Updated 4/13/25

Atmos Energy Corporation (ATO) is one of the largest fully regulated natural gas-only utilities in the United States, serving over three million distribution customers across eight states. With a market cap of $24 billion and a history of steady dividend growth, it appeals to investors seeking consistency and long-term income. The company has increased its dividend annually for more than 40 years, supported by strong operating margins, disciplined capital spending, and a stable regulatory environment. Its stock has climbed nearly 34% over the past year, backed by rising earnings, conservative financial management, and ongoing infrastructure modernization efforts. ATO continues to show dependable performance, with leadership focused on safety, system upgrades, and shareholder value.

Recent Events

Over the past 12 months, Atmos has put together an impressive run. The stock is up nearly 34%, far outpacing the broader market. That’s a strong move for any stock, but especially notable for a utility with a historically low beta of just 0.68. It moves slower than the market, but that’s part of the charm—it’s built for stability.

The company’s latest quarterly report, covering the period ending December 31, 2024, showed a solid 13% year-over-year gain in earnings. Revenue growth was more modest at 1.5%, which might seem underwhelming on the surface. But for a regulated utility like Atmos, the real story is in the margins and cash flow. Profit margins came in at 25.9%, while the operating margin was a healthy 39.7%. Those numbers are strong indicators of a well-run utility that’s controlling costs and maximizing return on its infrastructure.

This kind of performance is exactly what long-term dividend investors appreciate. It’s not flashy, but it’s reliable—and reliability is the bedrock of income investing.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.30%

💸 Trailing 12-Month Dividend: $3.29 per share

🧮 Payout Ratio: 47.06%

📊 5-Year Average Yield: 2.47%

📅 Dividend Growth Streak: 40+ years

📉 Beta: 0.68

🛠 Next Ex-Dividend Date: February 25, 2025

💰 Last Payment: March 10, 2025

Dividend Overview

Atmos currently pays an annual dividend of $3.48 per share, which works out to a yield of 2.30% based on recent prices. That’s just a bit under its five-year average, and that dip is really just a side effect of the stock’s recent price rally. The payout itself continues to climb, as it has done for decades.

With a payout ratio sitting around 47%, Atmos is in a comfortable position. That kind of buffer gives the company flexibility to continue raising its dividend even if earnings hit a bump. And with its business model focused on regulated returns, earnings volatility is rarely a major concern.

Atmos has paid a dividend every year since 1983 and has raised it annually for over four decades. That makes it a stalwart in the dividend world—no gimmicks, just steady checks arriving on time.

Dividend Growth and Safety

Atmos has grown its dividend at a consistent pace over the years, averaging around 7% annual increases over the past decade. That trend continued in 2024, with the company delivering another healthy bump. It’s a classic case of slow and steady—not just maintaining the payout but increasing it with discipline.

When it comes to financial footing, the company is holding its ground well. The debt-to-equity ratio is around 66.6%, which is quite reasonable for a utility. That’s because utilities often finance infrastructure improvements with debt, and in Atmos’ case, much of that debt supports long-term investments in pipeline safety and modernization.

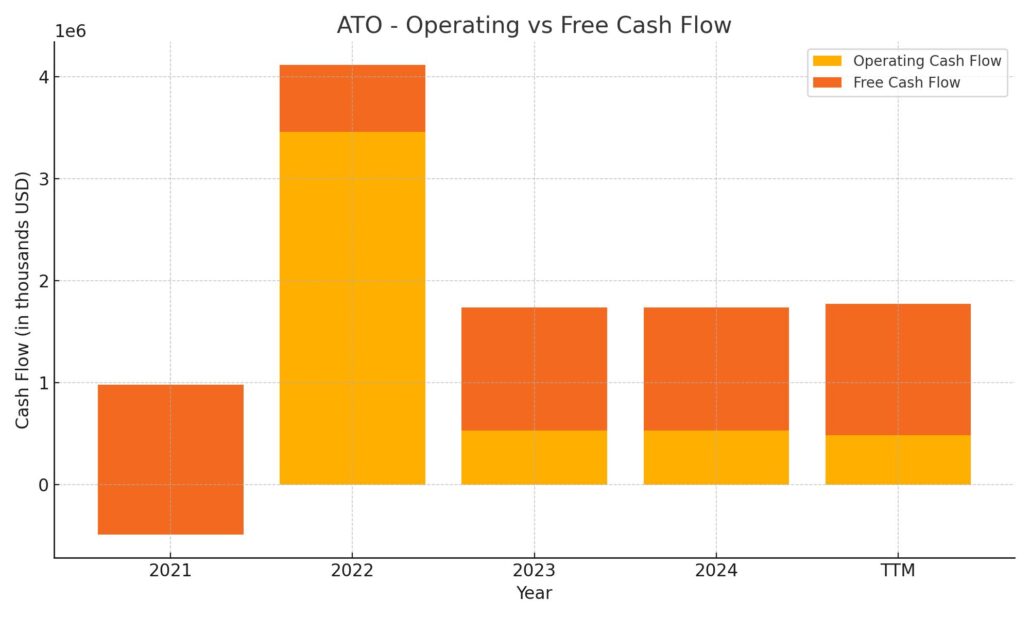

The company reported $1.77 billion in operating cash flow, which easily covers its dividend obligations. The one item that stands out is its negative levered free cash flow, currently at -$1.56 billion. That might look concerning at first glance, but it’s driven by capital investments—long-term projects that aim to boost rate base and ultimately justify higher regulated returns. It’s a tradeoff that makes sense for a company looking to the future while keeping the dividend on solid ground.

Institutional ownership is another quiet vote of confidence. Over 105% of shares are held by institutions, a number that reflects overlapping strategies from funds, retirement accounts, and large-scale investors who value predictability.

While Atmos isn’t offering a sky-high yield, what it does offer is a growing income stream backed by dependable earnings, solid management, and a long-term commitment to shareholder returns. For dividend-focused investors, this is the type of stock that lets you sleep well at night—rain or shine.

Cash Flow Statement

Atmos Energy’s cash flow statement over the trailing twelve months reflects the capital-heavy nature of its business. Operating cash flow came in at $1.77 billion, a slight increase from the previous year’s $1.73 billion. This steady inflow highlights the company’s reliable earnings and strong rate-regulated revenue. However, free cash flow was negative at -$1.29 billion due to substantial capital expenditures totaling just over $3.05 billion—consistent with Atmos’ ongoing infrastructure modernization and pipeline safety programs.

On the financing side, the company raised $1.58 billion, largely through a mix of equity and debt issuance, helping to cover its investment needs. That included issuing nearly $876 million in new stock and taking on $987 million in new debt. Despite these moves, Atmos ended the period with $589 million in cash, significantly higher than in previous years. The rise in cash reserves, coupled with consistent operating inflows, reflects a conservative yet proactive approach to funding growth while preserving liquidity.

Analyst Ratings

📊 Atmos Energy (NYSE: ATO) has seen a steady stream of analyst coverage recently, with opinions largely tilting toward cautious optimism. Wolfe Research began coverage with a “Peer Perform” rating, signaling expectations for the stock to keep pace with the market rather than outperform it. Meanwhile, Morgan Stanley reaffirmed its “Overweight” stance and nudged its price target higher from $142 to $147, showing continued confidence in Atmos’ stable cash flow and long-term infrastructure investments.

💡 The average consensus price target from analysts stands at $151.75, suggesting a slight upside from current levels. Targets span from $138 on the low end to $165 on the high, which reflects a reasonable spread in sentiment. These projections often tie into Atmos’ consistent earnings, regulated revenue streams, and disciplined capital allocation.

📈 Overall, analyst sentiment remains comfortably in the “Moderate Buy” territory. The combination of low volatility, a dependable dividend, and well-managed debt levels keeps Atmos attractive in the eyes of many on Wall Street. For income-focused investors, that kind of analyst backing offers another layer of reassurance—especially in a sector where stability often wins the day.

Earning Report Summary

Atmos Energy kicked off fiscal 2025 with a solid earnings report, showing once again why it’s often seen as a steady hand in the utility space. For the quarter ending December 31, 2024, the company delivered earnings per share of $2.23, just above what most were expecting. That’s not a big surprise for long-time followers of Atmos—it’s a company known for meeting its targets and doing so without a lot of noise.

Reliable Revenue, Modest Growth

Revenue landed around $919 million for the quarter, which is up slightly from the same period last year. This kind of modest growth is pretty typical for regulated utilities like Atmos. They’re not in the business of rapid expansion; their strength lies in predictable income and steady improvements through rate increases and long-term infrastructure upgrades. There’s nothing flashy here—just dependable operations doing what they’re supposed to do.

Focused Investment

Capital spending in the quarter came in at about $891 million, with most of it going toward pipeline upgrades and safety improvements. This is part of the company’s ongoing push to modernize its systems. Atmos isn’t cutting corners—it’s investing heavily to keep its network reliable and safe, which in turn supports its long-term regulatory and financial strategy.

Confident Outlook

Management didn’t change its full-year earnings guidance and still expects earnings per share between $7.05 and $7.25 for fiscal 2025. That shows confidence in how the year is shaping up. With its consistent performance, strong margins, and a clear game plan for capital investment, the company looks well-positioned to keep doing what it does best—deliver reliable service and return value to shareholders over time.

Atmos continues to show why it’s a favorite for income-focused investors. It’s not chasing growth at all costs, and that’s exactly why it holds up well in a market that can sometimes feel unpredictable.

Chart Analysis

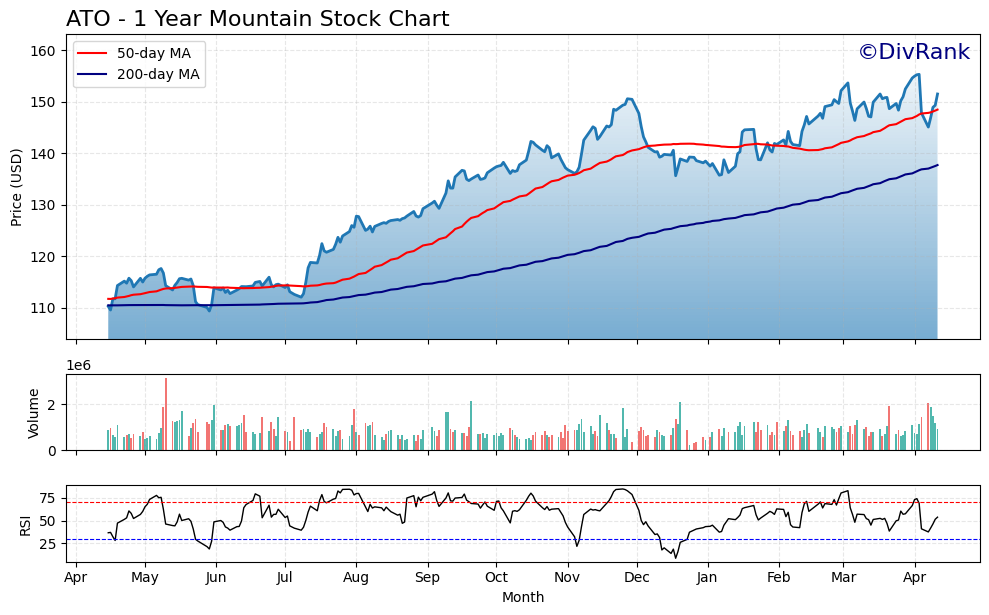

Price and Moving Averages

ATO has been on a clear upward trajectory over the past year, climbing from just above $110 to the mid-$150s. That steady ascent has kept the 50-day moving average (red line) well above the 200-day moving average (blue line) for most of the period, which is typically a good sign of momentum. Even during periods of consolidation—like in December and parts of January—the stock held its ground without breaking key trend levels. The recent bounce above both moving averages after a brief pullback reinforces the trend’s strength and signals continued confidence.

Volume Activity

Volume has been relatively stable, with a few noticeable spikes. These volume surges appear around price breakouts or strong upward moves, which suggests institutional buying rather than panic selling. There hasn’t been any sharp, sustained volume drop-off, which is often a sign of weakening interest. Instead, what stands out is the consistency—no erratic behavior, just a slow build of accumulation over the months.

RSI Trends

Looking at the Relative Strength Index at the bottom, ATO has mostly traded in the upper range of the RSI band, flirting with overbought territory several times since July. But even during those moments, there wasn’t a major correction, only a slight dip to reset the trend. It suggests strong buyer interest without the kind of speculative froth that typically precedes volatility. Most importantly, the RSI hasn’t dipped into oversold conditions all year, reinforcing the idea that support remains strong on the downside.

In all, the chart paints the picture of a company with stable price action, consistent investor interest, and strength during market dips. There’s a rhythm to how ATO trades—pullbacks get bought, momentum rebuilds, and the long-term trend stays intact.

Management Team

Atmos Energy’s leadership is anchored by Kevin Akers, who has served as CEO since October 2019. His career spans decades with the company, having held a variety of operational and leadership roles. That hands-on experience shows in the way he’s navigated Atmos through long-term infrastructure investments while maintaining regulatory compliance and financial discipline.

Supporting him is Christopher Forsythe, Atmos’ Chief Financial Officer. With the company since 2003, Forsythe brings consistency and a strong grasp of capital planning. His approach to managing Atmos’ substantial capital expenditures and long-term debt has helped maintain a strong balance sheet. General Counsel Karen Hartsfield adds legal depth to the team, ensuring the company’s actions align with complex regulatory environments.

The board of directors, led by Chairman Kim Cocklin, includes a mix of former industry executives and governance professionals. Cocklin, a former CEO of Atmos himself, brings institutional knowledge and long-term strategic vision. The board plays a steady hand in guiding the company forward, reinforcing a culture of reliability and long-term thinking.

Valuation and Stock Performance

Atmos Energy stock is trading around $151.48 as of mid-April 2025, sitting just a few points below its 52-week high of $157.62. That steady upward movement reflects strong investor confidence in the company’s fundamentals. Its trailing price-to-earnings ratio is around 21.66, which isn’t overly stretched for a utility with consistent earnings, growing dividends, and a stable regulatory model.

The past year has been a good one for the stock. It has climbed steadily without wild swings, reflecting the underlying strength of its earnings and investor trust in management. With a beta of 0.68, the stock moves more slowly than the broader market, which is often welcomed by those looking for predictability.

Analysts have been generally positive, maintaining buy ratings and forecasting a 12-month price target in the $148–$155 range. That shows there’s still room for appreciation, even after the recent run. The consensus points to a company that’s not expected to explode in growth, but rather deliver year after year of measured gains and rising dividends.

Risks and Considerations

Even with a reliable business model, Atmos Energy faces a few key risks. The biggest comes from its regulatory environment. The company’s ability to set rates and recover costs is determined by public utility commissions in the states it serves. If those relationships shift or if regulations change, earnings could come under pressure.

Another challenge is the ongoing capital spending. Atmos is investing billions in pipeline modernization and safety. While those improvements are essential and can support higher allowed returns, they also require significant funding. Too much reliance on debt or equity issuance could weigh on future cash flow or dilute shareholder value.

There’s also exposure to commodity pricing, particularly natural gas, though that’s less impactful than it might be for unregulated energy firms. Demand trends—driven by weather, economic cycles, and energy alternatives—can also sway results from quarter to quarter. Lastly, interest rate changes pose a risk, since higher rates increase borrowing costs, which matters in a capital-intensive business.

Final Thoughts

Atmos Energy continues to deliver what it’s known for—stable returns, reliable service, and a commitment to long-term planning. The leadership team brings deep experience and measured decision-making to the table. They’ve prioritized infrastructure and regulatory reliability over chasing fast profits, and it shows in the company’s consistent performance.

The stock’s valuation remains grounded in its ability to generate dependable cash flow and grow its dividend over time. While no investment is without risks, Atmos has shown it can manage through economic cycles and industry changes without losing its footing. For those drawn to companies that prioritize discipline, resilience, and long-term shareholder value, it’s a name that continues to earn attention.