Updated 2/25/26

Amdocs Limited (DOX) operates at the core of the global communications and media industries, delivering software and services that support customer experience, billing, and network operations for some of the largest telecom providers in the world. Headquartered in Missouri, the company maintains a strong financial foundation, with solid cash flow, consistent profitability, and a shareholder-focused approach that includes a steady dividend and ongoing share repurchases. With a forward dividend yield of 3.13% and a payout ratio under 41%, Amdocs continues to appeal to investors looking for stable returns. Backed by an experienced leadership team, the company is actively investing in cloud and AI solutions, positioning itself for future growth while maintaining operational discipline.

📌 Recent Events

Amdocs has continued advancing its position in cloud-enabled telecom software and managed services over recent months, leaning into AI-driven solutions as a key growth vector. The company has been active in deepening relationships with major North American and European telecom carriers, with managed services remaining the backbone of its commercial model. These long-cycle contracts provide revenue visibility that most software companies simply cannot match, and management has emphasized expanding that segment as part of its forward strategy.

On the capital return front, Amdocs raised its quarterly dividend to $0.527 per share beginning in early 2025, up from $0.479 in 2024, continuing a multi-year streak of annual dividend increases. That increase reflects confidence in the durability of free cash flow, which came in at approximately $598 million over the trailing twelve months. The company has also maintained an active share repurchase program, further underscoring management’s commitment to returning capital to shareholders even as it invests in next-generation service capabilities.

The stock has pulled back meaningfully from its 52-week high of $95.41, now trading near $66.45, close to the bottom of its annual range of $65.74 to $95.41. That gap between where analysts see fair value and where the stock is currently trading has widened considerably, making this a name that deserves closer attention from income-oriented investors willing to look past near-term price weakness.

💰 Key Dividend Metrics

🔔 Forward Dividend Yield: 3.13%

📅 Last Dividend Payment: $0.527 per share

📈 Annual Dividend: $2.28 per share

💵 Payout Ratio: 40.77%

📊 EPS: $5.17

📉 Free Cash Flow: $597,791,232

These metrics reflect a dividend that is well-covered, modestly growing, and sitting at a yield that is meaningfully above what Amdocs has historically offered. For income investors, the combination of a sub-41% payout ratio and nearly $600 million in annual free cash flow provides a comfortable margin of safety.

🧾 Dividend Overview

One of the more compelling aspects of Amdocs right now is that its dividend yield of 3.13% is being driven not by a dividend cut or financial stress, but by share price compression. The annual dividend of $2.28 per share represents a genuine increase from the $1.916 paid across 2024, and the payout ratio of 40.77% leaves ample room for continued growth without straining the balance sheet.

Cash generation remains the foundation of dividend confidence here. Operating cash flow came in at $863.7 million over the trailing twelve months, and free cash flow of $597.8 million comfortably covers the total dividend obligation. The business model, built around long-term managed services contracts with large telecom operators, provides the kind of recurring revenue predictability that makes dividend sustainability far easier to assess than in more cyclical tech businesses.

For dividend growth investors, the recent history tells a straightforward story. Quarterly payments moved from $0.435 in 2023, to $0.479 through 2024, and then stepped up again to $0.527 starting in early 2025. That pattern of steady annual increases is exactly what long-term income compounders are built on.

📈 Dividend Growth and Safety

Amdocs has now delivered consecutive annual dividend increases, each one modest but dependable. The move from $0.479 to $0.527 per quarter represents roughly a 10% increase, which is a meaningful step up relative to the company’s historical pace. That kind of consistency builds trust over time, particularly when accompanied by the financial metrics to back it up.

The safety profile of this dividend is strong. With a payout ratio of just under 41% against earnings per share of $5.17, there is considerable cushion even in a scenario where earnings soften. Free cash flow of $597.8 million represents a dividend coverage ratio that leaves substantial room for both dividend growth and share repurchases simultaneously. Return on equity of 16.48% and return on assets of 8.16% confirm that the business continues to generate real economic value, not just accounting profits.

Institutional ownership remains essentially complete, meaning the major long-term capital allocators, including pension funds and large asset managers, continue to hold positions in the name. That kind of institutional confidence does not disappear quietly, and it adds a layer of validation to the dividend’s sustainability. For investors who prioritize safety over yield maximization, Amdocs at current prices offers an unusually favorable combination of both.

This is a name that keeps showing up for investors who value cash flow and quiet consistency. The kind of stock that doesn’t need to shout for attention, because its numbers already do the talking.

Chart Analysis

Amdocs has had a difficult twelve months on the price chart, with shares falling steadily from a 52-week high of $92.33 to the current price of $66.45, a decline of just over 28% from peak levels. That kind of drawdown reflects sustained selling pressure rather than a brief bout of volatility, and the fact that today’s price sits exactly at the 52-week low tells you that buyers have not yet stepped in to establish a credible floor. For dividend investors who may have been accumulating shares at higher prices, the chart offers little short-term comfort, though the same trajectory that punishes existing holders does create a more attractive entry yield for new capital coming off the sidelines.

The moving average picture reinforces the bearish case on a technical basis. The 50-day moving average sits at $77.97 and the 200-day moving average at $83.02, both well above where the stock is trading today. When the shorter-term average crosses below the longer-term average, technicians refer to this as a death cross, and that formation is firmly in place here. The gap between current price and both moving averages is meaningful, with DOX trading roughly 15% below its 50-day and more than 20% below its 200-day. Until price can reclaim at least the 50-day, the path of least resistance on the chart remains downward, and any rally attempt will face overhead resistance at both levels.

The RSI reading of 31.46 places DOX just above the traditional oversold threshold of 30, which historically signals that selling momentum may be approaching exhaustion. That is not a call for an immediate reversal, but it does suggest the stock is stretched to the downside on a near-term basis, and mean-reversion traders may begin to take notice. For income-focused investors, an oversold RSI combined with a depressed price level can occasionally mark a period of accumulation opportunity, particularly when the underlying dividend remains well covered and the business fundamentals have not deteriorated proportionally to the price action.

Taken together, the technical setup for DOX is clearly challenged in the near term. The trend is down, the moving averages are bearish, and the stock is sitting on its annual low with no established support beneath it. Dividend investors should treat the chart as a caution signal rather than a green light for aggressive buying, and consider whether a position should be built gradually rather than all at once. The oversold RSI provides a small measure of encouragement that the worst of the selling may be close to running its course, but price confirmation, meaning a sustained close back above the 50-day moving average, would be a far more reliable signal that the trend is turning before adding meaningfully to exposure.

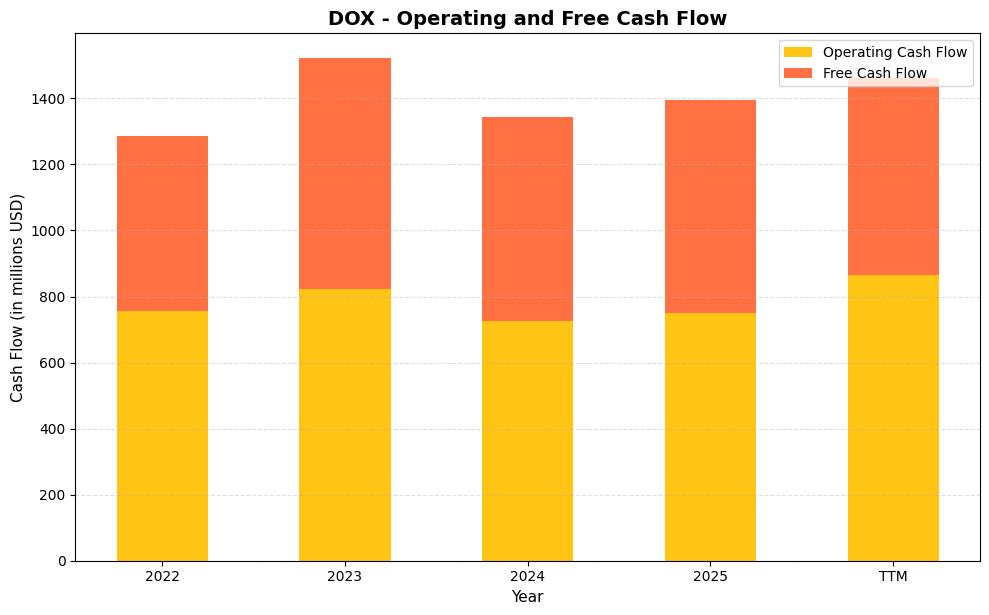

Cash Flow Statement

Amdocs generates consistently strong cash flows, which forms the bedrock of its dividend reliability. Operating cash flow has ranged between $724.4 million and $863.7 million over the periods shown, with the TTM figure of $863.7 million representing the strongest reading in this data set. Free cash flow has been equally impressive, holding above $597 million in every period and reaching $698.3 million in fiscal 2023. The TTM free cash flow of $597.8 million, while slightly below recent annual figures, still covers the company’s dividend obligation with substantial room to spare. For dividend investors, that level of free cash flow generation means the payout is not dependent on favorable earnings interpretations or balance sheet maneuvers, but rather on real cash arriving at the business each year.

Zooming out across the full trend, what stands out is the consistency rather than dramatic growth. Operating cash flow dipped modestly to $724.4 million in fiscal 2024 before recovering to $749.1 million in fiscal 2025 and accelerating further in the TTM period, suggesting the business has returned to an upward trajectory after a brief soft patch. Free cash flow conversion has remained healthy throughout, reflecting disciplined capital expenditure management. The gap between operating and free cash flow, typically in the $100 million to $150 million range, indicates a capital-light model that does not demand heavy reinvestment to sustain its revenue base. For shareholders, that capital efficiency translates into a company that can simultaneously fund dividend growth, share repurchases, and strategic investments without straining its financial position.

Analyst Ratings

Analyst sentiment on Amdocs presents a striking contrast with where the stock is currently trading. The consensus price target mean sits at $93.82, with a low of $87.08 and a high target of $105.00. Against a current price of $66.45, even the most conservative analyst target implies upside of more than 31%, and the mean target represents potential appreciation of over 41% from current levels. That kind of disconnect between analyst fair value estimates and market price is unusual for a company of Amdocs’ size and stability.

The $105.00 high target aligns with the level that more optimistic analysts have maintained, reflecting confidence in the company’s managed services backlog and the longer-term opportunity in cloud and AI-enabled telecom infrastructure. The breadth of the target range from five covering analysts suggests some divergence in views on near-term revenue trajectory, but the floor of $87.08 still represents substantial upside from today’s price. With the stock trading at just 12.85 times earnings and near multi-year lows, the valuation case is difficult to ignore. Analysts tracking this name appear to agree that the current price substantially understates the company’s intrinsic value.

Earnings Report Summary

Amdocs has continued to navigate a deliberate strategic transition, stepping away from lower-margin non-core business while investing in higher-value managed services, cloud infrastructure, and AI-enabled solutions. Revenue for the trailing twelve months came in at $4.58 billion, with net income of $571.1 million and earnings per share of $5.17. While reported revenue has faced headwinds from the company’s exit of certain segments, the underlying profitability picture remains solid, as evidenced by a profit margin of 12.47% and operating cash flow that has improved meaningfully to $863.7 million.

Profitability Holding Strong

Earnings per share of $5.17 reflect a business that is managing costs effectively even through a period of revenue mix reshaping. Return on equity of 16.48% and return on assets of 8.16% are consistent with a company that is deploying capital productively. The managed services segment continues to represent the largest share of revenue, providing the kind of long-term contracted visibility that supports financial planning and dividend commitments alike.

Solid Cash Flow and Shareholder Returns

Operating cash flow of $863.7 million is one of the most important data points in the Amdocs story right now. It demonstrates that the income statement profitability is translating directly into real cash, and that the company has the financial firepower to fund dividends, repurchases, and strategic investment simultaneously. Free cash flow of $597.8 million comfortably exceeds the total annual dividend commitment at current payout levels, leaving meaningful room for the company to continue growing the dividend without compromise.

Guidance and Looking Ahead

Management has emphasized cloud and AI as the primary growth vectors for the business going forward, and the backlog of managed services work provides a runway of committed future revenue. While near-term reported revenue may remain under some pressure as the company completes its non-core exit strategy, the margin profile and cash generation are expected to benefit from that rationalization over time. Leadership has maintained a disciplined approach to capital allocation, balancing investment in growth with consistent shareholder returns, and the financial metrics at the close of the most recent period suggest that approach is working.

Management Team

Amdocs is guided by a leadership team with years of experience both within the company and across the broader tech landscape. Leading the charge is Shuky Sheffer, who has been President and CEO since 2018. His career with Amdocs stretches back several decades, giving him an in-depth understanding of the company’s operations and long-term strategy. His previous executive role at another software firm added to the leadership depth he brought back to Amdocs.

Working alongside him is Tamar Rapaport-Dagim, who plays a dual role as both Chief Financial Officer and Chief Operating Officer. She has been with Amdocs since 2004 and has a strong background in finance and accounting. Her leadership has helped the company stay financially disciplined, which is especially important in periods of strategic transition. Other key team members include Rajat Raheja, who leads the India division, and Gil Rosen, who heads up marketing. Together, this team is steering the company toward newer tech frontiers while keeping its core strengths intact.

Valuation and Stock Performance

At a current price of $66.45, Amdocs shares are trading near the very bottom of their 52-week range of $65.74 to $95.41, representing a decline of over 30% from the annual high. The market cap has compressed to approximately $7.3 billion, and the stock now trades at just 12.85 times trailing earnings. For a company generating $863.7 million in operating cash flow annually, that multiple looks unusually modest.

The price-to-book ratio of 2.09 against a book value of $31.82 per share further reinforces the case that the current price reflects considerable pessimism that may not be warranted by the underlying fundamentals. Return on equity of 16.48% is a meaningful metric here, because it tells you the business is generating real returns on the assets it deploys, not just benefiting from leverage. The dividend yield of 3.13% at current prices is among the highest Amdocs has offered in recent years, and with analyst price targets ranging from $87.08 to $105.00, the stock appears to be pricing in a more negative scenario than the financial statements currently support. For long-term income investors, the combination of a 3.13% yield, a covered payout, and substantial analyst upside creates a setup that warrants serious consideration.

Risks and Considerations

Amdocs derives the vast majority of its revenue from the global telecom industry, which creates a meaningful concentration risk. Telecom clients tend to be stable, long-term partners, but any broad pullback in capital spending across that sector, whether driven by regulatory pressure, competitive disruption, or economic slowdown, would flow directly through to Amdocs’ top line. The company’s recent revenue pressure is partly a function of its own strategic choices, but the underlying dependence on telecom investment cycles remains a structural consideration that income investors should keep in mind.

The company is competing for cloud and AI-enabled infrastructure contracts against some of the largest technology companies in the world. While Amdocs has deep telecom domain expertise that many generalist cloud providers lack, scaling these newer offerings fast enough to replace legacy revenue streams requires sustained investment and flawless execution. Falling behind in this transition could limit the growth profile and eventually pressure the free cash flow that supports the dividend program.

Short interest of approximately 5.36 million shares is not alarmingly elevated, but the stock’s proximity to its 52-week low suggests the market is pricing in some degree of continued deterioration. Investors should monitor whether revenue trends stabilize as the company completes its non-core exit program, since a prolonged period of top-line contraction, even with margin improvement, could continue to weigh on sentiment and keep the stock range-bound near current levels.

Final Thoughts

Amdocs at $66.45 presents a different value proposition than it did a year ago, and in most respects a more compelling one for income-focused investors. The dividend has grown, the payout ratio is conservative, free cash flow is robust, and the stock is now trading at a P/E of 12.85 with analyst targets averaging nearly $94. That is a meaningful setup for investors who are willing to look past near-term price weakness and focus on what the business is actually generating.

The transition away from non-core revenue segments creates some near-term noise in the reported numbers, but management has been consistent and transparent about the rationale, and the margin and cash flow trajectory validates the strategy. For investors who value operational reliability, shareholder-friendly capital allocation, and a dividend that has grown every year in recent memory, Amdocs continues to make a quiet but persuasive case. Execution remains the key variable, but the fundamentals at current prices suggest the market may be offering a more attractive entry point than the stock has seen in some time.