Updated 4/14/25

Apple Inc. (AAPL) has long been a pillar of financial strength and consistency, with a market cap nearing $3 trillion and a track record of steady earnings growth. Over the past year, it delivered a 4% increase in revenue and continued expanding its services segment, while maintaining an active share repurchase program and a low payout ratio. Despite some recent volatility and a dip in iPhone sales, Apple’s leadership team, led by Tim Cook, remains focused on long-term innovation and operational efficiency. The stock trades at a forward P/E around 27, supported by strong free cash flow and a stable dividend, with analysts targeting a consensus price of $243.91.

Recent Events

Apple’s stock has been on a solid upward path again, regaining its momentum after a more tepid stretch last year. The company’s market value is knocking on the $3 trillion door once more, and its latest results showed a steady hand at the wheel. Revenue rose 4% compared to last year, and earnings climbed 7%, both signs that this isn’t a company just coasting on its legacy products.

Despite the maturing smartphone market, Apple continues to find ways to grow. It’s pushing deeper into services like Apple TV+, iCloud, and Apple Pay—businesses that offer stickier margins and more reliable revenue. But for dividend investors, the story that matters most is the one about Apple’s cash.

With nearly $54 billion in cash on hand and free cash flow approaching $94 billion over the past twelve months, Apple has the kind of balance sheet most companies can only dream of. And it’s not just sitting on that cash. It’s putting it to work, returning capital to shareholders through both dividends and one of the most aggressive share buyback programs in corporate history.

Key Dividend Metrics

🍏 Forward Yield: 0.50%

💰 Annual Dividend Rate: $1.00 per share

📈 5-Year Average Yield: 0.57%

📆 Dividend Growth Streak: 12 years and counting

🔁 Payout Ratio: 15.71%

🧱 Cash Balance: $53.77B

🚀 Free Cash Flow (ttm): $93.83B

These numbers don’t scream high yield, but they do signal strength, flexibility, and room to grow. That’s the kind of profile that gets dividend growth investors to pay attention.

Dividend Overview

At half a percent, Apple’s dividend yield is on the low side. There’s no sugarcoating that. For anyone seeking immediate income, Apple probably doesn’t top the list. But that doesn’t mean it doesn’t belong in a dividend-focused portfolio.

The most important number here might be the payout ratio—just 15.7%. That tells you Apple is not stretching to pay its dividend. In fact, it could afford to pay quite a bit more if it wanted to. But instead of chasing a higher yield, Apple has opted for something arguably more valuable: sustainable growth and financial discipline.

The dividend has been growing consistently since it was reintroduced in 2012. Management hasn’t missed a beat. That reliability, combined with the company’s scale and global reach, makes it a steady player for investors who value predictability.

And then there’s the buyback factor. Over the past decade, Apple has been reducing its share count at a relentless pace. Fewer shares mean more earnings per share and more dividend coverage per share. It’s a strategy that adds real value over time, even if it doesn’t show up as cash in your account.

Dividend Growth and Safety

This is where Apple’s story gets more interesting. Since bringing back its dividend, Apple has built a solid record of consistent increases. From just $0.38 per share in 2012 to $1.00 today, that’s an impressive growth pace. It’s not wild or unpredictable—it’s steady, intentional, and backed by real earnings.

The low payout ratio tells you Apple’s dividend is far from being at risk. The company brings in over $100 billion in operating cash flow annually. That’s more than enough to cover the dividend many times over. And even with nearly $97 billion in debt, Apple has the firepower to wipe that out if it chose to.

The current ratio just under 1.0 might raise an eyebrow for more traditional balance sheet watchers, but in Apple’s case, it reflects how capital efficient the business has become. Cash is king here, and Apple knows how to use it.

The ex-dividend date this year was February 10, with payment on February 13. Apple sticks to a reliable quarterly cadence, which makes it easy for investors to plan and reinvest consistently.

The real appeal for dividend-focused investors isn’t the check you’ll get today. It’s the potential for that check to grow, year after year, from a company that has proven its ability to weather nearly every kind of economic cycle.

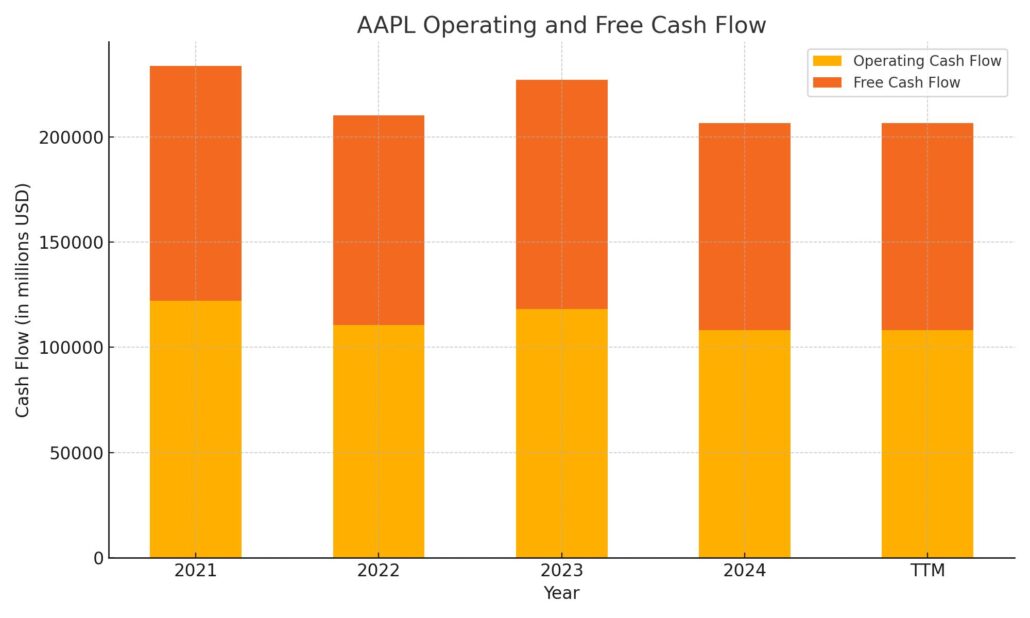

Cash Flow Statement

Apple continues to generate exceptional operating cash flow, reaching $108.3 billion over the trailing twelve months. While slightly below its 2023 figure, this level of consistency in operating cash flow highlights the durability of Apple’s core business, even in the face of shifting product cycles and macroeconomic headwinds. Free cash flow came in at $98.3 billion, showing Apple’s ability to convert nearly all of its operating income into accessible capital after reinvestment.

On the investing side, Apple reported positive cash flow of $10.8 billion, which is a notable shift from earlier years when capital outflows were the norm. The turnaround suggests tighter management of capital expenditures and a more strategic approach to asset deployment. Financing activities saw Apple return over $130 billion to shareholders, primarily through stock buybacks and dividends. Despite these massive capital returns, the company’s cash position remains stable at just over $30 billion, demonstrating disciplined financial control and long-term balance sheet strength.

Analyst Ratings

📈 Apple has recently seen a mix of analyst sentiment, with some firms adjusting their ratings and price targets in response to evolving market dynamics. Jefferies moved their rating from “Underperform” to “Hold” as the stock had already absorbed much of the near-term pressure. Still, they trimmed their price target to $167.88, citing worries about a potential global slowdown and muted expectations for innovation in smartphone AI in the immediate future.

⚠️ Meanwhile, Wedbush maintained its “Outperform” stance but revised its price target down to $250 from $325. Their reasoning hinged largely on the fallout from recently announced tariffs and Apple’s deep entanglement with Chinese manufacturing. Shifting production out of China, while a potential long-term play, isn’t a switch that can be flipped overnight—and investors are starting to weigh that risk more heavily.

🛠️ Citi kept its “Buy” rating in place and reaffirmed a target of $275. While acknowledging delays in Apple’s AI integrations—particularly with Siri—they remained confident that Apple’s broader ecosystem and services growth could drive performance over the coming quarters.

🎯 Right now, the average analyst price target sits at around $243.91, with the range spanning from $167.88 on the low end to $308.00 on the high side. That leaves room for approximately 21% upside from where the stock currently trades.

Earning Report Summary

Apple kicked off its fiscal 2025 with a strong performance that managed to strike a balance between steady growth and a few bumps along the way. The company reported revenue of $124.3 billion for the quarter, which is up 4% from the same time last year. Earnings per share landed at $2.40, a 10% jump, setting a new record for the tech giant.

Services Take the Spotlight

One of the big stories this quarter was Apple’s services business. Revenue from services rose 14% to hit $26.3 billion, showing that the company’s pivot toward a more subscription-driven model is really gaining traction. Whether it’s the App Store, iCloud, or Apple TV+, this area of the business continues to be a steady engine of growth.

Mac and iPad also had surprisingly strong quarters, each seeing double-digit gains. Mac revenue climbed 16%, and iPad wasn’t far behind at 15%. Those categories had been relatively quiet, so this bounce was a welcomed surprise.

iPhone Sales Slip, but Optimism Remains

Not everything was rosy. iPhone sales dipped slightly—down just under 1% to $69.1 billion. Tim Cook pointed out that the drop was mostly due to the limited rollout of Apple Intelligence features, which were initially available only in the U.S. The company plans to expand those features to other languages and regions this spring, and there’s a sense of confidence that demand will pick back up once that happens.

China a Challenge, Other Regions Shine

The Greater China region was a weak spot this time around. Revenue dropped 11.1% to $18.5 billion, thanks in large part to increased competition from local brands. Still, Apple managed to post record revenue in the Americas, Europe, and Japan. That kind of regional balance helps cushion any softness in one part of the world.

The global footprint continues to grow, too. Apple now has more than 2.35 billion active devices in use. That kind of reach gives it incredible leverage for upselling services and keeping customers locked into the ecosystem.

Looking Ahead

For the current quarter, Apple is guiding toward low to mid-single-digit revenue growth. Services are expected to continue leading the charge, with growth projected in the low-double digits. The expansion of Apple Intelligence to more users around the world could give hardware sales a boost as well.

Overall, the quarter was a reminder that while Apple might not always hit it out of the park in every category, its core strengths—loyal users, global reach, and an increasingly powerful services arm—keep it firmly positioned for steady, long-term growth.

Chart Analysis

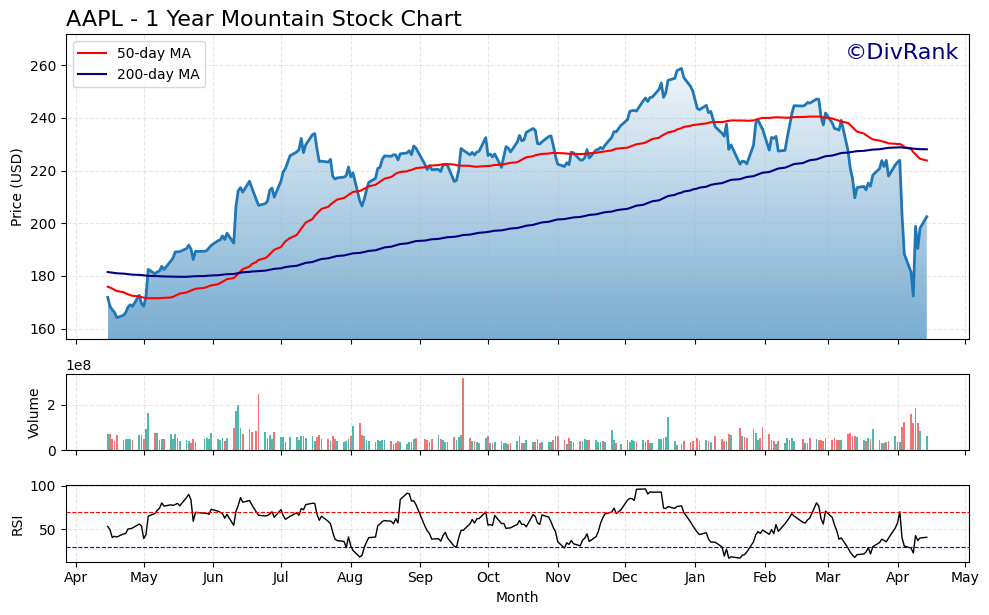

The chart for AAPL over the past year tells a story of resilience and shifting momentum. It’s had its share of volatility, but there’s a lot to unpack when you look closely at the technical indicators layered in.

Price Trends and Moving Averages

In the first half of the chart, the stock was on a clear uptrend, with the 50-day moving average climbing steadily above the 200-day moving average. That pattern held strong through most of the year, suggesting buyers were in control and confidence was high.

But things began to shift in early spring. The 50-day moving average started curling downward, eventually crossing below the 200-day line—a technical move known for flagging a change in trend. It didn’t happen suddenly, but the price action began to mirror that softening, drifting lower and eventually sliding below both moving averages. The steep drop in early April stands out as a panic-driven moment, likely tied to broader market or company-specific headlines.

Now, the recent bounce from those lows is notable. While the recovery hasn’t broken above either moving average yet, it shows renewed interest and possibly some bargain hunting.

Volume Behavior

Volume remained fairly stable through most of the year, with occasional spikes that tended to coincide with price pivots. The surge in volume during the sharp April decline is important—it suggests capitulation or forced selling, followed quickly by renewed accumulation as buyers stepped in.

What stands out here is that recent volume has picked up again during the rebound, indicating that the move off the lows wasn’t just a dead-cat bounce. There’s clear participation from market players showing up in those taller volume bars.

Relative Strength Index (RSI)

Looking at the RSI, it fluctuated in a healthy range through most of the year, moving between 40 and 70, which typically signals a balanced market. But in April, it dropped sharply into oversold territory before reversing quickly. That snapback is a positive short-term signal, showing that the stock got briefly too cheap relative to its recent price action.

Now, the RSI is moving back toward neutral, hovering just under 50. That doesn’t scream bullish, but it does suggest that the worst of the selling pressure may have passed, and the stock is stabilizing.

Overall Perspective

This chart doesn’t reflect a stock in crisis. It reflects a shift in sentiment after a prolonged rally, followed by a sharp correction and a budding recovery. The moving averages still need time to align with any potential new trend, but price and volume behavior hint that buyers are stepping back in. It’s a pattern of recalibration, not collapse.

Management Team

At the helm of Apple Inc. is Tim Cook, who has been guiding the company since 2011. Under his steady leadership, Apple has expanded far beyond the iPhone, growing its services, wearables, and hardware ecosystem while continuing to deliver strong financial results. Cook’s operational background has brought a steady, disciplined approach to running what is now one of the world’s most valuable companies.

Supporting him is Jeff Williams, Apple’s Chief Operating Officer, who’s often seen as a key figure in keeping Apple’s vast global operations running smoothly. In early 2025, Kevan Parekh was appointed as the new Chief Financial Officer. Having risen through Apple’s finance division, Parekh brings deep knowledge of the company’s inner workings and long-term financial strategy.

The executive team also includes Craig Federighi, who heads up software engineering, and Johny Srouji, who leads the hardware technologies group. Eddy Cue continues to run Apple’s services segment, which now plays a major role in Apple’s revenue and profit growth. This group has worked together for years and is known for its consistent, low-drama leadership style. They’ve built a culture that prioritizes user experience, product quality, and long-term thinking over short-term hype.

Valuation and Stock Performance

Apple’s stock has shown resilience in a market that’s been anything but predictable. As of mid-April 2025, AAPL trades around the $202 mark, placing its valuation near $3 trillion. That’s an enormous figure by any standard, but when you consider the company’s scale, its cash generation, and its loyal global customer base, it doesn’t seem disconnected from fundamentals.

Its current price-to-earnings ratio hovers around 27, which for a company with Apple’s level of maturity, may appear a bit rich. But that valuation reflects a premium investors are willing to pay for predictability, brand strength, and cash flow consistency. Even through recent dips tied to supply chain concerns and broader tech sector pullbacks, the stock has shown an ability to recover quickly.

Analyst sentiment is generally cautious but positive. Some see limited near-term upside purely from a valuation standpoint, while others point to Apple’s AI ambitions, services growth, and potential for margin expansion as reasons to believe there’s still room to run. Long-term holders tend to focus more on stability and dividends than short-term price moves, and Apple continues to deliver on that front.

Risks and Considerations

While Apple’s position in the tech world is dominant, that doesn’t mean it’s immune to risks. One of the most pressing concerns is its dependence on China for both production and a significant share of its revenue. Rising geopolitical tensions and shifts in U.S.–China trade policy have already created some turbulence. Although Apple has started to diversify production into countries like India and Vietnam, making those transitions at scale takes time and investment.

There’s also the matter of competition. Apple’s moat is strong, but it’s operating in fast-moving markets where innovation cycles are accelerating. Whether it’s pressure from Android rivals in smartphones, or streaming and cloud competition in services, Apple has to keep evolving or risk losing ground.

Regulatory scrutiny is another wildcard. Governments across the globe have become more aggressive in challenging the power of large tech firms. For Apple, that could mean more oversight over App Store practices, privacy standards, or its ecosystem strategy—any of which could lead to new costs or business model adjustments.

Lastly, while Apple’s hardware is known for its premium positioning, consumer behavior is sensitive to macroeconomic conditions. If inflation remains sticky or a slowdown hits discretionary spending, product upgrades could get delayed, which would ripple through revenue.

Final Thoughts

Apple continues to do what it does best—execute consistently, innovate cautiously but effectively, and return capital to shareholders. The leadership team has proven its ability to steer through both excitement and turbulence, and the company’s financial foundation remains among the strongest in the market.

There are headwinds, no doubt. Supply chain challenges, increasing regulation, and intense competition all pose meaningful questions for the road ahead. But Apple’s brand loyalty, services momentum, and global reach give it a degree of flexibility few other companies enjoy.

Whether the stock offers explosive upside from here is a different conversation. But for those looking for a name backed by strong fundamentals, consistent leadership, and a demonstrated commitment to shareholder returns, Apple continues to earn its place in the conversation.