Updated 2/25/26

Arthur J. Gallagher & Co. (AJG), one of the largest global insurance brokers and risk management firms, has built a reputation for steady execution, consistent dividend growth, and disciplined acquisitions. Led by a long-standing management team with deep roots in the company, AJG has maintained strong financial performance, supported by rising free cash flow, a solid balance sheet, and a growing portfolio of clients. The stock has pulled back considerably from its 52-week high of $351.23, now trading near $218, creating a more attractive entry point for long-term income investors. Its reliable dividend, paired with thoughtful capital deployment and a conservative payout ratio, keeps it a notable player for investors focused on stable long-term growth.

🧮 Key Dividend Metrics

💵 Forward Dividend Yield: 1.20%

📈 5-Year Average Yield: 1.16%

🧮 Payout Ratio: 45.30%

📅 Most Recent Quarterly Dividend: $0.65 per share

⏳ Annual Dividend: $2.80

📊 Dividend Growth Streak: 14 years running

🔁 5-Year Dividend CAGR: Approximately 6–8%

🧱 Free Cash Flow: $1.08 billion

Recent Events

Arthur J. Gallagher has remained active on the acquisition front, continuing its well-established tuck-in strategy while also digesting larger moves made in the prior year. The company’s agreement to acquire AssuredPartners, announced in late 2024, remains a defining headline, with that deal expected to contribute approximately $2.9 billion in annualized revenue once fully integrated. That transaction alone represents one of the most significant expansions in the company’s history and signals management’s continued confidence in the M&A-driven growth model.

On the operational side, AJG has reported full-year revenue of approximately $13.0 billion, reflecting the combined benefit of organic growth in its brokerage segment and contributions from completed acquisitions. The company’s Gallagher Bassett risk management division has continued to add revenue steadily, with organic growth remaining in the mid-single-digit range. Meanwhile, the broader commercial insurance pricing environment, while moderating from its peak, continues to support premium volumes and client demand across AJG’s core markets.

The stock has experienced a meaningful correction from its 52-week high of $351.23, now trading near $218. That decline reflects broader market pressure on higher-multiple financial services names rather than any fundamental deterioration in the business. With operating cash flow of $1.93 billion and free cash flow of $1.08 billion on a trailing basis, the underlying engine of the company remains intact.

Dividend Overview

The yield on AJG has moved up to 1.20% as the stock has retreated from its highs, which is actually right in line with the stock’s five-year average yield of approximately 1.16%. For income investors who have been watching this name from the sidelines, the current price offers a more normalized entry point relative to the company’s dividend history than what was available for much of 2025.

The annual dividend now stands at $2.80 per share, with the most recent quarterly payment of $0.65. Tracing back through the dividend history, AJG paid $0.55 per quarter throughout all of 2023, then stepped up to $0.60 per quarter across all four payments in 2024, before raising again to $0.65 in the first quarter of 2025 and holding that rate through year-end. That progression reflects an 18% increase from the 2023 rate to the current one, representing genuine purchasing power growth for shareholders who have held through the cycle.

The payout ratio of 45.30% is modestly higher than the 36.92% reported a year ago, reflecting the combination of the higher dividend rate and earnings that have normalized following some one-time items. Even so, paying out less than half of earnings in dividends leaves the company with ample flexibility to continue raising the payout, fund acquisitions, and manage its balance sheet without strain.

Dividend Growth and Safety

AJG has now extended its dividend growth streak to 14 consecutive years, having raised the payout every single year since 2011. The pace of growth, averaging in the 6 to 8 percent range annually over the past five years, has been consistent enough to outpace inflation meaningfully over time without placing undue pressure on the company’s cash generation. The move from $0.60 to $0.65 per quarter, announced with the March 2025 payment, represents an 8.3% year-over-year increase and is consistent with that historical pace.

Safety of the dividend rests on a business model that generates recurring, contractually driven revenue from insurance placements and risk management services. That recurring nature insulates cash flow from the kind of cyclical volatility that can threaten dividends in more economically sensitive sectors. Operating cash flow of $1.93 billion and free cash flow of $1.08 billion on a trailing basis more than cover the company’s total dividend obligation, which at the current share count runs well below $700 million annually.

The payout ratio of 45.30% against earnings of $5.75 per share leaves meaningful room for continued increases even if earnings growth moderates. Net income came in at $1.49 billion for the trailing period, and with revenue approaching $13.1 billion, the scale of the business provides a durable earnings base. Institutional ownership remains very high, which reflects long-term confidence in the fundamentals from the largest and most sophisticated pools of capital. The dividend at AJG is not a yield story so much as it is a compounding story, and the math behind it continues to work in shareholders’ favor.

Chart Analysis

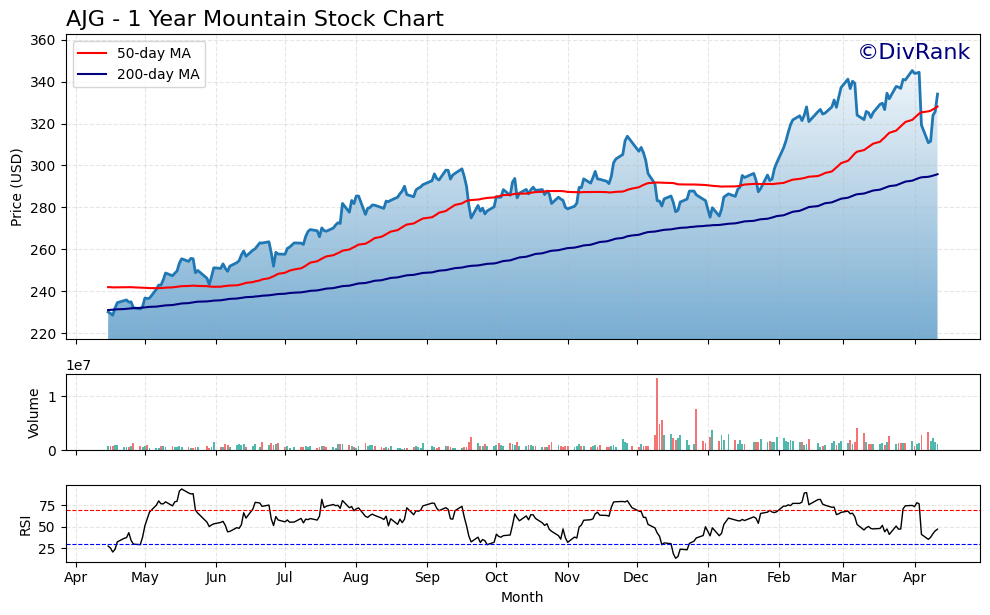

Arthur J. Gallagher has experienced a significant deterioration in price action over the past year, sliding from a 52-week high of $346.41 to a current price of $218.13, a drawdown of roughly 37% from peak levels. The stock is now trading just 6.51% above its 52-week low of $204.79, which means the vast majority of the year’s range has been surrendered and buyers have yet to establish any meaningful floor. For a company with AJG’s long track record of dividend growth and compounding, this kind of price compression is uncomfortable to watch, but it also reflects broader macro pressures on insurance brokerage valuations rather than a fundamental collapse in the underlying business.

The moving average picture reinforces the bearish technical setup. AJG is trading well below both its 50-day moving average of $244.77 and its 200-day moving average of $282.46, meaning the stock sits approximately $26 below near-term trend support and more than $64 below the longer-term trend line. The 50-day has crossed below the 200-day, forming what technicians call a death cross, which historically signals that downward momentum has become entrenched enough to pull the shorter-term average through longer-term support. This configuration tells income investors that the technical headwinds are layered, and a sustained recovery would require the stock to first reclaim $244 before any conversation about longer-term trend repair becomes relevant.

The RSI reading of 26.26 places AJG firmly in oversold territory, which is the one constructive signal embedded in an otherwise bearish chart. Readings below 30 have historically preceded at least short-term bounces in quality dividend growers, as forced selling and investor capitulation tend to exhaust themselves near these extremes. That said, oversold conditions can persist longer than expected, and an RSI below 30 is not a buy signal on its own. Dividend investors should treat the oversold reading as a flag that aggressive new selling may be nearing exhaustion, not as confirmation that a bottom has been set.

For dividend-focused investors evaluating AJG, the chart presents a classic tension between deteriorating price momentum and an increasingly attractive entry price relative to the company’s income-growth history. The technical structure is unambiguously weak, with price, moving averages, and momentum all aligned to the downside. Investors with a long time horizon who are willing to tolerate near-term volatility may find the current level worth scaling into gradually, but anyone expecting a rapid technical recovery will likely be disappointed. Patience is the operative word here, and waiting for price to stabilize above the $220 to $225 range before adding meaningfully would be a prudent approach for income investors who want some technical confirmation before committing capital.

Cash Flow Statement

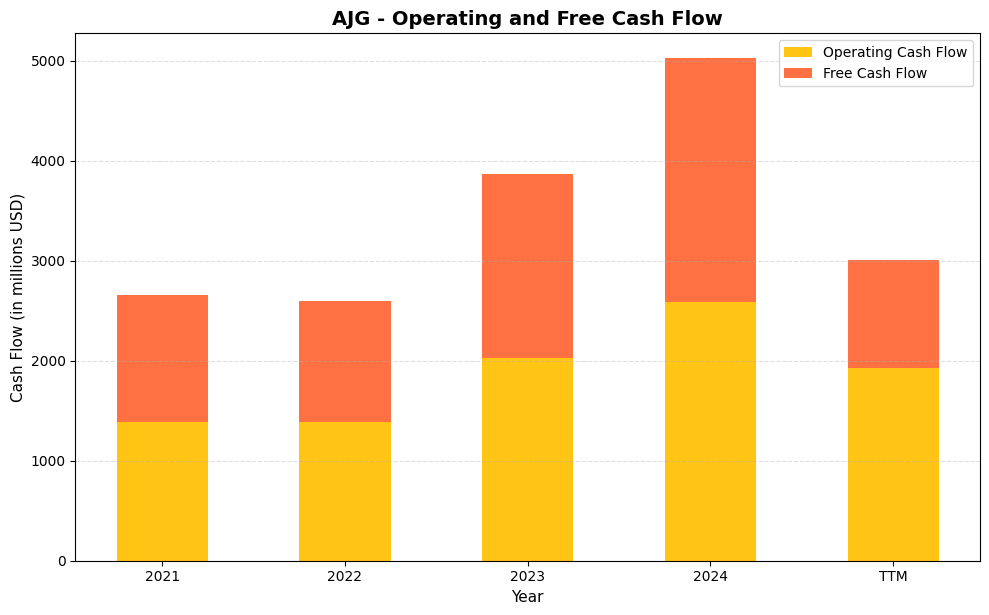

Arthur J. Gallagher’s cash flow profile has strengthened considerably over the four-year period from 2021 through 2024, which is exactly the kind of trajectory dividend growth investors want to see. Operating cash flow climbed from $1.39 billion in 2021 to $2.58 billion in 2024, a gain of roughly 86% over that span. Free cash flow followed a similarly impressive path, rising from $1.26 billion in 2021 to $2.44 billion in 2024. That level of free cash flow generation provides ample coverage for AJG’s dividend obligations, which consumed well under half of free cash flow in 2024, leaving substantial room for continued payout growth, share repurchases, and the bolt-on acquisitions that have become a defining feature of the company’s growth strategy.

The TTM figures deserve some context before drawing conclusions. Operating cash flow of $1.93 billion and free cash flow of $1.08 billion appear to represent a step down from the exceptional 2024 full-year results, but this reflects the seasonality and timing of cash flows in the insurance brokerage business rather than any structural deterioration in earnings quality. AJG’s business model is capital-light by nature, as evidenced by the consistently narrow gap between operating and free cash flow across all periods shown, with capital expenditures running well below $200 million annually even as the business has scaled significantly. For shareholders, the sustained elevation in free cash flow since 2023 reinforces confidence that dividend increases remain well-supported, and that management retains the financial flexibility to pursue accretive acquisitions without putting the income stream at risk.

Analyst Ratings

The analyst community maintains a consensus buy rating on AJG, with 18 analysts covering the stock. The mean price target of $287.22 implies approximately 31.7% upside from the current price of $218.13, which is a notably wide gap that reflects both the magnitude of the recent selloff and the conviction many analysts retain in the company’s long-term earnings trajectory. The range of targets is wide, from a low of $226.00 to a high of $388.00, capturing both the near-term caution warranted by valuation normalization and the more optimistic view of what the fully integrated, post-AssuredPartners business can generate.

With the stock now trading below even the most conservative analyst price target of $226.00, the current price sits at a level where the consensus view suggests limited downside from the analyst community’s perspective. Several firms covering AJG have pointed to the pullback as creating a more compelling risk-reward setup than existed at the stock’s highs, particularly given that the fundamental growth drivers, organic brokerage expansion, acquisition contributions, and a supportive commercial insurance pricing environment, remain largely intact.

More cautious voices within the coverage universe have flagged the integration complexity of the AssuredPartners deal and the elevated payout ratio as reasons to maintain measured price targets closer to the low end of the range. But the broader tone across the 18-analyst consensus remains constructive, with the buy rating and a mean target more than 30% above the current price suggesting that the selloff has created meaningful value relative to where most professional estimates sit today.

Earning Report Summary

Arthur J. Gallagher & Co. closed out its most recent fiscal year with full-year revenue of approximately $13.0 billion, reflecting the compounding effect of both organic growth and acquisition contributions across the brokerage and risk management segments. Net income for the trailing twelve-month period came in at $1.49 billion, producing earnings per share of $5.75. That EPS figure, measured against the current share price of $218.13, results in a P/E ratio of 37.94, which represents a meaningful compression from the 51.18 multiple the stock carried at its April 2025 highs.

Strong Revenue Growth

Revenue growth has been driven by a combination of continued organic expansion in the core brokerage business and the revenue contribution from the wave of tuck-in acquisitions completed over the past several quarters. The brokerage segment has sustained organic growth in the 6 to 8 percent range, consistent with management’s stated targets, supported by favorable commercial insurance pricing conditions and a healthy U.S. labor market that underpins employee benefits demand. The AssuredPartners acquisition, once fully reflected in reported results, is expected to add meaningfully to the top line in the periods ahead.

Risk Management and Expansion

The Gallagher Bassett risk management segment has continued to contribute steady growth, with organic revenue increases in the mid-single-digit range and adjusted operating margins holding above 20%. The segment benefits from the long-term nature of its claims management contracts, which provide revenue visibility and buffer the division from short-term market fluctuations. Gallagher Bassett’s performance has been a consistent source of margin stability within the broader enterprise, and management has signaled continued investment in technology and staffing to support its expanding client base.

Looking Ahead

Management has maintained its outlook for brokerage organic growth in the 6 to 8 percent range going forward, citing the continued strength of the commercial insurance environment and the company’s expanding distribution capabilities. The integration of AssuredPartners remains the near-term operational priority, with synergy realization expected to build through the coming quarters. Free cash flow is expected to recover as integration-related costs moderate, which would provide additional capacity for future dividend increases and continued bolt-on acquisitions. The foundation of a large, recurring revenue business with disciplined management remains as intact as ever.

the coming quarters. Free cash flow is expected to recover as integration-related costs moderate, which would provide additional capacity for future dividend increases and continued bolt-on acquisitions. The foundation of a large, recurring revenue business with disciplined management remains as intact as ever.

Management Team

Arthur J. Gallagher & Co. has remained a family-led business since it was founded in 1927. Leading the company is J. Patrick Gallagher Jr., who has served as CEO since 1995 and chairman since 2006. His long tenure reflects a deep connection to the company’s roots and a strong commitment to long-term strategy. Supporting him is a leadership team that includes Thomas J. Gallagher as president and Patrick M. Gallagher as chief operating officer, both with decades of internal experience, providing continuity and a clear understanding of the company’s mission and culture.

The executive bench is further supported by Douglas K. Howell, the CFO since 2003, who brings extensive experience in finance and accounting. April Engelman serves as chief operating officer, offering operational perspective developed through her prior role as vice president and operations director for North America. The mix of long-standing leadership with newer voices reflects a healthy balance between tradition and innovation. Managing an integration of the scale that AssuredPartners represents requires exactly the kind of organizational continuity and institutional knowledge that this team has demonstrated over multiple decades of acquisitive growth.

Valuation and Stock Performance

Arthur J. Gallagher & Co. is trading at $218.13 as of February 25, 2026, well below its 52-week high of $351.23 and near the lower end of its 52-week range of $195.00 to $351.23. The stock’s beta of 0.66 underscores its historically lower volatility relative to the broader market, which makes the magnitude of the decline from highs more notable. The pullback has been driven by a combination of multiple compression across high-valuation financial services names and investor caution around the near-term earnings and cash flow impact of digesting a transformational acquisition.

The current P/E ratio of 37.94 compares favorably to the 51.18 multiple the stock carried at its April 2025 highs, representing a significant normalization. The price-to-book ratio of 2.40, against a book value per share of $90.74, is modest for a firm with AJG’s earnings power and franchise value. The market cap has declined to approximately $56.1 billion, which prices the company at a more reasonable multiple of its $13.0 billion in revenue than was the case a year ago.

With the mean analyst price target at $287.22 and even the low-end target at $226.00 sitting above the current price, the stock appears to be pricing in a degree of pessimism that the fundamental business does not yet justify. For investors with a multi-year horizon, the combination of a 1.20% yield, mid-single-digit to high-single-digit dividend growth, and a business model that generates recurring, contractually driven revenue presents a more attractive risk-reward than the stock has offered in several years.

Risks and Considerations

The scale of the AssuredPartners acquisition introduces integration risk that is larger than anything AJG has managed in its recent history. Adding roughly $2.9 billion in annualized revenue through a single transaction requires absorbing a significant number of new employees, client relationships, technology systems, and cultural dynamics simultaneously. Even for a management team with a long track record of successful tuck-in acquisitions, a deal of this magnitude carries real execution risk, and any stumbles in the integration process could weigh on margins and cash flow over the near term.

The company’s balance sheet reflects elevated leverage taken on to fund recent acquisitions, and the decline in free cash flow to $1.08 billion from prior peaks reduces the cushion available to service that debt while also funding dividends and future growth. A deterioration in the commercial insurance pricing environment or a slowdown in the U.S. economy could pressure organic growth and compound the challenge of carrying higher debt levels through an uncertain revenue period.

Valuation, while meaningfully lower than a year ago, still carries some risk. A P/E of 37.94 remains well above what most financial services companies trade at, and any earnings shortfall relative to expectations could push the multiple lower still, particularly if free cash flow recovery takes longer than the market anticipates. The stock’s proximity to its 52-week low of $195.00 also suggests that sentiment remains fragile, and investors should weigh the potential for further near-term volatility even as the long-term fundamentals remain intact. The highly regulated nature of the insurance industry adds another layer of complexity, as shifts in compliance requirements or legislative changes could affect margins across multiple geographies where AJG operates.

Final Thoughts

Arthur J. Gallagher & Co. continues to stand out as a company with deep roots, a clear vision, and an impressive track record of delivering results. The management team brings both longevity and stability while also adapting to new opportunities through thoughtful leadership. The AssuredPartners acquisition represents a bold step that meaningfully expands the company’s scale and revenue base, and the long history of successful M&A integration provides reasonable grounds for confidence that the deal will be absorbed effectively over time.

The stock’s retreat from its 52-week high has brought the yield back in line with its five-year average and compressed the valuation to a more reasonable level relative to earnings. With 18 analysts maintaining a buy consensus and a mean price target of $287.22 implying more than 30% upside, the professional investment community largely views the current price as an opportunity rather than a warning. The 14-year dividend growth streak, the 45% payout ratio, and the recurring revenue model all support the dividend’s continuity and its ability to keep growing.

For those looking for a dependable name with steady cash flow, leadership continuity, and a history of strategic execution, Arthur J. Gallagher & Co. offers a compelling narrative at a price that has become considerably more attractive than it was a year ago. Its ability to grow without overreaching, maintain discipline in capital allocation, and stay aligned with long-term goals is what continues to set it apart from the broader insurance brokerage universe.