Updated 4/13/25

Artesian Resources Corporation (ARTNA) delivers water, wastewater, and related services across the mid-Atlantic, with a strong presence in Delaware, Maryland, and Pennsylvania. The company recently reported a 22% increase in net income for 2024, supported by steady revenue growth, disciplined cost management, and continued infrastructure investment. With a 3.60% dividend yield, consistent payout growth, and a low beta of 0.26, ARTNA offers stability with income appeal. Leadership transitioned smoothly to Nicholle R. Taylor, maintaining the family legacy while reinforcing strategic continuity. Despite recent stock softness, analysts maintain a positive outlook with a $46.00 consensus price target.

Recent Events

Over the past 12 months, ARTNA has seen a modest dip, falling just under 3%, while broader indices have gained ground. But that movement isn’t a reflection of operational issues. Utilities often lag when interest rates rise, as their yields start to look less appealing compared to bonds. For Artesian, it’s more about timing and macro pressure than anything broken in the business model.

That said, performance has been quietly solid. Revenue rose 9.4% year over year, and earnings climbed 10.5% in the same timeframe. Those aren’t fireworks numbers, but in the world of utilities, double-digit growth in either metric is worth noting. Profit margins are healthy, with an 18.9% net profit margin and a strong operating margin north of 25%. These are strong signals that the company is running efficiently, which is critical for a regulated utility with tight cost control.

Debt is something to watch—total debt sits around $179 million, and the debt-to-equity ratio is about 75%. That’s on the higher side, but not out of character for a utility, where steady cash flow allows companies to carry more leverage without raising too many eyebrows.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.60%

💵 Forward Annual Dividend Rate: $1.21

🧾 Payout Ratio: 59.70%

📊 5-Year Average Dividend Yield: 2.67%

📆 Most Recent Dividend Date: February 21, 2025

⛲ Dividend Growth (Trailing 5 Years): Modest, steady increases

🔍 Ex-Dividend Date: February 7, 2025

Dividend Overview

What stands out about ARTNA for income-focused investors is its yield. At 3.6%, it’s comfortably higher than the average among utility peers. That figure becomes even more appealing when you factor in the company’s long history of stable, predictable payments. Unlike some higher-yielding stocks that come with risk or volatility, this is a yield built on consistency.

Artesian doesn’t just pay a dividend—it’s part of the culture. The payout ratio sits just below 60%, which tells you there’s still plenty of room to reinvest in infrastructure and meet regulatory needs while still taking care of shareholders. Utilities need to walk a tightrope between payout and capital investment, and ARTNA seems to be balancing that well.

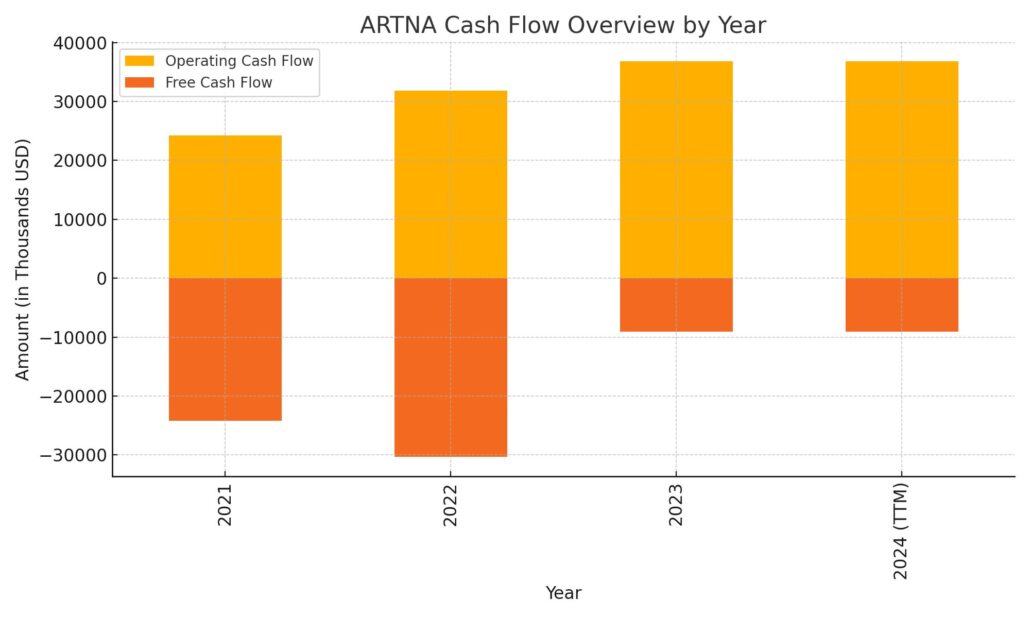

Even though recent free cash flow has dipped into the negative territory, that’s largely due to the nature of capex timing—utilities invest heavily in physical assets, and those investments often lead to lumpy cash flow. The core operations remain strong, with $36.8 million in operating cash flow generated over the past year.

Dividend Growth and Safety

This isn’t a stock that’s going to double your dividend in five years, but it’s not trying to. Artesian has a pattern of raising its dividend at a steady, measured pace. It’s not dramatic, but it is reliable. The most recent increase pushed the annual payout to $1.21 per share, up from $1.18 the year before.

That kind of consistency is meaningful, especially for investors using dividends as part of their income stream. A stock like this isn’t going to keep you up at night. The low beta of 0.26 means it doesn’t move much in line with the broader market—again, a positive for folks building portfolios to weather all kinds of economic climates.

From a valuation lens, the stock is sitting at around 17 times forward earnings. That’s not screaming cheap, but it’s not expensive either. Price-to-book is sitting around 1.44, which is fair for a business with hard assets and a dependable stream of regulated revenue.

What’s important is this: Artesian isn’t trying to be the fastest grower or the highest yielder. Its goal is to show up, quarter after quarter, with dependable results and a payout that you can count on. For dividend investors—especially those with a long-term mindset—that kind of predictability can be more valuable than flashier opportunities that come with a side of uncertainty.

Cash Flow Statement

Artesian Resources generated $36.8 million in operating cash flow over the trailing 12 months, a notable improvement from the prior year and a continuation of its positive trend since 2021. This steady climb reflects stronger earnings and consistent billing in its regulated utility services. However, the company’s capital expenditures remain high, with $45.9 million spent over the same period. That level of investment, typical for water utilities, is focused on infrastructure upgrades and system expansion, but it continues to weigh on free cash flow, which came in at negative $9.1 million.

Financing activities offset some of that pressure. Artesian raised a modest $780,000 in new debt and issued about $347,000 in new stock. Debt repayments were limited to $2.3 million, helping to keep liquidity in check, though the company ended the period with just $1.1 million in cash. The continued investment in core assets, despite generating stable operating cash, underscores the capital-intensive nature of the business and the long-term approach management appears to be taking. While free cash flow remains negative, the strength in operating cash generation provides some assurance that the company is maintaining its footing operationally even as it invests heavily in future capacity.

Analyst Ratings

Artesian Resources Corporation (ARTNA) recently saw a shift in sentiment from analysts, with Janney Capital adjusting its price target down to $56 from a prior $60. Despite the lower target, the firm maintained a Buy rating. The adjustment was tied to ongoing inflationary pressures, which could squeeze margins and modestly impact near-term earnings. Still, the long-term fundamentals remain intact in their view, and the Buy rating signals confidence in Artesian’s resilience and consistent dividend story.

🎯 The average consensus price target across analysts sits at $46.00, representing a meaningful upside from the current share price around $33.51. 📈 That gap suggests analysts see value in the stock that the broader market might be overlooking at the moment. The steady Buy ratings highlight faith in the company’s predictable revenue stream, regulatory support, and essential service status.

💼 While Artesian isn’t widely covered by a large group of analysts, those who do follow it have remained supportive, seeing potential in its long-term strategy and its dependable dividend yield. The downgrade in target, rather than rating, reflects a more cautious view on the pace of growth—not a loss of faith in the business itself.

Earning Report Summary

Artesian Resources wrapped up 2024 on a strong note, showing solid growth across its core operations and profitability. The company continues to lean into its strengths—steady service, stable demand, and a measured approach to expansion—and the numbers reflect that.

Strong Top and Bottom Line Growth

Net income for the year hit $20.4 million, which is a meaningful jump from the $16.7 million posted in 2023. That pushed earnings per share to $1.98, up from $1.67 the previous year. Revenue came in at $108 million, up just over 9% year-over-year. For a utility, that’s impressive momentum, and it’s being driven by more than just rate adjustments.

A good portion of that growth came from higher water sales. The company benefited from a rate increase that kicked in late in 2023, but also saw a bump in usage and continued customer growth across its service area. Beyond water, its wastewater segment also performed well, and even its smaller non-utility services—like its Service Line Protection Plan—contributed a bit more this time around.

Keeping Expenses in Check While Investing for the Future

Expenses did rise, as expected, with operating costs (excluding depreciation and taxes) increasing about 7%. Higher supply and treatment costs, payroll growth, and system upkeep were the key drivers there. That said, Artesian still maintained strong margins, suggesting it’s managing its cost base effectively while still delivering reliable service.

One standout is the company’s ongoing investment in its infrastructure. Artesian put nearly $46 million into capital improvements during the year. That’s a big number, but it fits with the long-term nature of their business. These aren’t splashy investments—they’re the kind that ensure continued service reliability and regulatory compliance for decades to come.

Overall, Artesian’s 2024 performance felt like a company staying the course. It’s not chasing aggressive growth or making big shifts, but rather executing on what it does well. Steady growth in income, controlled costs, and ongoing investment in its systems—this is the kind of rhythm long-term investors, especially income-focused ones, tend to appreciate.

Chart Analysis

Price Movement and Trend

The stock price of ARTNA has been on a downward slope for much of the past year. After peaking around early summer near the $40 mark, the price began a slow but steady decline, bottoming out just under $30 in the early part of the new year. Since then, there’s been a quiet recovery, with the price recently pushing back toward the $33 to $34 level. It’s still trading below both the 50-day and 200-day moving averages for most of the year, though it’s beginning to challenge the 50-day again.

What’s notable here is the relationship between the two moving averages. The 50-day average crossed below the 200-day average in the second half of the year—a classic sign of bearish momentum—but more recently, that gap has narrowed. The slope of the 50-day is flattening, and price action is curling upward toward it, a signal that the trend might be losing some of its downward force.

Volume and Momentum

Volume stayed relatively light throughout the year, with just a few brief spikes. Most notably, there was one unusual volume surge in mid-year, but it didn’t lead to a sustained shift in price direction. Outside of that, the chart shows low trading volume overall, which is consistent with a smaller-cap stock that typically flies under the radar. This kind of volume pattern reinforces the idea that moves tend to be gradual rather than driven by speculative bursts.

The RSI tells an interesting story as well. After staying under the midline through late fall and early winter, momentum began to build in the new year. In recent weeks, RSI has been flirting with the upper end of the range, even nearing overbought territory above 70. That suggests there’s some short-term strength behind the current price bounce, even if it hasn’t yet reversed the broader trend.

Outlook Based on the Chart

The chart doesn’t scream breakout, but it does show a potential bottoming formation. Price has stabilized, volume remains controlled, and momentum is creeping higher. If the stock can hold above recent lows and continue pressing toward the 200-day moving average, that would reinforce the idea of a slow reversal. This type of setup leans more toward a rebuilding phase than a speculative spike. The movement off the lows combined with steady RSI improvement could be signaling that the worst of the selling pressure has passed.

Management Team

Artesian Resources Corporation recently transitioned leadership, with Nicholle R. Taylor stepping into the role of Chief Executive Officer and President. She succeeds her aunt, Dian C. Taylor, who led the company since 1992. Nicholle isn’t new to Artesian—she’s been with the company since 1991 and has held several executive positions, including President of Artesian Water Company and Senior Vice President. Her long history with the business gives her a deep understanding of its operations, culture, and customer base.

Backing her is a strong executive team with years of experience in utility operations and corporate leadership. Joseph A. DiNunzio serves as Executive Vice President and Corporate Secretary, bringing depth in governance and compliance. David Spacht, the long-serving Chief Financial Officer, oversees the financial and strategic planning side. Other key leaders include John Thaeder, who manages operations; Jennifer Finch, handling corporate finance and treasury functions; and Pierre Anderson, the company’s Chief Information Officer. Together, this group blends stability with strategic oversight, which is important in a heavily regulated and capital-intensive industry like water utilities.

Valuation and Stock Performance

As of mid-April 2025, ARTNA is trading at $33.51 per share. Over the past year, the stock has moved within a 52-week range of $29.45 to $41.29. While it has declined slightly, down about 2.7% year over year, that performance reflects broader utility sector pressure related to interest rate trends, rather than any specific operational weakness. The stock maintains a market cap of around $344 million, with a trailing P/E of 16.92 and a forward P/E closer to 17.86—both suggesting fair valuation relative to peers.

The price-to-book ratio is 1.44, indicating the stock is trading at a modest premium to its underlying equity. That’s not unusual for a stable utility with recurring revenues and a regulated business model. With a dividend yield of 3.60%, the stock offers income at levels competitive within the sector. Analysts currently have an average price target of $46.00, pointing to a potential upside from current levels. Combined with the company’s historically low beta of 0.26, ARTNA’s stock continues to be seen as a stable play, particularly in more conservative investment strategies.

Risks and Considerations

While Artesian offers many strengths, it’s important to weigh some of the challenges tied to its business model. Like most utilities, Artesian operates in a capital-heavy environment. Infrastructure requires continual investment—something reflected in the $45.9 million spent in the most recent period. That level of spending puts pressure on free cash flow, which came in negative at just over $9 million in the trailing twelve months. While not uncommon for a utility, it’s a metric worth watching over time, especially when coupled with higher interest rates that can increase the cost of debt.

Debt remains a factor, with over $179 million in total liabilities and a debt-to-equity ratio nearing 75%. These levels are reasonable within the sector, but they limit financial flexibility, particularly if rates remain elevated. Regulatory oversight is another consideration. Water utilities rely on approval from state commissions to raise rates or adjust service structures. Any unfavorable ruling can affect profitability and cash flow.

Geographic concentration is also something to keep in mind. Artesian serves customers primarily in Delaware, Maryland, and parts of Pennsylvania. While this tight footprint allows for operational focus, it also exposes the company to regional economic conditions and environmental variables. Slower population growth or changing weather patterns in these areas could influence long-term demand.

Final Thoughts

Artesian Resources continues to show what steady execution looks like in the utility space. With new leadership at the helm, but deep roots in the company, there’s a strong sense of continuity in both vision and operations. The business remains focused on delivering reliable service, investing in infrastructure, and maintaining its dividend commitment to shareholders.

Its recent financial results underline its ability to grow modestly while holding operating margins. The stock, while down slightly over the past year, still trades in a reasonable range with a dividend yield that stands out. Analysts see potential upside, and even without aggressive growth, the consistency of the company’s model offers a sense of comfort in uncertain markets.

Like any investment, there are trade-offs. High capital spending, regulatory exposure, and a concentrated footprint all present risks. But for those comfortable with the pace and profile of a regional utility, Artesian brings a lot to the table—especially for those who value stability and income over headline-grabbing returns.