Updated 4/13/25

Avery Dennison (AVY) is a global materials science and manufacturing company known for its labeling, packaging, and RFID technologies. With operations in over 50 countries and a focus on innovation, the company serves industries ranging from retail to logistics and healthcare. It’s built a strong track record of steady earnings, reliable dividend growth, and disciplined capital allocation. Over the past year, AVY has faced pressure on its share price, trading roughly 27% below its 52-week high. Despite this, fundamentals remain solid with free cash flow nearing $700 million and a payout ratio under 40%. The leadership team, led by CEO Deon Stander, continues to steer the business through macroeconomic headwinds, while analysts maintain a favorable outlook, with a consensus price target near $220. As the company navigates current challenges, its dividend profile, financial resilience, and long-term positioning make it a closely watched name in its sector.

Recent Events

The past year has been more about stabilization than breakout growth. Avery’s stock has pulled back about 20% from its highs, which might sound concerning on the surface. But digging deeper, the fundamentals tell a very different story.

Earnings have bounced back, growing over 21% year-over-year, while revenue climbed a modest but positive 3.6%. The bigger picture? Operating margins are firming, and net income is holding up at just over $700 million over the last twelve months. These aren’t blockbuster numbers, but they reflect resilience.

Cash flow tells an even better story. Operating cash flow came in at nearly $939 million, with levered free cash flow sitting at $779 million. In other words, after all expenses and investments, the company still has plenty left over. That bodes well for maintaining—and growing—its dividend.

Debt is worth a glance. Total debt stands at $3.38 billion, and the debt-to-equity ratio is on the higher side at 146%. But with consistent earnings and manageable interest obligations, the balance sheet remains in decent shape.

Key Dividend Metrics 📊

💰 Forward Dividend Yield: 2.07%

📈 5-Year Average Dividend Yield: 1.58%

🔁 Dividend Growth Rate (5-Year): Steady mid-to-high single digits

📆 Payout Ratio: 39.52%

📊 Next Dividend Date: March 19, 2025

❌ Ex-Dividend Date: March 5, 2025

💵 Forward Annual Dividend: $3.52 per share

Dividend Overview

Avery Dennison isn’t trying to dazzle anyone with a high yield. At just over 2%, its forward yield is modest. But when you look under the hood, that yield is doing exactly what long-term income investors want it to do—it’s safe, consistent, and backed by real earnings.

The dividend payout ratio tells the story clearly. Sitting just under 40%, it signals a balanced approach: return cash to shareholders, but keep enough on hand to reinvest in the business and navigate whatever the market throws its way. That’s a sustainable number, especially for a company still spending on innovation and growth.

The dividend is well-covered by cash flow, and that’s really where confidence grows. When a business like AVY consistently produces nearly $1 billion in operating cash flow and has a long history of measured capital allocation, it makes those dividend checks feel secure.

A quick look back shows how dependable that dividend has been. Even through uncertainty and shifting global demand, Avery kept raising its dividend. Quietly. Steadily. No drama. That kind of dependability doesn’t always scream for attention, but it speaks volumes to those relying on income.

Dividend Growth and Safety

When it comes to dividend growth, Avery plays the long game. It’s not trying to impress with massive increases, but rather deliver annual raises that build over time. Over the last five years, the dividend has been bumped up consistently—enough to keep up with inflation and add real value for shareholders. That predictability matters.

What really gives confidence in future raises is the company’s free cash flow. With nearly $780 million in levered free cash flow, Avery has more than enough cushion to maintain and grow its dividend—even after reinvesting in operations and managing its debt load.

And while debt levels are something to watch, they don’t raise serious red flags in context. The company’s strong returns—particularly a 31.75% return on equity—help keep things in balance. Avery is generating more than enough from its core business to service debt and reward shareholders.

Another bright spot: the current yield is noticeably higher than its five-year average. That makes the stock’s current payout more attractive than it has been historically. For income investors, that might just be the sweet spot—when you can get a better-than-usual yield without compromising on quality or reliability.

Avery Dennison may not be loud or flashy. But if you’re looking for a company that delivers rising income year after year, backed by strong cash flow and steady execution, it’s one that earns a closer look.

Cash Flow Statement

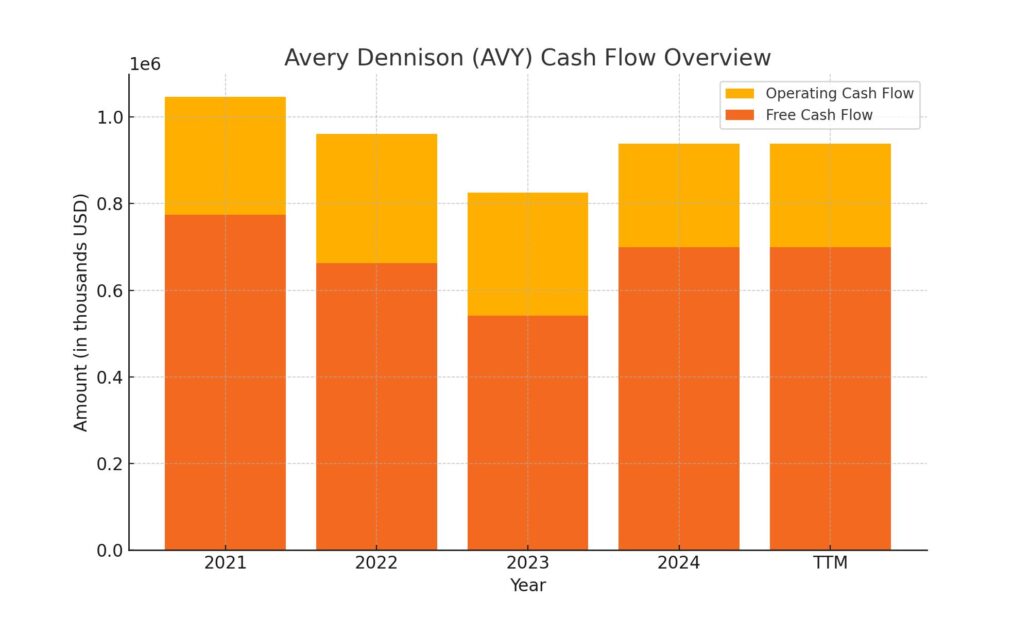

Avery Dennison’s trailing twelve-month cash flow paints a clear picture of disciplined capital management and strong underlying operations. Operating cash flow came in at $938.8 million, showing a solid uptick from the prior year’s $826 million. This strength was driven by improved profitability and working capital efficiency, allowing the company to convert a higher percentage of earnings into actual cash. Capital expenditures held steady at $239.8 million, reflecting ongoing investment in core business areas without overextending. That leaves a robust free cash flow figure of $699 million—ample coverage for dividends and other shareholder returns.

On the financing side, the company was active. Avery issued $539.2 million in new debt while repaying $308.1 million. Despite this net increase, it still managed to return significant capital to shareholders, with $247.5 million allocated to share repurchases and ongoing dividend payments. The company’s end cash position improved to $329.1 million from $215 million the previous year, offering extra liquidity. Overall, the cash flow statement reflects a business that is balancing growth, debt obligations, and shareholder returns with precision.

Analyst Ratings

📉 Avery Dennison has recently experienced a few analyst rating changes, showing a more measured yet steady outlook. UBS Group revised its price target downward from $207 to $189, while keeping a neutral rating. This move likely reflects short-term concerns around input costs and demand visibility in some of the company’s core end markets. There’s a sense that while the business remains fundamentally sound, analysts want to see a bit more clarity on margin trajectory before shifting to a more bullish stance.

📈 Still, the overall tone from Wall Street remains constructive. The average 12-month price target from analysts sits around $220.87, which implies a solid upside of over 30% from the current share price. That target suggests confidence in Avery’s long-term strategy, especially in high-growth areas like RFID and smart labeling technologies. Even as the company deals with near-term pressures, there’s belief in its ability to manage costs, grow free cash flow, and steadily increase shareholder value.

🔍 Most analysts covering the stock are in the “hold” to “buy” range, reflecting a cautious optimism. The pullback in share price seems to have caught attention, and for many, it’s now less about what Avery did last quarter, and more about how well it’s positioned for the next few years.

Earning Report Summary

Avery Dennison wrapped up 2024 with numbers that show a steady hand at the wheel. The company posted adjusted earnings per share of $9.43 for the full year, which is a solid 19% jump from the year before. Net sales came in at $8.8 billion, up close to 5% year over year, with organic growth nearly matching that pace. For the fourth quarter, EPS reached $2.38 and sales hit $2.2 billion—both showing healthy gains from the same period last year.

Materials Group Pulls Its Weight

Most of the heavy lifting came from the Materials Group. Sales here grew by 4% to hit $1.5 billion, thanks to strong demand in high-value product categories, which saw high single-digit growth. Base product categories also moved upward, albeit more modestly. The real highlight, though, was the margin improvement. Adjusted operating margin improved by 80 basis points to 14.8%, thanks to better volumes and productivity gains that helped the group run leaner and more efficiently.

Solutions Group Sees Growth, but Margin Pressure

The Solutions Group also had a decent showing, with sales climbing 3% to $714 million. But not everything was perfect. Operating margins slipped slightly, down 20 basis points to 11.4%. That drop mostly came from increased employee-related costs and investments the company is making to support future growth. Still, the top-line growth shows that demand remains solid in this segment, even with some cost pressure.

Strong Capital Returns and Forward Outlook

Avery wasn’t shy about rewarding shareholders last year. They returned a total of $525 million through dividends and share repurchases. Of that, $248 million went toward buying back 1.2 million shares, and the rest flowed out in the form of dividend payments. On top of that, the company raised €500 million in new senior notes. The proceeds are set to refinance existing debt and give the balance sheet some added flexibility.

Looking ahead, the company is projecting reported earnings per share in the range of $9.55 to $9.95 for 2025. Adjusted EPS is expected to land somewhere between $9.80 and $10.20. The tone is optimistic, and leadership seems confident about continuing to navigate through a mixed economic landscape while still growing earnings and staying focused on long-term goals. Overall, the results show a business that’s executing well and investing smartly for the future.

Chart Analysis

Price Action and Trend

The chart for AVY over the past year shows a steady deterioration in momentum, particularly since late summer. After peaking near the $230 level in mid-2023, the stock has been on a downward path. The 50-day moving average (red line) rolled over several months ago and has stayed below the 200-day moving average (blue line) since, a sign of ongoing weakness. This crossover, often referred to as a death cross, tends to confirm longer-term downtrends. Even recent attempts at a bounce were capped below the declining 50-day average, showing that the trend remains firmly to the downside.

The price touched new lows in early April, slipping below $165 before rebounding slightly. That bounce coincided with a spike in volume, suggesting some buyers stepped in aggressively at those levels, perhaps seeing value after the long selloff. However, price remains well below both major moving averages, which are still declining—indicating the stock hasn’t yet reversed the broader trend.

Volume and Participation

Volume has picked up meaningfully in recent weeks, particularly during selloffs. This increase in activity near the lows could be seen as a potential sign of capitulation, where weaker hands exit and longer-term capital starts entering. But until the price stabilizes above key moving averages, any short-term strength remains unconfirmed from a technical standpoint.

The consistent uptick in red volume bars during drawdowns shows that selling pressure has been persistent. What’s worth noting is the increased green volume during the most recent bounce, hinting that buyers may be getting more active as the price reaches prior support zones.

Relative Strength Index (RSI)

The RSI, shown at the bottom of the chart, has mostly stayed below the 50 level since late last year. That’s a clear indicator of continued downward momentum. It briefly dipped into oversold territory below 30 in early April and has just started to lift, following the small price bounce. This suggests the recent rebound may be more than just a dead-cat bounce, especially if the RSI continues climbing.

The key going forward is whether RSI can break above the 50–60 zone with strength, which would indicate that momentum is turning. For now, it’s still in a neutral range but starting to improve after a prolonged downtrend.

Overall Read

AVY has been under clear pressure for most of the past 12 months, but recent price action and volume behavior suggest a potential inflection point may be forming. The downtrend hasn’t broken yet, and both moving averages are still sloping lower. That said, increased volume at lower levels and some early signs of momentum stabilization offer a reason to monitor the chart closely for continued follow-through.

Management Team

Avery Dennison’s leadership team brings a thoughtful, measured approach to running the business. At the top is Deon Stander, who serves as President and CEO. He’s not new to the company, having previously led the Solutions Group, and his familiarity with the business shows in the consistent direction and clarity of execution. Working alongside him is Executive Chairman Mitch Butier, who transitioned from the CEO role and continues to shape the company’s long-term strategy with a steady hand.

The broader executive team is a well-balanced mix of operational expertise and strategic oversight. Danny Allouche is currently serving as interim Chief Financial Officer while also handling responsibilities as the company’s Chief Strategy and Corporate Development Officer. Deena Baker-Nel leads the people strategy as Chief Human Resources Officer, focusing on developing internal talent and strengthening company culture. Nicholas Colisto, the company’s Chief Information Officer, oversees tech initiatives aimed at boosting efficiency and keeping Avery Dennison ahead in digital transformation. Together, this leadership team has proven its ability to manage through cycles and position the company for future growth.

Valuation and Stock Performance

The stock is trading at around $169 as of mid-April 2025, which places it well below its 52-week high of $233.48 set back in July 2024. That pullback is hard to ignore, but it has more to do with broader market turbulence and macroeconomic headwinds than with anything fundamentally broken in the business. Despite the drop, Avery Dennison’s operational performance has held up, and that disconnect might be part of why analysts are still optimistic.

On valuation, the stock currently trades at a lower multiple than its long-term average and also trails some of its peers in the packaging and materials space. That has caught the attention of analysts, with the consensus 12-month price target sitting near $220.87. The stock’s underperformance on the chart doesn’t reflect any deterioration in its financials. Free cash flow remains strong, the dividend continues to grow, and the company is still buying back shares—all signs of a business that’s confident in its own long-term story.

Risks and Considerations

There are still risks to watch. Being a global business, Avery Dennison is exposed to currency swings, trade disruptions, and shifting geopolitical landscapes. Raw material prices, particularly for things like resins and adhesives, are another wild card. If input costs spike and Avery can’t pass those on quickly, margins could feel the pressure.

Competition is another consideration. The company has done well to stay innovative, but this space doesn’t stand still. RFID and smart labeling, in particular, are becoming more crowded. Then there’s the supply chain. While it’s stabilized significantly since the height of pandemic disruptions, any renewed issues—whether from global logistics snarls or regional slowdowns—could have ripple effects. These aren’t deal-breakers, but they’re variables worth monitoring.

Final Thoughts

Avery Dennison remains a solid company, even with the stock’s recent slide. The business fundamentals are intact. It generates healthy cash flow, maintains a disciplined balance sheet, and has a leadership team that knows how to navigate challenges without veering off course. While the market has priced in a fair amount of caution, the company’s actions—steady dividend growth, regular buybacks, and ongoing investment in its highest-growth segments—tell a different story. For those watching from the sidelines, it’s worth keeping an eye on how those fundamentals play out in the months ahead.