Updated 4/14/25

Aon plc (AON) has carved out a durable position in the global professional services space, delivering advisory solutions across risk, health, retirement, and human capital. With a market cap near $81 billion and revenue exceeding $15 billion, Aon’s model is built around consistency, strong margins, and efficient capital use. Its leadership team, led by CEO Greg Case and CFO Christa Davies, has focused on predictable cash flows and a steady return of capital through dividends and share buybacks. Backed by a return on equity of nearly 96%, a payout ratio just over 21%, and a track record of dividend growth, AON has become a long-term compounder. The stock is trading around $385 after a healthy year of performance, supported by rising earnings and improving operating cash flow. As the company leans further into data analytics and client-focused innovation, it remains focused on sustainable growth and disciplined execution.

Recent Events

Aon’s most recent financial performance has been a continuation of solid momentum. Revenue jumped 22.9% year over year, which is impressive on its own, but earnings growth came in even stronger at 43.8%. That kind of bottom-line acceleration tells us that management is not just growing the business, but doing it efficiently.

The company also reported an astonishing 95.6% return on equity—one of those numbers that makes you stop and take notice. Aon doesn’t rely on massive physical assets or product manufacturing; instead, it turns intellectual capital and data into revenue. That kind of model naturally supports strong margins, and Aon is clearly leveraging it to the fullest.

It’s also worth mentioning the capital structure. Total debt sits at nearly $18 billion, and the debt-to-equity ratio has climbed above 278%. That might look aggressive at first glance, but Aon’s recurring cash flows and steady demand profile help manage that load. Plus, its ongoing buyback program has significantly reduced the float over time, quietly increasing value per share.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.72%

💰 Annual Dividend Payout: $2.70

🧮 Payout Ratio: 21.14%

📊 5-Year Average Yield: 0.77%

📆 Next Dividend Date: May 15, 2025

⛳ Ex-Dividend Date: February 3, 2025

🔁 Last Stock Split: 3-for-2 in May 1999

Dividend Overview

At first glance, the yield on Aon doesn’t exactly jump off the page. A forward yield of 0.72% is modest, and it’s fair to say this isn’t the first stop for income seekers who want yield north of 3%. But for those who take a more patient approach, the story is in the details.

Aon’s dividend may be on the lower side, but it’s incredibly well-supported. The payout ratio of just over 21% leaves plenty of room for reinvestment, buybacks, or dividend growth. That kind of flexibility is what keeps the dividend sustainable through different market cycles.

This isn’t a company that tries to wow shareholders with big dividend bumps out of the blue. Instead, the approach has been steady and predictable, rising with earnings over time. The result is a consistent income stream that doesn’t wobble every time the market sneezes. That can be worth far more than an oversized payout that comes with a side of uncertainty.

Dividend Growth and Safety

When it comes to dividend growth, Aon has been quietly putting in the work. The company has been lifting its dividend year after year, aligning those increases with its rising cash flows. There’s nothing erratic about the approach—it’s measured, responsible, and backed by real numbers.

Over the past five years, the dividend has grown at a pace just under 9% annually. That’s not going to make headlines, but it tells a story of careful, earnings-driven growth. Aon isn’t stretching to keep up appearances. It’s paying what it can afford, and reinvesting the rest.

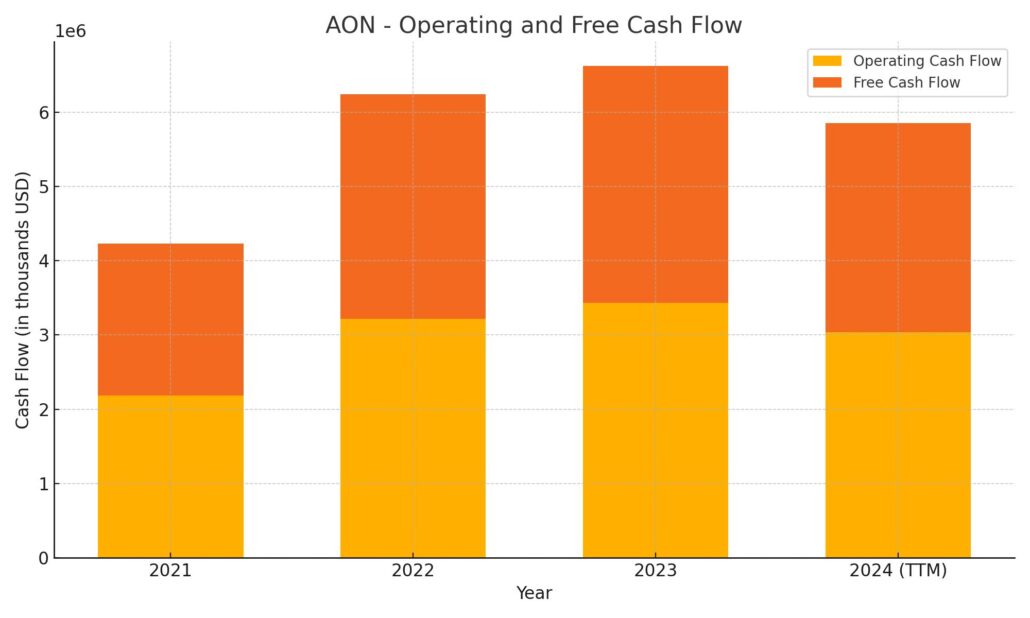

On the safety side, the business looks solid. Free cash flow over the trailing twelve months came in at $3.41 billion, more than enough to cover the dividend several times over. Operating cash flow is close behind at $3.04 billion, which means there’s no need to dip into reserves or lean on financing just to meet dividend obligations.

The balance sheet is carrying debt, no doubt about that, but the steady cash flow gives Aon room to manage it without cutting back on dividends. Add in a low beta of 0.82, and you’re looking at a stock that tends to move less than the broader market, which can be comforting if you’re relying on it as part of an income strategy.

The next dividend payout is scheduled for May 15, 2025, following an ex-dividend date in early February. For investors looking to compound wealth through steady, rising income, Aon offers a compelling profile—low drama, strong fundamentals, and a commitment to growing shareholder returns.

Cash Flow Statement

Aon’s trailing twelve-month cash flow statement reveals a business that remains highly cash generative despite heavier investment activity. Operating cash flow came in at $3.04 billion, reflecting consistent earnings strength and stable core operations. While that figure is slightly lower than the previous year’s $3.44 billion, it still signals strong fundamentals. Capital expenditures were modest at $218 million, resulting in a solid $2.82 billion in free cash flow—ample coverage for both dividend payments and share repurchases.

On the investing side, outflows jumped significantly to $2.83 billion, compared to just $188 million the year before. This spike suggests a strategic allocation, likely tied to acquisitions or longer-term growth initiatives. Financing activities flipped to a net inflow of $796 million, largely due to significant debt issuance that offset both share buybacks and repayments. Despite a $1 billion stock repurchase and nearly $5 billion in debt repayments, Aon’s year-end cash position increased to $8.33 billion. The company continues to manage its capital with a balance between rewarding shareholders and funding its growth playbook.

Analyst Ratings

📈 Aon plc has recently seen a wave of analyst updates, showing a mix of optimism and strategic recalibration. 🏦 JP Morgan kept its Overweight rating intact while nudging the price target up from $394 to $409, highlighting confidence in Aon’s resilience and steady execution. 🧮 Keefe, Bruyette & Woods echoed a similar stance, maintaining an Outperform rating and lifting their target slightly from $411 to $414. Their reasoning centers on Aon’s consistent financial delivery and improving margin outlook. 📊 Piper Sandler, meanwhile, remained more reserved—keeping a Neutral rating but adjusting their price target from $372 to $384 to reflect recent performance improvements without overcommitting to a bullish call.

📉 On the more cautious side, Barclays scaled back its price target from $440 to $430, even as it reiterated an Overweight stance. Their view suggests some macro-level caution, particularly around sector-wide risks in insurance and advisory services. ⚖️ Jefferies Financial Group took a middle path—raising its price target from $396 to $416 while holding firm on a Hold rating. The underlying message: solid fundamentals, but valuation is starting to feel full.

💵 The current analyst consensus for Aon places the average 12-month price target at around $416.43, with projections ranging from a low of $373 to a high of $468. The broader sentiment leans toward a Hold, implying confidence in Aon’s operational footing but acknowledging limited near-term upside at current prices.

Earning Report Summary

Aon wrapped up 2024 on a strong note, delivering a solid fourth-quarter performance that had investors and analysts paying attention. The company reported adjusted earnings per share of $4.42, coming in ahead of expectations and highlighting continued momentum in its core business areas. Total revenue for the quarter reached $4.21 billion, a 17% jump year over year, with organic revenue growth at 6%. That kind of combination—broad-based revenue gains and efficient execution—suggests Aon is firing on all cylinders heading into 2025.

Commercial Risk and Health Solutions Lead the Way

One of the standouts this quarter was Aon’s Commercial Risk Solutions segment. It pulled in $2.19 billion in revenue, reflecting a 15% increase from the previous year. That kind of growth isn’t just about favorable market trends—it speaks to Aon’s ability to deepen relationships and expand its reach across industries. Demand for insurance brokerage services continues to rise, and Aon seems to be capturing more than its fair share.

Health Solutions was another bright spot. The segment posted $1.07 billion in revenue, up significantly from $763 million a year ago. That kind of leap underscores how companies are increasingly turning to Aon for help managing healthcare benefits and wellness strategies in a tight labor market.

Leadership’s Vision for What’s Next

CEO Greg Case offered insight into where the company is headed and how leadership is thinking about the broader picture. He emphasized that Aon is focused on solving the most pressing challenges their clients face—things like trade volatility, emerging tech risks, climate shifts, and workforce transformation. These aren’t one-off issues; they’re systemic, and Aon is positioning itself as a long-term partner to help clients navigate them.

At the center of that effort is Aon’s “3×3 Plan,” which aims to improve decision-making across three key areas: risk, people, and capital. It’s a strategy built around client leadership, innovation in analytics, and continued investment in capabilities that add value. Case made it clear that this plan isn’t just a corporate tagline—it’s driving how Aon operates across every segment.

A Steady Outlook with Room for Growth

Looking forward, the company expects to maintain its pace of mid-single-digit or better organic revenue growth, along with further margin expansion. Management also anticipates continued growth in adjusted earnings per share, pointing to confidence in both execution and the broader demand environment.

While some companies are trimming expectations or holding back on spending, Aon is leaning in. The tone from leadership was steady and confident, grounded in real results and a clear strategic path. It’s not about chasing flashy short-term wins—it’s about building long-term value for clients and, by extension, shareholders.

Chart Analysis

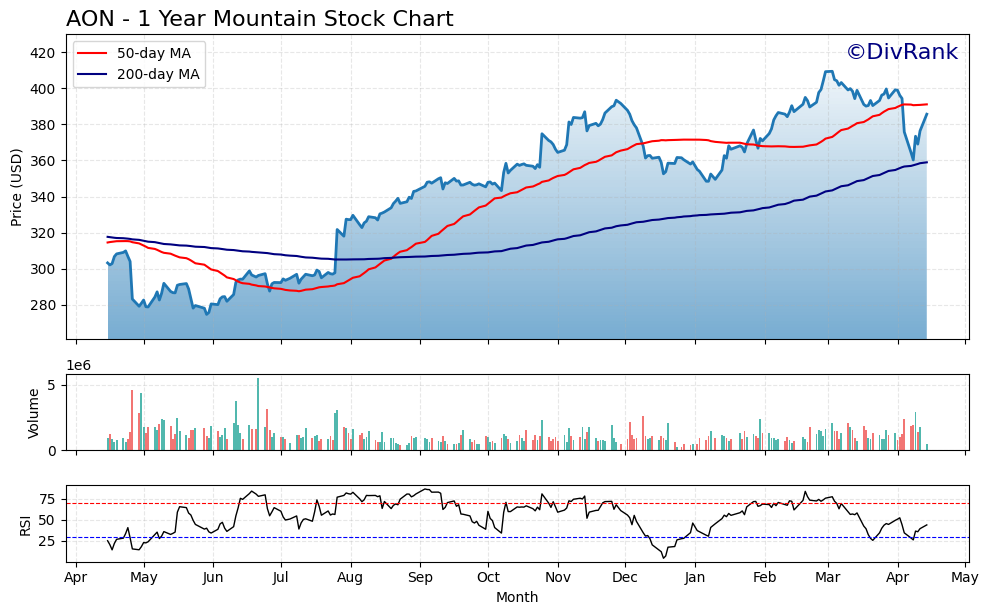

AON’s one-year chart reveals a steady and constructive uptrend that picked up real momentum through the second half of last year. From a low near $280 in late May, the stock has climbed steadily, peaking above $410 before a recent pullback. Even with that dip, the structure remains intact, and the broader trend still leans bullish.

Moving Averages

The 50-day moving average (red line) crossed above the 200-day moving average (blue line) around mid-July, forming what’s often considered a golden cross—a sign of strength in the underlying trend. Since then, price action has mostly held above both moving averages, which suggests continued buyer interest during dips. Recently, the stock bounced off the 200-day moving average with force, reclaiming the 50-day quickly, indicating renewed strength after a healthy correction.

Volume Behavior

Volume spikes during key price movements provide more depth to the story. Notably, large green volume bars appear during sharp rallies, including the surge in early April that followed a multi-week decline. That kind of accumulation typically points to institutional support. On pullbacks, volume has generally tapered off, which suggests sellers aren’t in control—buyers are simply taking a breather.

RSI Indicator

The RSI at the bottom of the chart shows the stock recently dipped into oversold territory (below 30), but quickly reversed higher. That oversold bounce aligns with the bounce off the 200-day moving average, offering confirmation that the price correction may have run its course, at least for now. Prior to this, the RSI spent a lot of time above 50, even nearing overbought levels in November and again in March, reinforcing the idea that momentum has remained strong overall.

Overall Price Action

From a price structure standpoint, the stock has formed higher highs and higher lows throughout the year—a textbook sign of a healthy trend. The sharp correction in early April pulled the price back toward a previous consolidation zone near $360, which now looks like it’s acting as support. The rebound from there was quick and came on strong volume, adding to the conviction that buyers are stepping back in.

AON continues to trade within a longer-term uptrend and is showing resilience despite broader market volatility. With both moving averages sloping upward and the RSI recovering from oversold levels, the technical setup remains supportive for continued strength if momentum holds.

Management Team

Aon’s leadership team is helmed by CEO Greg Case, who has led the company since 2005. Under his stewardship, Aon has transformed from a traditional insurance broker into a broader advisory powerhouse, focused on delivering insight and data-driven solutions across risk, health, and talent. Case is widely regarded for his long-term vision and measured approach to capital allocation. He’s not chasing headlines; instead, he’s focused on sustainable, compound growth.

One thing that stands out about Aon’s executive team is the consistency. There haven’t been abrupt shakeups or headline-grabbing exits. That stability translates into strategy execution that’s less reactive and more methodical. Christa Davies, Aon’s long-time CFO, plays a critical role in this. She’s known for managing the firm’s balance sheet with discipline, maintaining strong free cash flow even during macroeconomic headwinds. Together, Case and Davies have driven Aon’s capital-light model, prioritizing organic growth, strategic acquisitions, and consistent shareholder returns through dividends and buybacks.

There’s also a clear cultural focus from the top down. Aon has leaned into client-centricity and long-term partnerships. The company’s emphasis on talent, technology, and client results isn’t just a tagline—it’s become embedded in how decisions are made at every level.

Valuation and Stock Performance

AON shares have delivered a solid run over the past year. After starting below $300 last spring, the stock steadily climbed to a high above $410 before a recent pullback in April. Even with that dip, the current price around $385 reflects a strong gain from its lows. Momentum has cooled slightly, but the long-term trend remains positive, with the stock consistently riding above both its 50-day and 200-day moving averages.

From a valuation perspective, AON trades at a forward P/E of about 21.8. That’s not cheap, but it’s also not unreasonable for a company with Aon’s quality of earnings and return on equity pushing toward 96 percent. The PEG ratio sits just under 1.9, suggesting that while growth is priced in, it’s not overly stretched when you factor in earnings consistency and free cash flow.

Aon’s model generates predictable revenue through fee-based services and long-term contracts. Combine that with strong margins—operating margin sits close to 40 percent—and you get a company that commands a premium. It doesn’t rely on flashy growth but rather on steady execution. Over the long run, investors have rewarded that kind of stability. The stock has outperformed the broader market over the past few years, with less volatility, thanks in part to a low beta just under 0.85.

Buybacks also play a role in supporting valuation. Aon has been a regular repurchaser of its own stock, reducing share count and boosting per-share earnings. This capital return strategy complements the dividend, which remains modest in yield but consistent in growth.

Risks and Considerations

Aon’s business, while stable, isn’t without its risks. The most immediate one is macroeconomic pressure. Higher interest rates, inflation, or recessionary fears could weigh on client budgets, particularly in discretionary areas like human capital consulting or workforce analytics. Aon doesn’t sell insurance policies directly, but as a broker and consultant, it’s exposed to broader economic activity.

Another factor is regulation. Aon operates across multiple jurisdictions, and changes in insurance laws, employment policies, or financial services regulations could increase compliance costs or limit growth. Mergers and acquisitions are another layer. The company had a high-profile merger attempt with Willis Towers Watson blocked by antitrust regulators. While Aon has since moved on, the failed deal reminded investors that scaling through acquisition won’t always be straightforward.

There’s also some leverage to keep in mind. Aon’s debt-to-equity ratio sits well above 250 percent, which is higher than many peers. While free cash flow comfortably covers interest obligations and dividend payments, any sharp downturn could limit flexibility. The balance sheet isn’t stretched, but it’s something to monitor if growth slows or if acquisition activity picks up.

Lastly, technology disruption is a lingering consideration. Aon is investing in data and analytics, but the pace of innovation in AI and predictive risk tools is accelerating. Clients may start to demand more real-time insight, and competitors with a more nimble tech stack could put pressure on pricing or client retention.

Final Thoughts

AON offers something that often gets overlooked in a market obsessed with fast growth—consistency. The business generates strong margins, reliable cash flows, and delivers shareholder returns through a balanced mix of dividends and share repurchases. It’s not chasing trends or trying to disrupt an industry. Instead, it’s focused on refining what it already does exceptionally well: helping clients manage risk and make better decisions with data.

The management team has shown they’re more interested in long-term value than quarter-to-quarter excitement. They’ve built a model that emphasizes durability, which shows up not just in financial metrics but in how the company handles downturns and rebounds. Even during periods of broader market stress, Aon tends to hold its ground.

Valuation isn’t screamingly cheap, but it reflects quality. Investors paying up for AON aren’t buying into a gamble—they’re buying into a cash-generating machine that knows how to navigate complex, evolving markets. The risks are there, from economic sensitivity to regulatory hurdles, but they’re balanced by a management team that’s proven adept at managing through uncertainty.

As the company looks forward, its strategic focus on analytics, human capital, and long-term client partnerships puts it in a solid position. The dividend isn’t the biggest, but it’s backed by strong fundamentals and room for future growth. AON continues to reward patience with performance—quietly, methodically, and consistently.