is robust. These are qualities that often go underappreciated in fast-moving markets but become critical during more uncertain periods.

The stock isn’t likely to double overnight, but it doesn’t need to. With a modest valuation, reliable income, and a management team that prioritizes long-term performance over short-term optics, Avnet continues to offer a steady, grounded presence in an otherwise volatile space.