Updated 4/14/25

Applied Industrial Technologies (AIT) is a $9 billion industrial distributor that delivers motion control, fluid power, and automation solutions to essential sectors across the economy. Backed by over a century of operating history, AIT has built a reputation for operational discipline, consistent earnings growth, and strong free cash flow. Under the leadership of CEO Neil Schrimsher, the company has expanded its capabilities through strategic acquisitions while keeping its balance sheet healthy and its dividend secure. Shares have gained over 19% in the past year, outperforming the broader market. AIT maintains a low payout ratio and continues to raise its dividend steadily, supported by strong margins and a focus on long-term value creation. With a forward P/E under 21 and EBITDA margins above 12%, the stock reflects investor confidence in stable execution and durable growth.

Recent Events

Applied Industrial Technologies (AIT) isn’t one of those companies you hear about every day, but it quietly plays a crucial role in the world of industrial components and maintenance services. Headquartered in Cleveland and around for over a century, AIT specializes in engineered motion control, fluid power, and flow control systems. It delivers the behind-the-scenes parts that keep manufacturing plants and heavy equipment up and running.

While the broader industrial sector has faced some mixed signals, AIT has shown resilience. In the most recent quarter, revenue dipped just slightly—down 0.4% year-over-year—but earnings still managed to climb 2.3%. That alone says a lot about how well this business controls its costs and manages operations.

Margins are solid. Operating margin sits at 11.26%, and net profit margin is holding at 8.62%, both healthy for a distributor in this space. On top of that, free cash flow remains strong. The company brought in over $426 million in operating cash flow and turned more than $300 million into levered free cash flow. That’s the kind of cushion that gives management room to grow the dividend without sweating market cycles.

And while there haven’t been any major strategic announcements lately—no big acquisitions, no restructuring chatter—that kind of consistency is often exactly what income investors are after. A steady hand on the wheel and a commitment to cash flow matters more than headlines.

Key Dividend Metrics

📬 Forward Annual Dividend Yield: 0.81%

💵 Forward Annual Dividend Rate: $1.84

📈 5-Year Average Dividend Yield: 1.20%

🧾 Payout Ratio: 14.98%

📆 Last Dividend Date: February 28, 2025

🚫 Ex-Dividend Date: February 14, 2025

📊 Dividend Growth Trend: Steady, with consistent annual increases

🔁 Last Stock Split: 3-for-2 in 2006

Dividend Overview

AIT isn’t trying to compete with the utilities or REITs of the world when it comes to yield. At just 0.81%, the dividend might not look especially exciting at first glance. But for investors who dig a little deeper, the picture becomes much more attractive.

This is a company with a disciplined payout policy. The dividend is small relative to earnings, with a payout ratio of just under 15%. That means the company has a wide margin of safety and isn’t stretching to reward shareholders. It’s paying out what it can comfortably afford—and keeping the rest to grow the business or buy back stock.

That kind of approach usually leads to a more sustainable model. While you’re not getting a huge check every quarter, what you are getting is reliable, and there’s plenty of room for growth. It’s the sort of dividend you can build on over time, knowing that the business underneath it is solid.

AIT’s overall return is driven more by consistent appreciation and responsible financial management than by high-yield income. But that’s exactly the kind of setup that long-term dividend investors often gravitate toward: a company with a healthy balance sheet, low payout ratio, and a long runway for reinvestment.

Dividend Growth and Safety

There’s a certain comfort in watching a company raise its dividend year after year. AIT has done just that. It’s not raising it in double-digit spurts, but it’s moving the needle steadily in the right direction—usually in the mid-single-digit range. That predictability builds trust.

The low payout ratio is a big reason why that growth is possible. With earnings per share sitting at $9.89 and the annual dividend at $1.84, AIT could triple its dividend and still be in a healthy spot. But that’s not the company’s style. Management prefers to be conservative and retain plenty of capital for expansion and operations.

Right now, there’s about $303 million in cash on the balance sheet. Total debt is manageable at $572 million, and the debt-to-equity ratio is a modest 31.9%. Combine that with a current ratio of 3.76, and you’ve got a company that has no trouble meeting its obligations—and then some.

Free cash flow is strong enough to fund the dividend several times over, and the most recent dividend was paid right on time in February. Based on the historical pattern, there’s no reason to expect any hiccups going forward.

Institutional investors clearly see the stability, too. With over 96% of the float held by institutions, there’s strong conviction among the professional crowd. Insider ownership is low, under 1%, which is fairly typical for companies of this size.

AIT might not have the flashiest payout in your portfolio, but it earns its place through reliability, discipline, and consistent performance. This is the kind of dividend stock that works best over the long haul—quietly compounding in the background while you sleep at night knowing it’s not overreaching.

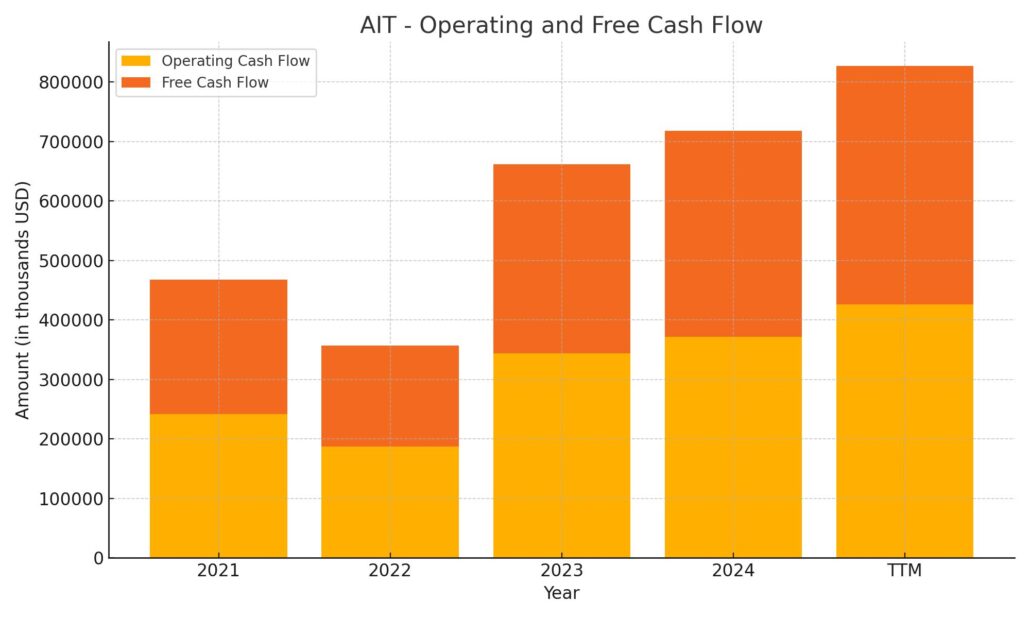

Cash Flow Statement

Applied Industrial Technologies continues to show strength where it counts—generating cash from its core operations. For the trailing twelve months, AIT delivered $426 million in operating cash flow, a notable increase from $371 million the previous year and more than double what it produced in 2021. This consistent growth in cash generation reflects both operational discipline and margin expansion, even in a slower revenue environment. Capital expenditures remain modest at under $26 million, keeping the business asset-light and allowing most of that cash to flow through as free cash flow, which came in at a solid $400 million.

On the investing side, cash outflows rose significantly to $347 million, likely driven by acquisitions or strategic investments aimed at long-term growth. Financing activity shows a net outflow of $178 million, mainly due to share repurchases and moderate debt repayments. The company returned capital to shareholders with nearly $93 million spent on buybacks and kept its debt management steady. While the cash balance declined to $313 million from $460 million a year ago, the overall liquidity remains healthy. These numbers paint a picture of a business with steady internal cash generation, cautious but intentional reinvestment, and disciplined capital returns.

Analyst Ratings

Applied Industrial Technologies (AIT) has recently attracted a fair bit of attention from analysts, with several updating their outlooks and adjusting price targets. 📈 Raymond James maintained its “outperform” rating, nudging the price target up from $250 to $265. Baird followed suit, lifting its target to $275 while also keeping an “outperform” view. KeyCorp made a slight revision in the opposite direction, lowering its target from $325 to $275, though it still kept an “overweight” rating on the stock. On the other side of the fence, StockNews.com dialed back its stance, downgrading AIT from “buy” to “hold.”

Overall, the sentiment among analysts leans clearly positive. 📊 The average 12-month price target now sits around $291.43, with projections ranging from $265 on the low end to $320 at the high. That puts the potential upside at nearly 29% from where the stock is currently trading. Most firms continue to hold a “buy” or “outperform” recommendation, pointing to AIT’s strong fundamentals and earnings consistency.

Much of the bullish sentiment stems from AIT’s reliable free cash flow, margin improvement, and steady execution in a challenging industrial environment. 🔧 The company’s ability to stay profitable and maintain growth has resonated well with analysts who see long-term upside in the stock’s story.

Earning Report Summary

Solid Results Despite a Soft Sales Environment

Applied Industrial Technologies turned in a steady performance for its fiscal second quarter ending December 31, 2024. Sales came in at $1.1 billion, which was just a touch below the prior year—off by 0.4%. But that slight dip doesn’t tell the full story. The company saw a positive lift from acquisitions and a little help from an extra selling day in the calendar. What held things back was a 3.4% decline in organic daily sales, with particular softness in their Engineered Solutions segment. Fluid power operations especially took a hit this time around.

Even with the sales pressure, the team delivered on the bottom line. Net income climbed to $93.3 million, or $2.39 per share, which was up 7% year-over-year. EBITDA also nudged higher, reaching $135.1 million. The margin expansion they pulled off came down to sharp execution—strong gross margins and tight control over costs. That kind of operational discipline makes a difference, especially when revenue isn’t moving much. They also closed the Hydradyne acquisition in December, which should open up new opportunities in the quarters ahead.

Leadership’s Take and the Road Ahead

CEO Neil Schrimsher was upbeat about how the quarter played out, especially given some of the seasonal and market-related headwinds they faced. He noted that while December saw some slower customer activity—thanks to typical year-end dynamics—the company still hit its stride operationally. Gross margin strength and cost control were the standout contributors, and he made it clear that AIT is well-positioned to build on its momentum heading into the back half of the fiscal year.

Looking forward, management raised their full-year guidance. They now expect EPS in the range of $9.65 to $10.05, which is a slight bump from the previous outlook. Sales growth is projected between 1% and 3%, factoring in the recent acquisition. Organic sales might still trend flat to slightly negative, but there’s confidence in the underlying setup. EBITDA margins are forecasted to land between 12.2% and 12.4%.

Schrimsher pointed to a few potential tailwinds, including a possible pick-up in industrial production and ongoing growth in their automation and tech-focused segments. It’s not all clear skies, but they seem cautiously optimistic about what’s ahead.

And in a move that didn’t go unnoticed, the board approved a 24% dividend hike. That’s a big jump and speaks volumes about how confident AIT feels about its cash flow and future prospects. It’s the kind of decision that sends the right signal to long-term investors—especially those who value both growth and income.

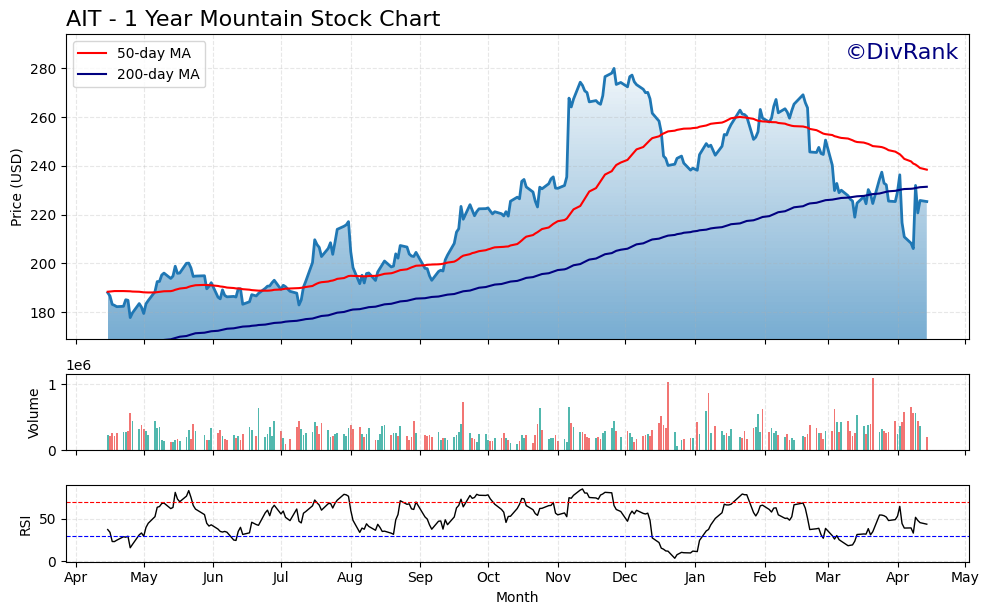

Chart Analysis

Price Trend and Moving Averages

AIT has had a strong run over the past year, moving steadily higher through much of 2023 before peaking around late December and beginning to pull back. The chart shows a clear uptrend that held for most of the year, supported by a rising 200-day moving average. However, starting in early 2024, the 50-day moving average rolled over and has been trending downward, now sitting well below its highs. This crossover is a subtle shift in momentum and suggests the pace of growth has cooled off for now.

What stands out is how the price recently dipped below both the 50-day and 200-day moving averages, then bounced back sharply. The stock briefly touched lows near $200 but quickly found support and has shown signs of resilience, snapping back above the 200-day average. This kind of bounce often indicates that buyers are stepping in at key technical levels, possibly seeing value at these prices.

Volume and Market Participation

Volume has been relatively steady throughout the year, with occasional spikes that correspond to major price movements. Notably, there’s a visible increase in volume around the recent bottom, hinting at some accumulation. It’s the kind of behavior that suggests interest is returning after the pullback, with larger players possibly adding positions while the stock is under pressure.

Even during periods of decline, the selling volume doesn’t appear extreme. That lack of panic is worth noting. It points to a market that’s digesting gains rather than abandoning the name altogether.

RSI and Momentum

The Relative Strength Index (RSI) has been useful for tracking AIT’s momentum swings. It pushed into overbought territory multiple times through the back half of 2023, particularly during the strong rally into December. Since then, momentum has clearly cooled. RSI readings fell near oversold levels in March before curling back upward, now sitting in neutral territory.

This shift in RSI echoes the broader price action—momentum has reset, and the stock is working through a consolidation phase. It’s no longer extended, and technically it’s positioned for a potential stabilization or new base-building phase if buying interest continues to firm up.

Overall Structure

Looking at the full year in context, AIT had a healthy run-up, a reasonable pullback, and is now testing important support levels. The long-term trend remains intact thanks to the rising 200-day average, and recent signs of recovery show there’s still investor appetite when prices dip. While the near-term momentum is less certain, the chart reflects a business that has moved through phases of growth, consolidation, and potential reaccumulation.

Management Team

Applied Industrial Technologies is led by a team that values steady execution over headline-grabbing moves. Neil Schrimsher, the CEO and President since 2011, has guided the company with a focus on long-term growth through margin improvement, selective acquisitions, and a sharp eye on operational efficiency. His leadership style reflects a commitment to performance over promises, and that’s helped the company stay on track through different economic cycles.

The executive team follows suit with a practical, measured approach. Their strategy centers on delivering consistent results, keeping costs under control, and investing in areas that offer strong returns over time. They’ve also shown an ability to successfully integrate acquisitions, which is no small feat in a sector where business systems and company cultures can vary widely. Communication with shareholders remains clear and balanced—acknowledging market challenges without sugarcoating the realities. That level of transparency builds confidence and trust in their long-term direction.

Valuation and Stock Performance

Over the past year, AIT’s stock has delivered a solid gain of more than 19 percent, easily beating broader market averages. The stock hit its high near $283 before pulling back into the $220s, where it has since settled. While this retracement may seem like a setback, it’s more of a reset following a strong run in 2023.

In valuation terms, the stock currently trades at a trailing price-to-earnings ratio just under 23 and a forward P/E below 21. These are reasonable multiples for a company that consistently generates earnings and free cash flow. The PEG ratio of around 2.1 suggests the valuation is aligned with expected growth, and not overly inflated.

Price-to-sales is under 2, and the price-to-book ratio hovers around 4.8, both indicating the market assigns a premium to AIT’s quality and dependability. Enterprise value to EBITDA stands around 15.7, which fits comfortably in the range of industrial peers with a similar mix of growth and income potential.

What stands out most is how closely the stock’s performance tracks with its underlying financials. There’s been little speculative movement. Instead, the price action reflects improving fundamentals, especially earnings growth and cash generation. The stock’s long-term technical trend remains upward, supported by a rising 200-day moving average even after the recent pullback.

Risks and Considerations

AIT is not immune to external pressures. One key risk is the health of the industrial economy. If manufacturing activity remains soft or weakens further, it could weigh on the company’s organic sales growth. While AIT has protected its margins effectively, sustained top-line weakness can eventually pressure earnings.

Acquisition integration is another area to watch. AIT has expanded through deals like its recent purchase of Hydradyne. These deals add capability and scale, but they also come with risk. Integration challenges, unexpected costs, or cultural misalignment can dilute the intended benefits.

Supply chain uncertainty, though improved from the peaks of recent disruptions, remains an ongoing consideration. Any renewed bottlenecks or rising costs could impact inventory availability and profitability. Inflation in input costs or wage pressures could also affect margins if not managed carefully.

The valuation itself could also be viewed as a mild risk. While not excessive, it does reflect investor confidence in continued consistency. If that narrative slips, the market could respond quickly. Additionally, interest rate changes or shifts in economic sentiment could pressure the broader industrial sector, and by extension, AIT.

For income-focused investors, the current yield is relatively low. The company prioritizes long-term dividend growth over a high payout, which might not appeal to those looking for immediate income.

Final Thoughts

Applied Industrial Technologies may not dominate headlines, but it has built a strong case for long-term value. Its leadership stays focused, delivering results without unnecessary risk or distraction. The balance sheet is healthy, earnings are growing, and the dividend, while modest, is backed by real cash flow and room to expand.

Valuation is reasonable and supported by fundamentals. The recent stock dip looks like a natural pause after a strong uptrend, not a breakdown. The company continues to show discipline with capital, focusing on strategic growth while returning value to shareholders through dividends and buybacks.

There are risks, especially tied to macroeconomic factors and integration of acquisitions, but these are being managed with care. What makes AIT appealing is its ability to stick to its strengths—quietly growing earnings, managing operations tightly, and moving steadily through cycles without overreaching.

The company’s story is built on doing the basics well, quarter after quarter. For investors who value stability, operational strength, and long-term growth, AIT offers a model of what consistency in industrial leadership can look like. It’s not about making bold moves—it’s about staying the course and letting results do the talking.