Updated 2/25/26

Allstate Corporation (ALL) has spent decades building a reputation as a reliable and disciplined insurer across auto, home, and life coverage. Backed by strong financial results and a clear strategic direction, the company has steadily grown earnings, improved underwriting margins, and strengthened its balance sheet. With operating cash flow topping $10 billion and a payout ratio just above 10%, Allstate offers shareholders a consistent stream of income supported by exceptional fundamentals. Its leadership team, anchored by long-time CEO Tom Wilson, continues to guide the company through market shifts with a focus on innovation, capital efficiency, and long-term value creation. Trading near $209 with a consensus analyst target of $240, and supported by steady dividend growth and buybacks, the stock reflects a stable player well-positioned for continued outperformance.

Recent Events

Allstate has continued to build momentum heading into 2026, with its turnaround from the catastrophe-driven losses of prior years now looking firmly entrenched. The company completed the strategic exit from its group health and voluntary benefits businesses, a move that sharpened its focus on core property and casualty operations and generated roughly $3.25 billion in proceeds. That capital has been redeployed to strengthen the balance sheet and support shareholder returns, reinforcing the disciplined capital allocation approach that CEO Tom Wilson has consistently championed.

On the pricing front, Allstate continued pushing through rate increases across its auto and homeowners lines throughout 2025, a strategy that has meaningfully improved underwriting profitability. The combined ratio across its property-liability segment has continued to trend in a favorable direction, with catastrophe losses running below the elevated levels that weighed on results in prior years. Management has also highlighted ongoing investment in Arity, the company’s data and analytics platform, and Allstate Protection Plans, both of which represent longer-term growth engines beyond the traditional insurance book.

The dividend was raised to $1.00 per quarter beginning with the March 2025 payment, up from $0.92 in 2024, representing an 8.7% increase that reflects the company’s confidence in its earnings trajectory. That increase came alongside record-level net income of over $10 billion for the trailing twelve months, a figure that underscores just how dramatically the business has recovered and accelerated from the loss-heavy environment of 2022 and 2023.

Key Dividend Metrics

🟢 Forward Annual Dividend: $4.32 per share

🟢 Forward Dividend Yield: 1.91%

🟢 Payout Ratio: 10.51%

🟢 Most Recent Quarterly Dividend: $1.00

🟢 Last Dividend Payment: December 1, 2025

🟢 5-Year Average Yield: 2.38%

🟢 Beta: 0.23

These numbers paint a clear picture of Allstate’s dividend profile. The yield is modest but growing, and the extraordinarily low payout ratio signals that earnings have surged well ahead of what the dividend requires. It is not a high-yield play, but it does not need to be. This is dependable income backed by real, substantial earnings power with a long runway for further increases.

Dividend Overview

Allstate’s dividend approach is a study in balance. The company is not trying to lure investors with flashy hikes or unsustainable yields. Instead, it is focused on consistency and sustainability, prioritizing strong underwriting, careful expense management, and solid free cash flow that supports shareholder returns year after year.

One standout here is the free cash flow. Allstate generated $8.92 billion in free cash flow over the trailing twelve months, a level that dwarfs the roughly $1.1 billion needed annually to cover its dividend at the current rate. That excess gives management considerable optionality: pay down debt, buy back shares, or reinvest in growth initiatives like Arity and Protection Services.

This kind of financial discipline builds confidence. Allstate has not had to cut its dividend even during tough stretches in the insurance cycle, and the most recent raise to $1.00 per quarter demonstrates that management is willing to pass meaningful income gains along to shareholders as earnings recover. With a payout ratio now sitting at just 10.51%, the dividend is among the most conservatively funded in the large-cap insurance space.

Allstate also balances its dividend with share repurchases. Operating cash flow topped $10.1 billion over the trailing twelve months, giving the company ample room to reduce share count while continuing to grow the dividend. Fewer shares outstanding means each remaining share captures a larger portion of future profits, compounding the benefit to long-term holders.

Dividend Growth and Safety

Allstate’s dividend growth over the past two years tells a clear story of recovery and renewed confidence. The quarterly payment moved from $0.89 through most of 2023 to $0.92 in 2024, and then stepped up again to $1.00 in March 2025, where it has remained through the most recent December payment. That represents a cumulative increase of roughly 12% from the 2023 baseline in just two years, a pace that comfortably outpaces inflation without straining the company’s finances in any meaningful way.

The safety of the dividend is not in question at these levels. With earnings per share at $37.97 and the annual dividend at $4.32, the coverage ratio is nearly 9x. Even if earnings retreated substantially from current elevated levels, as they might in a severe catastrophe year, the dividend would remain well protected. The company also carries a strong cash position and manageable debt, providing additional insulation in a stress scenario.

Allstate’s beta of 0.23 adds another layer of appeal for income-focused investors. The stock’s low sensitivity to broader market volatility means it tends to hold its value when equity markets get choppy, which is precisely when stable dividend payers become most attractive. That combination of growing income, conservative payout, and low market correlation makes Allstate a genuinely distinctive holding in a dividend growth portfolio.

Chart Analysis

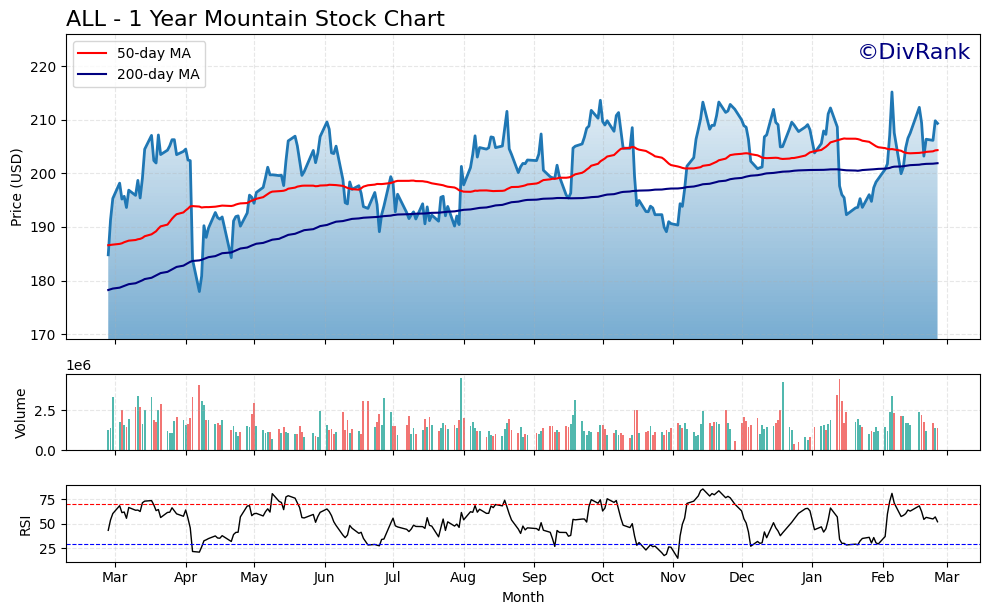

Agree Realty’s price action over the past year tells an encouraging story for income-focused shareholders. The stock has traveled from a 52-week low of $177.94 to its current level of $209.33, a recovery of roughly 17.6% from that trough, and has pushed to within striking distance of its 52-week high of $215.19. That ceiling sits just 2.7% above the current price, meaning ALL is trading in the upper band of its annual range rather than bouncing off a beaten-down floor. For dividend investors who prize capital stability alongside yield, that kind of positioning reflects a market that is growing more comfortable with the stock’s valuation.

The moving average picture reinforces that constructive view. ALL is trading above both its 50-day moving average of $204.34 and its 200-day moving average of $201.90, and the 50-day has crossed above the 200-day to form what technicians call a golden cross. That configuration is broadly regarded as a bullish structural signal, indicating that shorter-term buying pressure has absorbed and surpassed the longer-term trend line. The spread between the two averages remains relatively narrow, which suggests the rally has been measured and orderly rather than overheated, a characteristic that tends to attract the kind of long-duration capital that dividend growth names typically court.

Momentum, as measured by the 14-day Relative Strength Index sitting at 52.11, is essentially neutral. RSI readings in the low-to-mid 50s occupy the most comfortable zone a dividend investor could ask for: the stock is neither overbought nor flashing oversold distress signals. There is meaningful room to run toward the 70 threshold before any overheating concern would become relevant, and the reading suggests that recent price gains have been gradual enough to avoid the kind of speculative froth that often precedes sharp reversals.

Taken together, the technical setup for ALL presents a reasonably clean entry context for dividend-oriented investors. Price is trending above both key moving averages, momentum is calm and constructive, and the stock is consolidating near multi-month highs without evidence of exhaustion. Investors who focus primarily on the income stream may find the current chart less relevant than the dividend metrics, but the absence of technical red flags here means the price environment is unlikely to create near-term headwinds that complicate a long-term accumulation thesis.

Cash Flow Statement

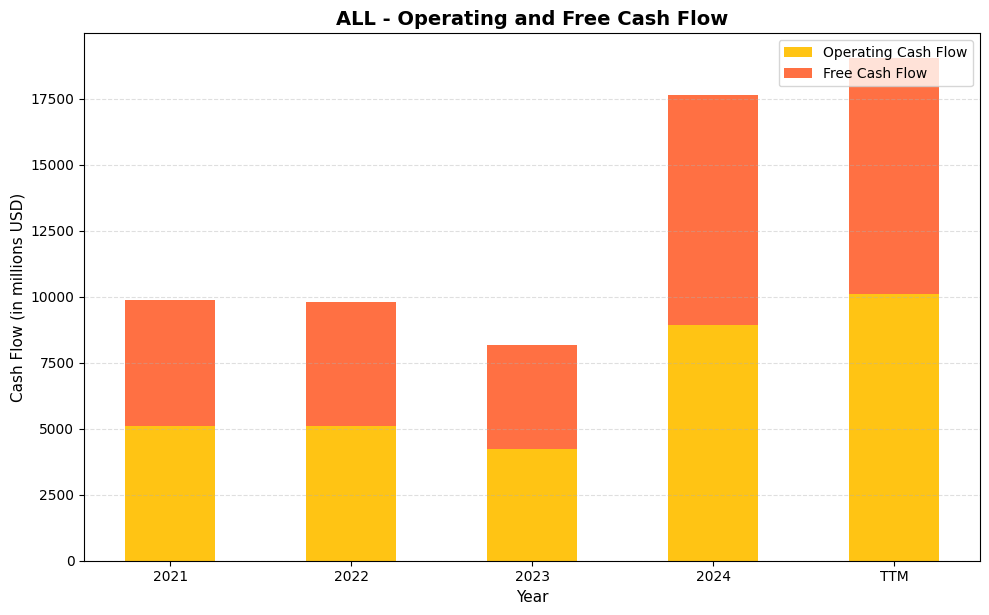

Allstate’s cash flow profile has strengthened dramatically over the trailing twelve months, giving dividend investors a compelling reason for confidence. Operating cash flow climbed to $10,110.0M on a TTM basis, up from $8,931.0M in full-year 2024 and representing nearly double the $5,116.0M generated in 2021. Free cash flow tells an equally impressive story, reaching $8,924.7M on a TTM basis after landing at $8,721.0M in 2024. That level of free cash flow generation provides substantial coverage for the current dividend obligation, and the gap between operating and free cash flow suggests capital expenditures remain modest relative to the cash the business produces. For a dividend growth investor, this is precisely the kind of trajectory that supports both ongoing payout increases and a durable margin of safety.

The path to today’s figures was not entirely linear, and that context matters. After holding relatively steady at roughly $5.1B in operating cash flow through 2021 and 2022, Allstate saw a pullback to $4,228.0M in 2023 and free cash flow compressed to $3,961.0M, a period that coincided with elevated catastrophe losses pressuring the core insurance business. The recovery in 2024 and into the TTM period has been sharp and decisive, with free cash flow more than doubling from the 2023 trough. That kind of mean reversion, driven by underwriting improvements and pricing actions rather than asset sales or one-time items, reflects genuine operational leverage. For shareholders, a business generating nearly $9B in annual free cash flow on a consistent forward run rate is one that can comfortably fund dividends, repurchases, and strategic reinvestment without stretching the balance sheet.

Analyst Ratings

The analyst community holds a constructive view on Allstate, with a consensus buy rating across 21 covering analysts as of late February 2026. The mean 12-month price target sits at $239.95, representing roughly 15% upside from the current trading price of $209.33. The range of targets is wide, spanning from a low of $167.00 to a high of $281.00, which reflects some divergence in views on how sustainable the current earnings level is given the cyclical nature of catastrophe losses and interest rate sensitivity in the investment portfolio.

Bulls in the analyst community point to the extraordinary earnings recovery, with net income exceeding $10 billion and EPS at $37.97, as evidence that Allstate’s pricing actions and underwriting discipline have fundamentally repositioned the business. They also highlight the exceptionally low payout ratio and strong free cash flow as indicators that capital return capacity is likely to grow further in coming years. The mean target of nearly $240 implies analysts expect some multiple expansion from current levels, where the stock trades at just 5.51x trailing earnings, a discount that appears unwarranted given the quality of results.

More cautious analysts flag the cyclical nature of P&C insurance earnings and the risk that catastrophe losses could revert toward historical norms, compressing margins from today’s elevated levels. The low price target of $167 essentially prices in a significant earnings normalization scenario. At the current price, the stock sits well below the mean target, which suggests the consensus view favors additional upside from here even without assuming a continuation of the exceptional 2025 earnings environment.

Earnings Report Summary

Allstate delivered outstanding financial results over the trailing twelve months ending in early 2026, with revenue reaching $67.7 billion and net income surpassing $10.1 billion. Earnings per share came in at $37.97, a level that reflects the full benefit of rate increases across the auto and homeowners books, improved loss experience, and strong investment income in a higher rate environment. Profit margins expanded to 15.19%, a significant step up from prior years when catastrophe losses and inflationary claims pressure weighed heavily on results.

Insurance Segments Show Real Momentum

The property and casualty business continued to drive results, with earned premiums benefiting from the multi-year pricing initiative that Allstate executed across both personal auto and homeowners lines. Combined ratios have improved materially as those rate increases earned through the book and loss trends moderated. Homeowners insurance, which had been under particular stress from weather-related claims, showed strong improvement as both pricing and geographic risk management measures took hold.

Investment Income Back in Play

Investment income remained a meaningful contributor to the earnings story, with the company’s fixed income portfolio continuing to benefit from reinvestment at yields well above what was available in the low-rate era. Performance-based investments also added to results in certain periods, providing upside beyond the more predictable coupon income. The overall investment portfolio is managed conservatively, which aligns with the company’s broader philosophy of protecting the balance sheet against tail risks.

Other Businesses Pulling Their Weight

Protection Services, which includes Allstate Protection Plans and the Arity telematics platform, continued to grow revenues and improve profitability. This segment represents an increasingly important part of Allstate’s long-term growth narrative, as it extends the company’s relationship with customers beyond traditional policy boundaries and generates recurring, fee-based income that is less exposed to catastrophe volatility than the core underwriting business.

Strategic Moves for the Long Game

The completed divestitures of the group health and voluntary benefits businesses sharpened Allstate’s strategic profile considerably. The proceeds from those transactions, combined with robust operating cash flows, have given management significant capital allocation flexibility. Share repurchases, debt management, and dividend growth all remain on the table as tools for enhancing per-share value going forward.

Leadership’s Take

CEO Tom Wilson has characterized the current period as one of execution and reinvestment, emphasizing that the pricing and underwriting actions taken over the past several years have created a more durable earnings foundation. CFO Jess Merten has pointed to the strength of free cash flow and the conservative payout ratio as evidence that Allstate has the financial flexibility to both invest in growth and continue growing capital returns. The overall tone from management has been one of measured confidence, grounded in the improving operational metrics visible across the business.

Management Team

Allstate is led by Tom Wilson, who has held the CEO role since 2007. His background includes leadership positions at Amoco and Sears, and under his direction the company has consistently pursued a strategy focused on innovation, efficiency, and long-term value creation. Wilson has been a steady hand through economic cycles, regulatory changes, and shifting market dynamics, and his stewardship through the difficult catastrophe years of 2022 and 2023 and into the recovery of 2024 and 2025 has reinforced confidence in the leadership team’s ability to navigate the insurance cycle.

Alongside him is a team of experienced executives who each play a key role in the company’s operations. Jess Merten has served as Chief Financial Officer since 2022, bringing a sharp focus to capital efficiency and financial stability. Christine DeBiase, the Chief Legal Officer, joined in 2023 with deep legal and compliance experience. Other notable members include John Dugenske, who oversees Allstate’s investment strategy, and Mario Rizzo, who leads the Property-Liability business. Together, this group brings a balanced blend of operational insight and strategic vision that has been central to the company’s improved results.

They have been instrumental in repositioning the business through technology investments, structural divestitures, and pricing discipline that align with the evolving insurance landscape. Their collective leadership is centered on customer satisfaction, strong underwriting, and scalable growth across new and existing platforms, and the financial results of the past twelve months validate that approach in tangible terms.

Valuation and Stock Performance

Allstate’s stock is trading near $209, approaching but still below its 52-week high of $216.75, with a 52-week low of $176.00 establishing a meaningful base of support. The stock has performed well over the past year as investors have gradually repriced the business to reflect the scale of the earnings recovery, though the current valuation still looks modest relative to the underlying fundamentals.

At a trailing P/E ratio of just 5.51x and a price-to-book of 1.90x against a book value of $110.03 per share, the stock does not appear to fully reflect the quality of earnings being generated. A P/E below 6x is unusual for a company delivering a 39.52% return on equity, and it suggests the market may still be discounting the sustainability of current earnings given the inherent cyclicality of property and casualty insurance. If even a modest earnings normalization is assumed, the stock still looks reasonably valued at this price level.

The analyst consensus target of $239.95 implies approximately 15% upside from current levels, and the high target of $281.00 suggests some analysts see a path to meaningful rerating if catastrophe losses remain benign and investment income holds. Allstate’s low beta of 0.23 means the stock tends to move independently of broader market gyrations, which adds to its appeal as a portfolio stabilizer. With a market cap of approximately $54.8 billion and strong institutional ownership, liquidity is ample and the shareholder base is long-term oriented.

Risks and Considerations

The most significant risk facing Allstate remains the inherent unpredictability of catastrophic weather events. Climate volatility has made the frequency and severity of large loss events harder to anticipate, and a bad hurricane season or a series of significant convective storm events could compress underwriting margins sharply from the currently elevated levels. Allstate manages this exposure through reinsurance and geographic diversification, but no amount of risk management eliminates the fundamental exposure that comes with writing property insurance at scale across the United States.

Earnings sustainability is another consideration worth examining carefully. The trailing EPS of $37.97 reflects an exceptional combination of favorable underwriting results, higher investment income, and the benefits of multi-year pricing actions. Some normalization of these factors is likely over a full insurance cycle, and investors should be prepared for periods where profitability falls well short of current levels. The payout ratio provides a very large buffer against such normalization, but the stock’s valuation will almost certainly be sensitive to any signs that earnings are reverting.

Regulatory risk remains a persistent backdrop for any large personal lines insurer. State insurance commissioners have significant authority over rate approvals, and in politically sensitive environments, the ability to push through adequate rate increases can lag behind rising costs. Allstate has navigated this challenge relatively well in recent years, but the regulatory dynamic varies considerably by state and can create friction that is difficult to predict or control.

Finally, the competitive landscape in personal lines insurance continues to evolve. Insurtech entrants, direct-to-consumer models, and the growing use of telematics and behavioral data are all reshaping how policies are priced and distributed. Allstate has invested meaningfully in its own technology capabilities through Arity and its digital distribution channels, but staying ahead of these structural shifts requires ongoing investment and organizational agility that larger incumbents sometimes find difficult to sustain.

Final Thoughts

Allstate has demonstrated remarkable resilience and execution capability over the past several years, moving from a period of elevated catastrophe losses and compressed margins to one of record earnings and exceptional cash generation. The numbers are genuinely impressive: $10.1 billion in operating cash flow, $8.9 billion in free cash flow, a 39.52% return on equity, and a payout ratio of just 10.51% that leaves enormous room for continued dividend growth.

The dividend story here is one of quiet compounding. The quarterly payment has grown from $0.89 to $1.00 over the past two years, and with earnings covering the dividend nearly nine times over, the foundation for future raises is as solid as it has ever been. Income investors who prioritize safety and growth potential over headline yield will find Allstate’s profile genuinely compelling at current levels.

Trading at just 5.51x trailing earnings with a consensus analyst target of nearly $240, the stock offers a combination of value, income, and quality that is relatively rare in today’s market. The risks are real, particularly around catastrophe exposure and earnings cyclicality, but Allstate’s scale, brand, and financial discipline give it the tools to manage through difficult periods while continuing to reward long-term shareholders. It remains one of the more interesting large-cap dividend growers in the financial services sector.