Updated 4/13/25

Accenture plc (ACN) is a global consulting and professional services company known for its deep expertise in technology, strategy, and operations. With a client base spanning more than 120 countries, it plays a central role in helping businesses adapt and modernize across industries. The company is led by Julie Sweet, who has focused the organization on digital transformation, cloud leadership, and emerging tech like generative AI. While recent earnings reflected steady growth and strong cash flow, shares have pulled back significantly from their highs, offering a valuation reset that’s drawing interest. Accenture maintains a disciplined approach to capital return, supported by consistent dividend growth and strong free cash flow. Even amid softer government spending and tighter client budgets, the company’s long-term outlook remains tied to its ability to evolve alongside shifting global business needs.

Recent Events

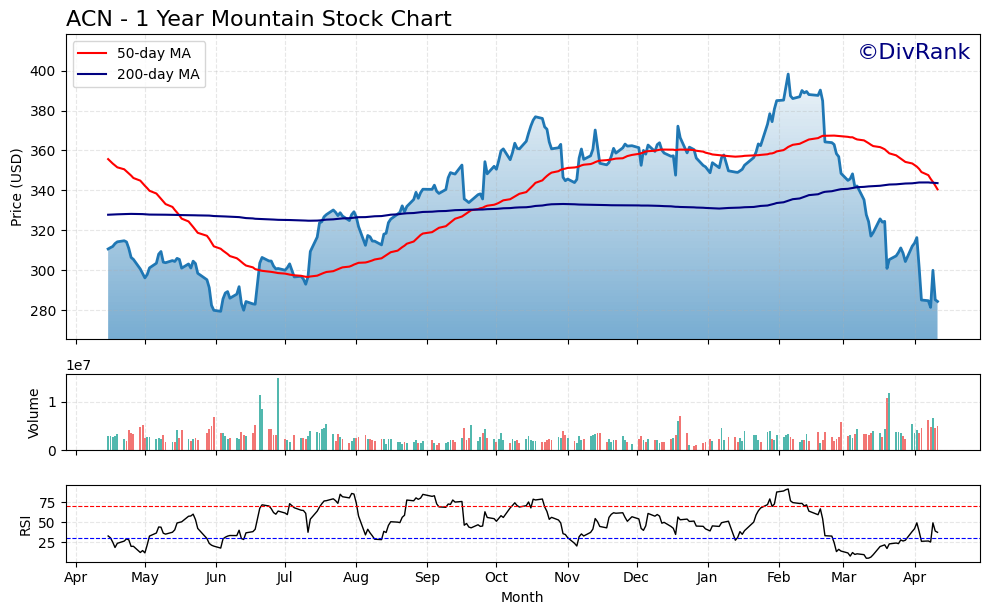

Over the past year, Accenture has taken a bit of a beating in the market. Shares are down around 9% from where they were twelve months ago, which isn’t exactly exciting on paper. After peaking at $398, the stock has now slipped to about $284. That drop has brought it well below its 200-day moving average, which sits around $344, and even its 50-day average is higher at $340.

But this isn’t a case of a broken business. The decline seems more like a reset than a red flag. Guidance came in cautious, which didn’t thrill the market. Earnings, while solid, weren’t quite the spark investors were hoping for. There’s also the broader story of IT spending being a bit tighter this year across enterprises.

Even so, Accenture hasn’t blinked when it comes to its dividend. While others might pull back or play it safe during uncertain times, Accenture has kept things moving forward, calmly, like it always does.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.08%

💵 Forward Annual Dividend Rate: $5.92

🧮 Payout Ratio: 45.67%

📅 Ex-Dividend Date: April 10, 2025

📆 Next Dividend Payment: May 15, 2025

📊 5-Year Average Dividend Yield: 1.36%

🔁 Consecutive Years of Dividend Growth: 19

This is the kind of dividend profile that doesn’t scream for attention—but quietly delivers. You won’t find flashy yields here. Instead, you get a history of increases, low payout ratios, and strong cash coverage. That’s the kind of setup that gets income investors leaning in.

Dividend Overview

With a forward yield just above 2%, Accenture may not top the list for high-income seekers. But compared to its own five-year average of 1.36%, the current yield actually represents one of the most attractive entry points in recent memory.

The company’s annual dividend now sits at $5.92 per share. For a stock trading just under $285, that’s not bad at all—especially considering the stability behind it. A 45% payout ratio means Accenture is only using less than half of its earnings to cover dividends, leaving a healthy margin for reinvestment and cushion for economic slowdowns.

The stock typically pays its dividend quarterly, and it’s consistent. The next payment lands in mid-May, and if you owned the stock before the April 10 ex-dividend date, you’re locked in to receive it.

When you zoom out and look at how this dividend has evolved over time, the discipline becomes clear. Accenture increases its payout once per year—usually in the fall when it wraps up the fiscal year. And while some companies raise dividends in tiny increments just to maintain a streak, Accenture’s bumps have been meaningful.

Dividend Growth and Safety

Here’s where the company really earns its stripes. Over the past five years, Accenture has averaged dividend growth around 9% annually. That’s a great pace—enough to outpace inflation, but not so aggressive that it feels unsustainable.

This growth is supported by serious financial muscle. The company brought in over $10 billion in operating cash flow over the past twelve months. Even after capital spending, there’s $8.6 billion in levered free cash flow to work with. Compare that to a total dividend payout under $4 billion, and you can see there’s plenty of room left to maneuver.

The balance sheet is equally solid. Cash on hand sits around $8.5 billion, just edging out the total debt of $8.06 billion. With a debt-to-equity ratio under 27%, there’s no sense of financial strain here.

What’s also worth noting is that Accenture runs a business model that doesn’t require heavy investment in physical assets. That lean setup helps generate consistent margins and reduces the pressure when economic conditions get a bit shaky.

Institutions clearly like what they see, too. Nearly 80% of the company’s shares are held by large funds, while insider ownership is minimal. That suggests professional managers see this as a dependable long-term holding—even if it doesn’t always move with the market’s flashiest names.

Yes, the beta is on the higher side at 1.32, so it’s a bit more sensitive to broader market moves than a utility or telecom stock. But for many dividend investors, that volatility is manageable if it’s backed by high-quality cash flows and disciplined capital allocation—which is exactly what Accenture delivers.

Valuation-wise, shares now trade at about 22 times forward earnings. That’s certainly not cheap, but it’s a far cry from the 30x multiple it carried not too long ago. If you’re looking at total return over a long horizon, and you care about growing income as part of that picture, Accenture starts to look pretty compelling here.

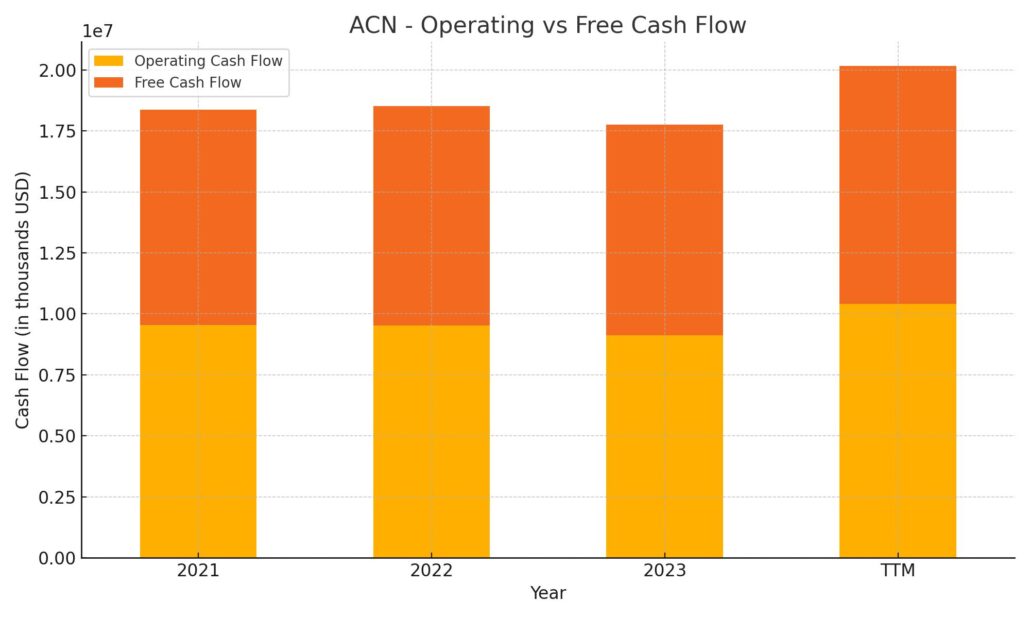

Cash Flow Statement

Accenture’s cash flow performance over the trailing 12 months underscores just how efficient and disciplined the company is in managing its capital. Operating cash flow came in at $10.4 billion, up from $9.1 billion the year prior, reflecting solid earnings quality and continued client demand across its business segments. After capital expenditures of $661 million, free cash flow reached $9.75 billion—a strong number that easily covers the company’s dividend commitments and leaves room for buybacks and reinvestment.

On the investing side, cash outflows totaled nearly $4.8 billion, which is significantly lower than last year’s $7 billion. That signals a more measured pace in acquisitions or capital deployment. Financing activities pulled out another $2.1 billion, down from $6 billion last year, with share repurchases accounting for the largest portion at over $4.3 billion. Despite the cash returned to shareholders and investments made, Accenture’s ending cash position grew to $8.6 billion, showing not only financial stability but also a balance sheet that’s been strengthened even after significant capital returns.

Analyst Ratings

📉 Analysts have been dialing back their expectations on Accenture in recent weeks, mostly in response to a softer revenue outlook and concerns tied to federal budget tightening. Several firms trimmed their price targets, reflecting caution around near-term performance. Deutsche Bank, for example, dropped its target from $365 to $290 while maintaining a Hold rating, pointing to weaker-than-expected government-related demand. Jefferies followed suit, cutting its target to $355, also reiterating a Hold stance, highlighting pressure in public sector consulting and a more conservative view on enterprise spending.

📊 Even with those tempered views, the broader analyst community hasn’t soured on the company. The average consensus price target now sits around $378.23. That suggests a decent upside from current levels and signals that many still see long-term value in Accenture’s global reach, steady client retention, and cash flow strength. While some see short-term headwinds, the underlying fundamentals remain appealing enough to keep most analysts in a cautiously optimistic stance. The mix of Hold and Buy ratings shows a market trying to balance macroeconomic uncertainty with a company that consistently delivers strong financial performance.

Earning Report Summary

A Quarter That Shows Strength With a Few Headwinds

Accenture’s most recent quarterly results for fiscal Q2 2025 were solid, but not without a few caution flags. The company pulled in $16.7 billion in revenue, which was a 5% increase year-over-year in U.S. dollars, and even stronger when measured in local currency. Earnings per share landed at $2.82, a 7% bump compared to the same time last year. They also generated $2.68 billion in free cash flow during the quarter, which speaks to how efficiently they’re running the business right now.

But not everything came in above expectations. Total new bookings for the quarter dropped by about 3%, falling to $20.9 billion. That raised some eyebrows, especially as clients seem to be taking a more measured approach to spending. The real standout was the $1.4 billion in new bookings tied to generative AI, showing that this is becoming more than just a buzzword—it’s turning into real business.

What Leadership Had to Say

Julie Sweet, Accenture’s CEO, was upbeat about the company’s position. She emphasized the strong client relationships they’ve built, especially highlighting that 32 clients had bookings of over $100 million each during the quarter. That’s a clear sign that the company is still seen as a go-to partner for major transformation efforts.

At the same time, she didn’t shy away from addressing some of the tougher spots. One of the main challenges came from delays and cutbacks in U.S. government spending, which has started to weigh on both revenue and bookings in that area. Still, Sweet sounded confident that these headwinds are temporary and sees real opportunity ahead to help modernize and streamline how federal agencies operate. She framed this not as a loss, but as a pivot point.

Adjusting Expectations, Staying Steady

Looking ahead, Accenture made some small tweaks to its guidance. The company now expects full-year revenue growth between 5% and 7% in local currency, which is a slight narrowing of the previous range. Earnings per share are projected to fall between $12.55 and $12.79. Operating margin is also expected to expand modestly, which shows that even with top-line pressures, they’re keeping costs under control.

Overall, the tone from management was measured but confident. The business is clearly adapting to a changing environment, and they’re doing it without compromising financial discipline or long-term strategy. That mix of realism and readiness is a big part of what keeps Accenture steady through market ups and downs.

Chart Analysis

Price Action and Moving Averages

The stock symbol ACN has been in a noticeable downtrend since peaking earlier this year. After hitting a high near $400, the price rolled over sharply and is now trading below both its 50-day and 200-day moving averages. That’s usually a sign that momentum has shifted firmly to the downside. The 50-day average (in red) crossed above the 200-day line back in late summer, a bullish signal at the time, but that advantage has now been erased. The red line is sloping downward again, and the blue 200-day average is flattening, even starting to drift lower.

The breakdown beneath the 200-day line earlier this spring coincided with a steep sell-off, pushing shares to new 12-month lows under $290. This move happened with heavier-than-usual volume, which adds conviction to the selling pressure. Technically speaking, it suggests that any short-term rebounds could run into resistance near the 200-day line around $340.

Volume Behavior

Volume has picked up significantly during the most recent sell-off. That’s something to pay attention to, as it signals stronger conviction behind the drop. Compared to the steady, lower-volume uptrend from July through January, the past month’s volume spikes look like institutional exits or heavy repositioning. The last time we saw volume this high was during a sharp rally in mid-summer, which gives this recent action added weight.

What’s also clear is that volume has not accompanied price stability—this hasn’t been quiet consolidation. It’s been reactive and heavy-handed, which implies sentiment has shifted quickly and decisively.

RSI and Momentum Shift

The RSI at the bottom of the chart has been hovering well below the neutral 50 mark, and even touched deeply oversold territory near 25 in March. While it’s bounced a bit since then, it hasn’t managed to sustain any kind of move back above 50, which would suggest improving momentum. This keeps the stock in a vulnerable position from a technical standpoint. Momentum simply isn’t supportive right now, and rallies are being sold rather than bought.

What we’re seeing here is a change in tone. Where buyers once stepped in during dips, they’re now sitting back—or worse, exiting on strength. Until RSI begins to build a more constructive pattern, momentum looks firmly tilted to the downside.

Overall Impression

This chart is flashing clear signs of short-term weakness following a long period of steady gains. The breakdown below key moving averages, rising volume on declines, and a lagging RSI all paint a cautious technical picture. It’s the kind of setup that warrants a wait-and-see approach until signs of price stability and momentum improvement start to show up on the chart.

Management Team

Accenture is led by Chair and CEO Julie Sweet, who stepped into the role in 2019. Since then, she’s helped shape the company’s vision around digital transformation, sustainability, and diversity. Her leadership has been marked by a consistent focus on helping clients reinvent themselves, while positioning Accenture as a strategic partner for long-term change.

The executive team includes several other key figures. Muqsit Ashraf heads the strategy division, bringing deep expertise in guiding clients through large-scale transitions. Jack Azagury leads consulting operations, ensuring sector-specific focus across industries. Karthik Narain is in charge of technology and also serves as CTO, overseeing cloud, AI, and platform innovation. Angela Beatty leads HR and organizational leadership, playing a major role in shaping the company’s culture and talent development approach. Together, this team brings a strong mix of operational rigor and forward-looking vision that continues to drive Accenture’s global momentum.

Valuation and Stock Performance

Accenture’s share price has pulled back meaningfully from its highs earlier in the year. After touching $398.35 in February, the stock has slid roughly 28%, now trading closer to $285. That kind of drop hasn’t gone unnoticed, especially with investors reevaluating tech-related names and consulting-heavy businesses in today’s environment.

Despite the decline, Accenture doesn’t look overly stretched from a valuation standpoint. The price-to-earnings ratio sits around 23.5, which is below peak levels and in line with its historical range. The market seems to be recalibrating expectations rather than losing confidence entirely. Analyst consensus places the 12-month price target near $378, which would imply a meaningful rebound if the business continues to deliver on its guidance. What helps support that outlook is the company’s track record of consistent earnings, a growing dividend, and steady margins even during less favorable cycles.

Risks and Considerations

There are a few things to keep in mind when evaluating Accenture’s outlook. One of the more immediate concerns is tied to its exposure to government contracts. About 8% of global revenue comes from U.S. federal work, and recent cost-cutting measures have created headwinds in that segment. Procurement delays and budget tightening have made it harder to secure new deals or renew existing ones at previous scale.

Outside of government spending, there’s a broader sense of client caution. Companies are reevaluating discretionary projects, especially around digital and strategic consulting, which are core parts of Accenture’s offering. While the long-term trend toward modernization and efficiency remains intact, timing is less predictable. Add to that a competitive market filled with agile, niche firms, and the pressure to innovate and adapt remains constant.

Final Thoughts

Accenture continues to operate from a position of strength, with a well-respected leadership team and a deeply embedded global presence. The recent dip in share price has come as the company navigates a mix of macroeconomic softness and shifting client priorities. That said, the long-term story remains anchored by recurring business, strong free cash flow, and a commitment to reinvention—not just for clients, but for itself.

As business needs evolve and technology reshapes the corporate landscape, Accenture appears focused on being at the center of that change. Its ability to stay relevant, expand its value proposition, and maintain operational discipline will likely define how well it emerges from this transitional phase.