Updated 2/25/26

Alamo Group Inc. (ALG) is a manufacturer of infrastructure and vegetation management equipment, supplying essential machinery for municipalities, agriculture, and industrial customers. With a strong cash-generating business model, disciplined capital allocation, and a conservative payout ratio, the company has carved out a reliable presence in its space. Shares have traded between $156.30 and $233.29 over the past year, recently settling near $213.09. Revenue climbed to $1.615 billion and earnings per share held at $9.63, supported by solid free cash flow of $141.7 million and a balance sheet that continues to reflect management’s preference for financial caution over leverage. The leadership team has navigated a CEO transition and continues to pursue strategic acquisitions alongside cost efficiencies. With a freshly raised dividend, steady financial footing, and an active acquisition pipeline, Alamo Group presents a story of durable fundamentals with meaningful potential for long-term income growth.

Recent Events

Alamo Group entered 2026 on a positive note after management raised the quarterly dividend to $0.34 per share in January, continuing the pattern of deliberate, incremental increases that has defined the company’s capital return strategy. The move reflects confidence in sustained free cash flow generation and follows a similar step-up in January 2025 when the quarterly rate moved from $0.26 to $0.30. The succession process that began with the announced retirement of longtime CEO Jeff Leonard also appears to have been managed without meaningful disruption, with the leadership bench maintaining its operational focus through the transition.

On the equipment demand side, the industrial infrastructure market has remained a steady contributor for Alamo, supported by continued public sector investment in road maintenance, snow removal, and essential municipal operations. The vegetation management segment, which faced pronounced headwinds in 2024 and early 2025 due to weakness in forestry and agriculture markets, has shown signs of stabilization, though a full recovery in that division remains a work in progress. Management has continued to flag an active acquisition pipeline, consistent with the strategic emphasis articulated under the prior leadership team, and the balance sheet provides ample capacity to act on opportunities as they materialize.

Shares have recovered meaningfully from the lows seen earlier in the 52-week range, climbing toward the $213 area after touching a low of $156.30. That recovery reflects improved investor confidence in Alamo’s cash generation and the durability of its business model across varied demand environments.

Key Dividend Metrics

📅 Ex-Dividend Date: January 16, 2026

💰 Most Recent Dividend Payment: $0.34 per share

📈 Trailing Yield: 0.54%

📊 Annual Dividend: $1.24 per share

💸 Payout Ratio: 12.03%

🚀 Dividend Growth: $0.22 → $0.26 → $0.30 → $0.34 quarterly over three years

🧱 Balance Sheet Support: Conservative leverage, strong liquidity

🔥 Free Cash Flow Coverage: Excellent at $141.7 million vs. ~$15 million in annual dividends

Dividend Overview

Alamo’s dividend remains one of the most conservatively structured payouts in the industrial equipment space. The company is now paying $1.24 per share annually, following the January 2026 increase to $0.34 per quarter, which translates to a trailing yield of approximately 0.54% at the current share price. That yield figure won’t attract income-first investors looking for immediate cash flow, but the mechanics underneath the payout tell a more compelling story for dividend growth investors.

With earnings per share at $9.63 and a payout ratio of just 12.03%, Alamo is retaining the overwhelming majority of its earnings for reinvestment and strategic flexibility. The company could more than triple its dividend tomorrow and still sit comfortably within what most analysts would consider a safe payout range. The fact that management has instead chosen to raise the dividend incrementally, from $0.22 per quarter in early 2023 to $0.34 today, reflects a philosophy that prioritizes sustained growth over short-term yield maximization.

Free cash flow of $141.7 million over the trailing twelve months provides coverage of the annual dividend obligation many times over, since total dividend payments at the current share count run roughly $15 million per year. That ratio of free cash flow to dividend obligation is among the most comfortable in the sector and gives investors meaningful confidence that the payout is not only safe but has substantial room to continue growing.

Dividend Growth and Safety

The dividend history since 2023 tells a clear story of deliberate, consistent growth. Alamo held its quarterly payment at $0.22 through the first three quarters of 2023, then stepped it up to $0.26 starting in January 2024, held it there for four quarters, raised it again to $0.30 in January 2025, and most recently moved it to $0.34 in January 2026. That represents a cumulative increase of nearly 55% in the quarterly payment over approximately three years, a pace that comfortably outpaces inflation while remaining well within the company’s financial means.

Safety is arguably Alamo’s strongest dividend attribute. A payout ratio of 12.03% leaves an extraordinary buffer against earnings volatility, and the company’s free cash flow generation at $141.7 million is so far in excess of the dividend obligation that even a significant earnings decline would not put the payout at risk. Operating cash flow of $181.6 million over the trailing twelve months reinforces the depth of that coverage, since the dividend is funded many times over by actual cash coming through the business.

The institutional ownership structure adds another layer of stability. Institutional investors hold a dominant share of the float, and there has been no meaningful dilution of the share count, which matters to dividend investors focused on per-share income over time. Short interest of approximately 623,690 shares is relatively modest and does not suggest widespread skepticism about the company’s ability to sustain its financial commitments. For investors who prioritize reliability and growth trajectory over headline yield, ALG’s dividend profile offers a genuinely rare combination of safety, consistency, and demonstrated willingness to reward shareholders.

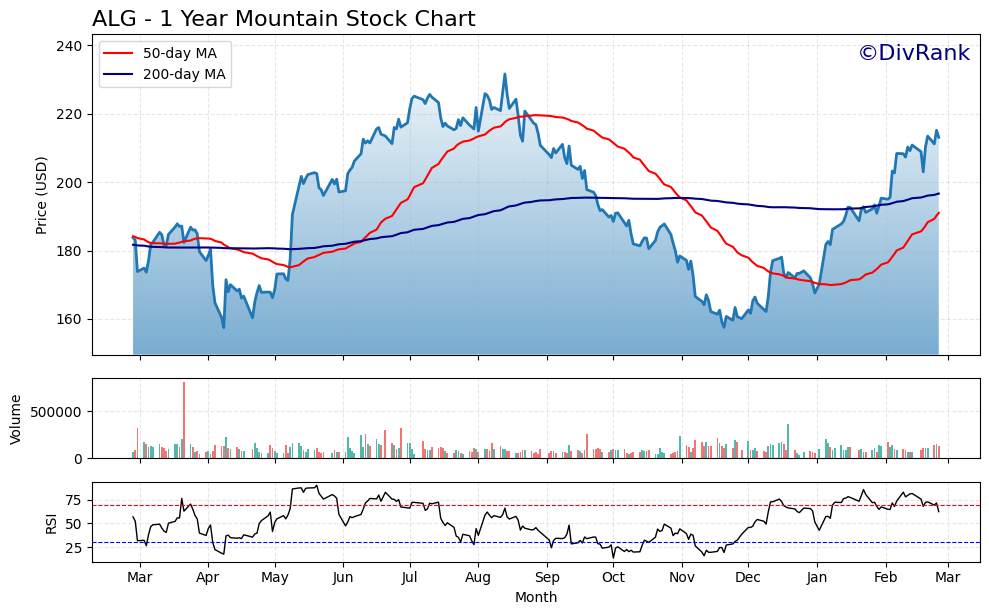

Chart Analysis

Alamo Group has put together a strong recovery over the past year, climbing from a 52-week low of $157.44 to its current price of $213.09, a gain of roughly 35% from the trough. That kind of range speaks to meaningful volatility, but the direction of travel has clearly favored buyers. The stock reached a 52-week high of $231.63 before pulling back modestly, and at current levels it sits about 8% below that peak. For a mid-cap industrial name, this is constructive price action. The recovery from the lows suggests institutional accumulation rather than a speculative spike, and the proximity to the 52-week high indicates that sellers have not aggressively reasserted control.

The moving average picture is mixed and deserves careful attention. ALG trades above both its 50-day moving average of $191.01 and its 200-day moving average of $196.65, which on the surface is a bullish configuration. However, the 50-day average sits below the 200-day average, a setup technically known as a death cross. This cross is a lagging signal, meaning it reflects the weakness that already occurred earlier in the year rather than predicting imminent deterioration. The fact that price has already recovered above both averages is an encouraging counterpoint, but dividend investors should recognize that the moving average structure has not yet fully healed. A sustained move higher that pulls the 50-day back above the 200-day would represent a meaningful technical improvement for the chart.

Momentum, as measured by the 14-day Relative Strength Index, reads at 62.47. That level sits comfortably in the upper half of the neutral range, well clear of oversold territory and approaching, but not yet at, the 70-threshold that typically signals overbought conditions. This is often described as a “sweet spot” for continuing trends, where buying pressure remains present without the chart flashing near-term exhaustion signals. If RSI pushes through 70 on the next leg higher, investors should watch for short-term consolidation. For now, momentum confirms the positive price action rather than contradicting it.

For dividend investors, the overall technical picture suggests a stock in recovery mode with improving momentum and a price trend that has moved decisively off the lows. The unresolved death cross is a flag worth monitoring, but it should be weighed against the fact that ALG is already trading above both key moving averages and within striking distance of a new 52-week high. Income-focused investors who are comfortable with the fundamental thesis are not looking at a technically stressed chart. The setup supports a patient, hold-oriented posture rather than a defensive one, with the next significant test being whether ALG can clear the $231.63 prior high and establish fresh highs on the year.

Cash Flow Statement

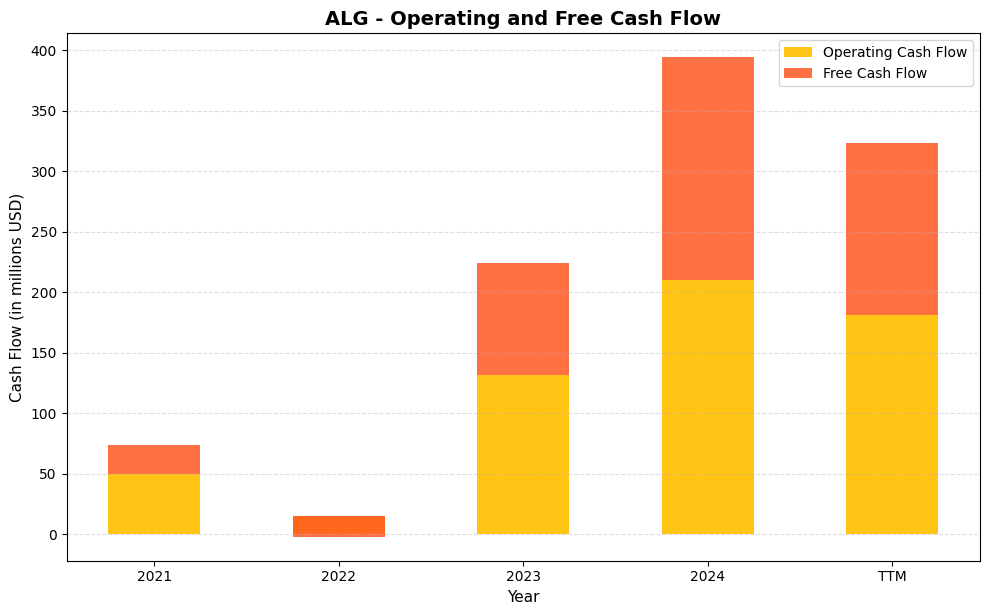

Alamo Group’s cash flow trajectory tells a compelling story for dividend investors. Operating cash flow swung from a modest $49.7 million in 2021 to a concerning $14.5 million in 2022, before rebounding sharply to $131.2 million in 2023 and reaching a peak of $209.8 million in 2024. Free cash flow followed the same arc, turning negative at $16.8 million in 2022 before recovering to $93.4 million in 2023 and surging to $184.6 million in 2024. The TTM figures of $181.6 million in operating cash flow and $141.7 million in free cash flow confirm that 2024 was not a one-time event but rather a reflection of a business that has genuinely strengthened its cash generation capacity. Against an annual dividend obligation that remains well below $20 million, the current free cash flow levels provide an exceptionally comfortable coverage ratio, leaving the company ample room to continue growing the payout without straining its balance sheet.

The progression from 2021 to 2024 reflects more than just revenue growth. Capital expenditures consumed roughly $25 million of operating cash flow in 2021, a figure that stayed elevated through the investment-heavy 2022 period, which helps explain why free cash flow turned negative that year despite operational activity continuing. As the company absorbed those capital commitments and operational efficiency improved, the gap between operating and free cash flow narrowed considerably, with 2024 showing capex of only around $25 million against operating cash flow nearly four times that level. This kind of capital efficiency is a meaningful positive signal for income investors, as it suggests Alamo Group is generating returns on prior investments rather than continuously requiring heavy reinvestment to sustain growth. Shareholders benefit from a business that is increasingly converting revenue into distributable cash, and the consistency of TTM figures near the 2024 peak indicates this is a durable shift rather than a temporary windfall.

Analyst Ratings

Analyst coverage of Alamo Group remains relatively limited, with four analysts currently tracking the stock, which is typical for a mid-cap industrial name with a market capitalization near $2.6 billion. No specific ratings actions have been reported in the most recent period, but the price target distribution among the covering analysts provides a reasonable picture of where informed outside observers see fair value. The mean price target across the four analysts sits at $219.75, while the range spans from a low of $190.00 to a high of $252.00.

At the current share price of $213.09, the stock trades modestly below the consensus mean target of $219.75, implying roughly 3% upside to the average estimate and more meaningful upside to the high end of the range at $252.00. The $190.00 floor estimate, meanwhile, sits about 11% below where shares trade today, suggesting that even the most cautious analyst on the coverage list does not see dramatic downside from current levels. That distribution reflects a broadly constructive but not aggressive stance, consistent with a company that generates reliable cash flow and maintains conservative finances but faces questions around top-line growth momentum and the pace of recovery in the vegetation management business. The absence of a formal consensus rating does not obscure the fact that the analyst community, taken together, appears to view ALG as fairly valued to modestly undervalued at current prices.

Earning Report Summary

Alamo Group reported full-year revenue of $1.615 billion alongside earnings per share of $9.63 and net income of $116.4 million. Those figures reflect a business that has settled into a more normalized demand environment following the elevated activity levels of the post-pandemic infrastructure spending cycle. Operating cash flow of $181.6 million and free cash flow of $141.7 million were the clear highlights of the financial results, demonstrating that the company’s ability to convert revenue into usable cash remains intact even as top-line growth faces near-term pressure.

Division Performance: A Tale of Two Segments

The industrial equipment division has continued to serve as the steadier of Alamo’s two primary business lines, supported by consistent demand from municipalities and public works operators investing in road maintenance, snow removal, and essential infrastructure upkeep. Public sector infrastructure spending has held up reasonably well, providing a durable demand base for this segment even as broader industrial conditions have remained mixed.

The vegetation management segment has been the more challenging half of the portfolio. Weakness in forestry and agricultural markets that began weighing on results in 2024 has not fully resolved, and while management has implemented cost reduction initiatives to partially offset the revenue softness, the timing of a meaningful demand recovery in this segment remains one of the more important variables for investors to monitor heading through 2026. The cost savings program, which management previously indicated could generate $25 to $30 million in annualized benefits, is expected to provide meaningful margin support as the segment works through its recovery.

Operating Metrics and Cash Flow

The profit margin of 7.20% and return on equity of 10.82% reflect a company that is managing its cost structure carefully through a period of uneven demand. Capital expenditures of approximately $39.8 million were disciplined relative to the operating cash flow base, and the resulting free cash flow of $141.7 million represents a solid cushion above and beyond what the company needs to fund its dividend, debt obligations, and routine maintenance investment. The balance sheet continues to reflect management’s preference for financial conservatism, with leverage remaining well within comfortable bounds.

Looking Ahead

Management has continued to express confidence in the acquisition pipeline, characterizing it as active and consistent with the company’s long-standing strategy of using M&A to supplement organic growth and add capabilities in adjacent markets. With free cash flow of $141.7 million and a conservative balance sheet, Alamo has the financial capacity to execute on acquisitions of meaningful size without compromising its dividend trajectory or straining its debt metrics. The combination of an active deal pipeline, ongoing cost reduction execution, and the potential for vegetation management demand to normalize creates a reasonable setup for improving financial results as 2026 progresses.

Management Team

Alamo Group’s executive leadership team has navigated the CEO transition that was set in motion by Jeff Leonard’s announced retirement, and the company has maintained operational continuity through that process. The leadership bench that supported Leonard during his tenure, including Agnes Kamps as EVP, CFO, and Treasurer, has been central to preserving the financial discipline and capital allocation philosophy that defined the company’s approach under his leadership. Kamps has been instrumental in maintaining the conservative balance sheet posture and ensuring that cash flow generation remains a primary focus of operational management.

The two primary operating divisions continue to be led by experienced executives with deep familiarity in their respective markets. Rick Raborn oversees the Vegetation Management segment, where the current challenge of navigating softness in forestry and agriculture demand requires both cost management discipline and a forward-looking view on when end markets will normalize. Kevin Thomas leads the Industrial Equipment group, which has been the more consistent performer and continues to benefit from public sector infrastructure investment. Ed Rizzuti manages corporate development and investor relations, helping coordinate M&A activity and maintain clear communication with the investment community. Collectively, the team has demonstrated an ability to manage through demand volatility without sacrificing the financial discipline that underpins the dividend and strategic flexibility.

Valuation and Stock Performance

Alamo Group shares have recovered substantially from the lows seen earlier in the trailing twelve-month period, with the stock trading near $213.09 after reaching a 52-week low of $156.30. The current price sits closer to the upper half of the 52-week range, which topped out at $233.29, reflecting improved investor sentiment around the company’s cash generation and the durability of its core industrial business. At a trailing P/E ratio of 22.13, the stock is priced at a modest premium to where it traded a year ago, though the valuation remains reasonable for an industrial compounder with conservative finances and a consistent dividend growth track record.

The price-to-book ratio of 2.26 against a book value per share of $94.47 reflects a company whose earning power and cash generation capacity are valued at a sensible premium to its accounting net worth. The consensus analyst price target of $219.75 implies modest additional upside from current levels, with the high-end estimate of $252.00 suggesting meaningful room for appreciation if the vegetation management segment recovery accelerates or acquisition activity adds incremental value. Return on equity of 10.82% and return on assets of 6.64% reflect efficient, if not spectacular, capital deployment, consistent with a conservatively managed industrial manufacturer operating with low leverage.

Free cash flow of $141.7 million relative to a market capitalization of approximately $2.58 billion implies a free cash flow yield of roughly 5.5%, which is a more telling valuation metric for income-oriented investors than the headline earnings multiple. That yield suggests the stock is not aggressively priced given the quality of the underlying business, and it provides a meaningful cushion for ongoing dividend growth and potential share repurchase activity without requiring heroic assumptions about future earnings expansion.

Risks and Considerations

The vegetation management segment continues to represent the most visible near-term risk for Alamo. Demand weakness in forestry and agricultural equipment markets has persisted longer than many observers initially anticipated, and while cost reduction efforts have helped offset some of the revenue impact, a sustained period of subdued demand in this division would weigh on total company earnings and cash flow. The timing of a recovery depends meaningfully on factors outside management’s direct control, including agricultural commodity prices, forestry industry capital spending cycles, and weather-related demand patterns.

Revenue growth at the consolidated level has been modest, and investors considering ALG need to be comfortable with the possibility that the company’s top-line trajectory will remain measured rather than robust in the near term. The company’s exposure to municipal and public works budgets also introduces policy and funding risk, since changes in federal or state infrastructure spending priorities could affect demand for industrial equipment in ways that are difficult to predict with precision.

The CEO transition, while apparently well-managed, introduces a degree of uncertainty around strategic continuity, particularly with respect to the M&A pipeline. Acquisitions have been a meaningful source of growth for Alamo over many years, and a period of leadership transition can sometimes slow deal activity or alter the criteria applied to evaluating targets. Investors will want to monitor whether the new leadership structure maintains the same level of acquisition discipline and deal flow that characterized the Leonard era.

Finally, with a beta of 1.12, ALG is not immune to broader market volatility, and the stock’s recovery to the upper half of its 52-week range means that some of the valuation cushion that existed at lower prices has been reduced. A return to macro uncertainty, rising interest rates, or broader industrial sector weakness could pressure the share price and temporarily offset the income and compounding benefits that make this stock appealing to dividend growth investors.

Final Thoughts

Alamo Group continues to operate from a position of financial strength that is relatively rare for a mid-cap industrial manufacturer. The combination of a 12% payout ratio, $141.7 million in free cash flow, conservative leverage, and a demonstrated willingness to raise the dividend consistently creates a profile that is genuinely compelling for investors focused on long-term income growth rather than near-term yield maximization. The quarterly dividend has moved from $0.22 to $0.34 over approximately three years, a 55% cumulative increase that reflects both financial capacity and management intent.

The near-term picture is not without complications. Vegetation management remains a work in progress, revenue growth is modest, and the stock’s recovery to the $213 range means the valuation is less obviously cheap than it was at the 52-week lows. But for investors with a multi-year horizon, those near-term uncertainties are unlikely to derail the core thesis, which rests on a cash-generative business model, disciplined capital allocation, and a dividend that has room to grow substantially before approaching any meaningful payout constraint.

Investors who value operational consistency, financial conservatism, and a dividend that has demonstrated a clear upward trajectory will find Alamo’s profile worth serious consideration. Watching for continued dividend increases, evidence of vegetation management recovery, and updates on the acquisition pipeline will be the key signposts for assessing progress against that long-term thesis.