Updated 4/14/25

Alerus Financial Corporation (ALRS) is a diversified financial services provider offering a mix of commercial banking, wealth management, retirement planning, and payroll solutions. Headquartered in Grand Forks, North Dakota, the company has steadily expanded its footprint through organic growth and acquisitions, including its recent integration of HMN Financial. Trading around $16.11 with a dividend yield near 5%, Alerus offers investors a stable income stream and trades at a price-to-book ratio of 0.83. Under the leadership of CEO Katie Lorenson, the company has emphasized operational efficiency, risk management, and long-term shareholder value. With consistent dividend payments, a conservative business model, and improving financial metrics, Alerus presents a compelling case for investors focused on reliable income and measured growth.

Recent Events

The past year hasn’t been the easiest for banks, and Alerus didn’t escape the turbulence. Rising interest rate pressures, changing loan demand, and broader economic uncertainty weighed on the stock. Over the last 12 months, ALRS is down about 19%, a noticeable decline that has outpaced the broader market’s fluctuations.

But it’s not all red ink. Revenue saw a massive bump—up nearly 189% year-over-year. While that kind of growth likely includes some unusual one-time boosts, it still hints at solid activity under the hood. Net income came in at $17.74 million for the trailing twelve months, translating into $0.83 per share.

Despite the macro headwinds, Alerus stayed the course on dividends. Not only did it continue to pay, but it also made a modest increase. That kind of quiet consistency is what dividend investors tend to admire—there’s no fanfare, just dependable distributions.

Key Dividend Metrics

🧮 Forward Annual Dividend Rate: $0.80

📈 Forward Yield: 4.97%

📉 Trailing Yield: 4.90%

📆 Dividend Date: April 11, 2025

🔃 Payout Ratio: 95.18%

📊 5-Year Average Dividend Yield: 3.11%

📉 52-Week Stock Change: -19.21%

💰 Book Value Per Share: $19.55

🔍 Price/Book: 0.83

Dividend Overview

Right now, ALRS is offering a dividend yield near 5%, and that alone will catch the eye of income investors. It’s been consistent with distributions and just sent out its most recent payment on April 11. The high payout ratio—currently above 95%—means the company is essentially returning nearly all of its earnings to shareholders.

This is not unusual in the banking space, especially among smaller, conservatively managed institutions. It signals a focus on shareholder return over aggressive growth reinvestment. But it also means earnings need to stay stable. Any disruption to profitability could make that payout more vulnerable.

The current yield also sits well above the company’s five-year average of 3.11%, mostly due to the dip in share price over the past year. For long-term dividend collectors, this could be a timely entry point to lock in that higher income stream.

Dividend Growth and Safety

ALRS hasn’t been flashy with its dividend increases, but it has been steady. Investors who’ve held on over the years have seen small but regular bumps in their payouts. It’s a slow burn—nothing dramatic—but there’s comfort in that kind of reliability.

The challenge going forward lies in the sustainability of the payout. With earnings per share at $0.83 and dividends set at $0.80 annually, there isn’t a lot of wiggle room. That’s not an immediate red flag, but it does limit flexibility if economic conditions take a turn or if profits soften.

Still, the business has some cushion. Alerus reported nearly $49 million in cash on hand in the most recent quarter. Yes, total debt sits at around $325 million, but as a financial institution, it’s operating within a structure where leverage is part of the model.

One other point that adds a layer of comfort: the beta on this stock is just 0.68. That tells you it doesn’t tend to swing wildly with the market. For income-focused investors, that kind of low volatility can be a nice complement to the yield.

Dividend growth hasn’t outpaced inflation, which is something to be aware of. But the fact that Alerus hasn’t cut its dividend—even during volatile stretches—adds to its credibility as a steady income source.

For those seeking a quiet, yield-focused position with a track record of consistent distributions, Alerus offers something that’s getting harder to find: a sense of stability in an often noisy market.

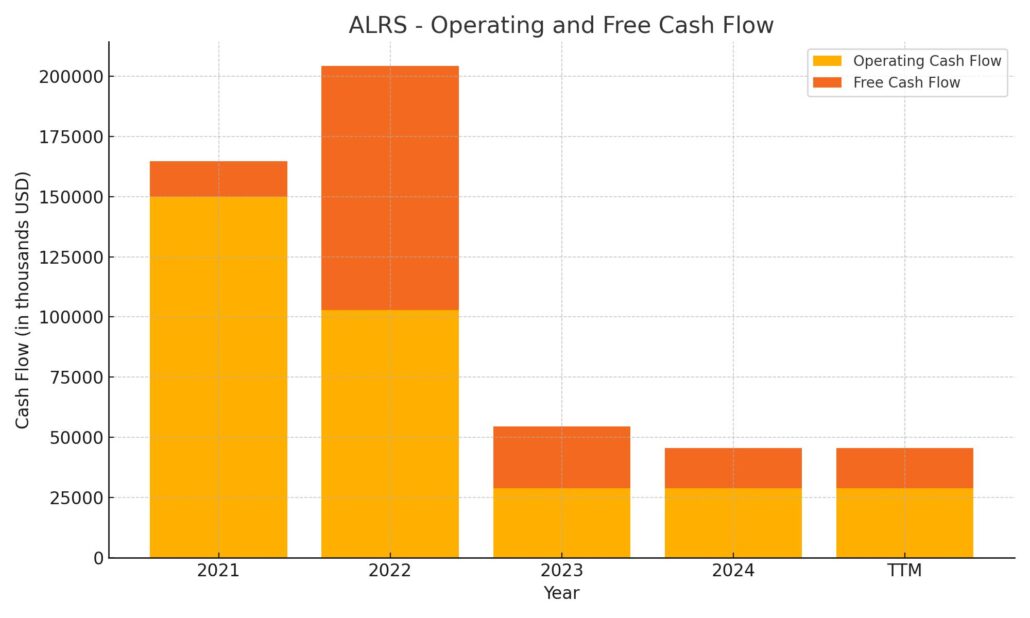

Cash Flow Statement

Alerus Financial’s cash flow picture over the trailing twelve months shows a business absorbing capital for growth and investment, while still maintaining positive cash generation from its core operations. Operating cash flow totaled $28.96 million in the TTM, almost flat compared to the prior year, signaling stability in the company’s ability to generate cash from its day-to-day business activities. However, it’s worth noting that free cash flow dipped to $16.59 million, down from over $25 million the year before, as capital expenditures rose to $12.37 million.

The real standout in the cash flow statement is the significant shift in investing and financing activities. Alerus recorded a steep outflow of $330 million in investing cash flow, a major increase compared to the prior year, reflecting aggressive deployment of capital—likely tied to acquisitions or portfolio repositioning. At the same time, financing cash flow swung sharply positive at $232.42 million, supported by funding activity that helped offset the investing drain. Despite this push and pull, the company ended the period with $61.24 million in cash on hand, maintaining liquidity even in the face of heavy capital movement.

Analyst Ratings

📝 Analyst sentiment for Alerus Financial Corporation (ALRS) has been fairly neutral lately, with most holding firm on a “Hold” stance. 🎯 The current average price target comes in at $21.60, pointing to some upside from where the stock has been trading. 📊 Targets range from a more conservative $20.00 to a more bullish $23.00, showing a modest but meaningful range of opinion on where this stock could head next.

📈 One of the more notable moves came back in September 2024, when Raymond James upgraded ALRS from “Hold” to “Buy.” Their shift in tone was driven by a more favorable earnings outlook and stronger performance across Alerus’ financial services divisions. Along with the upgrade, they pushed their price target to $24.00, suggesting a clearer runway for future growth.

📉 While Piper Sandler kept their “Hold” rating in place, they nudged their target up from $21.00 to $24.00 in early 2025. That tweak reflected a growing confidence in the company’s consistent execution. Meanwhile, DA Davidson also stayed neutral, but lifted their target to $23.00—another small signal of cautious optimism.

🧭 Overall, these changes reflect a slowly improving narrative around ALRS. Analysts may not be rushing to back up the truck, but they’re clearly watching the company’s direction with a bit more conviction.

Earning Report Summary

A Return to Positive Territory

Alerus Financial wrapped up 2024 on a much stronger note than the year before, turning in a net income of $3.2 million for the fourth quarter. That worked out to $0.13 per diluted share—a welcome shift compared to the $14.8 million loss they reported in the same quarter of 2023. This bounce back wasn’t just about cutting costs or temporary gains. A big part of the story came from the successful completion of their acquisition of HMN Financial, which has now officially become part of the Alerus family. With that deal finalized, both loans and deposits got a nice boost, each climbing by over 30% to $4.0 billion and $4.4 billion respectively.

Growth in Core Banking

Net interest income jumped nearly 70% from the previous quarter, landing at $38.3 million. That kind of growth isn’t something you see every day in this space. It came on the back of a stronger loan portfolio and better control over deposit costs. The company’s net interest margin widened to 3.20%, a meaningful improvement from 2.23% the previous quarter. It’s a sign that the balance sheet is not just growing, but doing so in a profitable way.

Steady Hand on Fee Income

Noninterest income also saw some momentum, rising just under 20% to $33.9 million. That now makes up about half of Alerus’ total revenue, which helps take some pressure off the traditional lending side of the business. Mortgage banking income saw some life again, and there were also some gains from asset sales that padded results.

Managing the Costs of Growth

Expenses did climb in the quarter, hitting $56 million. Most of that increase came from integration costs tied to the HMN deal, so it wasn’t unexpected. But despite that, the company still improved its operating efficiency. The adjusted efficiency ratio dropped to 69.0%, better than the 77.7% reported in Q3. That suggests management is keeping a close eye on expenses even as the company grows.

Leadership’s Outlook

CEO Katie Lorenson didn’t hold back on her optimism. She pointed to the successful integration of HMN Financial as a milestone that sets the company up for broader opportunities in 2025. She also reiterated the focus on building a more balanced business model—one that combines stable banking income with fee-driven services like wealth management and payroll. Looking ahead, Alerus plans to stick to its strategy of conservative credit management and organic growth, with an eye on long-term returns rather than short-term excitement.

All in all, this latest quarter gave shareholders something to feel good about again. The numbers are heading in the right direction, and leadership sounds confident about what comes next.

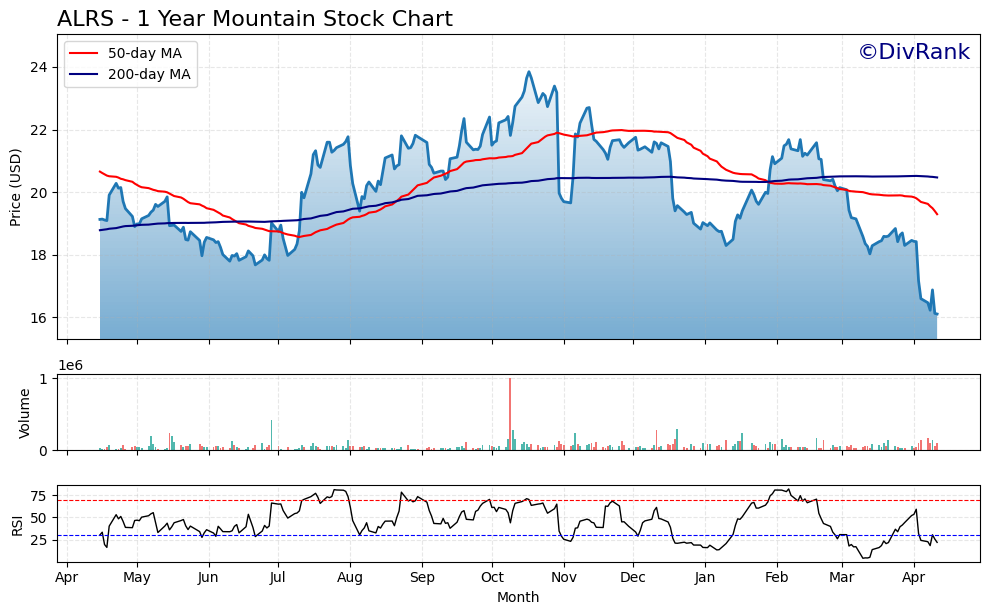

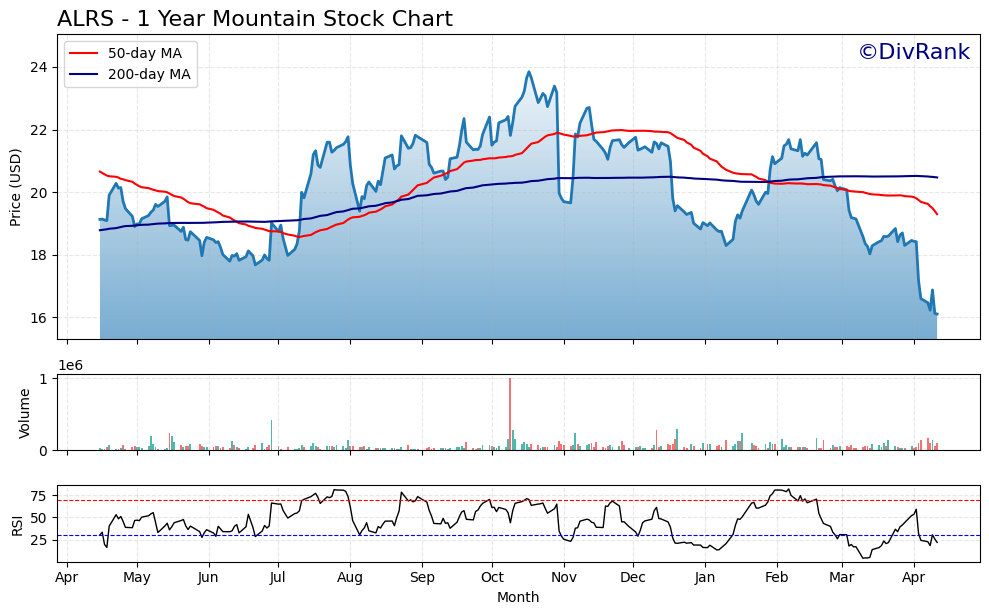

Chart Analysis

Price Action and Momentum

Looking at the recent price behavior of ALRS, the chart reveals a long downtrend that began around mid-2022 and carried well into 2023. The stock saw a steep decline from its previous highs above $24, gradually drifting lower and eventually stabilizing in the $16 range. This leveling off created what appears to be a base, a period of relative calm after extended selling pressure. That kind of stabilization can often mark the early stages of a recovery if supported by improving fundamentals.

More recently, there’s been a slow push higher, but nothing that signals strong momentum just yet. Volume during this base-building phase has been relatively muted, which is typical when buyers are cautious and sellers have mostly stepped away. This suggests the stock is in a transition phase—neither aggressively bought nor heavily sold—often referred to as a consolidation range.

Support and Resistance Zones

The lower bound near $15.75 seems to be acting as firm support. The stock has tested that level multiple times without breaking below, which adds some weight to it technically. On the flip side, resistance looks to be setting up near the $19.50 to $20 area. Price has struggled to break above that range, showing some hesitation from buyers.

A decisive move through the $20 area with solid volume would be a meaningful signal that confidence is returning. Until then, this range between $16 and $20 appears to be the playing field.

Structure and Recovery Potential

The chart structure shows characteristics of early-stage repair. It hasn’t yet formed the kind of breakout that typically excites short-term traders, but it is showing signs of accumulation. The stock is spending more time inching up rather than falling back, and that tilt often builds over time before a larger move begins.

For those focused on longer horizons, this kind of base formation—following an extended decline—can be a healthy sign. It gives the company room to rebuild investor confidence, especially as fundamentals like earnings, dividends, and cost controls continue to improve.

ALRS isn’t in the kind of roaring uptrend that grabs headlines. But quiet charts like this, with a slowly rising floor and declining volatility, often set the stage for more meaningful upside later on—especially when they’re backed by improving financial results.

Management Team

Alerus Financial Corporation is led by a team of experienced professionals who bring a mix of financial discipline and strategic thinking to the table. At the top is President and CEO Katie Lorenson, who stepped into the role in 2021 after serving as the company’s Chief Financial Officer. Her background in financial oversight and bank leadership has been instrumental in navigating Alerus through both expansion and more challenging macro environments. Her leadership style blends operational rigor with a steady focus on long-term growth.

The CFO position is held by Al Villalon, who joined Alerus in 2022. He brings over two decades of financial experience, including key roles at regional banks and asset management firms. His strength lies in understanding balance sheet dynamics and maintaining transparency with shareholders. The executive bench is rounded out by specialists in revenue strategy, risk oversight, client services, and technology—each contributing to a business model that spans banking, retirement planning, wealth management, and payroll. Together, this leadership group is focused on building a scalable financial services company with a strong regional footprint and national capabilities in niche areas.

Valuation and Stock Performance

As of mid-April 2025, ALRS is trading at $16.11 per share, a level that reflects a significant pullback from its 52-week high of $24.41. Over the past twelve months, the stock has declined by about 19 percent, a move that mirrors broader concerns in the banking sector and lingering questions around interest rate policy. Despite the recent softness in price, valuation metrics suggest there may be more substance under the hood than the market is currently pricing in.

The stock’s price-to-book ratio is sitting at 0.83, which means shares are trading below the company’s stated book value. That often indicates either undervaluation or a market concern about future earnings. Trailing earnings show a price-to-earnings ratio near 19, but the more forward-looking lens suggests a more moderate multiple when factoring in expected improvements. Meanwhile, the dividend yield of 4.97 percent provides a level of cash return that’s increasingly attractive in a market where many yields remain suppressed. In short, Alerus appears to offer a blend of modest valuation and income potential, though the stock hasn’t yet found the momentum to re-rate higher.

Risks and Considerations

There are a few clear risks to keep in mind when looking at ALRS. The first is the company’s high payout ratio, which is hovering above 95 percent. That leaves little room for error. If earnings were to stumble, there isn’t much cushion to maintain the dividend without dipping into reserves or adjusting the payout. For companies with more volatile earnings streams, that kind of tight margin could become a concern.

Operationally, Alerus is still working through the integration of HMN Financial, its most recent and largest acquisition. Integrations always carry risk—systems, personnel, and customer overlap need to be managed smoothly. Then there’s the external environment. Rising deposit costs, shifting loan demand, and potential changes in regulation could all pose headwinds in the quarters ahead. And while the diversification into fee-based services like retirement and payroll provides stability, any broader downturn in financial markets or business services could weigh on those segments too.

Final Thoughts

Alerus Financial sits at a crossroads of cautious optimism and practical execution. Its leadership has demonstrated an ability to maintain stability in uncertain times, and the recent earnings rebound shows they’re focused on fundamentals. The company’s diversified model brings resilience, and the current yield is a solid draw for those who prioritize income. That said, the high payout ratio and limited earnings flexibility mean investors should continue to monitor how profits trend and how leadership allocates capital moving forward.

The stock hasn’t been in a rush to recover, and that slow movement might actually be a strength for those who value consistency over quick gains. As integration efforts play out and the company continues refining its hybrid financial services model, ALRS could prove to be a quiet performer with steady returns for those willing to wait out the consolidation phase.