Updated 4/14/25

American Financial Group (AFG) is a specialty insurance company with deep roots, led by a seasoned management team that prioritizes underwriting discipline and strategic capital allocation. Headquartered in Cincinnati, AFG focuses primarily on property and casualty insurance through its flagship subsidiary, Great American Insurance Group. The company has consistently delivered strong returns, with a core operating ROE above 19% and a history of dividend growth backed by a conservative payout ratio under 28%. With $1.15 billion in operating cash flow, a solid balance sheet, and steady premium growth, AFG has proven its ability to navigate economic cycles. The stock trades at reasonable valuation multiples, including a forward P/E around 11.5 and a price-to-book of 2.36. Analysts have a consensus target of $132.75, supported by stable fundamentals and reliable cash generation.

Recent Events

Over the last year, AFG has kept a steady hand, even as some economic crosswinds created turbulence across the broader insurance sector. Revenue was up a respectable 4.7% year over year, and net income came in at $887 million. That’s paired with earnings per share of $10.57 on a trailing basis. While earnings growth ticked slightly negative in the latest quarter, the overall story is one of healthy profitability.

The company’s balance sheet remains solid. AFG holds $1.48 billion in cash, comfortably above its $1.72 billion in total debt. The debt-to-equity ratio is conservative at 38.5%, and the current ratio stands at 2.14—well above what’s needed to cover short-term obligations. Add in $1.15 billion in operating cash flow, and you’ve got a financial profile that supports steady dividend payments without stretching.

Stock performance over the past 12 months hasn’t been especially exciting, with a slight decline of about 0.35%. But that underperformance compared to the S&P 500’s rise doesn’t tell the whole story. AFG’s shares are trading below their 200-day moving average, signaling that while momentum has stalled, value may be building for patient investors focused on income.

Key Dividend Metrics

💰 Forward Dividend Yield: 2.55%

📆 Next Dividend Date: April 25, 2025

🚫 Ex-Dividend Date: April 15, 2025

📈 5-Year Average Yield: 1.99%

🎯 Payout Ratio: 27.72%

🔁 Dividend Growth Track Record: Annual increases, consistently

📊 Cash Flow Coverage: Over $1B in operating cash flow

💸 Trailing Annual Dividend Rate: $3.02

Dividend Overview

Right now, AFG is offering a 2.55% forward dividend yield—above its own five-year average of just under 2%. That’s not high enough to land it on a list of ultra-high yielders, but it’s a respectable return when paired with the company’s strong fundamentals. This isn’t the kind of dividend you chase. It’s one you hold onto.

The dividend is well-covered, too. With a payout ratio of less than 28%, there’s plenty of room for flexibility even if earnings dip or underwriting results soften temporarily. That conservative approach makes the yield more durable, which is exactly what income-focused investors should be looking for.

What’s also appealing is AFG’s occasional use of special dividends. These aren’t guaranteed, but when business performance exceeds expectations—as it has in certain years—the company has returned that surplus directly to shareholders. It’s a nice bonus on top of a stable base, and while not something to count on annually, it adds a layer of upside.

AFG’s dividend isn’t just sustainable—it’s growing. That growth might not make headlines, but it adds up over time. And with low payout ratios and ample free cash flow, there’s no reason to think the upward trajectory won’t continue.

Dividend Growth and Safety

One of the most consistent themes in AFG’s dividend story is growth. Over the past five years, the company has raised its dividend steadily, typically in the mid to high single digits. That kind of growth, backed by real earnings and not financial engineering, makes a big difference over time for long-term investors.

Dividend safety is also a standout here. The company’s return on equity is just over 20%, which is impressive. AFG’s capital discipline is clearly working, and with low leverage and high liquidity, there are no red flags in the financials.

Short interest is low, sitting at around 2.3% of the float, suggesting that few investors are betting against the stock. The company also has strong insider ownership, with over 21% of shares held by insiders. That alignment with shareholder interests adds a degree of confidence that management is focused on long-term value creation rather than short-term optics.

AFG’s beta is 0.58, which tells you it tends to move less than the broader market. That makes it a nice ballast in an income-oriented portfolio. It doesn’t spike wildly in good times, but more importantly, it tends to hold up well during volatility.

Overall, AFG’s dividend profile is built on the kind of foundation income investors like to see: healthy cash flow, conservative payouts, a history of consistent raises, and a management team with skin in the game. While it may not light up a growth investor’s screen, for those focused on predictable income and capital discipline, it’s exactly the kind of company worth keeping an eye on.

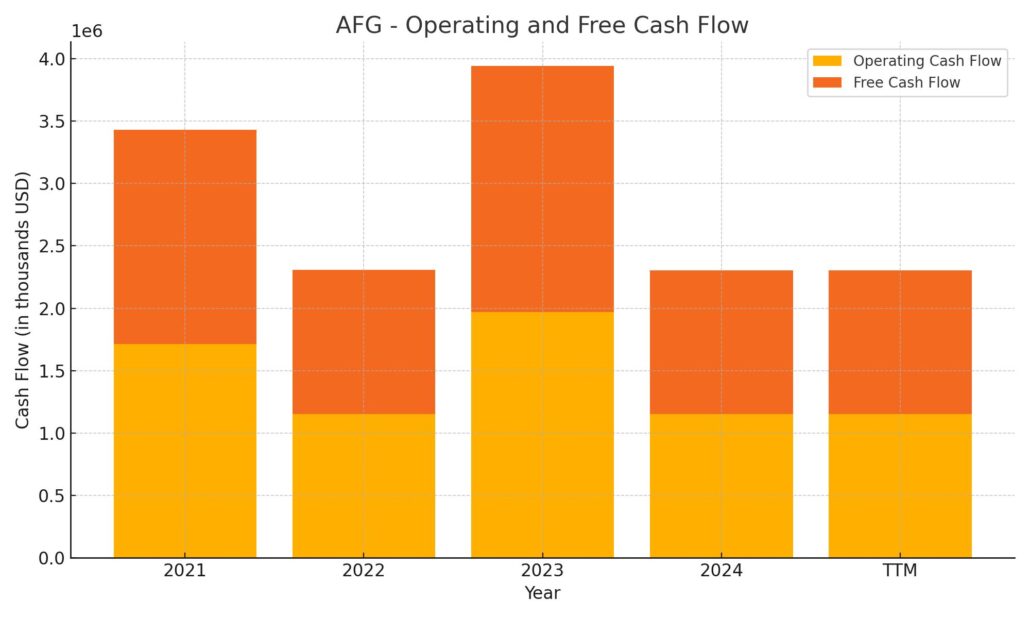

Cash Flow Statement

American Financial Group’s cash flow for the trailing twelve months shows a stable and resilient core. Operating cash flow came in at $1.15 billion, nearly flat compared to two years ago, though down from the 2023 peak of $1.97 billion. Still, it reflects strong underlying business operations, especially considering consistent insurance income and prudent expense management. Free cash flow matches operating cash flow exactly, reinforcing the lack of major capital expenditures during the period—something not uncommon in the insurance industry where capex tends to be minimal.

On the financing side, the company returned a substantial amount of capital to shareholders, with outflows of $1.07 billion. This continues a trend seen in prior years, including $2.03 billion in financing outflows in 2023. Much of this is tied to dividend payments and share repurchases, showing a clear commitment to shareholder returns. Meanwhile, investing activities contributed a modest $95 million in positive cash flow, reversing prior-year trends where investment cash flow was negative. The end cash position stands at $1.41 billion, comfortably up from the prior year, giving AFG flexibility for both internal needs and potential capital return initiatives.

Analyst Ratings

📉 American Financial Group (AFG) was recently downgraded by analysts at Keefe, Bruyette & Woods, shifting from an “Outperform” to a “Market Perform” rating. The price target was also trimmed down from $144 to $126. This move reflects a more cautious view of AFG’s near-term prospects, particularly given some moderation in earnings momentum and the broader market’s unpredictable tone around insurance sector valuations. Analysts pointed to softening growth expectations and the lack of short-term catalysts as reasons for dialing back their previous bullish stance.

📊 As it stands, the overall consensus among analysts has settled around a ‘Hold’ rating. The average 12-month price target now hovers at $132.75, suggesting mild upside potential from current levels. The spread of estimates ranges from a low of $124 to a high of $150, showing some divergence in outlook depending on the weight placed on AFG’s stable cash flow versus growth headwinds. While not a runaway favorite, AFG remains a name that some still see value in—especially for those prioritizing income and balance sheet strength over rapid capital appreciation.

Earning Report Summary

Solid Close to the Year

American Financial Group wrapped up the fourth quarter of 2024 with results that were strong overall, even if not flashy. They reported net earnings of $255 million, or $3.03 per share, which was just a bit under what they brought in during the same quarter the year before. What stood out, though, was their core operating earnings climbing to $262 million, up from $238 million. That boost was mainly thanks to stronger investment income in their property and casualty segment, especially from alternative investments performing well.

Their specialty insurance operations continued to be a consistent source of strength. The combined ratio came in at 89%, which is slightly higher than last year, but still comfortably below the 100% threshold that signals underwriting profitability. The quarter did see some impact from catastrophe losses tied to Hurricane Milton and some reserve adjustments, but underwriting profit still hit $204 million. Premium growth stayed positive too—net written premiums rose 1% while gross written premiums edged up 3%.

Leadership Perspective

Both Carl Lindner III and Craig Lindner, who serve as co-CEOs, were pretty upbeat about how things are shaping up. They pointed out the company achieved a core operating return on equity above 19% and ended the year with 7% growth in net written premiums. They also gave a nod to record investment income and strong underwriting discipline as the driving forces behind their steady performance. Shareholders didn’t go unnoticed either—AFG increased its regular dividend by nearly 13% and returned extra value through special dividends totaling $6.50 per share.

Looking Ahead

Heading into 2025, the company seems focused on keeping the momentum going. Management talked about continuing to reinvest in the business, exploring growth in both current lines and potentially new ones if they see the right opportunities. They’re also keeping an eye on pricing. Rate increases continued in the fourth quarter, especially outside of workers’ comp, where they saw renewal pricing move up around 8%. That kind of pricing power gives them a good runway for future earnings if they can keep underwriting sharp.

The tone coming out of this report wasn’t overly aggressive or cautious—it felt measured. AFG knows its lane, and they’re sticking to it. As long as investment income holds up and loss trends stay manageable, the company looks set to keep doing what it’s been doing—growing moderately and rewarding shareholders along the way.

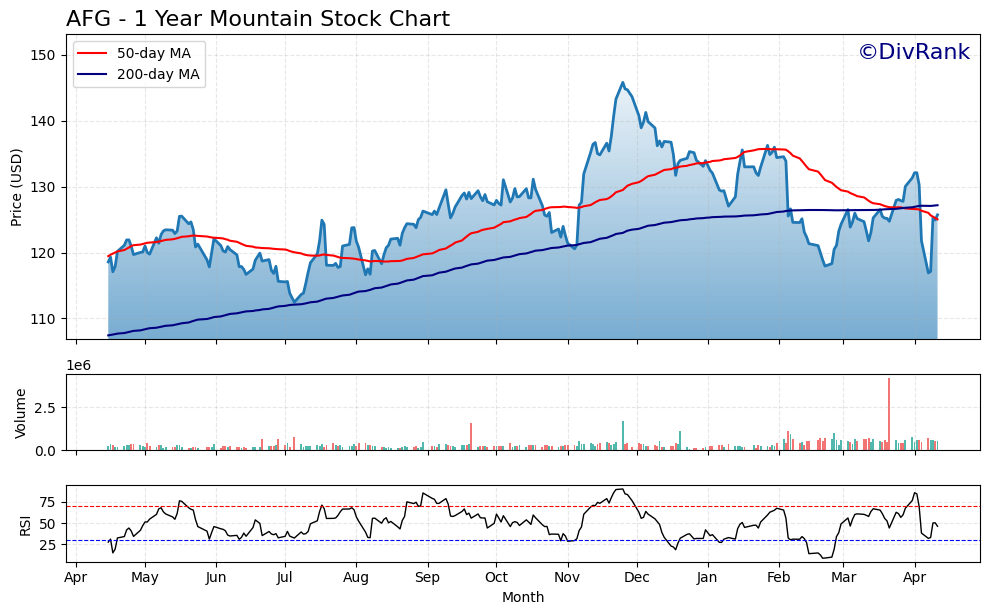

Chart Analysis

Price Action and Moving Averages

AFG has had a bumpy ride over the past 12 months, with some clear peaks and valleys. The stock started last spring around the $118 mark, pushed up through summer, and reached its high near $150 in late November. Since then, there’s been a noticeable downtrend that’s tested support multiple times, particularly in March and early April.

The 50-day moving average, shown in red, had a strong upward slope from late summer through February but has since started to turn over, reflecting some recent price weakness. Meanwhile, the 200-day moving average in blue has remained steadily upward, suggesting the longer-term trend hasn’t broken, though the price dipping below that level in recent weeks is worth watching. That kind of crossover between short and long-term moving averages is often a sign that momentum may be shifting or pausing.

Volume Activity

Volume has remained fairly consistent throughout the year, with occasional spikes that line up with significant price moves. Notably, there’s a surge in volume in early March, which appears to coincide with a steep drop in price. That could point to a reaction to news or earnings, and the heavier trading suggests institutional involvement. Since then, volume has trailed off, even as the stock tried to find footing, which may indicate hesitation or a wait-and-see sentiment in the market.

RSI and Momentum

The RSI chart below shows the stock has dipped into oversold territory several times this year, especially in late October and again in early April. These dips have typically been followed by short-term rallies, but the stock hasn’t been able to sustain a run back to prior highs. It’s worth noting that the RSI has hovered in the neutral zone for much of the year, suggesting that momentum has been range-bound and not leaning heavily in one direction.

Looking at where things stand now, AFG has bounced off recent lows with a sharp move higher, and RSI has ticked up again, pointing to a possible recovery attempt. However, the 50-day moving average now acting as resistance makes it an important level to watch. If the price can push back above both moving averages with volume support, that could restore some upward confidence.

All in all, the chart reflects a year of solid highs and corrective pullbacks. While the stock hasn’t broken its broader uptrend, it’s facing some technical challenges in the short term that need to be worked through before the next leg up.

Management Team

American Financial Group (AFG) is led by a management team that’s been remarkably consistent over the years. Co-CEOs Carl H. Lindner III and S. Craig Lindner have shared leadership responsibilities since 2005. Carl focuses on the company’s property and casualty insurance operations, while Craig oversees investment management. The two have been involved with the company for decades, bringing a steady hand and deep institutional knowledge that’s shaped the company’s long-term success.

John B. Berding stepped into the role of President in mid-2023 and continues to lead American Money Management Corporation, which handles AFG’s investment portfolios. He’s been with the organization since 1988, making his leadership a continuation of the company’s culture of promotion from within. CFO Brian S. Hertzman, appointed in 2020, has more than 20 years under his belt with AFG. Across the board, leadership depth and tenure stand out—something that provides confidence when evaluating the company’s strategic decisions.

Valuation and Stock Performance

AFG’s current share price is sitting around $125.72, falling within a 52-week range of $114.73 to $150.19. The stock has had its share of swings, but it hasn’t strayed far from its long-term averages. With a trailing P/E of 11.89 and a forward P/E of 11.53, the valuation looks reasonable, especially when compared to peers in the insurance space. The price-to-book ratio is 2.36, and the price-to-sales ratio stands at 1.27—figures that suggest the stock isn’t overpriced relative to its earnings power or balance sheet strength.

While the stock has been under a bit of pressure in recent months, longer-term performance shows a steady upward climb, with occasional pullbacks that reflect broader market behavior rather than any internal weakness. Analysts have a consensus price target of around $132.75, implying a bit of room to the upside. Nothing explosive, but that’s not really the play here—this stock has always leaned toward slow, reliable value rather than high-growth sizzle.

Risks and Considerations

Like any company in the insurance industry, AFG is exposed to a variety of risks that can impact results. Catastrophic events like hurricanes or floods can lead to sudden spikes in claims, and we’ve seen that play out recently with losses tied to Hurricane Milton. The nature of insurance means these types of events are part of the business model, but they still pose a threat to short-term earnings stability.

There’s also the broader concern around social inflation—rising litigation costs and jury awards that can make it more expensive for insurers to settle claims. AFG has done well managing its exposure and maintaining underwriting discipline, but it’s a pressure point that’s not going away anytime soon. On the investment side, they’re fairly conservative, but shifts in interest rates and market conditions can still impact returns, particularly on the fixed income side of the portfolio.

Final Thoughts

American Financial Group continues to show why it has long been viewed as a steady player in the specialty insurance world. The company’s leadership is seasoned, with a deep bench of experience and a clear sense of where the business is heading. Underwriting remains tight, investment income has held up well, and capital is being returned to shareholders through regular and special dividends.

While there are risks—some of them sector-wide and others more specific—the company’s history of managing through different cycles speaks volumes. It’s not a flashy name, but it’s a dependable one, with a financial profile built around sustainability rather than speculation. That measured approach is part of what’s kept AFG relevant in an evolving market, and there’s little reason to believe that will change anytime soon.