Updated 2/25/26

Aflac might be best known for its quirky duck commercials, but behind the scenes, it’s a disciplined insurance company with a strong foundation and a long history of rewarding its shareholders. Headquartered in Columbus, Georgia, Aflac specializes in supplemental insurance, covering things like accidents, illnesses, and other medical events that aren’t fully handled by traditional policies. It’s a business model that’s served the company well for decades, especially in its two main markets: the United States and Japan.

Founded in 1955, Aflac has quietly built itself into a nearly $59 billion enterprise. It’s not the kind of name that grabs headlines every week, but for investors who care about income and long-term growth, that’s part of the charm. Aflac has consistently delivered on earnings, maintained a conservative balance sheet, and increased its dividend year after year without ever making a lot of noise about it.

Recent Events

Aflac opened 2026 with its most recent quarterly dividend set at $0.61 per share, paid on February 18, representing a meaningful step up from the $0.58 quarterly rate the company held throughout most of 2025. That increase extended Aflac’s remarkable streak of consecutive annual dividend raises to well over four decades, reinforcing management’s commitment to returning capital to shareholders even as global insurance markets face evolving headwinds.

On the product and growth front, Aflac has continued pushing deeper into digital distribution and modernized claims processing across both its U.S. and Japan operations. The company has been investing in technology infrastructure to streamline the policyholder experience, a priority that management highlighted as central to retaining younger demographics and expanding its addressable market in the supplemental insurance space. These initiatives align with the broader industry shift toward digital-first customer engagement.

In Japan, Aflac has navigated ongoing dynamics around premium cycles and currency fluctuations with characteristic discipline. The Japanese operation remains the company’s largest revenue contributor, and management has focused on product innovation and distribution partnerships to sustain momentum there. Meanwhile, the U.S. business has continued to benefit from solid customer retention rates and incremental gains in premium income. With a beta of just 0.66, Aflac continues to offer income investors meaningful insulation from broader market volatility.

Key Dividend Metrics

🐣 Forward Dividend Yield: 2.06%

💵 Annual Dividend: $2.44 per share

📈 5-Year Average Yield: 2.32%

🛡 Payout Ratio: 34.02%

📆 Most Recent Dividend Payment: February 18, 2026

💰 Most Recent Quarterly Dividend: $0.61 per share

📊 Dividend Growth Streak: 40+ years

🔁 Last Stock Split: 2-for-1 on March 19, 2018

Dividend Overview

Aflac’s 2.06% forward yield won’t turn heads at a cocktail party, but it’s the quality and trajectory of that dividend that matter most to income investors. The payout ratio sits at 34.02%, which is notably higher than it was in recent prior periods but still leaves plenty of room for continued growth without pressuring the balance sheet. The company generated $3.65 billion in net income on $17.16 billion in revenue over the trailing twelve months, providing a sturdy earnings base underneath the dividend.

The most recent dividend history tells a clear story of deliberate acceleration. Aflac held the quarterly payment steady at $0.42 through mid-2023, then raised it to $0.50 at the start of 2024, a roughly 19% jump. It raised the payment again to $0.58 in early 2025, and has now pushed the quarterly rate to $0.61 as of February 2026. That pattern of step-increases reflects a management team that takes the dividend seriously as a capital allocation priority rather than an afterthought.

Aflac pairs its dividend with an ongoing share repurchase program, which supports earnings per share growth and amplifies total shareholder returns over time. With EPS coming in at $6.81 and the annual dividend at $2.44, the payout ratio leaves substantial retained earnings available for reinvestment, buybacks, and further dividend increases. For investors building an income portfolio, that combination of yield, growth, and coverage is precisely the kind of profile that compounds meaningfully over a decade or more.

Dividend Growth and Safety

Aflac’s dividend growth streak now stretches well past 40 consecutive years of annual increases, placing it firmly in the Dividend Aristocrat category and giving it a track record that spans multiple recessions, interest rate cycles, and global financial crises. That kind of consistency isn’t accidental. It reflects a management philosophy that treats the dividend as a binding commitment rather than a discretionary payout.

The recent cadence of increases has been particularly impressive. From $0.42 per quarter in 2023 to $0.61 per quarter today, Aflac has raised its dividend by roughly 45% in just three years. Even accounting for the step-up in payout ratio that accompanied these increases, the underlying earnings power at $6.81 in EPS provides more than adequate coverage. The 34.02% payout ratio, while higher than the sub-21% level of earlier periods, remains conservative by any reasonable standard and leaves Aflac with flexibility to absorb earnings variability without touching the dividend.

Return on equity of 13.12% and a profit margin of 21.24% confirm that Aflac is not sacrificing efficiency to fund these increases. The company’s dual-market structure, with its U.S. and Japan operations each contributing meaningfully to overall results, adds geographic diversification that smooths earnings over time. With a low beta of 0.66 and disciplined underwriting standards maintained across decades, Aflac’s dividend safety profile remains among the strongest in the insurance sector. This is a company that has demonstrated it can grow its payout through nearly any economic environment, and the current financial metrics suggest there’s no reason to expect that to change.

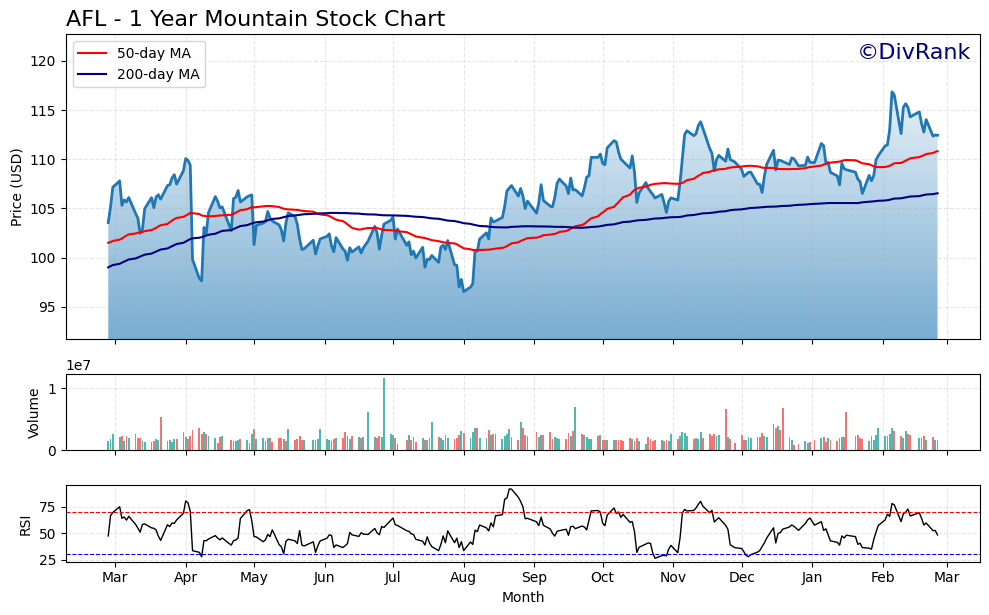

Chart Analysis

Aflac’s price action over the past year tells a constructive story for income investors. The stock carved out a 52-week low of $96.54 before staging a recovery that has carried shares up roughly 16.5% from that trough to the current price of $112.44. That kind of range expansion, from the mid-$90s to within striking distance of the $116.85 52-week high, reflects a market that has progressively revalued AFL higher as its earnings and dividend reliability remained intact throughout the period. The stock now sits just 3.8% below its annual peak, which signals underlying demand rather than a chart that is rolling over.

The moving average picture reinforces the bullish bias. AFL is trading above both its 50-day moving average of $110.83 and its 200-day moving average of $106.54, and the 50-day has crossed above the 200-day to form what technicians call a golden cross. That configuration, where the shorter-term trend line rises through the longer-term one, has historically been associated with sustained upward momentum rather than a brief bounce. The roughly $5.90 spread between the two averages gives the trend room to breathe before either line would pose a meaningful test to price. For a dividend investor primarily concerned with entry points and capital preservation, this alignment of price above both averages offers a degree of technical comfort that is not always present in higher-yielding names.

The RSI reading of 48.4 sits just below the neutral midpoint of 50, which is arguably the most investor-friendly momentum condition on the chart. AFL is neither overbought near levels that would warn of an imminent pullback, nor oversold in a way that would suggest deteriorating sentiment. This middle-ground reading indicates the stock has room to continue advancing without the kind of stretched valuation that often precedes sharp reversals. Momentum, in short, is balanced rather than exhausted, which tends to support a steady grind higher rather than a volatile swing in either direction.

Taken together, the technical setup for AFL is about as clean as a dividend investor could reasonably ask for. The trend is up, the moving averages are properly stacked and widening, and momentum is neutral with room to improve. The proximity to the 52-week high at $116.85 is the one area that deserves attention, as that level could attract some near-term selling pressure. A decisive close above it would open the chart to new highs, while a modest consolidation near current levels would simply give the moving averages time to catch up. Either outcome is consistent with a stable, income-generating holding rather than a high-risk speculative position.

Cash Flow Statement

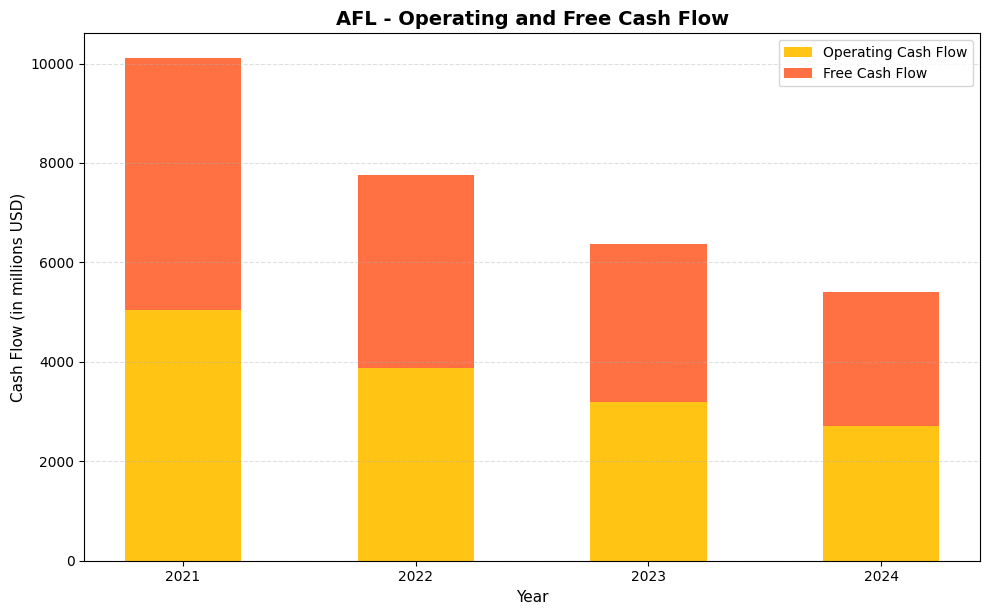

Aflac’s operating cash flow has declined steadily over the four-year period shown, moving from $5,051.0 million in 2021 down to $2,707.0 million in 2024. Because Aflac operates as an insurance holding company with minimal capital expenditure requirements, free cash flow mirrors operating cash flow exactly across all four years, which reflects the asset-light nature of the supplemental health and life insurance business. Even at the 2024 level of $2,707.0 million, the company generates substantial cash relative to its annual dividend obligation, which runs well under $1.0 billion per year at current payout rates, leaving a wide margin of safety for dividend continuity and growth. The consistency of that gap between cash generation and dividend cost is what dividend growth investors should focus on, rather than the directional decline in the headline figures alone.

The 46% reduction in operating cash flow from 2021 to 2024 deserves careful context before drawing conclusions about Aflac’s financial trajectory. The elevated 2021 figure of $5,051.0 million reflected a period of unusually high cash generation that included pandemic-era claims patterns and investment portfolio dynamics that were unlikely to persist. The step-down through 2022 at $3,879.0 million and 2023 at $3,190.0 million represents a normalization rather than a deterioration in the underlying business, though the continued slide into 2024 at $2,707.0 million is a trend worth monitoring in subsequent reporting periods. Capital efficiency remains a genuine strength here, as the company converts virtually all of its operating earnings into free cash flow without the drag of significant reinvestment requirements, and that structural advantage supports Aflac’s long record of returning capital to shareholders through both dividends and share repurchases.

Analyst Ratings

The analyst community currently holds a consensus “Hold” rating on Aflac, with 13 analysts contributing to that view. The mean price target sits at $113.00, which is essentially in line with the current trading price of $112.44, suggesting the street sees the stock as fairly valued at present levels rather than offering a significant margin of upside or downside from here.

The range of price targets tells a more nuanced story. The high target of $130.00 implies roughly 16% upside from current levels, reflecting the more bullish view that Aflac’s consistent capital returns, expanding dividend, and strong domestic execution are not yet fully reflected in the share price. The low target of $100.00, on the other hand, suggests some analysts see meaningful downside risk, likely tied to currency headwinds in Japan and questions about earnings growth sustainability in a more normalized investment income environment.

With the stock trading at $112.44 and the mean target at $113.00, there is very little gap between where the market has priced the shares and where the analyst consensus thinks fair value sits. That kind of alignment typically reflects a well-covered, well-understood business that the market has had ample time to evaluate. For dividend growth investors, the more important question is less about near-term price target upside and more about whether the company can continue compounding its payout at a mid-to-high single-digit annual rate, and the current financial profile suggests it can.

Earning Report Summary

Aflac delivered full-year results that demonstrated the underlying strength of its dual-market insurance model. Total revenue for the trailing twelve-month period came in at $17.16 billion, with net income reaching $3.65 billion and EPS landing at $6.81. The profit margin of 21.24% reflects disciplined underwriting and continued contribution from the company’s investment portfolio, which remains a meaningful component of overall earnings.

Return on equity of 13.12% and return on assets of 2.54% are both consistent with a conservatively managed insurer operating well within its risk parameters. While these metrics are somewhat lower than the elevated figures seen in prior periods when one-time investment gains boosted reported results, they represent a more normalized and sustainable earnings profile going forward.

Performance in Japan

Japan remains Aflac’s largest market by premium volume, and while the operation continues to face familiar headwinds from yen-dollar exchange rate dynamics and the natural run-off of older policy cohorts, the business has remained resilient. Management has focused on product innovation and distribution channel expansion to offset premium pressure in the mature Japanese market. Investment income from the Japan segment has continued to provide a stabilizing contribution to segment earnings, even as top-line premium growth has faced structural constraints.

Performance in the U.S.

The U.S. segment has been a consistent source of momentum. Aflac’s domestic operations have benefited from solid policyholder retention rates, incremental gains in new sales, and improving margins as the company leverages its digital infrastructure investments. Premium income growth in the U.S. has been supported by favorable trends in employer-sponsored supplemental benefits, a category that has seen growing interest as workers increasingly seek coverage that complements traditional health insurance. Pretax margins in the U.S. segment have remained healthy, reflecting both pricing discipline and ongoing expense management.

Capital Returns and Management Commentary

Aflac continued its track record of aggressive capital return during the most recent period, maintaining share buybacks as a consistent priority alongside the dividend. The quarterly dividend increase to $0.61 per share, effective February 2026, extended the company’s consecutive annual increase streak past 40 years. CEO Dan Amos has consistently framed capital return as a core part of Aflac’s identity, and the most recent results reinforce that the financial capacity to sustain that posture remains firmly in place. Management commentary has emphasized disciplined growth in both markets and continued investment in digital capabilities as the key operational priorities heading into the remainder of 2026.

Management Team

Aflac’s leadership continues to be anchored by Chairman and CEO Dan Amos, who has been with the company for over three decades. His steady hand and long-term focus have been central to the company’s consistent performance. Known for his down-to-earth leadership style and strong company culture, Amos has built a team that emphasizes financial discipline and long-term value creation.

Virgil R. Miller serves as President of Aflac Incorporated, a role he assumed at the start of 2025. Miller, who also serves as President of Aflac U.S., brings two decades of experience within the company. His leadership in customer solutions and operational efficiency has played a key role in driving domestic growth, particularly as Aflac continues expanding its digital services and new product offerings targeting younger demographics.

The executive bench also includes Max K. Brodén, the Senior Executive Vice President and CFO, who oversees the company’s global investment strategy and financial performance. Audrey Boone Tillman, Senior Executive Vice President and General Counsel, continues to lead Aflac’s legal and compliance functions with a strong focus on governance and risk management. Together, the team blends operational expertise, financial acumen, and legal oversight, helping Aflac remain stable through shifting economic cycles.

Valuation and Stock Performance

Aflac shares are trading at $112.44 as of February 25, 2026, sitting comfortably within their 52-week range of $96.95 to $119.32 and not far below the 52-week high. The trailing P/E ratio of 16.51 is modestly higher than where the stock has historically traded, reflecting a combination of market recognition of Aflac’s quality earnings and a slight normalization in the EPS base following years when investment gains produced elevated reported profits. At $6.81 in EPS, the current multiple is neither stretched nor particularly cheap for a company with Aflac’s track record.

Price-to-book of 1.98 against a book value per share of $56.85 places the stock at a reasonable valuation relative to its asset base, especially considering the 13.12% return on equity the company is generating. A market cap of approximately $58.9 billion reflects a business the market understands well and prices with a degree of stability that matches Aflac’s own operational character. The stock’s beta of 0.66 means it has historically moved meaningfully less than the broader market, which is a genuine advantage for income investors who want dividend growth without the volatility that often accompanies higher-yielding alternatives.

The analyst consensus price target of $113.00 is almost exactly where the stock is trading today, which suggests the market has done a reasonable job of pricing in current fundamentals. For long-term dividend growth investors, however, the valuation conversation is less about where the stock goes in the next 12 months and more about the compounding effect of a growing dividend backed by durable earnings. On that front, the current picture remains constructive.

Risks and Considerations

Aflac’s most prominent and persistent risk is its substantial exposure to Japan, which contributes a large share of overall premiums and earnings. When the yen weakens against the U.S. dollar, reported results in dollar terms can deteriorate even when the underlying Japanese business performs well on a local currency basis. This currency translation effect has introduced meaningful variability into Aflac’s quarterly results over the years and remains a structural feature of the company’s global business model that investors need to understand and accept.

The regulatory environment in both the United States and Japan represents an ongoing area of attention. Changes to insurance product regulations, reserve requirements, or distribution rules in either market could affect Aflac’s ability to price products profitably or expand its policyholder base. Japan in particular operates under a regulatory framework that can move slowly but can also introduce meaningful constraints when it does change. Aflac has a long history of navigating these dynamics, but the risk is real and requires continuous monitoring.

Interest rate movements continue to affect Aflac’s investment portfolio, which is heavily weighted toward fixed income assets. While rising rates have generally been a tailwind for reinvestment yields in recent years, any significant reversal or prolonged volatility in the fixed income markets could weigh on investment income, which remains a meaningful contributor to overall earnings. The interplay between investment results and underwriting income means that Aflac’s reported profits can be more variable than its supplemental insurance brand might suggest.

Competition in the supplemental insurance space has continued to intensify. While Aflac maintains strong brand equity, particularly in the United States where its marketing presence is distinctive, new entrants and the evolution of employer benefits platforms create ongoing pressure to innovate and compete on both product design and distribution. The company has been investing in digital capabilities to address this, but staying ahead of a changing competitive landscape requires sustained commitment and capital allocation that could limit near-term margin expansion.

Finally, cybersecurity and operational technology risks apply to Aflac as they do to any large financial services firm handling sensitive policyholder data at scale. Aflac has made meaningful investments in digital claims and policy administration infrastructure, which both improves customer experience and introduces new vectors for operational risk. Continued investment in security and system resilience is not optional at this scale, and any material breach or systems failure could carry both financial and reputational consequences.

Final Thoughts

Aflac enters 2026 in fundamentally sound shape. With EPS of $6.81, a profit margin above 21%, and a dividend that has now been raised for more than 40 consecutive years, the company continues to demonstrate that its business model holds up across a wide range of economic conditions. The recent step-up in the quarterly dividend to $0.61 per share is a concrete signal that management sees the earnings base as durable enough to support continued payout acceleration, and the 34% payout ratio gives them room to keep that trend going.

The valuation at 16.5 times trailing earnings and roughly 1.98 times book value reflects a market that respects Aflac’s consistency without ascribing a premium multiple to it. That’s a reasonable place to be for a company whose investment thesis is built on compounding dividend income rather than rapid earnings growth. The mean analyst price target of $113.00 sitting almost exactly at the current price suggests the stock is fairly valued today, which is not a reason to avoid it but rather a reminder that the return here comes primarily from the dividend and its growth over time rather than from valuation re-rating.

For income investors with a long time horizon, Aflac’s combination of a growing dividend, conservative financial management, low market beta, and a management team with decades of institutional knowledge makes it a credible core holding. The risks around yen exposure, regulatory complexity, and competitive pressure are real but well-understood, and Aflac has navigated all of them before. This remains a company built to last, and for investors who appreciate that quality, it continues to deserve a place on the watchlist.