Updated 2/25/26

Agilent Technologies (A), a long-standing leader in life sciences, diagnostics, and applied chemical markets, continues to navigate a period of measured recovery following a challenging stretch of sector-wide demand softness. Under CEO Padraig McDonnell, the company remains focused on operational discipline, product innovation, and consistent capital returns to shareholders. The stock has recovered meaningfully from its 52-week low near $96, though it still sits well below the year’s high of $160.27. With a conservative payout ratio, growing dividend, and strong free cash flow generation, Agilent remains a compelling hold for income-oriented investors who value quality over yield size.

Recent Events

Agilent Technologies has been regaining its footing after a difficult stretch that pushed shares down sharply from their highs. The stock currently trades near $124.72, representing a meaningful rebound from the 52-week low of $96.43 but still roughly 22% below the year’s peak of $160.27. The gap between where the stock sits and where analysts believe it should trade is notable, with the consensus price target sitting at $169.67, suggesting the market has yet to fully price in the company’s recovery trajectory.

McDonnell’s “Ignite” transformation initiative continues to draw attention internally and from the investment community. The program is designed to make Agilent more agile and customer-centric, and management has pointed to early operational wins as evidence the effort is gaining traction. The Life Sciences and Diagnostics segment has been a bright spot, aided by continued customer interest in the Infinity III LC platform, which has drawn strong adoption since its launch. Meanwhile, Agilent CrossLab, the services and consumables business, has proven its resilience as a recurring revenue engine even when instrument spending softens across pharma and biotech customers.

On the capital allocation front, Agilent raised its quarterly dividend from $0.248 to $0.255 per share beginning with the January 2026 payment, continuing its streak of annual increases that dates back to 2012. That move signals management’s confidence in the durability of the company’s cash generation even as demand conditions in parts of its end markets remain uneven. With operating cash flow of $1.56 billion and free cash flow of nearly $1 billion over the trailing twelve months, the financial foundation supporting that confidence is clearly visible.

Key Dividend Metrics

📈 Dividend Yield: 0.80%

💵 Annual Dividend Rate: $1.02

🧮 Payout Ratio: 21.71%

📊 5-Year Average Yield: 0.65%

📆 Most Recent Dividend: $0.255 per share (paid January 6, 2026)

📅 Dividend Growth Streak: 13+ consecutive annual increases

Dividend Overview

Agilent’s dividend yield of 0.80% is unlikely to attract investors who prioritize income above all else, but for those focused on dividend growth and long-term compounding, the story holds real appeal. The current yield sits above the company’s five-year average of 0.65%, a reflection of the stock price compression over the past year rather than any slowdown in the dividend itself. In fact, the dividend just grew again, with the quarterly rate moving from $0.248 to $0.255 in January 2026, bringing the annualized payout to $1.02.

What Agilent’s dividend lacks in size it more than compensates for in sustainability. The payout ratio sits at just 21.71%, meaning the company retains the vast majority of its earnings for reinvestment and strategic flexibility. That kind of conservatism is a hallmark of management’s approach to capital allocation, and it creates a meaningful buffer against earnings volatility. Even if profitability were to soften meaningfully, the dividend would face little immediate pressure.

The backing behind the dividend is genuine. Agilent is not relying on debt or one-time gains to fund its distributions. Revenue of nearly $6.95 billion, net income of $1.30 billion, and a profit margin of 18.75% all confirm that the dividend is rooted in real, recurring earnings power. Institutional ownership remains high, reflecting the confidence that large, sophisticated investors place in management’s disciplined approach to shareholder returns.

Dividend Growth and Safety

Agilent’s dividend history demonstrates exactly the kind of quiet consistency that long-horizon income investors tend to prize. The company has raised its dividend every year since initiating the payout in 2012, and the most recent increase, from $0.248 to $0.255 per quarter, extends that streak into 2026. Looking at the recent dividend history, the trajectory is clear: $0.225 per quarter through most of 2023, then a step up to $0.236 in late 2023, $0.248 from late 2024 through mid-2025, and now $0.255 beginning in January 2026. Each increment is modest, but the compounding effect over more than a decade is substantial for shareholders who have held the stock through the cycle.

Safety metrics for the dividend are reassuring across the board. The payout ratio of 21.71% is among the lower readings in the diagnostics and research sector, which means the dividend consumes only a small fraction of reported earnings. EPS stands at $4.58 on a trailing basis, covering the $1.02 annual dividend more than four times over. That level of earnings coverage leaves an enormous cushion even if results were to deteriorate meaningfully in the near term.

Free cash flow coverage tells a similar story. Agilent generated $998.5 million in free cash flow over the trailing twelve months. With an annual dividend obligation that represents a fraction of that figure, there is no strain on the company’s cash position from maintaining or growing the payout. Operating cash flow of $1.56 billion further underscores the depth of the liquidity runway available to management.

Return on equity of 20.62% and return on assets of 8.48% confirm that the business is deploying its capital productively, which is ultimately what sustains a growing dividend over time. The payout is not being propped up by financial engineering. It is the natural output of a profitable, cash-generative business with a management team committed to sharing those returns with shareholders in a measured and predictable way.

Chart Analysis

Agilent Technologies has had a turbulent twelve months from a price action standpoint, carving out a wide range between a 52-week low of $98.71 and a high of $156.92. The stock is currently trading at $124.72, which puts it roughly 20.5% off that peak and about 26.4% above the annual trough. That kind of spread reflects a meaningful period of distribution followed by at least a partial recovery attempt, and the current price sitting closer to the middle of the range than to either extreme suggests the market is still working through the valuation reset that began when life science instrumentation demand softened across the sector.

The moving average picture is sending mixed signals worth unpacking carefully. The 200-day moving average currently sits at $129.29, and the 50-day moving average is higher at $135.56, meaning price is trading below both trend lines at the moment. That is a classically weak technical posture for short-term momentum. However, the 50-day remains above the 200-day, which technically qualifies as a golden cross configuration, a setup that typically reflects a longer-term bullish trend still intact beneath the surface noise. For dividend investors with a multi-year horizon, the golden cross provides some reassurance that the broader trend has not fully broken down, even as the near-term price action remains under pressure.

The RSI reading of 31.97 is approaching oversold territory in a meaningful way. A reading below 30 is the conventional oversold threshold, and at just under 32, Agilent is knocking on that door. Historically, RSI readings at these levels in quality dividend growth names have corresponded with periods where patient buyers are rewarded over a six to twelve month window. Momentum is clearly negative in the near term, and there is no technical signal yet confirming a reversal, but the compression in RSI does reduce the probability of an aggressive further leg lower from current levels without a material fundamental deterioration.

For dividend investors, the chart tells a story of a quality compounder that has been caught in a sector-wide derating and is now trading at a technically depressed level relative to its own recent history. The combination of a sub-32 RSI, price below both major moving averages, and a 20%-plus drawdown from the 52-week high creates a setup where new capital is entering at a more favorable starting yield and a more defensible price point than was available for most of the past year. The technicals are not yet signaling an all-clear, but for investors focused on income and long holding periods, current prices reflect a more attractive entry than the chart has offered in some time.

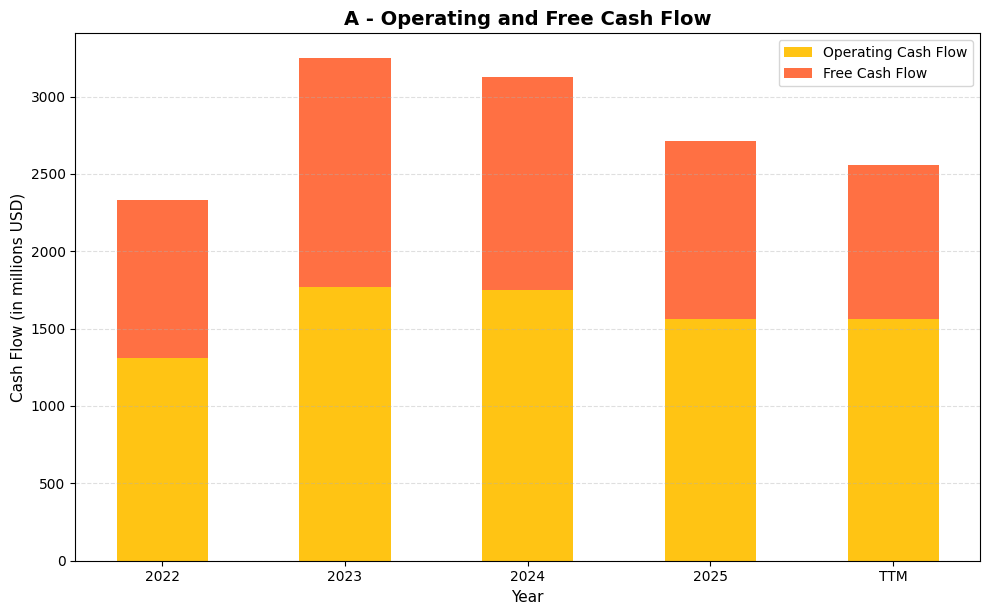

Cash Flow Statement

Agilent Technologies has generated consistently strong free cash flow over the past several years, giving the dividend a solid and well-covered foundation. Operating cash flow peaked at $1,772.0M in 2023 before pulling back modestly to $1,751.0M in 2024 and further to $1,559.0M in 2025, reflecting the cyclical softness that has pressured the life sciences tools sector broadly. Free cash flow followed a similar arc, reaching $1,474.0M in 2023 and settling at $1,152.0M in 2025. On a trailing twelve-month basis, free cash flow stands at $998.5M, which still comfortably covers Agilent’s annual dividend obligation by a wide margin. For dividend investors, the key takeaway is that even in a down cycle, the company is generating nearly $1.0B in free cash flow, leaving ample room to sustain and grow the payout without stretching the balance sheet.

Stepping back across the full trend, the progression from $1,021.0M in free cash flow in 2022 to a peak of $1,474.0M in 2023 reflects genuine operational improvement and disciplined capital spending, with capital expenditures remaining measured relative to the scale of the business. The subsequent moderation through 2024 and into 2025 is consistent with a company navigating softer end-market demand rather than any structural deterioration in cash generation quality. Agilent’s ability to convert a high percentage of operating cash flow into free cash flow across this entire period speaks to the capital-light characteristics of its instruments and services mix. For shareholders, this profile suggests a management team that has prioritized financial flexibility, and the current free cash flow level provides meaningful capacity not just for dividend growth but for share repurchases and bolt-on investments that can support future earnings power.

Analyst Ratings

Analyst sentiment toward Agilent Technologies has grown notably more constructive heading into early 2026. The consensus rating across 18 covering analysts stands at buy, a meaningful upgrade in tone compared to the more cautious posture many held during the sector-wide slowdown of the past year. The average price target of $169.67 implies upside of roughly 36% from the current share price of $124.72, which is a substantial gap that suggests the analyst community sees the stock as materially undervalued relative to its fundamental prospects.

The range of price targets is wide, spanning from a low of $150.00 to a high of $185.00, but even the most conservative target among the group sits more than 20% above where shares trade today. That floor-level target of $150.00 being above the current price is a meaningful signal that virtually no covering analyst views the stock as fairly valued at its current level. The convergence of a buy consensus and a target range entirely above the market price reflects growing confidence that Agilent’s operational recovery, aided by the Ignite transformation program and product cycle momentum, is not yet reflected in the share price. With 18 analysts aligned on a constructive view, the weight of professional opinion clearly favors the bulls at current levels.

Earning Report Summary

Agilent Technologies has been executing against a challenging macro backdrop while continuing to demonstrate the operational resilience that has characterized the business across multiple cycles. Revenue over the trailing twelve months reached $6.95 billion, supported by a profit margin of 18.75% and net income of $1.30 billion. EPS of $4.58 represents the underlying earnings power of the business on a reported basis, and the company’s return on equity of 20.62% confirms that Agilent is generating strong returns on the capital shareholders have entrusted to it.

Segment Performance

The Life Sciences and Diagnostics segment has continued to benefit from the rollout of the Infinity III LC platform, which has received strong customer reception and represents one of the more meaningful product cycle drivers Agilent has introduced in recent years. Agilent CrossLab, the services and consumables division, has remained a reliable revenue contributor, providing the kind of recurring, contract-based income that insulates the business from some of the lumpiness inherent in large instrument purchases. The Applied Markets Group has faced more variable conditions, particularly in regions where industrial and chemical market activity has been uneven, though management has characterized timing-related softness as distinct from any structural demand deterioration.

Regional Breakdown

The Americas and Europe have provided relative stability, while Asia has remained a more dynamic story. China continues to be a market where results can shift based on government policy and stimulus timing, and management has maintained a cautious but measured tone regarding the near-term trajectory there. Outside of China, the broader Asia-Pacific region has shown more consistent demand patterns, particularly in markets tied to pharmaceutical manufacturing and clinical research.

Margins and Cash Flow

Margins have held at levels consistent with Agilent’s historical positioning as a high-quality operator. A profit margin of 18.75% on nearly $6.95 billion in revenue, combined with operating cash flow of $1.56 billion, reflects a business that converts its top-line scale into tangible financial output efficiently. Capital expenditures remain measured, allowing free cash flow of approximately $998.5 million to fund the dividend, buybacks, and reinvestment without strain.

Looking Forward

CEO Padraig McDonnell has maintained a consistent message around the Ignite transformation effort, emphasizing that the operational changes underway are designed to improve customer responsiveness and long-term competitive positioning. With analyst consensus squarely in the buy camp and a price target well above current levels, the forward narrative for Agilent centers on recovery in end-market demand, continued execution on its product roadmap, and the compounding benefit of its disciplined capital return program.

Management Team

Agilent Technologies is led by Padraig McDonnell, who assumed the CEO role in May 2024 after more than two decades with the company. His background leading the Agilent CrossLab Group gave him direct operational experience in one of the company’s most strategically important divisions, and his familiarity with Agilent’s culture and customer relationships has provided continuity during a period when steadiness at the top has been particularly valuable. McDonnell’s early emphasis on the Ignite initiative reflects a desire to modernize how the company engages with its customers and executes internally, without abandoning the discipline that has defined Agilent’s approach to capital allocation for years.

CFO Robert McMahon continues to anchor the financial strategy, with a focus on transparent communication, responsible debt management, and a capital return framework that balances dividend growth with share repurchases. His track record of maintaining financial discipline even through sector downturns has been an important stabilizing factor. The broader leadership team includes experienced operators across Agilent’s key business segments and geographies, and the board of directors brings together scientific expertise and business acumen in a combination well-suited to the company’s dual identity as both a technology innovator and a returns-focused public company. Collectively, the management team projects confidence in the recovery path while remaining grounded in the operational realities of a complex, global business.

Valuation and Stock Performance

Agilent shares currently trade at $124.72, which puts them well above the 52-week low of $96.43 but still meaningfully below the 52-week high of $160.27. The stock’s trajectory over the past year has been one of sharp compression followed by a partial recovery, and the current price reflects a market that has grown more optimistic but has not yet fully embraced the recovery thesis. The trailing P/E ratio of 27.23 is modestly above the historical range for the stock, but in the context of a business with EPS of $4.58 and a clean, high-margin earnings base, it does not appear excessive. The price-to-book ratio of 5.24 on book value of $23.82 per share reflects the asset-light, high-return nature of Agilent’s operating model, which consistently generates ROE above 20%.

The most striking valuation observation at this price is the gap between where shares trade and where analysts believe fair value lies. With a mean price target of $169.67 and even the lowest target among covering analysts sitting at $150.00, the implied upside from current levels is substantial by any measure. Beta of 1.30 indicates the stock carries more volatility than the broad market, which is consistent with its sensitivity to biotech and pharma capital spending cycles. For investors with a medium-to-long time horizon, the combination of a conservative payout ratio, a growing dividend, a buy-rated analyst consensus, and a price that sits roughly 36% below the mean target creates a setup that income and total return investors alike may find worth exploring.

Risks and Considerations

Agilent’s business is meaningfully exposed to capital spending cycles in pharmaceutical, biotech, and industrial research markets. When customers in these sectors tighten budgets, as they have done over the past two years, demand for laboratory instruments and related consumables can soften faster than broader economic indicators might suggest. The timing and pace of a recovery in customer spending remains uncertain, and any delay could weigh on both revenue growth and the stock’s re-rating toward analyst targets.

China represents a specific geographic risk that management has addressed openly but cannot fully control. The region has shown some improvement thanks to government stimulus activity, but policy unpredictability and the broader trajectory of Chinese economic growth introduce a variable that is difficult to model with precision. A renewed slowdown in China, or any escalation in trade-related tensions affecting scientific equipment exports, could create headwinds for the Applied Markets Group in particular.

Competitive intensity in the life sciences tools space remains high. Peers are investing aggressively in automation, data integration, and next-generation analytical platforms, and Agilent must continue refreshing its product portfolio to maintain its market position. The Infinity III LC platform represents a meaningful recent investment in product competitiveness, but sustaining that momentum requires ongoing R&D commitment and successful commercialization of future launches.

The Ignite transformation program, while strategically sensible, introduces execution risk. Large-scale internal change initiatives can be disruptive if not managed carefully, and any stumble in customer-facing operations or internal processes during the transition could affect near-term results and investor sentiment. With a beta of 1.30, the stock has historically amplified broader market moves in both directions, meaning that even macro-level volatility unrelated to Agilent’s business can create outsized price swings for shareholders.

Final Thoughts

Agilent Technologies enters early 2026 in a position that is considerably more encouraging than where it stood a year ago. The stock has recovered from its lows, the dividend has been raised again, and the analyst community has shifted to a clear buy consensus with price targets that imply the market has yet to fully price in the company’s fundamental quality. For income investors who value the compounding power of a consistently growing dividend over the raw size of a yield, Agilent continues to offer a compelling profile.

The business itself has not changed in character. It remains a high-margin, cash-generative operator in markets tied to long-term secular growth in life sciences and diagnostics. The payout ratio of 21.71% leaves enormous room for continued dividend increases even if earnings growth is gradual, and free cash flow of nearly $1 billion provides real financial backing for both the dividend and ongoing investment in the business.

The path forward will depend on execution, both on the Ignite transformation and on navigating the uneven global demand environment. But for investors willing to take a patient view, Agilent represents the kind of grounded, well-managed business that can quietly compound value over time while paying a growing stream of income along the way.