Updated 4/14/25

Amphenol Corporation (APH) delivers steady, long-term value through a combination of operational discipline, global reach, and consistent financial performance. With strong positions across critical markets like datacom, aerospace, defense, and mobile, it continues to grow both organically and through targeted acquisitions. The company recently reported record earnings and revenue for 2024, showing double-digit growth in both areas. Management remains focused on expanding its portfolio of high-technology interconnect solutions while maintaining a healthy balance sheet. With a modest but reliable dividend backed by strong free cash flow, APH offers a solid foundation for income-focused investors seeking dependable performance and strategic growth.

Recent Events

Several recent developments have made Amphenol worth a closer look for dividend-focused investors.

In June 2024, the company executed a 2-for-1 stock split. While splits don’t change the fundamentals, they’re often a subtle indicator that management sees more growth ahead. It’s also a nod to shareholder accessibility—lowering the price per share makes it easier for retail investors to accumulate positions over time.

On the earnings front, Amphenol delivered some impressive numbers in its most recent quarter. Revenue jumped nearly 30% year over year, while earnings surged over 45%. These aren’t marginal improvements—these are signs of a company firing on all cylinders at a time when many others are trimming forecasts or struggling with margin compression.

Financially, the company is in a solid position. With over $3.3 billion in cash and a current ratio of 2.37, Amphenol has flexibility. Whether it wants to pursue acquisitions, ramp up R&D, or simply ride out economic bumps, it’s well-equipped.

📌 Key Dividend Metrics

📈 Forward Dividend Yield: 1.01%

💵 Forward Annual Dividend: $0.66 per share

📉 Trailing Yield: 0.84%

⏳ 5-Year Average Yield: 0.92%

🎯 Payout Ratio: 28.65%

📅 Dividend Date: April 9, 2025

🪙 Ex-Dividend Date: March 18, 2025

🔁 Last Split Date: June 12, 2024 (2-for-1 split)

Dividend Overview

Let’s be honest: you’re not going to buy Amphenol for the yield alone. Sitting just above 1%, it’s not built for those seeking high immediate income. But what makes this stock interesting isn’t the size of the payout—it’s the consistency and strength behind it.

APH pays out a dividend that’s solidly backed by earnings and cash flow, with a payout ratio that leaves plenty of breathing room. Under 30% of its earnings are going to dividends, which is a clear sign that the company isn’t stretching to reward shareholders—it’s doing it from a place of financial strength.

And that’s exactly the kind of stability that appeals to long-term income investors. Instead of luring with a flashy high yield, Amphenol focuses on sustainable returns, growing the dividend in line with actual performance rather than overpromising.

What stands out is the reliability. Even in tougher economic cycles, the company hasn’t paused or slashed payouts. The dividend may not grow in leaps and bounds, but it does grow—deliberately and in step with the business.

Dividend Growth and Safety

This is where Amphenol quietly shines. The company has built a dividend profile that balances modest yield with excellent safety and growth potential.

The current payout ratio of 28.65% is comfortably low. That kind of cushion tells you the dividend isn’t just safe today—it’s protected in the future, even if the business hits some bumps along the way. A low payout ratio like this also gives the company room to increase dividends over time without needing explosive earnings growth.

Looking at how the company has managed capital, it’s easy to see the discipline at work. Free cash flow stands at $1.64 billion, and operating cash flow is just under $3 billion. That’s more than enough to fund dividends, invest in growth, and maintain flexibility without taking on risky levels of debt.

Speaking of debt, Amphenol has about $7.28 billion on its books, but with a strong balance sheet and a debt-to-equity ratio under 75%, there’s no red flag here. The company is managing leverage well, especially given the capital-intensive nature of its industry.

And the returns speak for themselves—return on equity is sitting at a healthy 26.7%, while return on assets is just under 11%. These are signs of an efficient operation, which matters when you’re counting on those earnings to support a growing income stream.

For dividend investors who value safety, consistency, and a long runway for growth, Amphenol offers a lot. It’s not about chasing the highest yield—it’s about finding quality that can quietly keep delivering year after year.

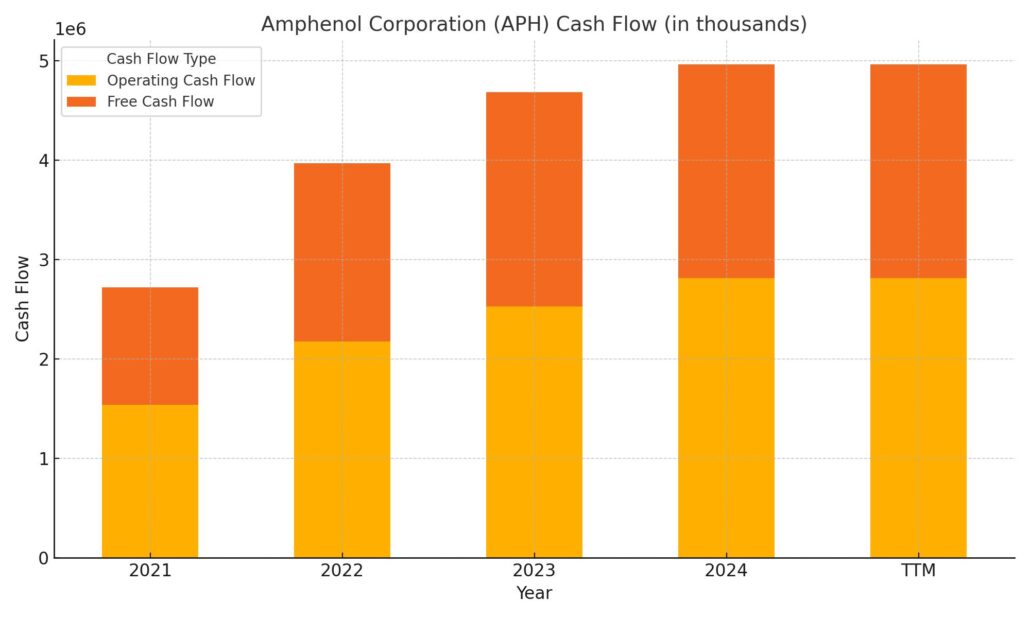

Cash Flow Statement

Amphenol’s cash flow over the trailing twelve months reflects the strength of its operations. The company generated $2.81 billion in operating cash flow, continuing a steady climb from $2.17 billion in 2021 and $2.52 billion in 2023. This consistent improvement highlights the underlying efficiency in the business, driven by strong revenue and solid margins. After capital expenditures of $665 million, free cash flow came in at a robust $2.15 billion, maintaining nearly the same level as last year. That’s a healthy cash cushion to fund dividends, support buybacks, and reinvest in the business.

On the investing side, Amphenol spent significantly more than in previous years, with outflows of $2.65 billion. This spike suggests stepped-up activity in acquisitions or internal investments—typical for a company focused on long-term positioning. Meanwhile, financing cash flow flipped positive, adding $1.73 billion, driven by new debt and capital market activity. Despite buybacks of $689 million and debt repayments of $364 million, Amphenol ended the period with $3.3 billion in cash, more than double its balance from the prior year. The company is clearly managing its capital base with intention, keeping plenty of liquidity while still returning value to shareholders.

Analyst Ratings

📈 Amphenol Corporation (APH) has recently seen a wave of analyst updates that reflect both confidence in its fundamentals and caution around its valuation. On April 10, 2025, UBS and Goldman Sachs reaffirmed their buy ratings, setting price targets of $78 and $90, respectively. These updates point to solid optimism about the company’s performance, particularly around its stable earnings growth and reliable cash generation. Truist Securities echoed that sentiment, maintaining a strong buy while nudging its target up to $102, signaling faith in the company’s long-term expansion potential.

📉 On the flip side, not everyone is leaning bullish. Bank of America Securities moved the stock to a hold rating back in September 2024, trimming its price target from $80 to $71. That move came down to valuation—Amphenol’s share price had seen a strong run, and in the eyes of some, it may have been moving faster than the underlying earnings growth could justify in the short term.

🎯 Across the board, the current average price target among analysts sits at $86.73. Targets range from a conservative $63.63 to a more bullish $107.10, suggesting that while sentiment is broadly positive, there’s still some divergence on how much upside remains in the near term.

Earnings Report Summary

Amphenol wrapped up 2024 with numbers that turned heads, showing strength across the board. The company delivered record-breaking results in the fourth quarter, with revenue reaching $4.3 billion—that’s a 30% jump compared to the same period last year. Even more impressive, a solid chunk of that growth was organic, driven by real demand rather than just acquisitions. Earnings followed suit, with adjusted earnings per share up 34% year-over-year, landing at $0.55, and GAAP EPS not far behind at $0.59.

Full-Year Performance

Over the course of the full year, sales came in at $15.2 billion, climbing 21% from the year before. Again, more than half of that was organic, pointing to strong execution across core segments. Adjusted EPS for the year hit $1.89, up 25%, with GAAP EPS rising 24% to $1.92. The company’s operating margins stayed healthy—above 20%—even as it continued to invest in growth. Operating cash flow hit $2.8 billion, and free cash flow was just over $2.1 billion, reflecting both financial strength and discipline.

Comments from Leadership

CEO R. Adam Norwitt didn’t hold back in his praise for the team and the strategy. He credited the impressive quarter to strength across multiple markets—datacom, mobile networks, commercial air, mobile devices, broadband, and defense. It wasn’t just about market momentum, though. Amphenol also benefited from recent acquisitions that helped it deepen its portfolio and expand into adjacent markets. According to Norwitt, the company remains committed to growing through a mix of innovation and acquisitions, aiming to stay one step ahead in a rapidly evolving tech landscape.

Strategic Moves and Capital Return

In 2024, Amphenol completed two major acquisitions—Carlisle Interconnect Technologies and Luetze—moves that bolstered its presence in high-growth areas and added to its range of interconnect solutions. On top of that, the company returned nearly $1.3 billion to shareholders through a combination of dividends and buybacks. That kind of capital return speaks volumes about confidence in their business model and the ability to keep generating cash even while expanding.

Looking Ahead

As for the start of 2025, the company is guiding toward revenue between $4.0 and $4.1 billion in the first quarter, which would be another solid double-digit increase. Adjusted EPS is expected to come in between $0.49 and $0.51. Leadership has been clear that these figures don’t even include contributions from upcoming acquisitions, so there’s potential for upside.

Norwitt made it clear the company is ready to keep building on its momentum. With the rapid pace of innovation in electronics and Amphenol’s expanded capabilities, they’re looking to stay aggressive while keeping their trademark operational flexibility. He wrapped things up with a confident tone, pointing to Amphenol’s entrepreneurial culture and its ability to grow through any part of the cycle.

Chart Analysis

The chart for APH over the past year shows a mix of strong rallies and healthy pullbacks, reflecting an active yet resilient trend. Starting from April last year, the price climbed steadily, pushing past $70 by late fall. The uptrend was supported by strong momentum through summer and into early winter, with the 50-day moving average staying well above the 200-day for a solid stretch. This was a period of sustained strength.

Moving Averages and Trend Shifts

As we moved into the new year, things began to shift. The 50-day moving average, shown in red, started to curl downward, eventually crossing below the 200-day around late March. That crossover, commonly referred to as a death cross, often signals a shift in short-term momentum, and we did see price action slip from earlier highs. Despite that, the 200-day moving average continued rising, showing the longer-term trend hasn’t fully broken.

Recently, the price bounced off lows near $60 and made a strong recovery, testing the underside of the 200-day line. This bounce, paired with a pickup in volume, suggests there’s still demand at lower levels, even as the broader trend cools.

Volume and Relative Strength Index

Volume has remained relatively stable throughout the year, with noticeable spikes during both selloffs and recoveries—particularly around late October and early April. These bursts often signal institutional interest, either on the buying or selling side, and lend credibility to those big moves.

Looking at the RSI, the stock dipped near oversold territory in late March but quickly reversed. It’s now hovering around the mid-50s, which leans neutral but is pointing upward. That could hint at a mild rebound building momentum, although it hasn’t reached overbought territory yet.

Current Setup

The most recent five candles show a recovery effort underway. There’s a clear push from buyers, with longer lower wicks indicating demand stepping in on dips. Still, with price sitting just under both key moving averages, it’s a moment of potential decision. If APH can hold above recent lows and push through that resistance around $67-$68, it could reestablish a more confident uptrend. If not, it may stay rangebound for a bit longer.

Overall, the chart reflects a name coming off a strong run, now taking a breather and looking for its next move.

Management Team

Amphenol’s leadership has played a big role in shaping the company into the consistent performer it is today. At the helm is President and CEO R. Adam Norwitt, who has been with the company for more than two decades. He brings a steady, strategic presence, and under his leadership, the company has leaned into innovation while staying grounded in operational discipline. Norwitt is known for being deeply involved in the business, regularly highlighting Amphenol’s entrepreneurial culture and decentralized operating model as key strengths.

What’s particularly notable is how the executive team has maintained a growth mindset without losing sight of margins and shareholder value. Acquisitions are a core part of their strategy, but they’re highly selective and targeted—typically aimed at adding complementary capabilities rather than pursuing flashy expansion. The finance team, led by CFO Craig Lampo, has also kept the balance sheet in great shape. Cash generation, prudent debt management, and shareholder returns have all been balanced carefully over time. There’s a clear alignment between leadership and long-term value creation, and that’s reflected in how consistently the company has executed through various market cycles.

Valuation and Stock Performance

Amphenol’s stock has shown solid long-term performance, and 2024 was no exception. It reached all-time highs in the fall before cooling off alongside broader market volatility. Still, the shares have outperformed many industrial peers over the past year, especially considering their strong rebound from the March pullback. With a 52-week range between roughly $55 and $79, the stock has shown resilience, particularly in the face of rising rates and cyclical pressures in tech and manufacturing.

From a valuation standpoint, Amphenol isn’t cheap—nor should it be. It currently trades at a forward P/E of around 29, and a trailing P/E in the mid-30s. Those numbers are above market averages, but the premium is largely justified given its consistent earnings growth, robust margins, and long-term visibility. The PEG ratio is just above 2, signaling that while the stock isn’t a deep bargain, growth expectations remain healthy and achievable.

Looking at enterprise value multiples, EV/EBITDA is in the low 20s, which aligns with other high-quality industrial tech names. Price-to-sales and price-to-book are also elevated, but not unusually so for a company with consistent cash flow and limited capital intensity. Investors have been willing to pay up for that blend of quality and predictability, and so far, they’ve been rewarded.

Technical indicators also tell an interesting story. The stock recently crossed below its 50-day and 200-day moving averages, typically a bearish signal, but recent buying pressure and a bounce off support show buyers are still active. This could set the stage for consolidation or a potential breakout if momentum builds.

Risks and Considerations

While Amphenol checks many boxes in terms of financial strength and execution, there are still risks worth acknowledging.

First, the company is tied closely to the broader technology and electronics ecosystem. While its end markets are diversified, demand still ebbs and flows based on global production cycles in areas like mobile devices, broadband infrastructure, and data centers. If we were to see a meaningful slowdown in global tech spending or a pullback in capital investment, it could ripple through Amphenol’s customer base.

Currency fluctuations are another factor. With a large portion of revenue coming from international markets, any sustained movement in exchange rates could affect reported results. The company does manage currency risk, but it’s a variable that can add noise to the numbers.

On the supply chain side, Amphenol has navigated disruptions better than most, but it’s not immune. Any resurgence of component shortages or shipping constraints—especially in high-growth areas like aerospace and defense—could impact timing and costs.

Acquisition risk is another area to watch. The company has a strong track record of integrating new businesses, but the more acquisitions they pursue, the higher the risk of integration missteps. That said, the leadership team has shown a consistent ability to maintain quality through this process.

And finally, valuation. At current levels, Amphenol is priced for continued growth. If earnings were to come in lighter than expected or if multiples compress due to macro factors, the stock could see pressure, even if fundamentals remain intact.

Final Thoughts

Amphenol stands out as a rare mix of industrial scale and high-tech exposure, with a business model that’s both diversified and remarkably consistent. It doesn’t rely on a single product or market to drive results, which is one of the reasons it has weathered so many different environments with grace.

The company continues to deliver strong organic growth, solid margins, and healthy free cash flow. On top of that, the management team has a disciplined eye for acquisitions and a clear commitment to long-term value creation. The dividend, while modest in yield, is backed by real strength and room to grow. That’s a rare combination, especially in a space where capital allocation can often lean too heavily in one direction.

Looking ahead, Amphenol is well-positioned to benefit from trends that are far from short-term—continued digital infrastructure buildout, growth in defense and aerospace technologies, and the expanding role of sensors and connectors in just about everything electronic.

There’s no telling what the broader market might do in the coming quarters, but Amphenol has built a business that’s more prepared than most. It keeps delivering, quietly and steadily, in a way that’s earned the trust of long-term investors. Whether the focus is on income, capital appreciation, or a mix of both, this is a name that continues to earn its place in serious portfolios.