Updated 4/13/25

Agree Realty Corporation (ADC) is a retail-focused real estate investment trust with a portfolio of over 2,100 net lease properties across 49 states. The company primarily leases to investment-grade tenants in essential sectors such as discount retail, auto services, and pharmacies. With a monthly dividend that currently yields around 4.10% and a strong record of dividend growth, ADC appeals to investors seeking steady, recurring income. Its disciplined management team, led by CEO Joey Agree, has consistently grown earnings and AFFO while maintaining a conservative balance sheet. The stock has gained over 30% in the past year, supported by stable cash flow, high occupancy, and thoughtful acquisitions. Trading near $75, ADC shows solid technical strength, with support from long-term moving averages and favorable analyst sentiment.

Recent Events

Lately, ADC has continued adding to its property base at a steady pace. It hasn’t rushed out to grab any and every deal, but it has selectively picked up new properties that fit its conservative, tenant-first model. The company remains laser-focused on properties leased to tenants that provide essential goods and services—think pharmacies, auto parts, and discount retail.

The past year has been kind to the stock. ADC has climbed roughly 34% in the last 12 months, which is a strong move, especially in the REIT world where rising rates tend to act like headwinds. Part of that performance likely stems from shifting expectations around interest rates, and part is due to the company’s consistent results and reliable payout track record.

In terms of financial positioning, the company still keeps leverage in check. Total debt to equity is sitting at a manageable 50.93%, and management continues to show they’re comfortable playing the long game. When they tap capital markets, it’s usually well-timed, and they remain focused on keeping their borrowing costs reasonable. It’s all about making sure those monthly dividends remain safe and uninterrupted.

Key Dividend Metrics

📈 Forward Dividend Yield: 4.10%

💵 Annual Dividend Rate: $3.07

📆 Dividend Frequency: Monthly

🧾 Payout Ratio: 168.54% (EPS-based)

📊 5-Year Average Dividend Yield: 4.12%

📅 Ex-Dividend Date: April 30, 2025

📥 Next Dividend Payable: May 14, 2025

🔁 Dividend Growth Streak: 9 years

Dividend Overview

ADC’s dividend story is where it truly starts to shine. The company pays monthly—yes, every month, like clockwork—and that’s a rare treat in the REIT space. For investors building a portfolio for income, this kind of predictable cadence is invaluable. It smooths out cash flow and makes planning that much easier, whether you’re reinvesting or drawing from it for expenses.

Right now, the forward yield sits around 4.10%, which is comfortably above the S&P 500 average and right in line with the company’s five-year average. So, you’re not buying it at an inflated yield or during a dividend lull. It’s steady, as expected.

What backs this consistency? A rock-solid tenant base. Over two-thirds of ADC’s tenants are investment-grade companies—businesses with strong credit ratings and a low risk of default. That means rent is getting paid on time, which means dividends are, too.

Add to that a property portfolio that’s consistently 99% occupied, and you’ve got a REIT that runs a pretty tight ship. ADC doesn’t play in speculative markets. It sticks to tenants and locations that make sense and that tend to be recession-resistant. Even during times of economic noise, its tenants—places like pharmacies, hardware stores, and discount retailers—stay open, and people keep shopping.

Dividend Growth and Safety

Now, let’s address the payout ratio, which can look a little scary at first glance. If you’re going off earnings per share, the company is paying out over 160%—which might make a red flag go up. But with REITs, EPS doesn’t tell the whole story. You have to look at cash flow, specifically Funds From Operations (FFO) or Adjusted FFO, which strip out the heavy non-cash depreciation expenses that inflate the payout number on paper.

Through that lens, ADC’s payout ratio is much more reasonable, typically falling in the 70–85% range. That’s a level that leaves breathing room while still delivering meaningful income.

What’s also worth pointing out is how ADC handles dividend growth. Rather than go for showy increases, management opts for modest, regular bumps. It’s been doing this consistently for nine years now. That may not be eye-popping, but it’s dependable—and dependable wins the race in income investing.

Interest rate cycles can wreak havoc on REITs, but ADC has navigated them fairly well. The company locks in long-term debt at fixed rates and spreads out its maturities, making sure no single year carries too much refinancing risk. That gives it some insulation from the whims of the Fed, which in turn helps stabilize its dividend coverage.

The stock also carries a low beta, around 0.56, meaning it’s not particularly volatile. That can be comforting for income investors who want to sleep well at night and not worry about big swings every time the market hiccups.

Lastly, ADC doesn’t chase yield. It doesn’t stretch to buy higher-risk tenants just to juice the numbers. It stays focused on quality income. That mindset won’t shoot the lights out, but it does give investors a sturdy foundation to build on.

In the end, Agree Realty isn’t trying to dazzle. It’s trying to deliver. And for investors who care more about getting paid month in, month out—without surprises—that’s a story worth following.

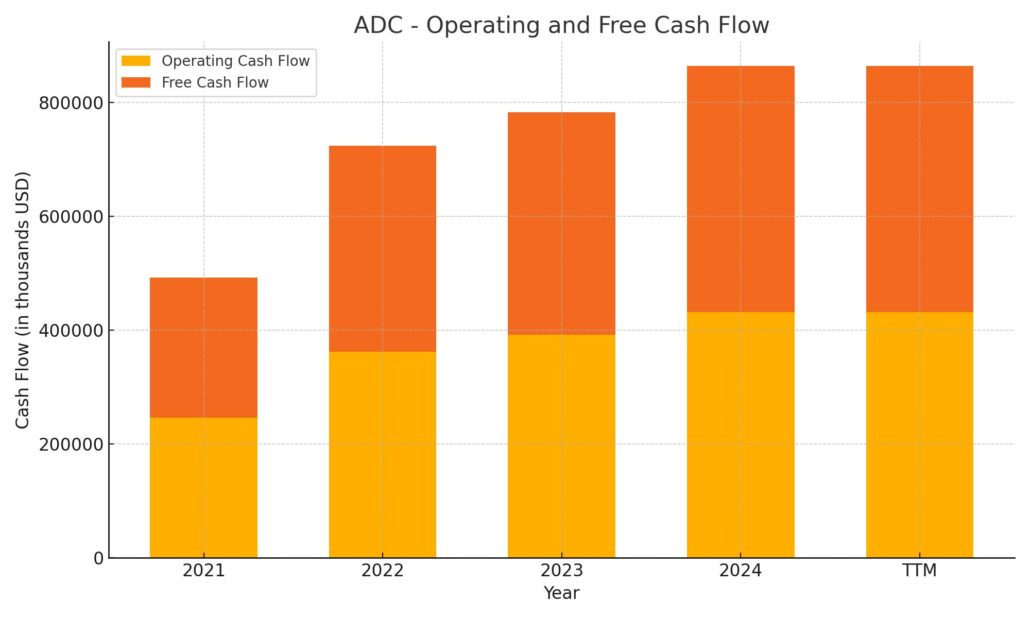

Cash Flow Statement

Agree Realty’s cash flow profile over the trailing twelve months reflects a REIT operating on stable footing. Operating cash flow came in at $431.97 million, showing solid growth from the prior year and demonstrating consistent earnings power. Free cash flow matched operating cash flow exactly, underscoring the capital-light nature of the business and confirming its ability to cover dividends with recurring cash. The upward trend in cash generation since 2021 speaks to the underlying strength of ADC’s leasing model and its disciplined approach to property acquisitions.

On the investing side, ADC spent $885.41 million, continuing its strategic property acquisitions and expansion plans. Financing activity brought in $445.31 million, largely driven by net debt issuance, with $1.52 billion raised and $1.15 billion repaid. The company remains active in managing its debt stack while keeping equity dilution minimal, as evidenced by negligible capital stock repurchases. While the ending cash position declined to $6.4 million, this isn’t unusual for a REIT that cycles cash back into growth and distributions. Overall, ADC’s cash flow dynamics remain aligned with its long-term growth and dividend objectives.

On the investing side, ADC spent $885.41 million, continuing its strategic property acquisitions and expansion plans. Financing activity brought in $445.31 million, largely driven by net debt issuance, with $1.52 billion raised and $1.15 billion repaid. The company remains active in managing its debt stack while keeping equity dilution minimal, as evidenced by negligible capital stock repurchases. While the ending cash position declined to $6.4 million, this isn’t unusual for a REIT that cycles cash back into growth and distributions. Overall, ADC’s cash flow dynamics remain aligned with its long-term growth and dividend objectives.

Analyst Ratings

🔼 Agree Realty Corporation (ADC) has recently seen a shift in analyst sentiment, with Barclays moving the stock from a “Sell” to a “Hold” rating. The price target was nudged up from $74 to $75. This upgrade reflects a growing appreciation for ADC’s reliable fundamentals and its consistency in delivering monthly dividends, which have kept investor interest high even in a higher-rate environment.

📉 While not all analysts have turned bullish, there’s an emerging tone of cautious optimism. RBC Capital continues to rate ADC as a “Buy” but has slightly reduced its price target from $79 to $78. That adjustment appears more tied to macro concerns rather than anything company-specific. ADC’s debt management and acquisition strategy remain sound, but with economic uncertainties still lingering, some analysts are trimming expectations at the margins.

📊 The overall consensus among analysts puts the 12-month price target around $80.38. That represents a moderate upside from current levels, with targets ranging from a more conservative $74 up to a high of $89. ADC’s consistent rent collection from investment-grade tenants and its strategic focus on necessity-based retail continue to be key reasons analysts remain constructive on the name, even as they recalibrate to reflect broader market sentiment.

Earning Report Summary

Agree Realty wrapped up 2024 on a strong note, delivering a performance that showed both stability and thoughtful growth. In a real estate market that still had plenty of moving parts, ADC managed to stay true to its core strategy—steady acquisitions, conservative debt management, and reliable income generation.

Strong Quarter for Core Metrics

In the fourth quarter, Adjusted Funds from Operations (AFFO) came in at $109.5 million, which marked a 9.1% increase from the same period a year earlier. That growth helped push the full-year AFFO per share up to $4.08, a 3.7% gain over 2023. Net income also grew by nearly 12%, landing at $181.8 million for the year.

These numbers reflect more than just financial strength—they show that Agree’s focus on quality tenants and essential retail continues to pay off. The company’s portfolio occupancy held strong at 99.6%, and a significant chunk of its rental income still comes from investment-grade tenants, which helps maintain consistency even when broader market trends get bumpy.

Investment Strategy and Future Outlook

Throughout the year, ADC invested around $951 million into 282 net lease retail properties and kicked off 25 development projects. That’s a clear sign the company isn’t just sitting back—it’s actively positioning itself for continued long-term growth.

CEO Joey Agree noted that while they’ve stayed selective and deliberate in acquisitions, they haven’t hesitated to move when the right opportunities came up. He also emphasized how healthy the company’s balance sheet remains, with over $2 billion in liquidity and no major debt payments due until 2028. That kind of financial cushion gives them room to operate without pressure.

Looking ahead to 2025, management expects to step things up even more. They’re projecting total investment activity between $1.1 billion and $1.3 billion for the year. If they hit the midpoint of that range, it would represent a 26% increase over 2024. It’s a clear signal that they’re confident in their model and see room to expand the portfolio in a disciplined way.

In short, Agree Realty finished the year by doing what it does best—delivering dependable results, staying true to its strategy, and setting the stage for another year of solid performance.

Chart Analysis

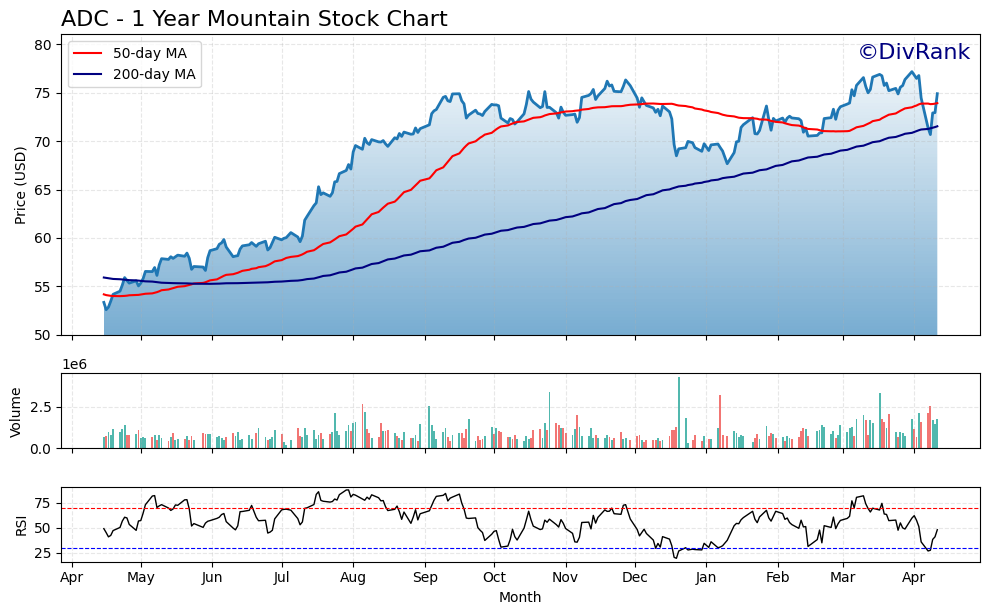

Price Trend and Moving Averages

ADC has shown a clear upward trend over the past year, with the stock steadily climbing from the low $50s to the mid-to-high $70s. The 200-day moving average (in blue) has maintained a consistent, gradual upward slope, confirming a strong long-term trend. The 50-day moving average (in red) saw more fluctuation, climbing steadily through the summer and peaking around November, before dipping slightly through winter and curling back up in April. The recent crossover above the 200-day line could be signaling a return of upward momentum after a cooling-off period.

This kind of pattern—where short-term averages correct and then realign with longer-term trends—often reflects healthy consolidation. Investors appear to have continued supporting the stock after each pullback, especially when prices approached or dipped just below the 50-day average.

Volume Patterns

Volume has remained fairly steady throughout the year, with only a few notable spikes, particularly during sharp moves in price. These bursts likely came from institutional activity or key market reactions to earnings or macro shifts. Importantly, there’s no sign of sustained selling pressure. Even during drawdowns in late fall and winter, volume didn’t suggest panic or widespread exit behavior. Recent price strength has come with slightly rising volume, which adds credibility to the bounce.

Relative Strength Index (RSI)

The RSI has mostly hovered in the 50–70 range, occasionally touching overbought territory above 70. There were only a few dips close to 30, notably during pullbacks in October and early March, and each time the stock bounced shortly after. This behavior indicates that buyers have consistently stepped in when the stock approached technical weakness, reinforcing confidence.

Most recently, the RSI has turned back upward from the mid-40s, suggesting renewed buying interest. It’s not overheated, and there’s plenty of room before approaching overbought levels again. That’s a healthy sign for a stock trying to regain upward momentum.

Final Thoughts on the Setup

The overall structure here shows a stock that has trended higher, handled pullbacks constructively, and is beginning to reassert strength. The price holding above the 200-day moving average is an encouraging technical marker, especially with the 50-day line curling upward again. As long as this setup holds, it reflects a stable, well-supported name with growing interest returning after a period of digestion.

Management Team

Agree Realty Corporation (ADC) is led by a management team that blends deep industry expertise with a practical, long-term mindset. At the forefront is President and CEO Joey Agree, who has been instrumental in evolving the company from a development-driven REIT into a nationally recognized leader in net lease retail. His leadership has focused on building a resilient, high-quality portfolio while maintaining conservative financial principles.

Executive Chairman Richard Agree, who founded the company, still plays an active role in strategic guidance. His foundational approach continues to influence the culture and long-term planning at ADC. The rest of the executive team, including CFO Peter Coughenour, COO Nicole Witteveen, and Chief Growth Officer Craig Erlich, bring a blend of operational strength, disciplined financial oversight, and a strong eye for growth. This team has consistently proven its ability to steer the company through changing economic conditions while keeping its investment priorities sharp.

Valuation and Stock Performance

ADC’s stock is currently trading around the mid-$70 range, reflecting a market cap of roughly $8 billion. The company’s valuation metrics—like a trailing price-to-earnings ratio in the low 40s and a forward P/E in the same ballpark—indicate that the market is pricing in consistency and reliability over flashier growth. Investors seem to appreciate the predictability ADC offers, particularly its focus on income-producing retail properties that serve essential consumer needs.

Over the past year, the stock has gained over 30 percent, outperforming broader market indices and showing clear momentum. It’s also worth noting the stock’s low beta, sitting around 0.56, which signals lower-than-average volatility. For investors who want exposure to real estate without taking on rollercoaster price action, that lower beta can be a meaningful factor.

ADC has managed to steadily grow its portfolio and dividend even in a rising rate environment. That’s been possible because of its disciplined capital allocation, prudent acquisitions, and long-term tenant relationships. Its 50-day and 200-day moving averages both show a generally bullish trend, with the price recently rebounding strongly off support levels. Volume and RSI data also suggest renewed investor interest without signs of froth.

Risks and Considerations

No stock comes without risk, and ADC is no exception. Its primary exposure comes from the retail sector, which can be affected by broader shifts in consumer spending, especially during economic downturns. While ADC focuses on necessity-based tenants like dollar stores, pharmacies, and auto parts retailers, the overall category still carries some sensitivity to economic cycles.

Another key consideration is interest rates. As a REIT, ADC relies heavily on the debt markets to fund growth. Rising borrowing costs could pinch profitability if not managed well, though so far the company has done a solid job laddering its debt and locking in favorable rates. Still, higher-for-longer rates could slow acquisition activity or make refinancing more expensive.

There’s also tenant concentration to consider. While the portfolio is broadly diversified, a large share of rent still comes from a relatively small group of major tenants. If one of those anchors runs into trouble, it could ripple across the company’s earnings in the short term.

Lastly, as with any REIT, the stock’s performance can sometimes decouple from real estate fundamentals and become more sensitive to shifts in sentiment around yields, inflation, or broader market risk appetite.

Final Thoughts

Agree Realty continues to build on a foundation of reliability and discipline. Its management team has shown time and again that they know how to navigate changing markets while staying true to their strategy. That strategy—focused on high-credit tenants, necessity-based retail, and long-term leases—has kept cash flow strong and dividends flowing.

Even in the face of rising interest rates and macroeconomic uncertainty, ADC has maintained a growth pace that feels measured and sustainable. Its ability to tap the capital markets when needed, manage its debt maturities, and stay selective in its acquisitions all speak to the maturity of its operating model.

For those watching from the sidelines or already holding a position, the company’s recent performance and forward outlook show a REIT that knows exactly what it’s trying to be—and is executing that vision with quiet confidence.